Martin Bodenham's Blog, page 5

February 29, 2016

Former Big Four Corporate Finance Partner trades in the boardroom for the book

Some of you may know that before I started writing financial thriller novels, I was a corporate finance partner at two of the Big Four global accounting and consulting firms. Recently, I was interviewed by Big4.com about my career and my change in direction when I took up writing.

Here is the link to the interview.

The post Former Big Four Corporate Finance Partner trades in the boardroom for the book appeared first on Martin Bodenham.

February 6, 2016

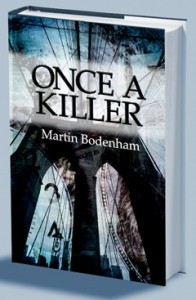

Financial thriller novels at Canada’s booktown

I saw these financial thriller novels on the shelf today at one of the book stores in Sidney, Canada’s own booktown. If any of my readers would like to order signed copies of my novels, these are available from Tanner’s Books in Sidney.

Some of the reviews:

I couldn’t put The Geneva Connection down once I started it. The intricate plot, laced with just enough background information to make it realistic and understandable, takes twist after turn until you reach the final destination, white-knuckling it all the way. An intense thrill ride through the world of investment banking, drug cartels, and money laundering… Long and Short Reviews

Novelist Martin Bodenham has penned The Geneva Connection, a thriller straddling the City, the English countryside, Mexican back roads and the US Drug Enforcement Administration. With this page-turner, Bodenham aspires to do for fund managers what John Grisham has done for lawyers… Corporate Financier Magazine

Murder, kidnapping, blackmail, multi-million dollar deals, drug cartels, adultery, law enforcement, The Geneva Connection has it all. It weaves a complex tale involving police, investors, and thugs… Night Owl Reviews

Take a close look at what you buy; you never know from where the funding came. Martin Bodenham and the Geneva Connection provide us with food for thought and leave us with an admiration for those who fight the drug cartels… SingleTitles.com

The Geneva Connection has a menacing opening with a hook and a barb to make the hook stick. Thriller readers are hooked, barbed and immediately reeled in. The narrative mesmerizes from the outset. The pace is swift and the action enough to make any reader’s toes curl in frightening expectation… Art Cockerill, Writer and Journalist

“This was an unputdownable financial crime thriller. And when the Mafia is involved, you know there is going to be lots of blackmail and murder. I felt Michael’s hopelessness as the innocent victim; how was he ever going to get out of this mess?” Amazon.com review

“Wow, what can I say about this book? Hmm… It was AMAZING! Every chapter was packed full of action and twists and turns, not knowing what’s going to happen next. Everybody, this book is a MUST HAVE!” Julie’s Book Reviews Blog

“Martin Bodenham has crafted a very entertaining financial thriller in ONCE A KILLER. After enjoying his previous novel, THE GENEVA CONNECTION, I immediately downloaded this book and hoped that it would be as good. I was delighted to find that it was even better. The plot focuses on blackmail, insider trading and money laundering and the characters are all very well developed. Even after reading 90% of the book, I was not sure how it would end which I find to be a rare treat. I was not disappointed in the clever and satisfying conclusion. If someone is looking for a good financial thriller, I would definitely recommend this author.” Top 500 Amazon.com reviewer

The post Financial thriller novels at Canada’s booktown appeared first on Martin Bodenham.

January 29, 2016

Veteran suicides – the forgotten casualties of war

Veteran suicides in the US are running at almost one an hour. The rate is 30 suicides per 100,000 veterans, which is more than double the rate for the general population. In Canada, where I live, things aren’t a great deal better. According to the Globe and Mail newspaper, 158 Canadian soldiers died in the Afghanistan mission, but at least 54 soldiers and veterans killed themselves after they returned from war.

It is not hard to understand why soldiers and veterans may experience suicidal tendencies. I know from discussions with my father – a veteran who died while serving abroad – combat exposes people to harrowing life and death situations, and it is common for depression and PTSD to follow. I know from some of my father’s peers how difficult life was adapting to “civvy street” and searching for employment and housing.

As a society, we send our troops to some of the most dangerous places on earth. The very least we owe these brave souls is to treat them with genuine respect and to extend them a helping hand upon their return. The military culture is one of self-reliance and stoicism, so we should not wait until veterans ask for help. It should be there waiting for them as a matter of course in the form of medical/psychological care, employment assistance and decent housing. This is not charity; they have earned it.

The recently passed Clay Hunt Suicide Prevention for American Veterans Act is a notable start, but it is not enough. Other countries must follow, and those of us in the non-vet population must work hard to change the culture. We cannot continue turning a blind eye to the struggle of those who were prepared to make the ultimate sacrifice to maintain our freedom.

The post Veteran suicides – the forgotten casualties of war appeared first on Martin Bodenham.

January 5, 2016

Best wishes for 2016

Here’s wishing my readers a happy new year and best wishes for 2016!

The post Best wishes for 2016 appeared first on Martin Bodenham.

December 25, 2015

Holiday Greetings

Here’s wishing my readers holiday greetings and a wonderful 2016.

One of my favourite birds came by this morning, wearing his Christmas hat!

The post Holiday Greetings appeared first on Martin Bodenham.

December 12, 2015

We need the entrepreneur more than ever

In spite of the west’s aging reliance on monetary stimulus – cheap interest rates and quantitative easing – western economies have seen weak growth in recent years. Today, most emerging markets are at or near recession; even China, in spite of its published data, is probably only growing at two or three percent. Little wonder stock markets have gone sideways for the last year and a half and the price of oil has tumbled.

The western world has a growth problem, particularly when measured on a GDP per capita basis. Productivity has been slipping for years and cheap money, rather than helping, has removed much of the impetus to unlock economic efficiencies. What have governments been doing to address these issues? In my view, most of the time, they have been focused on the wrong things. For example, there has been much talk of borrowing to invest in infrastructure projects in order to stimulate growth, but rarely has this been successful in the past. The sad fact is governments are not good allocators of capital, and history is littered with costly mistakes by well-meaning politicians.

What we need is an explosion in entrepreneurial activity if we are to witness real and sustainable economic growth. Unlike governments, entrepreneurs risk their own money. This reduces the chances of it being wasted by investments into the wrong projects. Entrepreneurs often spot unsatisfied demand in the market and ways of doing things more efficiently, both of which lead to real economic growth. Governments can help by creating an environment conducive to entrepreneurialism by celebrating – and not denigrating – corporate success, reducing red tape, lowering capital gains taxes for founders and backers of new businesses and lowering payroll taxes.

If the rest of the world is to avoid replicating Japan’s stagnation of the last two decades, we need to do things differently. I believe we need the entrepreneur now more than ever…

The post We need the entrepreneur more than ever appeared first on Martin Bodenham.

November 16, 2015

World debt and the mother of all recessions

Over the last eight years, all major economies have seen debt levels (as a percentage of GDP) increase from their pre-financial crisis highs reached in 2007. With the US Federal Reserve board about to begin raising interest rates, do continuing high debt levels threaten to destabilize the nascent economic recovery?

World debt rose by approximately $60 trillion, or almost 20 percentage points of GDP, between 2007 and 2015. Nearly half of this increase is accounted for by government borrowing used to fund bailouts, quantitative easing measures, and the shortfall in tax revenues. A third of it is due to corporate debt as companies have loaded up with cheap money to fund share buy-backs and dividend increases beyond the growth in earnings. Household debt has increased by an annual compound rate of 3% over this period, fueling rising stock prices and housing bubbles around the globe. Simply put, the world continues to live beyond its means in spite of the financial shock of 2007.

What does this mean for the world’s major economies? In my view, governments don’t have the stomach to stem the growth in debt, let alone do what it takes materially to deleverage. Finding a way to live with high levels of debt for longer is easier than addressing the fundamental problem. Consequently, our political leaders are likely to continue to pursue a policy of cheap money, thus kicking the issue down the road. This means any increase in interest rates is likely to be muted, but when eventually the debt super-cycle comes to an end, probably due to some unforeseen external shock, we are likely to witness the mother of all recessions.

The post World debt and the mother of all recessions appeared first on Martin Bodenham.

October 12, 2015

Why is deflation bad?

Interest rates are at historically low levels, and central banks remain fixated on quantitative easing some eight years after the economic crisis. What lies behind this reluctance to return western economies to “normal” monetary conditions? The answer lies in the fear of deflation.

For most of my adult life, central bankers have been concerned about controlling inflation, raising interest rates when animal spirits became excessive, so as to choke off the damaging pressure of rising prices for those on fixed incomes. But ever since the 2007/08 financial crisis, economies in the west have seen little if any wage growth and anaemic, if not negative, price increases. As a result, the focus has been on keeping economies stimulated to keep the plates spinning. What is it that they fear? Why is deflation bad?

Deflation (a sustained period of falling prices) is feared by central bankers because it has the capacity to sink an economy. The argument is that if consumers expect prices to be lower tomorrow, they will delay purchasing decisions today, particularly if big-ticket items such as cars and houses are concerned. Once deflationary expectations take hold, overall demand falls and so companies have to reduce the prices of their goods and services to attract the slumping demand. As a result, deflation becomes more acute, and so the spiral continues downward.

Another reason deflation reduces demand within an economy is because of its effect on borrowers. When we think of our parents, who bought houses decades ago using mortgage loans, we see how inflation has worked to their advantage. During that time, property prices have risen along with nominal wages, and what at first seemed like huge debts are now much more comfortable, having been eroded by inflation. Now turn that on its head and imagine that house prices and wages had fallen over the last twenty or thirty years. Suddenly, those mortgage loans would appear insurmountable as they would have risen in real terms, appearing much larger today than when they were taken out. When borrowers fear debt burdens rising in real terms, their confidence falls, so they cut back on spending, thus driving down demand and further fuelling deflation.

Many of our decisions as consumers are based on confidence in the future. If we expect our incomes to rise over time and if we anticipate houses to go up in value, we will be comfortable spending and borrowing today. Most economies work on this upwards and onwards principle, which is why central bankers target to achieve modest levels of inflation and fear stepping too near the deflationary cliff edge.

The post Why is deflation bad? appeared first on Martin Bodenham.

August 14, 2015

I love bad reviews

As most writers know, creating a full-length novel takes the best part of a year and sometimes much longer. During that time, our stories can become quite precious things, particularly as many of us obsess over the character development, countless edits and rewrites. Like most new writers, at first, I found negative reviews hard to swallow. After all, the reviewers were attacking something into which I had poured my heart and soul, so some of the comments felt personal.

With time, however, I came to appreciate the value of all reviews, both good and bad. Sure, it still feels great to find another five star review pop up on Amazon. Who doesn’t like their work to be praised? But now I am almost as excited to read the less than positive assessments of my work.

I am not saying I welcome poor reviews, but I have realized that those written by readers who have kindly taken the time to rationalize their opinions—setting out the specifics of what they didn’t like and why—provide me with an opportunity to improve as a writer. Of course, I don’t always agree with everything a reader says, but when there are common themes coming out of multiple reviews I pay attention. Often in those circumstances, if I am being brutally honest with myself, I find I agree with the reviewers’ comments.

If you are a writer who still feels bruised by critical comments, then I suggest you start looking for the kernels of truth they may contain and use the valuable reader feedback to perfect your trade. Using them to help develop as a writer, you will soon understand why I love bad reviews.

The post I love bad reviews appeared first on Martin Bodenham.

July 25, 2015

99 cents or lower

Great news! All of my thriller novels are now priced at 99 cents (UK 99 pence) or lower at Amazon’s Kindle store. Here are the links:

The post 99 cents or lower appeared first on Martin Bodenham.