Benjamin Tan's Blog

September 9, 2025

Suit Yourself Is Now Out!

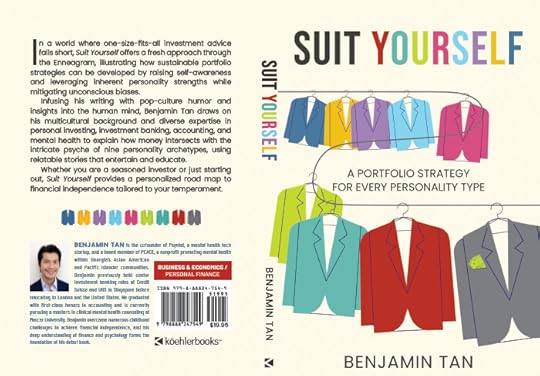

After years of reflection and writing, my debut book, Suit Yourself: A Portfolio Strategy for Every Personality Type, is finally out, published through Koehler Books. This side passion project brings together my professional and personal journey across psychology, personal finance, and the many ways our identities shape how we invest.

For those who have already started reading, thank you—and if you found the book useful or thought-provoking, I would be grateful if you left a review on Amazon. Every review helps the book reach more readers who might benefit from its message.

It is now available through:

Check out my recent interview with ThinkAdvisor: Perfectionist? Achiever? Investigator? How Clients' Personality Type Informs Their Investment Style by Jane Wollman Rusoff.

More interviews and features are in the pipeline—stay tuned.

People who have read the book have been giving me encouraging feedback, which still surprises me. I have had my moments of self-doubt about writing this book—even now. But maybe that is just part of being human and doing something for the first time. Writing and publishing a book is not a linear path, and I am learning to sit with that.

Thank you to everyone who has supported the journey.

To find out more about your typology, try the free quiz on my website.

Follow me on X.com (formerly Twitter) @ConsumeOwnTech

Thanks for reading Consume Your Own Tech Investing! Subscribe for free to receive new posts and support my work.

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.August 11, 2025

Life Time: A Small-Cap Bet on Stickiness, Scale, and Pricing Power

An abridged version of this write-up first appeared on Yahoo Finance as a featured community analysis.

Local Life Time club in Atlanta, Georgia

Local Life Time club in Atlanta, GeorgiaPeter Lynch’s core advice is simple: invest in what you truly understand. I have been a Life Time member since November 2024—using not just the gym, but also the spa, daycare, and café—and that proximity prompted deeper due diligence into the company as an investment opportunity. At the same time, I recognize the risks and potential for biases: remains a small-cap company, with a market value under $10 billion, and my favorable experience as a member may color my investor perspective. Nevertheless, I believe can more than double its current share price of approximately $27 within the next 2-3 years, and I have taken a small position to create alpha in my Traditional IRA.

Hard Moat and Meaningful White Spaceoperates 184 centers across ~30 US states and one Canadian province. The company has explicitly guided for 10 to 12 new openings per year—a measured pace that aligns with its premium positioning and capital discipline. Management has not set a long-term unit count target; however, investor materials suggest that meaningful whitespace remains in both urban and affluent suburban markets, particularly through mall integrations and residential developments. With an average club size of approximately 100,000 square feet, is building a national wellness infrastructure that cannot be easily replicated.

Inclusive Demographics, Pricing PowerWhile many gyms target specific groups or provide generic experiences, differentiates itself. It is more than simply a fitness facility; it serves as a lifestyle community that welcomes families with young children, working professionals, retirees, and individuals of all ages, genders, and sexual orientations. The diversity of its members becomes clear during my visits to the local club.

This inclusive appeal supports two of Life Time’s most durable advantages: member stickiness and pricing power. On the Q2 2025 earnings call, management noted that visits and retention were at all-time highs, prompting a deliberate focus on raising prices and ancillary revenues rather than expanding membership. That level of strategic restraint is rare in fitness retail and underscores the strength of Life Time’s value proposition.

Optimization and Greater Return on InvestmentFinancially, is entering a more disciplined phase. Revenue for Q2 2025 increased to $762 million, up 14% year over year. Net income rose by 37%, and free cash flow turned positive for the fifth straight quarter. These improvements are deliberate. The company is intentionally shifting its focus from rapid expansion to margin growth, cash generation, and debt reduction.

In contrast, , which relies heavily on a franchise model, reported $341 million in revenue for the second quarter of 2025, representing a 13% increase. Life Time's adjusted EBITDA was $211 million, surpassing Planet Fitness's $148 million. Membership numbers were 849,643 for Life Time and 21 million for Planet Fitness.

That gap reflects two very different business models: focuses on unit growth and franchise royalties, while emphasizes a more personalized, asset-intensive platform with greater monetization opportunities. In June 2025, Life Time signed a $150 million sale-leaseback deal, converting real estate into capital without losing control. Another $100 million in sale-leaseback transactions are expected in the second half of the year. This is a company trading scale for sustainability, doing so on its own terms.

What Could Go Wrong and Valuationis dependent on retaining affluent members across economic cycles, and its business model carries significant operating leverage. Any revenue slowdown or cost mismatch could disproportionately compress margins. Growth initiatives in digital and branded products are still relatively unproven. Momentum is real, but execution must remain tight.

Still, at the current valuation, the risks might be justified by the potential upside. Management expects 2025 revenue to grow by around 14%, reaching $3.0 billion. Adjusted EBITDA is forecasted to increase by 20%, and net income by over 86%—showing that margin expansion is now a key focus. has also reduced its net debt leverage from 3.0x to 1.8x over the past year, indicating disciplined cash flow management. Based on the company's 2025 adjusted EBITDA guidance, its enterprise valuation (with a $27 per share price) is about 12 times. In comparison, trades at roughly 20 times (at $105 per share).

If continues to grow revenues in double digits while further expanding margins, more than doubling its share price is plausible.

Final Thoughtis not trying to be everything to everyone. It is building a high-end, high-engagement wellness platform with a long runway for monetization and margin improvement. While the stock remains overlooked relative to its scale, pricing power, and member retention, the underlying business is gaining operating leverage with each passing quarter. For investors seeking exposure to health, fitness, and real estate in one disciplined vehicle, offers asymmetric upside.

Follow me on X.com (formerly Twitter) @ConsumeOwnTech and Yahoo Finance. My book, Suit Yourself: A Portfolio Strategy for Every Personality Type, blends Enneagram psychology, pop culture, and behavioral finance to offer a personalized roadmap to investing. Learn more at my author page or preorder the book on Amazon.

Thanks for reading Consume Your Own Tech Investing! Subscribe for free to receive new posts and support my work.

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.July 1, 2025

Early Praise for Suit Yourself and a Moment of Gratitude

Front and back covers of my upcoming book, to be published on August 18, 2025. See below for pre-order details.

Front and back covers of my upcoming book, to be published on August 18, 2025. See below for pre-order details.I started writing Suit Yourself: A Portfolio Strategy for Every Personality Type to bridge two worlds that rarely meet: the inner world of personality and the outer world of personal finance. I wanted to explore why investing feels so different for each of us—and why that difference deserves to be honored, not erased through a one-size-fits-all approach.

What began as a personal curiosity has evolved into a book that others are now starting to see themselves in. That has been the most rewarding surprise.

As we get closer to launch on August 18, I wanted to share a few words from early readers that have meant the world to me:

“One of the biggest challenges investors face is between the ears. Learning how to manage our emotions and understanding why we do what we do goes a long way towards market success. Benjamin has written a book helping outline those challenges and how to overcome them by understanding our personality types.”

— Dave Ahern, Co-host of the popular investing podcast, Investing for Beginners

“The highest ROI activity you can do isn't analysis of a company or a sector, it's understanding yourself… Suit Yourself helps you understand how you can leverage your own disposition to maximize your strengths, and avoid your pitfalls.”

— Nathan Worden, Community Manager, Yahoo Finance

“Suit Yourself is more than an investment guide—it goes beyond sound investment strategies and provides clarity into the emotional rollercoaster of life itself… Concise, yet powerful… Definitely a book to have on any bookshelf, to read, and to reflect upon repeatedly over time.”

— Felicia Teng, CPA and Founder of Get Counting

“Benjamin Tan's Suit Yourself provides an insightful exploration of investment strategies through the lens of the Enneagram personality framework. Through his entertaining use of pop culture references and personal stories, Tan turns complicated financial ideas into understandable concepts while providing customized investment strategies for people to match their portfolio choices with their personal characteristics.”

— Dr. Patrick Behar-Courtois, Author of Maximizing Organizational Performance

Writing this book stretched me in all the right ways. Publishing it has stretched me even more. I am grateful to everyone who believed in the core message: that the best investment plan is the one that suits you.

If you would like to be one of the first to read it, Suit Yourself is now available for pre-order:

Thank you for walking this journey with me. More soon.

To find out more about your typology, try the free quiz on my website.

Follow me on X.com (formerly Twitter) @ConsumeOwnTech

Thanks for reading Consume Your Own Tech Investing! Subscribe for free to receive new posts and support my work.

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.June 5, 2025

Mid-Year Lessons from Project 350k

When I began Project 350k (see Part 1, Part 2, and Part 3) earlier this year, the idea was simple: grow a modest Traditional IRA portfolio into something far more substantial, eventually hitting a $350,000 target. The implied target return is around 15%—ambitious but not unachievable. Statutory limits on the amount of capital contributions would also cap the amount of risk I take relative to my net worth, which comprises a mix of home equity, REITs, fixed income, large caps, and mid-sized companies poised for S&P inclusions.

Now that we’re halfway through the year, I thought I’d pause and reflect on a few things I’ve already learned.

Time for a mid-year stock take and make some pivots to investing style1. Timing of Deployments Matters:

Time for a mid-year stock take and make some pivots to investing style1. Timing of Deployments Matters:With a contribution cap of $7,000 per year, I should have been more strategic with the timing and sizing of my buys. Not used to making deployments of this size, I was still operating the Traditional IRA account without being fully cognizant of limitations.

Between January and February alone, I made all four of my current investments:

Disney ( ) : Purchased $2,782 @ $107/share (Jan 16)

Globant ( ) : Purchased $2,000 @ $200/share (Jan 27)

Life Time Group ( ) : Purchased $1,153 @ $32.95/share (Feb 18)

Trupanion ( ) : Purchased $1,050 @ $35/share (Feb 20)

Looking back, I essentially used up the annual limit within the first six weeks of the year! That decision left me with no capital to act on better opportunities. When markets wobbled in April and May, I had to sell my stake in Warner Music Group ( ) to free up capital. While that position was always earmarked for disposal due to its tepid growth profile, I still should have been more conservative with the deployments of this small portfolio.

There’s a discipline to pacing.

2. Sizing Should be ConsistentMy allocations were uneven. Disney ( ) and Globant ( ) got significantly larger portions than Life Time ( ) or Trupanion ( ). If I had stuck to $1k per name, I could have left room for later conviction adds—or scaled out more gracefully as earnings reports came in during Q1.

3. Risk is About MeReentering Globant ( ), a name I had previously owned and profited from, felt safe. But it is a small cap. And historically, I have had a blind spot for these.

This particular investment turned into my Achilles' heel. Q1 results disappointed, and revenue guidance for 2025 is well below my minimal 10% threshold for Project $350K. I am now looking for an exit from this name. Meanwhile, larger-cap names I already hold in my trading account—like The Trade Desk ( ) and Zscalar ( )—have fared much better.

Ironically, I ignored them to “diversify.” Geez.

4. My personality Showed UpLooking back, I can see how much my personality shaped the early moves in this portfolio—perhaps more than I realized at the time. In my upcoming book, Suit Yourself, I explore how each of the nine Enneagram types tends to approach investing, with their own psychological biases and behavioral tics. As a Type 5 who can lean into a Type 7—optimistic and, at times, impulsive—I now recognize how those traits showed up in my decision-making.

A preview of the front and back covers of my upcoming book,

Suit Yourself

A preview of the front and back covers of my upcoming book,

Suit Yourself

The rush to deploy capital was not just about market timing. It was about chasing momentum, fearing I would miss out on ideal entry points. It felt like decisiveness, but in hindsight, it was impulsivity disguised as confidence. I told myself I was making bold, reasoned moves. But really, I was skipping the part where I pause, zoom out, and ask: “Is this the best use of limited capital right now?”

There’s a core lesson here: investors are not spreadsheets. We are human. And when left unchecked, our patterns—risk-averse or risk-seeking—can lead us astray, even when we know better. I have spent years studying valuation, business fundamentals, and capital cycles. Yet in this small account, the psychological impulse to act quickly overrode what should have been a more methodical deployment plan.

Self-awareness does not guarantee success but gives you a fighting chance to interrupt your worst habits. That’s what Suit Yourself—and this project—is really about.

Follow me on X.com (formerly Twitter) @ConsumeOwnTech and Yahoo Finance

Thanks for reading Consume Your Own Tech Investing! Subscribe for free to receive new posts and support my work.

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.May 5, 2025

Part 3 of 3: A 10-Year Project for My Traditional IRA account

This article is a continuation from Part 1 and Part 2.

Statutory limits on annual contributions to the Traditional IRA basket provide a hard stop on the amount of capital at risk.Other portfolio rules for Project $350K include:

Statutory limits on annual contributions to the Traditional IRA basket provide a hard stop on the amount of capital at risk.Other portfolio rules for Project $350K include:Disposal Rules: Holdings will be evaluated for the long term, and disposals will be considered only if the fundamental growth story breaks or execution falters. Every quarter, I will assess their financial results, focusing on areas where management falls short. Often, I have noticed that consecutive gaps between Wall Street consensus numbers and actual results are a harbinger of deeper troubles. Think Unity ( ), ZoomInfo ( ), Peloton ( ), and Oatly ( ). While there are always mitigating circumstances to consider, red flags can be cloaked in management explanations that sound like broken records.

S&P 500 Names versus Others in Portfolio Balancing: I want to strike an intentional balance between S&P 500 constituent stocks—which arguably have already been uncovered by the markets—and non-constituent stocks. Currently, 75% of my traditional IRA account (in terms of market value) comprises S&P 500 constituent stocks, and Amazon ($AMZN) dominates it. It was not by design, and the allocation was random as mentioned above. Going forward, I will aim for a 50-50 split between S&P 500 names and non-constituent stocks, with an immediate focus on adding names that appear poised for index inclusion. They offer the highest potential for re-rating post-index inclusion and are suitable candidates for the lofty target returns of Project $350K.

Multiple Growth Engines: Each stock must have a proven track record of being able to keep adding new businesses and product categories. Amazon ($AMZN) is a prime example of a company that has been able to expand horizontally over multiple decades from a bookseller to the conglomerate that it is today, with more growth engines continually added (streaming, advertising, Buy With Prime). A single-product company just won’t cut it (think Oatly $OTYL and Peloton $PTON), even if they tout geographical expansion.

Caution with Mega Mergers: I will also be wary of companies that grow horizontally by entering large M&A deals relative to their existing sizes. I just don’t think it is a good sign, and I will stay away. While bolt-on acquisitions make sense since building new businesses from scratch can be riskier, when two peers try to swallow each other, it tends not to do well and can even result in more risk than a home-grown strategy. History is littered with more failures than successful mergers. Think of Time Warner and AOL as the quintessential cautionary tale.

The Road to $350KCombining the tax-deferred growth benefits of a Traditional IRA account with a focused investing approach, I aim to create a narrative that can resonate with others in this community. I want to prove that the 14% IRR required to reach this $350K goal by 2035 is achievable with a focused strategy and a commitment to learning from successes and mistakes.

Since I am already financially independent and have substantial resources reserved in safe asset classes, I will take more risk with my Traditional IRA account. At the same time, the statutory limits on annual contributions provide a hard stop on the amount of capital at risk.

Conclusion: Join This Journey of Community LearningProject $350K serves a few purposes. Firstly, the mission is informed by the lessons I learned from years of investing in a combination of multi-baggers (including Tesla , CrowdStrike , Cloudflare , and Datadog ) and certified losers (Peloton , Oatly , and Fastly ). Secondly, I want to create a disciplined, transparent challenge. Knowing my tendency for insular thinking, I want to make Project $350K into a Substack community project open to feedback, comments, and iteration. Plus, it adds an element of fun to the discipline of investing when there is lively engagement. Thirdly, using my Traditional IRA, I am testing the boundaries of higher-risk investing within a defined framework. This account allows me to explore the intellectual challenge of finding high-growth companies while limiting the overall impact on my broader financial picture.

Accordingly, this project is more than just hitting my desired investment returns. Project $350K reflects my past learnings and continuing journey to align investing strategies with a deeper understanding of discipline, focus, and long-term growth. Money heightens emotions like no other life variable. By executing Project $350K on this forum, I want to put my investment theses to the test of open feedback and become a better investor. This project also invites readers to share insights, learn from each other, and contribute to a community of thoughtful investors.

I hope Project $350K motivates readers to think more intentionally about their Traditional IRA accounts, which tend to take a backseat to regular trading accounts. Retirement accounts are not merely passive vehicles but can also be structured challenges for self-awareness and growth.

Update as of April 29, 2025: I have added to the following positions in my Traditional IRA account since Part 2 publication:

at $28.63 per share

at $132.50 per share

The above was funded by disposing of my original stake, a position that did not align with my new mandate due to its tepid growth profile.

Follow me on X.com (formerly Twitter) @ConsumeOwnTech and Yahoo Finance

Thanks for reading Consume Your Own Tech Investing! Subscribe for free to receive new posts and support my work.

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.April 1, 2025

The Book is Coming (and Why I Wrote it)

Visit my author’s website for more information.

Visit my author’s website for more information.When I first began writing Suit Yourself: A Portfolio Strategy for Every Personality Type, I had no idea how deeply personal this project would become. What started as a concept to blend two of my passions—investing and personality psychology—quickly evolved into something more introspective and meaningful. It became a lens through which I could reexamine my own financial habits, biases, and identity. And now, after years of development, research, interviews, writing, and countless rounds of editing, I'm thrilled (and relieved) to say that the manuscript is complete and heading into layout with Koehler Books.

Even before the manuscript was sent to the editor, I had revised it countless times and probably killed a few trees in the process!Message Recap: Don’t be a Copycat Investor

Even before the manuscript was sent to the editor, I had revised it countless times and probably killed a few trees in the process!Message Recap: Don’t be a Copycat InvestorSuit Yourself is a book about making investing personal using the Enneagram. I have written about this topic on Substack through a series of articles covering all nine personality types, but Suit Yourself takes it to another level of detail and scope. The book is not in a self-help-y, just-follow-the-author kind of way, but in a practical, structured, and psychology-informed manner. The core idea is simple: the best and most sustainable investment strategy reflects who you are.

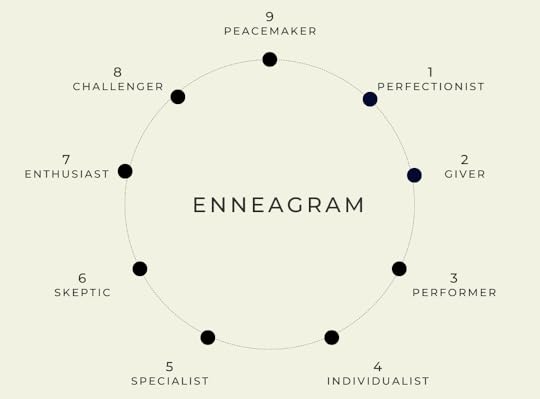

Using the Enneagram to Frame the Book The Enneagram as a framework for

Suit Yourself: A Portfolio Strategy for Every Personality Type

The Enneagram as a framework for

Suit Yourself: A Portfolio Strategy for Every Personality Type

The Enneagram—a model of nine personality types—is the framework I use to map out Suit Yourself. Through each chapter, readers will discover how their personalities influence risk tolerance, decision-making, reactions to market stress, and overall investing mindset. From Type One perfectionists to Type Nine peacemakers, I unpack how each type behaves with money. Suit Yourself is a book about self-awareness, behavioral finance, and taking ownership of your financial journey. It is for anyone who has ever wondered why they sell too early, hesitate to invest, chase small-cap stocks, or avoid looking at their financial roadmap altogether.

My diverse experience in investing, finance, accounting, technology, and clinical mental health helped shape this project. So did the incredible conversations I have had with friends, quiz-takers, readers, and fellow investors over the past few years. Thank you to all of you who took my personality quiz, offered feedback, or just cheered me on from afar.

Timeline for Suit YourselfThe book is going through its due process with the publisher, and we are estimating a late 2025 release. I will be sharing more in the coming months—cover reveal, pre-order details, giveaways, maybe even some bonus content. Until then, I just wanted to say thank you for being here. This Substack has been a quiet but steady companion throughout this journey, and I am excited to share more with you soon.

Meanwhile, below are the posts I have written about Enneagram types and their stock-picking habits:

Enneagram x Stock Picking (Part I): Type One Perfectionists

Enneagram x Stock Picking (Part II): Type Twos Investing in AMC to Save Movie Theaters?

Enneagram x Stock Picking (Part III): Type Three Investors, Successes, and Delaying Gratification

Enneagram x Stock Picking (Part IV): Type Four Investors and their Emotions

Enneagram x Stock Picking (Part V): Type Five Investors inside their heads

Enneagram x Stock Picking (Part VI): Type Six Skeptics

Enneagram x Stock Picking (Part VII): Type Seven Enthusiasts

Enneagram x Stock Picking (Part VIII): Type Eights

Enneagram x Stock Picking (Part IX): Type Nines

To find out more about your typology, try the free quiz on my website.

Follow me on X.com (formerly Twitter) @ConsumeOwnTech

Thanks for reading Consume Your Own Tech Investing! Subscribe for free to receive new posts and support my work.

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.March 3, 2025

Part 2 of 3: A 10-Year Project for My Traditional IRA account

This article is a continuation from Part 1.

In assembling my Traditional IRA portfolio, I will apply the following quantitative criteria to mitigate risks and ensure their long-term potential to thrive:

1. Revenue and Market CapitalizationCompanies must have a minimum revenue and market capitalization of $1 billion each, ensuring a focus on companies that have crossed the chasm (in the words of Geoffrey A. Moore). Smaller players that are still subscale—think the likes of Oatly ( ) and Peloton ( ) when they became popular—can quickly run into execution issues that derail operations and impair financial health. I should know since I invested in them years ago and took losses. These guardrails are essential to limit speculative risks. There is no upper limit since the big can get bigger.

2. Topline GrowthEach investee company must be expected to grow its top line consistently by at least 10%. Given the project's targeted IRR, this is an appropriate hurdle rate to impose.

3. ProfitabilityWhile looking for companies that have crossed the chasm, I am not necessarily imposing profitability measures in selecting my stocks for Project $350K. Growth requires heavy investments, many of which cannot be capitalized on the balance sheet. Accordingly, expenses like R&D and marketing will impact the income statement and often result in reported GAAP losses, regardless of the company's efficiency. Names like Datadog ( ) and Zscaler ( ) would meet the criteria. That said, companies must have clear targets to show profitability (think Block $XYZ and their path towards Rule of 40) and establish meaningful inflections in their financial statements.

4. Debt and CashflowsThis is the part where I will impose stricter guideposts. Companies with net debt/EBITDA of more than ~2.5x will be avoided. A combination of negative operating cashflows and a high debt load is a recipe for trouble and a prelude for heightened price volatility when markets turn bearish, no matter how strong topline growth may be. When a company desperately depends on external fundraising—whether from banks, markets, debt, or equity—for survival, it entails too much risk with skeletal safety margins. Accordingly, names like Rivian ( ) and Lucid ( ) are not for Project $350K.

5. ValuationHaving invested in technology names that do not even have positive book values (thus failing the cardinal Benjamin Graham rule) or report operating income, I am nevertheless of the belief that valuation guardrails are essential. Overpaying for a stock, even for the best-of-breed companies, can make a difference between market-beating returns and underperformance. “Price is what you pay, but value is what you get” is a mantra I live by, and it has proven useful when investing in value and growth names. In addition, especially when buying smaller companies that may become acquisition targets, paying multiples that exceed what private equity firms would pay might result in permanent loss, should acquisitions transpire. I have learned this the hard way with Avalara and Coupa Software. For profitable plays, my focus metrics are EV/EBITDA, and for growth stories, EV/Sales is key. Both will be evaluated as expensive or reasonable in the context of individual topline and bottom-line growth.

My natural tendency towards intellectual exploration can lead me to overanalyze and gravitate toward niche, smaller-cap companies while losing the plot. Hence, the above criteria provide structure, limit risks, and impose the often-hard lessons I have learned as an investor in clear terms.

Part 3 to come - stay tuned!

Update as of Feb 28, 2025: I have initiated Trapanion at $35 and Life Time at $33 in my Traditional IRA account.

Follow me on X.com (formerly Twitter) @ConsumeOwnTech

Thanks for reading Consume Your Own Tech Investing! Subscribe for free to receive new posts and support my work.

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.February 3, 2025

Part 1 of 3: A 10-Year Project for My Traditional IRA account

Project $350K: Growing My Traditional IRA by 2035

Project $350K: Growing My Traditional IRA by 2035Since 2021, when I moved to the United States from London, I have had to juggle the challenges of a transatlantic relocation, graduate school, a tech startup, writing a book, and preparing for parenthood. Amidst these demands, I found some time to open a Traditional IRA because my husband had touted all the tax advantages of doing so. So, once I obtained my green card, I began contributing, albeit with little thought or strategy, as I had limited bandwidth. I did not have a cohesive plan for deploying the funds I contributed. Consequently, I put them into names I had already invested in my separate trading account.

Despite a hasty start, my Traditional IRA account has grown by more than 50% over the last three years – see the breakdown of my results below. While I am satisfied with the performance—no doubt aided by a strong market performance lifting all boats—the lack of an intentional strategy left me feeling wanting.

Recently, I came across an article Project $1M: End Of A Journey With Mission Accomplished on Seeking Alpha. That mission resonated, and I felt inspired to do something similar. Hence, I am setting a goal: Project $350K, a mission to grow my Traditional IRA to $350,000 by 2035. It has an implied 15% internal rate of return (IRR) over the next decade. By sharing Project $350K on Substack, I hope to make this a community-driven project, taking onboard ideas and feedback from readers while providing an inspirational blueprint for investors wishing to embark on a more purposeful journey with their Traditional IRA accounts.

My Story and Where I Have InvestedWhile living in Singapore, I worked in the investment banking and buy-side sectors for over 13 years at firms like Credit Suisse, UBS, and Oaktree Capital. I earned my financial independence mainly through employment income and property investments. What did not work well for me were the obscure stocks I had been drawn to since my nascent days as a stock picker. I was also overly focused on assets trading at low price-to-net-tangible-asset ratios, mistaking cheap valuations for genuine value. The kind of insular thinking and scarcity mindset common among my breed of highly intellectualized personalities—see below article on Type Fives, in Enneagram speak—resulted in missed opportunities to invest in quality companies trading at fair prices.

In recent years, however, spurred by moves to London and Atlanta, I started investing more in growth names. It was not a sudden pivot but a slow one that began with companies that embodied growth and profitability, such as Match Group ( ), Starbucks ( ), and a streaming-focused Disney ( ). Then, I doubled down on rapid growth stories—all lacking in GAAP profits—deep within the technology space, with mixed results. Over a decade, the lessons I learned from investing in winners and losers have informed my portfolio philosophy, which I wish to apply in earnest to Project $350K.

Current Holdings and AllocationOverall, my current assets are anchored by home equity, and my liquid investments are evenly spread across S&P 500 constituent stocks, real estate investment trusts (REITs), cash, fixed income, and companies poised for index inclusion. My existing equity holdings—primarily in a separate trading account—comprise REITs and stocks in the technology and consumer sectors.

Below are the current holdings in my Traditional IRA account (as of December 31, 2024):

Current Holdings in My Traditional IRA Account

(market prices as of Dec 31, 2024):

Amazon (90 shares)

Closing Price: $219

Average Cost: $107

Market Value: $19,745

Gain: +104%

Lululemon (17 shares)

Closing Price: $382

Average Cost: $250

Market Value: $6,501

Gain: +53%

Shopify (45 shares)

Closing Price: $106

Average Cost: $58

Market Value: $4,785

Gain: +84%

Floor & Décor (25 shares)

Closing Price: $100

Average Cost: $119

Market Value: $2,493

Loss: (16%)

Disney (24 shares)

Closing Price: $111

Average Cost: $131

Market Value: $2,672

Loss: (15%)

Warner Music (75 shares)

Closing Price: $31

Average Cost: $39

Market Value: $2,325

Loss: (21%)

Square (1 share)

Closing Price: $85

Average Cost: $73

Market Value: $85

Gain: +17%

Total Portfolio Performance

Capital Cost: $25,635

Market Value: $38,606

Total Gain: +51%

Mandate: Growing with Consumer and Technology CompaniesI will make the maximum annual contributions to my Traditional IRA account for the next ten years. In 2025, year 1 of this project, it is $7,000. To calculate my target IRR, I assume it will remain the same for 2026-2035. As described above, I am starting with my seed investments, so to reach $350,000 by the end of 2035, the implied returns needed will be approximately 15%.

1. Sector Focus

Given Project $350K's high target returns, I will focus solely on technology and consumer names for this portfolio, not REITs. Having invested in these sectors for many years, I feel most comfortable with them.

Without stating the obvious, we are at the cusp of an AI revolution. Technology transforms every industry. I am working at a startup that harnesses AI to transform the mental health industry, so I see it firsthand. Having meaningful exposure to this sector and stakes in technology companies instrumental to this revolution is key to any portfolio’s relevance.

When investing in consumer stocks, my personal experiences come into play, and I find that to be most fulfilling when trends spotted early translate into portfolio performance. Spotify ( ), Lululemon ( ), and Tesla ( ) have been some of my best consumer stock investments, and they are all inspired by what I see myself or others consuming.

In combination, technology and consumer companies represent the highest potential for portfolio appreciation and align with my experience and professional background.

2. Research Universe

To find relevant names to add to my Traditional IRA account, I shall rely on the following sources:

- Current Holdings. My trading account currently comprises about 20 relevant names, including Tesla ( ), Zscaler ( ), Cloudflare ( ), and Adyen. These have been high-conviction, long-term holdings, and I know them sufficiently well. If prices dip to certain levels, I will add them using funds in my Traditional IRA account.

- Past Investments: I recently sold several names to fund a more significant home purchase for family planning purposes. Some names that I wish I had kept—including Trupanion ( ) and Globant ( )—are prime candidates for my Traditional IRA account.

- Sector Focus Lists via Research: I have access to multiple broker research databases, so I will examine related subsectors within the technology and consumer space. I will be monitoring cloud-native software makers, cybersecurity providers, fintech companies, and discretionary consumer-based companies.

Parts 2 and 3 are to come - stay tuned!

Update as of Jan 31, 2025: I have added more at $107 and initiated at $200 in my Traditional IRA account.

Follow me on X.com (formerly Twitter) @ConsumeOwnTech

Thanks for reading Consume Your Own Tech Investing! Subscribe for free to receive new posts and support my work.

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.December 3, 2024

The Rise and Fall of the Great Powers: Revisiting S&P 500 Performance

Over the past 25 years, the US stock market, particularly the S&P 500 index, has been among the top performers globally. This strong performance is largely attributed to the dominance of American companies, especially in the technology sector. Think of the likes of Apple (), Salesforce (), Netflix (), and Tesla () to visualize just how dominant the country has been at the cutting edge. Enormous wealth has been created through innovative offerings that simultaneously advanced mankind and made the S&P 500 index one of the best-returning indices in the world.

The S&P 500 has been the gold standard for equity investing for decades. It is often touted as a cornerstone of a diversified portfolio, and for good reason. Spanning the 500 largest publicly traded companies in the US, the index reflects the American economy's resilience, innovation, and dynamism. But what makes it such a consistent winner? As I recently revisited Paul Kennedy's The Rise and Fall of the Great Powers: Economic Change and Military Conflict from 1500 to 2000, it became clear that America’s enduring advantages—economic, geopolitical, and cultural—continue to endure.

Warren Buffet has always favored low-cost index funds for investors. Back in 2008, he even placed a million-dollar bet against a hedge fund manager that the S&P 500 would outperform a portfolio of hedge funds over 10 years. Buffet won that bet by a landslide in 2018.America’s Enduring Advantages

Warren Buffet has always favored low-cost index funds for investors. Back in 2008, he even placed a million-dollar bet against a hedge fund manager that the S&P 500 would outperform a portfolio of hedge funds over 10 years. Buffet won that bet by a landslide in 2018.America’s Enduring AdvantagesPaul Kennedy’s book offers a sweeping analysis of why some nations thrive while others falter. Written decades ago, Kennedy highlights several advantages intrinsic to America's rise: its geographical isolation, abundant natural resources, and ability to attract talent worldwide. These factors have fostered economic stability and an unparalleled environment for innovation and entrepreneurship.

As I read Kennedy’s observations, I was struck by their relevance. The US still enjoys a robust demographic profile, technological leadership, and deep capital markets that few other countries can rival. Despite global economic shifts and rising competition from different nations, the US remains the birthplace of industry-leading companies, from tech giants like Google and Microsoft to emerging players in artificial intelligence. This relentless ability to innovate and dominate global markets feeds directly into the S&P 500’s performance, making it a uniquely compelling investment vehicle.

The Genius of Index InvestingIn an article I wrote some time ago, I argued that index investing offers an elegant solution for managing the ever-changing tides of market relevance. The S&P 500, in particular, excels at this. By design, the index automatically renews itself, adding rising stars while shedding companies that can no longer compete. This natural selection mechanism ensures that investors are continuously exposed to the strongest players in the market without needing to manage their portfolios actively.

Consider this: companies like Kodak and Sears once dominated the American economy, but their eventual decline did not weigh down the S&P 500. The index replaced them with new giants like Amazon () and Palantir (). This adaptability makes the S&P 500 not just a reflection of the American economy but its engine, constantly evolving to capture the opportunities of tomorrow.

Comparing to Other CountriesUntil six years ago, I invested almost exclusively in Asian stocks. While I did well and had the homegrown advantage of familiarity, I could have done much better if I had broadened my universe to include American companies. While many countries and indices may appear promising, they often lack the structural advantages that underpin the S&P 500’s long-term success. Over the last few decades, most groundbreaking companies have emerged from the US. Whether it is OpenAI revolutionizing natural language processing or Tesla redefining the automobile, America has proven to be the global epicenter of innovation.

Since moving to the United States in 2021, I have found myself deeply influenced by its environment of creation, learning, and innovation. There is an infectious energy here—a collective belief that the next big idea is always within reach. This atmosphere inspired me to co-found Psyntel, a software company that leverages AI to support mental health professionals and to begin writing my first book, Suit Yourself. These ventures, alongside a vastly different investment focus, represent a significant shift from my life while living in Asia, underscoring how uniquely fertile the US is for innovation and ambition.

ConclusionInvesting in the S&P 500 is not just about betting on the U.S. economy; it is about investing in a system that has consistently adapted, innovated, and thrived. As Paul Kennedy’s historical insights remind us, America’s enduring advantages provide a strong foundation for its economic dominance and, by extension, the strength of the S&P 500. Combine this with the index’s built-in adaptability, and you have an investment vehicle that has stood the test of time without any sign of slowing down.

Follow me on X.com (formerly Twitter) @ConsumeOwnTech

Thanks for reading Consume Your Own Tech Investing! Subscribe for free to receive new posts and support my work.

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.November 5, 2024

Reflections on a Year of Change: Family, Startup, Portfolio Changes, and a New Book

It has been quite some time since my last post on October 24, 2023, when I reiterated my confidence in Spotify () following their Q3 results. Back then, Spotify’s share price was under $160, and now it is on the brink of breaking $400—a gratifying development.

In the summer of 2022, I shared three picks that I believed could become the next Amazon and Spotify () was one of them. The other two were Palantir (picked by my friend John Nardi, who made an excellent call) and Block (), which is still grappling with slower growth in its merchant segment.

Looking back, I wish I had followed John’s lead on Palantir !

Portfolio: Then and Now—A Shift Toward StabilityAs a Type Five, I know I can be wrapped up in my head and get swayed by insular thinking. My worst investment mistakes have been in the small to mid-cap sector, representing the greatest allure to my intellectual side, which wants to beat the market. There, I get excited by the idea of uncovering the next big thing and frequently ignoring (or underestimating) the immense execution risks that come with trying to crossing the chasm. Maturing into an established business—think Starbucks () and ServiceNow ()—is a gravity-defying act that only a few can manage. Many do not make it.

When my husband and I decided to purchase a larger home late last year, it became a forcing function to reassess my portfolio. Sky-high mortgage rates made it clear that we would need to reduce borrowing, which meant selling some stocks to fund the purchase. That decision led me to re-balance my portfolio toward a more concentrated, large-cap approach.

So, walking the talk, I let go of several small-cap names to release funds and concentrated my portfolio on larger companies.

Small-cap positions sold in late 2023 and early 2024 include:

Elastic ()

Sprout Social ()

Trupanion ()

Endava ()

In hindsight, selling some of these small-cap names felt like dodging a few bullets, especially with stocks like Endava () and Sprout Social (), which I exited near their highs. On the other hand, selling Trupanion (), a position I had held well before the pandemic and has since doubled my disposal price, felt painful.

Ultimately, shifting my focus to a smaller group of larger-cap, proven names—and balancing this with increased homeownership—was compelled by a mix of lifestyle choices and a growing recognition of my biases as a Type Five investor. I still hold some smaller companies outside of the S&P 500, but with a more cautious approach to avoid the intellectual allure these stocks can have for my personality.

I will continue to share insights on managing portfolio changes, specifically how to recognize and mitigate biases, blind spots, and mental traps associated with personality-driven investing.

Startup, Family, New Home, Non-Profit, and…Since mid-last year, life has introduced me to exciting new roles and responsibilities. I co-founded Psyntel, a mental health software company, with my good friend Sam Fargo, whom I got to know through my writing endeavors. At Psyntel, we are working to bring AI-driven insights to the mental health field, and we are thrilled to be approaching our commercial launch in the coming weeks.

On another front, I joined P.E.A.C.E, a non-profit that offers pro bono therapy to Asian Americans and Pacific Islanders in Georgia. Initially, I started as a volunteer advisor and recently joined the board. Our work in the AAPI community is incredibly fulfilling, providing meaningful ways to support those in need.

And perhaps the biggest change: On February 4, 2024, I became a father through gestational surrogacy. It has been a transformative journey, and I am immensely grateful for this experience.

…an Upcoming Book!In the early days of 2021, I first considered writing a book—and I am thrilled to share that this vision is coming to life. My debut book, Suit Yourself, is set to be published by Köehler Book in the fall of 2025. The book will explore personalized investing strategies through the Enneagram, blending finance, psychology, and practical insights to help readers find an approach that reflects their true selves. This is a passion project and I am excited to bring this closer to fruition.

Stay tuned for more updates!

Thanks for reading Consume Your Own Tech Investing! Subscribe for free to receive new posts and support my work.

ConclusionAs I step back into sharing my thoughts here, I am excited to bring a renewed focus and share how my perspectives—and portfolio—have evolved. Whether it is refining my Type Five approach to investing, managing new roles in family and business, or preparing for the release of Suit Yourself, each step has been a learning experience. I hope to bring you along on this journey, sharing insights that combine personal finance, psychology, and tech investing.

I look forward to reconnecting with you all here and in future posts, which will be monthly and at the start of each month. Be sure to subscribe and follow along as I share portfolio updates, reflections on my investing mindset, and, of course, previews of my upcoming book!

Follow me on X.com (formerly Twitter) @ConsumeOwnTech

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.