James L. Paris's Blog, page 230

October 17, 2014

Great Deal On A Color Printer, Fax, Copier, Scanner

I don't do a lot of product reviews, but wanted to pass along a great buy. I have been hating my office ' all in one'printer for the five years I have had it. The ink was overpriced, it was slow, and it could not do much of anything without a major hassle. Many times I hold on to outdated technology entirely too long (and this was definitely the case here). The good news is that after five years my printer stopped working completely and I had a great excuse to shop for a new unit.

I was really surprised at how much the price of all in one printers has come down. I found just what I needed in the Epson WorkForce WF-3620. It is a color printer, scanner, copier, and fax machine. It is also completely wireless and anyone on my home network can access it. I have had the unit now for about a week and I love it. At a total cost of just $125 it was an incredible bargain. I also got free shipping (since I bought it through my Amazon Prime account). I was also able to find a source of cheap ink refills as well. This unit has more than 200 Amazon reviews with an overall rating of 4.0. I would give it a 5 star rating at this point. The best part of all was the quick set up. It took about 15 minutes and I was up and running with the unit connected to my network. It was a slice of heaven to take my old printer out to the garbage can. I can't believe I waited so long...

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio

HBO To Offer Service Without Cable Subscription

Is it the beginning of the end of cable TV? Probably not, but the latest move by HBO will only accelerate the trend of content providers offering their programming outside of traditional cable TV packages. HBO just announced that starting next year they will make available their channel via the Internet. Of course, readers of this blog know that I dropped cable TV over a year ago and don't miss it one bit. I have found that with a ROKU device and subscriptions to HULU and Netflix that I can get everything I want on my television. While I am not personally a fan of HBO, I believe this news represents a 'tipping point' in the growth and popularity of Internet TV.

ROKU itself offers hundreds of free channels (news, sports, movies, and more). With major networks like HBO added to already available services like Netflix and HULU Plus, dropping cable is becoming more and more of a realistic option.

For those considering making the move, I have a comprehensive report and video at our premium site ChristianMoneyPlus.com. Most families can easily save more than $1,000 per year by switching to Internet TV.

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio

October 15, 2014

Budgeting: The Single Most Important Component to Wealth-Building

One of the best books I’ve ever read on personal finance is The Millionaire Next Door. It was first published in 1996, at a period in time when the accumulation mindset was in full force throughout American society. Without discussing it in great detail here (if you’ve not yet read it, I would certainly recommend doing so), the book emerged as the result of work done by two credentialed business academics, Dr. Thomas J. Stanley and Dr. William D. Danko, who studied the lifestyles of “typical” millionaires…the ones who work at fairly regular kinds of labors…to identify the patterns and common denominators that define them. First and foremost, the book emphasizes the chronic frugality of the “millionaires next door,” and it is this theme that comes up most frequently throughout the book, even when other topics related to achieving millionaire status are at issue. Does this mean that living substantially within one’s means is the most important component to growing one’s net worth to a significant size? I would say, “Yes.”

One of the best books I’ve ever read on personal finance is The Millionaire Next Door. It was first published in 1996, at a period in time when the accumulation mindset was in full force throughout American society. Without discussing it in great detail here (if you’ve not yet read it, I would certainly recommend doing so), the book emerged as the result of work done by two credentialed business academics, Dr. Thomas J. Stanley and Dr. William D. Danko, who studied the lifestyles of “typical” millionaires…the ones who work at fairly regular kinds of labors…to identify the patterns and common denominators that define them. First and foremost, the book emphasizes the chronic frugality of the “millionaires next door,” and it is this theme that comes up most frequently throughout the book, even when other topics related to achieving millionaire status are at issue. Does this mean that living substantially within one’s means is the most important component to growing one’s net worth to a significant size? I would say, “Yes.”

The reason for this is fairly simple and straightforward: the further inside your means you live, the more money you have to set aside into savings and investment accounts, as well as to apply toward any of the existing debts you have that serve to diminish your net worth. The budget allows you to clearly define your spending boundaries, and begin to work toward further distancing yourself further from them for the purpose of creating even more disposable income. There’s nothing exotic about the task of creating a budget and ensuring that you stay within the guidelines it establishes, but it may well be the single most important component to realizing financial independence. After all of these years and after all of the supposedly “new and improved” ways of getting things done that have evolved, it is still the time-honored principles of financial planning that best serve the vast majority of us.

Jim Paris and I just recorded a 2 hour video covering all aspects of budgeting and the variety of methods that are now available to set up and track your spending. If you are struggling to make progress in growing your net worth, you should grab a copy. The cost of the download is just $15, but it is free for members of ChristianMoneyPlus. If you are serious about taking control of your financial life, once and for all, this video will prove to be a great foundation of information and traning.

Order The Video Download Click Here

Robert G. Yetman, Jr.

Managing Editor, The James L. Paris Report

October 13, 2014

Stan Deyo Says He Has Found The Biblical Garden Of Eden

Researcher, writer, and filmmaker, Stan Deyo, says he has found the location of the Garden Of Eden. Deyo shares his methodology on how he determined the location, and some very startling facts that seem to confirm his find. How can this information be used to calculate the age of the earth? What are the spiritual implications of finding the Garden of Eden? What the local tribes say about this location being the Garden Of Eden, and more.

Embezzler's Pocket $28,000 For Each Month Of Prison

On this episode Jim discusses the shockingly light prison sentences for embezzlers. How one embezzler stole $53 million dollars from a small town. A Tulsa pastor embezzles amost $1 million dollars and his church does not fire him. New options with Over The Top TV. Should you take Social Security at 62 or wait? Edward Snowden's privacy tips.

Finding The 'Perfect' Budget System

Budgeting is truly the foundation of our personal finances. It used to be a simple matter of employing a yellow pad or even a small ledger book, but today there are a dizzying number of methods of budgeting. The truth is, however, that it does not have to be as complicated as we make it.

My mother is a 71 year old widow, and is by no means wealthy. She gets by just fine, and I asked her the other day if she had a budget. My mom simply explained that on the first of the month she pays all of her bills. Whatever money she has left over has to last for the month. Oh, if it could be that simple for everyone!

Are We In A Budgeting Crisis?

A Gallup Poll in 2013 concluded that two thirds of Americans do not budget. I was actually somewhat surprised that the number was so high. The bottom line, however, is that it does seem to explain a lot. I think Dave Ramsey nailed it when he coined the phrase 'financial peace.' I don't think most people have any idea how wonderful that feeling of peace really is. Without a budget, most people breathlessly stay just one tiny step ahead of their financial due dates. When the fly by the seat of your pants approach fails, hit the credit cards or take another payday loan.

Curly Had It Right

Do you remember Curly from the movie City Slickers? He was the very intimidating trail boss played by the legendary Jack Palance. Curly's advice was to focus on that 'one thing' (the one thing that was most important). So, if Curly were teaching on budgeting, the one thing would be this - spend less than your income. That is the one thing that any budget or spending plan has to be about.

It All Really Does Begin With A Budget

The truth is pretty simple. People that don't have a budget waste a tremendous amount of money. Some folks earn enough that they can make it just fine without a budget, but there is no doubt that 'budgetless living' is fraught with waste. Dave Ramsey says that if you don't manage your money it will leave you and go to someone else that will manage it. Dave could not be more right.

The reason that a budget is that one thing, and has to continue to be that one thing, is simple. It creates the necessary ingredient you must have for financial success - the financial surplus. The surplus is the fuel of all financial progress. It is what can be directed toward saving, debt reduction, or other goals (vacations, paying cash for that next car, etc...).

Not Having A Budget Is Flying Blind

If you don't have a budget, and a way to monitor it, you will likely end up making poor decisions. These mistakes are simply due to a lack of information. Being out of touch with your true financial picture will result in overspending. I can't tell you how many times people have told me that they got into a car loan, mortgage, boat payment, or other major obligation, believing they could afford it.

Tracking Expenses

I went to see Christian finance author Larry Burkett speak years ago and I will never forget one of his very funny lines. Burkett said that almost none of the couples that came to him over the years for counseling remembered to include clothing as a line item in their budget. He added that none ever showed up naked for their appointment. What a great way of making the point that most people don't really know where their money goes each month. This is why using a smartphone app or a journal to track every penny is an excellent discipline. You may not choose to do that forever, but try it for a week or two and it will be a real eye opener.

The Search For The Perfect Budget System

There are probably as many budget methods as there are diet plans. The truth is that the perfect budget system is whichever one works for you (and you might have to try a few). My mom has a very simple financial life and she can get by just fine with her no nonsense approach. I know that an informal method like this will not work for most.

More Wisdom From My Mother

My mom and I continued our discussion and both speculated about individuals we know that seem to always be struggling financially. In every case, these are people with very good incomes (which is why their situations seem so curious). Mom said, "I am convinced it is not how much your income is, but what you do with your money." She is so right, and there examples all around us of people living well on modest incomes.

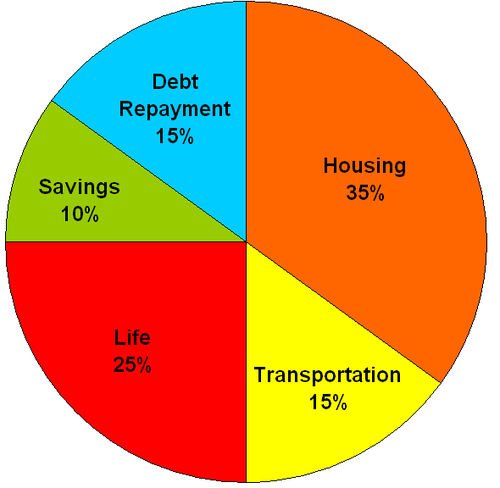

Many People Are Looking For A Pie Chart Like This To Base Their Budget On

There Is No One Size Fits All Budget Method

We constantly receive e mails from people wanting us to give them the percentages that they should be spending on various budget categories. I have never provided such a breakdown and never intend to. I really don't think that standardized percentages make any sense. If you are a single person, it is likely that you will spend a greater percentage on entertainment than a family. It is also likely that a family would spend a greater percentage on housing than a single person. None of this really matters as long as you are spending less than you have coming in.

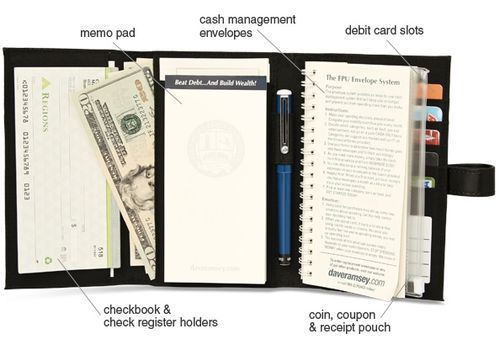

Dave Ramsey On The Envelope System

The Different Methods Of Budgeting

The first major budgeting choice you have to make is high tech or low tech. There are a ton of online and software options for setting up a budget. My recent article listing 7 Free Online Budget Tools is a good guide to some of the most popular online options. I think you simply have to know yourself here and make the right choice. I hear regularly from people that use the old fashioned ledger book approach and do just fine. Some are even still on the envelope system. This approach was made popular by Larry Burkett, and although low tech, highly effective. The old fashioned envelope system even has a new high tech platform.

My Upcoming Budget Workshop

On Wednesday night (Oct 15, 2014) at 8:05 pm Eastern Bob Yetman and I will be doing a workshop we are calling, Budget Mastery. What you will find very unique about our workshop is that we don't have our own budget system to push! This is why I think it will be the best budgeting workshop you will ever attend. What we will be doing is a review of the most popular budget methods and approaches. We will also share with you the most popular low tech and high tech options for managing your budget. Consider it an online 'budget fair.' Walk through our virtual convention center of ideas and tools and pick the ones that make sense for you.

The regular tuition of $15 applies (includes a free download of the video replay). Members of ChristianMoneyPlus go for free. Click here to sign up.

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio

October 11, 2014

If You Co-Sign, You’re Stuck

Recently, a friend asked my advice about what to do regarding a loan she co-signed for one of her children. It seems this person co-signed a car loan for a son who graduated last year from college, but he’s now having trouble coming up with the payments in a timely fashion. She’s concerned because he’s been late with some payments, and she now wants to make the obligation exclusively his. Unfortunately, I didn’t have good news for her.

It is very common for co-signers who wish to no longer be associated with the running obligation to inquire about how to be removed from the loan, thinking that key elements can be significantly augmented during its term. That is simply not the case; the loan, including the terms and the parties to it, are memorialized contractually, and the only way that material components to a loan can be changed is through a refinance, which means a new loan. The problem with that, of course, is because the present loan isn’t going so well, and the son is the one whose falling on his face regarding the obligation, there’s basically no chance that any lender will go along with a refinance in the way mom would like – he would have to qualify in his name alone, and the likelihood of that happening is nonexistent; she’s stuck.

Great Article Here By Geri Detweiler On This And Other Related Issues

I’m not going to flatly say that no one should ever, ever co-sign, because there may be an unusual circumstance that applies such that it makes sense, in one’s particular universe, to be a co-signer. However, for the vast majority of people, co-signing is simply unwise, and you would do well to generally assume that you are a permanent member of that group. The most important part of co-signing that anyone contemplating the decision must remember is that you are tied to the loan for the life of that loan. If it works out that the person for whom one is co-signing can eventually qualify for the obligation solely in his name, great, but if that cannot happen, you will remain a borrower of record for as long as the loan exists, which further means that if the loan goes bad, so will your credit.

I’m not going to flatly say that no one should ever, ever co-sign, because there may be an unusual circumstance that applies such that it makes sense, in one’s particular universe, to be a co-signer. However, for the vast majority of people, co-signing is simply unwise, and you would do well to generally assume that you are a permanent member of that group. The most important part of co-signing that anyone contemplating the decision must remember is that you are tied to the loan for the life of that loan. If it works out that the person for whom one is co-signing can eventually qualify for the obligation solely in his name, great, but if that cannot happen, you will remain a borrower of record for as long as the loan exists, which further means that if the loan goes bad, so will your credit.

The advice that I had, such as it was, is that it is incumbent upon my friend to squarely put herself into the present, daily existence of her son for the purpose of seeing to it that his financial house is appropriately in order – if it were me, I would demand to know the details of how my son is living, the amount of his income, as well as the amount of his expenses, and insist that he adhere to a budget to ensure that he can either make the payment, or, at the very least, that whatever amount I have to contribute to make up for the shortfall is as minimal as possible. As I told my friend, you did your son an enormous favor, and assume considerable risk, by co-signing for the loan and giving him access to a car that would have otherwise been unavailable, and so now that his ability or willingness to repay is in a deteriorated state, you now have the right to stick your nose in every aspect of his financial life.

This actually brings to mind something that those who insist on co-signing should do, at the outset – make the “sticking of your nose” in the other borrower’s business a consequence of what will happen if he cannot make timely payments; as long as the loan remains fully performing, all is well, but the moment it becomes in any way troubled, you will now become the personal, “in your face” financial coach until the problem goes away. However, it’s best to make this a clear, understood condition before signing, so that the person for whom you’re co-signing is not surprised when you become the warden of his new financial prison.

This actually brings to mind something that those who insist on co-signing should do, at the outset – make the “sticking of your nose” in the other borrower’s business a consequence of what will happen if he cannot make timely payments; as long as the loan remains fully performing, all is well, but the moment it becomes in any way troubled, you will now become the personal, “in your face” financial coach until the problem goes away. However, it’s best to make this a clear, understood condition before signing, so that the person for whom you’re co-signing is not surprised when you become the warden of his new financial prison.

Budgeting may well prove to be an important tool to fix the underlying problem associated with the inability to repay a debt. On this note, Jim Paris and I will be doing a comprehensive budget workshop next Wednesday, October 15, at 8:05 pm Eastern. The cost is just $15 (includes download of video replay). The workshop is free for members of ChristianMoneyPlus.

Register For The Live Workshop Click Here

Robert G. Yetman, Jr.

Managing Editor, The James L. Paris Report

October 10, 2014

Unlimited Credit Repair Help From Jim Paris

We had a huge response last week from the two hour workshop we did on credit repair. That video is still available for $15. It is also free for members of ChristianMoneyPlus. Many people were shocked to learn that they could get unlimited credit repair advice from me as a member (credit repair consultants usually charges hundreds for this service). As a member, you can submit unlimited questions to me about your credit. I will even review your credit report and give you suggestions on what to do. This is included in your $9.95 monthly membership at no additional cost.

For everyone that grabs an annual membership I want to extend the following bonuses (this offer good until midnight Eastern on October 11, 2014) -

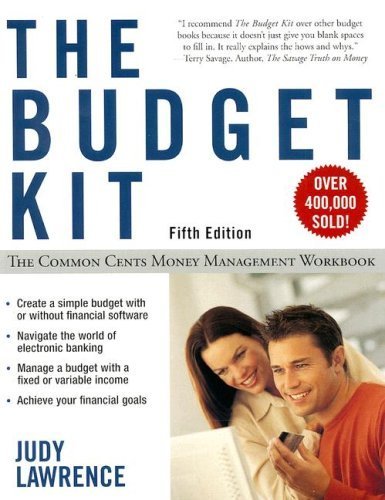

Bonus #1 The Budget Kit By Judy Lawrence

240 page book on budgeting, including all of the forms that you need to set up a complete home budget. This is my absolute favorite book on budgeting and I want to mail you your own copy.

Bonus #2 Dave Ramsey Deluxe Executive Budget Organizer

Bonus #3 A Free Ticket To My Upcoming Budget Mastery Online Workshop

Next week Bob Yetman and I will be doing an online workshop entitled, Budget Mastery. What you will find extremely unique about our training is that we are not promoting our own budget system. We are going to be providing an overview of the wide variety of methods that people use to budget, the major budget systems, free software that is available, and more. The idea here is to give you the opportunity to select the budget system that makes sense for you and your family. The workshop will be Wednesday night at 8:05 pm Eastern, but if you can't attend live you will receive a link to watch the video on replay.

There is so much more!

Budgeting and credit repair (although hugely popular) are just two areas we provide assistance on. ChristianMoneyPlus has resources to help you with virtually every area of your personal finances. Best of all, you get unlimited Q and A support on any personal finance topic. More details here

Helping you make the most of budget God's money!

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio

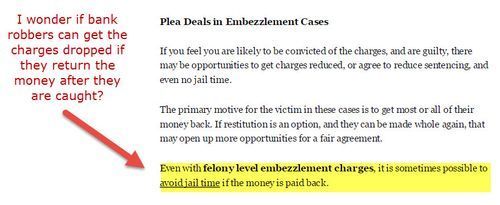

Embezzlers Pocket $28,000 For Each Month Of Prison

I published an earlier story today on a Tulsa Pastor that pleaded guilty to embezzling nearly one million dollars, and thought I might do a little more reading on other embezzlement stories currently in the news. As the victim of embezzlement myself, I find it fascinating how many cases there are each day in the news. Even more interesting is how short the prison sentences turn out to be. When an embezzler is initially arrested is when you will see most of the coverage. Reporters will routinely make completely ridiculous claims about the potential sentences when reporting on an embezzlement case. 'Faces up to life in prison' or 'if sentenced to the maximum, may serve thirty years' are typical tag lines in such stories. If you Google the phrase 'embezzler sentenced' you will (as Paul Harvey would say) know the rest of the story.

For those without a moral foundation, embezzlement represents an opportunity to become instantly rich. Even if they are caught and prosecuted, the consequences are remarkably small.

Prison Sentences For Recent Cases In The News

Nancy Dobrowski - Guilty of embezzling $650,000 from Village. Sentenced to 18 months.

Jerry Nishida - Guilty of embezzling $358,000 from the credit union where they worked. Sentenced to 13 months.

Patty E. Smith - Guilty of embezzling $500,000 from the school district where she worked. Sentenced to two years.

Travis Honaker - Guilty of embezzling $945,000 from his employer. Sentenced to three years and one day.

Leo Evans (fomer mayor of Escanaba, MI) - Guilty of embezzling $100,000 from the local Eagles Club. Sentenced to one year.

Richard Weir - Guilty of embezzling $235,000 from his local Rotary Club and the Special Olympics. Sentenced to three years.

Kathy Ann Winters - Guilty of embezzling $428,000 from her local school district. Sentenced to three years and four months.

Carol Libby - Guilty of embezzling $440,000 in donations from a crisis ministry. Sentenced to four years.

David Van Winkel - Guilty of embezzling $4.9 million from his employer. Sentenced to five years and ten months.

The Injustice Of Short Sentences For Embezzlers

I am convinced that only a small percentage of embezzlers are ever caught, and even a smaller percentage are prosecuted. In my own case, I made reports to multiple law enforcement agencies all the way up to the FBI, and not one would pursue the case. The message here is that embezzlement is a crime that really does pay. Even if you get caught, you will serve very little prison time, and will likely do so in a minimum security facility.

For the rest of us honest suckers that get up early every morning and put in a long day of work, it will take us a lifetime to accumulate this kind of money. These people leave a wake of destruction behind them, and ruin the lives of their victims. In my own case, I lost the businesses I spent most of my twenties and thirties building. I ended up having to go through bankruptcy and lost my home to foreclosure. Embezzlers are almost always guilty of not just the underlying theft, but the failure to declare this income on their tax returns. You would think just the tax evasion charges on tens of thousands of dollars would result in a tough sentence (but you would be wrong).

Embezzler Have Their Rights Too

James Santorella, the city accountant for Stamford, CT, will be allowed to keep his pension despite pleading guilty to embezzling from the city. White collar criminals can use the money they have stolen to hire the best lawyers to defend them (on the off chance that they are actually prosecuted).

Check it out for yourself on Google, defending embezzlers is a booming business. Lawyers and legal marketing firms across the country are vying for the coveted page one position in Google for the search phrase 'embezzlement defense.' Many times the embezzler is also your bookkeeper, and without good accounting records it may be impossible to prosecute them. In my own case, our accounting records for a ten year period were stolen the day I uncovered the embezzlement. It took nearly three years and thousands of dollars to piece things together. Since most accounting today is done with computer software, it is easier than ever for someone that has expertise using a program like Quickbooks to cover their tracks for years.

Embezzlement Attorneys Promise An Easy Out For Embezzlers

Once You Get Caught, Just Change Your Name

, Patrick Snetsinger relocated to California and legally changed his name to Patrick Leonard. Authorities recently caught up with Snetsinger. He has entered a not guilty plea to more than 14 counts in the indictment.

Even When You Get Caught, Embezzlement Is A Great Paying Gig

I took the above prison sentences and embezzlement totals and did a quick calculation - the results were even a bit shocking to me. In the above cases, the embezzlers pocketed more than $28,000 for each month of prison they were sentenced to. This calculation does not even take into account the likelihood of early release and parole arrangements. Yakov was right - what a country indeed.

Helping you make the most of God's money!

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio

Tulsa Pastor Pleads Guilty To $900,000 Embezzlement

The Reverend Willard Jones of Tulsa, Oklahoma changed his plea from not guilty to guilty after being confronted with what was reportedly a mountain of evidence.

The United States Attorney accuses him of stealing $930,000 from fundraising money that was to be used for a local community center. Willard be required to return cars, a mink coat, a Rolex watch, and other luxury items (included his own home) as part of the plea agreement. Funds were reportedly also used for liquor, hotels, and gambling.

After being indicted and pleading not guilty, Williams refused to step down as the pastor of his church. Oddly enough, despite changing his plea to guilty, the reverend still has supporters within his church that want him to continue on as pastor. He is free on $25,000 bond and will be sentenced in January.

Helping you make the most of God's money!

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio