Turney Duff's Blog, page 16

September 26, 2013

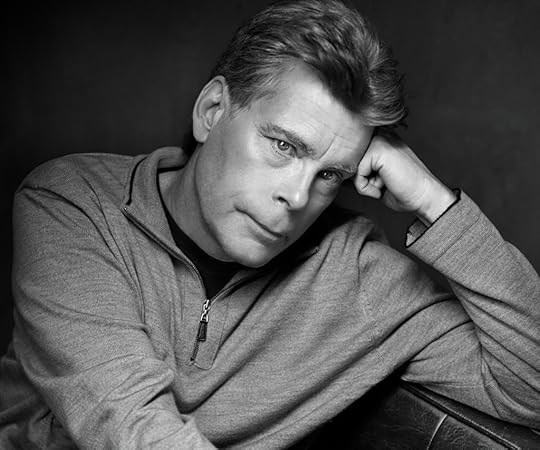

Dear Stephen King

Dear Stephen King,

Growing up in Maine in the ‘80s, there wasn’t a whole lot to brag about—or at least so it seemed. Sure we had the beautiful rocky coast, the best lobsters in the world and were one of the first states to initiate recycling! But who wants to stick their chest out about those things? By my teens, there was some improvement: Maine hockey, Cindy Blodgett and Joan Benoit. There was even a rumor that Judd Nelson, one of the stars from The Breakfast Club, was from Portland. But, in those pre-internet days, that factoid was hard to confirm.

But the one, indisputable, bragging right we did have was Stephen King. For Mainers, the idea of you packing up your stuff and moving to Hollywood evoked as much fear as a night in Room 217. It would have been more tragic than Lebron leaving Cleveland. Maine was home to Stephen King and WE could call him our own.

So from one hometown boy to another, here’s the reason for this letter: Being a fan, I always thought the scariest demons I’d encounter were the ones in your books. Then I tried cocaine. It was like a sinister butterfly-effect. I guess Nancy Regan did try to warn me, but obviously that never took. Thankfully, I’m now sober almost four years.

The first book I read out of rehab (my second stint) was On Writing. I’ve since read it two more times. For me, the book is magic. It spoke to me. And its message was more than how to write, it was a why aren’t I writing? So I wrote and wrote and wrote.

A little over a year ago, I received a book contract from Random House and in early June my book, The Buy Side, was published. It’s a coming-of-age/redemption story of my 15-year career on Wall Street. If you run into anyone who doesn’t believe in the miracles that can happen in sobriety tell them to call me.

Enclosed please find a copy of my book and know that I send it without any agenda but because it feels like something I’m supposed to do. I don’t know why, exactly. Maybe it completes some kind of universal circle. But I do know that I’m sending it with enormous gratitude. You and On Writing helped change my life and I will be forever thankful.

Sincerely,

Turney Duff

August 16, 2013

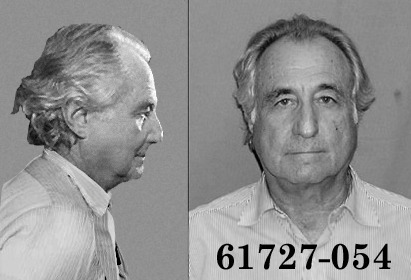

Wall Street Super-Villains

Would Bernie Madoff make a great movie villain? Maybe, if, say, Robert De Niro played him, with a cool catch phrase: “The only difference between a Ponzi scheme and a great investment model is the jail sentence…” or something like that. But in print or on the six o’clock news, Bernie’s more reviling than interesting. There’s nothing absorbing about someone who steals from Eli Wiesel’s charity or fleeces grandmothers out of their life savings.

But on the screen or in books we adore our Wall Street super-villains. They appear impenetrable and invincible with delightfully underhanded characteristics: When they steal someone’s money they offer to help their victims look for it; they have strong wives and very sexy girlfriends; they speak in sound bites, “Greed is good”; they surround themselves with scapegoats and disposable people like friends and family; they always keep lying, even when everyone knows they’re lying, “I didn’t do it!”; they act like the devil but dress like an angel. All of which makes the inevitable crash in the third act just as fun to watch as the climb in the first two.

The thing about Wall Street villains though, either real or imagined, is they don’t have staying power in popular culture. With the exception of Gordon Gekko, who lives on in infamy, and perhaps Bernie Madoff who was so much of a louse it’s hard to forget him, the rest of the crooked French cuff crowd disappear like smoke from a Cohiba. And as time goes on, these great liars become the answers to the “What ever happen to?” questions.

And so, in the interest of preserving the financial rogue’s gallery for posterity, below is my top ten list:

#10 – Kenneth Lay. Enron’s Smartest Guys in the Room is part of the Mt. Rushmore of corporate greed and under handling. R.I.P.

#9 – Sam Israel. He has issues. Guy Lawson, in his book Octopus, brings Israel’s utter insanity to vivid life. He was a bad boy. He may have scored higher on his VQ (Villain Quotient) if you didn’t feel so bad for him. While reading this compelling story you aren’t sure if he’s crazy or crazy smart. I still don’t know. But having faked a suicide, initiated a nationwide manhunt, embroiled in a secret shadow bond market and enlisting a former black-ops intelligence operative as his wingman – you’re a lock for the top ten villain list.

#9 – Sam Israel. He has issues. Guy Lawson, in his book Octopus, brings Israel’s utter insanity to vivid life. He was a bad boy. He may have scored higher on his VQ (Villain Quotient) if you didn’t feel so bad for him. While reading this compelling story you aren’t sure if he’s crazy or crazy smart. I still don’t know. But having faked a suicide, initiated a nationwide manhunt, embroiled in a secret shadow bond market and enlisting a former black-ops intelligence operative as his wingman – you’re a lock for the top ten villain list.

#8 – Nick Leeson. No villain list is complete without a dastardly Brit. Leeson’s memoir and the movie based on it both called Rogue Trader tell the tale of fraudulent and reckless speculative trading that bankrupts England’s oldest banking establishment. And he did all this by the time he was 28! It’s like a Wall Street version of the Children of the Corn. Ewan McGregor plays a Leeson on screen.

#7 – Jordan Belfort, The Wolf of Wall Street, who lied, stole and cheated his way to make millions on a daily basis at the firm Stratton Oakmont in the 90s. Scorsese and DiCaprio are bringing his story to the big screen. This will be one of those rare occurrences when the movie is better than the book.

#6 – The Duke Brothers, Randolph and Mortimer, in Trading Places make a wager in the “usual amount,” to settle a dispute on nature versus nurture. Laughing the whole way through, in the end we discover after all of the elaborate lengths they go to conduct their experiment that the “usual amount” is $1.

#5 – Greg Weinstein, the boss from hell in the movie Boiler Room is played by Nicky Katt: “We don’t sell stock to women. I don’t care who it is, we don’t do it. Nancy Sinatra calls, you tell her you’re sorry. They’re a constant pain in the ass and you’re never going to hear the end of it alright? They’re going to call you every fucking day wanting to know why the stock is dropping and God forbid the stock should go up, you’re going to hear from them every fucking 15 minutes. It’s just not worth it, don’t pitch the bitch.” And, “Don’t you have a canoli you can stick in your mouth?” A chauvinist or misogynist and evil son of a bitch, Nicky Katt’a portrayal makes you love to hate him.

dont pitch the bitch

#4 – Let’s see… Richard Miller (Richard Gere) in Arbitrage has it all: financial fraud, adultery, manslaughter, leaving the scene of an accident, cooking the books to sell his company and calling his young African American friend who is trying to live an honest life and making him an accomplice. And he gets away with it all… or does he?

#3 – Den of Thieves three-headed monster – Financiers, bankers and lawyers—oh my! Except in this story there’s no Dorothy. James B. Stewart’s non-fiction best-selling work fascinates the insider trading scandals of the 1980’s. Names like Milken, Boesky and Levine, which once held household status, have gone from inmates to their photos on the back of milk cartons.

#2 – “Fuck Warren Buffett,” says Dick Fuld played by James Woods in Too Big To Fail. Those are some fight’n words. There are a few people you never take shots at: Jesus, Shakespeare, Eminem and Warren Buffett. Woods played Fuld brilliantly. He makes you forget about the investors and employees of Lehman Brothers. Early on we learn of Fuld’s biggest weakness, he doesn’t know how to negotiate from a place of weakness–fun to watch. And the irony of his first name is lost on no one.

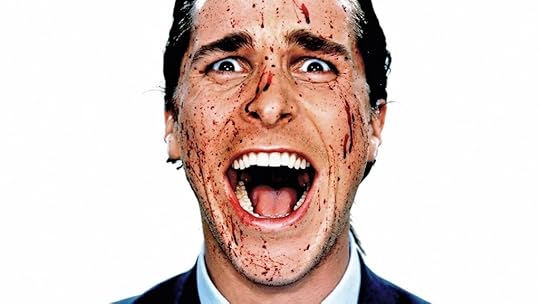

#1 – Patrick Bateman, the American Psycho. Stereotypes on steroids. Wall Street during the late 80s boom filled with sex and violence mixed with postmodern literature lands at number one. Bret Easton Ellis created a god. Bateman is insecurely insane or insanely insecure, it doesn’t matter.

Sorry Gordon Gekko professionals don’t count.

August 5, 2013

The Comment…

One of the best pieces of advice I received during this whole rollercoaster of having my first book published came from someone who had taken the ride before me. “Steer clear of the comment sections,” my author friend said “You’re only looking for validation, and that’s like looking for a neck massage from the Craig’s List Killer.” For the first two months I managed to stay away from the customer reviews on Amazon.com, and the online comments under the profiles and book reviews I received. But like a seductive whisper they began to call to me. I’ll take just one peek, I promised myself. You can guess what happened next. I was honored and grateful that a lot of them were complimentary. But there are people who frequent comment sections who have both unresolved abandonment issues and a lot of time on their hands. Below is the top ten from that group.

10. Looks like Tony Wonder got stuck in some sort of strip club early bird buffet special time loop….

9. I’m still not sure if he’s a douche or a really clever ploy to extract money from idiots by way of stitching every conceivable 80s wall street cliché in prose that would make Dan Brown blush.

8. I’m sick and tired of this. I’m going to write a book about guys writing books who couldn’t make it on Wall Street.

7. hey turney – the greasy hair parted in the middle, teenager necklace and king-douche memoir made it pretty clear what a titanic loser you are and the duckface is just gilding the lilly.

6. Based on syntax and the 7th grade-like simplistic writing style, I’m wondering if Turney Duff isn’t a pseudonym for Dick Bove…

5. Does anyone believe this tale? If he had been such a high flier, he would not be peddling cheap exaggerations today. However, his alternative is to stand by a freeway off ramp with a cardboard sign reading: “Will work for smack”.

4. Hey, he might be a tool – and ugly to boot – but what single guy in his 20′s wouldn’t want to live that lifestyle?

3. Sounds like he is not sorry enough. Haul him into a senate hearing and sing like Jose Canseco. Otherwise, what’s the point?

2. Can’t afford the book. Lost $$ lots of it.

1. Even his Eyebrows look smug…

I’d like to thank the Random House / Crown Publishing publicity team of Tara, Megan and Ayelet and my agent Lisa for the excellent job they did getting all of the publicity for The Buy Side.

July 28, 2013

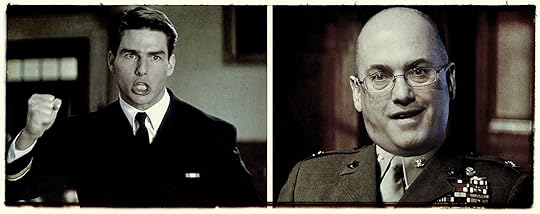

A FEW GOOD TRADERS

Judge Judy: Consider yourself in Contempt!

Charlie Gasparino: Steven A. Cohen, did you order the Inside Trade?

Judge Judy: You *don’t* have to answer that question!

Steve Cohen: I’ll answer the question!

Steve Cohen: You want answers?

Charlie Gasparino: I think I’m entitled to.

Steve Cohen: You want answers?

Charlie Gasparino: I want the truth!

Steve Cohen: You can’t handle the truth!

[pauses]

Steve Cohen: Son, we live in a world that has Chinese Walls, and those walls are guarded by compliance and bankers. Who’s gonna do it? You? You, Peter Lattman? I have a greater responsibility than you could possibly fathom. You celebrate Raj Rajaratnam, and you curse hedge funds. You have that luxury. You have the luxury of not knowing what I know. That Rajaratnam sentence, while tragic, probably saved money. And my existence, while grotesque and incomprehensible to you, saves money. You don’t want the truth because deep down in places you don’t talk about at parties, you want me on Wall Street, you need me on Wall Street. We use words like edge, proprietary, frontrunning. We use these words as the backbone of a life spent defeating something. You use them as a punchline. I have neither the time nor the inclination to explain myself to a man who rises and sleeps under the blanket of the very capitalism that I provide, and then questions the manner in which I provide it. I would rather you just said thank you, and went on your way. Otherwise, I suggest you pick up a phone, and make a trade. Either way, I don’t give a damn what you think you are entitled to.

Charlie Gasparino: Did you order the Inside Trade?

Steve Cohen: I did the job I…

Charlie Gasparino: Did you order the Inside Trade?

Steve Cohen: You’re Goddamn right I did!

By Turney Duff with apologizes to Aaron Sorkin

May 23, 2013

SKOOL

The one and only time I was asked to speak to an MBA class I had the microphone ripped from my hand. Goldman Sachs asked me to address their summer associates–big-brained kids pretending to be interested in what I was saying. The gig was sold to me as fifteen minutes of very casual dinner talk about how I made it on Wall Street, and then a Q&A. No problem. It might have gone fine–except for the couple of shots of tequila and my sudden desire to tell these kids what they weren’t going to hear from their famous faculty back at school.

Maybe I was wrong. Or maybe Goldman Sachs should go commando more often. You can decide for yourself—I describe the scene in Chapter 12 of The Buy Side. But in this spirit of telling the truth, I thought I’d offer a list of the classes MBA students should really be taking if they want to make it on the Street. Picture this course directory:

INTRO TO BACKBONE REALIGNMENT – In today’s Wall Street world, success is more often about what you don’t say rather than what you do. This course will introduce you to intensive lip-biting techniques and skin-thickening treatments, and remind you of how great your bosses and customers using early morning meditation methods.

RESEARCH & ANALYSIS – Everything you wanted to know about copying and pasting emails, instant messages and Bloomberg messages.

CREATIVE ACCOUNTING 101 – Expense accounts can be tricky. This course systematically explores how entertaining can be taken to inventive extremes. Additionally, we’ll examine critical opportunities and threats that arise from internal compliance—also, from that dickhead buy side guy who never sends in trades for the tickets you got him last night. Students will apply strip-club scenario planning and synthesize trends in the external environment in the presence of risk and uncertainty.

FAUX FRIENDSHIP FOUNDATION – More than ever, the ability to pretend to like someone is critical for success in sales and trading. Today, achieving a fake friendship means not merely smiling and paying compliments, but making strategic use of likes and dislikes. In this course, you’ll develop and refine these capabilities. For example, if your client or boss is a Cleveland Browns fan, you better know that the team selected Jamoris Slaughter in the 6th round and that his 40 yard dash at the combine was 4.6 seconds.

DENNIS RODMAN ECONOMICS – Inevitably, you and your coworkers will be invited to a charity event or to a Wall Street Back Patting Conference. This course will show how to box out other sales traders at these events, and leverage the value of being “up close and personal.” Key techniques taught are ingratiation by intimidation and, where appropriate, using soft elbows. In the cut-throat world of sales and trading, this course is mandatory. A good sales trader never let another trader dominate a conversation.

VELVET ROPE MANAGEMENT – One of the keys to sales and trading success is the ability to accurately evaluate—and maximally leverage for one’s benefit–bouncer and wait staff policies. In this course, you’ll learn how to use knowledge gained from successive nights out to “work” the velvet ropes like a maestro. The objective is always to seize competitive advantage in the club scene.

BACK TO BASICS 101 – We all know that getting a client a hot “date” maximizes returns, but in Back to Basics we focus on the little things. For example, a perfectly great night can be diminished by faulty car-service pick up. (Even a fifteen-minute delay might mean a slap on the wrist of 300K shares.) We also discuss the importance of calling the day after a huge order. Sales traders also must learn how to adroitly handle I was wrong phone calls.

BATHROOM ETIQUETTE – This is the follow-up to our wildly popular Elevator Etiquette course. Note that both etiquette methods impose a no-talking policy. Special bonus: best ways to get in and out when a Managing Director begins making urinal small talk or asking market questions through a bathroom stall.

May 6, 2013

60k…

The Galleon office is nearly empty. It’s just after 4 p.m. on the Friday before the 4th of July, 1999. All I have to do is check out a few more trades and then I can run downstairs and catch my car service, compliments of DLJ. My sales trader told me they were either going out of business or being acquired, which means that they’re going to expense everything they can.

What a day… Crazy! The Fed did something…or maybe it was some economic data that came out in this morning. It’s not that I don’t remember–I actually don’t know. It is way too early in my hedge fund career to be concerned with interest rate drops or jobless claims. I’m just trying not to get fired. I take one final look at the P&L for the day – see that we’re up thirty five million. I’m gonna miss my flight if I don’t get out of here.

“Great day,” comes a yell from our investor relations office.

“Crazy right,” I say.

“Probably sixty k for you today,” she says as I stop in front of her office. I give her a blank stare. “We take twenty percent of the profits—that means we made seven million bucks today.”

“Wow,” I say.

“So today probably added 60k to your yearend bonus,” she says as I blow her a kiss and tell her I’m late.

The plane touches down at the Portland Jetport. It’s the only real airport in Maine, but compared to the airports in New York, it’s little more than a landing strip. Both my parents greet me at the gate. Yup, I’m back in Maine all right, L.L. Bean wardrobes, facial hair and those cosmopolitan accents: “I pahked the caher in the pahking lot, ayuh.” My dad takes my bags and my mom gives me a big hug.

“We’re cooking burgers on the grill tonight, but you can go out with your friends after we eat,” my mom says. I’d already told her I was going out with some fellow Bunkies in the Old Port, two girls I graduated Kennebunk High School with in 1988.

I hear a horn honk in the driveway as I take my last bite of cheeseburger. Both my parents remain seated as I wipe my mouth and thank them for the meal. “It’s great to be home,” I say. “Don’t wait up.” It’s strange: even though I’m 29 years old, when I come home to Kennebunk I still feel like I’m a teenager. Maybe it’s the drunk driving arrest I earned while riding a moped when I was 15 is still fresh in their minds. But I’m not a complete degenerate, I’m managing just fine in the city.

I smell Patruli. I get in the backseat and the girls are up front. Jodi and Kelli look like the cute girls you’d see at a Grateful Dead concert, cutoffs, tie-dyes and ponytails. We head back to Portland, a drive of about thirty minutes. There are about twenty bars within a five block radius, but we usually start at Cadillac Jack’s.

Jodi hands me a beer from her twelve-pack in the front seat and I sprawl out in the back. For most of the drive we play catch up. They have no clue what I do or what a hedge fund is. I keep it simple, “I trade stocks,” I say. Kelli teaches at a high school—English, I think. And Jodi does something with shoes, I’m not sure. They want to know if I’m dating anyone, if I’ve seen anybody famous, and if I’ve ever heard of the Hamptons. “Yeah,” I say smiling, “I’ve heard of the Hamptons.”

Then the conversation turns and we start talking about some of our fellow alumni. “Did you hear about Timmy Seguin,” Kelli says, more to Jodi than me in the back.

“No what,” she says.

“He got a new job down in Portsmouth, he’s makin’ a wicked lot of money.”

I lean up from the backseat and peak my head between them, “So what’s he gonna make this year?” I ask. “A million?”

Jodi gives me a quick glance with one eye scrunched and Kelli says, “He’s gonna make like sixty thousand dollars this year.” I lean back in my seat, look out the window. We’re on the outskirts of the Old Port and you can see the lobster boats and docks and buoys everywhere in the canal. “I made that much today,” I say. They both look at me like I’m nuts and I catch my reflection in the rearview mirror. You’re right on the doorstep of douchedom, I warn myself.

April 29, 2013

Wall Street Therapy…

ONE HOUR SESSION

With my history I’m no stranger to a therapist’s office. One thing I’ve learned, the more comfy the chair the more expensive the therapy. I never understood why anyone would want to see a shrink. Seemed like a waste of time. Unless, that is, you’re trying to prove to the rest of the world that you’re trying to get your life back. I figure it might be fun to play a little word association game. I’ll write down the name of a brokerage firm and then respond with the first word or words that come to mind…

Goldman Sachs – ski masks

Morgan Stanley – suspenders

Bear Stearns – that little newspaper boy from the movie Better Off Dead

BTIG – G.F.E.

B of A – Jan Brady

Cowen – The Little Engine That Could

DBKS – offensive linemen

CSFB – Fight Club

JP Morgan – Alex P. Keaton

Leerink – Dr. Kevorkian

Barclays – crumpets

Lehman – MySpace

Piper Jaffary – purple velvet shoes

RBC – right fielder

Citigroup – George Foreman

UBS – Suicide Watch or the New York Jets

Bernstein – A Beautiful Mind

Cantor – Taco Bell

Canaccord – TJ MAX

FBR – a prostate exam

ISI – Stephen Hawking

Jefferies – Rothman’s Steakhouse bathroom

JMP – are they trying to trick everyone into thinking you’re giving an order to JP Morgan?

Jones – a professional fluffer

Lazard – fax machines and 8 tracks

Miller Tabak – Eyes Wide Shut

Macquarie – The Larva

Needham – Studio 54

Nite – serotonin

Pac Crest – Helen Keller

Raymond James – are they still in business?

Susquehanna – three-card Monte

Stern AG – Six Flags

Weeden – whale belts

Nomura – a haiku

March 11, 2013

BUY SIDE BANGERS

STRAIGHT OUTTA WALL STREET

Here’s something to ponder – something that is not in my forthcoming book The Buy Side:

A gang of buy side traders cruises up Park Avenue in their 1963 black Chevy Impala convertible with high performance exhaust system, 20-inch rims and leather upholstery. White dudes, average age 32, and all make around $900k a year. Instead of glocks, they have their buy and sell tickets locked and loaded.

They need capital. They roll up on Credit Suisse: pow pow, pow… All that’s left are chalk outlines. Then they make their way up to Midtown to light up Morgan Stanley with a sawed-off: ba-boom. After the closing bell they creep over to Barclays’ front porch to put down a couple of 40s of O.E. and marinate. Later, they make a move downtown to meet a tier IV broker – the mad hatter. They’re looking to pick up some rock. After they cop the package they come across a couple of suckas from Cantor Fitz. “Yo,” the buy side boys sing out, “You wanna open an account or what?” The brokers are overjoyed. That’s when the bangers take out a 9 millimeter and carjack the brokers’ expensed town cars. “Peace out – Girl Scout.”

Maybe it was just me, but in my later years working the buy side I noticed a bizarre subculture developing on the street: gangsta-trading. It’s as if we took everything we learned from Biggie, N.W.A. and Tupac and applied it to the trading world. I mean, we were working on the street, so I guess it

makes sense. Here’s a deleted excerpt from a chapter in The Buy Side:

My life is now a few gold chains short of a hip-hop video. Nights are a blur of bottle service, clubs, and women. Meanwhile, days are filled with

trading and our performance is great. The market keeps going up. The weekends feature private jets, helicopters and exotic locations. By the middle of 2003 we’re on pace to pay the street close to 40 million dollars in commissions. That’s a big number by any standard, but the fact that we only trade healthcare puts us in the spotlight.

I’m sure you can imagine where the chapter goes from there…blah blah blah made a million dollars blah blah blah got an eight-ball of cocaine blah blah blah flew on a private jet to some tropical island. The chapter just didn’t cut it, so I cut it. I laugh at myself now, but back then I believed money and power made me a baller. I even had a nom de rap – Cleveland D. Oh yeah, I was a banger. I even helped write — and performed on – that Galleon song “Put Your Money on Galleon,” which dropped in the spring of 2000.

The thing is, whether you’re a gangbanger on the street or a buy side trader busting caps in people, your life span isn’t very long. Sometimes it pays to be ruthless, but everyone pimping a buy side ride knows that the sell side is waiting in an alley, watching for a mistake to be made. And when a buy sider turns his back he’ll hear a click-click sound. I’m sure hedge fund guys will always be peacocking and Jim Crammer will never lose his borrowed trademark “booyah,” but as Ice Cube once said, “Today I didn’t even have to use my A.K. – I gotta say it was a good day.”

A couple of years after I left the business I rolled into Random House and called out to the editors there, “Yo, I wanna do a book deal, fools. And I already know the cover. A photo of Wall Street (the actual street) with telephone wires running across the top. And hanging from those wires, you want

to put some Prada shoes tied at the laces. Ya’ feeling me?”

Those guys just didn’t get it. WORD!

February 25, 2013

Sales Traders: A Taxonomy of the Good and the Bad

I offer the below listing (which you won’t find in my forthcoming book The Buy Side) mostly for those who don’t make a living on the Street, though those who do will recognize the following types.

A sales trader, by definition, provides trading assistance, research and market knowledge to his list of buy side clients. To attract more attention from these clients, brokers sometimes get very creative in the services they offer. In my years on the Street I relied on some excellent sales traders – both men and women. But even the great ones rarely represented as much as 25% of my total coverage. On any given day, I’d talk to 100 to 150 sales people.

Almost without exception, the sales traders I dealt with fit one of the following profiles:

1.) Lax Man – Typically, this trader grew up in Jersey, Long Island or maybe Westchester. He was in his late twenties or early thirties. Lax Man was the first guy to ask me if I wanted to get in the March Madness pool. He’d “crushed it” in Vegas the prior weekend and, the night before, the hostess at Stanton Social was “vibing him.” He referred to everyone as Bro, Pal, Chief, Guy or Boss.

2.) Honorary (Wo)Man – She was cute and could trade locker room stories with the best. She used her sex appeal to create business. Behind her back, the guys on her desk would say, “She blows for flow.” But, in reality, she worked hard — harder than most of the men on her desk. She had something to prove. She knew the business and did an excellent job. She wasn’t married.

3.) Salty Man – He’d been with his firm for twenty years and secretly — or maybe not so secretly — hated me and the business. He still talked in fractions and resisted using email or instant messenger. He’d been divorced three times and didn’t have two nickels to rub together. Odds were, he was going to die on the desk.

4.) No Man – This guy had no research, no flow and no worries. He liked to meet me after work.

5.) Low Man –If I sneezed he’d say “bless you,” if I was tired and hung over he’d worry he’d done something wrong. He worked extremely hard, but the problem was he didn’t get a lot of respect from his own desk.

6.) The Man – He’d answer the phone “250k up – what do you want to do?” Management loved him—he was the busiest guy on Wall Street. All you had to do was ask him. He’d get business done and wears his firm’s crest on his sleeve. He worked for one of the white-shoe investment banks and had gone to one of the best schools. He wound up as an

equity sales trader because he wasn’t smart enough to do something more difficult, but he always spun it that it was his choice to trade.

7.) Family Man – He’d been passed over for several promotions, and was often caught off the desk calling his wife to discuss the twins’ science project. He’d accepted the ceiling in his career; Family Man was honest, calm and genuinely cared about doing the right thing. He tended to whisper.

8.) Script Man – Every mornin he’d call at the exact time using the exact voice from the day before. Early in his career he’d been confused about the business, so he decided to keep it simple. He never cracked a joke in his entire career.

9.) Five Foot Ten Man – He was just a dude, laid back, did a good job, didn’t love the business, but realized he could make twenty times more doing this than being a teacher or going into the family business. We got along great because we both knew we were frauds.

10.) Dr. Serious Man – He had the most important job in the world. Trading stocks and talking about the market were as important as finding a cure for cancer. He’d yell at his wife for calling at 9:15 a.m.; his kids weren’t welcome to pay a surprise visit to the office; and his clients weren’t always right — he was.

Do these types still exist on Wall Street’s trading floors? Wherever there are orders flowing, they can be found.

February 6, 2013

I’m so honored and grateful…

Right before we went to the printers I received one more blurb for the book.

“This is why I keep my money safe and sound under the mattress. You could get high just reading this book. Mamas, don’t let your babies grow up to be Wall Street traders.”

–James Patterson, #1 New York Times bestselling author of Along Came a Spider and Kiss the Girls

And I’m so thankful for all of the other people who blurbed for me before. I’m very excited for June 4th…

“Turney Duff is a natural storyteller, and his tale of how a naive kid from Maine traded in L.L. Bean for Armani and got sucked into the seamy side of Wall Street is almost impossible to put down. The book is by turns hilarious, harrowing, maddening, and illuminating. After this debut, the smart money will be on Duff.”

–Bethany McLean, New York Times bestselling author of The Smartest Guys in the Room and All the Devils Are Here

“Turney Duff’s The Buy Side picks up where the Academy Award-winning film about systemic corruption on Wall Street, ‘Inside Job,’ leaves off. Duff, who at one time was the promising rookie on the trading desk at troubled hedge fund Galleon, gives us a front-row seat to the Street’s dark side – but the tale also features a personal story that will have you cheeringas Duff fights his way through a jungle of excess and figures out what really matters. To all those who want to rule the market not just during business hours but after hours, beware — you may not have Duff’s survival skills.”

–Lawrence G. McDonald, New York Times bestselling author of A Colossal Failure of Common Sense

“The Buy Side takes the reader on an extremely wild ride so eloquently and honestly that we never want it to end. Cocaine wants everything you love and everything that loves you. Turney Duff had everything and nothing while trading billions of dollars on a razor’s edge. His book takes you from Wall Street to Skid Row to the Thompson Hotel – and then, mercifully, back to sanity and finding a place in the world. Hang on, The Buy Side is gonna move you around, and there are no seatbelts to keep you from getting hit hard.”

–Brian O’Dea, author of High: Confessions of an International Drug Smuggler

“The Buy Side is ‘Wall Street’ meets ‘Breaking Bad’ – except that this book is fact not fiction. Turney Duff yields to temptation at every turn, and the sheer volume of criminal behavior he saw, and even participated in, is astonishing…If you want to see Wall Street’s seamy underbelly firsthand, read this book.”

–Frank Partnoy, bestselling author of F.I.A.S.C.O and Infectious Greed

“If you took Gordon Gekko, Bud Fox, a copy of Bright Lights, Big City, and threw them in a blender with an ounce of cocaine, a bottle of Patron Tequila, and your favorite teddy bear you’d have yourself a Buy Side smoothie. Turney’s my kind of guy; a madman with heart. I couldn’t put the book down.”

–Colin Broderick, author of Orangutan

“Does Wall Street make people crazy or are crazy people simply attracted to Wall Street? The Buy Side doesn’t get us any closer to answering that question, but along the way we get a look inside perhaps the most ethically-challenged investment firm in recent memory, and a harrowing journey through drug addiction and recovery. This is not a musical comedy; at the end, you’re just relieved that Duff is alive.”

–Jared Dillian, author of Street Freak: Money and Madness at Lehman Brothers

“Turney Duff’s The Buy Side is the perfect parable for Wall Street’s lost decade. Duff’s account of his rise and fall has it all, from a fast-paced coke-crazed trip through Manhattan nightlife that conjures Bright Lights, Big City, to an eyewitness account of insider trading and front running that reads like a federal indictment. Broke but not broken, Duff ends up better than others on Wall Street have–sober, chastened, and lucky to be alive after the self-destructive excesses of easy money and empty ambition.”

-Guy Lawson, New York Times bestselling author of Octopus