Craig Pirrong's Blog, page 32

December 22, 2021

Levitating the Lira–For How Long? Or, Erdo Promises the Impossible (Trinity)

The Turkish lira is now about 12, a big recovery from its nadir on Monday. I expressed skepticism that Erdoğan’s announced policy of guaranteeing some Turkish bank deposits against an adverse move in the TRY was the cause. As we’ll see in a moment there is something to that. But even if the policy announcement caused all or some of the rebound, my skepticism about the viability of this mechanism remains.

As to the logic behind the policy. In essence, there was a run on the lira, and one way of running was to sell lira on deposit, and buy dollars. A typical bank run is to sell deposits for currency. One reason bank runs are far less frequent today in places like the US is deposit insurance, which is basically a mechanism to ensure that a dollar on deposit will always be worth a dollar of currency. That short-circuits the run dynamics, in which fear that a dollar of deposits will be worth less than a dollar of currency, which induces people to race to convert deposits into currency, which can cause banks to fail . . . leading to deposits being worth less than the equivalent amount of currency.

What Turkey has announced–and note, it has not announced the details so this isn’t really a plan but a sketch of a plan–is equivalent to a form of deposit insurance. Except that here the government is promising the TRY value of deposits will be worth at least a fixed amount of USD or Euros. But the idea is the same. If people are convinced that their deposits will remain pegged to the dollar, they have less incentive to run.

There is a key word in the prior sentence: “convinced.” It might work if people believe it will work. It won’t work if people don’t. So how can they have confidence? This confidence is necessary, but not sufficient, for success.

The confidence depends on the reliability and solvency of the guarantor. It’s not quite clear who that is in this situation. Is it the banks? The government? The former would be ludicrous, so let’s go with the latter.

So how is the government going to fund the guarantee? It’s likely hoping that the mere fact that people believe it can and it will will mean that the government is never on the hook for anything.

But that’s not realistic. The value of the TRY will fluctuate for the same reasons that currencies always fluctuate. Macro shocks. Balance of payment issues. Capital flows. Whatever. The Turkish government is short a put on the currency (that’s essentially what the guarantee is–a put on the TRY). Sometimes these factors are going to push the TRY down, obligating the government to make good on its promise.

So how is it going to pay for that? And note that it will have to pay a good fraction of the time. Roughly 50 percent of the time if the floor is set at the current exchange rate.

Print lira? LOL. So the lira declines, and the government prints more lira to pay off on its short put. Which will depress the lira further. Requiring more printing, etc. etc. etc.

Short put=short gamma. Short gamma can create an unstable positive feedback mechanism, and positive feedback mechanisms in economics very often have extremely negative consequences. Lira declines feed further declines. And again–as with any currency, lira declines are always a major risk. This is especially true with a country like Turkey. And resorting to this mechanism would likely destroy the trust that it depends on.

OK. The printing option seems pretty dumb–though don’t put it past Erdo! So, to meet its obligation to top up lira-denominated accounts to compensate for a decline in the TRY, instead of printing lira Turkey could sell dollars and Euros for lira which it then gives to depositors. At least this would potentially create a beneficial (negative/stabilizing) feedback mechanism, with the $ and € sales tending to increase the value of the lira.

But where is Turkey going to get the dollars and euros? That’s what I meant the other day when I said don’t trust a madman whose mouth writes checks his wallet can’t cash.

This second mechanism can be viewed another way: as a commitment device. Specifically, a device committing Turkey to defend the lira. Effectively, a way of committing to a peg: it has to buy lira/sell $ or € when the lira declines. And if Erdo’s other promise–not to raise interest rates–is believed, committing to a peg and foregoing the option to raise interest rates to defend the currency.

And if this is the real plan, it faces all the risks that pegging inevitably entail. Pegs are always at risk to speculative attack. Turkey is particularly so, given its paucity of foreign exchange reserves and its bizarre government policies. No doubt George Soros’ interest has been piqued.

This is why I am skeptical. Skeptical as to the announcement of this sketch of a plan leading to a 33 percent rally–FX traders no doubt have figured out what I just laid out. Skeptical as to the feasibility and stability of this mechanism, even if it did levitate the lira.

And as I alluded to at the outset, it may well be the case that the plan didn’t raise the lira on Monday and keep it there–traditional government intervention has. The FT reports that the central bank has spent billions of dollars in recent days to stabilize the TRY. This suggests that the plan is basically just propaganda to (a) conceal what is really going on behind the scenes, a traditional defense of the currency, and (b) allow Erdo to take credit for the rally without admitting that more dollars are going out the door.

Regardless of the mechanism, defending the lira puts strains on Turkey’s public finances. The fact that Turkish credit spreads have widened even as the currency has strengthened suggests that Mr. Market has figured that out.

Turkey, like all countries, faces the “impossible trinity.” A country cannot have a fixed exchange rate, an open capital account, and an independent monetary policy. But Erdoğan is promising all three. Fixing interest rates at low levels as he promises, because he’s on a mission from Allah=independent monetary policy. He has promised to maintain free movement of capital. And now, he is implicitly promising to fix the exchange rate.

We know with metaphysical certainty that this is impossible–the “impossible trinity” phrase came about for a reason. So it’s going to end badly. The only question is which part of the trinity is Erdoğan going to jettison. Based on form, I predict the lira.

December 20, 2021

The Turkish Lira–Murdered by a Theory, and a Theology

The Turkish Lira has crashed, down over 50 percent since September, and now trading at less than a third of the value it had when I was in Turkey in 2018. It would be unfair to apply Jefferson Davis’ epitaph for the Confederacy: “Died of a Theory.” Instead, “Murdered by a Theory” would be more accurate.

And the murderer is readily identifiable: Turkish president Recep Tayyip Erdoğan. His theory is that high interest rates cause inflation, so as inflation accelerated and the Lira plummeted, rather than allowing the central bank to tighten monetary policy and raise interest rates, he pushed it to cut rates–which only accelerated the TRY’s crash.

Sunday, even Erdoğan apparently realized that his economic rationale was risible, so he switched gears, saying that this policy was dictated by Allah and the Koran:

“What is it? We are lowering interest rates. Don’t expect anything else from me,” Erdogan said Sunday in televised comments from Istanbul. “As a Muslim, I’ll continue to do what is required by nas,” he said, using an Arabic word used in Turkish to refer to Islamic teachings.

Meanwhile, Erdoğan has been telling his largely religious (and poor) political base (which is being devastated by inflation) that this is just a test from Allah. That the Koran says that Allah is seeing whether you can bear such trials in silence and faith, and that if they vote for him again in 2023 he will fix inflation. Whip Inflation Then (Insallah). Or something.

So now, the Lira is being murdered by theology instead of a theory.

The chaos became extreme on Friday, with Borsa Instanbul shutting down due to a crash in Turkish shares that triggered circuit breakers. The chaos continued on the open, with the USDTRY breaching 18 and the stock market shutting down again:

Note the big rally earlier today. Though it is rather sobering that 15 is, relatively speaking, good news.

The recovery was driven by an Erdoğan statement to the cabinet today in which he pledged to defend the currency and to protect Turkish depositors against currency declines. To be honest, I find it hard to take his announcement seriously, although the markets apparently have. He has made commitments, but their credibility is dubious at best, especially since he pledged to continue his Crazy Erdo interest rate policy.

To carry through on these promises, Erdo needs dollars and Euros. Which he doesn’t have.

So I would be short the TRY at 15. Relying on a madman’s mouth writing checks that his wallet can’t cash is foolish.

There are larger lessons here.

The first is that this demonstrates the extreme dangers of presidentialism and highly personalized political systems. A “leader” with no checks and balances can indulge in insane policies at a whim. Erdoğan has gutted every institution in Turkey that could counter his ambitions–and his flights of policy fantasy. The press is suppressed, with more journalists in jail in Turkey than anywhere in the world. Civil society figures (and ordinary people) are muzzled due to the threat of being arrested for “insulting the president.” (The friend of a friend, the head of the Ataturk Institute, has been convicted of this and has the sword of Damocles hanging over his head.) The courts are packed with his goons, and the military was neutered after the abortive coup of 2016 (which in retrospect looks more and more like a false flag operation, given how it has redounded to Erdo’s benefit).

(Erdoğan’s careening into megalomania actually makes Putin look good by comparison. Russian macroeconomic policy under Putin has actually been rather responsible. Perhaps because Putin is uninterested in the subject and willing to delegate, or because he realizes that he is not especially competent in the subject. Either way, his forbearance looks wise especially in contrast to Erdoğan.)

Another lesson is that fakakta economic policies can do incredible damage in short order, yet “leaders” may recklessly implement nonetheless. In the United States, the Biden administration’s continuing attempt to spend additional trillions in the face of the worst inflation of the last 40 years is economic insanity: here the United States is at risk of dying from ignoring a theory (the fiscal theory of the price level). Even non-righties like Larry Summers realize the danger

Fortunately, a semblance of checks and balances remains in the US, and Joe Manchin has played Horatio at the Bridge, holding off BBB for now. But for how long? The specter of presidentialism hangs over the US too: Manchin is being assailed viciously by the left as a threat to “our democracy” for his temerity in resisting the president’s will–even though said president’s mental incapacity is manifest.

The US should take heed of what is going on in Turkey, and not gut checks and balances, give carte blanche to presidents, and engage in reckless economic policies. Alas, given the sway that turkeys hold in politics and the media, this may be a vain hope.

December 16, 2021

You’ll Travel the Road to Serfdom on Public Transport–Oh Joy!

The private automobile has been the greatest liberating invention in history. Before the automobile, individual horizons extended a few miles for most. With the privately-owned car, billions of people have been able to travel where they want when they want. It has made it possible to separate considerably the workplace from the living place. It has expanded the range of stores and restaurants and service suppliers available to people. It has made travel–sometimes at a whim–possible in ways it was not possible before its widespread use.

So of course the world’s “elites” hate the automobile. Because they hate personal freedom.

A couple of data points.

First, consider this from the UK: “Car Ownership Could End in Massive Overhaul of UK Roads.”

A few excerpts (but read the whole thing):

GOVERNMENT transport ministers have backed calls to end private ownership of vehicles in a major overhaul.

She said the country needed to move away from its “20th-century thinking centred around private vehicle ownership”.

She added it was “staggering” almost two-thirds of trips were conducted by lone drivers.

How dare those proles weight the benefits and costs of going where and when they want alone vs. coordinating with others!

The Government has repeatedly stressed the need to switch from a reliance on cars to other forms of transport.

Oh, if the government says so . . . Better not disagree with our betters, given how remarkably competent governments are!

They said this was one of the “biggest opportunities” to switch short car journeys to cycling and walking.

In the rain? In the snow? When it’s 90 degrees? When its 20 degrees? At night? If you are elderly or infirm? If you’ve worked all day and really don’t want to walk 3 fucking miles? If you are going to the grocery store to pick up a week’s groceries for a family of 4?

I could go on.

Supposedly new technology will allow various forms of ride sharing.

Have they heard of Uber? Lyft?

People have always had the option to ride share. They typically choose otherwise. For obvious reasons. They have more options now. And again, they typically choose otherwise.

One wonders if these people actually live in the real world.

They also tout public transport. Which has been the hobby horse of the control freaks since forever, and with few exceptions driven by urban density and legacy investments has been a massive financial black hole. Further, although sitting in traffic is often a bad experience, being tied to public transport and exposed to the crowding, crime and assorted lunatics that it entails, not to mention the lack of flexibility, is quite often far worse than driving bumper-to-bumper. Which is why people choose not to use it, and why it is a financial black hole.

Again, let people choose. But no–that’s not the elite way! We’re too stupid to choose. We choose wrong.

Another data point:

“The Government is Your Next Car Passenger.”

Section 24220 of the [“infrastructure” law], titled Advanced Impaired Driving Technology, directs the secretary of transportation to issue a rule within three years requiring advanced impaired driving technology in all new vehicles, although the rule may be delayed if the technology is not ready for implementation. Automakers have up to three years after the rule is issued to comply.

Now, as written (though vaguely) this technology will be limited to detecting/monitoring “impaired driving.” Potentially laudable. But this is the camel’s nose under the tent. The future possibilities are endless. Speed control: all cars in Europe after 2022 must be fitted with speed limiters. Driving is bad for the climate, right? So driving must be limited directly or indirectly, and governments are hot to do that. One proposal in the US is impose a mileage tax. A system that can monitor if you’re buzzed can certainly count how many miles you drive, sober or drunk, send the results to the IRS or whomever, so that you can be charged accordingly. Or maybe you’ll get a mileage ration, and your friendly government sensor will shut down your vehicle when you’ve reached it.

Again the common theme here is that governments do not like the autonomy that private automobiles provide and are moving to impose, inch by inch, limitations on that autonomy. Leftists have always hated the automobile. They’ve always loved public transport. The former gives you freedom. The latter gives them control.

Guess which one they want, and will do anything to achieve?

And it’s not just automobiles. The elite–including the private jet elite–hates airline travel that lets the proles visit family or have a holiday at a pleasant location. Whether through carbon taxes or carbon credit pricing they will squeeze mass air travel like a python.

The main characteristic of serfdom was that people were tied to the land. Serfs moved or traveled at the sufferance of their lords, who almost never granted it. Restrictions on personal mobility whether by car or plane are not quite so draconian, but they rhyme. You will travel the road to serfdom on public transport.

Right now these restrictions are but specks on the horizon. But that is no reason whatsoever to discount them. They are part of a broader agenda, and the mere existence of that agenda and the conviction–and power–of those who advance it makes these restrictions a very, very real possibility.

Whether you want to call them leftists, or progressives, or globalists, or transnational progressives, etc., the “elites” in and out of government (e.g., the WEF, people like Bill Gates or George Soros or Jeff Bezos or Larry Fink) are central planners at heart. They are like Adam Smith’s Men of System, who believe (a) they can arrange society, and people in society, like pieces on a chessboard, (b) only they are possessed of the special knowledge and intelligence to do that arranging, (c) their arrangements are completely rational, and crucially (d) you are too ignorant and/or stupid and/or selfish to know what is rational for society and that as a result you make irrational choices. So your choices MUST be sharply constrained, if not taken away altogether.

For your own good, you know.

Note: most of these people admire China.

It’s all about control, in other words. And if you have been paying attention–hell, if you’ve been sentient–for the past two years you will realize that the push to control you is omnipresent. COVID–or more exactly, the responses to COVID–should give you all the evidence that you need. Most policies, whether it be lockdowns, or masks, or mandated “vaccinations” of dubious efficacy and largely unknown risk profiles, or vaccine passports, and on and on and on, make little if any sense as health measures: at the very least they are not backed by evidence that even remotely matches the fervor with which they are imposed and advocated.

But they do make perfect sense if you conjecture that the real objective is to expand and cement the control of the “elites” over vast swathes of your life. Everything in the last two years has been about depriving you of choice, and giving control of your life to bureaucrats and politicians and the plutocrats who exercise undue influence over them.

That is why these emerging threats to your personal mobility, and the autonomy that provides, need to be taken deadly seriously. They are just one piece of a far broader assault on liberty and autonomy, and a campaign intended to make you just another brick in the wall.

December 9, 2021

Die for Donbas?–Demented

Vladimir Putin’s Russia has massed large forces on the border of Ukraine, and there are widespread fears that he is planning an invasion. This has led to calls from many in the United States (and to a lesser degree in nations that are actually closer to Ukraine) to deploy military forces–read, American military forces–to Ukraine, and to contest any Russian invasion if it comes to that.

This call to die for Donbas is demented.

It is useful to deconstruct the dementia by breaking the problem into two pieces: (1) whether defending Ukraine is in the strategic interest of the United States, and (2) what would be the costs of of doing so?

The red line that is apparently motivating Putin is the possibility that Ukraine will be admitted to NATO. Put aside whether a Ukraine in NATO would objectively pose a strategic threat to Russia, or whether this is a Putin phobia or part of Putin’s romantic desire to gather Russian lands and reunite brothers divided by a perfidious West. What matters is that he, and most of the Russian establishment (especially the security establishment) believes it. Putin has said repeatedly that it is a red line. We have to accept this as a fact.

If keeping Ukraine out of NATO is a strategic imperative for Putin, is putting Ukraine in NATO a strategic imperative for the United States?

Absolutely not. NATO’s mission from its founding was to keep Russia out of Western Europe. It succeeded. Adding Ukraine to NATO will not advance that objective.

So adding Ukraine would represent mission creep: redefining the part of the world that we want to keep Russia out of. Is it desirable that Ukraine remain independent? Probably, but mainly for Ukrainians. But it’s hardly a major strategic interest of the United States. How would American security decline if Ukraine was in Russia, or in Russian orbit? Hardly a whit.

So the stakes for Russia are high and the stakes for the United States are minuscule. It is never advisable to enter into a contest with such an imbalance of stakes.

And as I’ve written before, expanding NATO by adding countries that increase the alliance’s obligations without increasing its capabilities is idiocy. Indeed, it’s worse than that. Adding countries like Ukraine degrades NATO’s capabilities. As I’ve also written before, it is crippled by the need for unanimous decision making: adding members with divergent interests and concerns only magnifies the difficulties of achieving coherent action. It is inimical to the unity of command (something Russia possesses, by the way, and NATO already does not). Moreover, as (yet again) I’ve written before, adding countries that are unduly prone to Russian influence is a particularly stupid way to strengthen an alliance against Russia. (Hell, Putin might want to rethink his opposition to Ukraine in NATO just for that reason. I’m reminded of a story–the source of which I can’t trace so this is based on memory–that Napoleon actually rejoiced at the news that another country had joined a coalition against him, precisely because he knew this would undermine its unity of action.)

It is said about Mexico “so close to the United States, so far from God.” Well, it can be said about Ukraine “so close to Russia, so far from God.” It’s a tragic fate. But addressing that tragedy (which is only one of many tragedies around the world) does not advance American interests.

In addition to being far from God, unlike Mexico Ukraine is also very far from the United States. Which brings us to the second issue: the cost of defending Ukraine, even if it were deemed to be a potentially desirable object of American policy.

Soviet military strategists spoke of the “correlation of forces.” The correlation of forces is decisively on the side of Russia with respect to Ukraine.

Distance is of course a major factor. Ukraine is on Russia’s doorstep. It is thousands of miles and oceans away from the United States, and is even distant from deployable NATO forces in Western Europe. If Russia decided to move tomorrow, the invasion would be over before NATO could do a damn thing about it. And if NATO were somehow able to deploy forces before Russia moved in (which generously assumes that Putin would stand idly by to let such a deployment occur rather than using it as a pretext to launch an invasion) it would be operating at the far end of a very long and vulnerable logistical tail, whereas Russia would be operating with a short and relatively invulnerable one. This makes about as much sense as Custer charging into a huge Sioux and Cheyenne camp on the Little Big Horn, and would probably have a similar result: though Custer could be excused because of his ignorance about just how large the forces he was facing were, whereas NATO commanders could have no such excuse.

The choice would therefore be between abject defeat and a huge escalation that creates the potential for unimaginably horrible consequences.

And for what? (See above re the negligible stakes for the US and NATO.)

I should also note that the United States has a doleful record when it comes to attempting to defend and prop up dysfunctional and corrupt nations–and make no mistake, Ukraine is a Sovok sewer of corruption. Vietnam. Iraq. Afghanistan. In each case, vast amounts of American treasure and huge numbers of American lives were expended in the futile hope of creating functioning states out of dysfunctional ones. And the dysfunctions made the mission impossible, and moreover deeply damaged and corrupted the American military (cf. the Afghanistan Papers).

Uber realist Bismarck memorably said that the Balkans were “not worth the healthy bones of a single Pomeranian grenadier.” America needs to be uber realistic, and recognize that not only is Ukraine not worth the healthy bones of a single Texan Marine, it would cost many, many such skeletons.

This is a time when it is imperative to take a tragic view of history. Too often in the 100+ years the United States has taken a missionary, progressive, romantic, and idealistic view instead. It has always worked out horribly.

Can we finally learn our lesson?

A couple of political notes. First, there is a report today that the Biden administration is advising Ukraine to concede extensive Russian control over the Donbas. In light of the above, that is wise. But can you imagine the hue and cry if Trump had said that. Perhaps we are lucky Trump is not president–he would have been under much greater political pressure to intervene in Ukraine than Biden will be.

Relatedly, the call to defend Ukraine with Americans is an illustration of the Russia mania that has beset the American political “elite” in the past 5 years. It truly is a mental illness.

Second, it is no coincidence comrade, that the crisis is coming to a head when Nordstream II is ready for operations and Europe is desperate for energy. The former potentially allows Russia to have its Ukrainian cake and its gas revenues too. The latter makes the EU (aka the Fourth Reich) acutely vulnerable to Russia and therefore far less likely to intervene in any way–including sanctions, for that matter. (This also means that the US could not depend on Germany and other NATO nations for meaningful military support, even assuming that the Broomstick Brigades of the Bundeswehr have any to offer.)

For this the blame lays squarely on perfidious Germany and on Angela Merkel in particular. And ironically, exactly what Trump warned them about, and which Merkel and the rest of the European establishment dismissed haughtily, is coming to pass.

December 4, 2021

Fuck (Normal, Politicized, Faucist) “Science®”

One of the most disgusting tropes in the ongoing (and ongoing and ongoing and ongoing) controversy over COVID policy is the resort to ritual incantations of “science.” This is epitomized by Fauci’s recent declaration that “le science c’est moi.” If you disagree with him, you are anti-science, because he represents science.

This is a logical fallacy (appeal to authority) squared: you can’t challenge Fauci’s authority because he is cloaked in the authority of science. Fauci rivals Louis XIV in his grandiosity.

The science fetishists should read about the sociology of science, and in particular Thomas Kuhn’s The Structure of Scientific Revolutions. It is a dense work that makes many penetrating observations, but the crucial concept he identifies is “normal science.” That is, he emphasizes the institutional context of science, and the incentives facing those who identify as scientists, and are widely recognized as such.

The basic idea is that in the aftermath of scientific revolutions, a “paradigm” emerges that represents the conventional wisdom, and that most scientists are working within that paradigm. Moreover, they are heavily invested in it and would suffer a massive loss in their human capital if that paradigm were to be displaced. Thus, even as contradictory evidence accumulates, the science community resists. It does not act as the scientific methodology dictates, that is, by rejecting or revising theories that fail empirical test. Instead, the community attacks the apostates and repeatedly appeals to its authority to thwart attacks on the ruling paradigm even as contrary evidence accumulates. It doubles down on the paradigm whenever contrary evidence emerges.

This is why most scientific revolutions come from rank outsiders. People who are not invested in, and protected by the existing system. People who have little to lose by pointing out that emperor has no clothes.

My favorite example of this is ulcers. An obscure Australian doctor hypothesized that a common bacteria caused ulcers. The response of the scientific community–and the pharmaceutical industry that profited greatly from ulcer medications–was furious. He was ridiculed and marginalized. But eventually, in a triumph of true science, his hypothesis was confirmed by the data, and the normal science hypothesis was displaced.

Thus, rather than genuflecting to the scientific community (which arrogantly identifies itself with Science), one should always treat it with skepticism. Indeed, the more strident the insistence that someone or some group represents Science the more skeptical you should be. Their stridence reveals that they are afraid, very afraid, that their paradigm is under credible assault.

True scientists are open minded. Normal scientists are close minded. Arrogant defensiveness is symptomatic of normal science under credible threat. A reasonable inference to be drawn from haughty invocations of Science in response to questions is that the science is indeed questionable.

The Kuhnian institutional/sociological forces that warp scientific inquiry are made far, far worse when a scientific issue intersects politics. This is especially true given the gargantuan role of government funding of science: the guardians of the paradigm control who gets the grants. And this is especially especially true when there are strong commercial incentives for supporting the paradigm–such as medications that are justified by the paradigm.

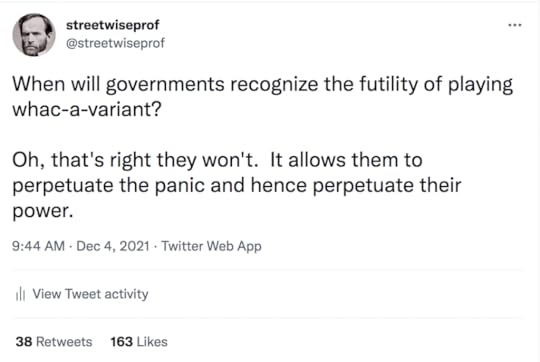

All of these factors are at work in COVID. The illness has been hijacked by governments and shadow governments to justify imposition of measures that deprive billions of people basic liberties and to extend the power of those governments far beyond what would have been imaginable even two years ago:

Sadly, it has come to the point where invocations of Science are the hallmark of charlatans and governments and shadow governments that want to control you. This is especially true with respect to COVID “vaccines.” (I use quotation marks because what are being touted as vaccines are very different from traditional vaccines, a fact that is itself suggestive of propaganda and bait-and-switch tactics.).

As I have noted before, the externality argument for these medications is rejected even by government authorities that advocate widespread, and indeed mandatory, vaccination. Even putting that aside, I dare you to name any other medical treatment in the FDA era that would be approved, let alone allowed to remain on the market, in the face of such dubious evidence of efficacy and such widespread indications of serious–and fatal–side effects. (The best proof of the lack of efficacy is the recent official insistence on “boosters.”).

There is no evidence that trade-offs are being evaluated rigorously–scientifically. Indeed, any suggestion that this be done is furiously attacked by government “scientists” and their government funded apparatchiks. This is most glaringly obvious in the case of children. The vast bulk of scientific evidence shows that children and young adults are at little risk of serious illness from COVID, and are not major vectors of spread. So the benefit of vaccinating them is approximately zero. There are plausibly risks of vaccinating them–this is especially true of young adults.

But governments around the world are currently proceeding to force giving children and young adults these shots.

And if you object, on scientific grounds, you are assailed as being an anti-science know nothing.

Science has been perverted in the name of fighting COVID. Sadly, the outcome of this will not be to improve the reputation of science, or to discredit “normal” politicized science: it will be to undermine the authority of true science. Those who proclaim most arrogantly in the name of science–Anthony Fauci most notable among them–are in fact science’s greatest enemies.

November 26, 2021

Boris’ Big Short

Due to the immovable object of price caps and the irresistible force of spiking natural gas and power costs, about 20 retail energy suppliers in the UK have gone toes up. Most of these have been addressed using what is called the Supplier of Last Resort (SoLR) mechanism, whereby customers of the failed firm are transferred to another supplier. (SoL sounds about right!) This mechanism effectively socializes losses:

Energy suppliers that rescue customers via the supplier of last resort can recoup their costs through an industry levy that is funded by bills.

Could bills go up?

When we appoint a new supplier using the Supplier of Last Resort process, we try to get the best possible deal for customers.

Suppliers we appoint will likely put you on a special ‘deemed’ contract when they take on your supply. This means a contract you haven’t chosen. A deemed contract could cost more than your old tariff, so your bills could go up. However, they are covered by the energy price cap Ofgem sets, which ensures you get a fair price if you are put on one.

When contacted by the new supplier, it’s best to ask to be put on their cheapest tariff or shop around if you want to. You won’t be charged exit fees. This is a challenging time in the market and we know that there may not be many tariffs available when shopping around right now.

Deemed contracts can cost more because the supplier takes on more risk. For example, they might have to buy extra wholesale energy at short notice for new customers. So they charge more to cover these costs.

Up to last week, all the failures had been dealt with using this mechanism. But the failure of Bulb (Dim Bulb?) was evidently too big for Ofgem to deal with using the SoL mechanism. Instead, it resorted to a “Special Administration Regime” which basically nationalizes Bulb. This regime permits the government to “make grants and loans to the company in administration and may also give guarantees for any sum borrowed while it is in administration.”

That is, SAR is essentially a bailout/nationalization of losses and risk.

Ofgem notes:

The energy price cap, which sets a maximum price for customers on standard default tariffs, will remain in place to protect millions of people from the sudden increases in global gas prices.

(Aside: It is impossible to protect millions of people from the sudden increase in global gas prices. It is only possible to determine–based on political mechanisms–which millions pay and how much. So this statement is typical government bullshit.)

Thus, given the price cap and the fact that Bulb is now owned by the UK government, Boris now has a big short position in natural gas. So how is he going to manage it?

I have heard that the government approached Vitol, which told them to fuck off. So . . . what next?

The company still has to procure energy at market prices and sell them at fixed prices. Since the government is now the residual claimant, it has a short exposure and can take this exposure on the balance sheet, as it were, and essentially run a naked short.

Or it can try to hedge by buying gas forward. But this is not a trivial problem. This is not a position of fixed size that faces only price risk that could be hedged using fixed quantities of swaps/forwards/futures. There is volumetric risk as well: cold weather increases both the price of gas and the amount of gas that must be supplied. A sophisticated hedge would involve both forward fixed price purchases and weather derivatives. Or through the purchase of a sophisticated structured product that has payoffs that depend on both volumetric and price variables.

I’m guessing that the government is not into sophistication, or frankly, capable of it. As a result, it is likely to be at a severe disadvantage in negotiating a price on a structured product or weather derivatives or long dated forwards.

It is also likely sweating out the hedger’s hindsight dilemma. If it doesn’t hedge and prices spike it will catch hell because of the large losses passed on to taxpayers. But if it hedges and prices don’t spike or in fact decline, it will catch hell too: you idiots overpaid!!!! Both of these judgments are based on hindsight, but even though hedging decisions should be evaluated ex ante on the basis of how they effect risk, inevitably they are evaluated ex post based on how they pan out.

Consider California in the aftermath of its 2000-2001 electricity crisis. It entered into long term contracts at what retrospectively was the height of the crisis, and thus paid higher prices than it would have had it procured on a short term basis. Of course, California attempted to recover by suing the contract sellers, claiming it was a nefarious manipulative scheme. Alas, it succeeded to some degree.

The best solution would be to do what clearinghouses do when a big member collapses–auction off the positions. This is what NYMEX did when the hedge fund Amaranth collapsed due to natural gas futures and swap losses in 2006: JP Morgan and Citadel assumed the positions in exchange for consideration. Similarly, when Lehman collapsed in 2008, the CME auctioned off its futures portfolio.

Even in these situations, however, there is always controversy about whether the price is right. Assertions that the buyers of Lehman’s futures positions received a windfall (i.e., bought on the cheap) led to litigation (filed by the Lehman bankruptcy trustee) and considerable controversy. (Here’s my take on the issue.)

Note that the factors mentioned above mean that the pricing in any putative auction of Bulb obligations is likely to be more discounted, and thus subject to more controversy, than the Lehman positions. As in the Lehman case, the positions will be auctioned in a stressed market. Moreover, as noted above, the exposures are far more complex and difficult to manage than Lehman’s rather vanilla (though large) futures positions. That complexity will bring a discount. Furthermore, apropos California circa 2001, the bidders realize that they are subject to government attempts to clawback any gains that result ex post due to favorable fundamentals (e.g., an unexpectedly warm winter). That is, the bidders may fear that the government will actually acquire a long option position, and hence they will be short an option: if prices spike, the auction “winner” will bear the brunt, but if they don’t the government will claim that it was exploited and over payed.

That is, unless the government can credibly commit to adhering scrupulously to the results of the auction, the auction may well fail to attract any bidders.

NB: credible commitment is not one of most modern governments’ strong suits. (This is likely one of the reasons Vitol told the government to bugger off. It realized that it was assuming a totally skewed position–heads they lose, tails they don’t win.).

According to the FT article linked above (amazingly factual and informative for a current day FT article, BTW) the government rejected two offers to assume the Bulb portfolio. I surmise that the bids were discounted heavily to reflect the factors mentioned above and Ofgem accordingly rejected them.

So I’m guessing the government will wear the risk. Perhaps it will try to manage it–and do it badly. Or more likely it will just let it ride. Maybe it will bet on Covid, thinking that the new variant or the new variant after that or the new variant after that will cause governments (stupidly) to lockdown again and crater economic activity and hence gas demand.

I note that Bulb might not be the end of the story. As noted above, the price caps remain in force, meaning that other suppliers may fail in the future–including those that have already gone through the SoL process. The government would be the ones SoL then. That is, the government not only has the Bulb liability–it has a big contingent liability that could dwarf Bulb.

Ofgem has already hinted at this:

In a letter to Kwarteng justifying the decision to pursue a special administration for Bulb, published on Wednesday, Ofgem’s chief executive Jonathan Brearley said the supplier of last resort mechanism was already “under considerable” strain from managing the failure of 20-plus other energy companies in recent months.

So Boris’s already big short could get bigger.

And perversely, it could influence government policy on COVID. Doing something (like lockdowns) that would crush energy demand would benefit its short energy position (existing and contingent). Talk about moral hazard.

Good luck with that Boris! Or should I say, good luck with that, Limeys?

November 21, 2021

The Rittenhouse Rorschach Test

The Kyle Rittenhouse trial has ended as it should, with his acquittal on all charges. Any fair viewer of the evidence would reach the same conclusion as the jury, namely, that Rittenhouse shot, and shot and killed, in self-defense.

That is an encouraging outcome, but it must be said that the case did not begin as it should have: it never should have begun at all. The prosecutors were in possession of all this evidence, and indeed (outrageously) in possession of other exculpatory evidence that they concealed from the defense. Absent the hyper-political atmosphere that prevailed after the August 2020 riots in Kenosha during which Rittenhouse shot three people, a fair-minded prosecutor would not have brought charges at all.

That’s the way I see it. It is obvious, however, that many do not see it that way. Like some modern Dreyfus case, Rittenhouse’s has proved a political Rorschach Test: for every person like me that sees it my way, there is another (perhaps more than one, alas) that sees it completely differently. Instead of an unjust prosecution resulting in a just verdict, these people see this as a righteous prosecution resulting in a travesty of justice. Indeed, a travesty of justice that demonstrates that white supremacy indeed reigns supreme in America, and that white supremacist vigilantes can kill with impunity.

Watch any establishment media coverage, and you will see the Supremacist Narrative on display virtually 24/7. I could provide literally hundreds of examples, but this is sadly representative:

"White supremacists roam the halls of Congress freely and celebrate this little murderous white supremacist, and the fact that he gets to walk the streets freely," said Tiffany Cross. "What are we to make of that?" @mediaite https://t.co/p92EgNULQv pic.twitter.com/pd58XPnI4V

— Caleb Howe (@CalebHowe) November 20, 2021

Needless to say, I find this utterly delusional–and mendacious. Virtually the entire narrative was built on lies–and things proven to be lies at the trial. Or more pointedly–things that were demonstrable lies before the trial, but which the establishment media repeated ad nauseum–and continues to repeat, verdict notwithstanding. The basic case for Rittenhouse’s alleged white supremacism–a slander repeated by Biden while a candidate in 2020–appears to be that he was white, and shot people at a (mostly peaceful?) “protest” of a police shooting of a black man. He shot three honkeys–kind of weird for a white supremacist, no? Never once has the establishment media presented direct evidence of white supremacist beliefs: no emails, texts, TikToks, tweets, Facebook posts, etc., etc., etc. They have made the weakest circumstantial argument ever to accuse Rittenhouse of being another Dylann Roof. Yet they believe (or at least assert) that their beyond flimsy circumstantial case is God’s truth.

The slander reached its heights when Rittenhouse took the stand (quite courageously, and against the near universal judgment of legal pundits) and broke down in tears. Oh, but those were “white tears” dontcha know according to scumbags like LeBron James and Joy Reid. A manipulative dog whistle that rallied all the defenders of the white race to the defense of one of their legion.

Apparently an 18 year old Olivier has been born. And one canny enough to know how to call forth the white phalanx to save him from the consequences of his actions.

It is disgusting and incredibly divisive that this trial was turned into racial issue. Indeed, it is disgusting precisely because it is so divisive–and because the racial narrative has absolutely nothing to do with the facts.

Many commentators have said that Rittenhouse should not have been there in the first place. From a legal perspective, that matters not a whit. Given that he was there, did he act in self-defense? is the only legal issue, and the one that the jury settled in the affirmative.

My take is that Rittenhouse was extremely naive, and was in Kenosha for reasons that he considered noble and idealistic. Funny, isn’t it, that leftist teens (or somewhat older young people) who act out of self-identified noble reasons with bad consequences are lionized (e.g., Rachel Corrie), but a conservative kid is demonized? Simply because his idea of a noble cause is an anathema to the left.

There’s also the question of whether the people he shot, or shot at (namely, the “jump kick man”), should have been there. Let’s put aside the quite real possibility that Rosenbaum, Huber, Grosskreutz, and Jump Kick Man should have all been in jail or a mental institution, rather than on the streets of Kenosha. Let’s just ask whether since they were at liberty they should have been there wreaking havoc? They were not engaged in anything remotely resembling peaceful protest. They found a place where they could wrap their antisocial pathologies in a gauze of social righteousness–something that the establishment media was fully complicit in.

The left believes its violence is speech, and your speech is violence. But that’s depraved: those who died by violent means were engaged in violence that was not Constitutionally protected speech, regardless of what you think about the Blake shooting. Their psychopathic and sociopathic behavior was encouraged by and validated by the establishment media, making them accessories. In contrast, Kyle Rittenhouse was behaving far more responsibly prior to the confrontation with the child rapist Rosenbaum than Rosenbaum was.

In other words, no riot, no Rittenhouse. So if you want to push back the causal chain to before Rosenbaum started to chase Rittenhouse, push it back to the riots, not to the time that Kyle Rittenhouse perhaps quixotically decided to protect Kenosha from the rioters.

Which brings us to who should have been there, but were not. The civil authorities were completely AWOL: they should have been there but they utterly failed in their duties. In particular, the mayor of Kenosha and the governor of Wisconsin consciously declined to take the measures necessary and sufficient to maintain civil order in Kenosha. They decided–like the “leaders” of many cities in the United States in the summer of 2020 (e.g., Portland, Chicago, Minneapolis, Seattle, and on and on and on)–to capitulate to mob rule. Because social justice. Or something.

If there is blood on anyone’s hands, it is on theirs, first and foremost, if you follow the chain of causation to its logical origin.

I know the foregoing makes the left apoplectic. And perhaps that’s the one solace of this whole sorry, depressing affair. The trial has proved to be the most reliable IFF (identify friend or foe) system I have ever seen. You know whether someone is your friend or foe based on the response to the trial and the verdict: and yes, that goes both left to right and right to left. No bogeys here. Only bandits and friendlies, and you know which is which with certainty. That’s quite useful information to have.

Sisyphus Does Energy Policy

For well over twenty years in my various energy pricing and policy classes I have pointed out that every energy price spike leads to accusations of manipulation and gouging and a call for an FTC investigation . . . which is always announced with great fanfare but never finds anything–something that is announced sotto voce, if announced at all.

And lo and behold, right on cue, due to the rise in energy prices in recent months Biden (or more likely, Howdy Joe’s ventriloquists) has asked the FTC to investigate rising gasoline prices:

President Biden called on the Federal Trade Commission to investigate whether oil-and-gas companies are participating in illegal conduct aimed at keeping gasoline prices high, in the latest effort by the White House to respond to public concerns about costs for everything from fuel to groceries.

Sisyphus would understand the drill. “Time to roll the price gouging rock up the hill again.”

And for the most idiotic, demented hot take, let’s turn to Lizzie Warren, speaking on Joy Reid’s show (talk about a singularity of stupid*):

Prices at the pump have gone up. Why? Because giant oil companies like @Chevron and @ExxonMobil enjoy doubling their profits. This isn't about inflation. This is about price gouging for these guys & we need to call them out. pic.twitter.com/kxiQkC2tYa

— Elizabeth Warren (@SenWarren) November 20, 2021

Recall, this is about a change in prices. So if the change in prices is due to gouging by oil companies, it would have to be due a change in gouging behavior. (I think even Joy and Lizzie should be able to follow this, it’s so basic: but maybe I’m too generous.)

But let’s follow that thread. It would imply that until recently, oil companies were not exploiting the opportunity to “double their profits” by price gouging.

So what happened? Did one day a few months ago the CEO’s of Chevron and ExxonMobil et al have a V8 moment, and slap themselves on the forehead and say “Wow! I could have doubled my profits by jacking up prices!”

So if they could screw consumers at a whim by jacking up prices why did they let oil prices go to single digits in 2020? Why does the urge to gouge seem to wax and wane?

This is so incandescently stupid. But I guess I should consider the sources, and remember that this sort of incandescent stupidity spikes every time oil prices do.

If the FTC exhibits the integrity it has in the past, this investigation will end the way all the others have, with a whisper not a bang, stating that fundamentals are the driver. But there is no guarantee that the current FTC will indeed exhibit such integrity, given how degraded government institutions have become (not that they were ever paragons, but everything is relative). Political imperatives and narratives, not realities, rule the day.

* Lizzie was dean of Harvard Law School, and a professor of law there. Joy Reid went to Harvard. God save us from Harvard.

November 15, 2021

And . . . We’re Back

Pardon the interruption. As several loyal readers informed me yesterday morning, the site was inaccessible due to a “bandwidth limit exceeded” error. Apparently, SWP was subject to a DDS attack that commenced shortly after I posted a crypto-skeptical piece. Go figure. I guess I got some crypto weirdos bent out of shape. Or maybe it was the deep state  whom I also fingered.

whom I also fingered.

You can tell a lot about a person from his/her enemies.

Regardless, in a way “bandwidth limit exceeded” is accurate in other ways. I am hip deep in testifying at a trial and have other deadlines looming, so my bandwidth is definitely challenged. I’ll post ASAP. Subjects of interest including a disturbing move to transform the United States Marine Corps into the United States Woke Corps, and the utter insanity of the Rittenhouse prosecution.

Stay tuned and be well.

November 7, 2021

You Can’t Spell “Cryptocurrency” Without “Crypt”

The libertarian/anarchist roots of cryptocurrency, especially Bitcoin, are well known. The supposed allure is that crypto would allow individuals to transact without requiring on state issued fiat currencies (which are subject to various government controls and monitoring) or state-sanctioned financial institutions. Crypto is in theory anonymous, decentralized, and peer-to-peer, outside of the purview or control of the state. A way to Go Galt, virtually.

In the early days of crypto, which of course are not that long ago, I expressed extreme skepticism about that vision. It could be realized only if crypto remained unimportant and utilized by few: if it were ever to become close to realizing the vision on a broad scale, it would be a threat to governments and they would intervene to control it, neuter it, co-opt it, or destroy it.

There’s an irony here. If you believe the ideological argument for crypto–that it is justified as a means of escaping a tyrannical government-sanctioned and controlled financial system–you also have to understand that governments would not permit crypto to survive as the true believers desire it to.

And we are at that point. Crypto has flourished in the last several years. Not surprisingly, governments are moving to crack down on it.

China–again not surprisingly–was the first to attack crypto in a systematic way, implementing a blanket ban on crypto transactions. But other governments are not far behind, including the US.

Indeed, perhaps you didn’t know this, but the marvelous “infrastructure” bill just passed by the House includes a provision mandating reporting of crypto transactions. The language is unsurprisingly murky, but the intent is quite clear: to bring crypto into the view of the federal government’s Panopticon, especially its tax Panopticon.

In both China and the US the regulatory/legal attack is focused on intermediaries (e.g., exchanges, brokers) that facilitate transactions. In theory, true peer-to-peer transactions (e.g., transactions between anonymous wallets) can be used to circumvent this, but the very fact that intermediation has proved so integral to the operation of the crypto market (which is in itself a refutation of the anarchist vision, as I pointed out in a post about Ethereum creator Vitalik Buterin) demonstrates that the regulations will seriously compromise the ability of crypto to achieve that vision. Moreover, this is just a first step, but one which strongly indicates intent: if non-intermediated transactions flourish, governments will devise means to bring them to heel too.

There’s also something else to keep an eye on: central bank digital currency. It is no coincidence, comrades, that the first country to crack down on non-government crypto–China–is also in the lead in implementing–mandating, actually–a government digital currency.

Private crypto is a competitor to government digital money. Governments don’t like competition. So they do their best to destroy it. Furthermore, the Chinese government truly desires to create an actual Panopticon that permits monitoring, rewarding, and punishing all aspects of individual behavior. Government digital currency greatly advances that objective, and private digital currency impedes it. So to advance the former China destroys the latter.

Governments world wide have cognitive dissonance when it comes to cash. On the one hand, it provides a source of revenue–seigniorage. On the other hand, it provides a way to circumvent the tax system as a way of generating revenue–and of monitoring and controlling behavior. Government digital currency allows states to resolve that dilemma. They can have their revenue cake and eat your privacy too.

China is open and unapologetic about its social credit system and its view that government digital currency will allow it to extend and deepen the operation of that system. Other governments are not so blatant, but there have been discussions in the US and Europe and elsewhere about not just the adoption of central bank digital currency, but how that system could be used to compel desired behavior.

A retired Swiss banker friend once held up a 100 CHF note to me and said: “when I hold this, I feel free.” Well, that’s a feature to him, but a bug to governments. When you “hold” government digital currency, you will not be free. Its use can be monitored. It can be wiped out at the speed of light if you use it in a way that offends governments–or if you do other things that offend governments. Think that social credit can’t come to the US? If so, you are a trusting fool. Especially since government digital currency incredibly leverages the power of a social credit system.

In other words, government digital currency is a major step to the implementation of a dystopian Panopticon. Destroying, or at least severely hobbling, non-government digital currency is a crucial first step to the successful introduction of government digital currency. So this provision buried in the “infrastructure” bill, along with other strong signals from the Treasury, OCC, SEC, CFTC, and Congress of an intent to throttle private crypto should be viewed with alarm, and not just if you are a believer in the crypto dream.

There’s another thought that comes to mind, more speculative, but one that cannot be dismissed out of hand. Namely, that what we are seeing is a huge bait-and-switch. Bitcoin’s origins are incredibly murky. Its creation myth is an anarchist one–which makes it very appealing to those who value freedom and independence, and bridle at government coercion and control. What better way to identify and ensnare such people–who are an anathema to control-obsessed governments–than creating cryptocurrency with an anarchist creation story?

And even if governments did not create the bait, they certainly not above exploiting an emergent phenomenon (if that’s what crypto really is) to advance their anti-liberty agenda. Crypto has gained a cachet in large part because of its anti-authoritarian aura. Once attracted to crypto by this aura, people are much more vulnerable to being seduced into the use of government crypto, with the loss of freedom that implies.

The poem The Spider and the Fly comes to mind.

But although these speculations would have important implications if proven true, in many ways they are beside the point. The point is that governments are turning the screws on anarcho-crypto and moving to create fiat-crypto. These actions are complementary, and bring closer the day in which fiat-crypto will supplant the fiat currency you can hold in your hand. And when that day comes, freedom will be on its death bed, if not dead already.

Remember, you can’t spell “cryptocurrency” without “crypt.”

Craig Pirrong's Blog

- Craig Pirrong's profile

- 2 followers