Steve Bull's Blog, page 171

October 31, 2022

Advocating World War Three Is Just Mainstream Punditry Now

Listen to a reading of this article:

❖

Mainstream punditry in the latter half of 2022 is rife with op-eds arguing that the US needs to vastly increase military spending because a world war is about to erupt, and they always frame it as though this would be something that happens to the US, as though its own actions would have nothing to do with it. As though it would not be the direct result of the US-centralized empire continually accelerating towards that horrific event while refusing every possible diplomatic off-ramp due to its inability to relinquish its goal of total unipolar planetary domination.

The latest example of this trend is an article titled “Could America Win a New World War? — What It Would Take to Defeat Both China and Russia” published by Foreign Affairs, a magazine that is owned and operated by the supremely influential think tank Council on Foreign Relations.

“The United States and its allies must plan for how to simultaneously win wars in Asia and Europe, as unpalatable as the prospect may seem,” writes the article’s author Thomas G Mahnken, adding that in some ways “the United States and its allies will have an advantage in any simultaneous war” in those two continents.

But Mahnken doesn’t claim a world war against Russia and China would be a walk in the park; he also argues that in order to win such a war the US will need to — you guessed it — drastically increase its military spending.

“The United States clearly needs to increase its defense manufacturing capacity and speed,” Mahnken writes. “In the short term, that involves adding shifts to existing factories. With more time, it involves expanding factories and opening new production lines. To do both, Congress will have to act now to allocate more money to increase manufacturing.”

…click on the above link to read the rest…

Fuel company issues diesel shortage warning, says conditions ‘rapidly devolving’

A major fuel supply and logistics company is raising a red flag on upcoming diesel foul shortages.

Mansfield Energy issued the alert Friday stating there was a developing diesel fuel shortage in the southeastern region of the United States. The company speculated that the shortage could be generated from “poor pipeline shipping economies” and a historically low supply of diesel reserves.

“Poor pipeline shipping economics and historically low diesel inventories are combining to cause shortages in various markets throughout the Southeast,” the company said. “These have been occurring sporadically, with areas like Tennessee seeing particularly acute challenges.”

Diesel and heating oil inventories are down for the Northeast from Maine to Maryland. iStock© iStock

Diesel and heating oil inventories are down for the Northeast from Maine to Maryland. iStock© iStockStates expected to experience serious affects of the shortage include Maryland, Virginia, Alabama, Georgia, Tennessee, North Carolina and South Carolina.

The Biden administration says it is keeping a close watch on diesel inventories and working to boost supplies following news that reserves have been depleted and could run out in less than a month if not replenished, sparking fears of shortages and rising prices.

President Biden announces his administration’s plans to eliminate junk fees for consumers, Oct. 26, 2022, in the South Court Auditorium on the White House campus in Washington. AP Photo/Patrick Semansky, file© AP Photo/Patrick Semansky, file

President Biden announces his administration’s plans to eliminate junk fees for consumers, Oct. 26, 2022, in the South Court Auditorium on the White House campus in Washington. AP Photo/Patrick Semansky, file© AP Photo/Patrick Semansky, fileThe Energy Information Administration (EIA) reported this week that, as of Oct. 14, the U.S. had only 25 days of reserve diesel supply, a low not seen since 2008. National Economic Council Director Brian Deese acknowledged to Bloomberg that the level is “unacceptably low,” and “all options are on the table” to address the situation.

…click on the above link to read the rest…

The Netherlands may be the first country to hit the limits of growth

© Harry Haysom

© Harry HaysomThe other morning I cycled around the Dutch town where I grew up. Behind our old house, the field where I spent half my childhood is now covered with homes. So is my old football club. My high school is now in a built-up area. At the local train station, the bike shed was full on a Saturday afternoon. When I got to Amsterdam, the business-traveller economy appeared to have broken down: endless waits for Ubers, nobody at hotel reception, restaurants closed at lunchtime for want of waiters.

I know over-construction and understaffing are now global problems, but they are particularly acute in the Netherlands. The country has run out of space and staff. Sure, a recession may temporarily loosen the jobs market, but the problem was acute pre-pandemic and will simply resurface whenever growth resumes. The Netherlands is probably the first country to hit the limits of economic growth.

Other overdeveloped places such as the Bay Area, New York and Singapore may follow, running out of room for new workers and businesses. This raises the question: can a rich place be happy if its economy stops growing?

With hindsight, the Netherlands was too well-suited to the era of globalisation. The trading nation with Europe’s biggest port experienced 26 years of unbroken economic growth until 2008, then a world record. Now it tops ETH Zurich’s KOF Globalisation Index as the world’s most globalised country.

And so its population mushroomed. When the counter hit 14 million in 1979, Queen Juliana said, “Our country is full.” In 2010, Statistics Netherlands said the population would probably never reach 18 million. Today it’s 17.7 million and rising…

…click on the above link to read the rest…Much Of Ukrainian Capital Without Power & Water After New Russian Airstrikes

Much of the Ukrainian capital of Kiev is without electricity or water, after the latest round of major Russian airstrikes on Monday. The Russian military announced ‘successful’ strikes on multiple of the country’s vital infrastructure facilities.

“The Russian Armed Forces continued to launch strikes with high-precision long-range air and sea-based weapons against Ukrainian military and energy facilities,” the Defense Ministry said. “The goals of the strikes were successful. All assigned objects were hit.” Meanwhile, Ukrainian Prime Minister Denys Shmyhal confirmed direct hits on 18 sites – most of which were connected to the nation’s energy supply. These ramped up attacks have created a growing sense of panic with temperatures plunging and winter approaching.

Getty Images

Getty Images“Missiles and drones hit 10 regions, where 18 sites were damaged, most of them energy-related,” Shmyhal stated on Telegram. “Hundreds of settlements in seven regions of Ukraine were cut off.” Facilities in Cherkasy and Kirovohrad also came under attack. Ukraine’s military said it intercepted projectiles over the Lviv region, which spared this western part of the country from damage.

The Washington Post noted there are “power outages continuing in the Kyiv, Zaporizhzhia, Dnipropetrovsk and Kharkiv regions,” and others. The Post listed some of the below regions impacted by large-scale power outages and water supply disruptions:

Kyiv region: Russian strikes damaged buildings, and rescuers are searching for victims, the regional police said. Attacks left 80 percent of the capital without water and are likely to cause sustained power outages, Mayor Vitali Klitschko said.Kharkiv: Two strikes hit critical infrastructure facilities in the eastern city, causing problems with the water supply and affecting the public transit network, the mayor said.Zaporizhzhia region: An infrastructure facility was struck by rockets, the local governor said, prompting warnings from officials in the southern region that energy supplies there could also be affected.…click on the above link to read the rest…

What collapse?

Western Europe, ca 2050.

Western Europe, ca 2050.I’ve been contemplating a lot recently on how modern industrial civilization would collapse. (That it will collapse was no question to me.) The term ‘collapse’ of course invokes fear and anxiety in most, as it implies a sudden, irreversible, truly catastrophic event on epic proportions. One really bad day all shit breaks loose then suddenly — puff! — everything goes up in smoke. (Mind you, this does can happen: it is called nuclear war, the probability of which is increasing should warring parties insist on further escalation — poking nukes under the other’s nose — instead of peace talks.) If we manage to avoid this rather unwelcome outcome though, collapse, I argue, will unfold at a much-much slower pace and will only be visible in retrospect.

Before we delve deep into what the future has in store for us, however, we must understand there are several types — levels if you like — of collapse. All of them share the trait of happening under the surface for years and decades, only to resurface in the form of a crisis, which then defies all methods of resolution and permanently ends the old status quo.

You can find a detailed description of the various steps leading to social breakdown in Dmitry Orlov’s list based on his experience living through the collapse of the Soviet Union. My goal however was not to reproduce his findings here, but to offer a different perspective. Orlov’s steps, to me at least, look like distinct phases in each of which the collapse of a certain structure (financial, commercial, political, social and finally cultural) has already been completed. What really fascinates me though is the process of how we get there, and how things might unfold on the way…

…click on the above link to read the rest…

October 30, 2022

The Military-Industrial Media Complex Strikes Again

Tens of thousands protested against the skyrocketing cost of living and against Macron in France October 16, led by left-wing politician Jean Luc Melenchon, but there were few front page or top-of-the hour headlines in the U.S. Huge protests occurred in Rome the same day to demand an end to Italy’s involvement in NATO, but no coverage on the west side of the Atlantic. Thousands protesting in Paris October 22 against NATO, but little notice in North America. Massive protests against NATO and inflation due to sanctions on Russian energy in France, Germany and Austria in September, but little news of it here in the heart of the empire. German police beat citizens protesting energy shortages and record-high inflation, both due to Russia sanctions, the week of October 17, but that was not covered in the USA. Seventy thousand Czechs protested in Prague September 3 against NATO involvement in Ukraine, demanding gas from Russia (before some mysterious imperial somebody with means and motive blew up Nordstream 1 and 2, probably to nip the political effects of those protests in the bud) and ending the war, but that got little coverage in U.S. corporate media.

Ever get the sense there are things our media hides from us? Hmm. Ever wonder why enormous protests against the policies of the Exceptional Empire and its attack dog, NATO, seem, um, to be downplayed? Ever think our corporate news outlets behave more like the propaganda arm of our neoconservative state department and military than a free press? Well, if so, you may be onto something.

Lots of Europeans are unhappy about NATO, the Ukraine war, sanctions on Russia and the wild inflation and deindustrialization – which will result in gargantuan unemployment – those sanctions caused…

…click on the above link to read the rest…

Should we have predicted Black Swan events like COVID and the war in Ukraine? Where is the next crisis coming from?

A Ukrainian serviceman looks out from inside a tank and as the war with Russian rages it’s not unthinkable that Vladimir Putin will unleash nuclear weapons.(Reuters)

A Ukrainian serviceman looks out from inside a tank and as the war with Russian rages it’s not unthinkable that Vladimir Putin will unleash nuclear weapons.(Reuters)Who predicted the 2008 global financial crash? COVID? The war in Ukraine?

Of course, some did. Hollywood gave us a taste of a global respiratory pandemic in the 2011 film, Contagion.

Some economists saw the unravelling of the financial markets and the ensuing recession long before it happened.

And we should all have seen Vladimir Putin’s war coming. He had already annexed Crimea, he massed troops on the border for months and kept warning he would strike.

But even if we should know, we often don’t want to know. We certainly don’t prepare.

These events are what statistician Nassim Taleb popularised as “Black Swans”. Why? Because they are outliers. They have extreme impact. What’s more, we are all wiser after the event, concocting explanations that make it all seem so predictable.

Vladimir Putin had warned for months he intended to strike Ukraine yet when he did few were prepared.(Reuters: Russian Defence Ministry)

Vladimir Putin had warned for months he intended to strike Ukraine yet when he did few were prepared.(Reuters: Russian Defence Ministry)Another pandemic was always going to happen. We had trial runs with SARS and Swine Flu. How we had erased the history of the so-called “Spanish Flu” pandemic that killed more people than World War I.

Financial crash? Well, Asia’s markets collapsed a decade before the GFC.

Let’s not forget the Great Depression.

War? When has the world not been at war?

‘Black Swan’ events are not so rare

But these recent Black Swan events reshaped our world. The best laid plans were reduced to dust. People die. Businesses are ruined. Livelihoods and homes are lost.

…click on the above link to read the rest…

$2 Quadrillion Debt Precariously Resting on $2 Trillion Gold

A Lehman squared moment is approaching with Swiss banks and UK pension funds under severe pressure.

But let’s first look at another circus –

The global travelling circus is now reaching ever more nations just as expected. This is right on cue at the end of the most extraordinary financial bubble era in history.

It is obviously debt creation, money printing and the resulting currency debasement which creates the inevitable fall of yet another monetary system. This has been the norm throughout history so “the more it changes, the more it stays the same”.

It started this time with the closing of the gold window in August 1971. That was the beginning of a financial and political circus which continuously added more risk and more lethal acts to keep the circus going.

An economic upheaval always causes political chaos with a revolving door of leaders and political parties going and coming. Remember, a government is never voted in but invariably voted out.

What was always clear to a few of us was that the circus would end with all of the acts crashing virtually simultaneously.

And this is what is starting to happen now.

We have just seen a political farce in the UK. Even the most talented playwright could not have created such a wonderful merry-go-round of characters who we have seen coming in and out of Downing Street.

Just look at the UK Prime Ministers. First there was David Cameron who had to resign in 2016 due to mishandling Brexit. Then the next PM Theresa May had to go in 2019 since she couldn’t get anything done, including Brexit. Then Boris Johnson won the biggest Conservative majority ever but was forced out in 2022 due to Partygate during Covid.

In came Liz Truss as PM in September this year but she only lasted 44 days due to her and her Chancellor’s (Finance Minister) mishandling of the mini budget. They managed to crash the pound and UK gilts (bonds) on the international markets leading to the Bank of England having to step in. Both gilts, derivatives and UK pension funds were at the point of implosion.

And now the carousel has gone full circle with Rishi Sunak the ex-Chancellor taking the helm as Boris bailed out. Boris clearly decided that speeches and other private engagements would be more fruitful than being part of the circus. But he will most certainly attempt to come back.

What a circus!

It just shows that at the end of an economic era, we get the worst leaders who always promise but never deliver.

In a bankrupt global system, you reach a point when the value of printed money dies and whatever a leader promises can no longer be bought with fake money which will always have ZERO intrinsic value.

No one must believe that this is only happening in the UK. The US has a leader who sadly is too old and not in command. He has a deputy who is not respected by anyone. So if Biden, as many believe, doesn’t make it to the end of his period, the US is likely to have a real leadership circus. Also, the US economy is chronically ill having run deficits for 90 years. What keeps the US alive temporarily is the dollar which is strong because it is the least ugly horse in the currency stable.

Scholz in Germany was given a very bad hand by Merkel but has certainly not improved it since he took charge and Germany is on the verge of collapse.

Most countries are the same. Macron doesn’t have a majority in France and strikes are paralysing his country on a daily basis. And his new Italian counterpart, PM Georgina Meloni certainly doesn’t shred her words. Just watch her having a very aggressive go at Macron (poor video quality).

But for people (like myself) who have difficulty accepting the current wave of Wokeism in the world, Meloni’s attack on this fad and her strong defence of family values is a “must watch” (video link). So there is still hope when leaders dare to express views that most media including social media censor today.

DEBT BONDAGEHistory has dealt with punishment of non payment of debt in a variety of ways.

In the early Roman Republic around 2,500 years ago, there was a debt bondage called Nexum. In simple terms, a borrower pledged his person as collateral. If he didn’t pay his debt he was enslaved often for an undetermined period.

Jumping quickly to modern times, it would mean that the majority of people, especially in the West would all be debt slaves today. The big difference today is that most people are debt slaves but they have physical freedom. Since virtually nobody, individuals, companies or sovereign states, neither has the intention nor the ability to repay debt, the world now has a chronic debt slavery.

It is even worse than that. The playing field is totally skewed in favour of the banks, big business and the wealthy. The more money you can play with, the more money you can make risk free.

UNLIMITED PERSONAL LIABILITYNo banker, no company management or business owner ever has to take the loss personally if he makes a mistake. Losses are socialised and profits are capitalised. Heads I win, Tails I don’t lose!

Putting the Land Back In Climate

What if we’ve been looking at the climate, well, incompletely? What if there’s another side to climate change, one less concerned with what we put in the atmosphere than what we do to the land, a side which, despite four decades of climate education, has yet to be explained to us?

What if we’ve been looking at the climate, well, incompletely? What if there’s another side to climate change, one less concerned with what we put in the atmosphere than what we do to the land, a side which, despite four decades of climate education, has yet to be explained to us?Scientifically speaking, there is. Scientists call it “land change,” a characteristically neutral term for the not-so-neutral ways humans alter landscapes, through things like logging, agriculture, road building and urban/suburban sprawl. By disturbing land this way, we disturb the land’s ability to hold and cycle water, and that affects climate, particularly on a local and regional level.

Though we tend to think of climate in terms of carbon, water is in fact the primary medium of Earth’s heat dynamics, perhaps not surprising on this 71% water planet. Water not only has the highest heat capacity around, it’s also a shapeshifter, continuously phase-changing between water, vapor and ice, absorbing and releasing heat at each juncture, elegantly distributing heat along the way.

Evaporation, the phase-change from water to vapor, is a cooling process. We’ve all felt it when we sweat. Plants essentially do the same thing when they respire, cooling themselves and their surroundings by releasing water vapor from under their leaves. Trees are the power lifters here, drawing upwards of 150 gallons per day through their roots and out through their leaves, giving an average tree the cooling power of two air conditioning units running all day.1

The vapor, with the heat held latent inside it as a chemical potential, rises until it is high and cold enough to condense back into clouds and rain, at which point the heat is released into the air again, only higher, some of which continues its journey out to space, the rest reentering the system elsewhere…

…click on the above link to read the rest…

October 29, 2022

East Coast retail diesel prices moving significantly higher than overall US hikes

Extremely tight inventories are seen as the driving factor blowing out spreads with benchmark Gulf Coast market

East Coast diesel prices are racing ahead of the rest of the country. Photo: Jim Allen/FreightWaves

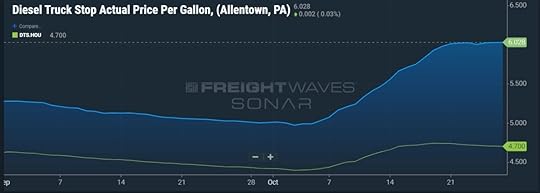

East Coast diesel prices are racing ahead of the rest of the country. Photo: Jim Allen/FreightWavesEast Coast retail diesel prices are soaring relative to the rest of the country, propelled by inventories in the region that are almost half of what they normally should be at this time of year.

Retail prices recorded in the DTS data series in SONAR tell the story of how much diesel has surged. On Sept. 16, retail diesel in Allentown, Pennsylvania, a major logistics center, was $5.116 a gallon, while the Houston price was $4.513 a gallon, a spread of just over 60 cents. On Oct. 15, Allentown was $5.663 a gallon while Houston was $4.70, a 96.3 cent gap. By Thursday, Allentown was at $6.028 a gallon and Houston was $4.70 a gallon, a spread of $1.328 a gallon.

The green line represents the DTS.HOU price for average retail diesel prices in Houston. The blue shaded area is the DTS data for Allentown.

The green line represents the DTS.HOU price for average retail diesel prices in Houston. The blue shaded area is the DTS data for Allentown.

The East Coast price blowout has been propelled largely by the tight inventory situation in what is known as PADD 1, the Department of Energy’s designation for that region.

Weekly statistical data reported by the EIA this week had PADD 1 inventories of ultra low sulfur diesel at 21.3 million barrels for the week ended Oct. 21, a more than 7% decline in just one week. But more striking was the fact that those inventories are 56.5% of the five-year average for the corresponding October weeks, excluding the pandemic-influenced data from 2020.

By contrast, national inventories for all distillates, which are not broken down by specific grades, are running about 80-81% of the five-year average, and that is considered extremely tight by analysts.

…click on the above link to read the rest…