Steve Bull's Blog, page 131

February 2, 2023

Long After WWII, Russia Once Again Threatened With German Tanks “With Crosses On Them”: Putin

On Thursday Russian President Vladimir Putin attended events marking the 80th anniversary of the battle of Stalingrad, and in his speech hailing Russia’s historic victory against Nazi Germany in World War II, he didn’t hold back, lashing out against Berlin’s contemporary decision-making regarding the war in Ukraine.

“Unbelievable, but it is a fact: we are once again being threatened with German tanks – Leopards – that have crosses [painted] on their sides,” Putin said in a provocative statement that evoked Nazi invasion imagery.

Sputnik, Kremlin Pool via AP

Sputnik, Kremlin Pool via AP“Those who expect to win on the battlefield apparently do not understand that a modern war with Russia will be utterly different for them. We are not the ones sending our tanks to their borders,” Putin added while saying Russia is sure in its victory, and ominously warning that “we will deploy more than just tanks”.

“These powers which try to wage an undeclared war against Russia will receive a tough response to their actions,” the president remarked, according to state media translation.

The city where the memorial ceremony took place has since 1961 been called Volgograd, a change that occurred during the de-Stalinization process:

Putin had earlier laid flowers at the eternal flame on Mamayev Kurgan, a hillside where much of the fighting took place that now hosts the “Battle of Stalingrad” museum complex and the city’s famous statue “The Motherland Calls.”

The crucial battle of August 1942 to February 1943 was key in ultimately deciding the outcome of WWII, given it ended with Hitler’s 6th Army surrendering, and marked the first devastating capitulation for Berlin, setting the stage for an allied victory by May 1945. But in total an estimated 2 million German and Soviet soldiers and civilians died in a mere 6 months of fighting.

…click on the above link to read the rest…

Why the End of the Petrodollar Spells Trouble for the US Regime

On January 17, the Saudi minister of finance, Mohammed Al-Jadaan, announced that the Saudi state is open to selling oil in currencies other than the dollar. “There are no issues with discussing how we settle our trade arrangements, whether it is in the US dollar, whether it is the euro, whether it is the Saudi riyal,” Al-Jadaan told Bloomberg TV.

If the Saudi regime does indeed embrace substantial trade in currencies other than the dollar as part of its oil-export business, this would signal a shift away from the dollar as the dominant currency in global oil payments. Or measured another way, this would signal the end of the so-called petrodollar.

But how large of a shift is this? With the increasingly frequent Saudi comments about trading in nondollar currencies, we’ve also seen an increasing number of pundits announcing the “collapse” of the dollar or the imminent implosion of the dollar’s currently outsized global power.

Will a shift away from the dollar in the global oil trade really lead to a big relative decline in the dollar? Probably and eventually. But a number of other dominoes would need to fall first, most especially the domino we call “Eurodollars.”

On the other hand, it would be foolish to simply dismiss the potential end of the Saudi preference for the dollar with hand-waving. The end of the petrodollar would indeed weaken the dollar, even if this would not be a mortal blow in itself. Moreover, it is especially foolhardy to ignore the status of the petrodollar because that status also has geopolitical implications. Saudi comments on the dollar signal that the Saudis no longer consider its alliance with the United States to be as important as it has been since the 1970s…

…click on the above link to read the rest…

February 1, 2023

Former UK Defense Minister Says NATO May Need To Send Ground Forces To Ukraine

The “domino theory” was once used to great effect in order to manipulate the American public into supporting the Vietnam War, but will the same narrative work to get the west to support World War III with Russia?

Former UK Defense Minister Sir Gerald Howarth seems to think so as he uses this exact claim to justify NATO boots on the ground in Ukraine.

It should be noted that a large percentage of the American populace and most of Europe have no interest whatsoever in engaging with Russia and possibly its allies in all out war, but the establishment appears intent on forcing the issue anyway. The delivery of NATO tanks and the possibility of longer range missiles will no doubt trigger a wider response from Russia, which will then be used by NATO as a reason to escalate further.

At the very least, Howarth does admit what many in the alternative media have been saying for some time – That Ukraine’s efforts have ground to a halt without further support from NATO troops. The deliveries of money and weapons are nothing more than a stop-gap; wars are won by men.

The former minister suggests that Ukraine is essentially too big to fail and that NATO cannot allow Russia to prevail in the region, otherwise they will be emboldened to strike other nearby nations. There is zero evidence to support this argument, but it is clear that NATO talking heads are desperate to drum up some kind of public fervor.

Are western citizens willing to fight and die for Ukraine? It’s highly unlikely.

European Natural Gas Prices Surge Ahead Of Cold Spell

Europe’s benchmark gas prices have rebounded this week as traders closed short positions at the expiry of the front-month contract and some weather forecasts suggested colder weather in northern and central Europe next week than previously expected.

The Dutch TTF benchmark price jumped by 11% at over $65 (60 euros) per megawatt-hour (MWh) at the opening of trade in Amsterdam on Tuesday, extending small gains from Monday and recovering some of the losses from last week, when prices slumped by 17%.

On Monday, the prices were supported by short covering and an unplanned outage at a Norwegian gas processing plant. However, wind power generation is still expected to be strong, which could curb some demand for gas-fired power generation.

But next week, temperatures could be lower than initially expected, which would boost demand for household heating. Colder spells are set to return to northern and central Europe next week, according to weather models by Maxar Technologies Inc, cited by Bloomberg.

Still, the record gas prices in Europe could be behind us, according to ING’s revised outlook on natural gas for this year.

“Mild weather and weak industrial demand have ensured that gas storage has remained strong. The region should get through this winter comfortably and prospects also look better for the 23/24 winter,” Warren Patterson, Head of Commodities Strategy at ING, said on Monday.

…click on the above link to read the rest…

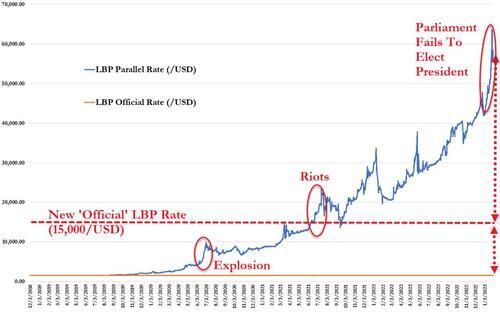

Hyperinflationary Hell: Lebanese Central Bank Devalues ‘Lira’ By 90%

Cash is now king in Lebanon, where a three-year economic meltdown has led the country’s once-lauded financial sector to atrophy and turned the country into a Venezuelan-esque hyperinflationary hell. The country has been hit hard by events over the past few years, starting with COVID.

In August 2020, the city of Beiruit was practically destroyed by a massive blast which killed at least 200 people and triggered as much as $15 billion in damage…

In March 2021, violent protests erupted across Lebanon as the currency collapse accelerated and with it the economy and people’s living standards.

And most recently, In December 2022, the Lebanese parliament failed for the eighth consecutive time to elect a new president, as a majority of lawmakers opposed the options laid on the table.

The prolonged power vacuum only exacerbates the situation, as Beirut is currently unable to enact sweeping reforms demanded by international lenders as a condition for releasing billions of dollars in loans.

All of which has sent the ‘parallel’ FX rate to a stunning 60,000/USD (compared to the official Pound – often nicknamed ‘Lira’ – rate of 1500/USD)…

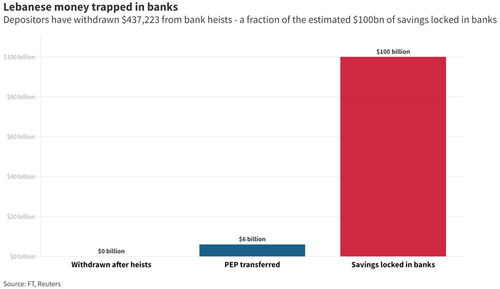

As Reuters reports, Zombie banks have frozen depositors out of tens of billions of dollars in their accounts, halting basic services and even prompting some customers to hold up tellers at gunpoint to access their money.

Not a week goes by without Lebanese depositors storming their own banks in a desperate attempt to access savings frozen after the country’s economy collapsed.

Banks began imposing draconian limits on withdrawals and transfers in 2019, leaving depositors able to access only a fraction of their savings in dollars and Lebanese pounds.

and heists…

The National has recorded 27 depositor bank “heists” since the start of the year, including armed and unarmed hold-ups and sit-ins.

…click on the above link to read the rest…

South Africa’s Energy Crisis Could Spark A Political And Economic Disaster

South Africa’s energy crisis is teetering on the edge of a major political and economic crisis. Bogged down by inefficiency, ineptitude, and severe levels of corruption, the country’s power utility Eskom has proven incapable of providing sufficient and reliable energy to the nation’s grid, despite the domestic abundance of coal. Once one of the most reliable utilities in Africa, Eksom now exists in a state of constant emergency which is currently threatening to push the country into civil disarray and economic catastrophe.

Eksom desperately needs to service its poorly maintained power plants. On any given day, Eksom operates at about 50% capacity. Rolling blackouts, known locally as ‘load shedding’ have become a normal and expected part in day-to-day life in South Africa. “It even has predictable stages,” Forbes reported in a recent excoriation of Eksom operations, “ranging from Stage 1 (reducing power for two hours at a time over a four-day period) through Stage 8 (reducing power for 12 hours out of every 24).”

In the last 12 months, however, these blackouts have gone into overdrive, with the power going out several times a day and up to 12 hours at a time. Adding insult to injury, Eksom has added a steep energy tariff to help bolster their own failing finances. The issue has transformed to a semi-accepted nuisance to a barrier to local livelihoods and the functioning of the national economy…

…click on the above link to read the rest…

January 31, 2023

Iran, Russia integrate banking systems

(Photo Credit : Atta Kenare/AFP)

A top Iranian official announced on 30 January that Iran and Russia had integrated their interbank communication and transfer systems to help enhance trade and financial operations in an effort to bypass strict economic sanctions on their financial infrastructure.With the signing of the agreement, 52 Iranian and 106 Russian banks are connected through the Russian Financial Message Transfer System, which will facilitate economic relations between the two countries, said Deputy Governor of the Central Bank of Iran Mohsen Karimi.

“This system is immune to sanctions as it is based on the infrastructures of both countries,” Karimi said, according to Iran’s Mehr news agency.

The global consortium SWIFT, the world leader in secure financial messaging services, excluded Iranian banks from its system following the reimposition of economic sanctions by the United States on Iran in 2018.

As a result of that suspension of services, the Iranian banking system is disconnected from the international one, making banking transactions with other countries difficult.

Russia was partially excluded from SWIFT last year due to its invasion of Ukraine.

While economic relations between the two countries have grown to 4 billion in recent years, Tehran has sold drones to Russia, which it has used in its invasion of Ukraine.

Official trips between the two countries have also multiplied in recent months, with Iranian President Ebrahim Raisi visiting Russia in January 2022 and Iranian Foreign Minister Hosein Amir Abdolahian making two trips to the Russian capital in less than a year.

“In today’s world, a country’s status is largely related to its economic power … We need economic growth to maintain our

regional and global position,” Iran’s top authority, Supreme Leader Ali Khamenei, said in a televised speech.

Prestigious Liberal Watchdog Condemns New York Times’ Russiagate Coverage

The Columbia Journalism Review (CJR) has issued a scathing indictment of the New York Times for yellow journalism during the Trump-Russia saga.

In short, the hyper-partisan ‘paper of record’ was operating in bad faith.

It’s wasn’t just the Times either. CJR’s findings accurately reflect what most objective thinkers have known this whole time – they were all operating in bad faith.

That said, CJR aimed the majority of criticism towards the NYT.

“No narrative did more to shape Trump’s relations with the press than Russiagate. The story, which included the Steele dossier and the Mueller report among other totemic moments, resulted in Pulitzer Prizes as well as embarrassing retractions and damaged careers,” wrote CJR executive editor Kype Pope in an editor’s note.

The findings were published in a lengthy, four-part series. The first section begins with a story about then-New York Times executive editor Dean Baquet’s reaction when he found out Special Counsel Robert Mueller didn’t plan to pursue Trump’s ousting, telling his staff “Holy s—, Bob Mueller is not going to do it.” –Fox News

“Baquet, speaking to his colleagues in a town hall meeting soon after the testimony concluded, acknowledged the Times had been caught ‘a little tiny bit flat-footed’ by the outcome of Mueller’s investigation,” according to Jeff Gerth – the author of CJR’s lengthy retrospective.

“That would prove to be more than an understatement,” he continued. “But neither Baquet nor his successor, nor any of the paper’s reporters, would offer anything like a postmortem of the paper’s Trump-Russia saga, unlike the examination the Times did of its coverage before the Iraq War.”

According to Gerth, the Times destroyed its credibility outside of its “own bubble.”

…click on the above link to read the rest…

Gold And The Shrinking Trust Horizon

Last week I posted an article on the implosion of the official vaccine narrative. That’s a controversial topic so not surprisingly it generated some heat on both sides. And a few readers expressed the wish that I’d stay in my lane (precious metals investing) and avoid venturing into unrelated and less well understood territory.

But believe it or not, the public health establishment losing its credibility is related to precious metals, via something called the trust horizon. It works like this: When things are good and the people in charge of big systems seem to be running them well, we’re content to trust the experts. We keep most of our money in banks, brokerage houses, and crypto wallets that exist for us only as websites. We buy produce that’s grown in a different hemisphere and shipped via boats, trains, and trucks to corporate chain grocery stores. We vaccinate ourselves and our kids according to the schedules set by the NIH or the CDC. We pop pills on our doctor’s orders without doing any research. We eat processed foods on the assumption that the FDA keeps them free of dangerous additives. And we believe what we see on cable news.

In other words, our trust horizon, defined as the distance from ourselves at which we’ll believe what we’re told, is global. We assume everything everywhere is working for our benefit and we’re thus willing to put our welfare in those distant hands.

But let some big systems fail to take proper care of us and we pull back, finding people and institutions closer to home that we can see and judge first-hand. We move our money out of distant banks and brokers and into local credit unions whose managers live down the street…

…click on the above link to read the rest…