Tyler Cowen's Blog, page 310

August 28, 2013

Asset Prices and Interest Rates

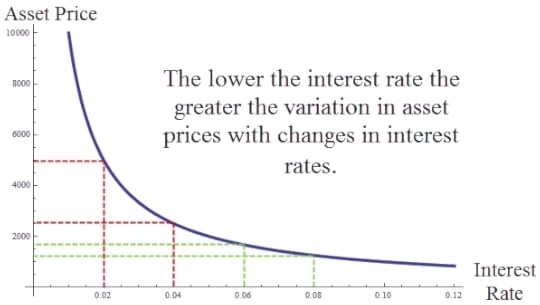

There has been a lot of discussion recently of Fed policy, tapering, and asset price “bubbles.” One point to bear in mind is that when interest rates are low even rationally determined asset prices may fluctuate wildly. Consider, the simplest Gordon model of asset prices in which future dividends are expected to be $100 forever, then the asset price is $100/r where r is the interest rate. If r is .1, for example, then the stock will be worth $1000. At an interest rate of 10% the price of an asset that pays $100 forever is just $1000 because the future is heavily discounted. If the interest rate were to fall to 9%, the asset price would rise to 1111.11 ($100/.09). The asset is worth more at a lower interest rate because the future counts for more but not that much more since the far future is still discounted to near zero. On the other hand, if the interest rate were .02 the asset would be worth $5000, much more since the future is discounted less heavily. Most importantly, notice that if the interest rate were to fall the same amount as before to .01 then the asset price doubles to $10,000. Thus, when interest rates are low we can expect very wide swings in asset prices. The figure illustrates:

The Gordon model is simple, of course, but adding other factors such as possible variations in dividend growth rates tends to reinforce the conclusion. At low interest rates, for example, even small variations in dividend growth rates will also generate large swings in asset prices.

The lesson is that QE doesn’t have to generate bubbles to generate wide swings in asset prices it just has to lower interest rates.

Indian food price inflation

Vegetable prices in India spiked 46.59% in July year over year, another ugly bullet point in the country’s persistent struggle with massive food inflation.

The longer story is here.

Last week an Indian truck was hijacked for its forty tons of onions. Here are Brendan Greeley and Kartik Goyal on India’s onion price crisis.

By the way, the falling rupee is not helping India’s export performance. The rupee is also creating planning horizon problems for Indian corporations.

What is the right way to think about China’s foreign reserves?

They are not just a big treasure chest for the absorption of bad debts. Paul J. Davies writes:

To buy the dollars that China does not want sloshing around the economy, the central bank creates Renminbi. However, in order to avoid a big money-printing exercise it also issues treasury notes into the market to soak up – or sterilise – the local currency created to buy the foreign currency.

The vast majority of the foreign exchange reserve assets at the People’s Bank are matched by Renminbi liabilities in China’s banks and other financial institutions. If it tries to spend dollars without repaying these liabilities it undoes its earlier sterlisation and prints money. If China wants to print money to soak up its bad debts – and take the risks that come with this policy – its foreign reserves are really irrelevant to that decision.

The other problem with “spending” these reserves lies in the misconception that they are an asset of the country – something like its retained profits from its trade with the outside world.

China has run a current account surplus of increasing size since the late 1990s. A good chunk of this is money paid for goods and services sold – but another good chunk is foreign direct investment. This is not money handed over by outsiders never to be seen again. (Okay, so maybe it often seems like it is, but losing to money to fraud and bad investments is not the point here…)

The point is that the stock of net foreign direct investment represents a liability of the country to outsiders – it is plant, equipment, streams of future profits and so on that are owned by foreigners not by Chinese.

This is interesting too:

Betweeen 2008 and 2012, the total accumulated by China, India, Korea, Taiwan, Hong Kong, Singapore, Indonesia, Malaysia, Thailand and The Philippines almost exactly matches the growth in the US federal Reserve’s balance sheet due to quantitative easing. As he says, the correlation appears very high.

What this suggests – and what is backed up by data from Hong Kong banks in particular – is that along with FDI, China has recently drawn in a lot of cheap credit from overseas. This also amounts to an external liability against the forex assets.

Here is more.

August 27, 2013

iheartpundits.com

That is the new web site run by my colleague Jerry Brito. It ranks what is hot now on the web, drawing upon wonky articles and sources, no cat photos, etc. I have found it very useful in the beta version.

Chinese insurance markets in everything

People in 41 cities in China can insure their enjoyment of the full moon during the Mid-Autumn Festival from Monday.

An internet-based insurance product was launched by Taobao Insurance under the Alibaba Group, China’s largest online shopping platform, together with Allianz China General Insurance Company.

Internet users can insure themselves against inconveniences during their moon gazing at the Mid-Autumn Festival, and will be paid off if they cannot see the moon because of poor weather on the day.

Residents of cities of Shanghai, Guangzhou and Shenzhen can pay a premium of 20 yuan (US$3.24) and receive 50 yuan (US$8) from the insurer if they cannot see the moon.

People living in 41 cities of China, including the three cities above and the country’s capital of Beijing, can pay a premium of 99 yuan (US$16) and receive 188 yuan (US$31) if they fail to see the moon through poor weather. Everyone who purchases the insurance will get a box of mooncakes as well.

Here is more, and for the pointer I thank Jonathan Zhou.

Assorted links

1. Profile of Thomas Pynchon (really).

2. The Chennai auto rickshaw tech upgrade.

3. How drones are revolutionizing archaeology.

4. How many people are in space right now?

5. How far are we from automated flight pilots?

6. George Packer dialog on Syria.

A new model for media paywalls?

The famous political science blog Monkey Cage will be joining The Washington Post (congratulations!) and apparently this will be the arrangement:

Actually, we negotiated a one year exemption from the paywall. So for first 12 months, not at all. After that, will continue to be open to anyone with .edu, .mil, and .gov accounts.

The economics of the war in Syria

The Dubai market just crashed seven percent, image here. Here is a longer story. The Saudi market is falling too; in theory that market is soon opening up to foreign investors. There are rumors that the Saudis are offering the Russians goodies to back away from supporting Assad.

The price of oil is going up.

Singapore and southeast Asia and tapering

This is from a comment by mbka at Scott Sumner’s blog, I had exactly the same impression:

…here in Singapore, the consensus of semi official and private chatter on investment matters, newspaper analysis etc., has long been that QE has fuelled Singapore’s real estate boom through unnatural capital influxes and that it caused all sorts of bubbles elsewhere in the region too. Further, consensus is that all this is going to come down now that QE is about to end. All this is practically presented as fact. (Counter-measures are being taken as well, for instance Singapore just introduced much tighter credit checks to limit the escalating debt service ratios of families to a maximum of 60% of income. That is because everyone expects interest rates to rise globally.)

Come to think of it, this means that bankers and officials in the region have an Austrian model of the world (printing hot money in the US leads to bubbles elsewhere).

Scott’s post is interesting too, as it represents his attempt to come to terms with the apparent bubble collapse from the unwinding of QE.

Measuring risk with VIX and VXV

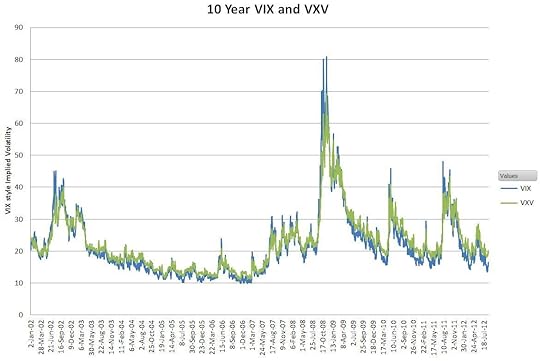

Discussing Robert Hall’s latest (pdf), Paul Krugman asks for a measure which shows the evolution of the risk premium for the U.S. economy. Here is one possible candidate:

Here is one discussion of that graph, and the difference between VIX and VSV. Here is a systematic look at VIX. It is “…a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. Since its introduction in 1993, VIX has been considered by many to be the world’s premier barometer of investor sentiment and market volatility.”

You can see that as of late 2011 measured risk is still fairly high. A wag might also wonder about the risk of measured risk and that seems to show a few noticeable bounce backs since the worst of the crisis period, suggesting that the U.S. economy has not really been in the clear.

Another relevant measure of risk is that people were for years willing to lend the Treasury money at negative two percent real rates of return, and at a time when equity returns turned out to be strongly positive and growth was moderately positive. That is to me the single strongest piece of information about risk. Someday (already?) we’ll look back and marvel at those prices.

This report from the Cleveland Fed shows how much small business lending has dried up, and much of this turns up in quantities rather than prices.

So in my view the evidence for higher risk premia is quite strong.

Tyler Cowen's Blog

- Tyler Cowen's profile

- 843 followers