Steve Bull's Blog, page 161

November 25, 2022

War on Cash: India Rolling Out Retail Pilot Program for Digital Rupee

NOVEMBER 23, 2022 BY SCHIFFGOLD 0 1

NOVEMBER 23, 2022 BY SCHIFFGOLD 0 1We recently reported that the Federal Reserve plans to launch a 12-week pilot program in partnership with several large commercial banks to test the feasibility of a central bank digital currency (CBDC). The US isn’t alone in experimenting with digital currency. India is working on developing a digital rupee and recently announced the second phase of testing.

After successfully running a pilot program to test its digital currency at the wholesale level, the Reserve Bank of India (RBI) has announced it will test the digital rupee in a retail setting.

According to the RBI, the central bank digital currency “is a legal tender issued by a central bank in a digital form. It is the same as a fiat currency and is exchangeable one-to-one with the fiat currency. Only its form is different.”

Digital currencies are similar to bitcoin and other cryptocurrencies. They exist as virtual banknotes or coins held in a digital wallet on your computer or smartphone. The difference between a government digital currency and bitcoin is the value of the digital currency is backed and controlled by the state, just like traditional fiat currency.

As the RBI put it, “Unlike cryptocurrencies, a CBDC isn’t a commodity or claims on commodities or digital assets. Cryptocurrencies have no issuer. They are not money (certainly not currency) as the word has come to be understood historically.”

According to a report in the Economic Times of India, the National Payments Corporation of India will host the platform for the digital rupee payment system during the testing phase. The Reserve Bank of India wants each commercial bank in the pilot to test retail use of the digital rupee with 10,000 to 50,000 users.

…click on the above link to read the rest…

November 23, 2022

Entire Season Of Snow Could Dump On Texas Panhandle; Pipeline Operators Warned About ‘Freak Storm’

One of the snowiest spots in the country during the Thanksgiving holiday is a very unlikely place: the Texas panhandle.

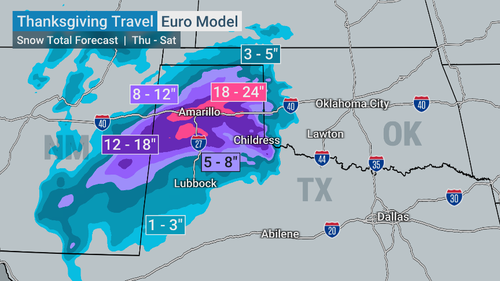

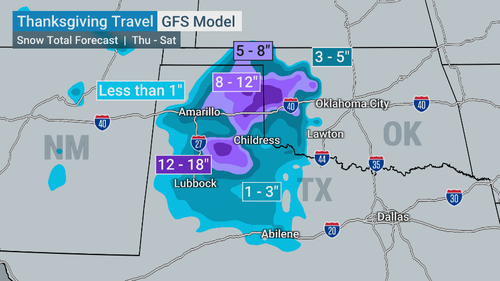

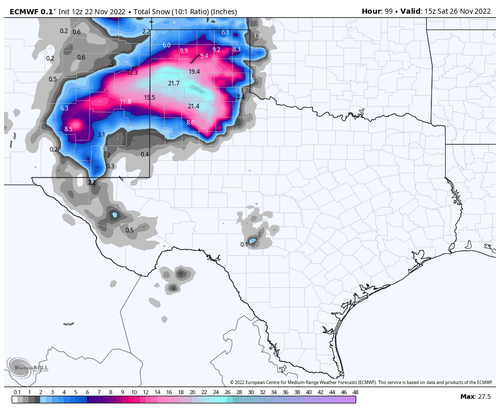

Weather Underground provides two forecasts: the EURO Model beating the GFS Model regarding how much snow accumulation is expected across the Texas panhandle.

The EURO model expects 12-18 inches for a large swath of the state’s northernmost part, consisting of 26 counties. In Amarillo, forecasts show 18-24 inches.

The GFS model isn’t as severe, with a large swath of the region forecasted to receive 8-12 inches with pockets of 12-18 inches south of Amarillo.

Meteorologist John Homenuk tweeted: “The TX Panhandle needs precipitation, but I can’t say this is how I envisioned them getting it in the short term.”

Homenuk tweeted snowfall forecasts through Saturday that show much of the Texas panhandle will expect accumulating snow.

“The combination of high winds and heavy wet snow through Thursday night into Friday will create whiteout conditions which will make travel extremely dangerous,” local news ABC 7 said.

According to the National Weather Service, Texas Panhandle averages 17 inches of snow throughout the winter. If the weather models hold up, some areas could receive an entire year’s worth of snow in the next few days.

This is undoubtedly a ‘freak’ event but not unexpected, as we noted on Nov. 7 that “Frigid Weather Set To Swoop Across Country.”

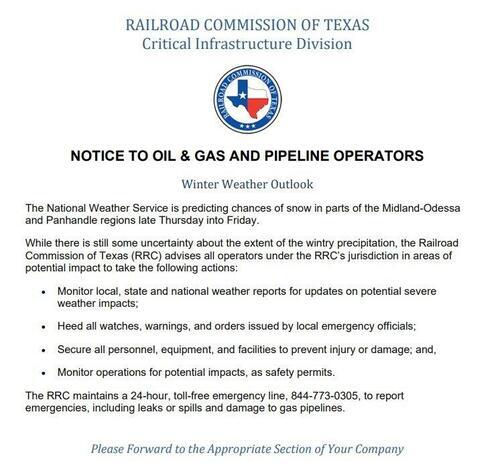

The Texas Railroad Commission warned oil and gas operators across the Midland-Odessa and Panhandle regions about wintry precipitation through Friday.

The devastating cold snap of early 2021 is still fresh in the minds of millions of Texans.

Credit Suisse Craters To Record Low After Revealing Staggering $88 Billion Bank Run

One month ago, weeks before the crypto sector was shaken by the crushing FTX bankrun which led to a quick and painful bankruptcy, and revealed that one of the world’s biggest crypto exchanges and its “JPMorgan-esque” owner were nothing but hollow shells of fraud, another bank was suffering from a far bigger bank run.

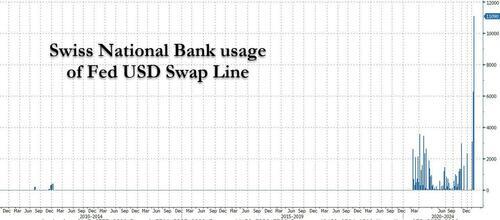

Readers will recall that in mid-October we reported that the Fed was quietly wiring over increasingly greater amount of dollars to the Swiss National Bank – which eventually peaked at around $11 billion weekly – which in turn was then using these dollar swap lines to plug funding holes within one or more Swiss commercial banks.

One didn’t need to be a rocket surgeon to figure out that the bank in question was Credit Suisse, which had seen its stock tumble amid a relentless barrage of scandals, corporate mistakes and the occasional fraud (that we know of), and which we said was likely suffering from a painful behind-the-scenes bank run.

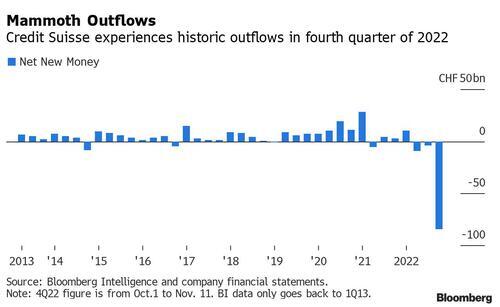

Fast forward one month, when this morning the 2nd largest Swiss bank confirmed our worst-case speculation, admitting that it had just gone through a staggering bank run in which clients pulled as much as 84 billion Swiss francs, or $88.3 billion, of their money from the bank during the first few weeks of the quarter, underlining ongoing concerns over the bank’s restructuring efforts after years of scandals.

Of course, as FTX learned the hard way, bank runs don’t have a happy ending, and the Zurich-based bank warned on Wednesday that it will face a loss of up to 1.5 billion Swiss francs ($1.6 billion) for the three final months of the year, in large part as a result of the decline in wealth and asset management client funds from the start of October to Nov. 11…

…click on the above link to read the rest…

Huge Swathes Of Ukraine Without Power & Water After New Russian Strikes

Ukraine’s energy operator Energoatom has announced Wednesday emergency power shutdowns in effect across all regions of the country amid a new large wave of Russian airstrikes. Sirens have been sounding throughout the day across the country.

President Volodymyr Zelensky in follow-up estimated that 10 million Ukrainians now lack access to electricity due to the attacks. “There are emergency shutdowns in addition to planned, stabilization ones,” he explained. “The elimination of the consequences of another missile attack against Ukraine continues all day.”

Prior file image, Ukrainian Presidential Press Service via Reuters

Prior file image, Ukrainian Presidential Press Service via ReutersCasualties have been reported in the eastern cities of Dnipro and Zaporizhzhia, and at least one person has been reported killed in Kiev. Speaking of the renewed attacks on the capital, Mykhailo Podolyak, head of the Office of the Ukrainian President’s office said, “A new massive attack on infrastructure facilities is underway.”

He described, citing recent anti-air defense systems acquired from Western countries, “While someone is waiting for World Cup results and the number of goals scored, Ukrainians are waiting for another score – number of intercepted Russian missiles. A new massive attack on infrastructure facilities is underway. In NASAMS, IRIS-T and Air Defense Forces we trust.”

Kiev’s mayor, Vitali Klitschko, issued an emergency message on social media warning that ongoing Russian strikes are “Hitting one of the capital’s infrastructure facilities. Stay in shelters! The air alert continues.” Also alarming is that the mayor in a follow-up message said that water services have been suspended in Kiev after the major strikes.

While it’s not the first time that some war-hit parts of Ukraine have been left without electricity and water, the country is now in an extremely dire and urgent phase, having already seen an estimated half its national power infrastructure degraded or destroyed…

…click on the above link to read the rest…

The Renewable Energy Transition Is Failing

Not sustainable: Vast quantities of minerals and metals are required for the renewable energy transition. (Photo credit: AleSpa/Wikimedia Commons)

Not sustainable: Vast quantities of minerals and metals are required for the renewable energy transition. (Photo credit: AleSpa/Wikimedia Commons)Renewable energy isn’t replacing fossil fuel energy—it’s adding to it.

Despite all the renewable energy investments and installations, actual global greenhouse gas emissions keep increasing. That’s largely due to economic growth: While renewable energy supplies have expanded in recent years, world energy usage has ballooned even more—with the difference being supplied by fossil fuels. The more the world economy grows, the harder it is for additions of renewable energy to turn the tide by actually replacing energy from fossil fuels, rather than just adding to it.

The notion of voluntarily reining in economic growth in order to minimize climate change and make it easier to replace fossil fuels is political anathema not just in the rich countries, whose people have gotten used to consuming at extraordinarily high rates, but even more so in poorer countries, which have been promised the opportunity to “develop.”

After all, it is the rich countries that have been responsible for the great majority of past emissions (which are driving climate change presently); indeed, these countries got rich largely by the industrial activity of which carbon emissions were a byproduct. Now it is the world’s poorest nations that are experiencing the brunt of the impacts of climate change caused by the world’s richest. It’s neither sustainable nor just to perpetuate the exploitation of land, resources, and labor in the less industrialized countries, as well as historically exploited communities in the rich countries, to maintain both the lifestyles and expectations of further growth of the wealthy minority.

From the perspective of people in less-industrialized nations, it’s natural to want to consume more, which only seems fair…

…click on the above link to read the rest…

“The Oil Machine” and the Changing Climate.

A tricky dilemma is nonetheless presented, as European nations scramble to get hold of hydrocarbons from alternative sources, in part to avoid supporting Putin’s war machine, but also now that there is no Russian gas coming to Europe down the Nord Stream 1 pipelines, which have suffered damage from deliberate sabotage, although it is not yet clear exactly who put the explosives there for the job. While the finger of blame seems to oscillate in its direction, depending on exactly who is pointing it, efforts to maintain current levels of oil and gas through this winter and beyond, strengthen their grip, while renewable energy is pushed onto the proverbial back burner.

The film admirably emphasises the extent and complexity of the oil and gas pipeline network under the North Sea, and on land too, which is conveniently but deceptively out of sight and hence out of mind; yet it is this sprawling and fragile infrastructure whose bounty underpins the mechanics of our daily lives…

…click on the above link to read the rest…

#243. The Great Inflexion

A SYSTEM UNRAVELS

INTRODUCTION

As everyone surely knows by now, the global economy has entered a recession which is likely to be both severe and protracted. For the most part, governments and central bankers are concentrating on the task of trying to tame inflation.

Their critics tend to argue for more expansionary fiscal and monetary policies, contending that stimulus could soften or shorten the recession. They claim, in defiance both of experience and of logic, that expansionary monetary policies needn’t contradict the effort to bring inflation under control.

Where almost everybody is in agreement is that, however long it takes, the recession will end. But there’s a striking absence of explanations for how or why growth is supposed to resume. The fall-back position is no more than an assumption – a recovery will arrive for no better reason than that all previous economic downturns have been followed by rebounds.

The underlying presumption here is cyclicality, a process accepted as routine, not just by policy-makers and central bankers, but by investors, business leaders and the general public alike. It is well understood that the Big Numbers – like economic output, and the aggregate value of the markets – oscillate in sine-wave patterns around central trends.

It’s further assumed that these secular trends are always positive – each recovery exceeds the preceding recession, and each market rebound more than cancels out the latest dip.

This latter assumption has reached the point of invalidation. What economies and markets are now experiencing is trend-inflexion. Cyclicality may indeed continue but, from here on, it will do so around downwards-inflected trends. This process of reversal can only be managed if it is recognized.

The consequences of trend inflexion are readily summarised. On an ex-inflation basis, economic output will deteriorate, whilst the real costs of necessities will carry on rising, even if there are some retreats from the severe spikes experienced in recent times.

…click on the above link to read the rest…

November 22, 2022

How Europe’s Energy Crisis Could Turn Into A Food Crisis

Runaway energy inflation has taken a toll on European industry, but another threat is looming.

Europe’s two biggest fertilizer suppliers, Russia and Belarus have retaliated against European sanctions by cutting off fertilizer exports.The fact remains that the global food chain, especially its European links, is not in a good place right now.[image error]Runaway energy price inflation has wreaked havoc on European industrial activity, with the heaviest consumers taking the brunt. Aluminum and steel smelters are shutting down because of energy costs. Chemical producers are moving to the United States. BASF is planning a permanent downsizing.

There is, however, a bigger problem than all these would constitute for their respective industries. Fertilizer makers are also shutting down their plants. And fertilizer imports are down because the biggest suppliers of fertilizers for Europe were Russia and Belarus, both currently under sanctions.

Both countries have retaliated against the sanctions by cutting off exports of fertilizers to Europe, and European officials repeating that fertilizer exports are not sanctioned is not really helping.

Russia accounts for 45 percent of the global ammonia nitrate supply, according to figures from the Institute for Agriculture and Trade Policy cited by the FT. But it also accounts for 18 percent of the supply of potash—potassium-containing salts that are one of the main gradients of fertilizers—and 14 percent of phosphate exports.

Belarus is a major exporter of fertilizers, too, especially potash. But Belarus has been under EU sanctions since 2021 on human rights allegations, and unlike Russia, it has seen its fertilizer industry targeted by these sanctions. This has made for an unfortunate coincidence for Europe and its food security.

…click on the above link to read the rest…

Is Washington’s Dangerous Ukraine Boondoggle Starting to Unravel?

But there was a problem. The missile was fired from Ukraine – likely an accident in the fog of war. Was it actually a Russian missile, of course, that might mean World War III. But Zelensky didn’t seem to be bothered by the prospect of the world blown up, judging from his reckless rhetoric.

While Zelensky has been treated as a saint by the US media, the Biden Administration, and both parties in Congress, something unprecedented happened this time: the Biden Administration pushed back. According to press reports, several Zelensky calls to Biden or senior Biden Staff went unanswered.

When US National Security Advisor Jake Sullivan finally returned Zelensky’s call, he is reported to have said, “tread carefully” on claims Russia was behind the missiles landing in Poland. The Biden Administration went on to publicly dispute Zelensky’s continued insistence that Russia shot missiles into NATO-Member Poland. After two days of Washington opposition to his claims, Zelensky finally, sort of, backed down.

We’ve heard rumors of President Biden’s frustration over Zelensky’s endless begging and ingratitude for the 60 or so billion dollars doled out to him by the US government, but this is the clearest public example of the Biden Administration’s acceptance that it has a “Zelensky problem.”

Zelensky must have understood that Washington and Brussels knew it was not a Russian missile….

…click on the above link to read the rest…

Emmanuel Macron: “We Need a Single Global Order”

LUDOVIC MARIN via Getty Images

During a speech at the Apec summit in Bangkok, where world leaders gathered, French President Emmanuel Macron called for a “single global order.”

Macron made the comments while discussing the power interests of Russia and China and the threat of war.

“We are in a jungle and we have two big elephants trying to become more and more nervous,” he said.

“If they become very nervous and start a war, it will be a big problem for the rest of the jungle. You need the cooperation of a lot of other animals, tigers, monkeys and so on,” added Macron.

“Are you on the U.S. or the Chinese side? Because now, progressively, a lot of people would like to see that there are two orders in this world. This is a huge mistake, even for both the U.S. and China.”

“We need a single global order,” he concluded.

Macron’s words are sure to confuse the ‘fact checker’ industry, which continues to insist that claims about the ‘New World Order’ or one world government are a baseless conspiracy theory.

Indeed, much hilarity ensued last week when it was revealed that Google-owned YouTube had effectively fact-checked a video published by ‘The World Government Summit 2022’.

In the video, the host of a panel discussion asks H.E. Dr. Anwar bin Mohammed Gargash, Diplomatic Advisor to the UAE President, “Are you ready for a new world order?”

Underneath the video is a fact check box about the ‘New World Order’ which links to a Wikipedia article that states, “The New World Order (NWO) is a conspiracy theory which hypothesizes a secretly emerging totalitarian world government.”

The tone of the article debunks the notion that there is a move towards a ‘New World Order’, despite the panelists at the World Government Summit openly discussing that very agenda.

— Tim Pool (@Timcast) November 16, 2022