Mark Polino's Blog, page 339

July 26, 2011

Exporting Data to a Text File | dynamicsgpinsights.com

Steve Priest, writing at Dynamics GP Insights, gets cozy with GP developers looking at Exporting Data to a Text File from Dexterity.

Zero Dollar Checks and Dynamics GP—Why? | dynamicsgpinsights.com

Writing at Dynamics GP Insights, Christina Phillips examines Zero Dollar Checks and Dynamics GP—Why?

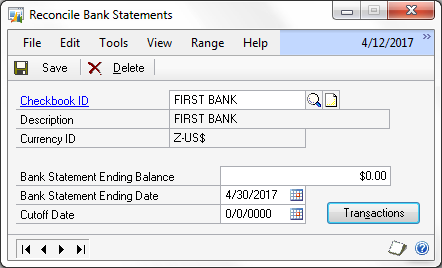

The Dynamics GP Blogster: Reconciling unchanged bank statements

Payables HATB With Aging Interesting Findings & Knowledge Sharing

Sivakumar follows up his AR HATB series with a series of SQL code to generate Payables Historical Aged Trial Balance reports. We've had some other folks who generated similar code but I love having options.

Payables HATB With Aging By Due Date (using GL Posting Date)

Payables HATB With Aging By Due Date (using Document Date)

Payables HATB With Aging By Payment Terms (using GL Posting Date)

Payables HATB With Aging By Payment Terms (using Document Date)

July 25, 2011

Customer Videos that support the Dynamics GP Story - Inside Microsoft Dynamics GP

I love success stories and I love applying the lessons to new scenarios so checkout these Customer Videos that support the Dynamics GP Story from Inside Microsoft Dynamics GP.

Receivables HATB | Interesting Findings & Knowledge Sharing

Sivakumar dropped a huge win on the Dynamics GP community last week with SQL code designed to replicate the Receivables Historical Aged Trial balance.

This is one of the most common requests I see and it's nice to have a common starting point.

He give a number of versions that I've linked to here:

Receivables HATB With Aging By Due Date (using GL Posting Date)

Receivables HATB With Aging By Due Date (using Document Date)

Receivables HATB With Aging By Payment Terms (using Document Date)

Receivables HATB With Aging By Payment Terms (using GL Posting Date)

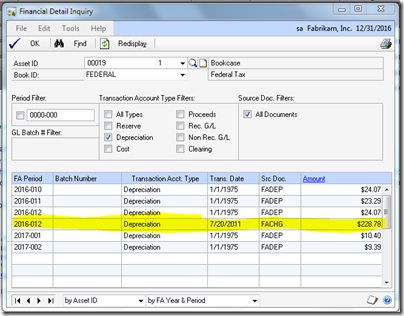

Weekly Dynamic: Fix Bonus Depreciation

I've covered a couple of times how Microsoft Dynamics GP lets companies deal with bonus depreciation. What happens if year end comes an goes and you missed taking bonus depreciation? Hopefully the accountants will catch it when preparing the tax return and now you've got to fix in GP.

Some of the obvious solutions won't work because once you've closed the year, resetting the year's depreciation only works in the current year, not last year.

This came up recently and this is best solution I've come up with.

Set the date in GP back to the previous year Open the Tax book for an item that didn't get bonus depreciation. Change the LTD depreciation to be the depreciation as of year end from the tax return for that asset PLUS the YTD depreciation.For example: 1,200 asset, depreciation with bonus should have been $700 as of 12/31. YTD is $50. New LTD would be $750. GP will book the transaction as of the GP date and will reflect the date of the change in the Financial Detail window

Bonus depreciation is tax only so this shouldn't change the ledger. Bonus depreciation should only apply to assets placed in service during the year, not all assets. Don't forget to change the GP system date back when you're done.

I haven't found any way to get GP to recalc the bonus depreciation and after I thought about it, you really want GP to reflect what was on the tax return right or wrong.

July 22, 2011

Friday Fun: Not Your Average Accounting Update [VIDEO]

Greg Kyte

Greg Kyte Greg is an MBA, a licensed CPA, and a working comedian. He has worked as an accountant in both public practice and in industry.

Follow Greg on Twitter here: http://twitter.com/#!/gregkyte

More about him here: http://gregkyte.com/Videos.html

July 21, 2011

Light Summer Reading

If you're looking for some light summer reading, don't miss these short stories highlighting Dynamics GP.

The Dynamics GP Blogster: SmartList Builder and creating Calculated Fields with Extender data

I missed this post of Mariano's looking at SmartList Builder and creating Calculated Fields with Extender data

Oops. Well, at least now you know that I'm human and not a bot.