Steve Bull's Blog, page 227

May 20, 2022

Half a million Indians flee floods in northeast brought by rain

GUWAHATI, India, May 18 (Reuters) – More than 500,000 people have fled their homes in India’s northeastern state of Assam to escape heavy floods triggered by pre-monsoon rains that drowned seven, authorities said on Wednesday, as they warned the situation could worsen.

One of the world’s largest rivers, the Brahmaputra, which flows into India and neighbouring Bangladesh from Tibet, burst its banks in Assam over the last three days, inundating more than 1,500 villages.

Torrential rains lashed most of the rugged state, and the downpour continued on Wednesday, with more forecast over the next two days.

“More than 500,000 people have been affected, with the flood situation turning critical by the hour,” Assam’s water resources minister, Pijush Hazarika, told Reuters, adding that the seven drowned in separate incidents during the last three days.

People disembark a boat after they were evacuated from a flooded village in Nagaon district, in the northeastern state of Assam, India, May 18, 2022. REUTERS/Anuwar Hazarika

People disembark a boat after they were evacuated from a flooded village in Nagaon district, in the northeastern state of Assam, India, May 18, 2022. REUTERS/Anuwar HazarikaSoldiers of the Indian army retrieved more than 2,000 people trapped in the district of Hojai in a rescue effort that continues, the state’s health minister, Keshab Mahanta, said.

Water levels in the Brahmaputra were expected to rise further, national authorities said.

“The situation remains extremely grave in the worst-hit Dima Hasao district, with both rail and road links snapped due to flooding and landslides,” said Assam’s revenue minister, Jogen Mohan, who is overseeing relief efforts there.

Cities elsewhere in India, notably the capital, New Delhi, are broiling in a heat wave.

Quick Shot Of Heat To Roast 100 Million People In Northeast

About 100 million people in the Northeast will be blasted with a quick shot of heat and humidity this Saturday and Sunday. High temperatures are expected to range between the upper 80s and mid-90s from Ohio to Washington, D.C. to Baltimore to Philadelphia to New York City.

AccuWeather meteorologists say some cities in the Mid-Atlantic and Northeast could see the hottest conditions since last August. In some metro areas, record highs for this time of year that have stood the test of time could be broken.

Daily record highs that have stood since the World War II and Great Depression eras will be challenged at a number of locations. At Philadelphia, temperatures could approach the record of 95 set in 1934 on Saturday. In both Raleigh, North Carolina, and Albany, New York, the daily records for Saturday, May 21, were set in 1941. The record in Raleigh is 96, while the record in New York’s state capital is 91. -AccuWeather

“Early season heat with likely record high temperatures will spread from the South into the Ohio Valley, Mid-Atlantic, and Northeast on Friday, Saturday, and perhaps Sunday,” the National Weather Service said. The agency has issued a Heat Advisory along the I-95 corridor in the Northeast.

It’s the first time since 2006 that a Heat Advisory for New York City has been issued for this time of year. Tomorrow, high temps in Central Park could reach 93 degrees, tying a record for the date. The quick blast of heat comes as temperatures in the urban park between the Upper West and Upper East Sides of Manhattan haven’t even breached 80 degrees yet this year.

“The brunt of it should just be a one-day thing … at the minimum, we will be close to all the records in NYC,” Matt Wunsch, a weather service meteorologist on Long Island, told Bloomberg.

…click on the above link to read the rest of the article…

Rabobank: We Are In An Undeclared Global Economic War, And Worldwide Famine Is Coming

How Dare You

Markets whipsawed yesterday after bad US initial jobless claims and Philly Fed data, with stocks down and bond yields also lower, as was the US dollar. Commodities were a mixed picture, however, and oil prices rose around 5% again from its intra-day low to close over $111. Referring again to a bond yields/commodities matrix, that suggested the Fed falling behind the curve, not getting ahead of it, in crushing demand to fit restrained supply. Lo and behold, we then got the headline, ‘Fed’s George Says ‘Rough’ Market Won’t Alter Fed Tightening Plan’. So, how far down can bond yields go when actual Fed Funds are still going up? Likewise, how far down can the US dollar go when the 1-month Treasury bill is 41bps, and trending lower, when Fed Funds is 100bps, and trending higher – which screams ‘Eurodollar collateral shortage’?

As I tried to flag yesterday, those (valid) questions are desperately small beer in the face of what now confronts us globally – or at they should be. That is because The Economist’s front page and main story this week is ‘The coming food catastrophe’, replete with a graphic of sheaves of wheat made up of human skulls. The summary concludes,

“The high cost of staple foods has already raised the number of people who cannot be sure of getting enough to eat by 440m, to 1.6bn. Nearly 250m are on the brink of famine. If, as is likely, the war drags on and supplies from Russia and Ukraine are limited, hundreds of millions more people could fall into poverty. Political unrest will spread, children will be stunted, and people will starve .”

…click on the above link to read the rest of the article…

China, U.S. lead rise in global debt to record high $305 trillion – IIF

A view of the city skyline in Shanghai, China February 24, 2022. Picture taken February 24, 2022. REUTERS/Aly Song

NEW YORK, May 18 (Reuters) – The world’s two largest economies borrowed the most in the first quarter as global debt rose to a record above $305 trillion, while the overall debt-to-output ratio declined, data from the Institute of International Finance showed on Wednesday.

China’s debt increased by $2.5 trillion over the first quarter and the United States added $1.5 trillion, the data showed, while total debt in the euro zone declined for a third consecutive quarter.

The analysis showed many countries, both emerging and developed, are entering a monetary tightening cycle -led by the U.S. Federal Reserve- with high levels of dollar denominated debt.

Global debt totals

Global debt totals“As central banks move ahead with policy tightening to curb inflationary pressures, higher borrowing costs will exacerbate debt vulnerabilities,” the IIF report said.

“The impact could be more severe for those emerging market borrowers that have a less diversified investor base.”

The yield on the benchmark 10-year Treasury note has risen some 150 basis points so far this year and earlier this month hit its highest since 2018.

SOVEREIGNS BEWARE

Corporate debt outside banks and government borrowing were the largest sources of the increase in borrowing, with debt outside the financial sector rising above $236 trillion, some $40 trillion higher than two years ago when the COVID-19 pandemic hit.

Government debt has risen more slowly in the same period, but as borrowing costs rise sovereign balance sheets remain under pressure.

Government financing needs

Government financing needs“With government financing needs still running well above the pre-pandemic levels, higher and more volatile commodity prices could force some countries to increase public spending even further to ward off social unrest,” said the IIF.

…click on the above link to read the rest of the article…

Washington state gas stations run out of fuel, prep for $10 a gallon

Gas stations in Washington state are resetting their price boards to accommodate double digits in preparation for fuel prices potentially reaching $10 a gallon, according to a report.

The move comes as several gas stations in the Evergreen State ran out of fuel, the Post Millennial reported.

At the 76 gas station in Auburn, about 30 miles south of Seattle, gas pumps were reprogrammed so the display could indicate a price of at least $10 a gallon.

The displays were limited to single digits as recently as March, but the surging price of gas has led to the change.

A 76 spokesperson told the Post Millennial that the change did not necessarily mean the company was predicting gas prices would reach $10 a gallon.

The station in Auburn also sells race fuel, which is more expensive than the fuel that is used by ordinary citizens.

Race fuel costs more due to the high-octane, premium fuel that is required to enable the engine to have a higher compression ratio, giving it a more energetic explosion and improving the performance of turbocharger and supercharger engines.

Gas stations in Washington state have adjusted their pumps to display double-digit gas prices, according to a report.Bloomberg via Getty Images

Gas stations in Washington state have adjusted their pumps to display double-digit gas prices, according to a report.Bloomberg via Getty Images

Motorists in the Evergreen State are also reporting that some gas stations have run out of fuel.AP

Motorists in the Evergreen State are also reporting that some gas stations have run out of fuel.APWashingtonians are also having to contend with gas stations that are running out of fuel.

Motorists who drive up to gas pumps in Kennewick, Pasco and West Richland are met with notes indicating that the station does not have any fuel to sell — except diesel.

On Facebook, local residents are reporting more than 10 gas stations that are out of fuel.

…click on the above link to read the rest of the article…

Supply Chain Congestion Set To Worsen As Container Rates Rebound On Easing China Lockdowns

Update (Friday): The locked-down megacity of Shanghai eased pandemic restrictions this week and will see public transportation networks reopen as soon as Sunday. After two months, the city of 26 million people appears to have contained the spread of COVID-19 via China’s zero COVID policy.

Restarting Beijing could be problematic for the rest of the world. We laid this out Thursday. The city’s lockdown and reduced port capacity created a massive backlog of products that need to be loaded on container ships and hauled westward.

Maersk and Goldman Sachs (in two separate reports) outlined the immediate restart of Beijing would create renewed global supply chain congestion.

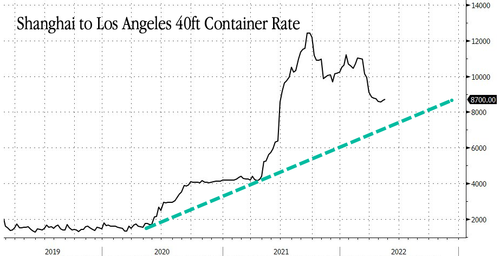

We told readers to monitor trans-Pacific container freight rates closely as a proxy for China’s restart.

New data from Fearnley Securities indicates container rates have finally rebounded after slumping for much of this year. This is an early indication that economic activity in Shanghai could be increasing as pandemic restrictions ease.

Fearnley’s Peder Nicolai Jarlsby expects a surge in freight volumes as container rates increase. He added this would be a bullish development for shares of A.P. Møller – Maersk A/S, the world’s largest container shipping company by capacity, and shipper Hapag-Lloyd.

Focusing on 40ft container freight rates on the Shanghai-Los Angeles shipping lane, prices have found higher lows and appear to be turning up after a 30% decline since peaking last September.

Goldman warned earlier this week: “We could see a resurgence of ship bottlenecks if sudden restarts in China lead to renewed sailings all at once.”

And if that’s the case, container rates for major shipping lines in the trans-Pacific region could increase more as shipping volumes surge. This would mean renewed supply chain congestion could hit US shores in late summer, perfect timing ahead of the US midterm elections.

…click on the above link to read the rest of the article…

Running On Empty

Well, we definitely seem to have passed a threshold of sorts. For most of the sixteen years since I started blogging, one of the things I had to point out constantly to my readers was the slow pace of historical change. Whenever I posted an essay on the twilight of industrial society, I could count on fielding at least one comment from a reader who expected the entire modern world to crash and burn in the next few months. I’d have to patiently remind them that Rome wasn’t sacked in a day—that it takes years of breathtakingly moronic decisions motivated by mindless greed, vicious partisan hatred, blind ideological dogmatism, and a total unwillingness to think about the long-term consequences of short-term decisions, to bring a civilization down.

Now of course all through the years while I was telling people this, decisions of the kind I’ve just described, guided by motives of the sort I’ve just characterized, were standard operating procedure throughout the industrial world. Those proceeded to have their usual effect. I still don’t expect modern civilization to crash to ruin in the next few months, but it’s reached the point that I no longer have to tell people that the Long Descent won’t show up as soon as they think. No, at this point it’s my ironic duty to suggest that they make whatever preparations they have in mind sooner rather than later, because the world shows no signs of waiting for them.

As I write this, the most obvious set of problems has to do with the economies of the United States and its client states. Those of my readers who follow financial media already know that signs of economic trouble are elbowing one another out of the way to get to the front pages……click on the above link to read the rest of the article…

May 18, 2022

Advancing interconnected solutions to the food, energy and finance crises

The governing body of the United Nations Food and Agricultural Organization (FAO) met in Rome on April 8, 2022 in an Extraordinary Session to examine the “impact of the Ukraine-Russia conflict on global food security and related matters under its mandate” and advise on how it should proceed. Meanwhile, just two days earlier, the Civil Society and Indigenous People Mechanism (CSIPM) at U.N. Committee on World Food Security (CFS) called for an Extraordinary Plenary Session of the CFS.

We must consider these developments along with a new initiative from the U.N. and against the background of the FAO’s global food prices index reaching its highest level ever.

In response to the immediate crises provoked by the invasion of Ukraine by Russia, on March 14 the U.N. Secretary General (SG) António Manuel de Oliveira Guterres announced the establishment of the Global Crisis Response Group on Food, Energy and Finance (GCRG). On April 5, he released the GCRG’s initial recommendations. According to remarks made by the U.N. SG at the U.N. Security Council Meeting, these initial recommendations are for the consideration of the member states, international financial institutions and others. In brief, they are:

On food: To avoid the risk of hunger and famine spreading further, the GRCG urges all countries to keep markets open, resist unjustified and unnecessary export restrictions, and make reserves available to countries at risk of hunger and famine.On energy: While some countries’ plans to release strategic reserves of fossil fuels in an attempt to reduce their dependence on Russian stocks could help ease the current crisis in the short term, the only medium and long-term solution is accelerated deployment of renewable energy, which is not impacted by market fluctuations. Renewable energy deployment is the best option in most cases and will allow the progressive phaseout of coal and all other fossil fuels.…click on the above link to read the rest of the article…

Report: US Gas Prices Could Double Soon, Amid Potential Supply Shortage

Prices for gas at an Exxon gas station on Capitol Hill are seen March 14, 2022 in Washington, DC. (Photo by Win McNamee/Getty Images)

Prices for gas at an Exxon gas station on Capitol Hill are seen March 14, 2022 in Washington, DC. (Photo by Win McNamee/Getty Images)Some gas stations across the country are already bracing for the Next Big Thing involving surging fuel prices, namely the price per gallon potentially exceeding $10.

For other stations, however, there might be no product left to sell at the pumps.

Throughout eastern Washington, according to a Post Millennial report, gas stations are running out of fuel.

In the Tri-Cities region of Kennewick, Pasco, and West Richland, customers are reportedly pulling up to pumps … only to find no gas available for purchase.

In fact, a local Facebook group has already identified 10 state stations that are currently out of fuel.

This current shortage mainly accounts for regular unleaded and premium gasolines; but the diesel supply is also in short supply, according to reports.

With the supply seemingly shrinking, and demand going way up, that naturally leads to higher fuel prices.

Privacy: We never share your email address.A “76” gas station in Auburn, Washington has already begun reprogramming its pumps to “make room” for double-digit pricing, according to the Post.

In the report, a 76 spokesperson confirmed the national gas chain was reprogramming the functionality of its pumps, while also falling short of predicting gas prices would rise that high.

Back in January 2021, the final month of former President Donald Trump’s tenure in the White House, the average price of gas was $2.41 per gallon — with some states even reporting gas at less than $2 per gallon.

In the aftermath, though, coinciding with President Joe Biden taking office, fuel prices have skyrocketed in America.

…click on the above link to read the rest of the article…

May 17, 2022

The Failure of Central Banking: Politics

The seal of the Federal Reserve on a U.S. banknote. (Mandel Ngan/AFP/Getty Images)The Failure of Central Banking: Politics

The seal of the Federal Reserve on a U.S. banknote. (Mandel Ngan/AFP/Getty Images)The Failure of Central Banking: PoliticsThe view was generally held that centralization of banking would inevitably result in one of two alternatives: either complete government control, which meant politics in banking, or control by ‘Wall Street,’ which meant banking in politics.

– Paul Warburg, 1930

The idea of the central bank was born in the Middle Ages, when failures of the largest merchant banks of that era, founded by the Bardi and Peruzzi families, shocked the Italian City-State of Florence in 1343 and 1346. These financial crises gave birth to the idea that the commercial banking sector would need a “liquidity backstop,” i.e., an entity that could lend to private financial institutions in trouble. This was the original aim of central banks: to act as piggy banks for solvent commercial banks with temporary liquidity problems.

The first central bank that resembled the modern ones emerged in 1609, when the Dutch empire created an exchange bank, Wisselbank, to convert foreign coins into domestic currency. The central bank of Sweden, the Riksbanken, was created in 1668, and the Bank of England (BoE) in 1694. These were mostly servants of rulers and governments. But the really big twist came in 1914, when the U.S. Federal Reserve Bank was created. Its creation was mired with worries that it might socialize the economy.

To calm these fears, the power of the Fed to issue legal tender (currency) was restricted by both the “real bills doctrine” and the gold standard. The real bills doctrine stated that the Fed could only extend credit and thus increase the supply of money against collateral that already had established value through a “commercial transaction.” This meant that the value of the collateral could not be in the future effectively banning, e.g., the monetization of the federal debt…

…click on the above link to read the rest of the article…