The Hunt for Yield

These are risky times for investors as the hunt for yield becomes ever more challenging. Interest rates are at near zero levels in many developed countries and even negative in a handful of European states and Japan. What is an investor supposed to do in the search for decent returns?

A famous tightrope walker once replied to a question as to whether he had any fear of heights. “No,” he said. “Heights don’t scare me; hitting the ground does.” In their hunt for yield, many investors today are walking a financial tightrope, knowingly or unknowingly accepting the risk of substantial capital loss if markets fall.

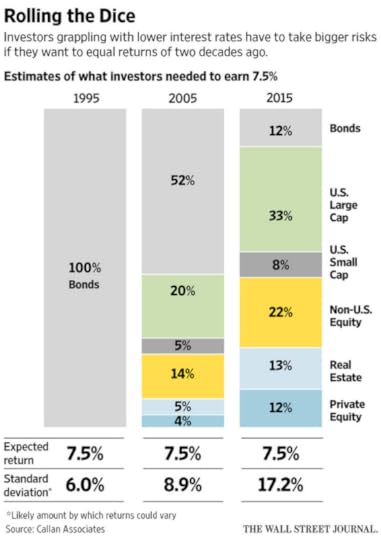

Take a look at the table below. It shows how much more risk investors have had to assume in the last twenty years to generate the same level of investment return. In 1995, you could generate a 7.5% return with minimal risk by holding 100% of your portfolio in bonds. Today, that same return would require substantial exposure to riskier asset classes such as private equity, real estate and small/large cap stocks.

The S&P 500 has seen corporate earnings decline year-on-year for five straight quarters, and yet the index has continued to make new highs. Much of the resulting P/E multiple expansion—bond proxies such as utilities, for example, are trading at ten year high multiples—has come from investors buying stocks, tired of receiving nothing on their cash.

My fear is, once the US election is over, the Fed will start raising interest rates so as to have some wriggle room when the next recession hits. Once rates begin to rise, the law of gravity will catch up with stocks and real estate values. Only then will some investors appreciate the risks they’ve been running in their hunt for yield.