Ezra Klein's Blog, page 894

February 18, 2011

Less spending on government doesn't mean less government spending

Last night, House Republicans cut $131 million from the budget of the Securities and Exchange Commission. Another proposal would slash a billion dollars from Social Security administrative budget. It fits the GOP's broader approach to cutting federal spending: the best way to shrink government to, well, shrink government. Fire the people who run it. And they're not exempting themselves. They've proposed cutting Congress's budget for the remainder of the fiscal year by about $100 million.

But the money they'll save in the next year with these cuts might end up dwarfed by the money we'll spend over the next decade because of these cuts. Looking back, the absolute best investment the federal government could have made between 2000 and 2005 would've been regulators able to see and stop what was happening on Wall Street. Missing the bubble and the build-up of risk cost us trillions.

Same goes for Social Security. You could imagine a number of reforms that would reduce the program's long-term spending. But cutting its administrative budget -- which is already extremely lean -- doesn't mean less spending. It probably means more fraud, as there are fewer inspectors able to check up on questionable disability claims.

Similarly, it's hard to write legislation well without the necessary staff. If members of Congress have to cut staff or cut staff pay, that means either less staff, or worse staff. But it doesn't mean that constituents and interest groups and party organizations will want less legislation overall. The answer? Lower-quality legislation, with more technical mistakes, unintended consequences and missed targets. Congress might've saved a few bucks by hiring a couple fewer legislative aides, but we might spend a lot more than that to clean up the shoddy work that comes from an overworked, underpaid office.

This is budget cutting for show: It's about ostentatious displays of belt tightening now rather than intelligent decisions that will reduce spending later. But like an ill patient who tries to save a few bucks by skipping a prescription only to end up in the hospital with much larger bills, we may well come to regret it.

How online retail is starving states

Speaking of state budgets, Kevin Drum brings up an important issue that's largely flying under the radar. One of the main ways state governments fund themselves is through collecting sales tax. But you can't collect sales tax on Internet retailers who aren't based in your state. And, as you can see in the graph atop this post, they're accounting for a lot of retail these days -- $44 billion in the last quarter alone, or about 4.3 percent of total sales. That total, as you might imagine, is rising steadily, and states that rely on sales taxes are finding they're raising less and less.

Speaking of state budgets, Kevin Drum brings up an important issue that's largely flying under the radar. One of the main ways state governments fund themselves is through collecting sales tax. But you can't collect sales tax on Internet retailers who aren't based in your state. And, as you can see in the graph atop this post, they're accounting for a lot of retail these days -- $44 billion in the last quarter alone, or about 4.3 percent of total sales. That total, as you might imagine, is rising steadily, and states that rely on sales taxes are finding they're raising less and less.

There's an easy answer to this: Shift over to income taxes, or some other kind of tax. But conservatives in state government won't allow that to happen. And in a state like California, where you need a two-thirds majority to raise taxes, they've got the veto power to keep it from happening. Drum comments:

This is a good example of what Jacob Hacker and Paul Pierson call "policy drift" in Winner Take All Politics ... state and local tax revenues will decline not because of any active change in public policy, but because Congress has chosen to sit idly by. Conservatives will succeed in starving government simply by doing nothing to respond to a technological change.

Unions aren't to blame for Wisconsin's budget

Let's be clear: Whatever fiscal problems Wisconsin is -- or is not -- facing at the moment, they're not caused by labor unions. That's also true for New Jersey, for Ohio and for the other states. There was no sharp rise in collective bargaining in 2006 and 2007, no major reforms of the country's labor laws, no dramatic change in how unions organize. And yet, state budgets collapsed. Revenues plummeted. Taxes had to go up, and spending had to go down, all across the country.

Blame the banks. Blame global capital flows. Blame lax regulation of Wall Street. Blame home buyers, or home sellers. But don't blame the unions. Not for this recession.

Of course, the fact that public-employee pensions didn't cause a meltdown at Lehman Brothers doesn't mean they're not stressing state budgets, and that the pensions they've been promised don't exceed what state budgets seem able to bear. But the buildup of global capital that overheated the American housing sector and got packaged into seemingly riskless financial products that then brought down Wall Street, paralyzing the economy, throwing millions out of work, and destroying the revenues from state income and sales taxes even as state residents needed more social services? The answer to that is not to end collective bargaining for (some) public employees. A plus B plus C does not equal what Gov. Scott Walker is attempting in Wisconsin.

In fact, it particularly doesn't work for what Walker is attempting in Wisconsin. The Badger State was actually in pretty good shape. It was supposed to end this budget cycle with about $120 million in the bank. Instead, it's facing a deficit. Why? I'll let the state's official fiscal scorekeeper explain (pdf):

More than half of the lower estimate ($117.2 million) is due to the impact of Special Session Senate Bill 2 (health savings accounts), Assembly Bill 3 (tax deductions/credits for relocated businesses), and Assembly Bill 7 (tax exclusion for new employees).

In English: The governor called a special session of the legislature and signed two business tax breaks and a conservative health-care policy experiment that lowers overall tax revenues (among other things). The new legislation was not offset, and it turned a surplus into a deficit. As Brian Beutler writes, "public workers are being asked to pick up the tab for this agenda."

But even that's not the full story here. Public employees aren't being asked to make a one-time payment into the state's coffers. Rather, Walker is proposing to sharply curtail their right to bargain collectively. A cyclical downturn that isn't their fault, plus an unexpected reversal in Wisconsin's budget picture that wasn't their doing, is being used to permanently end their ability to sit across the table from their employer and negotiate what their health insurance should look like.

That's how you keep a crisis from going to waste: You take a complicated problem that requires the apparent need for bold action and use it to achieve a longtime ideological objective. In this case, permanently weakening public-employee unions, a group much-loathed by Republicans in general and by the Republican legislators who have to battle them in elections in particular. And note that not all public-employee unions are covered by Walker's proposal: the more conservative public-safety unions -- notably police and firefighters, many of whom endorsed Walker -- are exempt.

If you read Walker's State of the State address, you can watch him hide the ball on what he's doing. "Our upcoming budget is built on the premise that we must right size our government," he said. "That means reforming public employee benefits -- as well as reforming entitlement programs and reforming the state's relationship with local governments." Not a word on his actual proposal, which is to end collective bargaining for benefits.

If all Walker was doing was reforming public employee benefits, I'd have little problem with it. There's too much deferred compensation in public employee packages, and though the blame for that structure lies partially with the government officials and state residents who wanted to pay later for services now, it's true that situations change and unsustainable commitments require reforms. But that's not what Walker is doing. He's attacking the right to bargain collectively -- which is to say, he's attacking the very foundation of labor unions, and of worker power -- and using an economic crisis unions didn't cause, and a budget reversal that Walker himself helped create, to justify it.

And it's not as if public employees aren't hurting. In the Wisconsin budget report I quoted earlier, the state's fiscal bureau goes on to survey the state of the economy. "Going forward, Global Insight expects private sector payrolls to grow by 2.1 million in 2011, 2.6 million in 2012, and 2.5 million in 2013. Projected cutbacks in the number of public sector employees, however, are expected to partially offset those private sector gains. In 2010, the number of state and local government employees fell by an estimated 208,000 positions. In 2011, those cutbacks are expected to total an additional 150,000 positions." In other words, private jobs are coming back, but state and local jobs are still being lost. Public-employee unions are on the mat. Walker is trying to make sure they don't get back up.

Featured Advertiser

Wonkbook: Wisconsin heats up; Boehner risks shutdown; health care defunding begins

By Dylan Matthews

Matthews is writing Wonkbook while Ezra is traveling.

Top Stories

Obama is siding with state workers in Wisconsin's state budget brawl, report Brady Dennis and Peter Wallsten: "President Obama thrust himself and his political operation this week into Wisconsin's broiling budget battle, mobilizing opposition Thursday to a Republican bill that would curb public-worker benefits while planning similar action in other state capitals. Obama accused Scott Walker, the state's new Republican governor, of unleashing an 'assault' on unions in pushing emergency legislation that would nullify collective-bargaining agreements that affect most public employees, including teachers... By the end of the day, Democratic Party officials were working to organize additional demonstrations in Ohio and Indiana, where an effort is underway to trim benefits for public workers."

John Boehner is threatening a government shutdown in the absence of immediate budget cuts, report Paul Kane and Shailagh Murray: "As the House continued its marathon debate Thursday over a bill to fund the federal government, House Speaker John A. Boehner (R-Ohio) acknowledged that Congress might not reach agreement over spending cuts before the government runs out of money next month. But Boehner ruled out passing a temporary funding resolution to keep the government operating unless it contained at least some spending cuts. Democratic leaders in the Senate said that position increased the risk of a federal shutdown. The government is currently operating under a temporary funding measure, which expires March 4."

House Republicans have begun in earnest the effort to defund health care reform, reports N.C. Aizenman: "Republicans launched this week the first of what they vow will be a series of attempts to use their control of the House of Representatives to defund the health-care overhaul law. Rep. Denny Rehberg (R-Mont.) offered an amendment to the pending bill to fund the final seven months of this year's budget...that would prohibit administration officials from using any of the money to implement the health-care law. The proposal appears likely to make it into the final version of the budget bill that the House is about to vote on. But the defunding effort faces two major obstacles: Democrats control the Senate and the White House, and nearly all funds the federal government will need to implement the law were appropriated in the law itself."

Late-night hip hop interlude: Odd Future play "Sandwitches" on Late Night with Jimmy Fallon.

Still to come: The House's budget cuts are getting deeper by the day; the Justice Department wants an anti-health care reform judge's help in moving implementation forward; the House voted to block net neutrality rules; a judge is forcing the administration to settle on an offshore drilling policy; and an all-too-literal cat burglar.

Economy

The amendment process in the House is making cuts deeper and deeper, reports David Rogers: "With tensions rising, House Republicans pushed through a third long night, hoping to win passage late Friday of more than $60 billion in immediate spending cuts that would severely affect agencies in the second half of this fiscal year. The leadership put the brakes on deep additional cuts, but a school reform program important to President Barack Obama would be decimated by a $336 million reallocation of funds approved by 249-179. The National Endowment of the Arts narrowly lost an additional $22.5 million. And in a blow to the president, Democrats failed to restore $131 million for the Securities and Exchange Commission, facing new responsibilities under Wall Street reforms enacted in the last Congress."

A "Gang of Six" is behind the bipartisan debt reduction effort: http://wapo.st/gzPVZM

Financial regulators told Congress yesterday that budget cuts are hurting their work, reports Brady Dennis: "The Securities and Exchange Commission, led by Mary Schapiro, and the Commodity Futures Trading Commission, headed by Gary Gensler, are wrestling with how best to bring transparency and oversight to the vast 'over-the-counter' financial derivatives and swaps markets. Schapiro and Gensler told the panel that budget pressures are hampering their efforts. Schapiro said the SEC has had to restrict hiring, cut travel and put technology updates on hold. 'And that's having an impact on our ability...to achieve our core mission as effectively as we could,' she said. Gensler said the trading commission needs to expand to be able to manage its mission."

Elizabeth Warren has hired three people from the financial sector as deputies at the Consumer Financial Protection Bureau: http://on.wsj.com/eA4x8r

The administration is skeptical of plans for a corporate tax holiday, reports John McKinnon: "Amid a growing corporate push for a tax holiday, the Treasury Department's top tax official reiterated concerns about letting U.S. multinationals bring home hundreds of billions of dollars in overseas profits at low tax rates. For decades, U.S. tax policy has allowed multinational corporations to defer taxation of much of their overseas earnings until the money is brought home--or repatriated--to the U.S. By now, more than $1 trillion of U.S. corporate earnings is parked offshore, according to estimates. But companies have been reluctant to bring it back to the U.S., because of the relatively high U.S. tax rates they face."

Obama needs to lead on the deficit in public, not negotiate in private, writes David Brooks: http://nyti.ms/fJH87O

It'll take a liberal president to make progress on the deficit, writes GOP Senator Tom Coburn: "For the president, dealing with our debt threat could be his "Nixon goes to China" moment. Only a liberal Democratic president may be able to reform entitlements. Fortunately for the president, those of us who backed his own debt commission's plan have already gone to China. Sens. Dick Durbin (D-Ill.) and Kent Conrad (D-N.D.) committed the heresy of backing some entitlement reform. Sen. Mike Crapo (R-Idaho) and I backed tax reform that would lower rates dramatically, stimulate economic growth and generate revenue by doing away with dysfunctional subsidies such as that for ethanol...If the president decides to go to China, he'll find plenty of company. We're all waiting for him."

Adorable animals robbing people interlude: San Mateo's all too literal cat burglar.

Health Care

The Justice Department wants a judge who declared health care reform unconstitutional to okay its implementation, reports Jennifer Haberkorn: "The Justice Department on Thursday asked the Florida judge who struck down the health care overhaul to declare that the law must still be obeyed...Vinson last month struck down the entire health care reform law as unconstitutional, which has caused confusion for the states and federal government about whether they have to proceed with implementation. Some legal scholars and opponents of the law, including the governors of Alaska and Florida, believe the ruling has the effect of an injunction against the law, though Vinson declined to issue one."

House budget chair Paul Ryan's budget proposal will include major Medicare and Medicaid reforms: http://politi.co/eKBNen

We need more health care reform, not "entitlement" reform, writes Paul Krugman: "What would a serious approach to our fiscal problems involve? I can summarize it in seven words: health care, health care, health care, revenue. Notice that I said 'health care,' not 'entitlements.' People in Washington often talk as if there were a program called Socialsecuritymedicareandmedicaid, then focus on things like raising the retirement age. But that's more anti-Willie Suttonism. Long-run projections suggest that spending on the major entitlement programs will rise sharply over the decades ahead, but the great bulk of that rise will come from the health insurance programs, not Social Security."

No one man should have all the power health care reform gives the HHS secretary, writes former Secretary Michael Leavitt: http://wapo.st/h0eB9G

Domestic Policy

The House voted to end funding for enforcing net neutrality rules, reports Cecilia Kang: "House Republicans voted Thursday to prohibit the Federal Communications Commission from using funds to carry out net neutrality regulations created last December. The vote was on an amendment to the continuing resolution introduced earlier this week by Communications and Technology subcommittee chairman Rep. Greg Walden (R-Ore.). Sens. Kay Bailey Hutchison (R-Tex), Mitch McConnell (R-Ky.), and John Ensign (R-Nev.) on Wednesday introduced a similar amendment aimed to knock down the FCC's rules that prohibit Internet service providers from blocking or arbitrarily slowing traffic on their networks. Ultimately, the amendment needs to pass both chambers and not be vetoed by President Obama."

Obama traveled to Silicon Valley to court the support of Steve Jobs, Mark Zuckerberg, Eric Schmidt, and others: http://politi.co/hA5KDp

Education secretary Arne Duncan has voiced support for Wisconsin's teachers, reports Jennifer Epstein: "Education Secretary Arne Duncan is voicing support for the teachers pushing back against governors in Wisconsin and elsewhere across the country who are directly taking on teachers' unions...'Governors across the country are facing, you know, tough budget issues - as the president is here - but we have to support our hardworking teachers and make sure that we do everything we can to help them do the critically important work they do every single day in the classroom,' Duncan said...Nonetheless, Duncan said he thinks there's room for everyone to compromise."

The Senate has passed an aviation "jobs bill": http://politi.co/ebQ7Ow

Sen. Pat Leahy's bill to fight Internet piracy goes too far, writes Brad Plumer: "Leahy's bill...gave the Attorney General the power to order websites accused of pirating to cease their activities, and, what's more, it required the supporting companies a website needs to thrive--the financial transaction providers, the search engines, the advertisers, and the ISPs--to stop doing business with the offending site...Trouble is, identifying genuine infringers isn't always so straightforward--and there's always the prospect that overly broad powers could be abused by the government. After all, it's one thing to go after a site that allows you to stream pirated movies. But what about a blog that merely links to said site--or an online discussion forum where members talk about the best places to downward bootleg films? "

'80s flashback interlude: The music video / trailer for Take Me Home Tonight.

Energy

The Obama administration has to decide on its drilling policy within the next month, report Stephen Power and Russell Gold: "A federal judge ordered the Obama administration to decide within 30 days whether to grant a set of five permits for deep-water drilling projects in the Gulf of Mexico, saying the administration's inaction on the requests is 'increasingly inexcusable.' The order, by Judge Martin Feldman of the U.S. District Court for the Eastern District of Louisiana, ratcheted up the pressure on the administration, which last fall lifted a months-long moratorium on deepwater drilling but has yet to grant any permits to drill new oil or natural-gas wells at depths greater than 500 feet."

A majority of voters in both parties oppose stripping the EPA of its ability to regulate climate change: http://bit.ly/fjs97z

Dylan Matthews is a student at Harvard and a researcher at The Washington Post.

February 17, 2011

Reconciliation

Recap: Why Social Security is a likelier target for reforms than Medicare or Medicaid; a realpolitik argument for why John Boehner is running an unexpectedly open House; and why this might be a good moment for a "grand bargain."

Elsewhere:

1) The case against cutting Social Security.

2) I've been slow to wake up to the importance of what's going on in Wisconsin. More on that tomorrow.

3) How you filibuster in the Wisconsin Senate.

4) Where Wisconsin's budget shortfall comes from.

A good moment for a grand bargain?

I take Digby's skepticism of grand bargains seriously. I also think that many in the GOP are cynically leveraging the deficit to argue for conservative policy priorities. As we've seen a couple of times now, when deficit reduction comes into conflict with tax cuts, tax cuts win. They win, in fact, every time, and have won every time since Ronald Reagan.

But that doesn't mean the deficit isn't a real problem. My best guess is we have something like five to eight years where we can sustain both the debt load we're carrying now and the debt load we're projected to be carrying in the future. And even before then, interest on the debt is getting a little nuts. As Steve Mufson notes: "Starting in 2014, net interest payments will surpass the amount spent on education, transportation, energy and all other discretionary programs outside defense. In 2018, they will outstrip Medicare spending. Only the amounts spent on defense and Social Security would remain bigger under the president's plan." The graph atop this post -- click on it to make it larger -- tells a similar story.

So I think the question is whether we want to deal with that debt now or later. At the moment, the White House is occupied by Barack Obama, and the Senate is led by Harry Reid. It's possible that the composition of the government will be friendlier than that to progressives in six or eight years, but I wouldn't bet a lot of money on it. Democrats look likely to face a rough couple of election cycles in the Senate, and even assuming Obama gets reelected, it's fairly rare for the same party to hold the presidency for more than eight years.

Which is all to say that if you think a deal on deficit reduction has to happen at some point, this might be a better moment than most. That doesn't mean that the plans that people propose should be accepted uncritically, or even accepted at all. That'll depend on the policy recommendations they contain. But it's not an obviously bad context for a grand bargain.

A deal based on the Fiscal Commission would include higher taxes

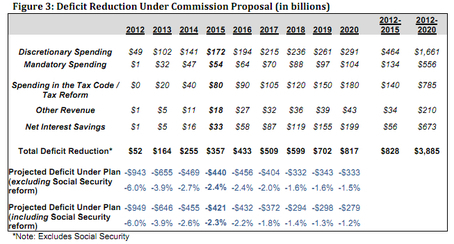

There's a bit of talk about the Warner/Chambliss/Durbin/Crapo/Coburn/Conrad effort to make legislation out of the Fiscal Commission's final report. Jon Chait and Steve Benen are annoyed, however, to read in Jonathan Weissman's article that "the deficit commission's version of tax reform would net $180 billion in additional revenues over 10 years." Chait notes that $180 billion would mean there's "nearly ten times as much spending cuts ($1.7 trillion) as higher revenue ($180 billion.) ... It's so nuts I'm tempted to assume this story couldn't possibly be correct."

At least as far as the Fiscal Commission's report goes, Chait is right and the number is incorrect. "Weisman said that the Fiscal Commission got $180 billion in tax revenue relative to the baseline over ten years," one of the commission's staff members told me. "That's wrong. The tax reform piece brought in $180 billion in 2020 alone, and $785 billion over ten years." You can see that in the table atop this post, which comes from the report.

I guess it's possible that the senators themselves have decided to edit the Fiscal Commission's report so it includes $600 billion less in tax revenue, but no one I've spoken to in those offices seems to think that's happened. So I'll try to get a firmer statement on this in one direction or the other and report back. But for now, my understanding is that the idea is to make the Fiscal Commission's report into legislation, not radically change its mix of revenues and spending cuts, and so I'd assume they're still targeting $785 billion.

But one thing to note: The baseline the Fiscal Commission was using assumed the expiration of the high-income tax cuts. So the way to think of the tax increases they recommended was that first the Bush tax cuts for income over $250,000 would expire, and then you would reform the tax code and add $785 billion in revenues. In a world where none of the Bush tax cuts are allowed to expire, the $785 billion doesn't get revenues anywhere near where the Fiscal Commission's report said they should be.

Lunch break

Rise of the robots

"Jeopardy!" master Ken Jennings got beat by IBM's trivia-playing computer Watson. Here's what he learned:

Playing against Watson turned out to be a lot like any other Jeopardy! game, though out of the corner of my eye I could see that the middle player had a plasma screen for a face. Watson has lots in common with a top-ranked human Jeopardy! player: It's very smart, very fast, speaks in an uneven monotone, and has never known the touch of a woman. But unlike us, Watson cannot be intimidated. It never gets cocky or discouraged. It plays its game coldly, implacably, always offering a perfectly timed buzz when it's confident about an answer. Jeopardy! devotees know that buzzer skill is crucial—games between humans are more often won by the fastest thumb than the fastest brain. This advantage is only magnified when one of the "thumbs" is an electromagnetic solenoid trigged by a microsecond-precise jolt of current....

IBM has bragged to the media that Watson's question-answering skills are good for more than annoying Alex Trebek. The company sees a future in which fields like medical diagnosis, business analytics, and tech support are automated by question-answering software like Watson. Just as factory jobs were eliminated in the 20th century by new assembly-line robots, Brad and I were the first knowledge-industry workers put out of work by the new generation of "thinking" machines. "Quiz show contestant" may be the first job made redundant by Watson, but I'm sure it won't be the last.

The sentient computers of the future are going to think it pretty hilarious that a knowledge-based showdown between one of their own and a creature with a liver was ever considered a fair fight.

Ezra Klein's Blog

- Ezra Klein's profile

- 1106 followers