Steve Bull's Blog, page 163

November 21, 2022

German Disaster Official Recommends Stockpiling ‘Several Crates’ Of Water, Canned Food

The head of Germany’s Federal Office for Civil Protection and Disaster Relief (BBK), Ralph Tiesler, has warned citizens to prepare for short-term power outages, particularly in January and February, and to stock up on rations in advance.

“We have to assume that there will be blackouts this winter. By that, I mean a regional and temporary interruption in the power supply. The cause will not only be energy shortages, but also the targeted, temporary shutdown of the networks by the operators, with the aim of protecting the networks and not endangering the overall supply,” Tiesler told the news outlet Welt am Sonntag, adding that local authorities in several German municipalities are preparing for the possibility of blackouts, and have developed ‘precise plans’ that include procuring emergency generators to support the system.

That said, some municipalities are not prepared – and despite German gas storage facilities being near capacity, experts don’t think the stockpile will be enough to last the country through the winter due to a lack of new supply from Russia.

“We expect short-term blackouts rather than long-lasting, large-scale blackouts. But good preparation is important for that, too,” Tiesler added.

Ralph Tiesler

Ralph TieslerWhat to do? Stock up…

“Primarily water, several crates, and canned food. That would be enough for ten days. That’s what my agency recommends… Our message is: prepare in the first place. Be prepared for possible crises, don’t assume that everything will be readily available all the time,” Tiesler stated, adding that residents should also purchase battery-powered radios and candles.

Germany’s energy woes stem from a drop in gas supplies from Russia, after an ill-advised scheme to shut off their nuclear power plants. The flow of gas was cut off much earlier than expected over Ukraine-related sanctions, as well as explosions in September which rendered the Nord Stream 1 pipeline inoperable.

November 20, 2022

What Qualities Do the Predicaments We Face Possess?

The view from Sunset Rock near Sparta, Tennessee

The view from Sunset Rock near Sparta, TennesseeI’d like to address something which has been on my mind quite a bit recently. How we view things or how we judge things has a lot to do with how we see life (our worldview) and the circumstances surrounding it. I was having a conversation with my mom and she asked me something rather interesting. She wanted to know if I thought that the topics I spend so much time dealing with causes me to feel down “because they are so negative.” I feel compelled to dive into this with zeal because I think that there are probably MANY of us who likewise see things from a different angle than society in general.

First things first; I don’t necessarily see collapse, climate change, energy and resource decline, and/or extinction as being bad or negative. They certainly have some bad qualities and negative effects. I cannot deny the grief I have felt as a result of learning that ecological overshoot has many serious symptom predicaments which I learned about mostly BEFORE I learned about overshoot itself. However, as part of the learning process, I was required to view the situation in geologic timescales and from nature’s perspective – and these change the viewpoint or perspective from an anthropocentric, human-focused worldview to a more natural biospheric-based perspective. Nature doesn’t care about our judgements or opinions. So, while I cannot deny the grief I have experienced, I also cannot label all these predicaments as being “bad” either. This is simply nature’s way of evolution. Only humans give such hubristic judgements about these predicaments, based on our perception of loss…

…click on the above link to read the rest…

November 19, 2022

384 billion serfs

Why it’s so hard to scale down fossil fuels

In an 8-hour workshift, a healthy 35-year-old man can generate about 75 watts of mechanical power per hour, enough to keep a bright old-fashioned light bulb going. In a year, he can generate about 140 kilowatt-hours.

How does that compare to the energy embodied in a barrel of oil?

A standard 42-gallon (159-litre) barrel of oil can perform 1,700 kilowatt-hours of work. Modern oil-driven power stations are about 37 percent efficient, since they produce lots of waste heat. So one barrel of oil has the same work potential as the physical labour of 4.8 human men over a year.

Oil is a super-concentrated form of energy!

Fossil fuel serfs

Fossil fuel serfsIn 2019, before lockdowns began, the world consumed about 35 billion barrels of oil, corresponding to the services of 165 billion labourers. Oil makes up two-fifths of all the fossil fuel energy the world consumes, the rest being mostly coal and natural gas. Our total fossil fuel use in 2019 amounted to the work of 380 billion men.

Those fossil fuel-equivalent workers are always on tap, don’t take holidays, don’t need to sleep and don’t go on strike. They have no rights. Let’s call them our fossil fuel serfs.

You can think of a fossil fuel serf as the work capacity of a full-time human labourer for a year, measured in terms of oil, coal or natural gas.

A Ford Focus, for example, has a 52-litre (11.5 gallons) fuel tank. One barrel of oil would provide the petrol for three fill-ups. Each fill-up corresponds to 1.5 fossil fuel serfs.

Those 380 billion fossil fuel serfs power our cars and factories, keep the lights on, heat or cool our houses and cities, produce fertilizer for our fields, help to make the concrete, steel and asphalt in our buildings, roads and dams, and provide the plastics, synthetic clothing, tyres, detergents and hospital equipment that make our lives so convenient…

…click on the above link to read the rest…

One Way Or Another, The Population Of The Globe Will Soon Be Much Smaller Than It Is Right Now

This week it is being reported that the human population of our planet has now reached 8 billion. We should all remember this moment, because soon the population of the globe will start getting much smaller. In “End Times”, I explain that we are moving into one of the most chaotic times in all of human history. There will be wars and rumors of wars, economic collapse, worldwide famines, horrifying pestilences and great natural disasters. Needless to say, in such a future the global population would fall very rapidly. But for purposes of this article, let’s imagine that none of those things will happen for the foreseeable future. For a moment, let’s imagine that conditions will be pretty much like they are today for decades to come. Unfortunately, even in such a wildly unrealistic scenario the human population of our planet would still plummet dramatically in the years ahead. In fact, if current trends continue there will be hardly anyone left by the end of this century no matter what happens.

I realize that I have just made some very outrageous statements, and a lot of you are probably wondering how I could have come to such wild conclusions.

So let me take this one step at a time.

According to the UN, the population of the world just hit 8 billion for the first time ever. The following comes from the official website of the United Nations…

The global population is projected to reach 8 billion on 15 November 2022, and India is projected to surpass China as the world’s most populous country in 2023, according to World Population Prospects 2022, released today on World Population Day.

…click on the above link to read the rest…

November 18, 2022

How Inflation Will Impact The 2020s & 2030s

Economic Macro Trends Of The Coming Decades And How They Shape My Investment Strategy.

Image by Alain Bonnardeaux

Image by Alain BonnardeauxRecently, people have been asking me a lot about what the next 10–20 years will look like.

How inflation will impact the economy and what this means for them personally.

This article describes the general outlook I have for the next one to two decades. I will explain how — in my opinion — inflation and potential deflationary crashes will shape the future and how I as an investor will prepare for this.

Buckle up, it’s gone be a wild ride.

Disclaimer: Please note that the following is a summary of what I believe has a high chance of happening. However, I DO NOT claim that things will exactly play out like this. And as always, this article is intended to educate people. It should not be taken as financial advice.

Going From A Non-Inflationary To An Inflationary WorldWe are facing difficult times.

After decades of living in a non-inflationary environment (not for all goods and assets, but in general) supported by lots of cheap high-density energy and a globalized economy, we are now facing strong price increases in all areas.

To understand the background of why that is happening, I recommend you to check out this article I wrote. It offers a detailed explanation about why inflation is suddenly picking up, and how this impacts my investment decisions in the short to medium term.

Here is a very short summary: We are running out of cheap high-density energy (fossil fuels) to run everything and grow our economies. Governments try to substitute missing energy by pumping money into the system. But this does not bring back growth and is also contributing to rising prices.

…click on the above link to read the rest…

Power Blackout Risks Loom For Quarter Of All Americans

The US heating season has officially begun, and new warnings show that a quarter of all Americans could experience energy emergencies this winter if temperatures fall below average due to tight fossil fuel supplies.

Power grids from the Great Lakes to Louisiana, New England, Carolinas, and all of Texas are the most at risk for power supply shortfalls during high-demand periods, according to Bloomberg, citing a new report from the North American Electric Reliability Corporation (NERC), a regulatory body that manages grid stability.

NERC said a cold snap for an extended period could spark grid strain due to soaring power demand from households and businesses. This would cause supplies of natural gas, coal, and backup diesel generators to draw down more quickly and possibly experience shortages.

“The trend is we see more areas at risk, we see more retirements of critical generation, fuel challenges and we are doing everything we can.

“These challenges don’t kind of appear out of nowhere,” John Moura, NERC’s director of reliability assessment, said during a media briefing.

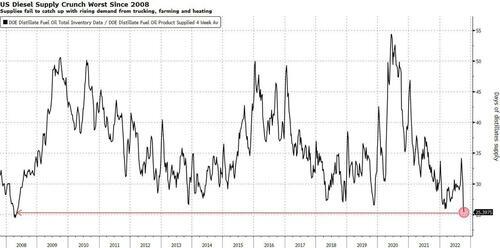

For instance, the demand for diesel is rising, but East Coast supplies are at record lows for this time of year. Shortage of fuel used to power the economy, from heating to trucking, has about 25 days left of supplies in storage. Any supply disruption could leave power generation plants with supply gaps this winter.

Jim Matheson, chief executive officer of the National Rural Electric Cooperative Association, told Bloomberg that electricity demand is set to outpace “available supply during peak winter conditions, consumers face an inconceivable but real threat of rolling blackouts.”

Matheson warned: “It doesn’t have to be this way. But absent a shift in state and federal energy policy, this is a reality we will face for years to come.”

…click on the above link to read the rest…

With thick ice gone, Arctic sea ice changes more slowly

Small remnants of thicker, multiyear ice float with thinner, seasonal ice in the Beaufort Sea on Sept. 30, 2016. Credit: NASA/GSFC/Alek Petty

Small remnants of thicker, multiyear ice float with thinner, seasonal ice in the Beaufort Sea on Sept. 30, 2016. Credit: NASA/GSFC/Alek Petty› Larger view

The Arctic Ocean’s blanket of sea ice has changed since 1958 from predominantly older, thicker ice to mostly younger, thinner ice, according to new research published by NASA scientist Ron Kwok of the Jet Propulsion Laboratory, Pasadena, California. With so little thick, old ice left, the rate of decrease in ice thickness has slowed. New ice grows faster but is more vulnerable to weather and wind, so ice thickness is now more variable, rather than dominated by the effect of global warming.

Working from a combination of satellite records and declassified submarine sonar data, NASA scientists have constructed a 60-year record of Arctic sea ice thickness. Right now, Arctic sea ice is the youngest and thinnest its been since we started keeping records. More than 70 percent of Arctic sea ice is now seasonal, which means it grows in the winter and melts in the summer, but doesn’t last from year to year. This seasonal ice melts faster and breaks up easier, making it much more susceptible to wind and atmospheric conditions.

Working from a combination of satellite records and declassified submarine sonar data, NASA scientists have constructed a 60-year record of Arctic sea ice thickness. Right now, Arctic sea ice is the youngest and thinnest its been since we started keeping records. More than 70 percent of Arctic sea ice is now seasonal, which means it grows in the winter and melts in the summer, but doesn’t last from year to year. This seasonal ice melts faster and breaks up easier, making it much more susceptible to wind and atmospheric conditions.…click on the above link to read the rest…

Today’s Energy Crisis Is Very Different from the Energy Crisis of 2005

Back in 2005, the world economy was “humming along.” World growth in energy consumption per capita was rising at 2.3% per year in the 2001 to 2005 period. China had been added to the World Trade Organization in December 2001, ramping up its demand for all kinds of fossil fuels. There was also a bubble in the US housing market, brought on by low interest rates and loose underwriting standards.

Figure 1. World primary energy consumption per capita based on BP’s 2022 Statistical Review of World Energy.

Figure 1. World primary energy consumption per capita based on BP’s 2022 Statistical Review of World Energy.The problem in 2005, as now, was inflation in energy costs that was feeding through to inflation in general. Inflation in food prices was especially a problem. The Federal Reserve chose to fix the problem by raising the Federal Funds interest rate from 1.00% to 5.25% between June 30, 2004 and June 30, 2006.

Now, the world is facing a very different problem. High energy prices are again feeding over to food prices and to inflation in general. But the underlying trend in energy consumption is very different. The growth rate in world energy consumption per capita was 2.3% per year in the 2001 to 2005 period, but energy consumption per capita for the period 2017 to 2021 seems to be slightly shrinking at minus 0.4% per year. The world seems to already be on the edge of recession.

The Federal Reserve seems to be using a similar interest rate approach now, in very different circumstances. In this post, I will try to explain why I don’t think that this approach will produce the desired outcome.

[1] The 2004 to 2006 interest rate hikes didn’t lead to lower oil prices until after July 2008.

It is easiest to see the impact (or lack thereof) of rising interest rates by looking at average monthly world oil prices.

Figure 2. Average monthly Brent spot oil prices based on data of the US Energy Information Administration. Latest month shown is July 2022.

Figure 2. Average monthly Brent spot oil prices based on data of the US Energy Information Administration. Latest month shown is July 2022.…click on the above link to read the rest…

November 17, 2022

The Regime Is Shifting, And Here’s What That Means

Authored by Simon White, Bloomberg macro-strategist,

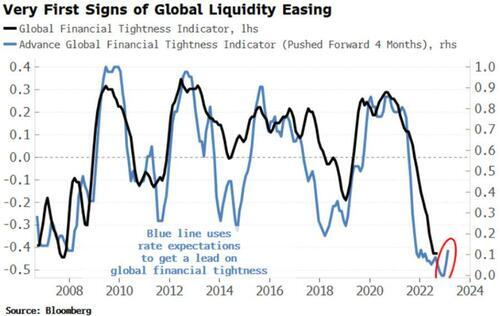

The macro landscape is changing. Inflation will remain in an elevated and unstable regime, but the first stage of the crisis is drawing to a close. That means the dollar in a downward trend, bonds in an upward trend, stocks underperforming bonds, and growth outperforming value.

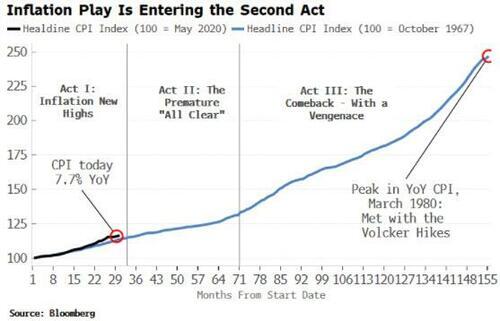

Regime shifts can be almost imperceptible in real time, but in retrospect they mark fundamental turning points. Inflation today is going through one of these shifts, analogous to the 1970s. In that decade, inflation could be understood as a play in three acts, a drama that is likely to be repeated in this cycle.

In the first act, inflation makes new highs and the Fed tightens aggressively.The second is when inflation begins to recede, allowing the central bank to pull back from tightening.The final act is when we see inflation return with a vengeance, eliciting a Volcker-esque monetary response and a deep recession in order to fully snuff it out.So what’s brought the curtain down on the first act? Three important indicators have made a decisive turn:

The market is now ahead of the Fed’s rate projections (the Dots)The real yield curve is emphatically flatteningMy Advanced Global Financial Tightness Indicator (AGFTI) is risingAll through this cycle, the market has been anticipating a lower peak rate than desired by FOMC members. That changed in the last couple of months, signaling that Fed hawkishness was peaking as the market was amplifying — not inhibiting — the Fed’s intended policy.

The real yield curve had steepened relentlessly as shorter-term real rates kept falling while the Fed rate lagged inflation. But the trend definitively turned in July, pointing to a peak in the dollar…

…click on the above link to read the rest…

Energy Aware #4: The Devil Is In the Diesel

Global diesel is in short supply.

Analysts are concerned about diesel because it is the hemoglobin of the global economy. The world’s mines, oil rigs, construction, ships, trains and trucks run on diesel.

Typically, inventories should be 30% higher this time of the year. Such low levels are alarming because diesel is the workhorse of the global economy. It powers trucks and vans, excavators, freight trains and ships. A shortage would mean higher costs for everything from trucking to farming to construction.

–Javier Blas, Washington Post, October 18, 2022

Most government leaders, journalists and industry analysts don’t understand why there is a problem. That’s because it’s a refining issue and it’s not something simple that can easily be fixed by pressuring refiners to make more diesel. Let me explain.There is a sequence of products made in a refinery that includes gasoline, kerosene, jet fuel, and diesel that all must be distilled from each barrel of oil. It’s not an a la carte menu in which you can order diesel but tell the waiter to hold the gasoline, kerosene and jet fuel.

Petroleum products are distilled from crude oil like whisky is distilled from fermented grain. For both petroleum and whiskey, a liquid is heated to create a vapor that is then condensed back into a liquid again. In the case of whiskey, distillation removes the heavier molecules that condense at the bottom of the still—the wash—and are later thrown away. Only the lightest fraction—the whiskey—that condenses at the top of the still is kept.

For petroleum, the whiskey is gasoline and a few lighter molecules. The wash is everything else including fuel oil, diesel, jet fuel and kerosene. These are not thrown away because in today’s market, they are worth more than gasoline.

…click on the above link to read the rest…