Steve Bull's Blog, page 1248

November 24, 2017

“Chernobyl in a Can” – 71 Vulnerable-To-Cracking Radioactive Waste Canisters Set for CA Ocean-Front Burial at San Onofre: Donna Gilmore, NH #335

“Chernobyl in a Can” – 71 Vulnerable-To-Cracking Radioactive Waste Canisters Set for CA Ocean-Front Burial at San Onofre: Donna Gilmore, NH #335

This Week’s Featured Interview:

Donna Gilmore of SanOnofreSafety.org reports on Southern California Edison’s plans to bury 1,800 tons – that’s 3,600,000 pounds <!> of high-level radioactive waste a mere 36 yards from high tide in canisters that are vulnerable to cracking and leaking. Each one contains a Chernobyl’s worth of radiation on the Pacific Ocean less than 70 miles from Los Angeles!

What to do:

Download petition and info sheets HERE – it’s the top story on the page.

Get signatures on the petition and send to San Onofre Safety (hard copy signatures on paper are necessary).

Use the info sheet to engage in conversation on the issues.

CA RESIDENTS: Call your state representative; locate her or him HERE: www.findyourrep.legislature.ca.gov

CALL the California Coastal Commission: (562) 590-5071

To read the Federal Register containing the Nuclear Regulatory Commission’s admission of no requirements for aging of radioactive waste-containing canisters, CLICK HERE .

Numnutz of the Week (for Outstanding Nuclear Boneheadedness):

“Shelter in place” after a nuclear accident… and stay there? New study provides a great way to keep the bodies out of the streets and the clean-up to a minimum! Beware of “*NEW IMPROVED*” methods of measuring radioactive risk… and always check out who’s behind the funding for this kind of bogus pro-nuclear “research.”

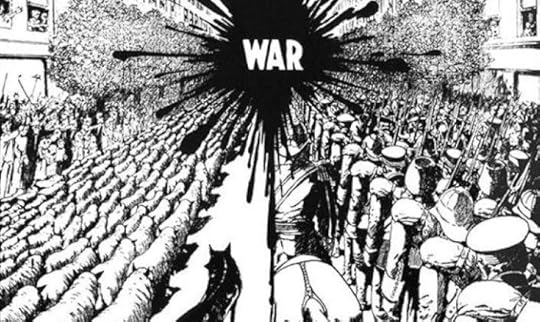

The Public Are All Alone: Understanding How the Enemy of Your Enemy Is Not Your Friend

The Public Are All Alone: Understanding How the Enemy of Your Enemy Is Not Your Friend

In political matters, the public are taught to believe that some political Party is ‘good’, and that the others are “bad”; but the reality in recent times, at least in the United States, has instead been that both Parties are rotten to the core (as will be clear from the linked documentation provided here).

Belief in this myth (that the opposition between Parties is between ‘good’ ‘friend’ versus ‘bad’ ‘enemy’) is based upon the common adage that “The enemy of my enemy is my friend.” One side is believed, and ones that contradict it are disbelieved — considered to be lying, distorting: bad. But, maybe, both (or all) Parties are deceiving; maybe all of them are enemies of the public, but just in different ways; maybe each of them is trying to control the country in the interests of (and so to obtain the most financial support from) the aristocracy, while all of them are actually against the public.

Can it really be false that “The enemy of my enemy is my friend?” Not only can be, but often is. And no one is able to vote intelligently without recognizing this fundamental political fact.

It’s true between entire nations, too — not only within nations.

For example: Hitler and Stalin were enemies of each other, but neither of them was a friend of America (except that Stalin did more than anyone else to defeat Hitler, and thereby saved the world, though the U.S. — far less a factor than the U.S.S.R. was in defeating Hitler — still refuses to acknowledge the fact that Stalin did more than anyone else did to prevent the entire world’s becoming dictatorships; so, whatever democracy exists today, is a result of that dictator, Stalin, even more than it’s a result of either FDR or Churchill).

…click on the above link to read the rest of the article…

November 23, 2017

WTI Prices Surge On Keystone Spill

Oil prices surged on Wednesday on news that the Keystone pipeline might not restart for several weeks. The outage at the damaged pipeline ended several years of contango for WTI, pushing the benchmark into a state of backwardation for the first time since 2014.

TransCanada made a lot of headlines in the past week. The Keystone pipeline ruptured and spilled more than 200,000 gallons of crude oil in South Dakota last week, just days before TransCanada was given a greenlight for the Keystone XL in the state of Nebraska. South Dakota regulators now say that they could revoke the permit for the Keystone pipeline if it is found that the company violated the terms of its license. The spill was the third for the Keystone pipeline in less than 10 years.

“If it was knowingly operating in a fashion not allowed under the permit or if construction was done in a fashion that was not acceptable, that should cause the closure of the pipe for at least a period of time until those challenges are rectified,” said Gary Hanson, a member of the South Dakota Public Utilities Commission, told Reuters.

TransCanada said on Wednesday that it could take weeks to clean up the spill and bring the pipeline back online – news that sent shockwaves through the oil market. WTI spot prices surged on the news, pushing the benchmark back up above $58 per barrel.

TransCanada said that November deliveries through the pipeline would be cut by about 85 percent, a major outage for the nearly 600,000-bpd pipeline. Phillips 66, a major refiner that purchases crude from the pipeline, said that it is expecting an outage of about four weeks.

…click on the above link to read the rest of the article…

The 10 Most Influential Oil Countries

The world’s top oil exporters are undoubtedly some of the world’s most influential countries. As such, it behooves analysts to always stay abreast of the internal dynamics of these economic power houses. Here’s what’s going on in the countries that have the power to make or break the oil market.

1. Saudi Arabia

As the world’s leading oil exporter, Saudi Arabia shipped 7.5 million barrels per day in 2016, according to data published by the Organization of Petroleum Exporting Countries (OPEC). As far as oil exports go, the Kingdom is top of the pile, despite the OPEC agreement that cut 486,000 barrels per day off its production level of 10.5 million bpd. The Kingdom holds a lot of clout in the oil market, and as such, plays a leading role in the industry cartel, which is currently implementing a 1.2 million-barrel per day production cut to rebalance a three-year supply glut plaguing oil markets.

Despite its reigning supreme in the oil export arena, not all is well in the royal palace. Mohammed bin Salman (MBS), the newly crowned heir to the throne, started the month off with a series of shocking arrests of powerful royals and businessmen in a domestic power consolidation marketed in official outlets as an anti-corruption drive.

The unity of the Saud family has been a hallmark of the nation since the establishment of the Third Saudi State back in 1902. Infighting in the palace could cause the nation to fall back into contentious politics at a time when it needs to chart its course towards economic diversification, as outlined in MBS’s Vision 2030—a plan that may move Saudi Arabia away from oil, unseating it from its top spot on the list.

…click on the above link to read the rest of the article…

Fed Fears New Record High Credit Bubble – Danielle DiMartino Booth

Former Federal Reserve insider Danielle DiMartino Booth says the record high stock and bond prices make the Fed nervous because it’s fearful of popping this record high credit bubble. DiMartino Booth says, “The Fed’s biggest fear is they know darn well this much credit has built up in the background, and the ramifications of the un-wind for what has happened since the great financial crisis is even greater than what happened in 2008 and 2009. It’s global and pretty viral. So, the Fed has good reason to be fearful of what’s going to happen when the baby boomer generation and the pension funds in this country take a third body blow since 2000, and that’s why they are so very, very intimidated by the financial markets and so fearful of a correction.”

Former Federal Reserve insider Danielle DiMartino Booth says the record high stock and bond prices make the Fed nervous because it’s fearful of popping this record high credit bubble. DiMartino Booth says, “The Fed’s biggest fear is they know darn well this much credit has built up in the background, and the ramifications of the un-wind for what has happened since the great financial crisis is even greater than what happened in 2008 and 2009. It’s global and pretty viral. So, the Fed has good reason to be fearful of what’s going to happen when the baby boomer generation and the pension funds in this country take a third body blow since 2000, and that’s why they are so very, very intimidated by the financial markets and so fearful of a correction.”

Why will the Fed not allow even a small correction in the markets? DiMartino Booth says, “Look back to last year when Deutsche Bank took the markets to DEFCON 1. Maybe you were paying attention and maybe you weren’t, but it certainly got the German government’s attention. They said the checkbook is open, and we will do whatever we need to do because we can’t quantify what will happen when a major bank gets into a distressed situation. I think what central banks worldwide fear is that there has been such a magnificent re-blowing of the credit bubble since 2007 and 2008 that they can’t tell you where the contagion is going to be. So, they have this great fear of a 2% or 3% or 10 % (correction) and do not know what the daisy chain is going to look like and where the contagion is going to land. It could be the Chinese bond market. It could be Italian insolvent banks or it might be Deutsche Bank, or whether it might be small or midsize U.S. commercial lenders.

…click on the above link to read the rest of the article…

China Deleveraging Hits Corporate Bonds As Cascade Effect Begins

Following the market lockdown during October’s Party Congress, many commentators were disturbed by the continued rise in Chinese government bond yields as we returned to “business as usual”, with the 10-year rising to 4%. At the beginning of this month, we discussed the sell-off (see “China: Shadow Bank Inflows Are Critical To Sustain The Ponzi…But They’re Falling”) and noted a useful insight from the Wall Street Journal.

An important anomaly to note about the bond rout: as government bonds sold off, yields on less-liquid, unsecured Chinese corporate bonds barely moved.

That is atypical in an environment of rising rates – usually, bond investors shed their less-liquid holdings and hold on to assets that are more easily tradable, like government debt.

The question was…why had corporate bond yields barely moved? The answer, according to the WSJ, was that China’s deleveraging policy led to redemptions in the shadow banking sector, e.g. in the notorious $4 trillion Wealth Management Products (WMP) sector. Faced with redemptions, shadow banks had to sell something…quickly…and highly liquid government bonds were the “easiest option”. Furthermore…and this is potentially significant…the WSJ noted.

Meanwhile, the nonbanks have held on to their higher-yielding corporate bonds, which at least have the benefit of helping them to maintain high returns.

Not any more (see below).

We agreed with the WSJ’s explanation at the time, but noted that the government bond sell-off was actually a sign of the unravelling of the WMP Ponzi scheme. The Chinese authorities are wise to the Ponzi which is why they announced the overhaul of shadow banking and WMPs last Friday (see “A ‘New Era’ In Chinese Regulation Means Turmoil For $15 Trillion In China’s ‘Shadows”). However, the new regulations don’t kick in until mid-2019, a sign to us that when they looked “under the bonnet”, they didn’t like what they saw.

…click on the above link to read the rest of the article…

Museletter #306: Saudis and Trump: Gambling Bigly

Download printable PDF version here (PDF, 205 KB)

“My grandfather rode a camel, my father rode a camel, I drive a Mercedes, my son drives a Land Rover, his son will drive a Land Rover, but his son will ride a camel.” – Rashid bin Saeed Al Maktoum, first Prime Minister of United Arab Emirates

Try this simple mental exercise. Imagine a hypothetical Middle Eastern monarchy in which:

Virtually all wealth comes from the extraction and sale of depleting, non-renewable, climate changing petroleum;

Domestic oil consumption is rising rapidly, which means that, as long as this trend continues and overall oil production doesn’t rise to compensate, the country’s net oil exports are destined to decline year by year;

The state has a history of supporting a radical version of Sunni Islam, but the people who live near its oilfields are mostly Shiite Muslims;

Power and income have been shared by direct descendants of the royal founder of the state for the past 80 years, but the thousands of princes on the take don’t always get along well;

Many of the princes have expatriated the wealth of the country overseas;

Population is growing at well over two percent annually (doubling in size every 30 years), and, as a result, 70 percent of the country is under age 30 with increasing numbers in need of a job;

Roughly 30 percent of the population consists of immigrants—many of whom are treated terribly—who have been brought into the country to perform labor that nationals don’t want to do;

A sizeable portion of the nation’s enormous wealth has been spent on elaborate weapons systems and on fighting foreign wars;

A powerful Shia Muslim nation located just a couple of hundred miles away has gained geopolitical advantage in recent years; and,

For the past three years oil prices have been too low to enable the kingdom to meet its obligations, so it has rapidly been spending down its cash reserves.

…click on the above link to read the rest of the article…

Trump Eyes Arctic Wildlife Refuge for Oil Drilling, Alarming Gwich’in

In the remote north-eastern corner of Alaska, just under 20-million acres have been set aside as a federal protected area since 1960. The Arctic National Wildlife Refuge has recently come under threat, however, with President Donald Trump’s Department of the Interior proposing lifting restrictions on seismic exploration.

The Arctic National Wildlife Refuge coastal plain has been described as America’s Serengeti, and is the year-round or migratory home to numerous species that are uniquely adapted to the conditions found within this rare expanse of undeveloped wilderness along the Arctic Ocean.

Over tens of thousands of years, both the Porcupine Caribou herd and the Gwich’in people have come to depend on the integrity of that coastal plain for their survival.

“The Gwich’in call this area ‘Iizhik Gwats’an Gwandaii Goodlit,’ the Sacred Place Where Life Begins,” explained Vuntut Gwich’in Councillor Dana Tizya-Tramm via email.

“It is a keystone in the ecosystems of the Arctic, and the heart that beats outside of the Gwich’in chest.”

Oil and gas lobbyists have had the Refuge in their sights from the outset. For decades now, for every push to open up the wildlife refuge to oil and gas development, multiple generations of Gwich’in have stood up to protect the land and the herd that has sustained their way of life.

Disturbance to the landscape can upset a delicate balance between the wildlife that makes its home on the coastal plain.

Brooks Range mountains tower behind lush arctic tundra in Yukon’s north slope region. Photo: Matt Jacques | DeSmog Canada

“In a miracle of phenology [the interaction of climate, habitat and plant/animal cycles], Porcupine caribou cows arrive at the coastal plain just as the first flush of spring growth provides a burst of nutrients to them, just as they all deliver their calves at once,” said Yukon Conservation Society energy analyst Sebastian Jones in an emailed response to questions from DeSmog Canada.

…click on the above link to read the rest of the article…

The Fight for Northern Iraq’s remaining oil

Fig 1: Iraqi crude exports by SOMO

Fig 1: Iraqi crude exports by SOMO

The above graph shows Iraqi crude oil exports by the SOMO oil marketing company. Until March 2014 Kirkuk crude from North Oil Company (Avana and Baba domes and Bai Hassan fields) was flowing through the Iraq-Turkey pipeline (ITP) Kirkuk – Baiji refinery – Faysh Khabur (capacity 600 kb/d, metering station under Baghdad control near the border with Turkey) and on to the Ceyhan terminal in Southern Turkey. It stopped operating due to frequent attacks by militants. In June 2014 ISIL attacked the Baiji refinery (230 kb/d) and heavy fighting started with the Iraqi army.

Fig 2: Baiji refinery in September 2014

Fig 2: Baiji refinery in September 2014

The refinery changed hands several times and was finally retaken by the Iraqi army in Nov 2015 but it was badly damaged.

The Kurdish Government built their own pipeline infrastructure with following capacities

Tawke oil field to Faysh Khabur (250 kb/d)

Taq Taq oil field to Khurmala, the northern dome of the Kirkuk oil field (150 kb/d)

Khurmala to Faysh Khabur (700 kb/d)

Fig 3: Northern Iraq’s oil field and pipeline map and KRG’s oil production 2015

Fig 3: Northern Iraq’s oil field and pipeline map and KRG’s oil production 2015

The map is from here:

The oil data are from the KRG government

Projects (a) – (c) were completed by end 2013. Another pipeline between Khurmala and Avana was built and opened in mid 2014. This allowed Kirkuk oil to be exported via the KRG pipeline.

In December 2014 an agreement was made between Baghdad and KRG with following provisions:

(1) the KRG give 250,000 b/d of the crude oil produced in its territory to SOMO at the Ceyhan terminal to market the crude,

(2) Iraq (Baghdad) export 300,000 b/d of Kirkuk crude through KRG’s pipeline to Ceyhan

…click on the above link to read the rest of the article…

When the Next Pandemic Hits, Will We Be Prepared?

The question isn’t whether a pandemic will strike—it’s how it will play out.

Thought leaders gathered at the National Museum of Natural History to discuss the past, present and future of the flu.(Daniel Schwartz)

Thought leaders gathered at the National Museum of Natural History to discuss the past, present and future of the flu.(Daniel Schwartz)What would it look like if the devastating Spanish flu crisis of 1918 hit today? That was the question that public health experts and thought leaders came together to address at this week’s “The Next Pandemic” symposium, organized in collaboration with Smithsonian Media, Johns Hopkins Bloomberg School of Public Health and Smithsonian’s National Museum of Natural History.

On the one hand, today’s public health landscape looks nothing like 1918—thanks in part to the continued reverberations of that fateful year. The waves of influenza that claimed the lives of anywhere between 50 and 100 million people ushered in a new era of public health and epidemiology. Today we have a seasonal flu vaccine, as well as the capacity to develop new vaccines within six months of identifying novel strains. We have international disease reporting and surveillance networks to ensure that a disaster on that scale never happens again.

On the other hand, all these tools could prove useless depending on what we find ourselves facing. Even a familiar culprit like influenza—which morphs every year and still largely manages to outsmart our vaccines—could easily overwhelm the world’s current healthcare systems and resources. Nor is the pandemic threat limited to immediate dangers to public health. A crisis of that magnitude would test our infrastructure and community response, and threaten countries’ economic and political security.

…click on the above link to read the rest of the article…