Martin Bodenham's Blog, page 4

November 16, 2016

Thriller Giveaway

Want to win a signed copy of my thriller novel, The Geneva Connection? It has been the number one book on Goodreads’ best financial thrillers list for three years in a row. All you have to do is head over to Goodreads and follow the entry instructions by clicking here.

Good luck!

October 16, 2016

Down and Out Books – Crime Thriller Publisher

Many of my readers have contacted me this year asking when they can expect to read my next financial thriller, Shakedown. Well, I’m delighted to report that I’ve just signed a publishing contract with Down and Out Books, and the novel should be out during 2017.

Florida-based Down and Out Books was founded in 2011 by publishing veteran, Eric Campbell, whose previous connection with the industry was through Tyrus Books. The associate editor is Lance Wright, whose other activities include executive editorship at Omnimystery News. The house focuses on publishing crime fiction, including the following genres: thriller (like Shakedown), mystery, suspense, noir and police procedural. The stable of writers shows real depth of talent and includes authors such as: J.L. Abramo, Jack Getze, Linda Sands and Richard Godwin.

You can read more about Down and Out Books by clicking here.

October 13, 2016

Focus on total return not just yield

Since the beginning of the financial crisis, investors have seen pitiful yields on cash deposits as central bankers have reduced interest rates to near zero. As a result, investors have been forced to look elsewhere in their hunt for yield.

The trouble is many of them have been overly focused on cash yields in their search for more attractive alternative investments. In my view, they have been missing out as a result. As a former private equity investor, I believe investors ought to be looking at total return and not just the narrow measure of running yield. After all, what matters most is overall cash on cash return.

I am not suggesting dividend yields are unimportant. I’m simply saying that they are only part of the picture and that an undue concentration on dividends can lead to less than optimal returns. Let’s take a look at a few examples to bring out my point.

REITs and utilities stocks have seen large inflows of investor cash in recent years, attracted, no doubt, by their generous yields. For example, Vanguard’s REITs and utilities exchange traded funds are showing current yields of 3.5% and 3.4% respectively. These same ETFs have seen annual total returns (including yield and capital growth) of 14% and 12% over the last five years. Not bad, but let’s now consider a couple of solid stocks that may have been overlooked by income seeking investors simply because of their meagre dividend payouts.

Zimmer Biomet is a medical devices company with a current dividend yield of only 0.7%. However, its annual total return for the last five years has been 20%. And take a look at Visa, the credit card company. Here’s another investment that may have been overlooked because of its relatively poor dividend yield of 0.7%. Yet its annual total return for the same five year period has been 29%.

If investors need annual cash income, dividends are not the only way to achieve this. An alternative source of cash could be generated by selling a portion of their investment to realize a capital gain. Indeed, in many countries, capital gains are taxed at lower rates than dividend income.

Next time you consider a potential investment, my suggestion is that you focus on total return not just yield.

September 16, 2016

The Fear of Deflation

Interest rates are at historically low levels – in many cases, they are negative on either a nominal or real basis – and central banks remain fixated on quantitative easing some eight years after the economic crisis. What lies behind this reluctance to return western economies to “normal” monetary conditions? The answer lies in the fear of deflation.

For most of my adult life, central bankers have been concerned about controlling inflation, raising interest rates when animal spirits became excessive, so as to choke off the damaging pressure of rising prices for those on fixed incomes. But ever since the 2007/08 financial crisis, economies in the west have seen little if any wage growth and anaemic, if not negative, price increases. As a result, the focus has been on keeping economies stimulated to keep the plates spinning. What is it they fear? Why is deflation bad?

Deflation (a sustained period of falling prices) is feared by central bankers because it has the capacity to sink an economy. The argument is that if consumers expect prices to be lower tomorrow, they will delay purchasing decisions today, particularly where big-ticket items such as cars and houses are concerned. Once deflationary expectations take hold, overall demand falls and so companies have to reduce the prices of their goods and services to attract the slumping demand. As a result, deflation becomes more acute, and so the spiral continues downward.

Another reason deflation reduces demand within an economy is because of its effect on borrowers. When we think of our parents who bought houses decades ago using mortgage loans, we see how inflation has worked to their advantage. During that time, property prices have risen along with nominal wages, and what at first seemed like huge debts are now much more comfortable, having been eroded by inflation. Now turn that on its head and imagine that house prices and wages had fallen over the last twenty or thirty years. Suddenly, those mortgage loans would appear insurmountable as they would have risen in real terms, appearing much larger today than when they were taken out. When borrowers fear debt burdens rising in real terms, their confidence falls, so they cut back on spending, thus driving down demand and further fuelling deflation.

Many of our decisions as consumers are based on confidence in the future. If we expect our incomes to rise over time and if we anticipate houses to go up in value, we will be comfortable spending and borrowing today. Most economies work on this onward and upward principle, which is why central bankers target to achieve modest levels of inflation and fear stepping too near the deflationary cliff edge.

August 30, 2016

Jenga Stock Market

One of my favourite games during the holidays is Jenga. As the game draws to an end—and just when it is most fun—everyone knows the tower is about to topple, and yet the players continue, more in optimistic hope than expectation.

I think we are facing a Jenga stock market right now with the last few blocks being removed. Not only do historic low interest rates appear to be coming to an end—the Fed is expected to raise rates next month or, at the latest, in December—but recently another major support has fallen away as stock buybacks are reined in. According to TrimTabs Investment Research, US company stock buybacks are down 21% in the first seven months of this year. During the period of ultra-cheap money since the financial crisis, cumulative stock buybacks have been running at record levels. Rather than invest, management teams have preferred to use corporate cash flows to buy in stock, continuing even as stock prices hit record highs. Earnings have been falling for five straight quarters now, but one way boards have maintained the upward direction in earnings per share has been to reduce the number of shares in issue through buybacks—financial engineering at its best.

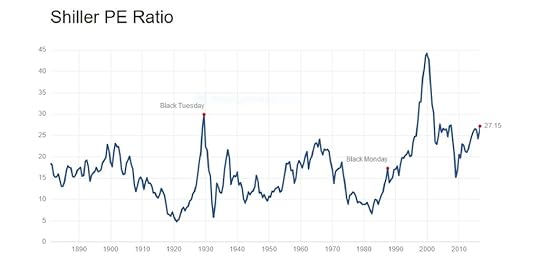

Don’t just take my word for a market living on borrowed time. Look at the Shiller PE ratio below. The cyclically-adjusted price earnings ratio is above 27x right now. It has only been higher than its current level twice in the last 140 years: first right ahead of the 1929 stock market crash and then again in 1999 during the dotcom madness.

Sure, it is possible for the stock market to go still higher from here, but any day now I expect the final block to be removed and the Jenga tower to come crashing down.

August 11, 2016

The Hunt for Yield

These are risky times for investors as the hunt for yield becomes ever more challenging. Interest rates are at near zero levels in many developed countries and even negative in a handful of European states and Japan. What is an investor supposed to do in the search for decent returns?

A famous tightrope walker once replied to a question as to whether he had any fear of heights. “No,” he said. “Heights don’t scare me; hitting the ground does.” In their hunt for yield, many investors today are walking a financial tightrope, knowingly or unknowingly accepting the risk of substantial capital loss if markets fall.

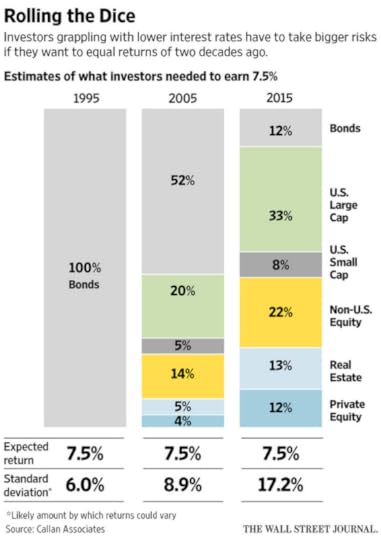

Take a look at the table below. It shows how much more risk investors have had to assume in the last twenty years to generate the same level of investment return. In 1995, you could generate a 7.5% return with minimal risk by holding 100% of your portfolio in bonds. Today, that same return would require substantial exposure to riskier asset classes such as private equity, real estate and small/large cap stocks.

The S&P 500 has seen corporate earnings decline year-on-year for five straight quarters, and yet the index has continued to make new highs. Much of the resulting P/E multiple expansion—bond proxies such as utilities, for example, are trading at ten year high multiples—has come from investors buying stocks, tired of receiving nothing on their cash.

My fear is, once the US election is over, the Fed will start raising interest rates so as to have some wriggle room when the next recession hits. Once rates begin to rise, the law of gravity will catch up with stocks and real estate values. Only then will some investors appreciate the risks they’ve been running in their hunt for yield.

June 8, 2016

Insider Trading

Earlier today, a former KPMG employee in Toronto was punished for insider trading. The junior tax accountant admitted using undisclosed material information relating to client M&A transactions in order to make stock trading profits. He went on to share some of that information with his father. The Ontario Securities Commission fined the ex-staff member $220,000 and prohibited him from trading in securities and becoming an officer of any investment fund manager for seven years.

Taken at face value, these sanctions appear quite severe, but I believe they do not adequately reflect the seriousness of the offence. Some $200,000 of the penalties merely represent repayment of the profits made on the illicit deals, and, as for the ban, it is unlikely the now unemployed offender will ever find work in the investment industry anyway. In my view, the punishment amounts to no more than a slap on the wrist.

Why do I say this? Partly, it is because I was once a partner at KPMG, and I know how hard it is to build and maintain a reputation of trust. It infuriates me to see people betraying that trust for personal enrichment. But insider trading is not just a breach of trust by someone in possession of confidential information. It goes much further than this. Confidence in capital markets is essential to the proper functioning of modern economies. Nothing erodes that confidence more than when those caught gaming the system seemingly face inadequate penalties, thus failing to discourage others tempted by a quick and seemingly easy buck.

My second novel, Once a Killer, told the story of a lawyer who had access to confidential client deals. He went on to share that inside information with a hedge fund backed by organized crime. It may be a work of fiction, but it shows what can happen if white collar crime such as this is not met with tough and more proportionate sanctions.

The post Insider Trading appeared first on Martin Bodenham.

May 3, 2016

Entrepreneurship and Social Mobility

It was in the blistering heat of early summer—a heavy kit bag strapped to his back—that my father collapsed and died of a heart attack. He was 37 and serving with the British army in Cyprus just after the Turkish invasion of the mid-1970s. I was only in my teens back then, but I still remember my father worrying over what he would do once he got to “Civvy Street”. He’d served almost 20 years and was due to leave the service two years later. One vivid memory I have is my father planning on working for himself in some capacity. He thought very few employers would be interested in him and he feared facing years of unfulfilling work to continue providing for his family. Years later, I wasn’t surprised when my brother set up his own business after he had served in the army. My father’s instinct to look to himself to create his own future stuck with me as I ended up founding a private equity firm of my own some fifteen years ago.

Becoming an entrepreneur and working for yourself is one of the few ways to find stimulating and meaningful work. Just as important, it is one of the last remaining ladders to achieve upward social mobility.

A couple of years ago, much was written about the UK’s then work and pensions secretary, Iain Duncan Smith, and his claim that he could live on £53 a week—broadly the amount someone below 25 would receive on jobseeker’s allowance. There is no doubt that it would be difficult for anyone to live on this amount. Harder still would be the prospect of having to survive on it and never being able to see a way out.

I don’t blame the government for trying to contain the spiralling cost of the welfare state. The benefit system for the unemployed was only ever designed to help those in need through a period of temporary difficulty. The intention was never to make welfare payments a viable alternative to work. But the reality is that many are trapped, let down by an education system that leaves them poorly equipped to take up the well-paid jobs available. Compared to living off meagre benefits, those jobs that are left hold little appeal unless they come with the prospect of advancement.

This is my main point. Most people want to work, but they do not want to work simply to meet their basic needs for food and shelter; they can get that on benefits. What people want is work that will enable them to climb out of poverty and, through hard work, build a better life for their families. Sadly, the days when Terry Leahy could go from stacking shelves at Tesco to become its CEO have long gone. Recent OECD figures show the UK has one of the poorest records for social mobility among western economies. Our earnings are more likely to reflect our fathers’ than any other OECD country. Those same figures show that UK social mobility has not changed since the 1970s. Today, for the poorest twenty percent in society, almost half have mothers with no qualifications. For the richest, it is only three percent.

If the government has to cut welfare spending, and I believe it does, then it must also offer people every opportunity to improve their lives. It should not matter where you come from. Everyone should have the same opportunity by having access to quality education, because it is education that is the real engine for advancement. Education does not have to be limited to school-age children. The government could make a huge impact on social mobility by encouraging a spirit of entrepreneurialism through educational and self-development schemes such as Heropreneurs and similar mentoring programmes.

Social mobility is the real issue faced by the UK-and many other western economies-not whether a former cabinet minister, who is married to an heiress, can survive on £53 a week.

This post first appeared on Heropreneurs as a guest article.

The post Entrepreneurship and Social Mobility appeared first on Martin Bodenham.

April 22, 2016

Risks of crowdfunding

Recently, crowdfunding has become a popular source of finance for start-up businesses and those young companies seeking expansion capital. It is not difficult to understand the appeal of such funding for the entrepreneurs behind the target companies. It can be much easier and quicker to raise money through one of the crowdfunding platforms than spending months locked in negotiations with a venture capital firm. Moreover, if the fundraising is in exchange for benefits or discounted products, and not equity, the entrepreneur can retain overall control of his/her business.

As a former private equity investment fund manager, I have a strong interest in seeing young companies grow and succeed. After all, they are the main driver of new job creation, and the entrepreneurs behind them, through their innovation and creativity, are responsible for much of the economic expansion we have seen since the financial crisis of 2008. That said, as an investor, I choose not to participate in crowdfunded investments because I believe the following risks far outweigh the rewards.

Poor returns. Most of the crowdfunded investment opportunities I have seen have not offered investors anything like the slice of equity they deserve for the risks they are assuming. Many such offerings do not even provide the basic forecast numbers needed to enable a potential investor to calculate the prospective return. Even when they do, quite often, the terms have been significantly skewed in favour of the company.

Social media platforms and other online forums offer a convenient means of reaching thousands of prospective investors quickly, but I worry about the risk of fraud as it takes little effort to create a seemingly legitimate website.

Lack of due diligence. Even if the website is legitimate, there is a risk that the target company is nothing more than a front to raise money from gullible and remote investors. At least when a venture capital firm considers a prospective investment, proper and thorough due diligence is carried out. References are taken on key managers and customers and suppliers are interviewed to assess the viability and legitimacy of the company. In addition, financial reports are commissioned to weigh-up the logic and assumptions behind the numbers. Doing this properly costs money—sometimes more than can be justified in light of the small amount of capital being raised, leading to the potential for corners to be cut.

When a venture capital firm backs a company, often one of its senior staff members will join the board of the target business, so as to monitor progress and to ensure that capital is being used for the purposes set out in the business plan. Without this layer of knowledgeable corporate governance, there is a real risk of strategic shift and poor allocation of capital.

Like many things found on the Internet, not all that glitters is gold…

The post Risks of crowdfunding appeared first on Martin Bodenham.

March 19, 2016

Red Notice by Bill Browder

Reviewing books by other authors is something I rarely do, but every now and then I stumble upon a story which is crying out for praise. Red Notice by Bill Browder is one such example.

Set over the last twenty years, it is a true story of finance, corruption and murder in the Russian financial markets. What sets it apart from other autobiographical works, however, is Browder’s honest account of the impact the book’s horrific events had on him and his family. It reads more like a high stakes thriller, in which the protagonist is faced with seemingly insurmountable challenges, leaving the reader aching for justice to prevail.

The details of how Browder and his team built from scratch a hedge fund business, Hermitage Capital, into the largest foreign investor in Russia are fascinating. As someone who has also built an investment fund management business from the ground up, I found his minute-by-minute description of the pitfalls and vagaries of the fundraising process rang true. Early on, it gave me a sense that the book was written from the heart—warts and all.

If you only read one book this year, I suggest you make it Red Notice by Bill Browder. You will not be disappointed by this terrifying page-turner. As a financial thriller writer, my only regret is that I didn’t write it myself!

The post Red Notice by Bill Browder appeared first on Martin Bodenham.