Tyler Cowen's Blog, page 503

May 29, 2012

“Childhood and child labour in the British industrial revolution”

Here is a new and important paper by Jane Humphries (pdf):

Quantitative and qualitative analysis of a large number of autobiographies by working men who lived through the industrial revolution has demonstrated that there was an upsurge in child labour in the late eighteenth and early nineteenth centuries with children’s work entrenched in traditional sectors as well as spreading in newly mechanized factories and workshops. I have interpreted this rise in terms of the appearance of a new equilibrium in the early industrial economy with more and younger children at work. The new equilibrium, in turn, was related to a number of co-incidental developments including: an increase in the relative productivity of children as a result of mechanization, new divisions of labour, and changes in the organization of work; the dynamics of competitive dependence linking labour market and families; high dependency ratios within families; stumbling male wages and pockets of poverty; family instability; and breadwinner frailty. The establishment of these links forges a new synchronization between revised views of the industrial revolution and a revisionist history of child labour.

The original pointer comes from the now back-up-and-running New Economist blog.

*The Oil Curse*

The author is Michael L. Ross and the subtitle is How Petroleum Wealth Shapes the Development of Nations. It is an excellent book, here is the bottom line:

Most social scientists trace the oil curse to the governments of petroleum-producing states…This book, though, shows that the events of the 1970s, especially nationalization, made the problems of the oil states a lot worse.

Recommended, here is the book’s home page.

Maybe a Walmart near your home isn’t so bad after all

From Devin G. Pope and Jaren C. Pope:

Walmart often faces strong local opposition when trying to build a new store. Opponents often claim that Walmart lowers nearby housing prices. In this study we use over one million housing transactions located near 159 Walmarts that opened between 2000 and 2006 to test if the opening of a Walmart does indeed lower housing prices. Using a difference-in-differences specification, our estimates suggest that a new Walmart store actually increases housing prices by between 2 and 3 percent for houses located within 0.5 miles of the store and by 1 to 2 percent for houses located between 0.5 and 1 mile.

Does anyone know of an ungated copy of the paper?

Santiago de Compostela bleg

I will be there in a bit, suggestions are welcome.

May 28, 2012

What views can you hold about Spain?

Choose A or B:

A: Spain is in a recession, which will end. For instance, this story reports: “The OECD on Tuesday predicted more pain for Spain over the next two years when the economy will remain mired in recession with a quarter of the population out of work.”

B: Spain is in a self-cannibalizing downward spiral, as Greece was and is. It will not end until there is, at the bottom, an absolute and total crash.

I choose B, noting that I wrote most of this post a few days ago and already A does not appear to be a serious answer. You add up the required deleveraging, the provincial debts, the shaky state of the banks, the shaky accounting at the banks, the productivity problems, the European-wide political uncertainty, self-defeating fiscal adjustments, the broken real estate lending technology, once-again spiraling yields, broader deflationary pressures, unsatisfactory ngdp performance, the drying up of credit for small and mid-size businesses, disappearance of quality collateral, and the de-europeanisation of the capital markets, and you have B. Oops, I forget to mention the massive proliferation of have-to-pay-them-back-first governmental senior debt claims; why wait in that line?

The fact that you are not used to seeing the credit institutions of an advanced economy unravel before your eyes — “going entropic” — should not blind you to this reality. Nothing new bad has to happen for Spain simply to go “pop,” rather the ticking of the clock will suffice.

Note that a sufficiently large bailout plan, starting with debt forgiveness and reflation, could convert B to A, but right now we are in B.

If you chose A, you think life will be (relatively) easy. I have spoken with numerous intelligent Europeans who believe in A, but because — in my view — they cannot grasp the terribleness of the alternatives, or the magnitude of the error of their previous attachment to the euro, not because they have strong macroeconomic arguments for pending recovery and capital market survival.

If you chose B, there are three more options:

B1: It is a political economy problem. If the Spanish could simply institute the right policies, whatever that might mean, they could convert the destructive spiral into a mere recession.

B2: It is fundamentally a problem of aggregate demand and credit contraction. Without a European-level major bailout and stimulus, Spain will go splat. Yet sufficient stimulus could bring Spain back to its PPF frontier relatively easily.

B3: There is a major problem of aggregate demand and credit contraction, and a political economy problem, and this is paired with multiple equilibria. Investors are judging whether Spain is still a major European economic force, as they had thought for a while, but perhaps had not thought back in 1963. The equilibrium which obtains will depend upon the Spanish response to the crisis, but the best bet is to expect Spain to revert to something, in economic terms, resembling 1999 + Facebook. The institutional quality and level of trust in Spain will receive a semi-permanent downgrade, most of all in the eyes of Spaniards, and it will look very much like an output gap but will not be remediable through traditional macro remedies.

The real euro pessimists are the multiple equilibria people.

Germany and Austria also have multiple equilibria, but those equilibria are not so far apart. For Greece the multiple equilibria are extreme — “Balkans nation,” or “European nation”? Or should I say were extreme?; probably we are down to one of those options at this point.

For Spain, if a truly major bailout does not arrive, the roller coaster ride down will be extreme and terrifying. But still, we must put this in perspective. I was in Spain in 1999 and it was very nice, the large fiction sections of the bookstores most of all, the Basque restaurants too.

I am arriving in Madrid as you read this, perhaps I will have more to say.

Assorted links

1. The global trade in meteorites.

2. Offshoring pregnancy and birth to India, and helping workers relocate.

3. The chess player who outsmarted JPMorgan.

4. What happens when a company tries truly transparent pricing? It is an interesting link.

5. 25 (!) “Propuestas” by XSiM, how to fix the Spanish crisis, in Spanish, how many of the twenty-five do they need? Consider this one: “19. Meritocracia.“

Bankruptcy tourism

A solicitor in Leicester has helped Irish clients escape more than €1bn (£798m) of debt by taking advantage of a booming trade in “bankruptcy tourism”.

Data seen by the Guardian reveal Steve Thatcher, who runs the new advisory service www.irishbankruptcyuk.com boasts at least 55 clients in the process of clearing some €1.2bn by using UK courts to wipe out loans taken out in the republic. One property speculator wrote off €150m during a 35-second court appearance.

While bankrupts in the UK face only one year in financial purdah, in Ireland it is 12 years – despite promises of reform from the Dublin government.

Such is the stigma still associated with bankruptcy in Ireland that “Michael” and “Mary” are unwilling to give their real names after they used the UK courts to write off nearly €320,000 of negative equity and other debts. They fear that in Ireland they could be blacklisted from jobs if potential employers knew they were bankrupts.

Here is more, and for the link I thank Philip Hegarty.

The blue bond/red bond proposal

The model by Mr. Delpla and Mr. von Weizsäcker , for instance, would let countries put some of their debt — equal to no more than 60 percent of gross domestic product — into so-called blue bonds issued by all members. These would presumably carry a very low interest rate.

The rest — the red bonds — would remain the responsibility of individual countries and would probably carry much higher interest rates.

Countries would need approval from a central committee to issue blue bonds, and could do it only if they followed responsible economic and budgetary policies. Germany would effectively have veto power.

“If you behave well, you have access to blue debt,” Mr. Delpla said. “If you start to behave like Berlusconi, you will not have access to blue debt, and the price of red debt will go up.” He was referring to the former Italian prime minister, Silvio Berlusconi, whose policies were blamed for much of Italy’s current economic and debt woes.

Thus Spain and Italy would still feel acute pressure to improve the way their economies function and to get better control of public spending. One big advantage of the proposal, Mr. Delpla said, is that it could be put into action quickly without a major restructuring of the European Union.

That is from Paul Geitner, here is more. What are the problems with this?:

1. GDP figures will be manipulated, to allow for the issuance of more guaranteed debt.

2. The key is guaranteeing the banks and their deposits, at reasonable cross-border cost. This doesn’t accomplish that.

3. Presumably a country has to pay back its joint bonds first, otherwise it is too easy to pass the buck on those and just pay back the national bonds. That makes the purely national bonds subordinated debt and may raise rather than lower their risk. Real private sector lending is already becoming subordinate to an unworkable degree, given all the “first in line” public lenders involved.

4. Germany still ends up with its finger on the “send you (and me) to doom” trigger, which already isn’t working out in the Greek situation. If Spain or Italy is approaching insolvency, can the Germans really withdraw credit? Didn’t the ECB just lend over a trillion euros, starting December 2012? How well is that going? Is Germany finding it easy to say “nichts mehr!”, or is the pressure for ever-greater bailouts integration? Why should the Germans let themselves be led further down that gangplank? Why not just call the plan “Germany commits to no more bailouts, not ever, ever again” and cross your fingers behind your back?

What else?

May 27, 2012

The real inflation problem

Competitors are said to pump air to deliberately inflate the udders before sealing the teats with superglue to stop the air or milk leaking out. The procedure gives the cattle the appearance of having full udders, an attribute believed to be desirable in show cattle. The practice, which leaves cows in “severe discomfort”, is understood to be an attempt to win agricultural prizes for their animals. Champion animals can fetch up to £100,000 at auction and are highly prized for breeding. The RSCPA has promised to investigate complaints, although no prosecutions have yet taken place.

Here is more, courtesy of Rahul.

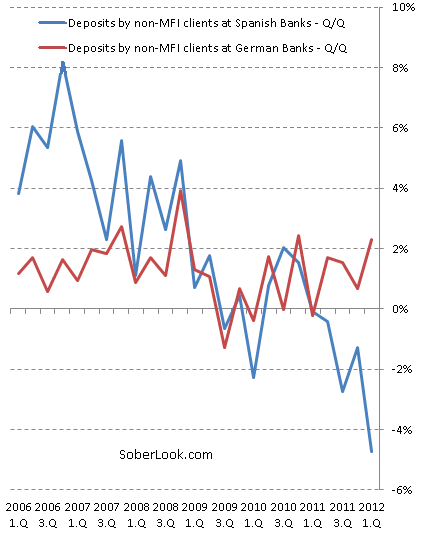

The run on Spanish banks

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers