Craig Pirrong's Blog, page 2

October 2, 2025

Bucket Shops Redux: If You Can’t Beat ‘Em, Join ‘Em

Odd Lots was in Chicago last week, and after interviewing Don Wilson they interviewed CME CEO Terry Duffy. The interview was posted today.

CME's Terry Duffy touts its partnership with FanDuel. What CME will offer is basically what bucket shops offered back in the day. The irony is that back then bucket shops were the betes noire of exchanges. https://t.co/Z34P89KDJZ

— streetwiseprof (@streetwiseprof) October 2, 2025

I’ll get to the FanDuel tie-up in a bit, but first I want to discuss something else that came up–perpetual futures, which are a hot topic now (even though hot topic is not punk rock). Duffy cast doubt on the feasibility of perpetual futures in most CME products–he mentioned ags specifically. I agree with his conclusion but not his reasoning.

Duffy argues that perpfuts can’t work for commodities because they don’t fit the legal definition of a futures contract, which involves pricing something for delivery at a later date. He also argues that it can’t work for deliverables.

Maybe perfuts check the legal box, maybe they don’t. Twirling my Oliver Wendell Holmes-esque mustache, I could come up with a clever legal argument that based on the way perpfuts work, they are pricing a commodity at the time of the next marking-to-market, say an hour from now. Or a minute from now. Which would be in the future, either way.

And that marking-to-market is the real reason commodity perpfuts won’t work. Take the case of Bitcoin. Bitcoin perpetuals involve periodic (usually hourly) “funding payments” based on the difference between the futures price and the reference spot price taken from an exchange like Coinbase or Bitstamp. Basically cash settlement on an hourly frequency. But the contract remains live after each settlement.

So basically, a perpfut it is a perpetually (automatically) rolling cash-settled one hour futures contract. The advantages of the future over trading the spot are (a) embedded leverage, often 100-to-1, and (b) the ability to short without borrowing the underlying. Perpfuts are like trading spot, but with leverage.

This works for things for which there is a liquid reference spot market. Bitcoin and some other cryptos have that.

You could do this with say the S&P 500 because there is a large, liquid, continuously traded, transparent cash/spot market. You could do it with currencies, and via its FX Spot+ (“Rolling spot”) contract, the CME (via its EBS subsidiary) is doing just that.

You can’t do it with most commodities because there are no liquid, continuously traded, transparent cash/spot markets. Not in grains. Not in oil or other energy products (with the possible exceptions of natural gas and power). Not likely in precious metals–there is RTC trading in gold, but it is bilateral and there is no transparent pricing. Maybe you could do it with LME non-ferrous metals, because of their unique “cash” pricing mechanism.

So it’s not legal obstacles or deliverability that preclude perpetual futures in most (if not all) physical commodities. It’s the lack of a reliable spot pricing mechanism that can tie the futures and cash/spot prices together as perps are intended to do.

This is basically a special case of why I have ridiculed proposals for cash settlement in commodities for over 30 years. It’s only that the problem is even more pronounced for perpfuts because you need to observe spot prices with metronomic regularity every day, not just around contract expirations.

Turning to CME and FanDuel, my X post basically says it all. It is hilarious to me that CME is offering “event contracts” that are indistinguishable from the kinds of bets one could make on bucket shops back in the bad old days. Duffy describes contracts like “will the price of gold be above X an hour from now?” (NB: if that’s a futures contract, as Duffy claims it is, then perpfuts are no different: see above). The contracts would be “digital” (i.e, have a fixed positive payoff if the event happens, zero payoff if it doesn’t).

Well, that’s exactly the kind of thing bucket shops traded back in the day. (0dte options, which are also a thing now on many exchanges, are also very similar to old-school bucket shot bets). Exactly like them.

That’s an 1892 painting of a bucketshop. Note the use of the high tech chalkboard app.

So why hilarious? Because exchanges waged war on bucket shops for decades in the late-19th and early-20th centuries. A journal article provides some color:

On the morning of August 29, 1887, Abner Wright, president of the Chicago Board of Trade, forcibly removed the instruments of the Postal Telegraph and the Baltimore and Ohio Telegraph companies from the floor of the exchange, literally throwing their equipment out of the building. A few months later, on the night of December 15, Wright discovered some mysterious electrical cables leading out of the basement of the exchange building. Thinking that they were telegraph lines, he ordered them cut with an axe. Instead, they were cables connecting the building to the police and fire departments.1 His desire to sever the Board of Trade’s telegraph connections might seem surprising, since the telegraph network was indispensable to the operations of the major stock and commodity exchanges.

That’s why the CME’s current move is hilarious. If you can’t beat ’em, join ’em.

I’m not censorious of bucket shops per se. People gonna gamble. The CBOT’s (and NYSE’s and other exchanges’) ire reflected not a moral judgment, but a dislike of competition. (Yes you can make arguments like Mulherin, Netter and Overdahl that the shops free rode on the price discovery of exchanges, and that impaired liquidity. But as I’ve shown in my academic work, this “free riding” can actually enhance efficiency if exchanges have market power, which they almost certainly do).

Exchanges today almost certainly realize that they can’t drive bucket shops, excuse me, betting apps, out of business: Terry Duffy can’t forcibly remove their equipment, a la his distant predecessor Abner Wright. So the best alternative is to get in the game with them.

Perfectly reasonable commercial strategy, but a deeply ironic one.

September 30, 2025

Dizzy With Success, With Chinese Characteristics

China is currently undergoing an “overcapacity crisis.” Due to investment booms that far outstripped demand, firms in several major industries are engaged in price wars, what at one time was referred to as “cutthroat competition.”

Presumably because of the negative connotations of phrases like cutthroat competition, the Chinese have coined a neologism–“involution”–to describe their predicament.

Involution ?? or ? doesn't have to be a hard word, but I keep seeing it misused in China commentary, e.g. this article, which I also have mixed feedback on.

— David Fishman (@pretentiouswhat) September 20, 2025

Simply: Involution is the state of intense competition AND the symptoms of that competition.?https://t.co/8D4rEDylZq

The resort to euphemisms is always a tell of a deep problem. And in fine CCP fashion, it has launched a “campaign” against it:

In prosaic terms, then, this campaign is about limiting overcapacity and ensuring China doesn’t fall into the fatal tendency toward deflation that took over Japan three decades ago. It’s also a way to combat the collective action problems that bedevil all economies.

Dressing it as a campaign follows the Communist Party’s long history of presenting major shifts in policy as popular drives against particular internal enemies. It’s a successor to Mao’s anti-rightist and anti-intellectual movements, or the anti-corruption purge that Xi used to exert control over the state apparatus after he came to power in 2012.

And it’s surely a coincidence, right, that the overcapacity is most acute in industries which the government has targeted to be world leaders, which include solar energy (40-50 percent capacity utilization, 90 percent of companies losing money, measured in the billions) and EVs? But it also extends to more prosaic sectors, like steel and coal, and even hogs. Then of course there are the glittering infrastructure and transportation projects that are dazzling, but generate far less value than their cost. And don’t even start on residential construction.

There are no coincidences, comrade.

What has occurred in China represents the largest misallocation of capital in human history. And like much of China generally, the external appearance is but a veneer that conceals a fundamentally flawed construction.

This misallocation is the direct result of the huge degree of central control and “planning” in the economy. No, it is not Patriotic Nail Factory Number 10 will produce 5 billion nails in 2025 style planning, but planning implemented through a vast array of explicit and subsidies, tax breaks, and inducements offered by local governments jumping to the central government’s “guidance” on growth targets.

What the CCP has done, in essence, is play the Sorcerer’s Apprentice, and unleashed economic forces it cannot control.

Xi and his minions are desperately trying to stem the flood by . . . exercising more central control. Specifically, by the “anti-involution” campaign, which is basically government mandated and monitored cartellization of the over-capitalized sectors.

Of course many, particularly in the West, fret that the CCP policies to stifle competition will fail because they are not stimulative. No, really.

It’s a similar situation today, except Chinese policymakers are rolling out only half the solution. While Beijing’s recent push to curb overcapacity is helping rein in the glut in steel and solar sectors, the “anti-involution” campaign is missing a stimulus spark and could hurt the economy instead of bringing inflation back.

Uhm, you think that just maybe that “stimulus spark” is the cause of the problem, not the cure? You can’t follow the logical implications of this–which was in the immediately preceding paragraph?

When President Xi Jinping faced a deflation spiral a decade ago, he not only cracked down on China’s oversupply problem but also unleashed an almost $900 billion housing investment boom.

Not to mention the Keynesian idiocy implicit in this analysis, that “bringing inflation back” is the same as bringing back economic growth. The Phillips Curve, with Chinese characteristics.

What are other alternatives for the CCP? More central direction, of course:

Options available to Xi’s government include overhauling the incentive structure for local officials so they will chase faster consumption instead of investment and production, according to Robin Xing of Morgan Stanley, as well as reforms to transfer more income to households.

They just need to pull different levers, that’s all. Throttle back the investment, juice the consumption. By command!

That always works out well. After all, these guys did so great before why wouldn’t they do great now?

I can’t even. The stupid here–within China, and the Westerners who presume to analyze the Chinese economy–is beyond measuring.

They all would be better off heeding Hayek:

The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design. To the naive mind that can conceive of order only as the product of deliberate arrangement, it may seem absurd that in complex conditions order, and adaptation to the unknown, can be achieved more effectively by decentralizing decisions and that a division of authority will actually extend the possibility of overall order. Yet that decentralization actually leads to more information being taken into account

But of course they won’t.

In sum, China is dizzy with success! It called forth massive investment, and its call was answered. Answered far too well, in fact.

The dizzying success is leading to a pullback, a tactical withdrawal like Stalin’s in 1930. But the fundamental communist mindset of direction from the top has not changed. Meaning that they won’t repeat the same mistakes. They will make new ones instead.

Paul Atkins: the Anti-GiGi. I Can Offer No Higher Praise!

SEC Chairman Paul Atkins has clearly set out to be the anti-Gary Gensler. If that’s not an endorsement, I don’t know what is!

Case in point–his move to abandon to the mercies of the courts Gensler’s cretinous, pointless, and incredibly burdensome climate reporting rule. (I use that Sierra Club link to provide some levity. I love the smell of hysterical panic in the morning).

Atkins is also largely reversing GiGi’s anti-crypto agenda. (Well, he is a “crypto peddler” after all, at least according to the Sierra Club!) I am not a crypto evangelist by any means, but broadly support letting consenting adults trade what they want to trade. The regulatory framework for such trading should focus on legitimate investor protection, anti-fraud, and anti-manipulation measures as set out in the SEC’s authorizing statutes. That’s what Atkins’ SEC is striving to do, in contrast to Gensler’s mission to strangle crypto at every opportunity.

In crypto, but more generally, Atkins is also moving sharply away from Gensler’s regulation by enforcement approach, which is another welcome change.

And hot off the presses, Atkins has taken aim at the bloated and (IMO) pointless Consolidated Audit Trail. (Seriously–I found the above announcement while Googling “Atkins CAT” while writing this post. It came out hours before I put pixels to screen). Proposed in the aftermath of the 2010 Flash Crash, it always struck me as a hugely expensive solution to a non-existent problem. Yes, the CAT could assist in forensic evaluations of market events like the Flash Crash and market manipulation, but having worked on such evaluations in markets lacking the CAT, and reading the analyses of others, I conclude it is possible to carry out these analyses without CAT. Put differently, the marginal benefit of the CAT is minuscule relative to the cost.

One issue that has received less attention outside the equity trading community is market structure, and particularly RegNMS. The 20th anniversary of that regulation was the occasion for an SEC conference to reevaluate that regulation. (At the time of the passage of RegNMS, I wrote an article saying that it marked the 30 Years War over market structure that began with the 1975 Securities Act, and wryly suggested that there would actually be a 100 Years War over market structure. We are now at the halfway mark!)

Along with several participants, Atkins criticized a key provision of RegNMS–the so-called “trade through rule” that prevents the execution of a trade on one exchange when a better price is displayed on another. Atkins favors elimination of the rule.

This rule is the keystone of RegNMS, and its removal would reshape the equity exchange environment as thoroughly as the regulation did 20 years ago. Indeed, its elimination would signal that the entire experiment was ill-conceived.

As I wrote in my Regulation Magazine piece, the trade through rule was the “centerpiece” of RegNMS. Its very purpose was to cause a fundamental restructuring of equity trading in the US. And it did.

As I phrased it, the purpose of the rule was to “socialize order flow.” That is, eliminate–or at least sharply circumscribe–the control that an exchange had over the order flow directed to it. The objective of this was to make the exchange landscape more competitive, and specifically to reduce the market power of the NYSE and NASDAQ. At the time of RegNMS’s passage, the NYSE executed 80 percent of the volume of shares listed on it.

Evaluated against its stated objective, RegNMS was a . . .

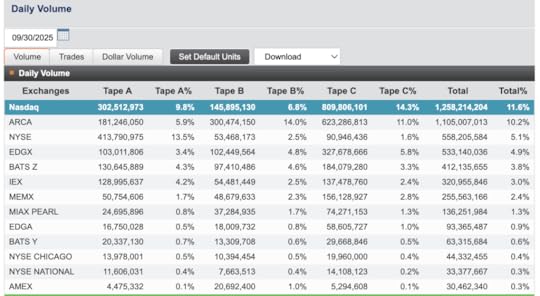

The equity trading landscape looks nothing like it did in 2005 or before. More than half of trades are executed off exchange. The remainder is divided among 12 exchanges, with the largest having a 10 percent market share:

But to Atkins and the critics of the trade through rule, this represents not great success, but great failure. To the critics, this fragmentation is deleterious.

That is, one man’s competition is another man’s fragmentation.

The post-RegNMS environment has clearly seen dramatic improvements in liquidity and declines in trading costs. This is plausibly, though not definitively, materially the result of increased competition. Moreover, the exchanges have adopted different order types, pricing rules (e.g., taker-maker/inverted v. maker-taker), and trading infrastructures. This means that heterogeneous market participants can choose among heterogeneous platforms, thereby achieving a better match than a one-size-fits-all system would.

The main disadvantage of fragmentation–and a major source of discontent–is that brokers and traders must connect to a variety of platforms, and crucially, must buy data from each. As I wrote some years ago, this creates strong complementarity among the data streams that exchanges provide, which as Cournot demonstrated two centuries ago creates considerable market power which inflates prices. Data is expensive, and economics implies it is too expensive.

What would happen if the trade through rule is abolished? I predict that by effectively re-privatizing order flow it would lead to a massive consolidation of trading venues, and a return to a market structure resembling that of 2004 and before. Less fragmentation, but less competition. Those are essentially two sides of the same coin.

The busy Mr. Atkins has also weighed in on the issue of the frequency of corporate reporting, favoring (fast-tracking, actually) the elimination of the quarterly reporting requirement. Since Trump proposed the same, of course this has led to shrieks and wails–which have been markedly absent when Warren Buffet mooted the idea.

Here’s another issue where I support letting the market decide, as is typically the case when there are trade-offs. Reporting frequency has costs and benefits. A company that provides too little information largely internalizes the cost, in the form of a lower stock price. That is to say, its shareholders internalize the cost. Yes, agency problems mean that managers who make disclosure decisions may act against the interest of shareholders and disclose too little or too infrequently, but that is a problem that is inherent in the corporate form (and the consequent “separation of ownership and control”) that manifests itself in many ways that are not the subject of government mandates and intricate regulations. It’s hard to see why corporate disclosure should be different. Yes, punish false disclosures, but don’t dictate how often companies must avoid lying.

One concern in recent years has been the large number of companies deciding to go private or remain private (rather than IPO’ing). There are myriad reasons companies make these choices, but one of them is the cost of being subject to the reporting obligations imposed on public companies. Easing those obligations somewhat would nudge more companies toward going/remaining public, meaning that the amount of information available to investors and the opportunities available to them might increase if the Trump/Atkins proposal goes into effect.

Overall, Atkins is a welcome relief. Though anyone probably would have been, after Gensler’s Reign of Error (and Terror). I’m ambivalent about his hostility to the trade through rule, but on non-market structure matters he is moving in the right–and pro-market–direction.

September 29, 2025

Don Wilson on the Future of Trading: GPUs, the Cloud, and Tokenization

Overall the ~40 minute conversation was very interesting. One of the most interesting parts related to the possibility of GPU futures trading. Wilson thinks it could become the world’s biggest market, and is putting his money where his mouth is. This includes the creation of GPU price indices.

I’m pretty skeptical on the prospects for this market. I note at the outset that it is very difficult to predict which futures contracts will succeed, and which will not. Most don’t.

In a nutshell, the necessary conditions for a successful futures contract are pretty well established. The underlying market must be large. The price of the underlying must be volatile. The underlying can be heterogeneous, but not too heterogeneous, otherwise basis risk is too big with any single contract, and no single contract can generate enough volume to be viable.

GPU would certainly tick the market size box. Perhaps the volatility box. The heterogeneity box–not so sure, although trading a contract that prices based on a service flow (e.g., flops) rather than chips themselves would probably tick that box as well.

Although the necessary conditions for a successful contract are pretty well established, sufficient conditions are not. One can launch a futures contract on something volatile with a large underlying and price volatility and watch it flop. That happens quite frequently.

What’s missing from most analyses, in my view, are more qualitative things. The most notable of these is market structure. In particular long marketing chains, with a lot of intermediation. Also, relatively low concentration on either the producer or the consumer side.

In commodities, for example, trading firms generate a lot of the hedging activity. They intermediate the flow of the physical, and typically their exposures turn over relatively rapidly, meaning that they are putting on and taking off positions frequently. This generates trading volume and liquidity.

The fragmentation of the value chain and fundamental volatility militate against long term contracts for most commodities. Moreover, the lack of concentration mitigates market power which is often associated with price rigidity (as Dennis Carlton showed many moons ago).

My understanding of the GPU market is that the marketing chains are short, not intermediated, and highly concentrated. For example, there are a small number of very large cloud storage providers. AI is likely to be highly concentrated on the buy side. The GPU production side is obviously very concentrated, being dominated by NVIDIA.

Moreover, transactions cost considerations are likely to lead to a good deal of vertical integration. AI firms are going to buy their own chips. Vertical integration also militates against the development of a liquid futures market.

Given the concentration on both sides of the market, I anticipate that to the extent buyers and sellers want to achieve some price stability, it will be via bilateral contracts between the producers and the big users.

Joe Weisenthal asked the question that came to my mind–what about DRAM futures, which were highly touted at the height of the dotcom boom, and crashed along with NASDAQ in 2000?

I have some personal history here. One of the (many) nascent DRAM futures markets (Buckaroo.com, if you are wondering) flew me out to Mountain View to give my opinion on the prospects for the market. Ironically, I was there the day NASDAQ crashed. (Hmmm, I also had some connection with the ’87 Crash–maybe it’s me!)

My assessment was negative. Not long after, the late CEO of Micron, Steve Appleton had me come out to Boise to give my view. Buckaroo had been importuning him, and when they told him they had talked to me, he invited me to tell him what I had told them. After hearing my take, he told Buckaroo “hard pass.”

My prediction, vindicated by experience, was based on market structure considerations. My skepticism about GPU futures is similarly grounded.

For his part, Wilson dismissed DRAM as a precedent. In his view, the fact that DRAM prices trend down strongly meant that there was no underlying volatility to hedge or trade around.

I don’t find that compelling. Yes, everybody knew that prices for a particular chip type tended to trend down (due mainly to learning-by-doing). But as long as there is variation around that trend, there is a price risk that sellers and/or buyers might want to hedge.

DRAM might not be the only cautionary tale. I’m so old I remember Enron touting bandwidth as the future world’s biggest commodity. Yeah. No.

Another issue is information flow. A high rate of information flow causes high rates of price changes which drive both hedging and speculation. Weather derivatives tick a lot of the necessary condition boxes, but information flow is very lumpy. Consider a weather derivative on July 2026 cooling degree days in Houston. From now until, oh late-June–maybe–there will be relatively little information that flows. So there’s nothing really to trade on until then. Meaning that volumes–and liquidity–will be moribund.

Which is why exchange-traded weather derivatives have never done any real volume.

My intuition is that the information flow about future DRAM value will be pretty modest.

So maybe GPUs will be unlike DRAM and bandwidth and weather, maybe it won’t. I will watch with interest.

Another interesting part of the Odd Lots conversation related to the CME’s move to the cloud. Wilson made the great point that the way the cloud works is not compatible with housing the matching engine there. Especially in a high speed world, it is nigh on impossible to implement time priority on the cloud.

Wilson, Alloway, and Weisenthal also discussed tokenization. Here I agree that this could become a thing, and a big one. It may finally be the moment for DLT/blockchain technology to have a big impact.

It was widely hyped for years as transformative, for everything–including financial markets and commodity markets. I had a 2022 JACF paper expressing skepticism about the potential of DLT/blockchain. I still am skeptical about a lot of the proposed uses (e.g., tokenizing shares of fine art or real estate, or in physical commodity trading). However, tokenizing standard securities, derivatives, or collateral offers some advantages. Like I wrote in the 2022 piece, the interesting thing to watch will be whether the blockchains will be permissioned or public.

Some tokenized ETFs and MFAs trade on permissioned chains, but some are on Ether. In 2022 my intuition was that most trading applications would be via permissioned blockchains, but now I’m not so sure. I’ll revisit that issue as time allows me to get more up to speed on what is going on.

September 24, 2025

Antifa and the KKK Are Doppelgangers, and the Federal Government Should Go After the Former Like it Did the Latter

Trump declared Antifa a terrorist organization. Which–I hope you are seated before you read this–sent Democrats into paroxysms of rage. Because Antifa doesn’t exist!

NY Representative and all around scumbag Daniel Goldman’s take is representative:

Name one member of “Antifa.”

— Daniel Goldman (@danielsgoldman) September 23, 2025

If it “explicitly” calls for the overthrow of the USG, where can I find that statement?

Trump is trying to suppress opposition by labeling anyone who dissents as a “domestic terrorist.”

Do not be fooled: This is lawless and unconstitutional. https://t.co/KmPYrAQew8

But of course Goldman is just one in a long line of Dems who have denied Antifa’s existence, and claimed that Antifa is merely an idea. These include Joe Biden, Jerold Nadler, and Christopher Wray among many others. (And yes, I definitely peg Wray as a Democrat).

Of course Antifa exists. It was on the streets of Eugene, Oregon yesterday:

Breaking: Antifa has surrounded the federal building in Eugene, Oregon, to protest ICE.

— Katie Daviscourt ? (@KatieDaviscourt) September 23, 2025

The domestic terrorist group is posted up at the entrances/exits, pounding on doors and windows.

Sources inside say employees are having to find alternative exits. pic.twitter.com/T4guyJDVzZ

There’s even a handy “handbook”:

(That by the way is another scumbag, Keith Ellison, Attorney General of the People’s Republic of Minnesota).

In the aftermath of Trump’s announcement, there has been much chin pulling over how it is possible to attack Antifa without violating rights of association. (Unasked is how people are associating in something that doesn’t exist). Or how it is even possible to attack an idea, something that does not have corporeal form.

This isn’t hard. Although the Democrats may hate the comparison, Antifa bears marked similarities to the Ku Klux Klan. Indeed, Antifa and the KKK are doppelgängers. The horseshoe of domestic terrorists.

The United States government aggressively attacked the KKK twice. If the USG can legally and Constitutionally dismantle the KKK, as it did, twice, it can dismantle Antifa.

There were basically three iterations of the KKK: during Reconstruction (“KKK 1.0”), during the 1910s-20s (“KKK 2.0”), and during the 1950s-60s (“KKK 3.0”). KKK 1.0 and 3.0 were identical to today’s Antifa in all relevant dimensions.

From Wikipedia (yes, I know, but this is accurate):

The Klan sought to overthrow Republican state governments in the South, especially by using voter intimidation and targeted violence against African-American leaders.The Klan was organized into numerous independent chapters across the Southern United States. Each chapter was autonomous and highly secretive about membership and plans. Members made their own, often colorful, costumes: robes, masks and pointed hats, designed to be terrifying and to hide their identities.

The only real difference is that Antifa “costumes” are rarely colorful. They are almost always black. But the two groups have “highly autonomous,” “secretive,” and “[hiding] identities” in common. Also common to them is “targeted violence” aimed at government overthrow.

You could say that KKK 1.0 was the reificaton of an idea–the idea of white supremacy and white control over state and local governments in the South. Antifa differs only in what idea it reifies–communist revolution, rather than white supremacy.

Klan 3.0 was very similar to its post-Civil War antecedent. Like KKK 1.0, it consisted of “local chapters with little or no central direction.” Like KKK 1.0, thse local chapters relied on secrecy and terror to commit local violence to achieve similar outcomes throughout the South.

And of course the US government targeted the Klan during Reconstruction. In 1871 a federal grand jury found that the Klan was a “terrorist organization” and handed down hundreds of indictments. President Ulysses S. Grant used the powers granted by the Civil Rights Act of 1871, commonly referred to as the “KKK Act,” to suppress Klan 1.0. Historian Eric Foner states: “By 1872, the federal government’s evident willingness to bring its legal and coercive authority to bear had broken the Klan’s back and produced a dramatic decline in violence throughout the South. So ended the Reconstruction career of the Ku Klux Klan.”

Although parts of the law allowing the Federal government to prosecute for murder and assault were found unconstitutional, other parts remain in effect and have been codified into US law. Moreover, the USG has legal means that allow criminal prosecution of the parts declared unconstitutional in 1872. For example murders or attempted murders of federal officials (like ICE agents), destruction of Federal property, and the like can be prosecuted under US law.

The US government used these powers to crush Klan 3.0. As a result of this aggressive campaign, it is a pathetic shadow of its former self.

What it comes down to is that the Federal government can prosecute individuals who commit violations of Federal law. It can focus its efforts on organizations or associations whose members commit such violations, or are highly likely to. It cannot prosecute members just for being members, but it can prosecute them for crimes they commit, and indeed, it can prosecute them under Federal conspiracy statutes. Such prosecutions can cast a wide net that catches many members of an organization.

Historically the Federal government has focused on the KKK, used myriad means to infiltrate its various autonomous entities, and prosecuted those who commit crimes under its banner. (NB: Antifa literally has a banner). It has twice, nearly a century apart, crushed the Klan.

It can do the same with Antifa–if it decides to. It can use the exact same playbooks it has employed against the Klan and other groups–if it decides to. All Trump is saying is–he has decided to.

What is striking is that previous administrations decided not to, and did so quite deliberately. And indeed, they claimed that there was nothing to go after, despite the evidence of Antifa’s existence and malignity that was in plain sight.

This raises the question of why, and the answer is most likely a disturbing one. And again, there are echoes with the Klan.

Foner wrote: “In effect, the Klan [1.0] was a military force serving the interests of the Democratic party, the planter class, and all those who desired restoration of white supremacy.” The same was true of Klan 3.0. A colorable case can be made that today one can substitute “Antifa” for “the Klan,” and the statement holds with equal force today. Another way in which the Klan and Antifa are doppelgängers.

If you find this comparison over the top, then riddle me this: why is the Democratic Party so determined to shield Antifa from attack by Federal law enforcement, and so hell-bent on denying its very existence? Perhaps people like Daniel Goldman don’t actively conspire with Antifa, but their efforts to defend it strongly suggest that Antifa serves their interests. It is useful to have around, so they want to protect it.

An article in the Washington Examiner compared the Provisional IRA and Sinn Fein to Antifa and the Democratic Party, respectively. The comparison is an apt one. The Provisional IRA was a terrorist organization that shared political objectives with the political organization Sinn Fein.

I think the administration should play up the Antifa-Klan comparison. The similarity in methods and structure justify action against Antifa: if the threat posed by the Klan justified a concentrated Federal effort to destroy it, the similar threat posed by Antifa does the same. Further, making the Klan comparison is a simple way of demolishing the various objections that have been raised to the feasibility of targeting Antifa. And it puts the Democrats in the position of trying to deny that Antifa exists even in the face of the evidence that an aggressive campaign against it will inevitably produce.

But of course that is what they will do. Deny. Gaslight. Obfuscate. And let them. That will only cement in the public’s mind the connection between Antifa and the Democratic Party, just as their pathetic objections to more aggressive prosecution of crime cements the connection between them and criminality.

September 23, 2025

Political Eunuchs Posing on the World Stage

The annual UN poseurfest is currently underway in New York. The main event is various Lilliputian leaders like Macron and Starmer announcing that their nations will recognize a “Palestinian state.”

Just what are they recognizing, exactly? Usually, recognition refers to a government. For example, in 1979 the US recognized the PRC as “the sole legal Government of China.” In the 1930s the US recognized the government of the Soviet Union.

So what government are these diplomatic giants bravely recognizing? The Palestinian Authority (PA), a corrupt, terrorist-adjacent (at least), autocracy? Hamas, about which nothing need be said?

And what are the borders of this “state”?

Details, details.

These initiatives are a direct response to the war in Gaza. If Manny and Two Tier Keir are recognizing the PA, it is utterly irrelevant–because the PA holds no sway in Gaza, having been eliminated from it by Hamas with extreme prejudice years ago. If the latter, they are recognizing a murderous terrorist regime.

Meaning that these stunning and brave initiatives are actually stupid and bullshit gestures.

For his part, Starmer adamantly denies that Britain’s recognition extends to Hamas. How principled!

Well, as the saying goes, possession is nine tenths of the law. And Hamas possesses Gaza–unless and until Israel extirpates them, that is. So what, exactly, will Britain’s recognition do to end the war in Gaza, which is supposedly the point of this political onanism?

For his part, Macron says that it is imperative to end “Israel’s war in Gaza.” Last time I checked, it takes at least two sides to have a war. Just whom are the Israeli’s fighting, exactly? Hamas could have ended the war they started months ago. By surrendering, thereby saving all those Gazan lives that Macron supposedly cares so much for.

They didn’t. So the beat goes on.

Macron has proposed that France will lead a multi-national effort that will disarm Hamas “gradually.”

I have read idiotic things before, but this is in the running for the most idiotic. Given their conduct in the last decades, who could possibly believe that Hamas would agree to be disarmed, and even if they did so in taqiyya fashion, they would actually follow through? And what is the point of disarming them if they are not combatants, meaning it is not “Israel’s war”? And doesn’t the necessity of disarming them imply they are not a legitimate government, and are in fact the cause of the war? Who is going to rule Gaza after they are disarmed? Islamic Jihad? And if they should be disarmed, why gradually? Is this like military methadone, slowly weaning Hamas off murder? And are we supposed to believe that France would follow through after the inevitable attacks, suicide and otherwise, on its “peacekeepers”?

The fact is that the only way that Hamas is going to be disarmed is when the Israelis pry Hamas’s weapons from their cold dead fingers.

The reality here is that Macron and Starmer et al are political eunuchs domestically who, unable to do anything at home, are strutting about the world stage. It is particularly pathetic in Macron’s case. France is a basket case right now, and his popularity ranks right up there with chlamydia. The chutzpah of this political Munchkin (who imagines himself to be Jupiter) lecturing the world on its moral duties is off the charts.

The other reality is that both Macron and Starmer are afraid of their restive Muslim populations. Better to throw a bone to les banlieues than deal with riots in them, eh, Manny?

Telling indeed was Manny’s meltdown over US ambassador Charles Kushner’s letter criticizing France’s feckless efforts to combat anti-semitism in the country. Just who are the most dangerous anti-semites in France? Its Arab Muslim population, obviously. Kushner (and hence Rubio and Trump) was essentially accusing Macron of cowardice for failing to address the source of the problem. Which hit Macron where it hurts.

Meaning that you cannot understand any action Macron takes with respect to the Muslim and Arab worlds without acknowledging its roots in one of Thucydides’ drivers of human behavior–fear.

Against the background of Macron’s posing and his hissy fit directed at the US, this is hilarious:

Priceless: Police in New York stops Macron's car, because the street is closed for Trump's convoy.

— Dr. Eli David (@DrEliDavid) September 23, 2025

Macron calls Trump to allow him to pass, but Trump humiliates Macron and tells him to walk instead, which he does ?

pic.twitter.com/K1cnWUOBrB

Maybe this was just a SNAFU due to a miscommunication between Macron, the US government, and the NYPD. But maybe it was Trump trolling:

(Macron is Henery Hawk to a “T”).

Regardless, it demonstrates just what standing Macron has in the US. Which, in turn, demonstrates that all his posing will get him nowhere, and earn him even more ridicule.

So go home, Manny. You might need to choose another prime minister.

September 20, 2025

The War Over Cancel Culture–Don’t Get Fooled Again

Though he’s not really worth the pixels, the hue and cry over the suspension (not firing–yet, anyways) of the beyond execrable Jimmy Kimmel compels me to respond. A reply is warranted primarily because of the alleged hypocrisy of those who criticized (and criticize) cancel culture yet called for and applauded his current hiatus (again, apparently temporary). This implicates issues far more important than the fate of a single media twat. It is essentially an attempt to beat back a social revolution that threatens those who occupy the commanding heights in media, academia, and government.

First, the criticism is a pitch perfect example of the “no punchbacks,” “no fair mommy, he hit me back!” mentality of the left. Deferring to this mentality out of fear of being called hypocritical is a recipe for submission to abuse into the infinite future. In a repeated prisoners’ dilemma, which accurately characterizes politics generally and current American politics specifically, tit-for-tat (i.e., punchbacks, and bigtime) is an evolutionarily successful strategy. Always cooperating in the face of defection (i.e., bending over when your adversary screws you) is a strategy that ensures extinction.

This mentality–strategy really–of the left can be devastatingly effective if one’s opponent falls for it. And alas, too many on the right are doing so. Hence the left is currently turning it up to 11. Smart by them, dumb by those who fall for it.

Instead, the appropriate reaction is the late, lamented Andrew Breitbart’s:

Say it loud. Say it proud.

Second, the most egregious aspects elements of High Cancel Culture involved the employment of government coercion to silence dissenting voices on social media. (Cf., The Twitter Files). For this reason, it was beyond wrong–and beyond stupid–for FCC Chair Brendan Carr and Trump to threaten revocation of ABC’s license if it did not do something about Kimmel, and indeed to threaten generally the revocation of licenses of broadcast outlets (that unlike cable, social media, etc.) that subject to “public interest” licensing conditions if they air things the administration doesn’t like.

Meaning that these were unforced errors that made Kimmel et al martyrs. Further, do not unsheathe a weapon that is likely to be in your enemies’ hands someday. Especially when that enemy has no compunctions whatsoever about punchbacks.

The public outcry over Kimmel’s false, slanderous, and disgusting remarks was likely sufficient result in sufficient market pressure on Disney to cause it to get rid of him. By opening their mouths, Carr and Trump (whom I know can’t help it) created countervailing pressure. Moreover, they have distracted attention from the odious content of what Kimmel said, and what far too many others on the left had said.

In other words: Never interrupt your enemy while he is in the middle of making a mistake. Carr and Trump have done exactly that.

Relatedly: Pam Bondi needs to STFU about “hate speech.” That insidious concept has been the primary means by which free speech has been undermined, and by which non-leftists have been silenced on media, social media, and especially college campuses. This, combined with the “Epstein files” fiasco, suggests that Bondi is hell-bent on validating blonde jokes.

Third, Disney/ABC provided Kimmel a platform to express his views and paid him to do it. He has no right to that platform and pay that allows him to say anything he wants. If those views–lies, in this instance–displease his employers, they are perfectly justified in terminating him, thereby denying him that platform. He can go out and find another platform. (Hello, Substack!). Meaning that absent the Carr/Trump own goal discussed above, there would be no question about infringing Kimmel’s rights.

Fourth, this gets at an issue that pervades the entire cancel culture debate: Rights vs. right. First Amendment rights protect the people against the government. Put crudely, the government cannot censor or punish speech (with exceptions like making threats of imminent harm). But with the exception of things like the Biden administration suborning Twitter, Facebook, MSM, etc., most of cancel culture does not violate Constitutional rights. (Censorship by public primary and secondary schools and public universities arguably would. Censorship by most private schools arguably would as well, under Grove City). It is an exercise of social coercion, not government coercion.

It is therefore an issue of whether it is right to object to, and in some cases sanction or even suppress, speech. And here the difficulty is that like almost everything in life, categoricals are counterproductive. There are trade-offs. Judgments must be made.

That is, the costs of some kind of speech exceed the benefits. The question is deciding when that occurs–and crucially, who decides. And that is the real issue.

The reality is that as the result of its successful march through the institutions, the left has achieved a near monopoly on deciding. And it has decided that speech that deviates from (today’s!) leftist orthodoxy is unacceptably costly, and that virtually any action (not just spoken or written words) that conforms to that orthodoxy is sacrosanct. “Your speech is violence! My violence is speech!” With “your” being conservative/right, and “my” being progressive/radical/left. And it enforces this decision with myriad coercive means. Social ostracism. Intense harassment. Deletion from social media. Expulsion from school. Loss of job and income.

The counterrevolution against cancel culture is driven by a deep conviction among a large number of people that this monopoly of social force and the means it employs are wrong and must be overthrown. They are wrong because they enforce an Animal Farm all-animals-are-equal-but-some-animals-are-more-equal-than-others hierarchy that violates the equality of citizens, and the equality of human beings. It is wrong because it is fundamentally coercive, and applies this coercion to behavior that those who are not ideological leftists strongly believe is not only not harmful to others, but is in fact in many cases is quite beneficial both to individuals and society. (Religious devotion and speech are examples of the latter).

In brief, the beef is “who died and made you God?” At root, it is an argument about social equality–of which equality before the law is only a part.

Thus, in the end it comes down to what is beyond the pale, and who decides what is beyond the pale. Vast swathes of people who have not been privileged to be deciders, and who have been persecuted by those who are so privileged, have taken it upon themselves to decide that what Jimmy Kimmel said about Kirk’s murder and responsibility for it is far, far beyond the pale. And that what all too many doctors, “educators” (gag), government employees have said is far, far beyond the pale. And that they should pay a price for these transgressions.

The hypocrisy charge thus comes down to a category error. That error being that “if you objected to the pale before, you cannot insist on a pale now.”

No. The argument has always been about where the pale lies, who establishes it, and who enforces it. And the “Fuck you Jimmy Kimmel–War!” response is a revolt against where it was drawn, who drew it, and who enforced it.

It is, in short, a social revolution. A challenge to the social order, rather than to government per se.

The irony is that leftists usually fetishize revolution–except when they are in power. And since they are in power in virtually all institutions–academia, government, media of all types–this revolution horrifies them. And that reaction is precisely what shows that this revolution is a righteous one.

There is no symmetry between the evil lord in a castle exercising the power of coercion, and the peasants with pitchforks and torches storming the gates to overthrow him. Our evil lords are trying to get us to disperse by appealing to a sense of fairness based on an assertion of just such a (false) symmetry.

Don’t get fooled again.

September 12, 2025

The Fed: Independence vs. Accountability

Needing a break from the social sickness displayed so prominently in recent days, I will distract myself with a post on economic policy, specifically, Federal Reserve independence and Lisa Cook.

I get the point about Fed independence. But the sacralization of it in recent days by commentators of virtually all stripes ignores the flip side of independence: accountability.

A Fed that is totally independent of political influence, or influence by other interests, is also totally unaccountable. And unaccounability has its own costs. Indeed these costs can be large.

The Fed is not immune to error. Indeed, the history of the Fed is riddled with colossal errors. I am an intellectual grandson of Milton Friedman (my PhD advisor being a Friedman student), so that fact is burned into my brain.

Indeed, even some of what are widely considered the Fed’s shining moments–e.g., Bernanke’s interventions during the GFC–were necessitated by its previous errors. Should you get credit for putting out the fire you threw gasoline on earlier?

What are the feasible mechanisms for identifying and correcting such errors, and more importantly, for preventing them? That is a hard problem, but complete freedom from accountability ain’t one of them.

The Fed likes to portray itself as a wizard-like entity. Well it is. The problem is, the wizard it most resembles is Oz.

That is, lack of accountability is the flip side of independence. Imperfect people and institutions that are not accountable are prone to make major mistakes, and to persist in making them even when outsiders identify them.

In other words, like all things human, there are trade-offs. Those clutching pearls at Trump’s Fed-bashing abdicate from grappling with those trade-offs.

The potential for Fed F-ups is amplified by another matter of current controversy swirling about Trump, also related to administrative agency independence. Specifically, the wretched record of the Bureau of Labor Statistics in its unemployment/employment statistics.

The huge revisions of the reports originally made in 2024 and early-2025 testify to the potentially wildly misleading nature of these statistics. Of course, Trump being Trump, he ascribes dark political motives to the overstatements of job creation under Biden. But regardless of the motive, the performance is appalling.

Meaning the BLS has to be held accountable. Those bewailing the firing of the agency head are objectively supporting the principle that it should not be so held.

This is of course relevant to the discussion of the Fed, because the Fed touts that its policies are “data driven.”

Garbage in, garbage out, anyone?

Should the Fed be held blameless for failing to identify and call out systemic failings in the production of the data on which it relies? Mightn’t it be better to spend billions on creating independent data sources, rather than, say, building Jerome Powell’s Taj Mahal?

I should also note that Fed independence will not survive a fiscal crisis in the United States. Listening to Treasury Secretary Scott Bessent, rather than Trump, I get the sense that it is fiscal and budgetary issues that lie at the heart of the administration’s hostility to Powell.

Meaning that the Original Sin here is American fiscal incontinence. Arguing about Fed independence focuses on a symptom, rather than the real problem.

As for the issue that has driven the latest “Oh My God Trump is Threatening the Fed!!!” panic–the firing of Fed Governor Lisa Cook–it is also really about competence and accountability.

Lisa Cook is utterly incompetent and unqualified for the position she holds. Full Stop. She is not a macroeconomist–not that that alone should be disqualifying, but it is relevant. She has credentials as an economist–but that is neither necessary or sufficient to demonstrate competence or qualification, especially for a job as vital as Fed governor.

Let me be blunt: she is an embarrassment to the economics profession. She plagiarized. Her CV is laughable. Her most widely cited paper–and the one she is most proud of, regarding the alleged causal role of lynching in stifling innovations by blacks–is so bad that I doubt I am capable of doing justice to its awfulness. She got hired at, and tenured at, Michigan State University. Yeah, and we know how that happened.

In a nutshell. If a la William F. Buckley you open the directory of the American Economic Association to a random entry, the person on whom your finger lands would be more qualified to be a Fed governor than Lisa Cook. Indeed, that would be true of you performed this exercise N times, with large N.

I will also point out that she is a nasty piece of work. Poor, poor pilloried Lisa was front and center in the efforts to cancel (persecute, really) an actually talented economist, Harold Uhlig, over his wrongthink in the George Floyd frenzy.

Which makes it particular disgusting that “450 prominent economists” have rallied around her.

450 prominent economists rally around an embarrassment to the economics profession. She is a plagiarist. Her CV is worse than a joke. Her most cited publication is a farce. The travesty here is not that she has been fired. It is that she was appointed in the first place. https://t.co/A3GSJF75M5

— streetwiseprof (@streetwiseprof) September 2, 2025

Probably an outbreak of Malcom Gladwell-ism by cowardly academics.

Think you are being unfairly attacked, Lisa? Well, karma is a bitch.

The real travesty here is that Lisa Cook was appointed to her august position by a mentally incompetent, race card dealing president, and the Senate confirmed her.

And so we have an indisputably incompetent person on the Fed. Fed independence is so sacred that error cannot be addressed? (Would that there were a way of making the Senate and “Biden” accountable).

As for the pretext for her removal, incompetence should be sufficient “for cause.” Given that’s probably too difficult and too precedential to get courts to buy, credible allegations of mortgage fraud will do.

And that is another testament to her incompetence, and the Senate’s failure of due diligence. She, through arrogance or stupidity or just plain dishonesty, gave Trump the means to remove her.

In addition to the screeching about “independence,” there are also wails about lack of due process.

FFS. you don’t get a trial by jury with a presumption of innocence for everything. The amount of process due depends on the context.

If you are an at-will employee, your due process is basically bupkus. If you can be fired “for cause,” the due process is typically a senior decision maker evaluating your conduct and determining whether sufficient cause exists.

If you are a financial regulator, yes, credible allegations of violating financial laws is pretty much a drop-dead cause. Caesar’s wife, etc.

Note that she has never denied that she lied on multiple mortgage applications. So she’s not even denying the cause. Just saying that it is not sufficient.

Well, what would be then?

Siding with her renders the entire concept of for cause termination null and void. Which would further immunize the Fed from accountability.

In sum, the whole Fed independence battle has been framed in typically Manichean terms, with Trump, as always, cast in the role of Demiurge.

That’s BS. It’s not good v. evil. It’s about difficult trade-offs. If you don’t take that seriously, I won’t take you seriously.

September 11, 2025

Two Murders Most Foul, Laden With Portents

In the past several days America has been transfixed by two murders. It may well be transformed by them.

If they are indeed transformative it is because they lay bare deep pathologies in the country. Pathologies plural. The two murders are very different, and thereby cast harsh light on very different pathologies.

The first murder is that of Ukrainian immigrant Iryna Zarutska, who was butchered by a (literal) psychotic, Decarlo Brown. This murder tragically reveals multiple pathologies, a cancer that has spread deeply into the nation’s viscera.

Of course there is the taboo subject of black male criminality. I’ve written about this before, and many others have done so in the aftermath of Zarutska’s death. It’s not immaterial, but it’s not the main issue here except to the extent that intersects with other, deeper matters.

Instead, the primary issue is why a man who was a clear and present danger to the public, a man with 14 entries on his rap sheet, was free to ride the Charlotte light rail in the first place. And indeed, he is a man who is (as alluded to above) psychotic, and who had been recognized as such by his own mother and sister and law enforcement.

But not by the courts in Mecklenburg County, NC. And this is where the intersectionality (to steal a word from the left) comes in. Especially in the aftermath of George Floyd, but not only, incarceration or institutionalization of patently dangerous black men has been deemed to be itself a crime, an injustice. So if they are even arrested (something police are reluctant to do, knowing the likely ultimate outcome) they are routinely released to commit more mayhem–and murder.

The roots are deeper though, and are not primarily racial in nature. The roots go back to the de-institutionalization of the insane in the late-70s and early-80s. This was driven largely by false compassion and moral outrage, fueled by a movie (One Flew Over the Cuckoo’s Nest). It was also predicated on a theory which has proven to be tragically false, but which has not been abandoned (and which is related to another current controversy). Namely, that psychotropic drugs rendered institutionalization unnecessary.

Even presuming the medications work (a dubious proposition), the theory requires the psychotic to take them. Which many don’t, for a variety of reasons–including notably their underlying mental illness.

It was crazy to think that crazy people would reliably take meds. But there we were, and here we are. As a stroll through any urban area will demonstrate.

This is arguably the greatest public policy error of the past half-century. Yet outside of Trump and a few others, few are willing to admit it and even contemplate whether a demonstrably false theory should be abandoned.

The policy was touted as compassionate, and those who opposed it demonized as cruel. Tell me how, exactly, this policy has been compassionate, even to the alleged beneficiaries of this compassion, let alone to the Iryna Zarutskas of the nation. It is the antithesis of compassion.

There are no easy solutions to hard problems. Handling the seriously mentally ill is a very hard problem. We were sold an easy solution. The salesmen were wrong. Yet they have long preened over their supposed moral superiority.

The second murder–assassination, actually–is of course that of Charlie Kirk. Like Zarutska’s, it reveals an ugly reality, but different ones (again plural).

To be honest, I only saw Charlie Kirk out of my extreme peripheral vision. This is almost certainly generational–I was not part of his main audience, which consisted (past tense, alas) of the college-aged, especially men. My main observation about him was that he obviously had a talent to trigger incandescent rage by many I despise.

And how right I was, and literally so. For some cowardly fuck pulled the trigger on him from a considerable distance at a rally at Utah Valley University yesterday.

My first thought was “trantifa.” And that conjecture has apparently been validated: the murder weapon was found with four 30-06 rounds with trans and “antifascist” slogans etched into the shell casings, a la Luigi Mangione.

The generational aspect could also explain why he had become such an object of hatred. He was incredibly successful at mobilizing the young, and the left views the young as its property. That made Kirk a particularly potent political threat to the left.

This murder is unbelievably horrific. The man had two small children, for crissakes. And yes, he was a deeply sincere Christian. He was passionate–something the left usually valorizes, when someone is passionate about leftist ideologies–but not violent. Indeed, in recent days he ironically warned against the rising tide of political violence in the US, noting that over 50 percent of Democrats support the assassination of Trump, and nearly that many the assassination of Elon Musk. His weapons were words: he was first and foremost a debater.

But the left views words as literal weapons: “Your speech is violence: my violence is speech.” Some twisted fuck acted out that slogan yesterday

As of the time of this writing, the cowardly fuck has not been apprehended, let alone received [] just reward. When [] is, I expect [] will be another Cluster B type. Another loser narcissist, like assassins before []–John Wilkes Booth, Charles Guiteau, etc. Someone who uses ideology to fill an emptiness of the soul, and whose inability to cope with the cognitive dissonance felt by a super special person who is a loser at life turns into rationalization for nihilistic violence.

A revelation common to the two murders is the mendacity of the media and the political class, especially on the left. Because it raised taboo issues the media studiously ignored Zarutska’s murder until videos of it went viral on social media. Forced to respond, it did so in its typical passive-aggressive way, bemoaning the fact that it had galvanized the right, rather than the horror of the murder. That was the real problem here, you see. A lunatic, released repeatedly by the state, butchering an innocent woman wasn’t.

I can’t even begin to express my disgust at the media response to Kirk’s assassination. The New York Times’ obituary is perhaps (and unsurprisingly) the acme of the genre. I will not link to it. If you want to find it, go ahead. Have a barf bag and blood pressure meds handy.

And that pales in comparison to the online vileness, which I also leave to you to discover, if you have the stomach for it.

The media reactions and online vileness are important because they clearly define the battle lines in America. For now, that expression is figurative, but a few more murders and it could well be literal.

They tell us who our enemies are. Fortunately, we are not prone to riot and violent resistance. But “not prone to” does not mean “absolutely incapable of.” The question is how far we are from that line. The events of the last weeks have pushed us closer.

As I wrote on X yesterday:

Walter Russell Mead pointed out years ago that Jacksonian America is slow to anger, but when pushed its fury is incandescent & burns everything that dares oppose it. That point is coming nearer with each passing murder.

— streetwiseprof (@streetwiseprof) September 11, 2025

Who will step back? The initial indications are that those who should–the left–will not.

September 4, 2025

Russia-China Gas Groundhog Day. Again.

News flash (irony intended): the news media are idiots with the memory of a mayfly.

The most recent example, the breathless coverage of the supposed gas deal between Russian and China announced with great fanfare during Putin’s visit to Xi.

Vladimir Putin's apparent breakthrough on a pipeline deal with China may redefine Russia’s energy future and the global gas trade, writes @SStapczynski https://t.co/asJNGUTKaG

— Bloomberg (@business) September 2, 2025

A new Russia-China gas pact could reshape global energy markets https://t.co/kbIeiAy2b3 | opinion

— Financial Times (@FT) September 4, 2025

“Apparent breakthrough.” “Could reshape.”

Uhm, if you have paid attention, or if you do some actual research, you will know that there have been multiple announcements of the same effing thing over the last 20 effing years. I wrote about these contemporaneously, and always in a tone of hilarity. As I will do today.

Why hilarity, you ask? Because they would make these announcements, and then say: “we’ve agreed to everything but price.” Minor detail!

And of course, the price was never right for both, so the deals always faded away, only to be resurrected to serve some political purpose, like proclaiming Russia’s status as an energy powerhouse, its ability to spurn Europe if the Euros failed to meet Russia’s price terms, or to testify to the deepening relations between China and Russia.

And so here we are. Again. Like Groundhog day.

And like in Groundhog Day, the same thing is happening. It’s a “binding deal,” but

Depending on the details, most of them yet to be hammered out, today’s announcement could connect Russia and China for decades to come. It also sends a message to Washington about a counterweight to US political power — and to American gas. [Emphasis added].

So I guess “most” of the terms aren’t binding, because they haven’t even been negotiated.

Even better:

The Russian-Chinese memorandum formalises intent but defers substance. The real negotiation over the gas supply agreement will rest on four key parameters: price, take-or-pay obligations, financing and timing. [Emphasis added].

Yeah. Everything is set in stone. Except price, quantity, financing, and timing. Other than those trivialities, take it to the bank!

The only reason why this deal might–eventually–happen is that now Putin has no options. Once upon a time, his contract kabuki with the Chinese mainly served to generate negotiating leverage for Putin with the Europeans. Now Europe is dead to him. Gas export revenues are minimal. Russia’s financial situation is dire, so he has more motivation to make a deal.

But of course Xi knows that too, and therefore knows that he can demand an extremely low price, one that barely covers Russia’s costs.

In other words, due to his strategic genius, in this instance launching a war that resulted in the loss of his biggest gas export market, Putin put his balls in Xi’s hands. And Xi is holding a pair of pliers, a la the 1:11 minute mark of this:

(The media is doing a good Gene Wilder impression BTW).

Well, maybe Putin will be able to bioengineer some new goolies.

But back to the media. It’s not as any of this should be news. You have to know this history to be qualified to write about Russia, and Russian gas in particular. But obviously the MSM is not qualified. Note even remotely. Instead, they are Charlie Browns, who never learn and always end up making fools of themselves.

Video of those who believe in Russian and Chinese announcements about gas pipeline deals. pic.twitter.com/0N7dXpJovx

— streetwiseprof (@streetwiseprof) September 2, 2025

Craig Pirrong's Blog

- Craig Pirrong's profile

- 2 followers