Craig Pirrong's Blog, page 33

October 30, 2021

Janet Yellen: From Elf to Clown

Once upon a time Janet Yellen was a respected and respectable economist. That time is long past. She is now the lead singer for a Say Anything cover band. It’s sad to witness.

Janet is currently saying anything–and everything–to justify the monstrosity that is the Biden “reconciliation package,” AKA Build Back Better. Perhaps I should call it the Incredible Shrinking Reconciliation Package, because apparently it has shriveled from $3.5 trillion to a mere $1.75 trillion. But even at half the size, it is a monstrosity.

One indefensible thing that Yellen defended that has subsequently been modified, and may disappear, is the requirement that banks report to the IRS the gross annual flows on bank accounts when those flows exceed $600/annum. Yellen said oh no no no no–this is NOT aimed at the little guy. It’s to prevent billionaires from cheating on their taxes:

“There’s a lot of tax fraud and cheating that’s going on.” Treasury @SecYellen tells @NorahODonnell the proposed $600 IRS reporting requirement for banks is “absolutely not” a way for the government to peek into American’s pocketbooks but to hold billionaires accountable. pic.twitter.com/M3VKOhdtSu

— CBS Evening News (@CBSEveningNews) October 12, 2021

This is so patently ludicrous it requires little comment. Indeed, it is an insult to everyone’s intelligence because it so so outrageously and transparently false: everyone with a few functioning synapses understands reporting on the account of everybody with a bank account (and surely, a $600 filter would catch virtually every account holder) will do F-all to prevent billionaires from cheating on their taxes.

Yellen’s latest outrage is her claim that no no no no a massive increase in government spending will NOT add to the mounting inflationary pressures. Indeed, it will reduce these pressures. Yes, you read this right: she said that the reconciliation bill will reduce inflation, despite its size.

Why? Well, according to Yellen, it will shift out the aggregate supply curve. Why? The one specific thing that she said is that the child care subsidy in the bill will free up women to work. Well, even granting that–what about the rest of the huge bill?

Casey Mulligan has taken one for the team, and tortured himself by reading the entire bill. (God bless you, Casey.) He finds it chock full of disincentives to work. Here’s one of this posts that focuses on that, but I recommend that you scroll through all of Casey’s recent posts to get the full effect.

In a nutshell, as in most welfare and subsidy programs, there are huge implicit marginal tax rates embedded in “Build Back Better.” Your benefits go away, or are reduced substantially, if you earn too much. That is a disincentive to work.

These various features shift back the supply curve, thereby exacerbating the inflationary effects of an increase in spending.

And as Mulligan notes, even the vaunted child care provisions are an economic nightmare, with many disincentives to work, and burdens on those who do work in childcare. This is a classic example of the government simultaneously stepping on the gas (subsidizing child care) and slamming the brakes (imposing mandates that dramatically increase the cost of child care). Among the costs are wage floors for child care workers and requirements that said workers obtain particular college degrees. Yeah, those are really great ways to juice productivity, right Janet?

There’s also how the bill is to be paid for, mainly with explicit or implicit taxes on capital. Those will–duh–discourage investment and capital accumulation, further reducing productivity growth. Another adverse shift in the supply curve.

But Yellen claims that the “investments” in Build Back Better will enhance productivity. Say Anything, indeed.

Yellen even defended the utterly insane idea to tax unrealized capital gains, something the desperate Dems seized on to replace the capital and wealth taxes that Krysten Sinema rejected. There aren’t enough hours in my day to explain all the ways in which this idea is insane, unworkable, inefficient, and a threat to freedom.

I’ll just say one thing: if you believe that this tax, if implemented, would be limited to billionaires in perpetuity, you have not been paying attention to the history of federal taxation since the passage of the 16th Amendment in 1913.

In sum, Yellen has not just defended, but advocated every bad idea in BBB. Shamelessly.

In 2009, Yellen was one of the Obama administration’s main justifiers of the stimulus bill. She did so on strictly Keynesian multiplier grounds. I disagreed with her on that, but that was a serious intellectual disagreement: I’m an anti-Keynesian, and she argued on traditional Keynesian grounds. At least there was a serious intellectual foundation for her view, although no doubt she was carrying administration water in advancing it.

Now, however, she is just spouting absolute garbage that has no foundation in any solid economic theory, and which is indeed contrary to good economics, but which happens to be propaganda for administration policy. She is as bad, or worse, than Jen Psaki. A flack and a hack.

I met Janet Yellen once, when I gave a presentation on clearing to the Board of Governors of the Fed when she was Vice Chair. She sat right next to me. She was very nice to me. She is quite small, and at this meeting she was dressed in a green velvet outfit with red trim. I couldn’t help thinking that she looked like an extra from Elf.

But alas, Janet Yellen is no longer an elf. She has become a clown, honking a horn to promote the clown show that is Biden administration economic policy.

As someone might say: Sad!

Coda. The subject of childcare reminded me of some work done by the late, great Sherwin Rosen on child care subsidies in Sweden. He drolly asked: ” If Swedish women take care of each other’s parents in exchange for taking care of each other’s children, how much additional real output comes of it?” More substantively, he said:

The most important finding is that the welfare state encourages excessive production of household goods and discourages production of material goods. Too many people provide paid household (family) services for other

people in the subsidized state sector and not enough are employed in the production of material goods.

Doesn’t sound like a shift out in the supply curve to me–especially for goods and non-household services.

October 22, 2021

Back, Back, Back–And It’s Outta Here!

No, this is not a post about baseball, with an outfielder running to the wall only to watch a home run soar over his head. It’s about the copper market, where backwardation (a positive difference between the price for immediate delivery–“cash”–and a futures price) has soared, and inventories have gone yard.

The peak of the frenzy was Tuesday of this week, when at one point the cash-threes backwardation on the London Metal Exchange (LME) soared to $1050/tonne (them’s metric tons, y’all).

LME COPPER FUTURES moved into a record backwardation on Oct 19 as available stocks in exchange-registered warehouses declined to the lowest level since 1974: pic.twitter.com/9IuO6r3jou

— John Kemp (@JKempEnergy) October 20, 2021

That was apparently an intraday price, because the official PM cash-threes back on that day was a mere $382.

The LME is unique in that it trades contracts for specific dates, and so there is a “tom-nex” spread too: the difference between the price for delivery tomorrow, and the price for delivery the day after that. Last Friday, this “daily back” reached $175/tonne–meaning copper delivered Monday was worth $175 more than copper delivered Tuesday. The tom-nex remained over $100 on Monday and Tuesday.

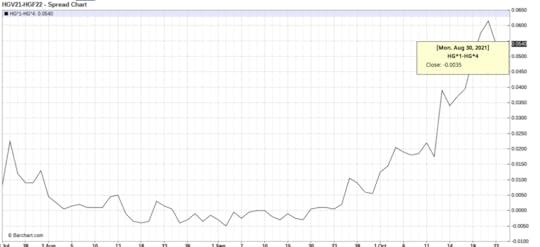

Backwardation on COMEX copper has also jumped recently. Here’s the October 21-January 22 spread(HGV1-HGF2).

Meanwhile, inventories have plummeted, declining to a mere 14,500 tonnes on Tuesday, down from around 250,000 MT in late-August:

So what’s going on? Let me first consider a fundamentals-based story.

The spreads between futures with different maturities for a storable commodity send signals on how to allocate resources over time. When demand is high/supply is low today relative to what is expected in the future, it is optimal to draw down inventories, and prices move away from “full carry” (i.e., spreads that cover the cost of carrying inventory) to incentivize this drawdown. With extreme (but expected to be fleeting) temporal imbalances, it can be optimal to consume all inventories and meet future demand out of future production (because future demand is expected to be lower or supply higher than at present). These extreme temporal imbalances lead to large backwardations to punish storage.

As an aside, that’s why this statement in a Reuters article is incorrect:

Backwardation is supposed to attract metal but this week’s deliveries into LME warehouses have so far amounted to a meagre 9,775 tonnes despite the biggest incentive in the market’s history.

No! Backwardation punishes stockholding–it’s an incentive to move stuff out to be consumed today rather than hold it into the future when it is anticipated to be more abundant.

In some respects, what is going on in copper is similar to what happened in lumber, which I wrote about some months ago. The lumber market went into a huge back due to tight fundamentals and inventories were low.

The good news here is that these price signals indicate that the extreme imbalance is expected to be temporary: copper is scarce today relative to what is expected to be the case some months from now. That’s pretty much what happened in lumber.

So why the temporary scarcity (relative to expected future scarcity)? One plausible explanation is energy prices, which are high now going into the high-demand winter season in the Northern Hemisphere. Due to supply responses that can occur in a period of months but also the seasonal decline in heating and power related energy demand, these prices are likely to fall. Metals refining is energy intensive, so such a rise in energy prices pushes up the metals supply curve today relative to what’s expected in the future: this can produce exactly what we’re seeing in copper, and is also becoming evident in zinc, nickel, and aluminum.

China is of paramount importance in metals refining, so the artificial shortage of power there (caused by price controls and high fuel prices) is exacerbating this problem. Power cutbacks to intensive energy consumers are exacerbating the short term supply disruption.

This points out how the world is hostage to Chinese policy–and Chinese policy mistakes. China has become so important in this area not because it sits atop large, cheap supplies of ores. Low labor costs made it cheaper to locate refining there, even taking into account transport costs. But also, Chinese subsidies of various sorts–financial suppression that makes capital cheap and subsidized power prices–have attracted arguably excessive amounts of capital to metals refining there. And add to that the relative indifference of China to pollution–and metals refining can pollute the air, the water, and the earth: lower environmental standards lead to lower costs and a great incentive to locate production in China.

The fallout from a concentration of metals refining capacity in China is reverberating around the world right now. Not just copper but a variety of metals are going haywire because of the energy-driven supply disruptions in China. Magnesium is just another example.

The former is a fundamentals-based story (albeit one in which central planning has distorted the fundamentals). Is this all that is going on?

Corners can also cause soaring backwardations. The LME was sufficiently concerned about the situation in the market to impose a limit on the amount of daily backwardation to .5 percent of the cash price (which is still a 180 percent annual rate boys and girls). The cash-threes backwardation has fallen by almost two-thirds (to $116/MT today) in the days since.

Fingers have been pointed at Trafigura for loading out large amounts of inventory, thereby exacerbating the tightness. Trafigura says it did so to meet obligations to customers. This would be consistent with the fundamentals story.

But . . .

It is not unknown for firms with large inventory holdings to remove them from the LME to create an “artificial” tightness, or to provide a cover story for a corner. Moreover, if a single firm owns enough inventory to be able to deplete stocks materially on its own, it doesn’t take too large a paper position for it to have a literal corner. Or even if one firm hasn’t cornered, a small number of firms with large physical and paper positions can have a nice little oligopoly that allows them to exercise market power, of which large backwardations are a symptom–and a source of profit. Think of how much money the holder of a large prompt position could make rolling that over at $100+ per day, day after day.

Put differently, fundamental tightness can create market power, and the exercise of this market power can greatly exacerbate backwardations.

The sharp drop in the cash-threes back after the LME intervened lends some plausibility to this explanation. However, a definitive diagnosis requires a deep dive into who was doing what that is not possible based on currently available public information. I am just laying out possibilities here.

Exercising market power in a tight market is sometimes referred to as a “natural corner” and has given some firms that have exercised market power a “get out of jail free” card in the United States.

I’ve just completed a paper on “natural squeezes” that critiques this flaw in US manipulation law. I’ll post it soon.

But when all is said and done, what is going on in copper now is possibly such a natural squeeze: a temporary tight supply and demand situation exploited to exercise market power. Maybe someday we’ll find out.

October 19, 2021

Chicken!

The United States is currently in the midst of a colossal game of chicken. The administration, state and local governments, and their CEO pilot fish at major corporations and hospitals are insisting on vaccinating all employees. Large numbers of nurses, pilots, flight attendants, ground crew, police, firemen, and other working stiffs are resisting. Notably, many in the military are resisting–including most notably special operators.

Who will blink? If neither side blinks, the crack up will be epic. There will be a severe loss of public protection services, and crime will spike. Ironically, given that the supposed justification for all of the various anti-COVID measures has been to protect the health care system, the loss of nurses will lead to a substantial overload on these systems: some hospitals are already cutting down on care, including emergency care. The already strained transportation will crack. Perhaps most ominously, the United States military will be seriously degraded, as the personnel loss is likely to be concentrated among the most highly trained, and disproportionately impact combat units.

Southwest Airlines was red pilled by what transpired over the Columbus Day weekend, and has relented on mandates. Alas, it is the exception, not the rule. (Delta is another exception. American and United are adamantly not.) Virtually all other mandate maniacs have their foot pushed to the floor.

It is beyond doubting that those resisting mandates are in the right, and those insisting are them are in the wrong.

I repeat: beyond doubt.

Even the administration’s politicized scientists at the CDC have acknowledged that vaccines do nothing–nothing–to prevent transmission. There is therefore no externality that can rationalize coercion. (And as I’ve noted before, even if such an externality existed, it does not necessarily support mandates: it is a necessary but not sufficient condition for them.)

Further, the efficacy of the vaccines is becoming more dubious by the day. The clinical trial results represent an extreme upper bound on efficacy, and real world experience is proving them far less robust than promised.

Moreover, although there is much controversy about this issue, the vaccines may have severe negative externalities: that is, they may supercharge the mutation process and lead to the the accelerated evolution of more virulent strains resistant to the existing vaccines. (Cynics will say that from the perspective of the vaccine makers, this is a feature, not a bug.) Here the science is not settled, but that in itself is reason not to proceed full speed with mandates.

Therefore, like virtually all government policy (and not just in the US), coercive vaccination is all pain, no gain.

Yet governments and their CEO collaborators proceed apace, undeterred by reality.

The administration blames everything–everything–currently ailing the country on the unvaccinated. They are the epitome of evil and the scapegoats for everything currently ailing America (the economy especially).

Example: Supply chain problems? THE UNVACCINATED!!! BLAME THEM!!!

And vaccinating everyone will fix everything, according to the “authorities.”

This is pure, 100 percent, unadulturated horseshit. Patent medicine barkers in the 19th century would be embarrassed at the abject dishonesty here.

So why are we here? Why are we in a situation in which government at all levels–with a mendacious administration in the lead–persisting hell bent on such a destructive and apparently irrational course?

Because from their perspective it is not irrational. Yes, it is irrational from a perspective of public health, economic health, and personal liberty. It is not irrational if your true objective is oppression for oppression’s sake. Then it makes perfect sense.

All of the non-pharmaceutical and pharmaceutical interventions make perfect sense if the objective is to compel submission to government authority. All of the unremitting attacks on therapeutic mitigation of COVID make sense if the objective is compulsion.

It’s about control, not health. Then the question arises what is the purpose of exerting such control?, but that’s the subject of future posts.

And governments are so obsessed with control that they appear dead set on steamrolling anyone who resists or objects, even though by doing so they will wreak great havoc on lives, and on the economy (which, of course, also impacts lives).

Many of those resisting mandates appear to be quite strong in their convictions. (When a football coach chooses to forego a $3 million payday rather than submit, he is definitely putting money where his mouth is. So are all the others who are jeopardizing careers and pensions with their refusal.) Governments and companies appear similarly committed. Given that neither appears to be likely to swerve or jump, the outcome is therefore likely to be ugly indeed.

October 10, 2021

Netback Hollaback? Probably Not.

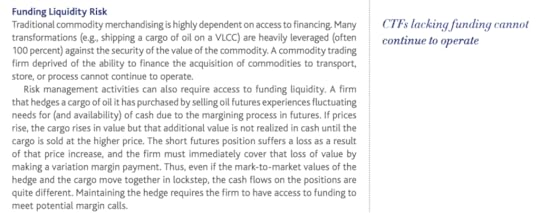

The unprecedented spike in European (e.g., TTF, UK Balancing Point) and Asian (mainly JKM) gas prices has apparently subjected major trading houses (e.g., Mercuria, Gunvor, Trafigura, Vitol, Glencore) to massive margin calls that have put strains on their liquidity resources. This happens every time there is an epic rally, as traders are usually short paper: Cargill, for example, ran into this problem when ag prices spiked in the first decade of this century.

I wrote about this in one of my Trafigura whitepapers:

This mismatch between timing of cash flows on a hedge instrument and the underlying physical can create extraordinary cash flow strains that can put a trader into financial distress.

The question is whether this is all that is going on in the natural gas markets now, or whether there is something more. There has been some hyperventilating about the potential collapse of trading firms, notably Gunvor and Mercuria. Is there anything to this?

Well, the answer is: not as described in that article.

Not to trivialize funding risk–I will come to that in a minute–but the biggest risk a hedger faces is basis risk: the price of the hedging instrument moves a lot relative to the price of the underlying being hedged. This basis risk depends on the relationship between the hedging instrument and the underlying.

The article linked above presents a situation where a trader (e.g., Gunvor) has purchased LNG on a netback basis, which essentially means that it pays the LNG supplier the difference between the price of gas at a destination market (e.g., TTF or JKM) and the price at the origin (e.g., Henry Hub). (There is also a shipping charge deducted.) But this means that the trader is short TTF (or JKM–to keep it simple, I’ll stick with TTF): its purchase price goes up as TTF goes up so a high TTF price is harmful, and harm resulting from a high price is the definition of a short position.

That can cause an increased need for cash to pay the supplier, but that’s different than a margin call on derivatives as represented in the article. And the article incorrectly identifies a purchase at a price linked to TTF as a long position in TTF: it is clearly a short position because a higher TTF translates into a higher cost.

How would the trader hedge this risk? One way is by selling LNG at TTF-linked prices: the higher the TTF, the higher the sales price, and assuming the sales linkage is the same as the linkage in the netback deal, the TTF risk is hedged tightly. (I never say “hedged perfectly”: the only perfect hedge is in a Japanese garden.)

Photo Taken In Shanghai, China

Photo Taken In Shanghai, ChinaWhether there is a funding liquidity risk here depends on the timing of the cash flows under the netback deal and the sales contract. It could be that the trader has to finance the purchase because revenue from the sale will be received later than the contractual payment to the supplier.

Another way is just to sell spot at into Europe. Here there could be a risk because the price obtained in the sale may not exactly match the TTF price in the netback contract.

There could also be a timing mismatch here that gives rise to funding risk.

The important thing to note is that neither of these strategies involves selling futures or swaps as a hedge. Indeed, selling forward would be an insane way to “hedge” a netback purchase. It would actually be what some wryly refer to as a “Texas hedge”: doubling down on a price bet, not entering into offsetting positions. Under the netback the purchase price goes up when TTF goes up. A rise in TTF also would cause losses on the short futures/swap. That is, both ends of this “hedge” would lose, meaning that it is actually a supersized short position in TTF.

Indeed, the netback seller (e.g., the LNG producer) would be the one to short futures as a hedge because the contract makes it long TTF. Selling TTF forward would lock in a sales price.

So the claim that netback purchases are going to kill Gunvor or Mercuria or whoever because margin calls makes no sense if these traders actually hedging: as netback-based buyers they wouldn’t be selling as hedges futures that would be subject to big margin calls in these markets.

Where hedging traders would be subject to margin calls is if they had fixed price purchases of LNG, not floating price purchases like netbacks. Then they would have sold futures/swaps as a hedge, and have received margin calls as prices spiked.

The main risk to the fixed price purchaser/futures hedger is the basis risk between the futures price and the sales price of the LNG. TTF futures prices will typically not track perfectly spot prices, giving rise to some basis risk, which could be acute in volatile market conditions.

Another reason to be skeptical about the claimed connection between margin calls and netbacks–netback pricing is not the current pricing model in LNG: it is largely aspirational.

In the US, Cameron operates under a tolling model, where the buyer pays a fee to Cameron and acquires its own gas. (A buyer could hedge these purchases by buying US natural gas forward, e.g., buying HH futures or swaps.) Cheniere operates under a pass through model. It buys the gas it liquifies. and charges the buyer Henry Hub plus a fixed fee. (A buyer could hedge these purchases and convert them to fixed price by buying HH futures/swaps.). Most non-US LNG has been sold under Brent-linked contracts (which could be swapped into fixed price by buying Brent forwards or swaps).

Gunvor has entered into a large netback-based contract with Tellurian (as have Total, Shell, and Vitol). But Tellurian’s Driftwood project has not even made FID, let alone is it actually selling gas. Tellurian touts netback pricing as an innovation. It’s certainly not the standard way of doing business in LNG now. (Full disclosure: Streetwise Daughter works for Tellurian.)

So pray tell from whom is Gunvor or Mercuria or whomever buying on a netback basis from now, especially in massive quantities? It is possible that there are unreported short term deals that have been done on a netback basis. But it’s not the current way that LNG producers sell gas. The article asserts that 80 percent of Gunvor purchases are on a netback basis. What is the support for that claim? It is certainly not the case that 80 percent–or anything close to that–of LNG overall is bought on a netback basks. What is the basis for asserting that Gunvor is such an outlier?

Meaning, color me very skeptical about this alleged impending implosion of commodity traders due to netback deals.

I think that a more plausible explanation of the huge margin calls is that the traders are short TTF/JKM futures/swaps against fixed price purchases, Brent-linked purchases, or Brent-linked purchases hedged into effective fixed price purchases.

And yes, as seen historically, and described in my white paper, this cashflow mismatch between what is hedged and the hedging instrument can cause major liquidity problems. And banks, for various reasons (e.g., exposure limits, asymmetric information), may not be willing to extend credit sufficient to meet these liquidity needs. This would lead firms to have to cut positions. This hurts, but it’s not Armageddon.

Margin calls are one big headache for traders. Another is credit risk. A trader that has sold LNG basis JKM or TTF has to worry that the counterparty will default at such elevated price levels, either because of financial distress (e.g., the counterparty must sell power or gas at fixed prices, hasn’t hedged its purchases, and goes bust) or “price majeure” (the counterparty just refuses to adhere to the contract. because of the high price): price majeure has long been a major issue in selling commodities to China. Perhaps the CCP’s desperation for energy and its order for utilities to obtain fuel at any price will reduce the PM risk, but it’s always dangerous to count on the CCP.

Another interesting aspect of the recent LNG spike is that unlike the one last winter, this one has not seen an explosion in LNG shipping rates. Thus, the yawning spread between TTF or JKM and Henry Hub (upwards of $50/mmBTU) cannot be explained by shipping rates.

So, to reprise one of my favorite games with my students: Find the Bottleneck!

Spreads price bottlenecks. The spread between TTF/JKM and Henry Hub cannot be explained by shipping cost, so shipping is not the bottleneck. So what must be the bottleneck?

To find the bottleneck, always look what is between the consumption and production location. What (other than shipping) is between importing markets (Europe, Asia) and the gas supply locations (e.g., Henry Hub)? Liquefaction capacity. So the huge spread (which exists even after deducting shipping costs) between JKM/TTF and Henry Hub means that the shadow price of liquefaction capacity is huge. That capacity is the bottleneck.

Qui bono? Well, Cameron and Cheniere have sold their capacity at a fixed price. By selling at oil linked prices, Qatar, etc., are not capturing the shadow price of capacity via that pricing mechanism. So the buyers profit–if they have not hedged their purchases/sales. If they have hedged, the counterparties to the hedge transactions (those that bought TTF or JKM swaps) are the winners.

That is–the speculators in TTF or JKM win by profiting on an explosion in the shadow price on liquefaction capacity.

Meaning . . . how long before this becomes understood, and therefore how long before “kill the speculators!” again becomes the cry heard throughout the land.

October 8, 2021

That Putin, He’s a Gas*: Or, Gazputin Returns!

Churchill called Russia “a riddle, wrapped in a mystery, inside an enigma.” Those following the natural gas market, particularly in Europe, during the Great Spike of 2021 have no doubt agreed wholeheartedly. What is Russia’s (specifically Gazprom’s) game? Why haven’t they increased sales/output to profit from the spike? Because they can’t due to output constraints? Or because China is outbidding Europe for supplies? Or because they need to build domestic stocks?

Or because they are deliberately withholding output for some strategic purpose, a la 2006?

Yesterday Putin unravelled the riddle/mystery/enigma quite a bit: it’s the latter.

Specifically, Putin said Russia would be more than happy to send Europe more gas. But, only via Nordstream 2, not via currently operating pipelines, through Ukraine in particular. Too expensive to send via Ukraine, you see.

Nordstream 2 was just completed, at the insistence primarily of chief Putin-Versteher, Angela Merkel (whose energy policies have been boneheaded from start to finish), and against the determined efforts of Trump and Congressional Republicans. Biden caved recently on the issue and, waived Trump-imposed sanctions, thereby allowing the completion of the pipeline.

But there are still major disagreements between the European Union and Gazprom regarding the pipeline so gas is not flowing yet. Specifically, the EU has ruled–and EU courts have agreed–that Gazprom must “unbundle.” That is, there must be a separation between control of pipeline capacity and ownership of the gas. Meaning that Gazprom must auction off its capacity on NS2:

The Nord Stream 2 gas pipeline is not exempt from European Union rules that require the owners of pipelines to be different from the suppliers of the gas that flows in them to ensure fair competition, a German court ruled on Wednesday.

The Duesseldorf Higher Regional Court rejected a challenge brought last year by the operators of the Gazprom-backed (GAZP.MM) project to carry gas from Russia to Germany under the Baltic Sea. They had argued the rules were discriminatory.

.

“Russia’s Gazprom will be forced to auction pipeline capacity, which could delay deliveries further,” said Refinitiv gas analyst Xun Peng.

EU rules require the companies that produce, transport and distribute gas within the bloc to be separate, or “unbundled”. They aim to ensure fair competition in the market and to prevent companies from possibly obstructing competitors’ access to infrastructure.

This means that the company transporting the gas must auction its capacity to third parties.

Gazputin no likey!

And now he has a desperate gas short, winter-dreading Europe by the balls.

Did you really think he would pass on an opportunity to squeeze?

So he’s squeezing. Hard. The threat is clear: if you want more gas, cave to me on unbundling.

“Nice little continent you have here. Shame if something happened to it. Like, you know, freeze.”

In other words, Putin is not the Riddler, or a mystery, or an enigma after all. He is just playing to type. Where type includes adding sanctimonious snark to sugarcoat his threat.

Putin hasn’t changed a bit. The circumstances have changed, and Putin, in his oft-proven opportunistic fashion, is playing the scorpion in Aesop’s fable the Frog and the Scorpion. “I couldn’t help it. It’s in my nature.” Gazputin is back, baby.

For precisely this reason the Europeans–and Merkel in particular–have no one to blame but themselves. They are the ones who put the scorpion on their backs. One would think this sting would be a lesson. But given how many times they’ve been stung in the past, and continued in their course, that will almost certainly not happen. So I for one am shedding no tears.

*The title is an homage to Chicago Bears great Gale Sayers, and his commercials for Cheker Gas stations, in which the closing line was always: “That Cheker, it’s a gas.”

October 2, 2021

Today’s 70s Acid Flashback: Energy Crisis Edition

Back oh-so-long ago, during the California electricity crisis and its aftermath, I would say that California wanted to deregulate its power market in the worst way, and succeeded. (Wanting to keep up my ESG score, I recycled this line to describe Gibbering Joe’s Afghanistan exit.)

The main design failure of California’s restructuring (a more accurate description than deregulation) of its power market was that it capped retail prices for the two largest utilities in the state (SoCal Edison and PG&E) while requiring them to acquire power at market-determined wholesale spot prices. (San Diego Gas and Electric had met criteria to allow it to enter into long term forward purchase contracts and as I recall was not subject to the same retail price cap.). Thus, SCE and PG&E were massively short wholesale (spot) power. When those prices spiked, due mainly to fundamental factors, the utilities hemorrhaged cash and hurtled towards bankruptcy. Their financial distress led to further dislocations in the California market (and the western US power markets generally).

The world is currently undergoing what is being called an “energy crisis,” focused on power markets, and their inputs, mainly natural gas and coal. There are two parts to this “crisis,” one fundamentally driven, the other driven by ill-conceived regulatory and political factors redolent of California circa 1999-2001.

The most pronounced indicator of the fundamental-driven stress is the price of liquified natural gas (LNG), which has reached dizzying heights.

That price spike is in early “shoulder” months, boys and girls. Lord knows what the peak demand months have in store.

And that’s the nub of the problem: storage.

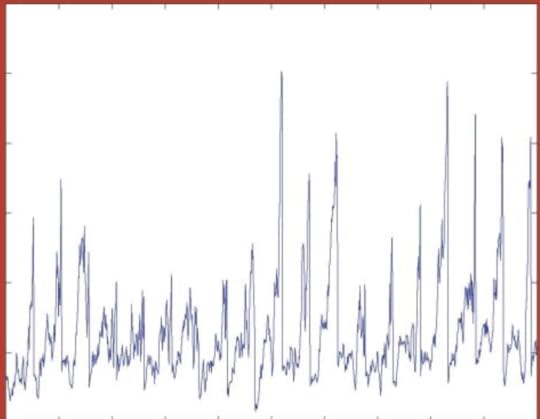

Historically, natural gas has been a “spikey” commodity. The shale boom mitigated spikeness in US natural gas prices, but periodic price spikes are an inherent feature of storable commodities. The truly motivated can read about it in my book, but the CliffsNotes version is this. It is optimal for inventories to run out periodically: if inventories were never exhausted, some of the commodity would never be consumed, which makes no sense. So “stockouts” will occur periodically. When they do, it is impossible to accommodate demand increases or supply declines by drawing down on inventory. Instead, prices bear the entire burden of adjusting to a demand shock (for example). Thus, periodically stocks will be tight, and when they are, a demand increase causes prices to rise dramatically (because inventories can’t cushion the blow).

The cover illustration in my book, based on a purely theoretical model of a storable commodity market, illustrates the point. Note the periodic spikes.

That is, price spikes are inherent in storable commodities.

The magnitude of the price spikes is amplified by the nature of natural gas production and consumption. Both demand and supply are extremely inelastic. The inelasticity effects optimal storage decisions, but when natty inventory constraints bind, inelasticity means that price impacts of shocks are extreme.

This is why going short natural gas (or shorting the calendar spread especially in the winter) is referred to as a “widow maker” trade.

There are lots of widows out there today. In essence, a hard winter of 2020/2021 depleted stocks. The 2020 COVID demand collapse and subsequent price crash (JKM traded at $2.20/mmBTU in May 2020) cratered drilling, constraining current supply (as wells drilled then would have been producing now) making it difficult to build stocks. Warm summer weather in 2021 drained stocks and impeded stock build. Outages in Norwegian production, and a wind drought in the UK (which required greater utilization of gas generation) stoked demand. Stocks are now at historically low levels, setting the stage for even bigger spikes this winter.

The gas market–due to LNG–is now international, meaning that shocks in any region impact prices around the world. Asia (especially China) and Europe are now playing tug of war for gas, and prices are spiking in both places.

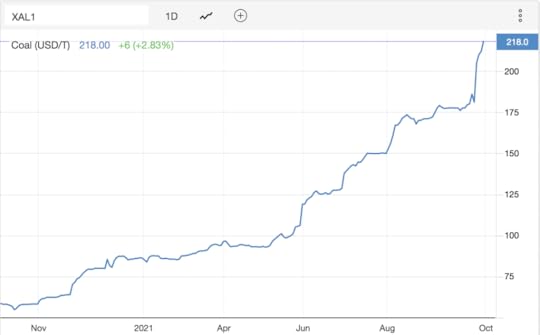

Since gas and coal are substitutes, the price spike in gas is resulting in a price spike in coal:

Oil can also be used to generate power, although this has become relatively rare in recent years. However, the spikes in gas and coal are making fuel switching to oil more attractive, and additional gas/coal price spikes in the winter will likely result in more use of oil in electricity generation, which will put upward pressure on oil prices too.

This is all fundamentals driven, and exactly what occurs periodically in storable commodities. There’s nothing really that can be done about it, policy wise. But that won’t stop governments from trying.

You’ve no doubt read of energy “shortages” in recent days and weeks. Well, low supplies and high prices are not a “shortage” per se. A true shortage is a failure for a market to clear, resulting in queueing for the good. That is, a shortage occurs when the price is kept to low, leading to a gap between the quantity demanded and the quantity supplied.

Think gasoline lines in the US in the 1970s.

That’s where regulation comes in. Various regulations, adopted for political economy reasons, create shortages and the other dysfunctions currently observed in world energy markets.

Take China. The authorities have implemented power rationing. The reason commonly given is a “coal shortage.” Yes, coal prices are high in China (and the world), but that doesn’t create a true shortage. What has? Power prices are capped. The big increase in input costs (both coal and LNG) mean that Chinese generators can’t sell profitably, so they restrict output, leading to a true shortage.

What this means is that the shadow price of power–the price that market participants would be willing to pay for an additional megawatt–is (a) above the regulated price, and (b) above the market clearing price. Consumption would be higher in the absence of the price cap.

High coal prices do not reflect a “shortage”, properly defined. Yes, they represent constrained supplies, but that is not a shortage.

And do not forget that China’s coal supply constraints (and high prices) are in large part a result of their brilliant central planners. China imposed quotas on coal production some years back. The reason was–wait for it–coal prices were too low. Now the government is winking at the quotas in order to encourage production–because prices are too high.

France is going to cap gas and power retail prices, but make suppliers whole (though how it will do so remains unstated as of now). Compensating suppliers (effectively having the government pay the difference between marginal cost and the capped price) will prevent true shortages, but will have the perverse effect of exacerbating the spikes in gas and coal prices because at the capped price consumers will not internalize the true scarcity of fuel, and will overconsume.

The UK is experiencing another echo of California. Several of its retail gas suppliers have imploded because they are required to sell at a capped price and chose to cover their sales commitments by purchasing wholesale spot. The price cap made no sense: competition among retail suppliers would have kept prices in line. Adding the price cap just put the competitive retailers at risk of bankruptcy. (Admittedly, such can occur when retail prices are not capped if retailers offer fixed prices to consumers and don’t hedge, as occurred in Texas this last winter. But price caps make that outcome more likely.)

The UK is also suffering a true shortage of gasoline–excuse me, petrol–a la the US in the 1970s. A true shortage, because there are lines:

Man heads to the petrol station with his horse to 'stir up' some laughs pic.twitter.com/NsPiW8Ijcg

— The Sun (@TheSun) September 29, 2021

Scarcity of truck drivers to distribute fuel is at the root of the problem. But that can’t lead to a true shortage–lower supplies and higher prices yes, but not a shortage with people waiting in line. So what gives?

Apparently there was an information cascade about impending shortages, which led to a panicked run for gas stations. This evidently started with a leak (probably politically motivated) of cabinet deliberations.

A sudden demand increase of this magnitude can lead to true shortages–queueing–if prices do not rise to clear the market. This raises the question of why petrol sellers didn’t increase prices. I’m not aware of formal caps, but I surmise that fear of allegations of “gouging” led retailers to choose to allow customers to pay the high price implicitly (through the time cost of sitting in line) rather than raise price to reflect the sudden (and perhaps contrived) scarcity.

For storable commodities like natural gas, coal, and refined petroleum products, price spikes can last for some time. That’s what we are experiencing today: it’s just one of those spikes like on the cover of my book that happen in commodity markets. Given that we are going into a peak demand season with constrained supplies, the prospect for a continuing spike–and indeed, a higher spike–is very real indeed.

Governments can’t change this fundamental reality. Market prices are sending a signal about underlying conditions. Governments don’t like the message the prices are sending, and will try to do something about it. Alas, their knee-jerk response–to shoot the messenger by capping prices–will make things worse, not better. But because governments can’t help themselves, look for many 1970s energy market flashbacks in the coming months.

September 29, 2021

Build Back Bullshit

Joe Biden and the Congressional Democrats are scrambling madly to pass a $1.5 trillion “infrastructure” bill, and a $3.5 trillion “Build Back Better” monstrosity. Both are execrable, but the latter is beyond grotesque.

Do you know what’s in them? No? Well, then you are almost certainly as informed as most of those who are supposed to vote on them.

These bills are being sold with lies, starting with the Liar in Chief, who claims that his build back bullshit (BBB) costs nothing, zero, zip, nada. How can a $3.5 trillion spending bill cost nothing? Because it includes $3.5 trillion in taxes, silly!

This line is being regurgitated ad nauseum by assorted Congressional idiots (e.g., Nancy Palsy, I mean Pelosi), the White House, and assorted journalistic slugs like the WaPo’s Glenn Kessler.

I should actually write this lie is being regurgitated ad nauseum because it is outrageously false as a matter of economics. The cost of something is the value of the resources used to produce it. In the present instance, the resources used to produce it are extracted by taxes. The cost is real, and the taxpayers bear the cost.

Put differently, the entire administration propaganda effort is asserting that the No Free Lunch Fallacy is in fact no longer operative. Free lunches for all!

Much of the bill consists of massive transfer payments that have resource allocation implications, e.g., a gargantuan expansion of child care tax credit, two years of free community college. The additional resources used to provide child care and community college are real costs. The same can be said of virtually everything in the bill.

There is no free lunch, but the entire ruling class is attempting to gaslight you that there is in order to gain your support, or at least your acquiesance.

But that doesn’t end the gaslighting. The administration and Democrats in Congress claim that you won’t be paying higher taxes. It will be corporations and billionaires. Nobody earning under $400K will pay higher taxes!

Yeah, right.

First, taxes on capital (including corporate taxes, capital gains taxes, inheritance taxes, which are the main sources of revenue in BBB) are borne predominately by wage earners. Reduce after tax returns on capital means less investment means a lower capital stock means lower wages. A reasonable estimate is that virtually all taxes on capital are paid by labor, not capital. So if you look at tax incidence, working schmucks will pay the bulk of the cost. But the incidence of the cost is concealed from those who bear it, which represents yet another lie being used to smuggle these bills to passage.

Second, a billion is 3 orders of magnitude smaller than a trillion. It would be necessary to expropriate around 70 percent of the the entire wealth of billionaires in order to cover $3.5 trillion: their entire wealth would not pay for the two bills together.

And as if that could be accomplished anyways.

There are also stealth features of the bill that are very disturbing. There is a “pilot program” to study mileage taxes. That camel’s nose is therefore under the tent, and any such tax will be highly regressive and impact people who live in rural areas particularly hard. (But they’re Republicans, so fuck ’em, right?) There is also a provision to require the reporting of the IRS all–all–transactions over a certain dollar amount. Biden (or, more accurately, his puppeteers) proposed a $600 floor. $600. Which would mean pretty much every mortgage payment, a lot of credit card payments, etc. This has apparently been raised to $10,000, but don’t be surprised if that gets lowered to a level that will impact millions of Americans.

Most Americans do not really experience the tender mercies of the IRS (because most income tax revenue is generated from high earners who draw the greatest IRS attention). They really don’t understand how draconian (and Kafkaesque) it is. Subjecting American’s ordinary banking transactions to IRS scrutiny will be a shock.

BBB also increases IRS funding by $80 billion, and would double-yes, double-the staffing of the IRS. Doubling the size of the most oppressive part of the US government is another leap and bound down the road to serfdom.

I could go on. But you get the idea. These bills are a monstrosity.

The Democrats are hell bent on getting these bills done, and are therefore resorting to exceptional procedural measures, namely reconciliation, to pass BBB. They are also trying to condition passage of the infrastructure bill on passage of BBB, because the former is more palatable to the mushy middle, e.g, Manchin and many Senate Republicans.

They are doing so precisely because they feel that they have a very short window to implement their agenda, most of which is embodied in BBB. Their margin in Congress is razor thin–and basically non-existent in the Senate. Further, they realize that it is very likely to disappear altogether in the aftermath of next November’s election: ironically, the less popular Biden is, the more crazed the Democrats are in their pursuit of the bill. It’s now or never.

Such massive endeavors should never be passed on a purely partisan basis, especially when the legislature and the country are so closely divided. Doing so only exacerbates division and political conflict. But progressives are in a hurry precisely because they see their window of opportunity closing. So expect the lies to get even more grotesque, and the political strong arming to become even more thuggish.

If these bills fail, the Republic may have a chance. If they pass, they are likely to seal its doom, for they represent a point of fiscal no return.

September 28, 2021

I Have Returned

Howdy. Miss me?

My absence was due to a long deferred vacation (a week spent in Paris) and my annual teaching gig at the University of Geneva (which fortunately returned to in person instruction after a year online).

I was originally supposed to go to the Netherlands first, to give a talk at the Erasmus University Leadership in commodity trade & supply networks program (which I also teach in). However, due to the US being, er, “promoted” to being an Orange country (though no longer a Bad Orange Man country!), doing so would have required 10 days quarantine. So I did the talk online, and went to Paris instead.

Given the news accounts of anti-Pass Sanitaire demonstrations and a first hand description of the nightmarish application of that system in the provinces, I had my reservations about how that would go.

Fortunately, however, in Paris anyways the PS BS was rather lightly applied. I started to rate restaurants and other businesses on a GAF scale. Roughly half gave zero fucks. They didn’t even check. A few gave half a fuck, or maybe one fuck, and subjected my awesome CDC card to a cursory glance and did not bother to check whether the name on it matched my passport. One place, near Luxembourg Gardens, required me to show it to 3 different waiters, including apparently the head waiter.

Nor did I see any evidence that the authorities were monitoring compliance. The main evidence of police presence was convoys of cops in tactical gear on motorcycles or in paddy wagons (Pierre wagons?) racing around the boulevards on Saturday (protest day! yay!) sirens wailing.

More than a week prior to departure, I applied online for “Demande de conversion d’un certificat de vaccination étranger en passe sanitaire français (étrangers).” Didn’t hear anything until 2 days after my return, when the French government (a) acknowledged receipt of my “dossier”, and (b) in a separate email, told me that my dossier had been rejected . . . since I had departed France.

We’re in the best of hands, non?

What France did GAF about during my visit was the Australia-UK-US defense deal, which shtupped the French out of a $90 billion contract to build conventional submarines for Australia, and replaced it with a deal to provide nuclear subs and nuclear technology to Australia. The French were incandescent with rage, and it was the lead subject on most news programs for almost my entire trip. (Energy prices were #2 on the hit parade–I’ll post on that in due course.)

Given France’s history of defense unilateralism (de Gaulle, anyone?) the outrage is a bit hard to take. Moreover, as is often the case with such contracts, France’s performance on deadlines and costs was poor, angering the Australians. (Maybe their dilatory response to requests for a PS is representative of their general attitude to timely performance.) Further, from a capability and geopolitical perspective, nuclear boats are far more suitable to contribute to collective defense in the Asia-Pacific, and against China in particular–which is why China was also incandescent with rage. (A good sign! Though they freak out about everything so it’s not that meaningful an indicator.) (Although the extended timeline for delivery means that any real contribution will benefit any college-aged readers I have.)

That said, the way that the deal and announcement were handled was appalling. It was a public humiliation for France, and indeed, almost seems like a deliberate humiliation. Given the antagonism between Macron and BoJo that can’t be ruled out. This puts paid to Biden’s “rebuilding alliances” BS. Right now the French are pining for mean tweets. Sticks and stones may break my contracts, but tweets will never hurt me.

The Geneva portion of my trip was excellent. I always enjoy teaching in the master of commodity trading program at UNIGE, and the students this year were a particularly good group. Not surprisingly, the Swiss were a little more manic about COVID documentation than the French, but there were many restaurants there that achieved the precious Give Zero Fucks rating. The one exception being a place that had never heard of J&J or its vaccine, or that it was one dose, or that it was approved in Switzerland.

Getting tested to return was something of a hassle, with few appointments on offer. But Swiss physicians apparently collect a little swag on the side (paid in cash!) by giving tests, so I had a new experience–my first ever appointment with a gynecologist, who blessedly only looked up my nose.

Hopefully the pace of posting will pick up over the next few days. The rest of today is a loss, but there’s much to comment about so I’ll leave you waiting in breathless anticipation.

September 12, 2021

Gabby Biden’s 911 Stream of Dementia

Apparently not wanting to risk Joe Biden breaking his own record for Worst Presidential Speech on as solemn an occasion as the 20th anniversary of 911, his handlers decided that he would not give formal live remarks in New York, the Pentagon, or Pennsylvania. Instead, they decided to unleash the allegedly avuncular Gabby Biden, who responded to some questions in Shanksville.

The question that started this verbal train wreck, this word succotash, was the most dangerous that Biden could have faced:

Q Mr. President, what is going through your mind today, sir?

Dear God in heaven, anything but that.

Biden responded by saying exactly what was going through his mind. Which is to say, he unleashed a stream of dementia (I would never say consciousness) that veered between something that had at least some connection to 911 (though that (a) ended up being all about him, and (b) sounded like Fractured Fairy Tales as written by Hunter on crack), to his alleged attempts to unite the country, including a foray into his domestic agenda–“human infrastructure”–to a defense of his decision to withdraw from Afghanistan, to (amazingly) a defense of how we got out of Afghanistan (there was no other way to get out), to a slap at Trump (who apparently lives in his head, granted there is a lot of empty room).

The man said “anyway” SEVEN TIMES. This is a common verbal tick of someone (usually elderly) whose mind wanders, and subconsciously knows his/her mind has wandered. Like Grandpa Simpson:

“You see, back in those days, rich men would ride around in zeppelins, dropping coins on people. And one day, I seen J. D. Rockefeller flyin’ by– so I run out of the house with a big washtub, and—Anyway, about my washtub. I just used it that morning to wash my turkey, which in those days was known as a “walking bird”. We’d always have walking bird on Thanksgiving with all the trimmings: cranberries, Injun eyes, yams stuffed with gunpowder. Then we’d all watch football, which in those days was called “baseball.”

So, anyway, I’m going to do my thing.

That last was Joe Biden, not Grandpa Simpson. And Judas Priest. “I’m going to do my thing.” That’s exactly what we’re petrified about. We’ve seen the thing. And we’re afraid. Very afraid.

Really. You have to read the whole thing to get the full effect.

Apparently Gabby’s puppeteers have never heard the aphorism: “Better to remain silent and be thought an idiot, rather than to speak and remove all doubt.”

If you had any doubt, you shouldn’t now. And if you do, I have no doubts about your mental state.

Not only was this Journey Into Joe’s Mind disturbingly revealing about his lack of a functioning mind, it was wildly inappropriate for an extremely somber occasion like yesterday’s remembrance of a shattering episode in American history. It had nothing to do with him, his political agenda, or his performance as president. But this makes it plain: narcissism will win out. Always.

Why do I call him Gabby? Reading his remarks reminded me of Blazing Saddles, and Gabby Johnson’s genuine frontier gibberish.

There were other awful moments from yesterday. Like Biden giving a shoutout to someone at Ground Zero–while Obama looked on in horror.

Getty captures Joe Biden pulling down his mask to shout out at someone in the crowd at the 9/11 ceremony pic.twitter.com/am8SeGK4rI

— Charlie Spiering (@charliespiering) September 11, 2021

Insert “WTF Joe” word bubble over Obama’s head.

Or when Biden geriatrically shuffled over to someone pointed out to him by security, and the crowd heckled him–including saying “don’t sniff ’em”–a reference to Creepy Joe’s predilection for inappropriate gropes and sniffs of underaged girls (though not just girls)

Coward in Chief was booed & jeered by the crowd

— Baharak (@Baharak_Irani) September 12, 2021

????? ????? ???? ?? ????? ??????? ?? ??????? ?? ??

??? ??? ???? ??????? ?? ????????? ??????? ???!

??? ???? ?? ??? ???? ?? ??????? ? ?????? ???? ???? ???? ?? ?? ???? ??!

pic.twitter.com/5wCbzsuUmj

This on a day where raucous college football crowds around the country (for the second consecutive weekend) erupted into “Fuck Joe Biden” chants:

FUCK JOE BIDEN CHANT IN DEATH VALLEY ? @OldRowLSU pic.twitter.com/wS1yzbl7Yq

— Old Row Sports (@OldRowSports) September 12, 2021

This is not sustainable. The problem is that the alternatives are as bad or worse. Look at the line of succession. Kamala. Pelosi. Leahy.

We are truly putting Adam Smith to the test. Yes, there is much ruin in a country. But not infinite ruin.

September 10, 2021

If You Believe “The Worse, the Better” Joe Biden Is the President You’ve Been Waiting For

In my next-to-last post I said Joe Biden gave the worse speech by any president in my lifetime. In his relentless pursuit of perfection, Biden excelled himself and gave an even worse speech yesterday.

Afghanistan last week, COVID yesterday.

As with the Afghanistan speech, the COVID speech was wretched both in terms of atmospherics and substance. The speech dripped with condescension and disdain for large numbers of Americans, notably those who are not vaccinated. (Implicit in most attacks on the unvaccinated is that they are white MAGA Neanderthals: in fact, Biden’s and the Democrats’ most important constituency, low income blacks, are disproportionately represented: why aren’t Biden and his party tarred as racists?)

One line in particular was disgusting: “We’ve been patient, but our patience is wearing thin.” Our patience? Our patience? Who are you? Just who the fuck are you that your patience matters fuck all?

And who is this we/our? You royalty now Joe? Or are you speaking on behalf of those actually pulling the strings.

Biden made two main arguments: it’s hard to decide which is more idiotic and insulting.

The first is that the unvaccinated pose a threat to the vaccinated: “We’re going to protect vaccinated workers from unvaccinated co-workers.”

Well, it looks like Dumb and Dumber have a new partner–Dumbest:

The externality argument for mandated vaccinations has always been extremely weak. (Not surprisingly, alas, many economists have pushed this lazy argument because too many economists thinking about externalities is lazy in general.) As Coase pointed out long ago, it takes at least two to have an externality, and it is neither obvious nor relevant who “causes” it. The optimal assignment of a property right (and in the case of vaccination policy, what is involved is property rights in one’s person) depends on who is the least cost avoider.

With vaccines, if you are at high risk of COVID, and/or petrified of it, and/or think that the risk of vaccine is low, you can avoid COVID by becoming vaccinated yourself at lower cost than requiring someone who, for example, perceives the vaccine risk to be higher or incurs some other cost to take it (e.g., a religious objection) to be vaccinated. You can protect yourself at low cost: why force someone else to protect you at high cost?

So vaccinate yourself, and don’t force anyone else to do it–or demand the government force anyone else to do it.

But that argument is really moot now. Biden’s mandate is driven by the Delta variant, and Biden’s own CDC–you know, the experts whom we are supposed to defer to–says that vaccination doesn’t reduce the risk of transmission (though it does reduce the risk of serious illness–supposedly, although experience in Israel and elsewhere is casting doubt on that).

(One aside. This speech and the policies expressed were cast specifically as being a response to Delta. If you follow the data, you will see Delta has crested and is declining rapidly: even the NYT admits as such. As well as representing an unwarranted and unjust exercise of power, this policy is cynical: the administration will take credit for the decline in Delta even though it will have nothing to do with it.)

Further, there is the issue which has been raised by very esteemed (or at least once-esteemed) scientists (e.g., Nobel winner Luc Montagnier, but not just him) that the vaccines have spillover effects. Namely, it is hypothesized, and there is some evidence to support, that the vaccines accelerate mutation and in particular mutations that evade the vaccines. Meaning that there could be negative externality not from avoiding vaccination, but from being vaccinated.

As for the other costs that Biden mentions, namely the higher risk of serious illness and death among the unvaccinated, well that’s internalized: people willingly run the risk, and pay the consequences.

Biden’s other argument was “keeping our children safe and our schools open.” “For the children” is the last refuge of the modern (leftist) scoundrel. There is massive evidence–far more definitive than just about anything related to COVID–that children are at extremely low risk of either contracting or communicating COVID.

So hey, teacher, leave those kids alone.

It is particularly disgusting to see children used as Trojan horses for oppressive government policies given the massive harm that has been inflicted on them by governments at every level, most notably by denying them more than a year of education, as well as isolating them socially.

Not only are vaccine mandates a policy monstrosity, the means by which Biden is attempting to implement them are constitutionally monstrous. He has issued an executive order instructing OSHA to issue an emergency rule requiring all those firms employing more than 100 to make employment conditional on vaccination. As an emergency rule, this will be rushed through without the normal procedural safeguards the can sometimes prevent the promulgation of misguided and destructive policies. Moreover, doing this at the federal level by executive–something Biden said during the campaign he would not do and which his execrable flack Psaki said he could not do as recently as 23 July–runs roughshod over the Constitution and federalism.

But that was then. This is now. The even more execrable White House Chief of Staff, Ron Klain, called the OSHA gambit “the ultimate work-around.” Funny I remember the oath of office being about protecting and defending the Constitution, not “working around” it.

Why do we even have a Congress? That’s a serious question. Why do we have states? Another serious question.

Many parts of the country are strongly opposed to his. Many governors in states in those parts of the country have vowed to fight. To which Biden said: “If they will not help, if those governors won’t help us beat the pandemic, I’ll use my power as president to get them out of the way.”

What powers would those be? Just how, pray tell, can the president get governors “out of the way”? A drone strike? (You know, like the one that killed an Afghan who had helped Americans and his children?)

I’ve said before, and I will say it again: we are hurtling towards a constitutional crisis. Vaccine mandates are bad on the merits, and even worse when rammed down our throats while throwing constitutional and federal principles to the winds.

Not only has Biden given the worst presidential speeches of my lifetime, he has cemented his place as the worst, most destructive president of my lifetime, supplanting–by a mile–the loathsome LBJ. Alas, LBJ’s deficiencies became acute when he was entering the last year of his first full term (and his fifth year in office). Biden’s are manifest mere months after his inauguration. And his abject failings, and stubborn, disdainful refusal to brook any objection, are fanning the flames of civil conflict that could make the Vietnam protests look tame by comparison.

I have considered whether we have reached a stage where “the worse, the better” is a reasonable position. If one does indeed believe that, these are the times for you, and Joe Biden is the president for you.

Craig Pirrong's Blog

- Craig Pirrong's profile

- 2 followers