Benjamin Tan's Blog, page 2

October 24, 2023

REPOST (Spotify): Emerging Public Companies: Next Amazons (Part Four of Four)

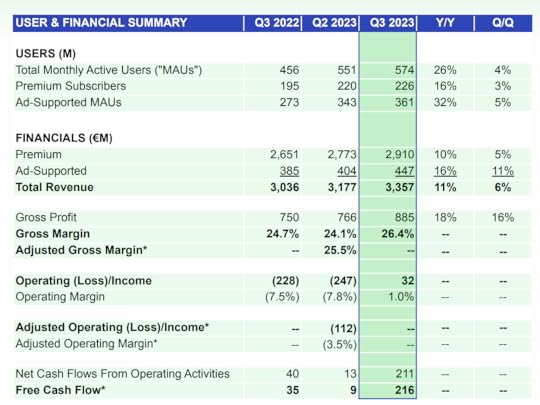

Below is a repost of my first Spotify () article I wrote in 2022. With the release of Q3 2023 results, this streaming giant is heading toward sustained profitability and a year-end subscriber base of 600 million.

Could Spotify be finally due for rerating? Read on below—I believe my original thesis has been reinforced by the latest quarter.

**************

(August 2022)

Spotify has been a difficult investment for many, simply because current share price is even lower than its direct listing reference price of $132 back in 2018. It is especially confounding, since as a business, Spotify is expected to more than double its 2018 revenue by 2022.

Investor Day 2022: More than Just Music DistributionAmidst bearish market sentiment, Spotify hosted an investor day on June 8, 2022. Daniel Ek, co-founder and CEO, outlined how far its business has evolved since it became a public company. From its origins as a passive music distributor subject to the whims of major record labels, Spotify is now the world’s largest demand service platform and single most important revenue contributor to the recording industry. Not only that, with over 430 million users generating a plethora of first party data, Spotify offers valuable tools for labels to drive engagement for their artists. This has enhanced Spotify’s bargaining position vis-à-vis record labels as well as the profitability of its music business, similar to how Sponsored Products boosted Amazon’s e-commerce clout and margins.

Additional monetization channels have also been initiated to not only benefit artists, but also Spotify’s bottom-line:

“Beyond music, touring and merchandise are significant pieces of the equation. So we’re building solutions for both artists and fans, all while growing new lines of profit for artists and Spotify. We’ve integrated listings from top ticketing platforms to sell concert tickets at scale within Spotify. We’ve also enabled artists to sell merch, vinyl, and other offerings directly to fans via their Spotify artist pages through a custom integration with Shopify. And we’ve continued to make great progress with our Fans First program, which uses Spotify data to identify and reward the most passionate fans with exclusive offers, like advance access to concert tickets, exclusive merchandise, or invite-only events. To date, the program has generated more than $300 million in revenue for the music industry”

Type your email address below to get more ideas and articles straight to your inbox

Podcasting – Second Core BusinessSpotify has become the number one podcast platform – surpassing Apple – since starting the business from scratch back in 2019. Today, there are more than 4 million podcasts available on Spotify, up from just 500,000 in 2019. Podcast revenue grew tenfold over the same period.

Podcast is expected to be a gamechanger in the coming years. While the most relevant music content – especially back catalogue – is owned by major record labels, key podcast content is either exclusive to Spotify or user-generated by disparate content creators. Spotify wants to reach a lot more independent voices in the coming years, aiming to become the YouTube of audio content to aggregate both supply and demand. With celebrity-driven podcast deals making headlines, more creators have joined the Spotify platform to reach its vast audience, much like how third-party sellers continue flocking to Amazon to reach its insatiable customers. Advertisers have followed suit – total advertising dollars are likely to hit almost $2 billion in 2022, thanks in part to the hypergrowth in podcast revenue:

Daniel Ek – The Man who beat Apple, Google, and Amazon in the Race for Audio Dominance“In 2021, we generated close to €200 million in podcast revenue. We expect this to increase materially in 2022, and going forward, we believe podcasting in itself will be a multibillion-euro business for Spotify”

Behind all these pivots is Daniel Ek, a patient and strategic thinker who has outmaneuvered all attempts by Apple to crush the service. To understand Ek, I would recommend reading The Spotify Play.

Similar to Jeff Bezos, Ek is willing to play the long game – invariably at the expense of short-term profits – in establishing new business lines and doubling down on winning initiatives. To accelerate its podcasting business, Spotify has spent considerable sums acquiring Gimlet Media, The Ringer, Megaphone, and most famously, a rumored $100 million for the exclusive rights to stream The Joe Rogan Experience. Impressively, they have been carefully funded by internal cashflows from the music business, without raising equity or debt, aside from an opportunistic $1.5 billion convertible bond issuance in early 2021:

“We have generated positive operating cash flow in each year, including more than €1 billion in cumulative free cash flow—even while investing into new areas like podcasting. This has enabled us to finance more than €900 million in mergers and acquisitions while returning more than €600 million in capital to date over the past four years”

So far, the strategy appears to be working, judging by the engagement levels of podcast listening on its platform, as well as the flywheel spinning content creation, audience attraction and advertiser interests.

During the investor presentation in June 2022, Ek declared Spotify’s 2030 revenue target to be $100 billion, nearly 10 times more than what 2022 is expected to reach. Not only that, Ek aims to expand profitability alongside, demonstrating his confidence in Spotify’s powerful operating leverage as it scales:

“From everything I see, I believe that over the next decade, we will be a company that generates $100 billion in revenue annually and achieves a 40% gross margin and a 20% operating margin”

Spotify has come a long way, and judging by the Amazonian moves made in expanding its audience and reach, it should be on the playlist of growth investors seeking the next big thing.

Drop a comment if you have any other names on your mind.

(Author is long $SPOT)

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

Latest Top 10 positions in my high conviction portfolio that combines value with growth stocks

Book recommendations on investing, consumer, and technology sectors

Articles are delivered to your inbox on Tuesdays

Preview of upcoming articles

Follow me on Twitter @ConsumeOwnTech and Commonstock @ConsumeOwnTech

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.October 3, 2023

Tesla: Key Broker Takes on Q3 Production and Deliveries

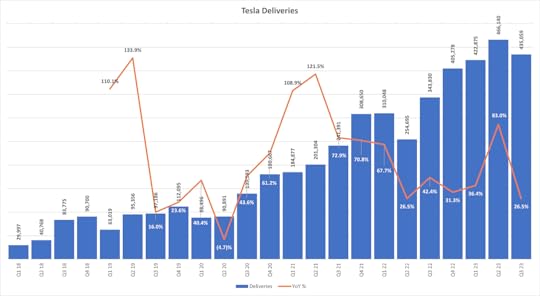

Tesla produced over 430,000 vehicles and delivered over 435,000 cars in Q3 2023. Numbers came in lower than expected, despite advanced notice from management on the planned factory downtimes, mainly due to the Model 3 refresh during Q3.

Year-on-year growth rates amounted to 18% and 27%, respectively. Under current economic conditions, these numbers are impressive, albeit below their 50% CAGR long-term guidance and Q2 levels.

FY 2023 production is still targeted at 1.8mn. I wonder if Elon will repeat his aspiration for 2mn on Oct 18, when Tesla hosts its Q3 earnings call. The descriptor “around 1.8 million” in yesterday’s announcement is causing some concern that Tesla may fall short of the baseline volume guided.

More importantly, what will FY 2024 look like? On the one hand, Cybertruck will be a meaningful addition, with pre-orders already exceeding 2mn; conversely, much will also depend on the demand environment next year.

See Tesla’s quarterly delivery trends since Q1 2018:

Q3 delivery was a rare sequential decline, partly due to the Model 3 refresh—customers holding back from ordering the prior model—and the lower volume of the much more expensive Model S/XMargins, Margins, Margins: Now What?

Q3 delivery was a rare sequential decline, partly due to the Model 3 refresh—customers holding back from ordering the prior model—and the lower volume of the much more expensive Model S/XMargins, Margins, Margins: Now What?With lower production volume this quarter, Tesla would have had to extract greater cost discipline in Q3 to maintain their 18% automotive gross margins (excluding regulatory credits) from Q2.

This appears unlikely, especially given more price cuts in recent months.

Nevertheless, Tesla remains fundamentally well-positioned in the electric vehicle race—see below a past article I wrote about its enduring competitive advantages:

Further Color from Goldman, Deutsche Bank, and Morgan Stanley ResearchI have compiled some snippets from the above research houses to provide additional color on Q3 production and delivery numbers and what they may imply:

From Goldman Sachs (Oct 2): “3Q23 deliveries first take”

While we reduced our 3Q23 volume estimate in our 9/17 note to 460K to better reflect what we believed was lower S/X demand and the impact of the changeover for the Model 3 Highland, 3Q23 deliveries were lower than we had expected…We believe key debates will now shift to:

1) What is the margin impact in 2H23 from the reduced production levels (recall that last quarter Tesla's non-GAAP automotive gross margin ex. credits was 18.1%, and the lower production/deliveries and price cuts imply 3Q will be down sequentially).

2) To what extent new models (Model 3 Highland, Cybertruck) can help drive stronger volumes in 4Q23 and 2024. Consensus per Visible Alpha Consensus Data is at 499K in 4Q and 2.358 mn in 2024. We model a pick-up to 494K in 4Q and 2.275 mn in 2024, in line to modestly below the Street.

3) Price-cost in 2023 and 2024. We expect Tesla to benefit from lower costs in 4Q23/2024, although we believe that it may further lower prices to drive volume next year and mitigate margin improvement.

4) Tesla's opportunity and timelines with technology and new products, including FSD. We see Tesla as a leader in autonomy technology, although we think it will take time for Tesla to be able to offer an eyes-off and hands-off (L3/4) capable vehicle.

From Deutsche Bank (Oct 2): 3Q Deliveries a slight miss, expect large risk to 2024

To us, we think the more meaningful downside risk is to 2024 consensus due to limited volume growth next year and minimal Cybertruck contribution…we continue to see larger risk to downside to expectations for 2024 on both growth and earnings, as Tesla indicated recently at our DB IAA investor meetings that it is no longer planning to expand output at Austin and Berlin factories to 10k per week, providing only incremental volume from these two factories next year as well as minimal contribution from the Cybertruck with slower and more complex ramp-up of the vehicle. Our base case is for Tesla to guide to ~2.1m deliveries next year, vs. current Consensus of 2.3m units.

From Morgan Stanley (Oct 2): 3Q Delivery Miss + A Warning On ‘Too Fast’ EV Adoption

While the company cited disruption related to planned downtime for factory upgrades (Model 3 refresh) we believe investors will remain cautious on the near-term progression of price (downward) as supply of EVs exceeds demand in key pockets. Our current forecasted US GAAP OP margin (SBC burdened) progression for Tesla in 3Q and 4Q is 9.6% and 9.8% respectively. This compares to 10.5% in 1H23 and 16.8% in FY23. Looking ahead to FY24, we forecast approx. 33% growth in deliveries to 2.48mm units. On our calculations, removing 100k units from this figure at a 30% decremental margin would be worth between 9 and 10% of total company GAAP OP.

(Author is long )

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

Latest Top 10 positions in my high conviction portfolio that combines value with growth stocks

Book recommendations on investing, consumer, and technology sectors

Articles are delivered to your inbox on Tuesdays

Preview of upcoming articles

Follow me on Twitter @ConsumeOwnTech and Commonstock @ConsumeOwnTech

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.September 19, 2023

Disney: In the Midst of Reorganization

Recent rumors of Disney () selling a chunk of its linear assets have generated a flurry of new headlines as the 100-year-old company continues reorganizing its cost structure, DTC strategy, and leadership.

From Reuters (September 15, 2023):

Media entrepreneur Byron Allen has made a $10 billion bid to buy Walt Disney's ABC television network and assets including the FX and National Geographic cable channels, a spokesperson for Allen said on Friday.

The Walt Disney Company may soon bid ABC goodbye after owning and extracting plenty of profits from the network since 1995

The Walt Disney Company may soon bid ABC goodbye after owning and extracting plenty of profits from the network since 1995Since Bob Iger returned as CEO in November 2022, many speculate his next moves. What will he do differently in his second swing at the job? Some journalists even wonder if he will sell Disney to Apple!

Selling Linear to Free up Balance Sheet?The monetization move is almost inevitable, given Disney’s plan to buy out Hulu this year. Based on the put-call agreement (signed in May 2019) between Disney and NBC Universal, Hulu is valued at a floor of $27.5bn. This implies a potential upfront cash payment of $9bn (minimum) by Disney for the remaining 33% stake unless NBC Universal takes non-cash consideration or accepts some form of deferred payment.

From Reuters (September 6, 2023):

Comcast has moved up the date for the sale or purchase of its remaining stake in Hulu to Disney to Sept. 30 this year, CEO Brian Roberts said on Wednesday…the companies will go through an appraisal process to determine the value of Hulu, and that process appraises “a lot more than Hulu”

Between the potential selling price of ABC and the buyout quantum for Hulu, Disney will not be improving its balance sheet unless it can shift some of its existing $47bn debt along with the ABC assets.

Nevertheless, this asset swap will remove the uncertainty surrounding how Disney will fund the Hulu purchase, when its balance sheet is already laden with acquisition debt from the 21st Century Fox and COVID-19-related borrowings. In addition, Disney promises to resume paying dividends by this year after suspending them since May 2020. The amount will be small relative to its cashflows, but it will welcome dividend-yielding only funds back to its institutional shareholder manifest.

Disney Stock: Been a Wild RideSince co-writing “Disney 2.0: Iger to Reclaim the Magic?” on this blog in December 2022, the stock has not moved at all, which frustrates any shareholder. After the initial excitement surrounding Iger’s return faded, markets have focused more on the faults of its DTC pivot—cash burn, subscriber loss, dilution, competition, Hulu overhang—than the strength of its Parks, franchise value, consumer business, and its still-powerful ESPN network.

I believe the sum-of-the-parts valuation in “Disney 2.0: Iger to Reclaim the Magic?” has not aged. Current share price does not appear to ascribe any value to its DTC business, which should pivot to profitability sooner than later.

Disney has been a wild ride for shareholders who have been holding the stock since pre-pandemic days. Share price peaked at almost $200 before making its ways down to the lows last seen during the height of COVID-19.

We shall see how the ABC-Hulu moves pan out in the coming months, as this will be the first real strategic pivot since Iger took back control—more so than the changes to management and cost structures in the last year.

(Author is long )

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

Latest Top 10 positions in my high conviction portfolio that combines value with growth stocks

Book recommendations on investing, consumer, and technology sectors

Articles are delivered to your inbox on Tuesdays

Preview of upcoming articles

Follow me on Twitter @ConsumeOwnTech and Commonstock @ConsumeOwnTech

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.