James L. Paris's Blog, page 228

October 28, 2014

The End Of Cash? IRS Confiscating Accounts Of Cash Businesses

http://www.christianmoney.com Jim discusses the shocking New York Times story of the IRS confiscating the bank accounts of cash businesses, California woman stabbed to death in front of children in dispute over parking space, pastor fakes death and becomes cage fighter, woman escapes ATM attack with panic button alarm, radio talk show host Warren Ballentine convicted of mortgage fraud, Ferguson Missouri a tinder box as Grand Jury decision is imminent, and how one nurse earned more than $600,000 in overtime pay in just five years.

October 27, 2014

Double Your Financial “Power” in Retirement by Working While You Save

Tom Sightings has written a great piece for the online version of U.S. News & World Report that details both retirees’ typically most substantial expenses, as well as some ways to limit each. There’s actually a lot of good information inside of what is a relatively brief piece; to what is surely no one’s surprise, expenses like housing, health care, and taxes make the list. It is, of course, a great idea to limit one’s expenses in retirement whenever possible, but the reality is that many people will find it to be extremely helpful to double their financial power in retirement by actually making continued employment a component of retirement.

The plain truth is that the definition of retirement is changing for a lot of people – for many, many decades, retirement meant a cessation of work, outright, in our elder years, and taking all of the time we have remaining to stop and smell the proverbial roses. However, the confluence of a variety of socioeconomic factors has required many folks to reconsider just what “being retired” will mean to them – the bottom line is that fully retiring from work may no longer be synonymous with retirement, and that retirement may more commonly be seen as a status wherein the average person is still generating an income, in some form or fashion.

The good news is that working as a senior citizen no longer necessarily means having to get up each morning and going to work, in the way we commonly think of that routine; the advent of Internet-based opportunities to generate income means people can, with increasing frequency, earn additional money from home. As a matter of fact, with communications platforms, more broadly, continuing to evolve, it is now not at all uncommon for people to even work as employees for well-known companies from home. This way of earning money was just not available to our grandparents or even our parents, but it is now available to us, which means that it is more convenient than ever to further enhance our financial strength as “retirees,” and not have to rely solely on the ability to effectively cost-cut in order to stay financially viable as we age.

Robert G. Yetman, Jr.

Managing Editor, The James L. Paris Report

When Paying Off Credit Cards, It’s Tough to Beat the “Lowest Balance” Approach

These days, it’s hardly out of the ordinary for people to carry significant credit card balances. It’s not necessarily due to self-indulgent, carefree living or anything like that, but, rather, because of just how difficult it is to get by these days, in a world still characterized by economic malaise, to include rampant underemployment, which, in many respects, is worse than the outright unemployment problem plaguing the nation. One such person recently asked for my thoughts on just how to get out from under his burdensome credit card debt. His situation is not unusual: he’s a fellow with three cards, and a total balance of around $20,000. He asked me what I thought of the “highest balance” approach to paying down this obligation, as this is something he heard a financial planner recommend recently on the radio; what he’s referring to is the targeting of multiple credit card debt on the basis of focusing on the card with the highest rate, making minimum (or thereabouts) payments on the other two while applying any extra resources to the card sporting the highest rate.

To be honest, that’s not my favorite system. I prefer the “lowest balance” approach, which is what I told this gentleman. By focusing on the card with the lowest balance, without regard to the rate of that card, this tactic allows the consumer to more quickly eliminate the entire debt of one of the cards he’s currently holding. The overriding benefit of this approach is that it affords the consumer the opportunity to enjoy that inspiring feeling of accomplishment more quickly, which is so important to maintaining an ongoing, oft-times burdensome effort at achieving a significant financial objective. In my experience of having witnessed countless numbers of people engaged in debt reduction efforts, the psychological boost earned from eliminating an entire credit card balance outright trumps the intellectual satisfaction of knowing that the card with the highest rate is being targeted.

In the end, any kind of long-term effort at achieving a financial goal requires psychological self-support, and so each person has to ask himself, at the outset of whatever the undertaking is, which way of achieving the goal will, inherently, provide the most support along the way. In the case of paying down multiple debts, the sense of achievement that comes with ridding oneself of one of those obligations completely is unrivaled, which is why I like best the method that allows you to realize that goal in the fastest way possible…and why I believe you will, as well.

Robert G. Yetman, Jr.

Managing Editor, The James L. Paris Report

October 25, 2014

4 Reasons To Get A Business Credit Card

Even if you operate a very small home business, there are some good reasons to consider getting a business credit card.

1. Establishing credit for your business is an important milestone that might really pay off down the road. Whether it is taking the step to lease your first office space, or apply for terms with a supplier, your business credit will become a valuable asset.

2. Having a business credit card gives you a simple way of segregating your business and personal expenses.

3. Business credit cards have recently been offering enormous rewards in the form of airline mileage points. In some cases, I have read stories of people earning a free round-trip airfare for obtaining just a single business credit card.

4. Doing business solely in your personal name leaves you open to the greatest amount of personal liability. A business credit card will help your business to build a credit profile separate from your personal credit score. It may allow you to enter into loans, leases, and contracts without the need of a personal guarantee. If you get into trouble with your business at some point in the future, you will be in a much better position to negotiate with creditors if you are not personally liable for the business' debts.

It is interesting to note that most business credit card issuers don't necessarily require that you have a corporation or even a separate taxpayer ID. Apparently, even if you are simply using your Social Security number to apply, you can do so as a 'business.' I guess this rather informal approach takes into account the tens of thousands of people that operate a small home based enterprise without the formalities of incorporating or even listing a business name with their local county (also known as DBA 'doing business as').

Helping you make the most of God's money!

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio

October 24, 2014

Radio Host Faces 30 Years In Prison For Mortgage Scam

He called himself the 'People's Lawyer' and claimed that his nationally syndicated radio show had 3 million listeners. His name is Warren Ballentine, and it took a jury less than 90 minutes today to convict him on six counts related to a $10 million dollar mortgage scam.

Ballentine was not expecting a guilty verdict. Reports are that he was calling this vindication week, and both he and his 35,000 Facebook followers expected an acquittal. The allegations against Ballentine were that he used so called straw buyers to purchase real estate that they never intended to live in. The government says that he coached these mortgage applicants to lie.

This post appeared On Ballentine's Facebook page Friday afternoon

Ballentine is an attorney and a former prosecutor. His show focused on the theme of black empowerment, and was syndicated by Radio One. His big name guests have included President Obama, Hillary Clinton, and Al Sharpton. He faces up to 30 years in prison.

Helping you make the most of God's money!

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio

7 Airfare Alert Services That Hunt For Cheap Plane Tickets 24/7

One of my favorite ways to find cheap plane tickets is to set a 24/7 alert at an airfare deal monitoring site. These services are amazing and every so often you can even jump on a 'mistake' airfare. You have no doubt heard the stories where the airline accidentally sold a ticket for $20 that was supposed to be $200; the people that get these deals are usually set up with 24/7 airfare monitoring. It is free to set up these alerts, and there are a number of different sites with a wide array of features to choose from. The best way to take advantage of airfare alerts is to be as flexible as possible on your travel dates and jump on a deal when it becomes available.

Here is a great list -

Airfare Watchdog (my favorite)

Helping you make the most of God's money!

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio

October 23, 2014

Georgia Woman Loses Home Over $94.85

CBS Atlanta is reporting that a woman lost her condo to auction over an unpaid tax bill in the amount of $94.85. The woman, Xui Lui, says she never received any of the notices of the unpaid tax or the anouncement of the auction of her home. It turns out that the city of Norcoss, GA was using an incomplete address. This, in turn, led to the letters being returned to the city's office as 'undeliverable.' Reports are that the letters did not even include a street name. The city apparently had no procedure to deal with the multiple letters that were returned.

Last week Lui did finally receive a properly addressed letter. It was the notice informing her that her home had been sold and that she had until November 25 to move out. What is especially tragic is that the woman purchased the home in 2011 for cash and owned it free and clear. She lives there with her four year old child. The city said that they don't know what can be done now that the condo has been legally sold. The city manger, Rudolph Smith, told CBS Atlanta on Monday that they are trying to work something out.

The Atlanta Journal Constitution is reporting today that Lui will be able to keep her home if she pays a $300 late fee.

Helping you make the most of God's money!

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio

October 22, 2014

Weird Trick Can Put Your eBook On The Top Of Amazon's Search Results

Many first time eBook authors spend little time doing advance research on their topic prior to writing their book. Why spend the time writing even a short eBook unless you know in advance that there is a demand for it? Well, this is one of those sound bites that is great to use if you are teaching an eBook workshop, but not always easy to follow through on.

It can be difficult to determine how popular a topic really is at Amazon, and then there is the issue of competition. Even if you select a topic that is in high demand from readers, there may be such stiff competition that you still don't achieve much with your sales efforts. So, the trick is to pick a niche with an existing demand that is not overly competitive. So, how do you do that?

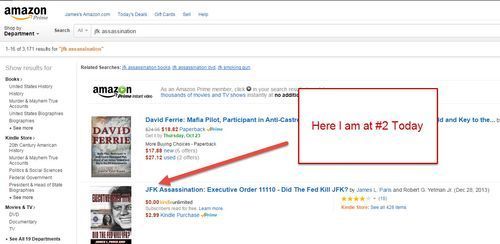

I stumbled across an interesting software program that does Amazon keyword research. I am still experimenting with it, and I will have a more complete report later. At this point, I can tell you that I will be using this software as a major resource to help me decide on what eBook topics to pursue. I should also add that there is the very important issue of titles and descriptions that are keyword optimized. Take for example my book on the JFK assassination. By including the phrase 'JFK Assination' in the title I am boosted to position 1 or 2 in the Kindle store.

I don't want to lead you to believe that you can trick Amazon into selling a ton of books for you by gaming the system. You still need to have a well written book and a great cover. To make a full time living as an author you need to build a following of readers. If your books are simply lost in the sea of other options at Amazon, you will never even get to first base. This is why I would highly recommend grabbing Kindle Samurai.

Also, check out my new video on how to write short eBooks and our overall eBook training program.

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio

Domain Investor Draws Ire For Ebola.com Asking Price Of $150,000

Jon Schultz bought the domain name Ebola.com for $13,500 in 2008. Now, Schultz is offering the domain for sale for $150,000. Many are downright angry at Schultz for what they consider to be 'profiting from a disease.' Reports are that Schultz owns quite a few disease inspired domains, including H1N1.com and Birdflu.com.

I heard one news anchor even suggest that the government should just take away his Ebola.com domain. Of course, the idea of buying domain names and holding them as an investment is nothing new. Domaining, as it is called, is a booming business and many people buy and sell domains like a portfolio of stocks. This is all pure speculation, and domain investors like Schultz are playing long odds in many cases. Not only is there the upfront cost of acquiring a premium domain, but then there are the annual renewal fees.

There are a couple of reasons that the right domain name can be highly valuable. First, many people will go to the Internet and simply type in a topic and then add the .com to it (e.g. shoes.com). This direct traffic can be worth millions of dollars. Secondly, the search engines will steer people toward .com domains that contain a given search phrase. Selecting a domain for a new website is a huge ingredient in capturing website traffic. In my Internet business coaching program, I regularly address this issue.

Flippa.com, one of the top sites for buying and selling premium domains, is an interesting site to spend a few minutes on. It is really remarkable how much certain domains sell for and the amount of bidding that takes place. In the case of Schultz, I do think he has an extremely weird niche (diseases), but to each his own. As for the notion that the government should just take it away from him, I can't believe anyone would even suggest that. There are a lot of people that make money from diseases and even death. Why should Schultz be singled out?

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio

Prison Nurse Earns $630,000 In Overtime Pay

Well, you know all of those articles that you read that say nursing is a good profession to go into? it turns out that they are right. Her name is Mercy Matthews, and USA Today is reporting that she owns a home worth nearly a half million dollars, and during the most recent five years was paid $630,000 for overtime. She is a nurse at the Bedford Hill's Correctional Facility For Women.

The New York Department Of Corrections has refused to answer questions about the details of Matthew's enormous overtime, or whether or not she was paid to sleep overnight at the prison. Her regular shift was 3 to 11 pm, but she typically did not clock out until 7:30 am (the next day). The local media had to file suit to obtain Matthew's time cards, as their Freedom Of Information requests were denied. Some are making reference to her as the 'bionic nurse' for the number of hours she has worked, others are wondering if all of this overtime is on the up and up.

James L. Paris

Editor-In-Chief ChristianMoney.com

Follow Me on Twitter Twitter.com/jameslparis

Christian Financial Advice

Jim Paris 24 Hour Radio