Steve Bull's Blog, page 130

February 6, 2023

Oil To Face “Serious” Supply Problem In 2024 As Production Capacity Runs Out, Goldman Warns

Heading into 2023, Goldman was bearish on most asset classes, except commodities where the bank forecast a 43% gain as “supply shortages bite.” Since then the commodity picture has ebbed and flowed, and after commodities experienced a modest bounce following China’s unexpected reopening, they have resumed sinking with oil trading just above the Biden admin’s (supposed) SPR refill floor of $72, despite a near consensus that Chinese oil demand will hit record highs in 2023.

So has the recent setback dented Goldman’s optimism? Not at all: in fact, according to Goldman chief commodity strategist, not only will oil rise back above $100 a barrel this year, it will rise much more in 2024 when it will face a serious supply problem as spare production capacity runs out.

Speaking on the sidelines of a conference in Riyadh, Saudi Arabia, on Sunday, Goldman chief commodity strategist Jeff Currie said that with sanctions likely to cause Russian oil exports to drop and Chinese demand expected to recover as the country ends its Covid Zero policy, prices will rise above $100 from their current level of around $80. Meanwhile, doubling down on his key long-term thesis, Currie said that a lack of spending in the industry on production needed to meet demand will also be a driver of higher prices, and this lack of capacity may become a big issue by 2024.

“The commodity super cycle is a sequence of price spikes with each high higher and each low higher,” said Currie, who predicted that by May, oil markets should flip to a deficit of supply compared to demand. That could use up much of the unused capacity global producers have, which will send prices higher.

…click on the above link to read the rest…

February 5, 2023

A tale of two worlds

In the war between the western alliance and the Asian axis, the media focus is on the Ukrainian battlefield. The real war is in currencies, with Russia capable of destroying the dollar.

So far, Putin’s actions have been relatively passive. But already, both Russia and China have accumulated enough gold to implement gold standards. It is now overwhelmingly in their interests to do so.

From Sergey Glazyev’s recent article in a Russian business newspaper, it is clear that settlement of trade balances between members, dialog partners, and associate members of the Shanghai Cooperation Organisation (SCO) optionally will be in gold. Furthermore, the Russian economy would benefit enormously from a decline in borrowing rates from current levels of over 13% to a level more consistent with sound money.

To understand the consequences, in this article the comparison is made between the western alliance’s fiat currency and deficit spending regime and the Russian-Chinese axis’s planned industrial revolution for some 3.8 billion people in the SCO family. China has a remarkable savings rate, which will underscore the investment capital for a rapid increase in Asian industrialisation, without inflationary consequences.

With a new round of military action in Ukraine shortly to kick off, it will be in Putin’s interest to move from passivity to financial aggression. It will not take much for him to undermine the entire western fiat currency system — a danger barely recognised by a gung-ho NATO military complex.

Introduction

In the geopolitical tussle between the old and new hegemons, we see the best of strategies and the worst of strategies, where belief is pitted against credulity. It is the season of light and the season of darkness, the spring of hope and the winter of despair…

…click on the above link to read the rest…

February 4, 2023

Companies in UK Are Hitting the Wall at Fastest Rate Since Global Financial Crisis

As the price of everything, including debt, continues to soar, life is getting harder and harder for the UK’s heavily indebted businesses.

Business insolvencies in the UK surged by 57% in 2022, to 22,109, according to the latest data from the Insolvency Service, a UK government agency that deals with bankruptcies and companies in liquidation. It is the highest number of insolvencies registered annually since 2009, at the height of the Global Financial Crisis.

Last year “was the year the insolvency dam burst,” said Christina Fitzgerald, the president of R3, the insolvency and restructuring trade body. Insolvencies peaked in the fourth quarter, underscoring the compounding pressures on companies grappling with surging costs and rapidly slowing economic activity.

“Supply-chain pressures, rising inflation and high energy prices have created a ‘trilemma’ of headwinds which many management teams will be experiencing simultaneously for the first time,” Samantha Keen, UK turnround and restructuring strategy partner at EY-Parthenon and president of the Insolvency Practitioners Association (IPA), told the Financial Times. “This stress is now deepening and spreading to all sectors of the economy as falling confidence affects investment decisions, contract renewals and access to credit.”

Other headwinds include soaring interest rates, falling consumer demand, nationwide strikes, lingering Brexit-induced supply chain issues, an epidemic of quiet quitting and both chronic and acutely bad government.

Closest to the Edge

None of this, of course, should come as a surprise. Of all the large economies in Europe, the UK’s is arguably closest to the cliff edge. As newspaper headlines trumpeted this week, the UK economy this year will probably fare worse than Russia’s sanction-hit economy, according to the IMF’s latest forecasts. But then the same could be said of many other European economies, including Germany and Italy.

…click on the above link to read the rest…

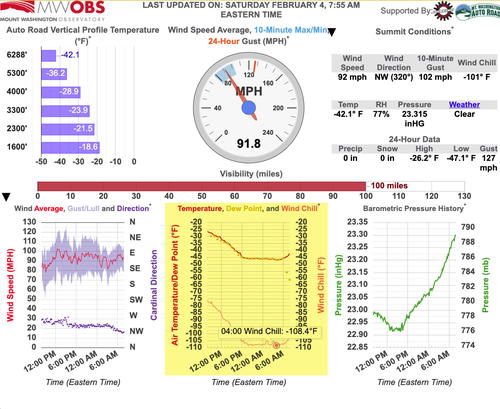

Mount Washington Observatory As Cold As Mars With Record-Breaking Wind Chill

The polar vortex that moved in yesterday has been nothing short of impressive. Records were broken at the Mount Washington Observatory (MWObs) in New Hampshire’s White Mountains.

At 6,288 feet, MWObs is located at the highest peak in the Northeast and has some of the most wicked weather in the world.

The lowest-ever wind chill was recorded early Saturday morning near -109 degrees Fahrenheit, surpassing the previous record of -103 degrees. At the same time, temperatures were around -47 degrees.

“There is half of me that loves what is going on right now, and the other half of me is pretty terrifying,” meteorologist Francis Tarasiewicz, stationed at MWObs, told NBC 10 Boston .

Here’s a live feed from MWObs.

For some reference, Mars averages about -81 degrees. So the temperatures at MWObs are out of this world.

Recall Friday, we noted that the polar vortex weakened and would pour the coldest air in the world into New England.

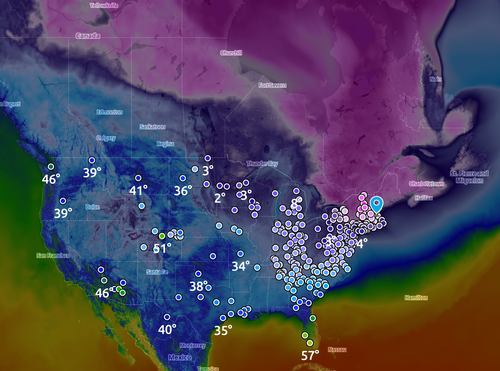

Here’s a snapshot of temperatures around 0800 ET via Ambient Weather data.

The National Weather Service in Boston said record cold was achieved at 3 out of 4 weather stations.

Brr, it’s freezing in Boston.

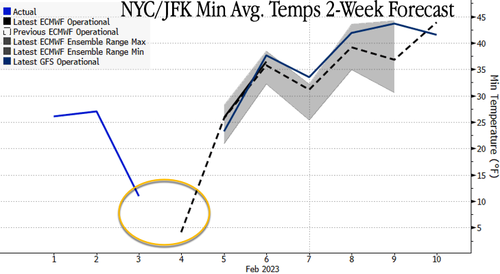

As well as in NYC.

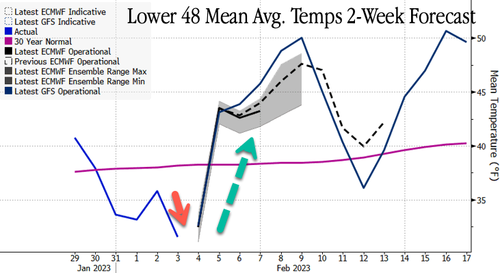

There is some good news. The cold shot across the Lower 48 will only be brief, and above-average temperatures are forecasted for next week.

Meanwhile, legendary Punxsutawney Phil saw his shadow on Thursday, which means the possibility of six more weeks of winter.

Pepe Escobar: Ukraine War is Desperate Move by U.S. to Preserve Hegemony and Prevent Multipolar World

The war in Ukraine is not just about Ukraine and Russia with the U.S. and NATO acting as seemingly benevolent supporters of Ukraine, as the Western media portray.

The war in Ukraine is not just about Ukraine and Russia with the U.S. and NATO acting as seemingly benevolent supporters of Ukraine, as the Western media portray.

The United States and its NATO allies are deeply involved in the conflict. The military withdrawal from Afghanistan in 2021 – after 20 years of futile occupation – was a calculated “reorganization of firepower” against Russia, says Pepe Escobar.

Ukraine is merely a proxy and ultimately cannon fodder for American imperial planners.

This war is part of a bigger geopolitical confrontation between the U.S. and Russia, China and other nations that are pushing for the emergence of a multipolar world. That is a multipolar world no longer under the hegemony of U.S.-dominated Western capitalism.

Pepe Escobar assesses the bigger picture and outlines how the U.S. imperial state is in “panic mode” to shore up the collapsing American-controlled global capitalist system, and in particular the privileged position of the U.S. dollar.

Going to war with Russia presently and in the longer term against China is part of the desperate dynamic to prolong the dominant position of Washington that was established after the Second World War. That postwar imperial order – euphemistically called the “rules-based order” – is increasingly falling into disrepute from unbridled imperialist wars and abuse of financial controls.

The vast majority of the planet wants liberation from the U.S./Western warmongering system that underpins capitalist exploitation that only enriches a global elite. The war in Ukraine is but the manifestation of the breakdown in U.S. global power and the desperation to preserve the systematic inequality that defines capitalism.

…click on the above link to read the rest…

February 3, 2023

Kris De Decker: “Low Tech: What, Why, and How.”

More Than 400,000 Texans Without Power Amid Dangerous Winter Storm

The freezing conditions will end for Texas soon, but they’re set to move into the Northeast this weekend.

[image error]A woman waits for paramedics in the back of a Lyft Ride vehicle on February 01, 2023 in Austin, Texas. A winter storm is sweeping across portions of Texas, causing massive power outages and disruptions of highways and roads.Photo: Brandon Bell (Getty Images)Central Texas has been frozen since earlier this week after an Arctic front rolled into the Southern U.S. Parts of central, west, and north Texas and nearby states Arkansas and Tennessee were under ice storm warnings, per the National Weather Service Prediction Center. The freezing temperatures and sleet should end by this weekend.

“The prolonged and damaging ice storm that has impacted a large region from Texas to Tennessee is forecast to finally come to an end today as a final surge of moisture slides eastward,” the NWS said. “Highs will return into the 40s and 50s by Friday, likely eliminating any icy concerns.”

“FINALLY beginning to see some clearing on radar. Road conditions will slowly improve as we climb into the mid 30s today. Slick spots will persist overnight but widespread improvement is expected tomorrow. Allow for extra travel time today. It’s still slushy!” the Fort Worth National Weather Service account tweeted Thursday.

More than 405,000 customers out of 13 million are without power, according to Poweroutage.us.

Several days of icy conditions had canceled over 2,000 flights across several states as of Wednesday afternoon, the Wall Street Journal reported. Driving was dangerous throughout Texas this week. The storm has been blamed for 10 traffic accident deaths across three states, the Associated Press reported. The sleet and freezing rain also created ice layers on trees, causing the branches to snap off.

…click on the above link to read the rest…

Norway Finds Rare Earth Metals That Could Make Europe Less Dependent On China

Norwegian scientists have made a discovery of rare earth metals in the country’s northern region. The findings have the potential to transform the country’s economy and secure its place as a major player in the global market for high-tech and green technology. Furthermore, the findings could make Europe less dependent on China for the critical metals.

Today, China is believed to account for more than 80 percent of many metals that are needed for green energy solutions, such as rare earth metals used in electric cars and wind turbines.

Karl Kristensen, a consultant for Bergfald Environmental Consultants, says that the green shift in economics will only multiply the world’s dependence on these materials. He warned that China has almost complete control of the market for rare earth metals in his lecture on the topic during the KÅKÅnomics economics festival in Stavanger, Norway, in October 2022.

The discovery in Norway was made during a routine survey of the region and was confirmed through extensive drilling and analysis.

The deposits are believed to be among the largest of their kind in the world, and the potential for further discoveries in the area is significant.

The Norwegian Petroleum Directorate (NPD) was responsible for conducting the research that led to the find. “The NPD has built up expertise over many years, in part through a number of expeditions. We’ve mapped relevant areas, collected data, and taken large volumes of mineral samples,” said Kjersti Dahle, director, technology, analysis and coexistence at the NPD.

NPD’s research shows that there is a large area of the Norwegian continental shelf with significant mineral resources, particularly in the deep sea, where several of these minerals are concentrated. The Norwegian government and NPD are now working together to create the necessary framework for a sustainable and responsible exploration and utilization of these minerals…

…click on the above link to read the rest…

France Hit By Strikes, Protests Amid Outrage At Hiking Retirement Age To 64

French labor unions have been holding several days of mass strikes and protests against raising the retirement age, in a test of the momentum driving defiance to Emmanuel Macron’s signature economic reform… which is hardly surprising: France is one of the biggest “western” bastions of socialism.

As Bloomberg reports, the country’s rail operator, SNCF, said only one-third of high-speed TGVs were running and urged people to work from home. Subway and commuter trains serving the capital were severely disrupted, with limited service on most lines. Many schools were also closed.

Protesters also blocked three oil refineries operated by TotalEnergies SE and strikes by Electricite de France SA’s workforce took more than 3 gigawatts of nuclear-reactor capacity offline. Air France-KLM’s French arm said it had scrapped 10% of short-haul flights.

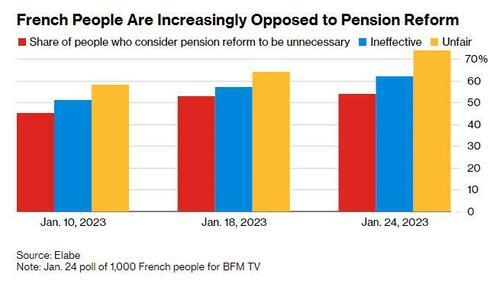

Macron, already very unpopular, has faced the biggest protests yet of his time as president on Jan. 19 when the country’s usually fragmented unions united to bring more than 1.1 million people onto the streets. Polls carried out since suggest opposition is growing: a Feb 1 poll carried out by BVA for RTL which surveyed 1,001 people showed that 60% of participants oppose pension reform, up 2 points.

Speaking to French television channels at the start of the Paris March on Tuesday, CGT union head Philippe Martinez said there were more people in the streets than Jan. 19.

“The president and the government must hear the discontent and change their plan,” Martinez said, and perhaps he is right: after all, why work when the ECB can just print and make everyone super wealthy.

According to a government count mid-way through the day, fewer public sector workers went on strike than Jan. 19. Martinez said many chose not to this time in order to preserve their wages, while a bigger turnout of white collar, private sector workers made up the numbers.

…click on the above link to read the rest…

You Think the Global Economy Is Brightening? Beware: The Big Hit Is Yet to Come

Relief is spreading among economic analysts and stock market experts. Energy prices are decreasing noticeably. The energy supply this winter seems secure; in Europe, government support for consumers and producers is available if needed. China is turning away from its zero-covid policy, and production is ramping up again. High goods price inflation is still a major concern for consumers and producers, but central banks are delivering at least some interest rate hikes to hopefully reduce currency devaluation. So should we bid farewell to crisis and recession worries? Unfortunately, no.

Because there is an overall economic development that is tantamount to a storm but remains unnamed by many experts and investors. And that is the global contraction of the real money supply. What does that mean? The real money supply represents the actual purchasing power of money. For example: You have ten dollars, and one apple costs one dollar. So with your ten dollars, you can buy ten apples. If the apple price increases to, say, two dollars per piece, the purchasing power of the ten dollars falls to five apples. It becomes obvious that the real money supply is determined by the interplay between the nominal money supply and the prices of goods.

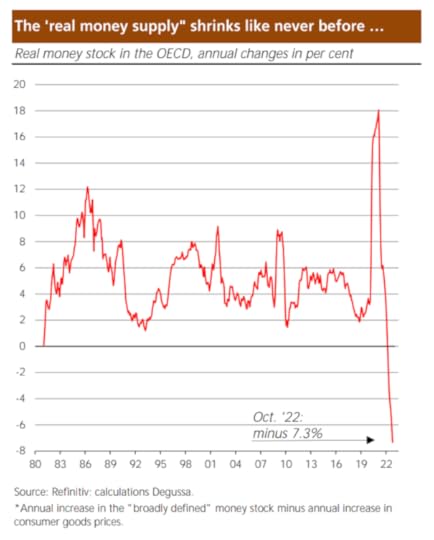

The real money supply in an economy can decrease when the nominal money supply goes down or goods prices rise. This is exactly what is currently happening around the world. The chart below shows the annual growth rate of the real money supply in the Organization for Economic Cooperation and Development (OECD) from 1981 to October 2022. The real money supply recently contracted by 7.3 percent year on year. There has never been anything like this before. What is the reason?

…click on the above link to read the rest…