Ezra Klein's Blog, page 2

March 17, 2014

The housing recovery is leaving minorities behind

Daniel Acker/Bloomberg

It's hard to get a mortgage right now – not just relative to the free-for-all days at the height of the housing boom, but compared even to what now feels like the housing market's last moment of "normal." Let's call that, say, 2001. Back then, lenders weren't doling out loans with the gleeful abandon of the housing bubble. But they were considerably more welcoming than they are today of would-be homeowners without pristine credit.

If we compare the housing market today to this pre-bubble moment, many people who might have qualified for mortgages by 2001 credit standards are walking away empty-handed. In some sense, their loans have gone "missing," a casualty of today's abnormally tight credit.

Exactly how many loans are we talking about? Using the most recent data from 2012, Laurie Goodman, Jun Zhu and Taz George at the Urban Institute's Housing Finance Policy Center peg the number at about 1.2 million. That figure represents would-be borrowers who would have met the credit standards for a mortgage before the bubble ever inflated. These are not your 25-year-old baristas buying a first condo on $30,000 a year circa 2005. These are individuals and families whose credit would have qualified them for a home loan at just about any other moment in recent history.

Look even closer at who's contained within this group, and another cruelty of the housing market emerges: Minorities who disproportionately lost wealth during the housing bust are now disproportionately left out of the recovery, too.

Minority borrowers tend to be over-represented among lower FICO scores. That means that as credit expands (as it did during the boom), the housing market opens up to more minorities; as it contracts, it drops them. "When credit was very, very loose at exactly the wrong time, they were able to get into the market," Goodman says. "Now this is a very good time to get into the housing market, and it’s exactly a time when credit is unusually tight."

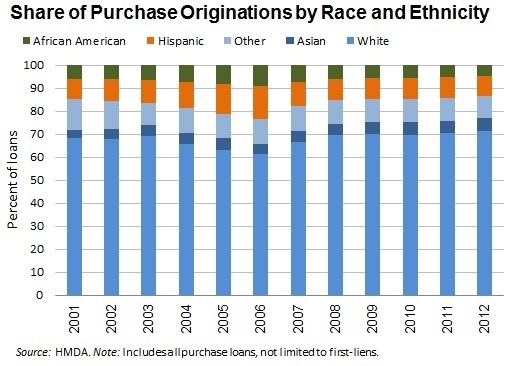

This chart, from Goodman's latest analysis with Zhu and George, illustrates how the minority share of new home purchase loans has shifted over the last decade (using data from the Home Mortgage Disclosure Act):

Urban Institute

Between 2001 and 2005, the total number of such mortgages that went to black homebuyers jumped by 102 percent. For Hispanics, it jumped by 129 percent (the comparable number for non-Hispanic whites over the same time period was 41 percent). Then, just as dramatically as the number of mortgages to minority homebuyers swelled during the boom, it has tumbled since then.

In 2001, black borrowers represented 6 percent of all these loans. By 2005, their share was up to 8 percent. Now it's down to 5 percent. For Hispanics, the proportion shifted from 9 up to 13 percent, back down to 9 percent again. That means their share of new home purchase loans has declined even as the Hispanic share of the U.S. population has risen.

No doubt some minorities who were targeted with predatory loans during the mid-2000s saw their credit ruined as a result. But the above chart reflects a larger trend: tight credit disproportionately excludes minorities. At the beginning of a recovery – as housing prices are relatively affordable – that also means that minorities in particular are losing out on a chance to build up wealth when the breakdown of who's getting loans looks dauntingly like this:

Urban Institute

Here’s why the gender wage gap hasn’t budged in a decade

The progress in closing the gender wage gap has stalled -- but not for the reasons you might think.

The problem is not that women’s earnings aren’t keeping pace with men’s. In fact, over the past decade, men’s wages have fallen. The problem is that women’s wages haven’t grown much.

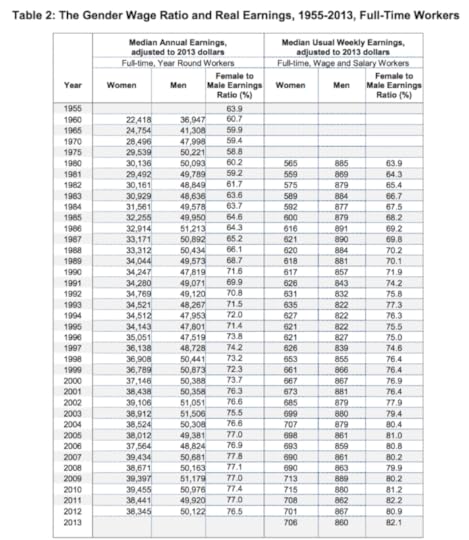

That finding is highlighted in a new report to be released today by the Institute for Women’s Policy Research. In 2003, the median usual weekly earnings for women who worked full-time was $699, adjusted for inflation. Men earned $880 a week. The ratio of female-to-male earnings was 79.4.

Fast forward to 2013. Men’s wages fell $20 to $860 over the decade. But despite that drop, the earnings ratio only crept up to 82.1. The culprit? All but stagnant wages for women, which rose $7 to $706.

“Basically, no progress,” said Heidi Hartmann, IWPR president.

In the 1980s and ‘90s, women’s rising real earnings drove much of the narrowing of the gender wage gap. Men’s earnings fluctuated during that period, up some years and down others. But women steadily brought home more bacon. Median usual weekly earnings jumped from $565 in 1980 to $617 in 1990 and then to $667 in 2000. The trend holds using annual earnings as well, though data from last year is not yet available.

Source: Chart by Institute for Women's Policy Research. Annual median earnings data from Census Bureau. Median usual weekly earnings data from Bureau of Labor Statistics.

In an ideal economy, wages for both men and women would be rising, with the latter at a slightly faster pace to close the gap. But that’s not how the real world worked. Hartmann said that improvements in the wage gap since 1975 have generally occurred when women’s earnings were rising and men’s were steady or falling. Now that women’s wages are stalling, so is progress on the wage gap.

Hartmann surmises some of the factors holding back wages could be the levelling off of the number of women in the workforce, particularly in traditionally male jobs. In addition, historically female jobs, such as teachers and clerical workers, fared poorly in the aftermath of the Great Recession.

“The fact that it’s gone on so long is discouraging. Women are getting the education. They’re out there working,” Hartmann said. “Where’s the progress?”

Obama administration wants fewer people to get insurance cancellation notices

(REUTERS/Jessica Rinaldi)

After insurance policy cancellations created a huge political headache for the Obama administration last fall, the administration has offered a plan to reduce the cancellations going forward.

The administration has proposed laxer standards for defining what constitutes a modification of an existing insurance policy instead of the cancellation of a health plan.

The proposal came in a batch of HHS rules and guidance issued around 7:15 pm on a Friday. My Friday night post focused on the administration’s decision to broaden exchange provider networks and increase federal oversight after some early backlash aimed at limited networks this year. The HHS rule dump contained all sorts of policy proposals that will influence how Obamacare is implemented in 2015 and beyond.

That includes this new policy on plan cancellations. The administration has proposed letting insurers make more tweaks to benefits and cost-sharing when it comes time to renew health plans. If the changes meet certain conditions, insurers would consider that a continuation of an existing plan instead of the cancellation and creation of a new plan.

HHS clearly spells out in the proposed rule the motivation for the change: “We believe these proposed standards will minimize unnecessary terminations of coverage, ensuring predictability and continuity for consumers, while reasonably providing issuers the flexibility to make necessary adjustments to coverage.”

The HHS proposal doesn’t spell out how many fewer cancellations it expects as a result of this change. Estimates peg the number of individual health plan cancellations last year at around 4-5 million. Of course, some of those people were offered new plans by the insurers, but the headlines about cancellations were politically damaging. This latest proposal seems to be the administration's latest effort to help bring that number down.

This is the biggest decision Janet Yellen will have to make at her first Fed meeting

[image error]

Is it possible to be too transparent?

That’s the question the Federal Reserve will be grappling with this week when its top officials meet in Washington for their regular policy-setting meeting. Transparency has been the mantra of the central bank since former Fed Chairman Ben S. Bernanke took the helm of the historically secretive institution in 2006. He has cited changing that mindset as one of his greatest achievements.

But officials may realize that less could be more when it comes to the Fed’s official guidance on when it will raise interest rates. The central bank has gone through several iterations of its promise to keep its benchmark short-term rate at zero over the past five years, each one more definitive than the last. Most recently, it vowed not to raise rates at least as long as the unemployment rate was above 6.5 percent.

That explicit commitment helped convince Wall Street that the Fed meant what it said. But the jobless rate fell more quickly than officials expected. It’s now at 6.7 percent and flirting with the Fed’s threshold, leaving officials once again searching for the right words to reassure markets.

One thing seems clear: The threshold will be swept away. Deciding what to replace it with is the hard part.

It’s unlikely that the Fed will opt for a single statistic again. The unemployment rate turned out to be an insufficient measure of the health of the labor market. Many economists believe it has fallen largely because the workforce is shrinking -- baby boomers retiring, millenials staying in school longer and the unemployed giving up hope of finding a job. Fed Chair Janet Yellen has cited at least four alternative indicators she uses to take the pulse of the job market; officials at the Bank of England released a list of 18.

The Fed’s communication conundrum underscores a broader point: It’s much easier to explain what a healthy economy isn’t than what it is. In other words, almost everyone can agree that an economy in which the unemployment rate is above 6.5 percent pretty much stinks and interest rates should remain at zero. But below that point, there’s a lot more uncertainty about how far the Fed should go.

“Markets like the idea that there was a single measure [the unemployment rate] for them to look at,” said David Stockton, the Fed’s former chief economist and now a senior fellow at the Peterson Institute for International Economics. “They want the Fed to tell them when they’re going to change interest rates. The Fed can’t really do that because they don’t really know how the economy is going to evolve”

San Francisco Fed President John Williams and Atlanta Fed President Dennis Lockhart have both said that the first rate hike should come when the jobless rate is about 6 percent. Williams in particular warned about the dangers of the Fed getting too close to the economy’s natural rate of unemployment. But Minneapolis Fed President Narayana Kocherlakota believes no move should be made until the jobless rate falls to at least 5.5 percent. Others think the Fed’s policies are breeding instability in the financial system and that rates should be hiked as soon as possible.

What do public officials do when they’re not really sure of something? Say as little as possible. Instead of “quantitative” guidance that relies on a single number of set of statistics, several key officials have been pushing for a “qualitative” description of the economic conditions that would justify a rate hike.

“They want to be vague, right? That’s what qualitative means,” said Roberto Perli, head of global monetary policy research at Cornerstone Macro. “They don’t want to be too precise. I think the reason is that the economy is approaching some sort of inflection point … They don’t want to tie their hands.”

If you’re thinking this strategy sounds familiar, you would be right. The Fed used the phrase “substantial improvement in the outlook for the labor market” as the guidepost for ending its $1 trillion-and-counting bond-buying program. (And if you’re also thinking that markets were confused by that language -- and that the Fed exacerbated the problem -- you would also be right.)

“Trying too hard to explain can be counter-productive,” said Mark Olson, co-chairman of Treliant Risk Advisers and a former Fed governor.

The trouble is that investors and the public have come to expect nothing less than full disclosure. But the limit to Fed transparency may be its own uncertainty about the right path for policy. Here’s the real truth: Fed officials aren’t exactly sure when the right moment to raise rates will be. And that may be the clearest answer they can give.

Wonkbook: With 2 weeks to enrollment deadline, March Madness sets in for Obamacare

Welcome to Wonkbook, Wonkblog’s morning policy news primer by Puneet Kollipara. To subscribe by e-mail, click here. Send comments, criticism or ideas to Wonkbook at Washpost dot com. To read more by the Wonkblog team, click here.

(Photo by Mark Wilson/Getty Images)

Wonkbook’s Number of the Day: 98.6. That's the February value of the Economic Policy Uncertainty Index, the lowest level since the earliest days of the recession.

Wonkbook’s Chart of the Day: Why the wealthiest countries are also the most open with their data.

Wonkbook's Top 5 Stories: (1) The Obamacare full-court press; (2) Yellen's big week; (3) U.S. relinquishes last bits of Internet control; (4) housing bill released; and (5) could Crimea vote hasten U.S. action?

1. Top story: Two weeks until mandate deadline, and Obamacare full-court press continues — March Madness style.

Obama says enrollment is high enough to ensure his health law’s survival. "President Obama said Friday he was confident enough Americans had enrolled under the Affordable Care Act to make the program 'stable.' In an interview with WebMD, Obama said the fact that 4.2 million people have already signed up for plans under federal and state marketplaces mean enough companies will be invested to stay in the system.... Obama noted, however, that the larger question is whether the risk pool is diverse enough to ensure premiums don't skyrocket, since "the more you can spread the risk with more people, the better deal you’re going to get"...Even as he touted the virtues of the law, Obama acknowledged that some previously-uninsured Americans may not be able to see the providers they want if they were focused on keeping costs down." Juliet Eilperin in The Washington Post.

Exclusive: House Republicans craft their vision for an alternative to Obamacare. "House Republican leaders are adopting an agreed-upon conservative approach to fixing the nation’s health-care system, in part to draw an election-year contrast with President Obama’s Affordable Care Act. The plan includes an expansion of high-risk insurance pools, promotion of health savings accounts and inducements for small businesses to purchase coverage together. The tenets of the plan — which could expand to include the ability to buy insurance across state lines, guaranteed renewability of policies and changes to medical-malpractice regulations — are ideas that various conservatives have for a long time backed as part of broader bills. But this is the first time this year that House leaders will put their full force behind a single set of principles from those bills and present it as their vision. This month, House leaders will begin to share a memo with lawmakers outlining the plan." Robert Costa in The Washington Post.

And some experts seem to agree with Obama that enough have enrolled. "Health benefits consultants agree with President Obama’s assessment this week that enough Americans have signed up to private health plans under the Affordable Care Act that it will work even though there could be up to two million fewer Americans covered than the White House had hoped….Health benefits consultants said there is reason to worry about whether enough younger Americans have signed up due to the website issues early on that may have hurt enrollment. In addition, slow signups in certain states that have continued to have more technical issues, such as Oregon, could trigger health plans to sustain greater losses and consider pulling out of the program, benefits consultants said….So far, however, health insurance companies have said the enrollment is trending younger and there have been few surprises that would require them to pull out of the program." Bruce Japsen in Forbes.

Explainer: This is Obama’s explanation for why you might not get to keep your doctor. Jason Millman in The Washington Post.

And then the White House announced that it would seek to expand Obamacare health plans in 2015. "Health plans selling on the federal marketplaces in 2015 must include 30 percent of area 'essential community providers,' which are usually health centers and other hospitals serving mostly low-income patients. That's up from a 20 percent requirement in 2014, the first year of expanded overage under the health care law. The federal Centers for Medicare and Medicaid Services, which oversees the marketplaces, will also take a much more active role in reviewing health plan networks. CMS, which outlined the new standards in a Friday night letter to insurers, will evaluate whether the plans include enough access to hospitals, primary care doctors, mental health providers and oncologists. The updated standards came after a Friday interview in which President Barack Obama acknowledged that pressure to keep down costs could mean consumers may not have access to their choice of doctor." Jason Millman in The Washington Post.

Administration making full-court press with March Madness-themed outreach. "The White House will court basketball fans in a March Madness-themed campaign to increase ObamaCare enrollment ahead of a March 31st deadline. The administration on Monday will release its '16 Sweetest Reasons to Get Covered' bracket listing the top reasons to get health insurance, according to a White House official. Each day, the bracket will be updated based on votes from online users." Kyle Balluck in The Hill.

Video: Speaking of basketball, LeBron helps out with Team Obama’s full-court press for Obamacare.

So are some celebrity moms. Dylan Scott in Talking Points Memo.

Administration could deploy mandate leeway in event of last-minute technical problems. "Federal officials are planning a workaround that would effectively extend the March 31 deadline to enroll for health-care coverage for some users if technical glitches hamper a last-minute surge of signups on HealthCare.gov, people familiar with the matter say. Despite improvements since its rocky Oct. 1 launch, the website still faces problems, including some involving the same software that stymied users in the fall. Problems with the site at least three times this past week kept some users from being able to log on, including an almost hourlong outage that struck Friday morning, some of the people said….Under the workaround plan, people who can demonstrate that they tried to enroll in a plan before the deadline, but failed because of website troubles, would be able to sign up after March 31. " Christopher Weaver, Spencer E. Ante and Louise Radnofsky in The Wall Street Journal.

More health care reads:

Surgeon general nominee on hold. Kristina Peterson and Colleen McCain Nelson in The Wall Street Journal.

House passes 'doc fix' bill that delays individual mandate. Kristina Peterson in The Wall Street Journal.

Federal judge rules Arkansas abortion law unconstitutional. Joseph Serna in the Los Angeles Times.

HHS will let sickest patients stay on their health plans longer. Jason Millman in The Washington Post.

Government approves medical marijuana research. Evan Halper and Cindy Carcamo in the Los Angeles Times.

U.S. says Obamacare covers married gay couples under family plan. Reuters.

MILBANK: Why millennials are abandoning Obama on health care. "Young voters, after playing a big role in the campaign, became little more than an e-mail list for the White House and Obama’s Organizing for Action group. Then came health-care reform. The millennials, very liberal overall, saw Obama’s plan as too timid; they were disillusioned by his failure to fight for the ‘public option’ of government-run health plans. This cost Obama the young activists he would need to rally enrollment in Obamacare. Polling by the nonpartisan Pew Research Center found that, while the generation looks more favorably on big-government solutions than do older generations, the millennials disapprove of Obamacare in the same proportion as the rest of the population. Even if Obama had worked harder to keep his youth army engaged, it’s not entirely clear that the effort would have succeeded. As a group, the generation’s attachment is fickle." Dana Milbank in The Washington Post.

COHN: Should Democrats come out swinging on Obamacare? "The Democrats’ loss in this week’s special congressional election probably wasn’t a referendum on Obamacare. But, at the moment, the law still looks seems more like a political liability than an asset. And with Republicans making Obamacare the focus of their midterm strategy, many Democrats have been responding with a mixed message: Acknowledge the Affordable Care Act has flaws, but vow to fix them rather than repeal the whole program. That seems to be roughly consistent with polls, which suggest the majority of Americans don’t like the health care law but the majority also don’t want to get rid of it. But nuanced messages have problems, even if the nuances reflect public sentiments. A politician who starts with backpedaling (“Yes, the law has problems, but…”) is bound to sound weak. And weak politicians don’t generally make attractive candidates." Jonathan Cohn in The New Republic.

SCHUCK: Obamacare's market problem. "Parts of the ACA such as the exchanges wisely seek to exploit some of the market's advantages in providing choice and efficiency. But other parts of the program -- including costly mandates for insurance benefits for which even subsidized consumers are unwilling to pay -- seem to ignore those advantages. The program's effectiveness requires striking the right balance between markets and mandates. The ACA's herky-jerky implementation suggests that Washington has not yet gotten it right." Peter Schuck in The Huffington Post.

BLOOMBERG VIEW: Don't ruin Obamacare to pay for 'doc fix.' Here's a better way. "The estimated cost to make this change is $138 billion over 10 years. That's a lot of money, but it could be drawn from other Medicare spending on health-care providers, doctors among them. This is not a radical idea; various bipartisan deficit-reduction proposals put forward since 2010 have recommended such measures. Among their good suggestions are using Medicare's buying power to get better rebates from drug makers, ending overpayments to hospitals for training doctors, making it harder for doctors to refer patients to their own businesses, and reducing Medicare's reimbursements to hospitals to cover unpaid deductibles and copayments. These aren't the only possibilities….Of course, cutting some types of Medicare payments to increase others won't win friends in the health-care industry. But Congress's more important and lasting priority must be to curb the long-term growth of health-care spending. Getting started now will easily make it possible to manage a permanent doc fix." The Editors.

Top opinion

KRUGMAN: That old-time whistle. "One odd consequence of our still-racialized politics is that conservatives are still, in effect, mobilizing against the bums on welfare even though both the bums and the welfare are long gone or never existed. Mr. Santelli’s fury was directed against mortgage relief that never actually happened. Right-wingers rage against tales of food stamp abuse that almost always turn out to be false or at least greatly exaggerated. And Mr. Ryan’s black-men-don’t-want-to-work theory of poverty is decades out of date." Paul Krugman in The New York Times.

WILL: Democrats are making income inequality worse. "Democrats are making income inequality worse. “Someone who is determined to disbelieve something can manage to disregard an Everest of evidence for it. So Barack Obama will not temper his enthusiasm for increased equality with lucidity about the government’s role in exacerbating inequality....The monetary base having expanded 340 percent in six years, there is abundant money for businesses. But, says Fisher, the federal government’s fiscal and regulatory policies discourage businesses from growing the economy with the mountain of money the Fed has created. This is why “the most vital organ of our nation’s economy — the middle-income worker — is being eviscerated.” And why the loudest complaints about inequality are coming from those whose policies worsen it." George Will in The Washington Post.

BLOW: We can't grow the income gap away. "The shocking level of income inequality in this country has set off alarms that grow louder by the day, but little seems to be underway to reverse the trend….We can’t grow our way out of this obscenity. It’s a barrier to growth. We must forthrightly address the issue with policy prescriptions. The I.M.F.’s list includes things like means-testing benefit programs, improving access to higher education and health care for the less well off, and ‘implementing progressive personal income tax rate structures” while “reducing regressive tax exemptions.’ Surely we can figure out how to fix this. We just don’t have the political will to do so.” Charles Blow in The New York Times.

LAZEAR: The hidden rot in the jobs numbers. "Most commentators viewed the February jobs report released on March 7 as good news, indicating that the labor market is on a favorable growth path. A more careful reading shows that employment actually fell—as it has in four out of the past six months and in more than one-third of the months during the past two years….The improvement in average weekly hours worked was reason for celebration after the recovery began. The recent decline is cause for concern. It gives us a more accurate but dismal picture of the past two quarters." Edward P. Lazear in The Wall Street Journal.

SAMUELSON: The verdict on the stimulus. "When proposed, President Obama’s stimulus was desirable. (Disclosure: Though disliking details, I favored it.) Regardless of multipliers, it supported the economy. It also sent a message along with the auto-industry bailout, the Federal Reserve’s easy money and the Troubled Asset Relief Program: The government won’t let the economy collapse. This was crucial to restoring confidence. The stimulus was a justifiable emergency measure. But the emergency has passed….More stimulus won’t cure underperformance and may perversely contribute to it. By highlighting the economy’s weakness, it may magnify consumer and business caution. Pessimism becomes self-fulfilling. An economy dependent on periodic shots of stimulus is an economy in eclipse." Robert J. Samuelson in The Washington Post.

AMBINDER: One way for Obama to burnish his legacy: FOIA reform. "If President Obama wanted to take a stand in favor of transparency, there are worse ways to do so than a presidential push for real FOIA reform. Real FOIA reform would require that agencies be accountable for their processes. It would increase the number of FOIA processors at each agency. It would expedite processing times. It would allow much more transparent appeals. It would be technologically modern. It would not necessarily be adversarial. FOIA officers might be rewarded for helping requesters find the documents and information they need. Maybe it's a pipe dream. But Obama's current record here is not very good. A lot of his problems aren't his, and he can't fix them. This one he can, if he pays attention and takes the time." Marc Ambinder in The Week.

HILTZIK: A helping hand or cold shoulder for the middle class? "If you're not rich, things aren't so fabulous. Spending at grocery stores is down, Swonk reported; even upscale supermarket chain Whole Foods is offering more discounts. Spending at mid-level family restaurants is being 'squeezed,' some of them replacing wait staff with tablets from which customers can place their orders directly. Home builders 'have almost abandoned building homes for first-time buyers and moved upscale to attract all-cash buyers.' As we move into budget season in Washington, these are the conditions that demand to be addressed through fiscal policy. Frighteningly, almost no one is taking heed." Michael Hiltzik in the Los Angeles Times.

‘Simpsons’ interlude: Couch gag done entirely with Lego bricks.

2. Big challenge for Yellen in first meeting of Fed this week.

Key challenge for Fed: Pull back without pulling the rug out. "The bull market reached its fifth anniversary last weekend, and if the trend continues this week, on Saturday it will become the fifth-longest bull market since 1928....All of this is undoubtedly reason for celebration, especially for the affluent households that hold the bulk of the wealth and have benefited most from the stock market’s big rebound. For anyone with even a modest stake in the market — as well as for Janet L. Yellen and the other Fed policy makers who are at least partly responsible for the market’s rise — the startling increase in asset prices also raises difficult questions. For market strategists, chief among them may be this: How will the bull market respond as the Fed throttles its accommodative monetary policy? When the Federal Open Market Committee meets on Tuesday and Wednesday, with Ms. Yellen at the helm for the first time, policy makers are expected to discuss how to proceed with the tightening of monetary policy without causing serious problems for financial markets." Jeff Sommer in The New York Times.

The backdrop: The Fed's ongoing tapering of bond purchases. "Some of the drama is gone after the decent February jobs number all but guaranteed the Fed will stay the course on the pace of asset purchase tapering. But it will still be very important for markets and the media to take Yellen’s measure and get a clear sense of her plans for further tapering, her opinion on the slight uptick in wage growth and the long-term prospects for interest rate hikes. She will also certainly face questions on if and when the Fed plans to ditch its 6.5 percent unemployment target as a measure of labor market health indicative of imminent rate hikes." Ben White in Politico.

About that unemployment target... "Federal Reserve officials are discussing ways to revise their guidance about the likely future path of interest rates, but it takes some detective work to pin down how they might do it. The Fed has said in its recent policy statements it won't start raising short-term interest rates from near zero until well past the time the unemployment rate falls below 6.5%. That position hasn't changed. But with joblessness at 6.7% in February, several officials have indicated in recent speeches and interviews they might want to scrap the threshold entirely or revamp their message in other ways. Fed policy makers will debate the matter at their meeting Tuesday and Wednesday, though reaching agreement on a new approach could be a challenge." Pedro Nicolaci da Costa in The Wall Street Journal.

Explainer: A big debate is playing out at the Fed: Economists do not agree about how to measure unemployment. Danny Vinik in The New Republic.

The Fed's bond-buying spree has helped the government's coffers. "The Federal Reserve paid $79.6 billion to the Treasury Department in 2013 as the Fed’s enormous investment campaign to stimulate economic growth continued to generate windfall profits for taxpayers. Since 2008, the Fed has expanded its holdings of Treasury and mortgage-backed securities from less than $1 trillion to more than $4 trillion in an effort to suppress interest rates and encourage risk-taking. Its earnings from those holdings have increased apace. The Fed, required by law to put most of its profit in the government’s coffers, has contributed almost $323 billion in the last four years. The Fed invests exclusively in federal government bonds, so its profits come from lending to the Treasury. In returning the money, it is effectively reducing the government’s borrowing costs." Binyamin Appelbaum in The New York Times.

Another potential economic booster: Government may actually be reducing business uncertainty. "Worries over the upheaval in Crimea are rising, along with fears of an economic slowdown in China. But another drag on optimism — business uncertainty — is heading the other way. The reason is twofold: Years of gyrating policy in Washington are giving way to comparative calm. And companies are becoming more nimble, using real-time data to maintain a close watch on their operations to adjust quickly to a volatile world. On the first front, one gauge of the nervousness — the Economic Policy Uncertainty Index — has dropped to levels not seen since the earliest days of the 2007-2009 recession....Recent budget deals as well as distance from last year's spending cuts and government shutdown have sharply diminished the fear of more curveballs from Washington, even as wild cards—like the political turmoil in Ukraine — persist." Brenda Cronin in The Wall Street Journal.

More economic indicators:

Producer prize index falls. The Associated Press.

Consumer confidence down. David Gaffen in Reuters.

Other economy reads:

Long read: Income gap, meet the longevity gap. Annie Lowrey in The New York Times.

U.S. agencies consider redefining manufacturing. Timothy Aeppel in The Wall Street Journal.

Low-wage workers finding it’s easier to fall into poverty, and harder to get out. Steven Greenhouse in The New York Times.

Aww interlude: Two elephants are reunited after 20 years.

3. Why it's a big deal that the U.S. is giving up its last vestiges of control of the Internet.

U.S. to relinquish last vestiges of control over the Internet. “U.S. officials announced plans Friday to relinquish federal government control over the administration of the Internet, a move that pleased international critics but alarmed some business leaders and others who rely on the smooth functioning of the Web….The change would end the long-running contract between the Commerce Department and the Internet Corporation for Assigned Names and Numbers (ICANN), a California-based nonprofit group. That contract is set to expire next year but could be extended if the transition plan is not complete.” Craig Timberg in The Washington Post.

Timeline: 25 years of the World Wide Web. Laura Ryan and Stephanie Stamm in National Journal.

Does the U.S. actually have 'control'? "The U.S. does not have 'control of the Internet.' Along with other countries for which the free flow of information, ideas, and innovation matter, it does have a large stake in continuing to protect the Internet from government control. Relinquishing NTIA’s residual role will makes that job easier." Cameron F. Kerry in

March 14, 2014

White House orders broader Obamacare health plans in 2015

(Photo by Mark Wilson/Getty Images)

The Obama administration is requiring health plans in Obamacare insurance marketplaces to include a more robust offering of care providers in 2015 after some early backlash over limited networks in the health care law's first year.

Health plans selling on the federal marketplaces in 2015 must include 30 percent of area "essential community providers," which are usually health centers and other hospitals serving mostly low-income patients. That's up from a 20 percent requirement in 2014, the first year of expanded overage under the health care law.

The federal Centers for Medicare and Medicaid Services, which oversees the marketplaces, will also take a much more active role in reviewing health plan networks. CMS, which outlined the new standards in a Friday night letter to insurers, will evaluate whether the plans include enough access to hospitals, primary care doctors, mental health providers and oncologists.

The updated standards came after a Friday interview in which President Barack Obama acknowledged that pressure to keep down costs could mean consumers may not have access to their choice of doctor.

“You may find out that network is more expensive than another network, then you have to make choices in terms of what’s right for your family,” Obama told WebMD. “Do you want to save on costs, or do you want to save on convenience?”

A senior administration official defended the health law’s standards in a Friday afternoon statement.

“What is what true before the health law is true today insurers have always made decisions about which providers and doctors are in their networks – that won’t change,” the official said. “What is different now is the Affordable Care Act marks the first time that federal law requires insurance plans to offer adequate networks of doctors, including mental health practitioners, pharmacies, hospitals, and community providers. Americans can now choose between different types of plans with different networks to find a plan that best meets their needs.”

CMS late Friday night also released a slew of new standards related to the insurance marketplaces, also known as exchanges. For instance, the agency issued new rules related to in-person Obamacare assisters, known as navigators. It also builds on small business insurance marketplaces, which have face several delays in the law's rollout.

CMS also said it will excuse insurers' administrative spending for costs stemming from the failed roll out of Healthcare.gov. The health law requires insurers to provide rebates to customers if they spend more than 20 percent of premium dollars on administrative costs, but CMS says it won't count administrative costs related to the enrollment website's turbulent launch.

This is Obama’s explanation for why you might not get to keep your doctor

(Photo by Jewel SamadJ/AFP/Getty Images

During the health care debate, President Barack Obama said people can keep their doctor if they wanted. Now he’s explaining why that might not be the case.

Don’t blame his health care law, Obama suggested in a Friday interview with WebMD. He said it comes down to narrowing provider networks, a health care trend that predates Obamacare.

Here’s how Obama described it this morning:

If you’re in the middle of life-saving treatment with a particular doctor, then we will work to make sure that you can keep that treatment and not shift. But for the average person, for many folks who don’t have health insurance initially, they’re going to have to make some choices. They might have to end up switching doctors in part because they’re saving money. But that’s true if your employer suddenly decides this network is going to give you a better deal. ‘We think this is going to help keep premiums lower. You gotta use this doctor as opposed to this one.’

Even if your doctor is in a new Obamacare health plan, consumers are going to have to make a choice, Obama said. “You may find out that network is more expensive than another network, then you have to make choices in terms of what’s right for your family,” he said. “Do you want to save on costs, or do you want to save on convenience?”

Obama made the comments during a 30-minute interview as part of the White House’s Obamacare enrollment push. For obvious reasons, conservative media today have focused on Obama’s comments about keeping your doctor.

Obama faced huge political backlash over cancelled health policies late last year, forcing him to apologize for saying that people could absolutely keep their health plans if they liked them. The “keep it if you like it” promise earned Politifact’s “Lie of the Year,” and the controversy prompted the administration to exempt people with cancelled policies from the individual mandate for three years.

It’s true that provider networks were narrowing before the health care law. But it also looks like health plans shrunk networks in 2014 to keep costs down, according to data compiled by McKinsey and Co:

The issue of narrow networks has received a ton of attention during this first Obamacare enrollment period. The administration and state-run exchanges seemed to make a clear choice that it was more important to offer cheaper premiums in Obamacare’s first year instead of broader networks.

That could change for next year, though. The administration last month proposed boosting provider participation requirements for exchange networks. The feds are also poised to take on a larger role in reviewing provider networks.

In the same interview this morning, Obama preached patience with the health care law’s rollout.

“I think as the Affordable Care Act grows, and more and more people sign up, you may see insurance companies starting to add more doctors to their networks, putting more options on the table,” he said.

The U.S. government owns thousands of unused buildings it doesn’t know what to do with

The U.S. government is the nation’s largest property owner – 42 million acres of land and nearly three billion square feet of real estate, if the latest data from the Federal Real Property Council (FRPC) can be trusted. The problem is, according to a recent GAO report, the FRPC’s data can’t be trusted. And this raises all sorts of issues, not the least of which is that the government doesn’t even know how much unused property it owns.

As reported by NPR, the FPRC lists nearly 80,000 properties that are either completely unused or sorely under-utilized. If these numbers are correct, this unused property could be costing taxpayers upwards of $1.7 billion in annual upkeep costs.

But as the GAO report points out, the FRPC’s data is so unsound that it’s difficult to verify how accurate it is. GAO inspectors visited 26 sites on the FRPC’s list, and found inconsistencies or inaccuracies in the reporting on 23 of them. Vacant buildings were incorrectly coded as occupied, and vice-versa. Partially demolished buildings were listed as 100% sound.

Given the inaccuracies in the data it’s difficult to get a clear sense of where the underused buildings are, or what agencies they belong to. But other government datasets can shed some light on the issue. In 2010 and 2011 the White House made a push to dispose of “excess” federal properties – which it defines as property no longer needed by the government - as a cost-saving measure. They published their 2011 dataset, which contains a list of excess properties as of that year.

Among other things, the dataset shows that the USDA holds the most excess properties of any federal agency – over 3,500 of them. Nearly all of these are forest service buildings in national forests, and many of them are in Western states like California and Colorado. The Navy is another major holder of excess real estate – over 2,000 properties.

The data also provide a state-level breakdown of where excess properties are located, although military properties are excluded from this list due to potential security concerns. The geographic distribution of unused real estate tilts westward, with California leading the pack, followed by Washington state. Much of this is likely a reflection of the USDA’s holdings in national forests, which are more prevalent out West.

It’s tough to say for certain where the government goes from here. The GAO report rather archly notes that federal efforts to achieve cost savings associated with better property management are in a state of limbo – “some of these efforts have been discontinued and the potential savings for others are unclear.” It also hints at some intra-agency disagreement over the true extent of the problem: “OMB agreed that real property challenges remain but raised concerns about how GAO characterized its findings. GAO believes its findings are properly presented.”

At any rate, with the potential for billions of dollars in annual savings on the table it’s hard to imagine why Congress would turn a blind eye to the issue for much longer.

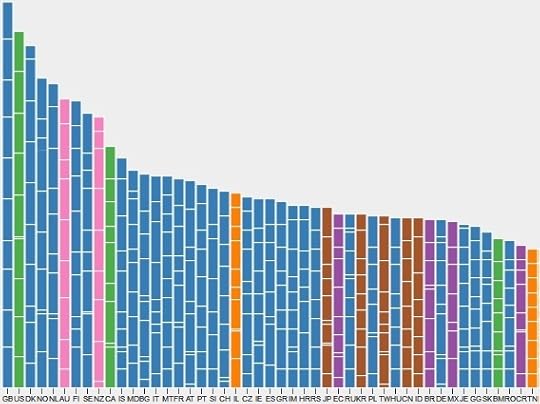

Why the wealthiest countries are also the most open with their data

Oxford Internet Institute

The Oxford Internet Institute this week posted a nice visualization of the state of open data in 70 countries around the world, reflecting the willingness of national governments to release everything from transportation timetables to election results to machine-readable national maps. The tool is based on the Open Knowledge Foundation's Open Data Index, an admittedly incomplete but telling assessment of who willingly publishes updated, accurate national information on, say, pollutants (Sweden) and who does not (ahem, South Africa).

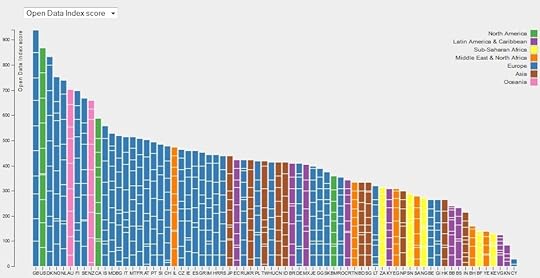

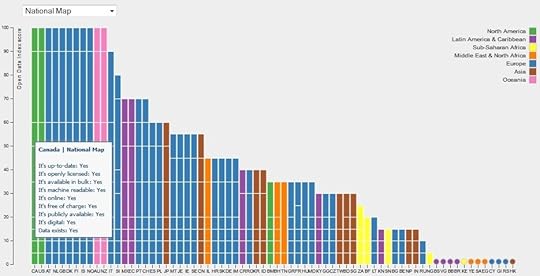

Tally up the open data scores for these 70 countries, and the picture looks like this, per the Oxford Internet Institute (click on the picture to link through to the larger interactive version):

Oxford Internet Institute

That's Great Britain in the lead at left, followed by the U.S., Denmark, Norway, the Netherlands and Australia. Each segment in the above chart corresponds to a country's score on one of the component metrics (election results, government budget, etc.). The orange outlier in that left group is Israel. Meanwhile, Kenya, Yemen and Bahrain are among the countries at the far right. To drill down even further, here's the picture of who releases national mapping data:

OII

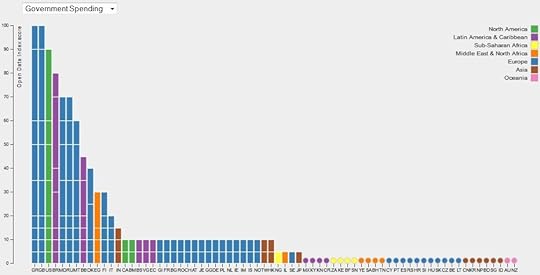

And details on government spending:

OII

With apologies for the tiny, tiny type (and the fact that many countries aren't listed here at all), a couple of broad trends are apparent. For one, there's a prominent global "openness divide," in the words of the Oxford Internet Institute. The high scores mostly come from Europe and North America, the low scores from Asia, Africa and Latin America. Wealth is strongly correlated with "openness" by this measure, whether we look at World Bank income groups or Gross National Income per capita. By the OII's calculation, wealth accounts for about a third of the variation in these Open Data Index scores.

Perhaps this is an obvious correlation, but the reasons why open data looks like the luxury of rich economies are many, and they point to the reality that poor countries face a lot more obstacles to openness than do places like the United States. For one thing, openness is also closely correlated with Internet penetration. Why open your census results if people don't have ways to access it (or means to demand it)? It's no easy task to do this, either.

"And it is imaginable that governments in rich economies simply have more manpower to throw at the problem," says the OII's Mark Graham in an email. "You can't really enact an open data strategy on autopilot: i.e. you need an actual implementable strategy that might require a lot of people to alter some embedded path-dependencies."

There are also, obviously, a lot of (bad) reasons to lock down your data even if you've got the manpower to release it: If you've got a corrupt government, transparency's probably not your thing. If you've got high unemployment, deep poverty or a serious pollution problem, you're probably not inclined to hand over information about those problems to the people who live with them.

HHS will let sickest patients stay on their health plans longer

The Obama administration is again extending a temporary Obamacare program insuring some of the sickest patients in the country amid concerns not enough people will find new coverage by the end of the month.

The Obama administration is again extending a temporary Obamacare program insuring some of the sickest patients in the country amid concerns not enough people will find new coverage by the end of the month.

People enrolled in the temporary Pre-Existing Condition Insurance Plan, which was set to expire March 31, can purchase an extra month of coverage, the Obama administration said this afternoon. The PCIP program covers people who traditionally had trouble affording or finding individual insurance because of a medical condition.

The White House is standing by the March 31 deadline for enrollment, but the administration's announcement shows that officials are carving out more exceptions to it.

“As part of our continuing effort to help smooth consumers’ transition into Marketplace coverage, we are allowing those covered by PCIP additional time to shop for new coverage while they receive the ongoing care and treatment they need," Centers for Medicare and Medicaid Services spokesman Aaron Albright said in a statement.

The extension is available to PCIP enrollees who haven't yet enrolled in another health plan. They have until April 15 to enroll in new coverage that starts May 1.

The administration said it wanted to avoid a possible lapse in coverage for PCIP patients, which include many people getting treatment for diseases like cancer and diabetes. About 21,000 people are still in the program, according to enrollment figures updated today.

This marks the third extension of the Affordable Care Act’s $5 billion high-risk pool program, which under the health care law was supposed to sunset at the end of 2013. In mid-December, CMS extended the program until January. A month later, CMS said it would keep the high-risk pools open through March 31.

The ACA program, launched in 2010, was meant to serve as transition to 2014, when insurers can no longer deny people coverage based on a pre-existing condition or charge them more for it.

Enrollment in the program was lower than expected, but the administration struggled with low funding. CMS suspended new enrollment in February 2013 in order to pay for existing members. About 100,000 people were enrolled in PCIP plans at the time.

Cancer advocates cheered Friday's extension.

“We’re pleased cancer patients and survivors with health coverage through the Pre-Existing Condition Insurance Plan can keep it for another month, so they can avoid a gap in coverage," the American Cancer Society Cancer Action Network said in a statement. "We encourage patients in PCIP to look at other insurance options, including the health insurance marketplace at HealthCare.gov, as soon as possible so they are assured of coverage beyond the short term.”

In a separate announcement Friday, HHS said insurers selling health plans in Obamacare exchanges cannot deny coverage to same-sex couples.

Ezra Klein's Blog

- Ezra Klein's profile

- 1105 followers