Steve Bull's Blog, page 196

August 30, 2022

“Don’t Be Fooled By Recent Strength… A Post-Dollar World Is Coming”

The currency may look strong but its weaknesses are mounting…

This month, as the dollar surged to levels last seen nearly 20 years ago, analysts invoked the old Tina (there is no alternative) argument to predict more gains ahead for the mighty greenback.

What happened two decades ago suggests the dollar is closer to peaking than rallying further. Even as US stocks fell in the dotcom bust, the dollar continued rising, before entering a decline that started in 2002 and lasted six years. A similar turning point may be near. And this time, the US currency’s decline could last even longer.

Adjusted for inflation or not, the value of the dollar against other major currencies is now 20 per cent above its long-term trend, and above the peak reached in 2001. Since the 1970s, the typical upswing in a dollar cycle has lasted about seven years; the current upswing is in its 11th year. Moreover, fundamental imbalances bode ill for the dollar.

When a current account deficit runs persistently above 5 per cent of gross domestic product, it is a reliable signal of financial trouble to come. That is most true in developed countries, where these episodes are rare, and concentrated in crisis-prone nations such as Spain, Portugal and Ireland. The US current account deficit is now close to that 5 per cent threshold, which it has broken only once since 1960. That was during the dollar’s downswing after 2001.

Nations see their currencies weaken when the rest of the world no longer trusts that they can pay their bills. The US currently owes the world a net $18tn, or 73 per cent of US GDP, far beyond the 50 per cent threshold that has often foretold past currency crises.

…click on the above link to read the rest of the article…

European power prices shatter records as energy crisis intensifies

Power prices in Europe continue to smash records, intensifying the region’s energy crisis and fanning fears about access to electricity and heating as the weather begins to cool.

Russia is one of the world’s top producers of oil and natural gas.German power prices for next year, which are considered Europe’s benchmark, briefly jumped above €1,000 ($999.80) per megawatt hour on Monday before falling back to €840 ($839.69) per megawatt hour.“This is not normal at all. It’s incredibly volatile,” said Fabian Rønningen, a senior analyst at Rystad Energy. “These prices are reaching levels now that we thought we would never see.”

Prices have jumped since Russia’s Gazprom announced that it would shut down the Nord Stream 1 gas pipeline for three days starting Wednesday to perform maintenance work, reigniting fears that Moscow could completely shut off gas to Europe, which is racing to stockpile supplies ahead of the winter.

When the crucial pipeline went offline for repairs for 10 days in July, many policymakers feared it wouldn’t come back. When Russia did restart operations, flows were significantly reduced.

France’s nuclear sector, which provides about 70% of the country’s electricity, is also struggling with lower output, pushing up the country’s energy prices.

The Czech Republic announced Monday that it would convene an emergency meeting of Europe’s energy ministers in Brussels next week as the region hunts for solutions.

Businesses are concerned they may have to periodically halt operations over the winter if power is in short supply, while households could struggle to pay soaring heating bills. The fallout could trigger a deep recession.

There was some reason for optimism on Monday. German Economy Minister Robert Habeck said the country’s gas inventories were filling up, and the country won’t have to pay the high prices currently commanded by the market.

…click on the above link to read the rest of the article…

USA Henry Hub Gas Prices Climb to Record High

The commodity almost hit the $10 per MMbtu mark for the first time.

The commodity almost hit the $10 per MMbtu mark for the first time.U.S. Henry Hub prices have climbed to a record high, Rystad Energy analyst Lu Ming Pang highlighted in a market note sent to Rigzone on Wednesday.

The commodity almost hit the $10 per MMbtu mark for the first time, Pang outlined, adding that Henry Hub has typically averaged about $2 to $4 per MMbtu in previous summers.

“Prolonged abnormal weather and a high demand for LNG internationally has applied upwards pressure on prices,” Pang said in the note.

“Mild weather in the past week has reduced gas-for-power demand for cooling, resulting in 5.4 billion cubic feet per day (Bcfd) taken off gas demand. Given that domestic natural gas production has decreased by only 1.1 Bcfd, it appears that Henry Hub prices are responding to the reverberations in Europe, as compared to domestic fundamentals,” Pang added.

In the note, Pang highlighted that U.S. storage levels were at 2.519 trillion cubic feet full as of August 17, which he said is 367 billion cubic feet (Bcf) below the five-year average, and 296 Bcf below last year’s levels for the same period, “adding further pressure on refilling U.S. storages, which may keep Henry Hub prices high”.

At the time of writing, the Henry Hub price was trading at $9.39 per MMbtu. Henry Hub was trading under $4 per MMbtu at the start of the year.

In a separate market note sent to Rigzone last week, Pang said the heatwave across the U.S. in July had led to record Henry Hub prices of beyond $9.46 per MMBtu.

According to scientists from the U.S. National Oceanic and Atmospheric Association’s National Centers for Environmental Information, July 2022 will go down in the history books as the third-hottest July on record for the United States.

…click on the above link to read the rest of the article…

The End of Reason — Part 1

Light a torch, dark times ahead

Have we just passed Peak Rationality? Data Source: Google Search, red line: my extrapolation

Have we just passed Peak Rationality? Data Source: Google Search, red line: my extrapolationMost societies that have fallen before ours, have went through a similar pattern of rise, prosper and fall. Ours is no exception. Towards the end of their prosperous phase, brought about by discovering some rational rules on how things work (science) and developing an ability to exploit those observations (technology), societies tended to hit limits of all kinds, only to find themselves unwillingly embarking on their journey down.

One of the many limits is the limit to human rationality. We, modern humans, tend to think of ourselves as highly rational beings. We take pride in building systems based on scientific discoveries and manage them based on facts and figures — a method enabling further discoveries and ever newer innovations. The early successes of this approach led us to think: ‘hey, this could go on indefinitely!’ or ‘there is no limit to human ingenuity!’

Scientific progress has not only become the norm, but an outright expectation: that every ‘problem’ besetting humanity from climate change to hunger can and will be ‘solved’. We have lured ourselves into believing that since scientific discoveries and reason have brought us to our present state we could continue innovate our way out every situation.

This idea of infinite progress made us thinking in linear terms, where people imagine a straight line with a starting point back in the dark (dumb, stupid, aggressive etc) times of the stone age, with all its superstitions and ‘false beliefs’, swooshing all the way through history towards the shining victory of reason and knowledge — pointing eventually into infinity, and beyond.

…click on the above link to read the rest of the article…

August 28, 2022

Wave Of European Ammonia Plant Closures To Exacerbate Food Crisis

A wave of European ammonia-plant shutdowns due to soaring natural gas prices has resulted in a devastating fertilizer crunch, worsening by the week, with as much as 70% of production offline.

“Ammonia prices, though volatile, rose 15% in 3Q and could climb higher as Europe’s record gas prices curtail output and send ammonia producers to the global market in search of replacement supplies to run upgrade facilities — with winter still around the corner,” Bloomberg Intelligence’s Alexis Maxwell wrote in a note.

As of Friday, 70% of capacity is offline across the continent, according to Fertilizers Europe, representing top regional producers.

“The current crisis begs for a swift and decisive action from EU and national policymakers for both energy and fertilizer market,” Jacob Hansen, director general of Fertilizers Europe, said in a statement.

Producers from Norway’s Yara International ASA to CF Industries to Borealis AG recently reduced or halted production because European NatGas prices hit a record high of 343 euros per megawatt hour, making it uneconomical to operate.

“We confirm we are reducing and stopping production of some fertilizer plants in the different EU sites and this for economic reasons,” a spokesperson for Borealis AG said.

Europe’s benchmark NatGas price soared nearly a third this week as Russian supplies to Europe via Nord Stream 1 pipeline have been reduced to 20% over the summer and face a temporary halt on Aug. 31 for three days.

The region’s fertilizer industry association warned the energy crisis is rippling across many industries and could heavily impact the food industry.

“We are extremely concerned that as prices of natural gas keep increasing, more plants in Europe will be forced to close.

…click on the above link to read the rest of the article…

“This Is Beyond Imagination”: Polish Homeowners Line Up For Days To Buy Coal Ahead Of Winter

Several weeks ago we reported that amid Europe’s mindblowing gas and electricity prices, Deutsche Bank predicted that a growing number of German households will be using firewood for heating, a forecast which appears to have become self-fulfilling as German google searches for firewood (“brennholz”) had since exploded off the charts:

But while Germans are still “searching” merely in the virtual realm, for countless Poles the search is all too real.

According to Reuters, with Poland still basking in the late summer heat, hundreds of cars and trucks have already lined up at the Lubelski Wegiel Bogdanka coal mine, as householders fearful of winter shortages wait for days and nights to stock up on heating fuel ahead of the coming cold winter in queues reminiscent of communist times.

Artur, 57, a pensioner, drove up from Swidnik, some 30 km (18 miles) from the mine in eastern Poland on Tuesday, hoping to buy several tonnes of coal for himself and his family.

“Toilets were put up today, but there’s no running water,” he said, after three nights of sleeping in his small red hatchback in a crawling queue of trucks, tractors towing trailers and private cars. “This is beyond imagination, people are sleeping in their cars. I remember the communist times but it didn’t cross my mind that we could return to something even worse.”

In Poland, where coal is king, dozens are lining up at the Lubelski Wegiel Bogdanka coal mine, waiting for days and nights to stock up on heating fuel. Read more: https://t.co/jVGwSEfLam pic.twitter.com/zZV3vtzEQk

— Reuters Business (@ReutersBiz) August 27, 2022

…click on the above link to read the rest of the article…

What Will An EU Economic Collapse Look Like?

Saudi Prince Delivers a Message About the Second Cold War

Saudi Prince Abdulaziz bin Salman (ABS) said this week that OPEC+ may need to cut oil production. This may be necessary, he said, to correct problems in the market because “the paper and physical markets have become increasingly more disconnected.”

This is rhetorical theater. It has no real basis is fact. But that’s not what this is really about.

This is about the second Cold War to create new world order.

In a written statement to Bloomberg, ABS stated,

The paper oil market has fallen into a self-perpetuating vicious circle of very thin liquidity and extreme volatility undermining the market’s essential function of efficient price discovery.

–Abdulaziz bin Salman

It is true that volatility has been extreme since the Russian invasion of Ukraine in late February, 2022 but that was nearly six months ago. The worst of the volatility ended in April so the timing of ABS’s comments makes little sense based on oil-market technical concerns.

Liquidity and volatility are inversely related. When volatility is high, investors are reluctant to invest in futures contracts. That’s because the price variance is too high to make manage risk. With limited capital flowing in and out of oil markets, it is difficult to convert an asset/contract into cash. High volatility begets low liquidity.

ABS’s distinction between the futures (paper) and physical (spot) markets does not survive the light of day.

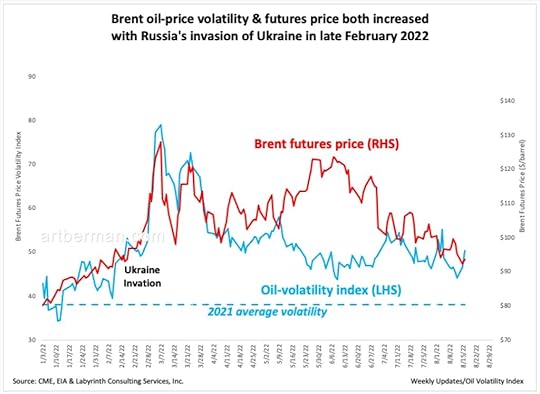

Figure 1 shows Brent futures price (red), futures price volatility (blue) and 2021 average price volatility (dashed blue). Both price and price volatility increased after Russia’s invasion of Ukraine in late February of 2022. Volatility decreased in April but has not returned to the pre-invasion 2021 volatility average.

Figure 1. Brent oil-price volatility & futures price both increased with Russia’s invasion of Ukraine in late February 2022. Source: CME, EIA & Labyrinth Consulting Services, Inc.

Figure 1. Brent oil-price volatility & futures price both increased with Russia’s invasion of Ukraine in late February 2022. Source: CME, EIA & Labyrinth Consulting Services, Inc.…click on the above link to read the rest of the article…

Department of Transportation declares regional emergency following BP refinery fire in Indiana

Kirklareli / Turkey – Aug, 30, 2021: Lighted Sign Board with Large British Petroleum, BP Logo Placed on a poll in the highway gas station.

Kirklareli / Turkey – Aug, 30, 2021: Lighted Sign Board with Large British Petroleum, BP Logo Placed on a poll in the highway gas station.A Department of Transportation agency declared a regional energy emergency for four Midwestern states on Saturday after a fire at an oil refinery in Indiana forced the facility to shut down.

The Federal Motor Carrier Safety Administration made the declaration to address the need for the immediate transportation of gasoline, diesel and jet fuel for Illinois, Indiana, Michigan and Wisconsin.

The declaration allows the states to be exempt from certain federal regulations to manage the emergency.

It will permit motor carriers and drivers providing direct, related assistance to the impacted states not to abide by regulations setting a maximum driving time.

The declaration states that drivers are required to take a 10-hour break when moving from emergency relief efforts to normal operations if the total amount of time they engage in emergency relief efforts exceeds 14 hours. This regulation also applies if the total amount of time combined from emergency relief and normal operations exceeds 14 hours.

Reuters reported on Wednesday that BP shut down some of its units at its Whiting, Ind., refinery due to an electrical fire. The fire was extinguished, and the company said it was deciding when the affected units would restart.

There were no injuries. The refinery handles more than 430,000 barrels per day, according to Reuters.

It provides about 20 to 25 percent of the refined gas, diesel and jet fuel that the four states collectively use.

Whiting is located on Lake Michigan, near the state’s border with Illinois.

FBI says it ‘routinely notifies’ social media companies of potential threats following Zuckerberg-Rogan podcastMan arrested for allegedly trying to establish ISIS training center in New Mexico…click on the above link to read the rest of the article…

August 27, 2022

UK “Passed Debt And Death Sentence On Millions” By Increasing Energy Price Cap By 80%

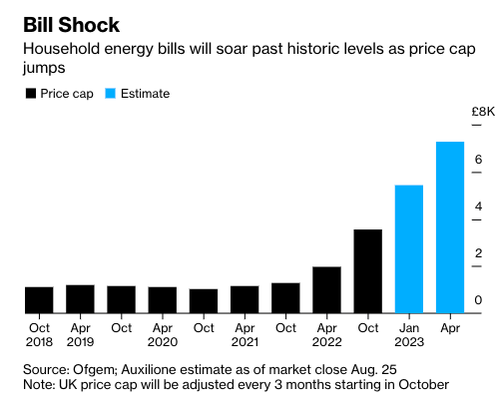

The 80% rise in the U.K.’s cap for consumer electricity and natural gas bills this fall will drive millions of households into energy poverty this winter as the worsening cost-of-living crisis stokes fears of recession.

All the chatter today among British people is energy regulator Ofgem’s rise in the cap on power bills to a record £3,549 ($4,189) beginning Oct. 1 from £1,971 ($2,330) at present. That cap is expected to rise to £5,439 ($6,427) by January and £7,272 ($8,594) by spring — all due to skyrocketing wholesale NatGas and electricity prices caused by declining Russian energy supplies to Europe, made worse by Western sanctions that have backfired.

Source: Bloomberg

Source: Bloomberg “An increase of this much cannot be budgeted for by households with no wiggle room,” said Peter Smith, director of policy and advocacy for the National Energy Action charity. “Come October, low-income households will simply not turn on their heating.”

Reuters spoke to one Brit, Philip Keetley, who said:

“The cost of living has increased and yet you’re still expected to live on the money provided for when there wasn’t a crisis … I either can have my heating on or eat.”

Another Brit, Dawn White, who has kidney failure, fears the cost of soaring energy costs means she won’t be able to afford life-saving medical treatment:

“Without my (dialysis) machine five times a week, 20 hours, I will die,” the 59-year-old woman said.

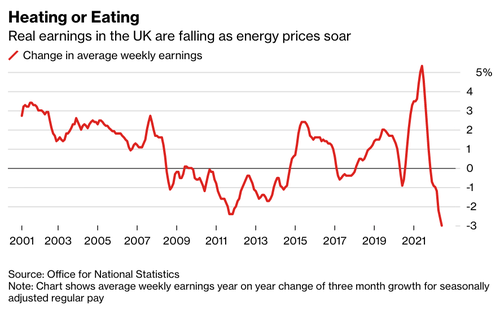

Soaring energy inflation has crushed real earnings for Brits, forcing many to pull back on spending.

Source: Bloomberg

Source: Bloomberg The higher cap rate could push inflation to even more elevated levels as U.K. economists at Citi warned CPI inflation could reach a mindboggling 18.6% print in January due to soaring energy prices.

The last time CPI printed above 18% was during the stagflationary years of the mid-1970s (more precisely, 1976) after an oil supply shock led to soaring energy prices worldwide.

…click on the above link to read the rest of the article…