Steve Bull's Blog, page 1245

November 27, 2017

NBC Pushes an Unfounded Conspiracy Theory on Behalf of CIA

NBC Pushes an Unfounded Conspiracy Theory on Behalf of CIA

Retired National Security Agency (NSA) chief technology officer William Binney is being branded as a “conspiracy theorist” by corporate media outlets, most notably, the Comcast-owned National Broadcasting Corporation, for co-authoring a controversial memo issued this past summer by a group of former intelligence officers – Veteran Intelligence Professionals for Sanity.

The memo opined that the leak of Democratic National Committee e-mails during the 2016 presidential campaign were not the result of Russian state-sponsored hacking but the result of an inside job by a DNC staffer who loaded the purloined e-mails onto a thumb drive. That view is contrary to an assessment made in a 2017 intelligence assessment by 17 US intelligence agencies. That assessment claimed that Russian government-sponsored hackers broke into the email servers of the DNC and then provided the emails to WikiLeaks. However, the assessment was not the unanimous view of 17 US intelligence agencies, but merely four – the Central Intelligence Agency, the National Security Agency, the Federal Bureau of Investigation. It was provided a chapeau of legitimacy by the Director of National Intelligence. Contrary to news reports, the Defense Intelligence Agency, the State Department Bureau of Intelligence and Research, and intelligence elements of the military services did not provide input to the assessment.

Binney was also accused by NBC “national security reporter” Ken Dilanian of pushing the “conspiracy theory” that the “NSA is collecting and storing nearly every US communication.” Far from being a conspiracy theory, NSA’s unconstitutional eavesdropping program, code-named STELLAR WIND and officially known as the “President’s Surveillance Program,” was proven in classified documents revealed by NSA whistleblower Ed Snowden and, earlier, by Justice Department prosecutor Thomas Tamm. A metadata-capturing program called PRISM ensnared the personal data of millions of Americans from AT&T, Verizon, Sprint, Facebook, Apple, Google, Microsoft, Yahoo, and AOL.

…click on the above link to read the rest of the article…

Corruption is Pervasive & Standard Operating Procedure

COMMENT: I read your post on Trump, Jr. and it does appear obvious that there is no investigation into the whole Maginsky Act and why are Trump Jr.’s lawyers not exposing this more? It seems that corruption only really exists when it always involves government.

KA

ANSWER: Corruption is a huge problem in all governments worldwide. It is the possession of power in the hands of authorities that can be bribed which regularly instigates corruption. The ONLY possible way to prevent this corruption is term limits. Believe it or not, California’s notorious Senator Dianne Feinstein announced that she said she was running for reelection in 2018. “I’m all in!” she tweeted and wrote in a Facebook post. These people have to be dragged out of office by their hair. She is 84 years old! Feinstein is the oldest Senator in Washington. Her next term, if Californian elect her again, which is likely, she will be past her 91st birthday. She has been the leading person taking all our liberty and a staunch supporter of the NSA. I have written before that “She is an outright liar” claiming if the government had more power they would have prevented 911. They were in on it!

Feinstein’s husband, Richard C. Blum, is chairman of C.B. Richard Ellis, or CBRE. Because of his wife, his real estate firm was hired in 2011 to serve as the exclusive agent to the Postal Service, selling facilities from post offices to plots of land worth hundreds of millions of dollars. They claim it was a competitive bid and Blum owns less than 5% of the stock. Blum’s investment firm, Blum Capital Partners, is the real estate company’s fifth-largest institutional shareholder, according to Factcheck.org.

…click on the above link to read the rest of the article…

Spain’s Third Biggest Bank Just Made it Harder to Get Cash

War on Cash bogs down, despite best efforts of government, banks, and credit card companies.

Spain’s third biggest lender, CaixaBank, has just launched a pilot project in Madrid aimed at limiting cash services in their branches to less than three hours a day, from 8:15 am to 11 am. After that point, all cash operations, including the settlement of bills and cash withdrawals and deposits, must be conducted through an ATM.

Caixabank is not the first Spanish bank to try out such a scheme, but it is the biggest. Spain’s fourth largest lender, part state-owned Bankia, has removed all cash services from select branches (including my local branch), forcing customers to withdraw or deposit cash at the ATM or travel further afield to another branch that still offers cash services.

It’s part of a broad trend. Bank branches are increasingly becoming so-called “customer advisory points,” where the primary role of branch staff is to sell customers a myriad financial products, many of them no doubt risky.

Those same customers are forced to perform many of the more rudimentary bank operations (cash withdrawals and deposits, transfers, payment of bills…) themselves, either at the ATM or online. It’s a great way of getting your customers to do your work for you while also cutting back on staffing costs.

pain’s banking industry has already witnessed a savage cull of branch and office staff since the financial crisis began as many banks collapsed while those left standing closed many of their branches. In 2016 the total number of workers in the sector was 189,280 — 81,605 fewer than in 2009. What’s more, it’s a trend that shows little sign of ending, especially with most other banks almost certain to follow CaixaBank and Bankia’s lead in paring back their cash services.

…click on the above link to read the rest of the article…

114 Italian Banks (Roughly 23%) Have NPLs Exceeding Tangible Assets

114 Italian banks have non-performing loans that exceed tangible assets. Ratios above 100% are signs of severe stress.

The headline image is from the from ilsole24ore.com. The article is dated March 25, 2017. The translated headline reads “Here are the 114 Italian banks at risk for suffering”

The image shows 24 banks where non-performing loans total 200% or more of tangible assets.

The image title “Texas Highest Rate” refers to a measure of banking stress called the “Texas Ratio“.

The Texas Ratio was developed by Gerard Cassidy and others at RBC Capital Markets. It is calculated by dividing the value of the lender’s non-performing assets (NPL + Real Estate Owned) by the sum of its tangible common equity capital and loan loss reserves.

In analyzing Texas banks during the early 1980s recession, Cassidy noted that banks tended to fail when this ratio reached 1:1, or 100%. He noted a similar pattern among New England banks during the recession of the early 1990s.

Texas Ratio Analysis

In 2012, the Dallas Fed did an article on the So-Called Texas Ratio.

“So-called” pertains to a discussion as to whether or not the measured should be renamed the “Georgia Ratio”.

Georgia Ratio?

US vs Italy (6% vs 23%)

At the peak of the SNL crisis in the 1980s, just over 5% of US banks had Texas ratios over 100%.

In the Great Financial crisis the number approached but did not top 6%.

In Italy, 114 of “almost” 500 banks have NPLs that exceed tangible assets. If were to add real estate owned (bank-owned real estate) to the Italian banks, they would be in even worse shape.

2015 Data

The caveat in this analysis is the article’s numbers are from 2015. But are Italian banks better or worse today?

I suspect worse.

…click on the above link to read the rest of the article…

Venezuela Could Lose A Lot More Oil Production

After defaulting on debt, Venezuela’s crisis continues to unfold, threatening to worsen the state-owned oil company’s production.

PDVSA reportedly told employees that they needed to carry out an austerity campaign, looking for ways to cut costs by 50 percent. The internal memo said that savings needed to be found amid the “national economic emergency” while avoiding any hit to the company’s oil production. Profits at PDVSA fell by 90 percent in 2016 compared to the year before.

But it is hard to see how the company can prevent a deeper slide in output after slashing spending to such a degree. Bloomberg reported that PDVSA is demanding financing plans from its joint venture partners, and that any projects will be halted if they do not receive financing. The memo included a long list of other cost saving measures: credit card use for employees will be limited, employees should use video conferencing instead of traveling; company vehicle use should be curtailed; and the use of electricity, water, cell phones, internet cards, computing gear and PR will all see reductions.

Venezuela’s oil production has been sliding for years, but the descent accelerated in 2015 amid low oil prices and a deteriorating cash position for PDVSA and the government. Production dipped below 1.9 million barrels in recent weeks, the lowest level in more than three decades.

The problems will only grow worse, especially because they tend to snowball. Without cash, PDVSA will struggle to import diluent to blend with its heavy oil – the result could be steeper production losses. Again, without cash, existing facilities cannot be maintained, likely leading to an accelerating pace of decline. An array of refineries are “completely paralyzed,” the head of an oil workers union told Bloomberg. Defaults on more debt payments could spark retaliation from creditors, which could eventually put oil exports in jeopardy.

…click on the above link to read the rest of the article…

The movement to replace neoliberalism is on the ascendency – where should it go next?

Ten years after the crash, the movement to replace neoliberalism is in the ascendency. Well organised campaigns cover everything from the promotion of pluralism in economic curricula to the application of new economic principles in local communities. Academics and campaigners, who prior to the crash were lone voices in the wind, have been joined by a growing chorus of economists and commentators acknowledging that neoliberalism is not working. Importantly, these now include those in mainstream institutions that have become synonymous with the status quo, such as the IMF and OECD. Meanwhile, bottom up movements, surfing a heady mix of social media and dissatisfaction with orthodox economic ideas, are beginning to score political victories across the world.

This is because neoliberalism – the broad set of political-economic ideas and policies which have dominated public life over the last 40 years – has failed, in both theory and in practice. It is in the wake of the global financial crisis that these failures have plumbed new depths. Financial instability looms over economies shackled by insufficient investment. Living standards stagnate and work becomes ever more insecure, shattering the implicit bargain of the entire endeavour. The human costs of this experiment have been enormous, with psychological and non-communicable ill-health becoming the hallmark of a system that cares for little but profit. Inequality, itself linked to ill-health, has grown to levels unseen since the nineteenth century, leading to large power imbalances throughout society. Socio-economic mobility has been further stalled by the erosion of the public realm, from universities to the legal system. Most pressingly, neoliberalism continues to rely on a growth model that is destroying the biophysical preconditions upon which it relies, increasing the chance of collapse in the climate and other natural systems.

…click on the above link to read the rest of the article…

Be kind, it’s all connected

In a conversation over the holiday I posited to a friend that the modern worldview which guides human action practically worldwide has all the hallmarks of a religion. I contended that this “religion” is at the root of our ecological predicament and that changing the current perilous trajectory of humankind would entail the adoption of an ecologically sound religion to replace it.

When I say religion, I mean “worldview,” and I believe the two are synonymous. Even if one has a supposedly secular worldview that relies on economics, psychology, biology or any other field for an explanation of how the world works, it will inevitably look like a religion since such worldviews have unquestioned (and often unquestionable!) premises and may make claims to explain all the social and/or physical phenomena we experience. These secular worldviews tend to be reductionist, describing the interactions of humans with one another and the physical world as nothing but a product of economic laws, human psychology or biological imperatives.

One cannot invent a religion. Religions either grow out of an accretion of spiritual and philosophical traditions over time or they start with a charismatic figure who brings a new set of ideas and standards into a society and is later labelled a divine prophet or the originator of a new philosophy or discipline.

I’ve tried to imagine what the shape of an ecologically sound religion/worldview might be. My friend wisely offered the following humble beginning: “Be kind. It’s all connected.”

The first two words are familiar to anyone affiliated with a religion. It is the equivalent of “Love thy neighbor.” But the second phrase creates an altogether more expansive meaning for the first, implying that we should not only be kind to our fellow humans, but to all nonhuman entities, animate and inanimate.

…click on the above link to read the rest of the article…

The Problem Isn’t Populism: the Problem Is the Status Quo Has Failed

The top 5% who have benefited so immensely from the consolidation of wealth and power cannot confess the status quo has failed the bottom 95%.

The corporate/billionaires’ media would have us believe that the crisis we face is populism, a code word for every ugly manifestation of fascism known to humanity. By invoking populism as the cause of our distemper, the mainstream media is implicitly suggesting that the problem is “bad people”–those whose own failings manifest in an attraction to fascism. If we can successfully marginalize these troubled troglodytes, then our problem, populism, would go away and the wonderfulness, equality and widespread prosperity of pre-populist America will be restored.

The problem isn’t populism–the problem is the status quo has failed 95% of the populace. Life isn’t wonderful, prosperous and filled with expansive equality except in the Protected Elite of the top 5% of technocrats, corporate executives, tenured academics, bureaucrats, financiers, bankers, lobbyists and wealthy (or soon to be wealthy) politicos.

The bottom 95% need a time machine to recover any semblance of prosperity.They need a time machine that goes back 20 years so they can buy a little bungalow on a postage-stamp lot for $150,000 on the Left and Right Coasts, because now the little bungalows cost $1 million and up.

Housing valuations have become so detached from what people earn that even the top 5% has trouble qualifying for a jumbo mortgage without the help of the Bank of Mom and Dad or the family trust fund.

The bottom 95% need a time machine to return to the days when college tuition and fees were semi-affordable–say, 30 years ago.

The bottom 95% also need a time machine to return to a time when they could afford healthcare insurance without government subsidies–a generation ago, or better yet, two generations ago.

…click on the above link to read the rest of the article…

November 25, 2017

A Golden Opportunity in 2018 Awaits as Distrust in Our Fiat Based System Accelerates

Americans prepare to sit down, feast and give thanks this weekend for what they have, who they have and the good blessing that they have enjoyed over the past year.

This comes amidst a time period when their email boxes are being flooded with Black Friday specials for trinkets, bobbles and cosmetic goods that will provide a temporary reprieve from the more realistic situation that the vast majority are experiencing: growing debt levels and increased uncertainty.

The fact is, the stock market continues to tick higher, though not to the benefit of the mass majority of individuals who have simply not been able to partake in the “recovery” after the decimation they experienced via the 2008 crisis – a crisis that I contend has simply been papered over and one that will eventually once again rear its ugly head.

At the same time as new record highs in the stock market, we see that debt levels are also at all time highs, breaking new records and reaffirming my previously mentioned belief that the rot within our system continues to persist, silently behind the scenes. It appears that as a mass, we have learned nothing.

I am not trying to be pessimistic, but the fact is, people are rushing out to buy goods this weekend that they don’t need, can’t afford and ultimately that won’t make them any happier.

The only saving grace is the fact that a growing trend continues to manifest. This trend is one that cannot be ignored at this point and one that has central Banksters privately meeting and discussing what they are going to do about it.

…click on the above link to read the rest of the article…

Citi’s Shocking Admission: “There Is A Growing Fear Among Central Bankers They’ve Lost Control”

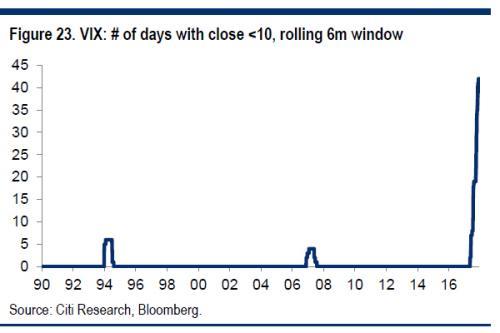

Earlier we showed a variation on a VIX chart from Citi’s Hans Lorenzen which, if it doesn’t impress, or scare you, then nothing probably will.

However, leaving readers unimpressed – and unscared – will not satisfy Lorenzen, which is why the credit strategist who works together with the godfather of rational doom, Matt King, and has been warning for weeks that now is the time to sell credit, unloads in one of the more effusive missives of dripping negativity to hit during this holiday week when one after another equity sellside analyst has been desperate to outgun each other with their ridiculous 2018 year end S&P forecasts.

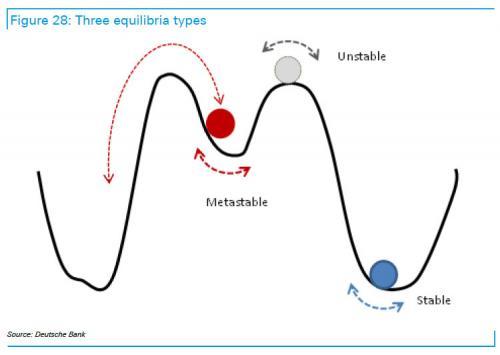

And while Lorenzen touches on many things, at its core, his warning is straight out of Shumpeter: the longer nothing changes, the greater the crash will ultimately be, a topic which DB’s Aleksandar Kocic dissected over the summer, even defining an entirely new term in the process: metastability.

So without further ado, here is Lorenzen explaining why “embellishing the status quo will be the market’s undoing.

Ultimately, extreme valuations, the lack of risk premia, and a lack of responsiveness to tail risks are merely symptoms. The real question is what the skewed incentive structure resulting from that backstop has done to the fabric of markets after so many years. To our minds the answer is that trades and strategies which explicitly or implicitly rely on the low-vol environment continuing, are becoming more and more ubiquitous.

Realised historic vol is de facto an exogenous input to much of the risk management framework that underpins modern finance. With lookbacks extending a few years, an extended period of market stability reduces VaR measures and improves Sharpe ratios.

…click on the above link to read the rest of the article…