Tyler Cowen's Blog, page 312

August 24, 2013

Assorted links

1. The culture that is Ukraine, watch out for salads with mayonnaise.

3. Profile of Marianne Bertrand.

4. Toward a theory of the Very Serious People.

5. John Cochrane will be running a MOOC on asset pricing models, at the Ph.D or near Ph.D level.

How long does it take mammals to learn the optimal commute?

Here is just one bit from a fascinating article, most of which concerns bears learning to use a road overpass:

But over the years, critics and transportation planners, even some environmentalists have groused about the idea: Taxpayer money, building overpasses for bears? Is that really necessary? Would they even use the things? Researchers have been methodically studying the crossings since 1996 to answer this. And it turns out that, yes, animals deterred by fencing that now runs the full 70-kilometer length of the highway in the park actually cross the road an awful lot like a rational pedestrian would. It takes them a while, though, to adapt to the crossings after a new one is constructed: about four to five years for elk and deer, five to seven years for the large carnivores.

The full piece is here, and for the pointer I thank Philip Wallach.

August 23, 2013

Spying on your loved ones? (or what you don’t know can’t hurt you?)

National Security Agency officers on several occasions have channeled their agency’s enormous eavesdropping power to spy on love interests, U.S. officials said.

The practice isn’t frequent — one official estimated a handful of cases in the last decade — but it’s common enough to garner its own spycraft label: LOVEINT.

Here is more.

Singapore has a very low wage share

Singapore has one of the highest GDP per capita in the world. However, our wage share of GDP (at around 43 per cent) is lower than the shares of most developed economies (at 50 per cent or more).

Of course Singapore is one of the wealthiest countries in the world.

You will find a variety of interesting graphs at this pdf link. That is from the Economic Survey of Singapore, more here.

Assorted links

1. World’s first bulletproof couch.

2. Replacing a soccer coach doesn’t seem to matter.

3. Using drones to fight mosquitoes.

4. How to mail a cockroach (pdf), background here.

5. Should Japan opt for more flexible, freer markets?

6. Various claims about various workplaces, interesting, some speculative, includes HFT too.

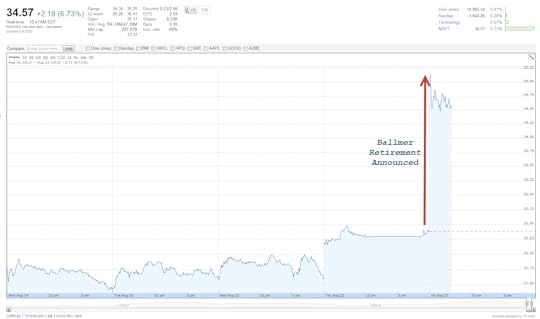

The Value of a CEO

Steven Ballmer announced today that he would retire. Microsoft stock shot up immediately by ~$2.18 or 6-7%. Given 8.33 billion shares outstanding that’s an increase in value of about $18 billion dollars. Of course that’s embarrassing for Ballmer but the lesson cuts both ways. If Ballmer’s exit and replacement with an unknown is worth $18 billion then hiring the right CEO at $27 million annually, the average annual pay for the 100 highest paid CEOs in America, looks like a bargain. Small differences are a big deal for large corporations, you know like a marginal… something or other.

Hat tip: Justin Wolfers.

An update on labor market polarization

Here is Mark Thoma quoting Josh Lehner:

What we see here is strong job growth at both the top and bottom ends of the wage spectrum. Yes, food preparation and personal care account for a disproportionately large share of jobs gained in recent years, but so too have business and financial services, healthcare practitioners, computer and mathematical occupations and management. Where we have seen slower growth is in the middle. The light blue bars, which I term lower middle-wage jobs account for about 40% of all occupations in 2012 yet account for just 26% of the growth. The dark blue bars, which I term upper middle-wage jobs, account for another 19% of all occupations and 0% of the growth. This, by definition, is job polarization.

There are useful pictures at the link.

Why has growth in per capita Medicare spending slowed down?

There is a new CBO study, which I have not read, but which is noteworthy virtually by definition. The abstract is here:

Growth in spending per beneficiary in the fee-for-service portion of Medicare has slowed substantially in recent years. The slowdown has been widespread, extending across all of the major service categories, groups of beneficiaries that receive very different amounts of medical care, and all major regions. We estimate that slower growth in payment rates and changes in observable factors affecting beneficiaries’ demand for services explain little of the slowdown in spending growth for elderly beneficiaries between the 2000–2005 and 2007–2010 periods. Specifically, available evidence does not support a finding that demand for health care by Medicare beneficiaries was measurably diminished by the financial turmoil and recession. Instead, much of the slowdown in spending growth appears to have been caused by other factors affecting beneficiaries’ demand for care and by changes in providers’ behavior. We discuss the contribution that those factors may have made to the slowdown in spending growth and the difficulties in quantifying those influences and predicting their persistence.

The full paper (pdf) is here.

August 22, 2013

Amazon will offer free shipping to Singapore (and India)

Matt will be excited:

Popular online shopping site Amazon now provides free shipping to Singapore.

As long as shoppers in the country make a purchase of SGD$160 (USD$125) or over, they will be entitled to this free shipping under the site’s “Free AmazonGlobal Saver Shipping” program.

This new privilege, which also applies to consumers in India, was announced on the website on Friday.

The qualified amount to be spent by shoppers for the free shipping does not include import fees, gift-wrap charges, duties and taxes.

The free shipping is only provided to online shoppers purchasing goods sold directly by Amazon and not by their third party retailers.

The goods purchased must also be eligible for the AmazonGlobal program, which makes up a majority of the site’s product catalog, ranging from automotive products, electronics and jewelry to name a few.

However, shoppers need to make sure that the goods to be shipped do not exceed 20lbs. (9 kg) or they will not qualify for the free shipping service.

The link is here.

*Affordable Excellence*

The author is William A. Haseltine, the subtitle is The Singapore Health System, and the Kindle edition is itself an…affordable excellence at $0.00.

This book is a clear first choice on the Singapore health system and everyone interested in health care economics, or Singapore, should read it. It is short, clear, and to the point. And anyone interested in public policy or fiscal policy must, these days, be interested in health care economics.

Singaporeans have some of the best health care outcomes in the world and yet the system consumes only four (!) percent of gdp. Here is one short bit:

Private expenditure in Singapore amounted to around 65 percent of the total national expense (2008). Note that this includes payments out of the government-run MediShield scheme and related insurance schemes, MediSave accounts, and other private insurance schemes or employer-provided medical benefits. The figure for the United States is 52 percent, 17 percent for the United Kingdom, and 18 percent Japan. Singapore’s relatively high private expenditure is a direct result of the government’s efforts to shift more of the cost burden to consumers than do most other countries.

Before you pure libertarians get too happy, however, note that public sector hospitals account for about 80% of all patient hours and there is a single payer system for catastrophic expenditures.

Definitely recommended, at this price or even the paperback for $20.00.

By the way, here are some changes they likely will be making to the Singaporean health care system, moving it closer to traditional welfare state policies (for better or worse).

Tyler Cowen's Blog

- Tyler Cowen's profile

- 843 followers