Turney Duff's Blog, page 15

January 27, 2014

Interview with short selling home owner, twice drug rehabbing, three time hedge fund trading Ex Wall Street guy…

I’m heading to London for the U.K. book launch in February.

A trader told me: ‘Nobody gives a shit about your education/GPA/resume. To get a job on Wall St you need to know someone who already works there, and be able to handle numbers’. Is that true?

There’s a lot of truth to that statement. And even more so when you get a job. Once you’re in the only thing people care about is the bottom line: Performance. If you didn’t go to a target school getting into Wall Street is like breaking into a house. The front door is locked so you have to try every window and door until you can break in. A young aspiring kid once asked me “what’s the best way to get a trading job at Goldman Sachs?” My reply “Build a time machine and go back and convince your grandfather to work there.”

What’s the go-to restaurant/bar for Wall St traders? Bloomberg talks about Smith and Wollensky’s – is that tourist bullshit? Or do the top-earning traders actually hang out there?

Not to be rude, but I would rather sit in the bleachers in 100 degree heat at a NY METS game in the 7th inning when they stop selling beer than go to Smith and Wollensky’s. If you’re looking for Wall Street playgrounds that serves food you should go to HARLOW, NOBU 57 or The General.

During your time, was there a ‘Dorsia’ equivalent? (You talk about Canal Room in the book… was that the place to be seen, or simply a place you liked?)

The Canal Room was a great place to throw a party… But the Dorsia equivalent in my day was Bungalow 8. I guess for a minute it was also Lotus and Marquee.

What’s the most extravagant party you threw at The White House?

The foot massage party was pretty insane, but I think the most extravagant one was the bring an intern after work party because they had no idea what was behind door #3… Some interns after that became members for life…

Is there one Wall St party that has become legendary? (i.e. one that traders acknowledge as the benchmark when it comes to hedonism.)

The benchmark for the haves and have not’s is the Super Bowl weekend invite. Typically it’s a private jet with hired help, luxury hotel suites and parties at night. Things can get a little crazy…

In terms of pranks between traders, what’s the best one you ever heard about?

There’s so many of them, but one of my favorites is when an intern or new employee is asked to find “the upticks” so they are sent by cabs and subways all over Manhattan trying to find them. So the trader on the floor will tell the intern “oh man, they just left but if you go up to XYZ Capital on 57th and Park they should have them… and so on and so on…

I feel bad about it now, but I once called a sales trader on their first day and said I needed to buy 1 million shares of T-W-A-T – I spelled out the letters so it didn’t sound like a word. So he stood up on trading floor with all of his new fellow employees and screamed for a market on 1mm T-W-A-T – it took him a few minutes to realize it wasnt a real symbol and it actually spelled a word. I’m going to hell aren’t I?

The hazing/initiation ceremonies sound quite tame (getting a junior member of staff to pick up a $5000 tab). Does more extreme stuff go down? Or is it all myth?

It’s more about verbal humiliation. Worse stuff probably goes on in fraternity basements all across the country.

You indulged in many hedonistic pursuits. Looking back, what’s the dumbest thing you spent money on?

I was on a quest to have the most comfortable bed in Manhattan for obvious reasons… I went to ABC Carpet and told the sales woman what I wanted. I really wasn’t impressed, but after prodding a little bit they finally let me into a secret backroom for linens and such. So I brought my items to the register and handed over my credit card. When I saw the total bill was $10,000 for a duvet cover, pillows and sheets I was ill, but it was too late to back out.

Wall St has it’s own language (‘fuck-you money’, ‘elephant hunting’) – what was your favourite bit of Wall St slang?

My favorite bit about Wall Street language is making fun of it. When guys and girls are so enthralled with their trader talk they start to use it in everyday life… It doesn’t work. Here is an excerpt from my book…

He is coming dangerously close to becoming “Johnny Wall Street.” Randy and I have names for guys like this. We just say J Wall for short; he’s the guy who wears button down shirts un-tucked over his khakis. In the office he tells you to protect him on the lunch print as if he was asking to be protected on a block trade of a million shares. Johnny Wall says he’s a size buyer when he sees a hot chick. He tells you at Happy Hour how he whacked a bid and sold another 250,000 shares behind it. At dinner he brings up commissions and research. He asks you what your favorite stock ideas are as you put a slice of buffalo mozzarella in your mouth. He doesn’t own any stocks; he just wants to impress. Johnny is the last one to show up at your high school reunion driving his new car and checking his Rolex. Johnny Wall is a douche.

Bizarrely, given the insane amounts of money that traders are responsible for, I’ve heard a lot of them are extremely superstitious. Did you have any superstitions?

Superstitious or Super-vicious? No, no superstitions…

If there a particular tailor’s shop where you’ll find all the top Wall St guys having their suits made?

No not really. Occasionally you’ll see a guy sneak in the side door and take a few quick measurements, but there isn’t a go to place.

You were in Wall St around the time of the second dot-com bubble – did the relaxed dot-com vibe change Wall St’s suit-and-tie culture?

It changed here and there, but it wasn’t industry wide. You can learn a lot about your peers on casual Fridays… Black jeans and turtlenecks say so much…

Privately, did Wall St traders ever say to each other: ‘Yeah, the valuations on these dot-com companies are complete bullshit’?

Sure – people said it all the time, but it wasn’t bullshit until they were right. Someone much smarter than me once said… Being early and wrong are the same thing…

January 24, 2014

Bathroom Etiquette on Wall Street…

Once upon a time there was a bulge bracket firm. The wide open trading floor had rows and rows of desks. Computer screens stacked one on top of the other rose to midair. The seats occupied by mid-life and fledgling Corporate America. Phone cords stretched twenty feet while traders and salesmen spit compliments and hum venom, heels up, jackets off and sleeves rolled up–ready to trade.

Across town I hit my direct wire as the microwave transmission shoots across the copper wires carrying audio and control signals. “Hello,” I hear with a chuckle. My equity sales trader clearly thinks something’s funny. He’s like Chachi from Happy Days, the Scott Baio of Wall Street, a regular heart throb and super proud of his Italian decent. I like Chachi, he’s fun, but I’d have to guess the first thing listed under SKILLS on his resume is: Copy & Pasting Instant Messages. I don’t get much coverage.

“What’s so funny?”

“Nothing,” he says.

“I’ll give you 50,000 shares if you tell me.”

“Throw in 500 contracts and you got yourself a deal,” my derivative sales person says. I didn’t even know she was listening on the line. She’s a tough chick, Wall Street folklore, worked her way up from the mail room. I don’t argue with her much because I never win.

“Fine, 50,000 shares and 500 contracts… Now what’s so funny?”

It turns out that Chachi and Mrs. Folklore keep a running Excel spreadsheet on their computers. Whenever they go to the bathroom they take copious notes. I guess it’s sort of like Santa making a list and checking it twice, he’s going to find out who’s been naughty and who’s washing it right. On one tab of the Excel spreadsheet is the name of the employee and there are two columns: Pee-Pee No Wash and Poo-Poo No Wash. So when they enter the bathroom and see one of their fellow employees accidently forgetting to wash their hands they make a mental note. Then they come back out to the floor and enter it into their system.

But they’re still laughing.

“Keep going,” I say.

Apparently Chachi got cornered at the coffee station with a Managing Director who was on the Pee-Pee No-Wash and the Poo-Poo No-Wash list. Chachi was boxed in, he couldn’t make a move when the right hand reached over and rubbed the top his head like he was an eight year old baseball player. He felt the thumb and forefinger graze his cheek. He almost threw up. So if you are wondering why other employees are avoid shaking your hands, maybe it’s because they’ve seen the Excel spreadsheet.

Other helpful hints for Wall Street bathroom etiquette:

Don’t announce you are looking for the NY POST and then go missing for twenty minutes. It gives us a visual.

If you must talk at the urinal, keep it light and don’t ask me what I think about AAPL’s earnings.

No talking between stalls.

No grunting.

Please flush. Use your shoe like everyone else.

If you don’t flush and there’s no paper in the bowl – it really scares us.

Robbie Stephens Rule – no wiping boogers on the wall especially at eye level.

No cell phones. Do you really need to check your email and make phone calls?

Don’t hang around waiting for someone else to touch the door handle to open it.

No recaps when you get back to the desk.

January 14, 2014

The Wolf of Wall Street (irony)

I’ve never met Jordan Belfort. So I can’t speak to the kind of man he was / is… But I just stumbled upon his Facebook page with his most recent post. The irony is too great to ignore…

To all my friends and fans, and my “friends” in the press. This is one of the most important posts I’ve ever made:

There was an utterly insane and libelous article in the Wall Street Journal that alleged, among other things, that I have fled to Australia to avoid paying my restitution, and that I am using loopholes to keep my assets out of reach of the US government. In addition, it also alleged that I have not paid any restitution in years, have been keeping book royalties for myself, and that I have not agreed to turn over 100% of the profits of both books and the movie (that I essentially made that whole post last week up)!. But the truly craziest part of all was that the WSJ’s source was allegedly a spokesperson for the government, a Mr. Nardoza, from the US Attorney’s office.

This is insane? So what you’re saying is – you can’t fathom how someone might lie or cut corners to profit from it?

This false and libelous story has now been circulated around the globe, in all forms of media, and has caused significant damage to my reputation as a man who not only owns his mistakes but also makes it a point to go above and beyond to do the right thing.

If I’m understanding this correctly – you’re the victim???

Fortunately, the US Attorney’s Office, through my attorney, has issued me a personal apology and the Wall Street Journal will run a correction. I respect them for promptly admitting their mistake (which I believe was isolated to this one man, and, hence, not indicative of the integrity of the entire office), although the damage it has caused has already been done. Please repost my post, to spread the word, as the article was the most idiotic, venomous and blatantly false attack on my character, and how I have lived my new life, that i have ever experienced. As always, I am still 100% committed to turning over 100% of the profits of both books and the movie, which I hope will amount to many, many millions.

The damage has already been done? Didn’t people lose their homes, retirement money, life savings? It’s great that you respect the WSJ for promptly admitting their mistake, but how long did it take you? Was it prompt? I know for myself I had to admit mistakes I made ten years ago. You got an apology and a correction and it’s not enough? Isn’t that what you’re trying to do? Is it enough for your victims or has the damage already been done?

We all learned in 3rd grade that two wrongs don’t make a right. I’m sorry if you feel like you’ve been treated unfairly. But to play the victim and try and defend yourself will only make it worse.

The golden rule of writing is SHOW don’t TELL. It works in life too. If you show everyone how much you’ve paid the victims I’m sure all of this goes away. I hope you sell as many books and movie tickets as you can. And wishing you a happy, joyous and free life.

December 11, 2013

To Catch a Trader

Airing January 7th on PBS Frontline… I’m very excited to see this film – I did an interview with them for about 90 minutes back in July. Watch the trailer…

December 2, 2013

Pursuit of Happiness

Everyone knows the most famous line from the Declaration of Independence… The Pursuit of Happiness. But I think for myself I didn’t really understand the true meaning of happiness. Aristotle wrote, “the happy man lives well and does well; for we have practically defined happiness as a sort of good life and good action.” Happiness is not, he argued, equivalent to wealth or pleasure. It is an end in itself, not the means to an end.

It only took making and losing 10 million dollars, 2 rehabs, 3 outpatients, a broken relationship, a foreclosed house and several hundred AA meetings for me to figure that out…

Even after I was 2 years sober, out of family court, had wonderful relationship with my daughter and ex girlfriend, all of my amends had gone flawlessly and just received a huge book deal from Random House… I still wasn’t happy. At that moment I declared that was an asshole… I would never be happy… I don’t even want to be happy… My goal was now serenity – - -screw happiness. And… ironically ever since that day – I’ve never been happier.

November 20, 2013

Financial Phone Sex

2009…

My phone buzzes. It’s a blocked call. This can’t be good. I light a cigarette as I walk out to the porch. It’s freezing, but the smell of burnt tobacco isn’t pleasing to a young daughter and realtors. The phone buzzes again, and again. My breath looks like cigarette smoke or my cigarette smoke looks like breath, I’m not sure. Finally I answer my phone.

“Good afternoon Mr. Duff this is Tammy from Chase home equity loan. How are you doing today?”

“I’ve been better,” I say as I put my cigarette out and go back inside.

The six-bedroom, Queen Anne Victorian in Huntington Bay, New York, sits nearly empty. Most of the furniture has been removed; I was able to piece together a living room and a bedroom for when my four-year-old daughter, Lola, visits. It was the furniture that didn’t move out with her and my ex-girlfriend. The price tag for the house was 2.1 million dollars in 2007 and I put another 600k into fixing it up. The house is now on the market for 1.5 million dollars, exactly what I still owe on it. Prospective buyers don’t call, however. Only Tammy.

Tammy spends the next five minutes explaining to me that I still owe sixty thousand dollars on the home equity loan. “I know,” I say. “I don’t have the money.” My bills are piling up faster than BMW’s at a valet service in the Hamptons.

“This will go on your credit report,” Tammy warns.

I want to respond: ohhhhh I’m scared, but I settle for “okay thank you,” and manage to somehow get off the phone without hanging up on her.

At the end of 2008, after the subprime bust, I knew I was in trouble. I just always assumed I’d be able to figure something out. Now I’m like hundreds of thousands of other American homeowners swimming in underwater mortgages. Ironic that. Just a few years ago I had a dream job in the place that started the whole mess. Early 30s and single, I treated Wall Street like my own giant ATM and, when the sun went down, my own private theme park. But that was then, and now, well, things are far different.

The next day at the same exact time my phone buzzes again. Another blocked call. “Hello,” I answer. It’s Tammy again. She wants her sixty thousand dollars. I let her read from her script and then tell her I have no money.

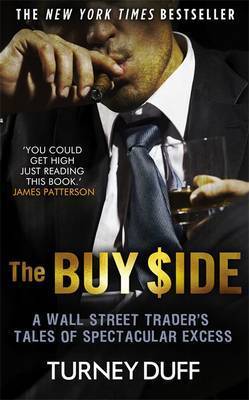

The first cover idea for my book

Like Wall Street, excess categorized my life. At one point I was making a couple of million a year and doing enough cocaine to keep a small cartel busy. It’s no surprise that those excesses brought me to my knees. And my knees are still fresh with scabs to prove it. But somehow Wall Street can turn its back on the past and still manage to thrive—money has a way of doing that, I guess. It’s never that easy for people.

On the third day when my phone buzzes I answer, “Hey Tammy how you doing?”

“Mr. Duff we are going to have to start proceedings against you and as I’ve stated before this will go on your credit report,” Tammy says.

“I have no money,” I say. “Actually that’s not true… I have negative money.”

“Mr. Duff do you have a credit card?”

“Do you have ears?”

On the fourth day at the same exact time Tammy calls again. But this time I’m prepared. “Mr. Duff this is Tammy from Chase home equity loan department.”

“Mmmmm,” I groan.

“We need to know how you plan on paying off your debt.”

“Mmmm, yeah mmmm.” I pace my rhythmic breathing slowly. I make my way from the kitchen to the bathroom room. I want my voice to echo. “Mmmmm.”

“We’re sorry for your financial hardship, but-”

“Say that again, say it again,” I say. “Mmmmmm.” I let out a few short breaths.

“Excuse me?”

“Hardship… say hardship,” I say. “Hardship,” I whisper. “Mmmmm.”

“We’re going to need you to fax your financials to us.”

“I love when you tell me what to do.” I say breathlessly. “Say it again. Please. Please say it again.” I close my eyes and rock back and forth. My exhale blows right into the receiver. “I can fax it, I’ll fax it, I’ll fax it real good,” I say. I speed the rhythm of my breathing up. “Mmmmm, mmmm, yeah mmmm I’ll fax it.”

Click…

Tammy never called again. Nobody did for an entire year. Until one day a nice little old lady calls, probably working off the same script as Tammy did. She’s super sweet. “I’d really like to pay you,” I say. “But I’m just returning from my second drug and alcohol rehab and I’m just trying to survive. I have a total of six thousand dollars in my bank account. You can have it all if we can just settle this right now.”

“Let me call you back,” she says. Fifteen minutes later she accepts my offer and I wire the money the same day.

As a sober man I realize the way I treated Tammy was in the bad form. There’s no excuse. So Tammy if you’re out there – I’m sorry.

November 15, 2013

Chapter 3…

July 1996

I’m surrounded by women. The bar, Cite is across the street from our office and is a fan favorite. I’d only recently begun going out after work with my peers. I’m not really all that comfortable with the suit-and-tie, Wall Street hangouts. Give me a pair of jeans and a sawdust floor any day. Cite is primarily a restaurant and, I must admit, with the curved bar and intimate space, the place has its merits. The wine glasses are gigantic and bartenders pour heavy. On a typical night at Cite, pronounced “sit-tay,” as in “par-tay,” there are ten to fifteen women from our floor at the bar and five to ten men from the trading floor. The spot isn’t a secret. Many a six-hour love stories have started here.

A bunch of my ex-Morgan Stanley friends came to one of my book readings… Thank you for the support. Much Love…

November 5, 2013

November 4, 2013

Insider Trading 101

Somewhere downtown in the spring of 2001…

The club is at capacity, but V.I.P. is spacious. It’s darkly lit to perfection. My feet vibrate from the booming bass; the bottle in front of me reflects the candlelight and beautiful women flutter about. It’s like a hedge fund mafia up in here with a few dot com clowns mixed in. Sitting across from me is Lance. Like me, Lance is a hedge fund trader. He’s got an in at a few research boutiques like Avalon. Lance always gets a wink or a nod before they put out a scathing report on a company. Over in the corner is Michael, he’s on the sell side; he’s good for an early heads up on stock upgrades and downgrades. He’s sitting next to his client, Pesto who knows what’s on the front cover of Baron’s on Thursday before it comes out. A few tables down are some bankers with knowledge of some imminent takeovers. The guy trying to get into the V.I.P. section is a Frenchman from U.B.S., Lance tells me the guy leaks all of their program trading flow. That’s a nice call. If you know a billion dollars of S&P are coming to market, adjust accordingly. The V.I.P. host is playing defense so I make my way over. “He’s with me,” I say. The Frenchman smiles as he goes to shake my hand. Typically I don’t like to share my cocaine, but for him I’ll make an exception. I slide the tiny bag from my pocket into his hand with the skill of a professional pickpocket. “We should talk,” I say.

“Indeed,” he says sliding the baggie into his own pocket. “I’ll hit you up on Monday.”

I don’t remember the first time I jaywalked, it was probably somewhere in Cleveland in the early 70’s. I’m sure I was holding one of my parent’s hands as we looked both ways. Not for the authorities, but for oncoming traffic. I know what you’re thinking… This joker is going to try to compare insider trading to jaywalking – what a shame. But the truth of the matter is, ever since I arrived on the street in 1994 insider trading was commonplace. There were things that might be a bit questionable, but qualified as part of the game. In the span of two years I went from a sales assistant at Morgan Stanley making about 40k a year to being the head trader on a billion dollar fund at the Galleon Group. We called it edge. It wasn’t considered insider trading. Maybe the late 90’s and beyond can be compared to the steroid era in major league baseball. If you want to put an asterisk next to my earning statistics, that’s fine. And I was never getting into the Wall Street Hall of Fame. It’s how things were done, maybe still are. Get an edge or get cut.

I’m not sure I’d have been able to stay at the Galleon Group if I didn’t try to get every available edge possible. There were three primary ways to get an edge: inside, outside and sideways. Insider trading has been around since, well, probably forever. For me the landscape shifted in August of 2000. Individual investors cried no fair, but we know it’s called edge. So the Securities and Exchange Commission introduced Regulation FD which simply stated that all public companies must disclose material information to all investors at the same time. It was an effort to put an end to selective disclosure. The change didn’t happen overnight. It took years for companies and investors to comply. What we were left with was an even playing field of no disclosure.

But somebody needed to start talking. So the emergence of “expert networks” started to come into full bloom. Let’s say someone from Pfizer won’t tell us what’s going on. Well then maybe a doctor or a lawyer familiar with Pfizer will have material information to help formulate a trade. To say this was the beginning of expert networking is simply not true; this has been going on across every country club in America and all over the world forever.

Another primary source of insider tips comes within the very walls of Wall Street. Analyst know about upgrades before they become public, bankers work on deals before they’re announced and traders see behemoth order flows. There are more people not operating on this level than are, but to think its taboo isn’t correct either.

“We’re going to upgrade XYZ in ten minutes,” or “We’ve got seventeen million shares of XYZ to buy at the close from our program trading desk,” hardly makes you feel like Charlie Sheen posing as a janitor and stealing files from a law office. It’s a great call, its edge. And the end result is a couple of fist bumps, maybe a smile from your portfolio manager (they’re hard to come by) and more money. The guy on the other end of the phone gets more order flow, more commissions and a few gold stars next to his name.

One of the many things I learned at the Galleon Group was how to not get caught. If you want to play it fast and loose there are certain rules you must abide by.

• Never trade options on a sure thing; it’s the first place they look.

• Always have a paper trail, an email pitching you the idea for every reason except the inside information.

• Buy more than you want and then sell some before the announcement. It shows misperception. If you knew about the announcement then why would you sell some right before?

• Never have anything in print. Only use the phones (this one is changing)

• Find the derivative stocks that will benefit from the news, play those big.

• Be prepared for a phone call with the S.E.C. Play dumb, but have your story straight.

• Discuss the trading idea with other employees, but withhold the secret sauce.

• Reward your informant handsomely.

I’m sure there are hundreds of reasons why this wouldn’t work, but I know one way to stop or slow down insider trading. Instead of fishing around trying to get lower level guys to flip and wear a wire, I think you should go after the informants, the guys supplying the information. Then instead of arresting them right away, we should make them remain at their current jobs as trusted informants. As an alternative of wearing wires we have them supply wrong insider trades. If they know a stock is going to decline on particular news item, have them leak misinformation to get their buddies to purchase the stock. Personally if I touch a hot stove and burn my hand, I don’t touch the stove again. So instead of worrying if your phone is tapped, you’ll worry if the information is correct.

This is the thing about jaywalking though. Chances are you aren’t getting a ticket or having to pay a fine, sure it’s happened, but highly unlikely. That’s not the risk. Even if you do get caught, you’ll probably just be told not to do it. The risk to jaywalking is being run over by a Mack truck. In the last five years that risks has dramatically increased so if you are still planning on jaywalking – look both ways.

October 17, 2013

Photos from The Buy Side

I’ve had some request for photos from The Buy Side… It was a struggle to come up with these – but this is the best that I’ve got.

Moving to NYC with Jayme 1994

Moving to NYC with Jayme 1994

Galleon Party…

Galleon Party…

Before I ever tried cocaine

Before I ever tried cocaine

Laight Street Bedroom

Laight Street Bedroom

I’m not proud…

I’m not proud…

Random Night with Orange Prison Jumpsuit – oh god!

Random Night with Orange Prison Jumpsuit – oh god!

The drugs were starting to kick in… trouble ahead…

The drugs were starting to kick in… trouble ahead…

I meet Jenn right after her tour with Enrique.

I meet Jenn right after her tour with Enrique.

Laight Street view & Greece

Laight Street & Greece

Lola is born

Jenn and I on vacation

Jenn and I on vacation

I’m going downhill…

I’m going downhill…

Two dogs: Houdini and M.C.

Two dogs: Houdini and M.C.

The house in Huntington Bay…

The house in Huntington Bay…

Movie theater on 3rd floor

Movie theater on 3rd floor

From the porch

The first book cover idea…