Tyler Cowen's Blog, page 504

May 27, 2012

A China Video

Short video from blogger Sinostand of a bike ride in China with interesting material on religion, real estate bubbles and living standards.

Hat tip Walter Russell Mead’s blog via Daniel Lippman.

The culture that is Washington, D.C.

The article is here, or try this link, and it is scary. Here is perhaps the worst bit:

Aside from its wealth, the single defining feature of über-Washington is its youth. Most of the people who have moved to Washington since 2006 have been under 35; the region has the highest percentage of 25-to-34-year-olds in the U.S. “We’re a mecca for young people,” Fuller says. One recent arrival says word has gotten out to new graduates that Washington is where the work is. “It’s a place where a liberal-arts major can still get a job,” she says, “because you don’t need a particular skill.”

Every paragraph in the article is terrifying.

For the pointer I thank Chug.

A Power Vacuum is Killing the Eurozone

That is the title of my latest column, here is one excerpt:

We thus face the danger that the euro, the world’s No. 2 reserve currency, could implode. Such an event wouldn’t be just another depreciation or collapse of a currency peg; instead, it would mean that one of the world’s major economic units doesn’t work as currently constituted.

We are realizing just how much international economic order depends on the role of a dominant country — sometimes known as a hegemon — that sets clear rules and accepts some responsibility for the consequences. For historical reasons, Germany isn’t up to playing the role formerly held by Britain and, to some extent, still held today by the United States. (But when it comes to the euro zone, the United States is on the sidelines.)

THERE appears to be a power vacuum, and the implications are alarming. We may be entering a new world where international cooperative arrangements, in environmental areas as well as finance, are commonly recognized as impossible. If the core European nations cannot coordinate effectively, what can we expect in dealings with China, Russia and other countries that have less of a common background and understanding?

I consider this a big deal, even beyond its immediate macroeconomic ramifications, which of course are a big deal too.

There is a second, more technical point too:

…some of the banking systems in the periphery nations may be too broken for monetary policy to take hold. Imagine the European Central Bank trying to infuse new money and credit into Spain, while bank deposits move quickly to Germany, Switzerland and other safer places. Again, why would anyone want to keep money in the bank of a fiscally troubled nation? That loss of confidence will not be easily repaired.

At this point, probably euro-wide deposit insurance is needed before monetary policy can help in Greece or Spain (that wasn’t true two years ago). Yet creating a eurozone-guaranteed safe asset in those economies ultimately boils down to the eurobond idea, which of course the Germans are reluctant to do.

Here is a related Op-Ed from Mark Mazower, focusing on the theme of a collapse of European and international cooperation. Here is a good article on why plans for tighter political union in Europe will not easily work. There is talk the UK will cut off migrants if the euro collapses. Switzerland may introduce capital controls. What else? I do not see this turning out well.

May 26, 2012

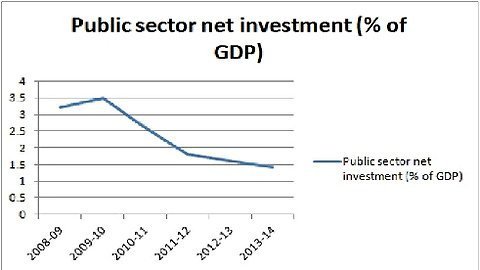

Falling public investment in the United Kingdom

Paul Krugman draws our attention to the following chart (via Portes):

Maybe that really is worrisome. Still, if I look at the longer run chart — which is on p.14 from this pdf — sorry it will not reproduce — I start thinking that the matter is more complex. After all, in the early 1970s the figure for public investment was well over thirty billion pounds, and it is mostly falling sharply except for the late 1980s and very early 1990s. In the year 2000 it ends up at around five billion pounds, about one sixth the initial level. Yet the 1970s were pretty awful times for Great Britain, with pretty awful economic policies.

Why is public sector investment falling so much over the longer term? Mostly it is the decline in the number of public corporations, a healthy development if you ask me. Check out Figure 2 on p.15 of the same paper, noting the difference between net and gross investment. You also will see that changes in local government have been more important than changes at the national level.

If you read this paper, which runs to 2000 or so, you will see that public investment in health services has been plummeting for a long time, well before Cameron or “austerity,” defense spending seems to be included in these figures, and a lot of transport is not included in these numbers at all. I am happy to take corrections if things are done differently now.

Now what is the recent decline in public investment due to? I do not know, and in part I am asking for your help. I really am willing to believe that the United Kingdom is not investing enough in its future, including in science and education, but we haven’t yet gotten to the bottom of this matter. How much of that decline in the first graph is simply due to defense spending cuts and a shifting composition of expenditure for the national health care service, as higher service bills crowd out investment? How much is driven by changes in the housing market? (Here is a good historical source on changes in public housing policy over the longer term.) How do the recent declines in public investment compare to the longer term trend? How much is driven by a change in the gross rather than the net?

By the way, to cite a separate but related debate, to the extent immediate health care expenditures are pushing out health care investment, should that really count as “austerity”? I don’t think so, however mistaken such a policy may be, and thus I don’t see why “net public investment” is the proper metric for the short-run stance of fiscal policy (for that matter the “gross” figure may be more appropriate for short-run macro).

Inquiring minds wish to know. I hope that inquiring British minds wish to know too, or better yet already do know. I will gladly reproduce the best of what we learn from the comments.

Addendum: Here is a published data series. I am not sure I understand the notation, but my initial reading seems to suggest that current data are not out of line with the longer-term trend, including under Labour.

Assorted links

2. Are CEOs who served in the military more trustworthy?

4. Prologue to the new Taleb book (pdf).

5. On the imperfections of Dietrich Fischer-Dieskau.

Which are the undervalued countries these days?

With the eurozone falling apart, and growth in China, India, and Brazil slowing down, which countries remain undervalued? I have a few — and I stress that word few — selections:

1. Philippines. Their rate of growth has been picking up as of late, they have plenty of “low hanging fruit,” they don’t rely too heavily on durable goods exports to the wealthier countries (that’s the bad news too, of course), and sooner or later they are due for a burst of investor attention. I don’t wish to oversell this one, but we are talking “undervalued” here, not “the next Singapore.” One danger is 14.9% of their exports going to China, another is bad institutions. Still, articles about this country use the phrase “bucking global trends.”

2. Pakistan. Most of all, the bad news here is already on the table. As far as the economic data, here is a quick review of where they are at. I’m not claiming it is impressive. Still, all they need is a bit of peace and order to prosper more, and while I am not predicting that in an absolute sense, it is mostly uncorrelated with the economic performances of the wealthier countries. Think of the country as a kind of risk-free asset, in the covariance sense that is. Keep in mind that until the late 1980s they usually had higher rates of economic growth than India did. They stand a good chance of playing catch-up, especially if they are willing to accept a subordinate place in India’s economic orbit. Which right now they are not, but arguably that is the future trend, and indeed Bangladesh has made exactly that leap in terms of economic self-image.

3. Mexico. I’ll be writing on this more elsewhere, so I’ll save up my arguments for now. One point is that China’s slowdown, and the relative economic stability of the U.S., both augur well for the Mexican economy.

4. Gujarat. Just pretend it is a country, after all it has more than fifty million people. They have averaged more than 10 percent growth for the last seven years.

You can make a case for Ghana and Rwanda as well, mostly because of their satisfactory record in agricultural productivity. Most other places are due for a fall.

Addendum: Via Michael Clemens, here is a related article. I view Turkey and Poland as “capitalized,” however.

“Getting a good meal in D.C. requires some ruthless economics”

This piece is by me, in The Washington Post. Here is one bit:

The key is to hit these restaurants in the “sweet spot” of their cycle of rise and fall. At any point in time Washington probably has five to 10 excellent restaurants; they just don’t last very long at their highest levels of quality.

Here’s how it works. A new chef opens a place or a well-known chef comes to town and starts up a branch. Good reviews are essential to get the place off the ground, and so they pull out all stops to make the opening three months, or six months, special. And it works. In today’s world of food blogs, Twitter and texting, the word gets out quickly.

…Through information technology, we have speeded up the cycle of the rise and fall of a restaurant. Once these places become popular, their obsession with quality slacks off. They become socializing scenes, the bars fill up with beautiful women (which attracts male diners uncritically), and they become established as business and power broker spots. Their audiences become automatic. The transients of Washington hear about where their friends are going, but they are less likely to know about the hidden gem patronized by the guy who has been hanging around for 23 years, and that in turn means those gems are less likely to exist in the first place.

In economic terms, think of this as a quest for the thick market externalities. Search and monitoring are most intense in the early stages of a restaurant’s life, and so that is the best time to go. There is an analogy in music: Bob Dylan and Chuck Berry do not always give the very best concerts, because they do not have to. You may or may not like up-and-coming bands, but at least they will be trying very hard.

The full article is here.

May 25, 2012

Caveat emptor black markets in everything

Nonetheless this story, from the BBC, caught my eye:

South Korea says it will increase customs inspections targeting capsules containing powdered human flesh.

The Korea Customs Service said it had found almost 17,500 of the capsules being smuggled into the country from China since August 2011.

The powdered flesh, which officials said came from dead babies and foetuses, is reportedly thought by some to cure disease and boost stamina.

But officials said the capsules were full of bacteria and a health risk.

Here is more.

Assorted links

1. What word use tells us about blogger personality types.

2. David Leonhardt reviews the new Michael Lind book.

3. Survivorship bias in art price indices.

4. Arnold Kling reviews Edward Conard.

5. Haiti photo show, and Harvard’s quest for an economic historian.

Rand Paul Wants to Bring European Medicine to the United States

From a Rand Paul press release:

Today the U.S. Senate voted to pass the Food and Drug Administration Safety and Innovation Act (S.3187), which included language inserted by Sen. Rand Paul. This language would force the FDA to accept data from clinical investigations conducted outside the United States, including the European Union, to speed the process of getting life-saving drugs on the market by the FDA.

“Innovation in clinical drug trials should not be confined to the data received from trials in the United States. Findings from countries that incorporate the same rigorous requirements as we do when developing life-saving drugs and devices should be accepted by the FDA as well,” Sen. Paul said.

I agree but I would go further: Any drug or medical device introduced into say the EU, Japan, Canada or Australia ought to be automatically approved in the United States within 90 days. Such a procedure would reduce delay, eliminate needless duplication and cut costs.

Think about it this way: Europeans don’t regard the FDA as the best or final arbiter of safety and efficacy so why should we?

See FDAReview.org, especially the section on reform options, for more.

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers