Centre for Policy Development's Blog, page 17

April 25, 2021

Directors liable for ‘greenwashing’ disclosures

Published in the AFR on Monday 25 April 2021

Companies and their directors could be sued for “greenwashing” their commitments to achieve their net zero carbon pledges or emissions reductions targets, according to a legal opinion backed by some of Australia’s top business leaders.

Amid a growing movement across industry to disclose to shareholders climate-related risks, Noel Hutley, SC, and Sebastian Hartford Davis warned boards might be liable for “misleading or deceptive conduct” for selectively disclosing exposures to climate change or declaring green goals while lacking credible plans to achieve them.

It comes as Prime Minister Scott Morrison looks to escalate the government’s carbon ambitions by the end of the year after the Biden administration warned on the eve of its global climate summit that co-operation with the White House could be hurt if Australia’s position did not shift towards firmer climate action.

The missive is the third in a series of opinions by the legal experts after a 2016 opinion said directors could be liable for failing to understand and disclose climate risks and a 2019 opinion saying directors could be liable if they failed to act on those risks once they were known.

The opinions have been backed by the Reserve Bank of Australia, the Australian Securities and Investments Commission, the Australian Prudential Regulation Authority, the ASX corporate governance committee and the Australian Accounting Standards Board, while the Taskforce on Climate-related Financial Disclosures is now seen as the global standard for notifying shareholders of the climate-related risks faced by companies.

The latest iteration, organised through the Centre for Policy Development, has been endorsed by Australian Institute of Company Directors chief Angus Armour, Business Council of Australia president Tim Reed and president of Chief Executive Women Sam Mostyn, who is also deputy chairman of the policy think tank.

The Centre for Policy Development is an independent think tank chaired by Terry Moran, former secretary of the Department of the Prime Minister and Cabinet between 2008 and 2011, which has been instrumental in an overhaul of the local business, financial and regulatory approach to climate change.

In just a few short years, the CPD’s work on climate-related financial disclosure, which encourages directors to consider global warming in how their businesses are run under threat of legal liability, has been endorsed by the RBA, the banking regulator and the corporate watchdog.

“‘Greenwashing’ on climate creates clear legal risks,” notes Mr Davis and Mr Hutley’s legal opinion.

“Care needs to be taken to ensure that climate-related targets and analysis are rigorous, underpinned by appropriate governance, strategy and action, and reflected in financial statements as required.

“Flawed or inaccurate disclosures may be regarded as misleading or deceptive, particularly those that rely on dated information or constitute incomplete or selective disclosure of findings.”

A 2020 report by then-Citi senior environmental, social and governance analyst Zoe Whitton, now executive director of consultancy Pollination Group, found more than 3000 big global companies have started to disclose climate-related risks, meaning two-thirds of companies are giving investors guidance on how climate change or the transition to a low-emissions economy could affect operations.

However, Citi found only a third of current market disclosures are “quality”, and the majority of disclosures are “highly variable”, “challenging to compare” and avoided “disclosing comparable financial impacts”, while often companies were producing lengthy sustainability reports that had little or no connection to company strategy.

Section 1041H of the Corporations Act prohibits conduct which is misleading or deceptive, or likely to mislead or deceive, Section 12DA of the ASIC Act, while Section 769C of the Corporations Act finds that individuals who make representation about a future matter without reasonable grounds are likely to be engaging in “misleading” conduct.

“Companies that make net zero commitments should expect close scrutiny of the structures and planning in place to achieve them,” notes the legal opinion, which said that while climate-related disclosures had improved significantly in recent years, little has been done to bed down operations to meet long-term climate commitments.

Mr Davis and Mr Hutley said superannuation funds were particularly vulnerable as they played a “catalytic” role in supporting a transition to a lower-emissions economy, while the sole purpose test likely required a focus on climate risks.

And while concerns around competition laws were valid, the competition regulator has previously granted authorisation for environmentally significant initiatives that may otherwise constitute cartel conduct.

The legal opinion was informed by a December 2020 roundtable discussion involving two-dozen business leaders, lawyers and policy experts, including Woolworths chairman Gordon Cairns, AustralianSuper boss Ian Silk, Rio Tinto director Simon McKeon and AGL director Patricia McKenzie.

In February, ASIC commissioner Cathie Armour said disclosing and managing climate-related risk was a key director responsibility, and that the regulator had already written to several companies that had come to its attention as potential “laggards” in the area of climate disclosure.

The world is fast adapting to a situation where the norm is for companies to disclose risks in line with recommendations under the Taskforce on Climate-related Financial Disclosures, which will soon be mandatory in some sectors in Britain and New Zealand.

Meanwhile, the United States, the European Union and China have stated commitments to achieve net zero emissions by mid-century, along with similar commitments by 14 of Australia’s top 20 trading partners.

While all Australian states and territories have various net zero targets, the Morrison government has faced pressure to make a formal commitment.

Late last year Rest Super settled a landmark court case that forced the fund to recognise the financial effects of climate change when making investment decisions. Several of Australia’s largest superannuation funds made similar commitments in the wake of the Rest case.

“The duty of care for directors on climate risks is now clear,” Centre for Policy Development boss Travers McLeod said.

“The focus is now on the gap between what needs to happen, or what is being promised, and what is being done.

“Directors must ensure net zero commitments are underpinned by proper information, governance processes, strategy and action.”

Ms Mostyn said the discussion was “a clear reminder of what boards need to do to manage climate risks” and that “better risk management, better industry-wide responses and better policy will be essential” to tackling climate change.

Mr Reed said board-level duties are “well understood” and “climate risk is an economic risk and requires a whole-of-economy response”.

Mr Armour said the Hutley legal opinions underscored the need for directors to consider how climate change may affect their organisation.

“There is clear momentum in the corporate sector towards more concrete climate commitments, with the topic now a mainstream item on boardroom agendas. The AICD looks forward to publishing guidance to assist directors in the middle of this year,” Mr Armour said.

You can read more about CPD’s materials on directors’ duties, climate risk and net zero here.

The post Directors liable for ‘greenwashing’ disclosures appeared first on Centre for Policy Development.

CPD releases new materials on directors’ duties, climate risk and net zero

Today, the Centre for Policy Development has released a range of new materials relating to directors’ duties and climate change that have emerged from a special roundtable convened by CPD in December 2020. That discussion, which brought together senior legal experts, company directors, business leaders and union and public sector representatives, considered key climate-related challenges for boards and businesses, and priorities for delivering more proactive and ambitious responses.

The materials released today include a new supplementary legal opinion by Noel Hutley SC and Sebastian Hartford Davis on climate change and directors’ duties, building on their landmark 2016 and 2019 opinions on company directors’ duties to consider, disclose and respond to climate-related risks. This latest analysis emphasises that the bar for directors continues to rise amidst surging global action on climate, and highlights legal risks associated with “greenwashing” – including around corporate net zero emissions commitments – as scrutiny of climate-related targets grows. The full set of roundtable materials, participants and conclusions are available below along with the updated legal opinion.

December 2020 roundtable with Noel Hutley SC and colleagues on directors’ duties and climate change

Our 2020 roundtable examined critical challenges and flash points for directors and trustees seeking to meet their climate-related obligations. Participants included Tim Reed (President of the Business Council of Australia), Sam Mostyn (Chair, Citi), Angus Armour (Managing Director and CEO of the Australian Institute of Company Directors), James Pearson (CEO of the Australian Chamber of Commerce and Industry) and Catherine Bolger (President, Australian Institute of Superannuation Trustees). The discussion was conducted under the Chatham House Rule.

The discussion was built around three hypothetical scenarios designed to tease out key legal and practical questions faced by company directors and other decision makers.

Key conclusions from the discussion (which have been prepared by CPD and do not necessarily reflect the views of the participating individuals and institutions) were:

‘Greenwashing’ on climate creates clear legal risks. Greenwashing can constitute misleading or deceptive conduct, including for organisations selectively disclosing their exposures or not taking credible steps to operationalise net zero commitments. Care needs to be taken to ensure that climate-related targets and analysis are rigorous, underpinned by appropriate governance, strategy and action, and reflected in financial statements as requiredSuperannuation funds can play a catalytic role in supporting the climate transition and should prepare for greater scrutiny of their climate-related governance and risk management. Recent developments, including the REST settlement, have highlighted the need to mainstream climate risks as a core focus of governance and risk management, especially as the investment risks and opportunities related to climate become increasingly dynamic and complex. As universal owners, superannuation funds have a major interest in supporting an economically and socially sustainable zero carbon transition. Industry-level collaborations on climate must consider the implications of competition law but, if properly managed, these issues should not impede collective action to address climate change. There is growing enthusiasm to collaborate across sectors and supply chains to develop and roll out low-emissions technology, and to design and deliver industry-level net zero pathways. In some circumstances, coordination between competitors, on climate as on other issues, may constitute cartel conduct, but exemptions and authorisations are available. Provided collaborative initiatives across industries and sectors are mindful of these provisions and proactively address them, competition law need not represent a major obstacle to collaboration on climate.Further information on the roundtable agenda, hypothetical scenarios and participants are available below, along with a detailed summary of conclusions and reflections from roundtable participants.

Summary of Conclusions

Agenda & Hypothetical Scenarios

Media Release

Summary of Conclusions

Agenda & Hypothetical Scenarios

Media Release

New supplementary legal opinion by Noel Hutley SC and Sebastian Hartford Davis

Following the roundtable, CPD commissioned an updated legal opinion by Noel Hutley SC and Sebastian Hartford Davis to further examine key legal questions that were highlighted during the discussion.

The new supplementary opinion, which was provided on instruction from Sarah Barker of MinterEllison, builds on earlier Hutley-Hartford Davis opinions released by CPD in 2016 and 2019. The landmark 2016 opinion found that directors who do not properly manage climate risks could be held liable for breaching their legal duty of due care and diligence. A supplementary 2019 opinion emphasised that the standard of care expected of directors in addressing climate risks had been raised by a series developments, and that directors’ exposure to climate change litigation was “increasing, probably exponentially, with time”.

The new supplementary opinion emphasises the increasing standard of care expected of directors in managing climate-related risks and opportunities, and highlights legal risks surrounding “greenwashing”, especially as scrutiny of climate-related disclosures and commitments grows.

Its key findings are:

The standard of care to be exercised by directors with respect to climate change has “risen and continues to rise”;Net zero commitments by companies are becoming common and appear to be regarded by many directors as an appropriate or necessary step in the discharge of their duties;Companies making net zero commitments should have “reasonable grounds” to support the representations contained within them – otherwise, a company (and its directors) could be found to have engaged in misleading and deceptive conduct; There are practical steps companies and directors can take to reduce the likelihood of liability arising from a net zero commitment.

New supplementary opinion 2019 and 2016 legal opinions

New supplementary opinion 2019 and 2016 legal opinions

Reflections from roundtable participants and key excerpts from the new supplementary opinion

Reflections from roundtable participants:

“This discussion was a clear reminder of what boards need to do to manage climate risks… We are at a critical moment – on climate and on the broader task of building a more resilient and sustainable economy as we emerge from the COVID pandemic. These challenges go hand in hand and proactive leadership from business – to support better risk management, better industry-wide action and better policy – will be essential.” Sam Mostyn, Deputy Chair, CPD

“The Hutley opinions underscore the need for directors to consider how climate change may impact their organisation. Directors across Australia are grappling with how they can provide effective oversight of this complex area of risk. There is clear momentum in the corporate sector towards more concrete climate commitments, with the topic now a mainstream item on boardroom agendas.” Angus Armour, CEO, AICD

“The roundtable facilitated by CPD demonstrated that the bar continues to rise for directors on managing climate risk. This is a pivotal moment for shaping Australia’s response to climate change and a net zero agenda. Board-level duties are well understood, climate-related capabilities are growing and proactive business leadership will be essential. Ultimately, climate risk is an economic risk and requires a whole-of-economy response. To keep pace globally, Australia needs business, investors, communities and all levels of government to drive this agenda and ambition together.” Tim Reed, President, BCA

Key quotes from legal opinion:

“In our opinion, it is no longer safe to assume that directors adequately discharge their duties simply by considering and disclosing climate-related trends and risks; in relevant sectors, directors of listed companies must also take reasonable steps to see that positive action is being taken: to identify and manage risks, to design and implement strategies, to select and use appropriate standards, to make accurate assessments and disclosures, and to deliver on their company’s public commitments and targets.” – [4]

“Companies making net zero commitments require “reasonable grounds” to support the express and implied representations contained within such commitments at the time those commitments are made. It is foreseeable that a company (and its directors) could be found to have engaged in misleading or deceptive conduct or other breaches of the law by not having had reasonable grounds to support the express and implied representations contained within its net zero commitment. – [7.4 and 7.5]

“In our view, risks relating to greenwashing do not mean it is safer for directors to avoid making net zero commitments. Directors will need to consider in a robust way whether such a commitments is in the best interests of the company. Indeed, given the developments cited above, the risks of inaction on this front appear to be profound. – [40]

“Accelerating impacts of climate change, and responses to climate change overseas and domestically, are profoundly influencing, positively and negatively, the interests of many Australian businesses. It is now perfectly clear that reasonable directors and firms should foresee these risks. We would caution against any misrepresentation about the steps such directors and firms may be taking in response.” – [51]

Media Coverage

Directors liable for ‘greenwashing’ disclosures, Michael Roddan, AFR, 25 April 2021

Business leads where politics fail on climate, AFR, 25 April 2021

Links and related reading

The Climate & Recovery Initiative

CPD business roundtable on climate and sustainability, 2019

Remarks by Ken Hayne at CPD business roundtable on climate and sustainability, 2019

Climate change and the economy, speech by RBA Deputy Governor Dr Guy Debelle, March 2019

Climate change, speech by ASIC Commissioner John Price, June 2018

The weight of money: a business case for climate risk resilience, APRA Executive Member Geoff Summerhayes, November 2017

CPD roundtable on directors duties, climate risks and sustainability (2016)

Heavyweights now speaking with one voice on climate change risks, Sam Hurley, The Age and The Sydney Morning Herald, 24 March 2019

Directors’ climate liability exposure increasing ‘exponentially’, Ben Potter, Australian Financial Review, 29 March 2019

Climate change raising company liabilities, barristers warn, Peter Ryan, ABC RN The World Today, 29 March 2019

Time for an Australian Sustainable Finance Taskforce, Travers McLeod and Sam Hurley, Sydney Morning Herald, 22 July 2019

The post CPD releases new materials on directors’ duties, climate risk and net zero appeared first on Centre for Policy Development.

April 22, 2021

CPD is Hiring

We’re looking to recruit an Events and Communications Coordinator (parental leave backfill – 6 months). You can access the Position Description below.

How to Apply

Candidates should apply by emailing their application to admin@cpd.org.au with the subject line ‘Application for Events and Communications Coordinator’. The deadline for applications is Friday 30 April, and the candidate will ideally be available to start in mid to late May. Only shortlisted candidates will be contacted.

The Centre for Policy Development is committed to being a diverse and inclusive workplace. We encourage applicants of all backgrounds, cultures, genders, abilities and experiences to apply.

The post CPD is Hiring appeared first on Centre for Policy Development.

April 15, 2021

Recent Submissions

Across the early months of 2021, CPD has made a number of important submissions to various government inquiries. Read on for more details below.

In late February, CPD made a submission to the National Disability Insurance Agency in regards to the Access and Eligibility Policy with Independent Assessments. Our CEO Travers McLeod and Chair Terry Moran outlined two key concerns with the reforms proposed. The first related to the specific independent assessment process set out by the consultation paper. The second concern spoke to the broader trajectory of the NDIS given the history of outsourcing vital areas of service delivery across the Commonwealth. You can read the full submission below.

In early March, CPD also made a submission to the parliamentary Inquiry into the current capability of the Australian Public Service (APS). Our submission stated that “the starting point for renewing Australian democracy after COVID-19 is to reinvest in the creativity of our public services and ensure they are enriched by direct experience of the services Australians expect government to provide”. You can read the full submission below.

The post Recent Submissions appeared first on Centre for Policy Development.

April 13, 2021

Zoe Whitton on a gas-fired future

Broadcast on Monday 12 April 2021

CPD Board Member Zoe Whitton appeared on the ABC’s Four Corners to discuss what’s behind the Federal Government’s push for a gas-fired future.

Watch the full episode below:

The post Zoe Whitton on a gas-fired future appeared first on Centre for Policy Development.

April 6, 2021

Sam Mostyn in the Media

March was a busy month in the media for our Deputy Chair Sam Mostyn. Follow the links below to watch (and listen to) all of her appearances.

Broadcast on 08 March 2021.

Sam appeared on The Business with Elysse Morgan to discuss gender equality in the workplace and women in leadership.

Broadcast on 24 March 2021.

Sam also made an appearance on RN Breakfast with Fran Kelly to talk about quotas, how to improve the treatment of women in the workplace, and what parliament should do next.

Broadcast on 25 March 2021.

Finally, Sam was a panellist on Q+A alongside Stan Grant, Bruce Pascoe, Gigi Foster, Adam Creighton and Thomas Piketty.

The post Sam Mostyn in the Media appeared first on Centre for Policy Development.

April 4, 2021

Travers McLeod: The public sector’s pandemic: Part 1

Recorded on 03 April 2021.

In the first of a four-part series, CPD CEO Travers McLeod spoke to Geraldine Doogue on ABC Saturday Extra about public sector capability, and the strengths, weaknesses and challenges revealed by the COVID-19 pandemic.

Listen to the full interview below:

The post Travers McLeod: The public sector’s pandemic: Part 1 appeared first on Centre for Policy Development.

February 9, 2021

Toby Phillips: Global climate action will reshape Australia’s trade

Published in The Australian Financial Review, 09 February 2021

Last week at the National Press Club, the Prime Minister said Australia would “reach net zero emissions as soon as possible, and preferably by 2050”. Those final words are key, and represent a shifting tone more in line with our global partners. Just two weeks ago, US President Biden signed an executive order aiming for net-zero by mid-century. Before Christmas, it was Hong Kong. A couple of months before that, Japan and China.

They say a week is a long time in politics, but where will we be in a decade? What about three decades? National discussions about climate change rightly focus on the choices of Australian governments, businesses, and people. But just as important are the global forces shaping Australia’s place in the world.

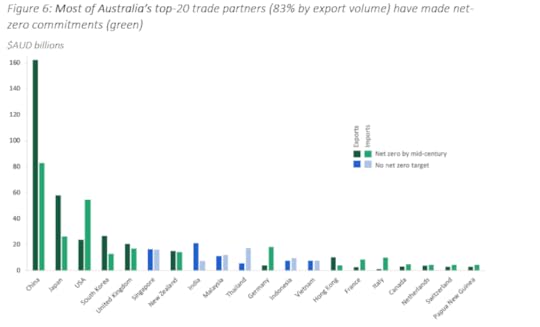

Global climate action is reshaping Australia’s trade outlook.

The numbers are stark. Looking at Australia’s top 20 trade partners, over 80 per cent of our exports are to countries that have pledged net-zero emissions by the middle of the century (China, South Korea, the UK, the EU, and several more). And Australia’s export mix is highly concentrated in carbon-intensive commodities: 70 per cent of what we sell to those countries is fossil fuels, minerals or metals.

Australia currently has one of the most stable and globally competitive economies because of our natural resources. But as major global partners decarbonise, the commodities that got Australia here today will not get us where we need to go next. Just last year, we saw how exposed Australian industry is to small changes in demand from giant importers like China: leading to lost billions in both agricultural and fossil fuel exports.

History is full of examples where the tides turn on a commodity-dependent economy. In the early 1900s, Chile was one of the richest countries in the world. Its saltpetre mining industry produced two-thirds of the world’s fertilisers. At its peak in 1920, this export industry employed 60,000 Chileans. But this high point coincided with the commercialisation of the Haber process for synthesising ammonia in the lab.

By the 1930s, Chile’s nitrate exports were a tiny fraction of their peak, the mines only employed 10,000 people, and Chile had slipped out of the top 20 largest global economies. The industry continued for some decades, eking out a living on what remained of global demand for natural nitrates. Meanwhile, the factories of Europe prospered by providing the world with cheap, synthetic fertilisers.

Like Chile, Australia will be forced to come to terms with lower global demand for some key exports. But like Europe, Australia can be at the forefront of the new technological revolution. There are two big industrial opportunities in a post-carbon era: renewable energy and carbon-efficient industry.

Ammonia is once again at the centre of an economic transition. The same Haber process that made saltpetre redundant in the 1920s can be used to convert hydrogen gas into ammonia for storage and transportation, at least partially solving the intermittency problem of renewables. Australia has some major investments here, but the world still lacks global standards and infrastructure for trading hydrogen. Apart from investing in production, Australia needs to help ensure the whole chain – from production, storage, transport and end-use – is viable and globally standardised.

While some commodities may go out of fashion – like coal – other commodities like iron, lithium and aluminium will be in demand for the foreseeable future. But Australian exporters cannot rest on their laurels. In the past week, the European Union voted to progress import taxes on carbon-intensive goods, and BMW signed a deal worth hundreds of millions of dollars with the United Arab Emirates for green aluminium. Australia can remain globally competitive by having the least carbon-intensive industries in the world.

Many heavy industries in Australia are already highly efficient, so the biggest wins come from decarbonising the grid they run on. Beyond that, investments in R&D can push out the efficiency frontier. In aluminium smelting, new technologies could eliminate the use of carbon anodes; in steel making Australia could pioneer alternatives to metallurgical coal, such as bio-coke or direct chemical reduction.

Some MPs are proposing that any national decarbonisation plan include exemptions and carve-outs for specific sectors, such as steel or agriculture. This is a mistake: these are exactly the sectors that need to be pushed (and supported) to decarbonise. Otherwise Australia’s attempts to move up the value chain will be stymied by solar-powered smelting in Dubai or Brussels’ farm-to-fork strategy for sustainable agriculture imports.

Despite the opportunities, none of this is a given. The Commonwealth’s technology investment road map is helping to fill some of these gaps, but it is modest compared to the plans of our trade partners. Australia needs more investment and, crucially, more national co-ordination to meet the challenge.

The prime minister doesn’t want to commit to a net-zero timeline because it would be “just a bit of paper.” Actions do speak louder than words, but the words will matter too, especially ahead of G7, G20 and COP26 meetings this year where the rest of the world is co-ordinating on climate action and trade.

By 2050 we will be living in a hotter world, that’s guaranteed. We will also have the benefit of hindsight. Let’s hope we look back on an adroit shift to a post-carbon global economy. If Australia’s approach is too timid, we will look back and wonder why we sat holding the bag as the rest of the world moved on.

The post Toby Phillips: Global climate action will reshape Australia’s trade appeared first on Centre for Policy Development.

February 8, 2021

Discussion Paper: Chasing the Pack

In a paper released today by the Centre for Policy Development (CPD), Program Director Toby Phillips analyses how Australia’s immediate economic and diplomatic future could be defined by global activity around climate diplomacy, green trade and low-carbon investment.

“Maintaining Australia’s existing industrial mix is akin to making a big strategic bet that global coal trade will still be booming in 2050.

With a proactive, pro-transition approach, Australia can adroitly shift from one wave of globalisation (the rise of China, demanding iron ore and coal) to another (global decarbonisation).”

Key Points:

Most of Australia’s main trade partners have made commitments to reach net zero, making its carbon-intensive export profile vulnerable;With the rise in climate-centric diplomacy, Australia’s domestic climate policy is putting the country firmly outside the global diplomatic club.COVID-19 will likely lead to a sustained multi-year drop in global demand for key industries (such as oil and tourism), but will also bring new opportunities as global value chains are restructured;Countries are looking to preferentially favour trade in green goods, providing an opportunity for Australia to build new export industries.

With countries around the world making significant commitments toward achieving net-zero emissions by 2050, the Biden administration’s proactive stance on climate action, including recommitting to the Paris Agreement, and increased global activity around aligning long-term trade plans toward a focus on the emerging renewable energy and green tech sectors, Australia’s existing industrial strategy and current stance on climate diplomacy puts it at risk of falling outside the international status quo.

There is, however, a clear opportunity for Australia to establish itself at the forefront of these new global markets, one that could drive significant economic growth for years to come.

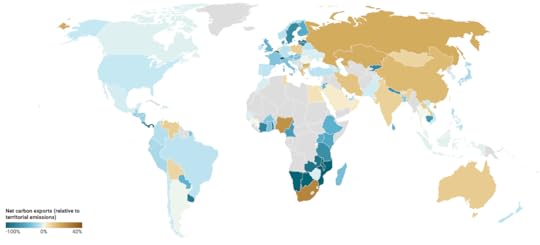

Chasing the Pack: Australia’s prospects on green trade and climate diplomacy takes into account the current state of play when it comes to Australia’s trade position. Despite perceiving itself as a knowledge-based economy, Australia’s global performance is heavily reliant on a narrow set of primary industries. Exporting commodities is not a problem, as long as those commodities remain in high demand. But Australia’s lack of competitiveness in knowledge-intensive industries, in partnership with its status as net exporter of carbon, makes Australia vulnerable to shifts in global demand.

To respond effectively, Australia needs to consider the prevailing global trends around climate diplomacy, green trade and investment. Despite strong signals of decreasing demand for carbon-intensive goods, an increase in preferential trade in low-carbon green goods represents a potential boost to Australia’s economic outlook.

Chasing the Pack also delves into the major global trends and issues currently facing Australia, with particular reference to the COVID-19 pandemic, the Biden administration’s position on green trade, finance and diplomacy, and the status of Australia’s current trade negotiations with the EU and UK (as well as the recently-concluded RCEP).

Finally, the paper considers how Australia’s long-term economic position can be strengthened by diversifying and expanding its industrial base through “producing goods and services that are in demand for decades to come”, with a specific focus on renewable energy, green products, and goods with low embedded carbon.

Does Australia have the wherewithal to claim a seat at the global decarbonisation table? Or, in years to come, will this moment in time be looked upon as a missed opportunity?

Related Reading

Chasing the Pack: Australia’s prospects on green trade and climate diplomacy

Third Climate & Recovery Initiative Stakeholder Roundtable

Climate & Recovery Initiative Public Forum

The post Discussion Paper: Chasing the Pack appeared first on Centre for Policy Development.

January 21, 2021

Virtual Roundtable on Mainstreaming Child Protection in the Context of International Migration

In December 2020 the Secretariat of the Asia Dialogue on Forced Migration (ADFM) was pleased to co-convene a virtual regional roundtable with the International Detention Coalition (IDC), focused on mainstreaming child protection in the context of international migration.

Agenda and Participant List

Event Summary

Agenda and Participant List

Event Summary

This discussion was part of the ongoing regional platform and program of learning and action on alternative care arrangements for children in the context of international migration in the Asia Pacific, which was initiated in November 2019 at a two-day meeting in Bangkok.

Since that meeting, the COVID-19 pandemic has posed significant challenges for governments and civil society in the region, including in responding to children in the context of international migration. With travel restrictions in place due to the pandemic, participants from the 2019 roundtable expressed an interest in re-convening virtually to continue the peer-learning platform. In particular, there was an interest in learning more about Australia’s experience in mainstreaming child protection.

The virtual meeting brought together approximately 35 experts from government ministries, civil society organisations, and international organisations in Australia, Indonesia, Malaysia and Thailand to share their experiences and positive practice and assist each other to meet and address implementation challenges.

The ADFM Secretariat and IDC are now working with participants to design a program of work for the coming year, which will likely include a series of virtual discussions given ongoing travel restrictions. Some themes or topics for future discussions include:

The role of civil society in the provision of alternative care arrangements to children and their families, and lessons learned from partnerships between different levels of government (city, provincial and national) and civil society organisations,Lessons learned from case management practices,Laws, policies and practices relating to access to education for refugee and migrant children,How this regional platform could connect with the work of regional institutions including the ASEAN Commission on the Promotion and Protection of the Rights of Women and Children (ACWC),Responses to unaccompanied and separated children, and foster care systems.The ADFM is grateful to IDC for co-convening the event, to the Australian Department of Home Affairs and New Zealand Ministry of Foreign Affairs and Trade for their support, and to all participants for their active engagement in the process. Despite the challenges posed by COVID-19 over the course of 2020, we were pleased to find a strong desire to continue the platform and build an ongoing program of peer-learning and action.

Key documents and related reading

Asia Dialogue on Forced Migration

Regional Roundtable on Alternatives to Child Detention | 21-22 Nov 2019 | Bangkok

The post Virtual Roundtable on Mainstreaming Child Protection in the Context of International Migration appeared first on Centre for Policy Development.

Centre for Policy Development's Blog

- Centre for Policy Development's profile

- 1 follower