Steve Bull's Blog, page 168

November 8, 2022

One Of Spain’s Largest Hydro-Power Plants To Halt Operations As Drought Worsens

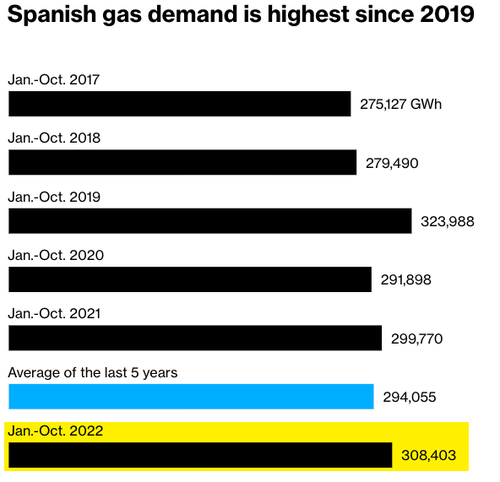

A large drop in renewable energy output is forcing Spain to increase natural gas demand to generate electricity at a time Europe is in the worst energy crisis in a generation.

Spain’s hydropower output has been halved this year due to drought, and things could get a lot worse as one of the country’s largest hydropower plants is set to close.

Bloomberg reported the Mequinenza facility in the northeastern region of Aragon would halt hydropower generation in mid-November after water levels were 23% below capacity. It’ll be the first time the hydro plant has closed since it was constructed in 1996.

In the week through Nov. 1, Mequinenza was only producing 6,221 gigawatt-hours or operating at around 27% of total capacity. According to Bloomberg calculations based on Environmental Transition Ministry data, water levels in the reservoir have hit the lowest level since 1995. This means there’s not enough water flow to turn the plant’s turbines.

Spain’s hydropower generation has tumbled a whopping 53% this year through October, according to grid operator Red Electrica Corporacion SA. So when temperatures rise, and droughts persist, the hydropower industry gets squeezed hard.

Regarding other renewables like wind and solar, there is not enough output between the two to offset the loss in hydro, which means Spain has increased NatGas demand for power generation.

Data via network operator Enagas SA shows NatGas demand to generate electricity jumped 78% through October.

Source: Bloomberg

Source: Bloomberg“A steep fall in renewable energy output is prompting the Mediterranean country to tap the fossil fuel to generate electricity at a time when Europe struggles with an unprecedented energy crisis following Russia’s decision to cut supply, which pushed prices to a record high,” Bloomberg said.

…click on the above link to read the rest…

Peter Schiff: Very Scary Admissions from the Fed

Last week, the Federal Reserve delivered a 75-basis point rate hike, but Fed Chair Jerome Powell failed to deliver the more doveish rhetoric that many expected. The messaging did not indicate much softening in the stance on the future trajectory of rate hikes, despite an apparent “soft pivot” the week before.

In his podcast, Peter broke down Powell’s messaging and pointed out a number of very scary admissions that came out of the Fed meeting.

Peter said the Fed did do a soft pivot but was able to back off when the bond market stabilized.

I believe the Fed was forced into making that pivot because it stood on the precipice of a bond market crash, which was in the process of happening. And I think the only way the Fed was able to stop that slow-motion crash from playing out accelerating was by throwing a bone to the markets and indicating through the Wall Street Journal that there was going to be some type of statement that was going to go along with the rate hike that would indicate that maybe there was going to be a pause in the pace, a slowdown in the pace, that the Fed was going to take a step back and reflect and assess, and maybe acknowledge the progress that had been made without indicating complete victory, but at least acknowledging that victory was at least in sight and that the Fed could take a more cautious approach going forward. … Something to that effect was expected.”

However, the Fed didn’t deliver anything close to that.

Initially, the markets thought the Fed was going more doveish. The statement released by the FOMC left some wiggle room for a slowdown in hiking or even a pause with language about monetary policy “lags” and “cumulative” effects.

…click on the above link to read the rest…

November 7, 2022

Oil is Bankrupt (If We Want It)

Alberta’s Oil Companies Are the Walking Dead.

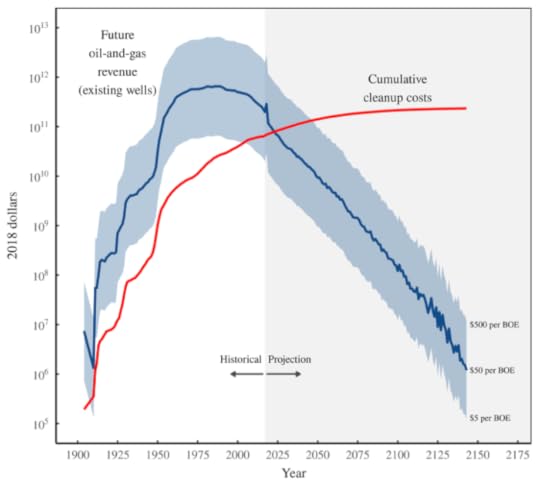

Albert’s oil-patch is a zombie, the walking dead. The companies that extract oil there owe more money than they can pay, more than they can borrow, more than they can earn. If they were made to pay their lawful debts, they would all go bankrupt, and, in so doing, would end the extraction of one of the dirtiest, worst sources of oil in the world.

Now, there’s an argument that all the oil companies are busted, Alberta or no. If they were made to pay for the damage they’ve done to our world, the millions their deadly products have killed and the billions they threaten, they would all be cleaned out.

But that argument depends on making those companies pay for those debts, which are not legal debts, but moral ones. Big Oil has proven itself remarkably adept at avoiding those moral debts . The costs that Big Oil imposed on all of us are diffused, the profits they gained through their crimes are concentrated into their hands, so it’s very hard to hold them to account.

The economics researcher Blair Fix has written a long companion piece to The Big Cleanup, a report by his collaborator Regan Boychuk for the Alberta Liabilities Disclosure Project (ALDP).

In his essay, Fix examines the power relationships that have allowed the oil companies to go on risking our civilization and our species with impunity. He observes that many environmentalists claim that if the true costs of the oil industry were borne by the extraction companies, they’d all be bankrupt already.

…click on the above link to read the rest…

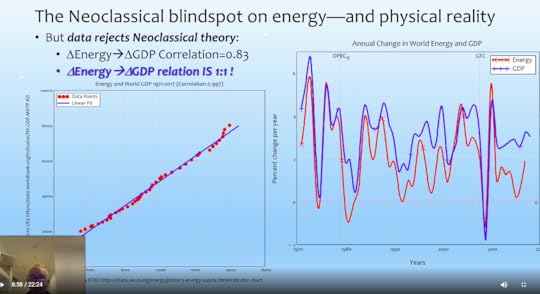

Energy’s role in economic production is severely underestimated!

Another brilliant exposition by Prof Steve Keen. The wording below is from a LinkedIn post I made tonight, targeted to Megan Woods (NZ Energy Minister) and Tina Schirr (BEC Lead)

I posted the following to LinkedIn tonight, here’s the link to the OP: https://www.linkedin.com/posts/nathansurendran_friede-gard-prize-lecture-05-energy-in-production-activity-6994962828289851392-oU7s

Friede Gard Prize Lecture 05 Energy In Production Functions – Both Neoclassical and Post Keynesian economic models have been “energy blind”, as Dr. Steve Keen outlines in this 23 minute talk: https://lnkd.in/gmCn6hzA

(- I’ll update this post with an embed of this video, once it’s available on YouTube.)

Megan Woods – MBIE’s modelling fails to take this reality into account, and you are getting erroneous assurances (the magnitude of risk is massively underestimated, potentially by a factor of 20 or more) on the magnitude of energy supply fluctuation risks, from the SADEM and GEM economic modelling.

Tina Schirr – this line of thinking is fundamental to getting the scenarios in your BEC Energy Scenarios to properly reveal the relative risk to business of energy supply challenges. This is of critical importance, as the current tightening global diesel supply is a huge risk to BAU and the proposed transition scenarios, which your current modelling is failing to identify.

The fundamental risk that this points to is a cascading failure of the financial system, as FEASTA analysed in this report: bit.ly/trdoff. This could easily be triggered by energy supply disruptions, as explored in this article: https://lnkd.in/gtbPP8im

#energy #business #energytransition #biophysicaleconomics

Massive Anti-Russian ‘Bot Army’ Exposed By Australian Researchers

‘Bot armies’ are on the march in the Ukraine-Russia war, with automated ‘bot’ accounts sending up to 80% of tweets in the study sample size of over 5-million tweets, with anti-Russia accounts comprising 90.2% of all accounts. Here, shelves of confiscated GSM gateways, containing hundreds of sim cards using the mobile network to create thousands of fake bot accounts to distribute millions of fake tweets. (Photo: Ukraine Security Service, SBU)

‘Bot armies’ are on the march in the Ukraine-Russia war, with automated ‘bot’ accounts sending up to 80% of tweets in the study sample size of over 5-million tweets, with anti-Russia accounts comprising 90.2% of all accounts. Here, shelves of confiscated GSM gateways, containing hundreds of sim cards using the mobile network to create thousands of fake bot accounts to distribute millions of fake tweets. (Photo: Ukraine Security Service, SBU)Ateam of researchers at the University of Adelaide have found that as many as 80 percent of tweets about the 2022 Russia-Ukraine invasion in its early weeks were part of a covert propaganda campaign originating from automated fake ‘bot’ accounts.

An anti-Russia propaganda campaign originating from a ‘bot army’ of fake automated Twitter accounts flooded the internet at the start of the war. The research shows of the more than 5-million tweets studied, 90.2 percent of all tweets (both bot and non-bot) came from accounts that were pro-Ukraine, with fewer than 7 percent of the accounts being classed as pro-Russian.

The university researchers also found these automated tweets had been purposely used to drive up fear amongst people targeted by them, boosting a high level of statistically measurable ‘angst’ in the online discourse.

The research team analysed a massively unprecedented 5,203,746 tweets, sent with key hashtags, in the first two weeks of the Russian invasion of Ukraine from 24 February this year. The researchers considered predominately English-language accounts, with a calculated 1.8-million unique Twitter accounts in the dataset posting at least one English-language tweet.

The results were published in August in a research paper, titled “#IStandWithPutin versus #IStandWithUkraine: The interaction of bots and humans in discussion of the Russia/Ukraine war“, by the University of Adelaide’s School of Mathematical Science.

…click on the above link to read the rest…

US NatGas Futures Jump As Frigid Weather Set To Swoop Across Country

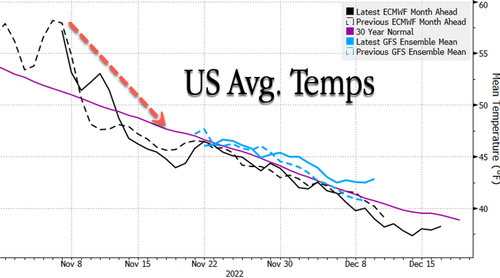

US natural gas futures bottomed on Oct. 24 after a 50% haircut on warmer weather. In the last two weeks, prices have staged a rally on the prospect of cold weather and tighter supplies. Last Monday, we penned a note titled “US NatGas Spikes As Temperatures Are About To Dive Nationwide.” Now, with colder weather sweeping across the US, NatGas prices are up a staggering 49% in eleven sessions.

On Monday morning alone, NatGas futures are up 10%. Bloomberg said the move higher is weather-related, “as a winter storm hits the Pacific Northwest and frigid weather is expected across most of the country.”

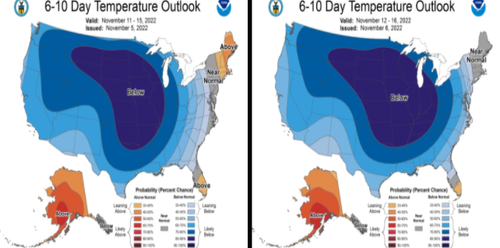

National Oceanic and Atmospheric Administration released a 6-10 day temperature outlook for the lower 48 states showing that most of the country will experience below-average temperatures.

An 8-14 day temperature outlook by the weather agency also points to continued below-average temperatures for much of the US.

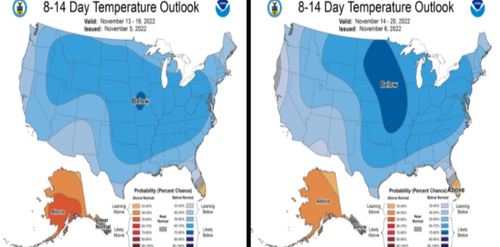

After an unseasonably warm end of October and the first week of November, the warm spell is forecasted to turn today. Average temperatures are expected around 58 degrees Fahrenheit and will revert to a downward sloping 30-year mean of the mid-40s by mid-month.

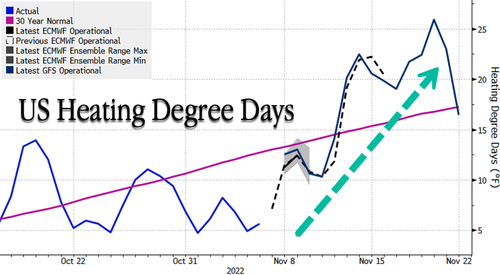

Colder weather indicates heating demand will rise, and so will the demand for NatGas.

The latest rally in NatGas outlines how sensitive traders are to potential cold snaps, as below-normal stockpiles and surging exports could strain domestic stockpiles in a deep freeze in the months ahead.

Are You Ready for the Coming U.S. Government Default?

The vast herd of investors are a deluded crowd. Following the Federal Reserve’s much anticipated 75 basis point rate hike on Wednesday the major stock market indexes jumped upward.

The vast herd of investors are a deluded crowd. Following the Federal Reserve’s much anticipated 75 basis point rate hike on Wednesday the major stock market indexes jumped upward.

Optimistic investors keyed in on the Federal Open Market Committee (FOMC) statement and, in particular, the remark that the Fed, “will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation and economic and financial developments.”

Somehow this was perceived as being the precursor to a policy pivot. Yet during the post-FOMC statement press conference, Powell clarified that, “It’s very premature to be thinking about pausing.”

Stocks then fell off a cliff. The Dow Jones Industrial Average (DJIA) closing out the day with a loss of 505 points.

Will there be a pivot, pause, or no pivot? This is the wrong question to be asking. The reality is the major stock market indexes have much farther to fall before the bear market is over, regardless of if the Fed pivots anytime soon.

If you recall, the Fed began cutting interest rates in September of 2007. Yet the stock market didn’t bottom out until March of 2009. Similarly, the Fed began cutting interest rates in January of 2001. Still, the stock market didn’t bottom out until October of 2002.

Thus, using these two most recent bear markets as a guide, once the Fed finally begins cutting interest rates, which would come after inflation has begun to abate and a period of interest rate pause, the stock market will continue to fall for another 18 to 22 months.

In other words, this bear market may not bottom out until well into 2025. What’s more, the entire dollar based financial system will likely blow up sometime beforehand.

How’s that for a grim outlook?

…click on the above link to read the rest…

Vietnam Gas Stations Start To Close Due To Widespread Shortages

While the US awaits with bated breath to see if there will be any diesel inventories after the midterm elections (see “Forget Oil, The Real Crisis Is Diesel Inventories: The US Has Just 25 Days Left”), other countries are already seeing gas stations run dry. Take Ho Chi Minh City, the city known as Vietnam’s economic engine, whose gas stations are being forced to suspend operations due to shortages of the fuel.

Believe it or not, it is possible to have an even worse government response to an energy crisis than that of the US democrats, and Vietnam is it: a tangle of reactions to a constrained petroleum market – including government price controls and distributors’ decreasing profits – has worsened the country’s gasoline shortage, increasing the burden on domestic refineries.

While these refineries are moving to increase gasoline production, it will take time for Vietnam to fully solve the fundamental problems behind its petroleum crisis according to Nikkei Asia.

The government in mid-October called on two refineries to boost output to the maximum extent possible in a bid to meet domestic demand. The government also asked distributors to speed deliveries to gas stations. PetroVietnam, the country’s largest state-run oil company, responded by raising the operation rate of its Dung Quat refinery in the central province of Quang Ngai to 109% from 107%. A refinery executive said the rate can be pushed to 110% or even higher, should the government make further requests.

Oil refineries generally save some production capacity even when declaring they are running at 100%. When they crank up production during emergencies, their operation rate can surpass 100%…

…click on the above link to read the rest…

There Is No Way Out for Europe

“Civilizations die from suicide, not by murder”

The late historian Toynbee argued, that when civilizations meet a challenge they cannot overcome or resolve, they rather commit suicide than to let themselves murdered by outside forces. I sincerely doubt however that anyone from the political class in the West read Toynbee, let alone be influenced by his thoughts… Yet, here we are at this historical juncture clearly marking the end of centuries long Western dominance, colonization and exploitation — and together with a looming fall in global oil production: the slow decline of industrial civilization. What do we do next? Are we strong enough to step back and stop this madness?

Systems, which took centuries to build up and evolve to their current form are not willing to give up on their dominance easily. What we are witnessing today is but a beginning to a long political, economical and technological struggle lasting (probably many) decades into the future. The economic superorganism encircling the planet is doing everything to keep itself alive for a little longer while being starved of energy. It would first crack in two large chunks, then after the crumbling an fall of its more depleted half, the other would follow suit.

With the above process in mind, let’s first make a quick sweep through the economic news in Europe, where the idea of Western dominance born and where it seems to meet its fate. So, how things look like on the onset of Europe’s long descent? On the face of it, the continent it seems has now filled up its gas storage units to the brim and LNG tankers are now queuing up in front of European ports waiting to be unloaded…

…click on the above link to read the rest…

November 6, 2022

No Such Thing As An Objective Journalist: Notes From The Edge Of The Narrative Matrix

Listen to a reading of this article:

❖

I feel like we haven’t been talking enough about the fact that US government agencies were just caught intimately collaborating with massive online platforms to censor content in the name of regulating the “cognitive infrastructure” of society. The only way you could be okay with the US government appointing itself this authority would be if you believed the US government is an honest and beneficent entity that works toward the benefit of the common man. Which would of course be an unacceptable thing for a grown adult to believe.

❖

It’s still astonishing that we live in a world where our rulers will openly imprison a journalist for telling the truth and then self-righteously bloviate about the need to stop authoritarian regimes from persecuting journalists.

Look at this scumbag:

Look at him. Can you believe this piece of shit? The gall. The absolute gall.

❖

There is no such thing as unbiased journalism. If someone tells you they are unbiased they are either knowingly lying, or they are so lacking in self-awareness that you should not listen to them anyway.

The divide is not between biased journalists and unbiased journalists, it’s between journalists who are honest and transparent about their biases and journalists who are not. There are no unbiased journalists. There are no unbiased people. You’re either honest about this or you’re not.

Of course journalists should try to be as fair and honest as they can. It’s just the epitome of childlike naivety to believe that western mainstream journalists do this.

…click on the above link to read the rest…