Stuart Jeanne Bramhall's Blog: The Most Revolutionary Act , page 1383

August 19, 2013

The Role of Secret US Funding in Egypt’s Coup

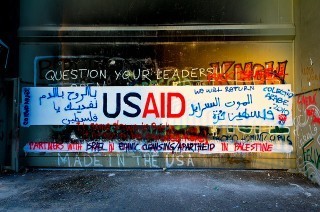

State Department Funnels Millions to Anti-Morsi Activists

The Obama administration has come under fire for violating Section 508 of the 1999 Foreign Assistance Act by continuing $1.5 billion in military aid to the Egyptian generals who led the coup against Egypt’s democratically elected president and recently slaughtered more than 1,000 peaceful civilian protestors. The millions of dollars of secret aid the State Department funneled to anti-Morsi activists responsible for the mass protests preceding the coup is also illegal. However the corporate media is silent on this issue. It’s a non-event in the US mainstream media, despite the July 10 Al Jazeera expose by Emad Mekay from University of California-Berkeley’s Investigative Reporting Program.

Mekay’s article is mainly based on Internal Revenue and State Department documents he received via a Freedom of Information Act request, interviews with former Egyptian police intelligence officer Colonel Omar Afifi Soliman and Stephen McInerney, Executive Director of the Washington-based non-profit Project on Middle East Democracy (POMED), Egyptian court documents from Soliman’s 2011 trial in absentia for inciting violence against the US and Saudi embassies, and Soliman’s social media posts.

The Key State Department Front Groups

What Mekay learned was that since 2002, the State Department has been channeling hundreds of millions of dollars to Middle East pro-democracy activists through three State Department agencies, the US Agency for International Development (USAID), the Bureau for Democracy, Human Rights and Labor (DRL), and the Middle East Partnership Initiative (MEPI), as well as the CIA-linked nonprofit foundation National Endowment for Democracy (NED). Australian political scientist Michael Barker and William Robinson (Promoting Polyarchy 1996) have both written extensively about the role of NED and similar CIA-funded foundations in promoting US friendly “revolutions” in Eastern Europe and third world countries.

The funds are then re-routed to other organizations, such as the International Republican Institute, the National Democratic Institute (NDI), and Freedom House. Tax returns and federal grant records show these groups have subsequently disbursed these funds to Egyptian non-profit organizations run by senior members of anti-Morsi political parties. This – funding foreign politicians and financing subversive activities targeting democratically elected governments – is also illegal under US law.

The NED has removed public access to Egyptian grant recipients in 2011 and 2012 from its website. However POMED’s executive director Stephen McInerney estimates Washington spends approximately $390 million annually on “democracy promoting” groups in the Middle East, with roughly $65 million going to Egypt in 2011 and $25 million in 2012. McInerney estimates anti-Morsi groups will receive comparable funding for 2013.

Our Man in Falls Church

Mekay mainly focuses on Soliman, who began receiving NED funds in 2008. Until 2011, Soliman’s “pro-democracy” group targeted Mubarak’s repressive regime. More recently his social media sites have targeted Morsi’s government. Tax returns show that NED paid Soliman tens of thousands of dollars through an organization he created called Huku Al-Nas (People’s Rights), based in Falls Church, Virginia. Soliman is the only employee.

After he was awarded a NED human rights fellowship in 2008, Soliman moved to the US. His group Ukuk Al Nas subsequently received a $50,000 NED grant in 2009, a $60,000 grant in 2010 and a $10,000 grant in 2011. Soliman acknowledged receiving the funding in an interview with Mekay. It also complained it was nowhere adequate.

In 2012, an Egyptian court sentenced Soliman in absentia for his 2011 role in inciting violence against the US and Saudi embassies. Court documents Mekay obtained revealed Soliman used media interviews, YouTube, and Facebook to call for the violent overthrow of Mubarak’s government.

Court documents indicate Soliman has taken down some of his older social media posts. However his recent Facebook posts to his 83,000 followers are pointedly graphic. A post in late May, as anti-Morsi opponents were in the planning stage for massive anti-government street protests instructs protestors to “behead those who control power, water and gas utilities.”

Then in late June, he advises his followers to “incapacitate them by smashing their knee bones first … ake a road bump with a broken palm tree to stop the buses going into Cairo, and drench the road around it with gas and diesel. When the bus slows down for the bump, set it all ablaze so it will burn down with all the passengers inside … God bless.”

On a YouTube video, Soliman takes credit for a December attempt to storm the Egyptian presidential palace with handguns and Molotov cocktails.

Other Anti-Morsi Groups Funded by the State Department

Mekay’s article goes on to detail (with dates and amounts) other anti-Morsi groups calling for the former president’s removal by force who have received State Department funding. These include the The Salvation Front main opposition bloc, a key organizer of recent protests that turned violent and Esraa Abdel-Fatah, a prominent figure in the Egyptian Democratic Academy. Last year Abdel-Fatah called on her followers to lay siege to mosques that supported Egypt’s new constitution, which was established via public referendum in December 2012. Other organizations identified in the IRS and State Department documents include the Hand in Hand for Egypt Association, which rallied Egypt’s Coptic Christian minority to take to the streets on June 30, and Reform and Development Party member Essmat al-Sadat, founder of the Sadat Association for Social Development. Sadat was a member of the coordination committee, the main organising body for the June 30 anti-Morsi protest.

US Encouragement to Incite Unrest

A number of recipients of US “democracy promoting” funding indicate that their US funders encouraged them to incite protests to whip up public sentiment against Morsi. Mekay’s article links to a YouTube video by anti-Morsi activist Saaddin Ibrahim, as well as an article in Egypt’s English language Daily News.

Mekay’s findings about the US role in fomenting public unrest in Egypt are corroborated by French Canadian Ahmed Bensaada’s 2011 Arabesque Americaine. The book details the role of State Department and CIA funding in all the so-called “Arab Spring” revolutions. I have posted an English summary of Bensaada’s key finding at Smoking Gun: US Role in Arab Spring.

There have been a few rather timid attacks against Mekay’s article and Al Jazeera (for running it) at the usual “free market” and pro Obama websites. Predictably the role State Department funding may have played in Egypt’s recent coup has been invisible in the corporate media. It’s an issue Washington policy makers prefer to keep hidden from the American people.

Reposted from Veterans Today

photo credit: modenadude via photopin cc

August 17, 2013

How Land Monopoly Hampers Industry

photo credit: Renegade98 via photopin cc

(This is the 2nd half of a speech that Churchill made in Edinburgh on

17 July 1909 in support of the People’s Budget, which the British Parliament enacted later that year. In this section he describes how land monopolization hampers industry, how most charitable donations end up in the hands of rent-seekers, and how it’s the process, rather than individual land owners he’s attacking. Below is a brief video about Land Value Tax featuring US economist Michael Hudson.)

See how this evil process strikes at every form of industrial activity. The municipality, wishing for broader streets, better houses, more healthy, decent, scientifically planned towns, is made to pay, and is made to pay in exact proportion, or to a very great extent in proportion, as it has exerted itself in the past to make improvements. The more it has improved the town the more it has increased the land value, and the more it will have to pay for any land it may wish to acquire.

The manufacturer proposing to start a new industry, proposing to erect a great factory offering employment to thousands of hands, is made to pay such a price for his land that the purchase price hangs round the neck of his whole business, hampering his competitive power in every market, clogging him far more than any foreign tariff in his export competition, and the land values strike down through the profits of the manufacturer on to the wages of the workman. The railway company wishing to build a new line finds that the price of land which yesterday was only rated at its agricultural value has risen to a prohibitive figure the moment it was known that the new line was projected, and either the railway is not built, or, if it is, is built only on terms which largely transfer to the landowner the profits which are due to the shareholders and the advantages which should have accrued to the travelling public.

It does not matter where you look or what examples you select, you will see that every form of enterprise, every step in material progress, is only undertaken after the land monopolist has skimmed the cream off for himself. And everywhere today the man or the public body that wishes to put land to its highest use is forced to pay a preliminary fine in land values to the man who is putting it to an inferior use, and in some cases to no use at all. All comes back to the land value, and its owner for the time being is able to levy his toll upon all other forms of wealth and upon every form of industry.

The Error of Public Tollways

A portion, in some cases the whole, of every benefit which is laboriously acquired by the community is represented in the land value, and finds its way automatically into the landlord’s pocket. If there is a rise in wages, rents are able to move forward, because the workers can afford to pay a little more. If the opening of a new railway or a new tramway, or the institution of an improved service of workmen’s trains, or a lowering of fares, or a new invention, or any other public convenience affords a benefit to the workers in any particular district, it becomes easier for them to live, and therefore the landlord and the ground landlord, one on top of the other, are able to charge them more for the privilege of living there.

Some years ago in London there was a toll-bar on a bridge across the Thames, and all the working people who lived on the south side of the river had to pay a daily toll of one penny for going and returning from their work. The spectacle of these poor people thus mulcted of so large a proportion of their earnings appealed to the public conscience; an agitation was set on foot, municipal authorities were roused, and at the cost of the ratepayers the bridge was freed and the toll removed. All those people who used the bridge were saved 6d. a week. Within a very short period from that time the rents on the south side of the river were found to have advanced by about 6d. a week, or the amount of the toll which had been remitted.

Neutralising Philanthropy

And a friend of mine was telling me the other day that, in the parish of Southwark, about 350 pounds a year, roughly speaking, was given away in doles of bread by charitable people in connection with one of the churches, and, as a consequence of this, the competition for small houses, but more particularly for single-roomed tenements, is, we are told, so great that rents are considerably higher than in the neighbouring district.

All goes back to the land, and the landowner, who, in many cases, in most cases, is a worthy person utterly unconscious of the character of the methods by which he is enriched, is enabled with resistless strength to absorb to himself a share of almost every public and every private benefit however important or however pitiful those benefits may be.

Let Us Alter the Law

I hope you will understand that, when I speak of the land monopolist, I am dealing more with the process than with the individual landowner. I have no wish to hold any class up to public disapprobation. I do not think that the man who makes money by unearned increment in land is morally a worse man than anyone else who gathers his profit where he finds it in this hard world under the law and according to common usage. It is not the individual I attack, it is the system. It is not the man who is bad, it is the law which is bad. It is not the man who is blameworthy for doing what the law allows and what other men do, it is the State which would be blameworthy were it not to endeavour to reform the law and correct the practice. We do not want to punish the landlord. We want to alter the law.

Take the case to which I have already referred, of the man who keeps a large plot in or near a growing town idle for years, while it is “ripening” – that is to say, while it is rising in price through the exertions of the surrounding community and the need of that community for more room to live. Take that case. I daresay you have formed your own opinion upon it. Mr. Balfour, Lord Lansdowne, and the Conservative Party generally, think that that is an admirable arrangement. They speak of the profits of the land monopolist, as if they were the fruits of thrift and industry and a pleasing example for the poorer classes to imitate.

The Dog in the Manger

We do not take that view of the process. We think it is a dog-in-the-manger game. We see the evil, we see the imposture upon the public, and we see the consequences in crowded slums, in hampered commerce, in distorted or restricted development, and in congested centres of population, and we say here and now to the land monopolist who is holding up his land – and the pity is it was not said before – you shall judge for yourselves whether it is a fair offer or not-we say to the land monopolist – “This property of yours might be put to immediate use with general advantage. It is at this minute saleable in the market at 10 times the value at which it is rated. If you choose to keep it idle in the expectation of still further unearned increment then at least you shall be taxed at the true selling value in the meanwhile.”

Free Trade – Free Land!

Every nation in the world has its own way of doing things, its own successes and its own failures. All over Europe we see systems of land tenure which economically socially, and politically are far superior to ours; but the benefits that those countries derive from their improved land systems are largely swept away, or at any rate neutralised, by grinding tariffs on the necessaries of life and the materials of manufacture.

In this country we have long enjoyed the blessings of Free Trade and of untaxed bread and meat, but against these inestimable benefits we have the evils of an unreformed and vicious land system. ln no great country in the new world or the old have the working people yet secured the double advantage of Free Trade and Free Land together, by which I mean a commercial system and a land system from which, so far as possible, all forms of monopoly have been rigorously excluded.

An Hour of Tremendous Opportunity

Sixty years ago our system of national taxation was effectively reformed, and immense and undisputed advantages accrued therefrom to all classes, the richest as well as the poorest. The system of local taxation to-day is just as vicious and wasteful, just as great an impediment to enterprise and progress, just as harsh a burden upon the poor, as the thousand taxes and Corn Law sliding scales of the “hungry forties.”

We are met in an hour of tremendous opportunity.

“You who shall liberate the land,” said Mr. Cobden, “will do more for your country than we have done in the the liberation of its commerce.”

***

Click on the link to view a 39 minute Australian video featuring Michael Hudson about reducing income inequality by replacing income, company, and sales tax with a Land Value Tax:

http://www.youtube.com/watch?v=XL3n59wC8kk

August 15, 2013

The Mother of all Monopolies – Part I

By Winston Churchill

[From a Speech Delivered at King's Theatre in Edinburgh on 17 July 1909]

It is quite true that land monopoly is not the only monopoly which exists, but it is by far the greatest of monopolies – it is a perpetual monopoly, and it is the mother of all other forms of monopoly. It is quite true that unearned increments in land are not the only form of unearned or undeserved profit which individuals are able to secure; but it is the principal form of unearned increment which is derived from processes which are not merely not beneficial, but which are positively detrimental to the general public.

Land, which is a necessity of human existence, which is the original source of all wealth, which is strictly limited in extent, which is fixed in geographical position. Land, I say, differs from all other forms of property in these primary and fundamental conditions.

Nothing is more amusing than to watch the efforts of our monopolist opponents to prove that other forms of property and increment are exactly the same and are similar hl all respects to the unearned increment in land.

Misleading and False Analogies

They talk to us of the increased profits of a doctor or a lawyer from the growth of population in the towns in which they live. They talk to us of the profits of a railway through a greater degree of wealth and activity in the districts through which it runs. They tell us of the profits which are derived from a rise in stocks and shares, and even of those which are sometimes derived from the sale of pictures and works of art, and they ask us – as if it were the only complaint: “Ought not all these other forms to be taxed, too?”

But see how misleading and false all these analogies are. The windfalls which people with artistic gifts are able from time to time to derive from the sale of a picture – from a Vandyke or a Holbein – may here and there be very considerable. But pictures do not get in anybody’s way. They do not lay a toll on anybody’s labour; they do not touch enterprise and production at any point; they do not affect any of those creative processes upon which the material well-being of millions depends.

Rewards for Service

If a rise in stocks and shares confers profits on the fortunate holders far beyond what they expected or indeed deserved, nevertheless that profit has not been reaped by withholding from the community the land which it needs, but, on the contrary, apart from mere gambling, it has been reaped by supplying industry with the capital without which it could not be carried on.

If the railway makes greater profits, it is usually because it carries more goods and more passengers. If a doctor or a lawyer enjoys a better practice, it is because the doctor attends more patients and more exacting patients, and because the lawyer pleads more suits in the courts and more important suits.

At every stage the doctor or the lawyer is giving service in return for his fees, and if the service is too poor or the fees are too high other doctors and other lawyers can come freely into competition. There is constant service, there is constant competition; there is no monopoly, there is no injury to the public interest, there is no impediment to the general progress.

Fancy comparing these healthy processes with the enrichment which comes to the landlord who happens to own a plot of land on the outskirts or at the centre of one of our great cities, who watches the busy population around him making the city larger, richer, more convenient, more famous every day, and all the while sits still and does nothing.

Enrichment Without Service

Roads are made, streets are made, railway services are improved, electric light turns night into day, electric trams glide swiftly to and fro, water is brought from reservoirs a hundred miles off in the mountains – and all the while the landlord sits still. Every one of those improvements is effected by the labour and cost of other people. Many of the most important are effected at the cost of the municipality and of the ratepayers. To not one of those improvements does the land monopolist, as a land monopolist, contribute, and yet by every one of them the value of his land is sensibly enhanced. He renders no service to the community, he contributes nothing to the general welfare; he contributes nothing even to the process from which his own enrichment is derived.

If the land were occupied by shops or by dwellings, the municipality at least would secure the rates upon them in aid of the general fund, but the land may be unoccupied, undeveloped, it may be what is called “ripening” – ripening at the expense of the whole city, of the whole country for the unearned increment of its owner. Roads perhaps have to be diverted to avoid this forbidden area. The merchant going to his office, the artisan going to his work, have to make a detour or pay a tram fare to avoid it. The citizens are losing their chance of developing the land, the city is losing its rates, the State is losing its taxes which would have accrued if the natural development had taken place, and that share has to be replaced at the expense of the other ratepayers and taxpayers; and the nation as a whole is losing in the competition of the world – the hard and growing competition of the world – both in time and money.

And all the while the land monopolist has only to sit still and watch complacently his property multiplying in value, sometimes manifold, without either effort or contribution on his part. And that is justice!

Monopoly is the Keynote

But let us follow the process a little further. The population of the city grows, and grows still larger year by year, the congestion in the poorer quarters becomes acute, rents and rates rises hand in hand, and thousands of families are crowded into one-roomed tenements. There are 120,000 persons living in one-roomed tenements in Glasgow alone at the present time. At last the land becomes ripe for sale -that means that the price is too tempting to be resisted any longer. And then, and not till then, it is sold by the yard or by the inch at 10 times, or 20 times, or even 50 times its agricultural value, on which alone hitherto it has been rated for the public service.

The greater the population around the land, the greater the injury which they have sustained by its protracted denial, the more inconvenience which has been caused to everybody, the more serious the loss in economic strength and activity, the larger will be the profit of the landlord when the sale is finally accomplished. In fact, you may say that the unearned increment on the land is on all fours with the profit gathered by one of those American speculators who engineer a corner in corn, or meat, or cotton, or some other vital commodity, and that the unearned increment in land is reaped by the land monopolist in exact proportion, not to the service, but to the disservice done. It is monopoly which is the keynote, and where monopoly prevails the greater the injury to society the greater the reward to the monopolist will be.

To be continued.

From http://www.cooperativeindividualism.org/churchill-winston_mother-of-all-monopolies-1909.html

photo credit: monkeyc.net via photopin cc

August 13, 2013

Follow the Money

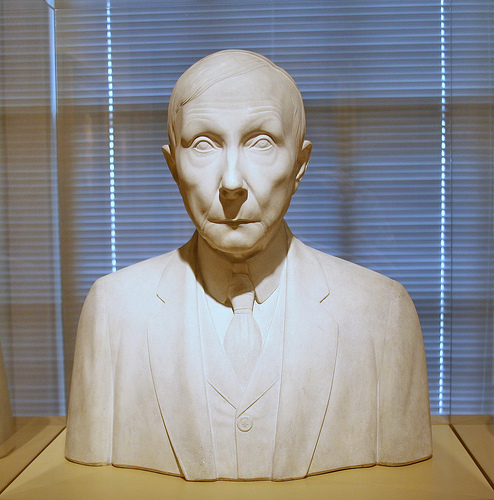

Bust of John D Rockefeller

Classical Economics as a Stratagem Against Henry George (free link)

By Mason Gaffney (2007)

Book Review-Part II

(In Part I, I discussed how Henry George’s work inspired the Populist and Progressive movements of the early 1900s and how the corporate elite struck back by inventing a new type of economics for the rich, called neoclassical economics)

Who Paid for Neoclassical Economics to Take Over American Universities?

Gaffney’s book traces the phenomenal public support Georgism enjoyed before the tenets of neoclassical economics took hold in American universities. In addition to inspiring the Populist and Progressive movements, an LVT to fund irrigation projects in California’s Central Valley made California the top producing farm state. In 1916 the first federal income tax law was introduced by Georgist members of Congress (Henry George Jr and Warren Bailey) and included virtually no tax on wages. In 1934 Georgist Upton Sinclair was almost elected governor of California.

Gaffney also identifies the robber barons whose fortunes financed the economics departments of the major universities who went on to substitute neooclassical economics for classical economic theory. At the top of this list were

Ezra Cornell (owner of both Western Union and Associated Press) – founder of Cornell University

John D Rockefeller – helped found the University of Chicago and installed his cronies in its economics department.

J. P Morgan – investment banker and early funder of Columbia University

B&O Railroad – John Hopkins University

Southern Pacific Railroad – Stanford University

The final section of Gaffney’s book lays out the tragic economic, political, and social consequences of allowing the Red Scare and neoclassical economics to stifle America’s movement for a single Land Value Tax:

Economic Consequences

The corporate elite has privatized, or is privatizing, most of the public domain (including fisheries, the public airwaves, water, offshore oil and gas, and the right to clean air) without compensation to the public.

The rate of saving and capital formation continues to fall rapidly. This is the main reason there is no recovery. Although profits soar, corporations have no incentive to invest in expansion and jobs. Instead they invest their profits in real estate, derivatives, and commodities speculation.

American capital is decayed and obsolete. The US has lost much of its steel and auto industries. Power plants and oil refineries are ancient and polluting. Most public capital (infrastructure) is old and crumbling.

The number of American farms has fallen from 6 million in 1920 to 1 million in 2007.

The USA, once so self-sufficient, has grown dangerously dependent on importing raw materials and foreign manufacturers.

The US financial system is a shambles, supported only by loading trillions of dollars of bad debts onto the taxpayers.

Real wage rates have continued to fall since 1975,

Unemployment has risen to chronically high levels.

Inequality in wealth and income continues to increase rapidly.

Political Consequences

The corporate elite has nullified all the Progressive Era electoral reforms by pouring money into politics and “deep lobbying,” at all levels of government, including our institutions of higher learning and our public schools.

The corporate elite continue to pour ever more of our tax money into prisons.

Social Consequences

Homelessness has risen to new heights, in spite of decades of subsidies to home-building and, favorable tax treatment of owner-occupied homes

Hunger is rampant.

Street begging, once rare, is everywhere

Americans have experienced a sharp loss of community, honor, duty, loyalty and patriotism.

In the shadow world between crime and business there is now the vast, gray underground economy that includes tax evasion, tax avoidance, and drug-dealing.

The US which once led the world in nearly every endeavor, has fallen far behind in infant survival, in longevity, in literacy, in numeracy, in mental health.

American education no longer leads the world. Privatized education in the form of commercial TV has largely superseded public education.

Below is an 8 minute interview with author Mason Gaffney from 2011:

photo credit: cliff1066™ via photopin cc

August 11, 2013

Karl Marx vs Henry George

photo credit: Felix42 contra la censura via photopin cc

http://homepage.ntlworld.com/janusg/100yrs.htm

Classical Economics as a Stratagem Against Henry George (free link)

By Mason Gaffney (2007)

Book Review-Part I

Why do American school children study the beliefs of a German radical named Karl Marx, the villain we love to hate? Yet Henry George, whose views on land and tax reform gave rise to the Progressive and Populist movements of the 1900s, is totally absent from US history books. During the 1890s George, author of the 1879 bestseller Progress and Poverty, was the third most famous American, after Mark Twain and Thomas Edison. In 1896 he outpolled Teddy Roosevelt and was nearly elected mayor of New York.

In Neo-classical Economics as a Stratagem Against Henry George (2007), University of California economist Mason Gaffney argues that George and his Land Value Tax pose a far greater threat than Marx to America’s corporate elite. America’s enormous concentration of wealth has always depended on the inherent right of the wealthy elite to seize and monopolize vast quantities of land and natural resources (oil, gas, forests, water, minerals, etc) for personal profit. Adopting an LVT, which is far easier than launching a violent revolution, would essentially negate that right. What’s more, every jurisdiction that has ever implemented an LVT finds it works exactly the way George predicted it would. Productivity, prosperity, and social wellbeing flourish, while inflation, wealth inequality, and boom and bust recessions and depressions virtually vanish. See Can an LVT Save Us?

When Progress and Poverty first came out in 1879, it started a worldwide reform movement that in the US manifested in the fiercely anti-corporate Populist Movement in the 1880s and later the Progressive Movement (1900-1920). Many important anti-corporate reforms came out of this period, including the Sherman Antitrust Act (1890), a constitutional amendment allowing Americans to elect the Senate by popular vote (prior to 1913 the Senate was appointed by state legislators), and the country’s first state-owned bank, The Bank of North Dakota (1919).

The Corporate Elite Strikes Back

As with any major reform movement, the corporate backlash was predictable. In Neo-classical Economics, Gaffney reveals that this backlash took two main forms. The first was the Red Scare (1919-1989), overseen by J Edgar Hoover as Assistant Attorney General and later as FBI director. The second was more insidious and involved the deliberate reframing of the classical economic theory developed by Adam Smith, Locke, Hume, and Ricardo as so-called neoclassical economics. The latter totally negates Adam Smith’s basic differentiation between “land”, a limited, non-producible resource. and “capital”, a reproducible result of past human production. Smith, Locke, Hume, and Ricardo all held that individuals have no right to seize and monopolize scarce natural resources, such as land, minerals, water, and forests. They believed that because these resources are both limited and essential for human survival, they should belong to the public.

Neoclassical economics, which first developed in the 1890s, was based on the premise that growth and development can only occur if a handful of rent-seekers are allowed to monopolize scarce land and natural resources for their personal profit. Henry George, who publicly debated the early pioneers of neoclassical economics, claimed the science of economics was being deliberately distorted to discredit him. Gaffney agrees. Because George’s proposal to replace income and sales tax with single land value taxed is based on logical concepts of land, capital, labor, and rent advanced by Adam Smith, Locke, Hume, and Ricardo, they all had to be discredited.

Gaffney believes neoclassical economic theory undermines George’s arguments for a single Land Value Tax in two basic ways: 1) by claiming that land is no different from other capital (ironically Marx made the identical argument) and 2) by portraying the science of economics as a series of hard choices and sacrifices that low and middle income people must make. Some examples:

If we want efficiency, we must sacrifice equity.

To attract business, we must lower taxes and shut libraries and defund schools.

To prevent inflation, we must keep a large number of Americans unemployed.

To create jobs, we must destroy the environment and pollute the air, water, and food chain.

To raise productivity, we must fire people.

To be continued.

August 10, 2013

Facebook’s Billionaire Tax Refugee

French actor Gerard Depardieu

In January Forbes reported that Facebook’s billionaire co-founder Eduardo Severin had renounced his U.S. citizenship to move to Singapore, where the top tax rate is 20%. The article about millionaires and billionaires fleeing high western tax rates was triggered by French actor Gerard Depardieu’s renunciation of his French citizenship to move to Russia. He chose Russia based on its top tax rate of 13% on individuals and 20% on corporations (except for the oil and gas industry – see below). France had just enacted a 75% tax on millionaires to pay off the 1.7 trillion euros it owes to international banksters. Socialist president Francois Hollande sees taxing the rich as a better alternative than laying off public servants and cutting health care, education, and pensions like Greece, Spain, Portugal, and Italy.

Forbes clearly disagrees. Predictably the article represents the traditional neo-classical economic viewpoint – slashing public services is always a better alternative than increasing taxes on the rich. They also leave out the most important part of the story – namely why income taxes in Singapore and Russia are so low.

The main reason income is taxed at a low rate in Singapore and Russia is because both countries have adopted a modified Land Value Tax (LVT). An LVT is a tax on unimproved land, resources and the cultural commons (e.g. public airwaves). It was journalist Henry George who first proposed replacing taxes on income and capital with a single LVT in his 1879 international bestseller Progress and Poverty. See What If Marx Got it Wrong?

Singapore ’s Economic Miracle

Singapore, a flourishing city-state of 5.3 million people, faced massive unemployment and a major housing crisis when it first gained its independence from Malaysia in 1965. Its leaders immediately launched a modernization program funded by an LVT. Although Singapore no longer relies on a single tax, income taxes still remains extremely low with corporate rates between 8.5 and 17%.

Thanks to the LVT, Singapore recovered much more rapidly than western countries from the 2008 economic collapse. In 2011 a 12% increase in GDP enabled them to pay a dividend to all adult citizens of approximately $269 each (total $1.22 billion).

How Putin Saved Russia ’s Moribund Economy

Russia’s LVT, introduced by President Vladimir Putin as part of a 2001 tax reform package, falls more heavily on mineral (e.g. oil and gas) extraction than unimproved land. Taxes on oil and gas revenues amount to approximately 45% of net sales (compared to 12 percent in the construction industry and 16.5 percent in the telecommunications industry). Property owners pay a tax ranging from 0.1 – 0.3% on land value (and a comparable rate on state-owned land that they lease).

Experience with LVT in other countries

Hong Kong (1985) – thanks to LVT, enjoys low taxes, low inflation, high investment and high salaries. Often voted the world’s best city for business and the freest for residents. According to Bloomberg’s they, too, paid a $700 dividend to all adult residents in 2011. Unfortunately since rejoining China, Hong Kong has been gradually replacing land and resource taxes with income tax. This has resulted in a return of land speculation and increasing income inequality. The Hong Kong real estate holdings of China’s multimillionaire president Xi Jinping are valued at more than $24.1 million.

Taiwan (1949) – following the Communist takeover of mainline China, Chinese nationalists under General Chiang Kai-shek fled to Formosa (Taiwan), a brutally poor feudal island controlled by a handful of rich farmers. Chiang Kai-Sheck, a follower of Sun Yat-Sen, the first Chinese president and a great admirer of Henry George, introduced a LVT. When plantation owners found themselves paying as much in taxes as they were collection in rent, they sold off their excess land to peasant farmers. Taiwan went on to set world records with growth rates of 10% per annum.

Denmark (1957) – the small Georgist Justice Party won seats in parliament and a role in the ruling coalition. A year later, inflation had gone from 5% to under 1%; bank interest dropped from 6.25% to 5%. By 1960, 100,000 unemployed (out of a population of 5 million) had found jobs and received the highest average pay increase in Danish history. In the 1960s, a media backlash funded by wealthy bankers and corporations caused the Justice Party to lose its seats. Land taxes were decreased and income tax and sales tax (currently at 25%) drastically increased. Inflation quickly rose to 5% and by 1964 reached 8%. Land prices began to sky-rocket, increasing 19-fold from 1960 to 1981 increasing 19-fold.

Estonia (1990s).- enacted a 2% LVT following the break-up of the Soviet Union . It was much easier to collect than the income taxes enacted by other former Soviet republics, more successful than trying to collect from others, succeeding over 95% of the time. It’s largely the LVT that has enabled Estonia to become the electric car capitol of the world. In addition to installing 165 electric vehicle fast-charging stations country-wide, it provides a 50% subsidy for residents who purchase electric vehicles.

Other jurisdictions that opted for LVT:

Ethiopia 1990s

Saudi Arabia, Kuwait, UAR – resource-based LVT on oil and gas exports

Baja California (Mexico) 1990s

British Columbia (1912) – resource-based LVT on forestry

Vermont 1978

Kansas City 1930s

Pennsylvania – Pittsburgh and Scranton in 1975 and 18 other cities following suit in the 1990s. Housing costs and crime in both Pittsburgh and Scranton have trended the lowest in the US, despite the collapse of the steel industry. Both avoided the 2000-2007 real estate bubble and 2008 collapse. Foreclosure rates in Pittsburg remain the lowest in the country.

Single tax colonies founded by Henry George’s American followers:

Free Acres (New Jersey) 1910

Arden (Delaware) 1900

Fairhope (Alabama) 1894

August 8, 2013

My Identity Crisis

Who me? A Politician?

After about a week of sleepless nights, I recently agreed to stand (in New Zealand. you “stand” for office) as a Green Party candidate for Taranaki District Health Board (DHB). Does this mean I’m a politician now? I sure hope not. For most of my life “politician” has been one of the vilest words in my vocabulary – one I associate with sociopathy, criminality, and moral bankruptcy. Is a candidate for public office automatically a politician? Or is there some invisible ethical boundary most political leaders cross that transforms them into politicians.

The First National Health Service in the World

For readers unacquainted with New Zealand, our National Health Service, established in 1938, was the very first. Funded through tax-payer dollars, our health system is similar to the British National Health Service, in that hospital doctors and nurses are government employees. One important difference is that primary care remains in the private sector. Kiwis pay most of the cost of a GP visit themselves. Although the government subsidizes GP care for seniors and other disadvantaged groups, cost remains a significant barrier for many low and middle income Kiwis.

This, in turn, means New Zealand has an abysmal record in treating chronic conditions like high blood pressure and diabetes and delivering preventive health services. A recent University of Otago Study revealed that low income Kiwis die 6-9 years younger than other New Zealanders. In my mind, a national disgrace.

Taranaki’s Health Care Mess

I’m standing on a platform of increasing transparency and accountability over major service cuts that are occurring under our current National-led (conservative) government. Like many “provincial” (i.e. rural) areas in New Zealand, Taranaki has a chronic GP shortage – made worse by recent budget cuts. Moreover at present even middle income Taranaki residents have difficulty getting “elective” services, such a joint replacements, through the public system. Pressure from the New Zealand government to reduce long waiting lists means that many patients with degenerative hip disease can’t even get on a waiting list. In other words, unless they can pay $25,000 to have their hip surgery done in a private hospital, it won’t happen.

Efficiency Adjustments: Austerity Cuts in Sheep’s Clothing

The New Zealand NHS is divided into twenty health districts, each supposedly governed by a District Health Board. Increasingly, however, the Ministry of Health is centralizing all the really major decisions over health care delivery, reducing the DHB role to that of a rubber stamp.

Our current government, which has laid off thousands of public service workers, made a campaign promise that they wouldn’t cut health care or education. Thus they play this elaborate shell game called “efficiency adjustments.” What it amounts to is a scheme to magically erase the cost of inflation, population growth, and caring for older, sicker patients from the health budget. In 2012, they allocated $111 million less than the twenty DHB’s needed to continue existing services.

Because DHBs aren’t allowed to run deficits, they have no choice but to cut staff, decrease GP subsidies, and prioritize cheaper, less complicated surgeries. Here in Taranaki, they started by laying off clerical workers and administrators, shifting this paperwork load to doctors and nurses. In 2013, the DHB has begun to cut clinical staff positions. As doctors and nurses are still expected to care for the same number of patients, this is an ominous development which greatly increases the risk of medical errors.

Crossing the Line

If there is an invisible line, it must be the one a candidate crosses when he or she makes a campaign promise they can’t possibly keep. This is what worries me as I get up to give my stump speech. With Taranaki DHB having so little authority over health service delivery, I sometimes worry what I can keep.

I tell people I’m standing on a platform of increasing transparency and accountability over all budget and service cuts. I know I can keep the first part of this promise. I’m starting a watchdog-type blog on my new website and will take great joy in exposing National “efficiency adjustments” for what they really are: austerity cuts. Delivering on accountability (i.e. forcing the government to respond to what the public wants) will be more difficult. I am prepared to stick my neck out and be an extremely forceful advocate for the residents of Taranaki. I really worry, though. Will this be enough?

August 6, 2013

Can World War III Be Prevented?

With the 2012 elections out of the way, the US edges ever closer to war with Iran. China and Russia have clearly indicated they will support Iran if it is attacked by Israel or the US. Both are nuclear powers. Thus there is no longer any question where or when World War III is likely to start. Below are two fascinating videos that offer compelling arguments that the corporate oligarchy controlling the US government is doing everything in their power to launch a war against Iran.

Land Hunger as a Motive for War

The first and longest is by Fred Harrison, author of The Traumatised Society. Arguing from a macroeconomic perspective, Harrison explains why the capitalist elite automatically turns to war when confronted with a severe economic depression. He illustrates with the two worst global depressions in history: the one occurring in the 1900s that led to World War I and the one in the 1930s that led to World War II.

As Harrison explains it, land confiscation, speculation, resource extraction and monopolization of the cultural commons (e.g. the public airwaves and money) is the single most important mechanism for the transfer of wealth from Producers (i.e. workers) to the Predators (the ruling elite). Eventually, however, the Producers are squeezed dry, which manifests in a severe economic depression. The Predators typically respond by looking for new land and resources to confiscate. They do this through conquest and military and economic colonization – and war.

Harrison lays out in detail the land hunger that led the ruling elite in Italy and Germany to instigate World War I. Likewise Hitler and his corporate backers sought to alleviate the severe depression confronting Germany in the 1930s by expanding Germany territory through the invasion of Poland and Czechoslovakia.

Harrison concludes by linking US aggression in the Middle East to land (and resource) hunger on the part of the US rent-seekers (i.e. corporate elite). China, in turn, has their own rent-seekers – party bureaucrats who have made themselves obscenely rich through land development and speculation. A good example is millionaire real estate tycoon Xi Jinping, China’s current president. Chinese rent-seekers are driving China’s economic colonization of South Africa, South America, Asia (and Detroit). They’re also pushing Chinese territorial claims on Japanese and Filipino islands.

War to Stall the Collapse of Capitalism

A much shorter video by Storm Clouds Gathering, also argues that war in Iran and World War III seem increasingly inevitable. However it does so from a microeconomic perspective. Specifically it links an imminent attack on Iran with the likely collapse of the US dollar and the American economy. Because the US dollar is no longer backed by gold or silver, it only continues to have value because of its petrodollar status. The US has military treaties with a number of oil producing countries that they will oil in dollars. This forces most oil importing countries to keep US dollars in reserve, with the resulting demand inflating its value.

Unbeknownst to many Americans, George W Bush’s invasion of Iraq closely followed a decision by Saddam Hussein to sell oil in euros, rather than dollars. Likewise the US/NATO invasion of Libya closely followed a similar decision by Muammar Gaddafi. In a similar vein, US military designs on Iran have nothing to do with Iran’s non existent nuclear weapons program. Since March 2012, Iran has been selling oil for euros, yen, and gold and is open to negotiating acceptance of other currencies, including Indian rupees:

The Storm Clouds Gathering film emphasizes the importance of the mother of all corporate lobby groups, the Council on Foreign Relations, in pressuring Obama to declare war on Iran. Hillary Clinton’s reference to the CFR telling the State Department what “we should be doing” is no slip of the tongue.

Both Harrison and SCG video argue that the only way to stop a US/Israeli invasion of Iran and World War III is by mobilizing the American public to launch a massive pressure campaign, of the scale Egypt is currently witnessing in Tahrir Square. I agree.

Want to stop World War III? Here’s how:

Join the anti-Iran war movement. No matter what your ideological bent – liberal, conservative, progressive, libertarian, socialist, anarchist – there’s a group nearby that’s right for you.

Below are links to five of the largest antiwar coalitions (and the US Green Party):

http://www.answercoalition.org/

http://stopwaroniran.org/iranstatement.shtml

http://www.peacecoalition.org/campaigns/iran.html

http://libertarians4peace.net/

photo credit: roberthuffstutter via photopin cc

August 4, 2013

It’s Official: US Funding Al Qaeda and Taliban

At Least 43 Reconstruction Contracts Going to Terrorist Groups

At Least 43 Reconstruction Contracts Going to Terrorist Groups

It’s extremely ironic for the US State Department to be issuing travel alerts for US citizens in the Middle East and North Africa the same week we learn that the Pentagon is contracting with Al Qaeda and Taliban supporters to carry out Afghan reconstruction projects.

Tony Capaccio of Bloomberg News cites a quarterly report to Congress by Special Inspector for Afghan Reconstruction John Sopko.The report reveals Sopko asked the US Army Suspension and Disbarment office to cancel 43 contracts to known Al Qaeda and Taliban supporters. They refused. The reason? The Suspension and Disbarment Office claims it would violate Al Qaeda and Taliban “due process rights.”

Curious, isn’t it? Official terrorist groups have due process rights, but not whistleblowers, Guantanamo detainees, or ordinary Americans subject to continual surveillance by NSA.

The intelligence community has been quietly leaking evidence for more than a decade that the US is secretly funding Al Qaeda to promote political instability (and justify continued military intervention) in the Middle East. In the last two years the CIA has been caught red-handed funding and training Al Qaeda militants in Libya and Syria.

Based on Sopko’s report, Pentagon support for Al Qaeda and the Taliban is official as of August 1.

Let me see if I can think this through: the Pentagon is giving Al Qaeda and the Taliban funding, even though Al Qaeda and the Taliban are planning to carry out attacks on US citizens. How can this be happening? It would appear the US government is at war with their own people.

The 236 page quarterly report Sopko submitted to Congress also raises grave concerns about Obama’s request for $10.7 billion in 2014 for Afghan reconstruction projects. All would be carrying out by civilian contractors, of which 30-40% would be local Afghan businesses.

Sopko argues the Pentagon already fails abysmally in monitoring an existing $32 million program to install bars or gratings in culverts to prevent insurgents from planting roadside bombs in them. He thinks at bare minimum the Department of Defense should now how many contracts they have issued under this program. They don’t. Thus it seems pretty obvious they aren’t vetting the contractors, much less monitoring where the money is going.

photo credit: Mike Licht, NotionsCapital.com via photopin cc

Reposted from Veterans Today

August 2, 2013

Sarah Palin and Alaska’s Resource-Based LVT

photo credit http://www.flickr.com/photos/charkes/

photo credit http://www.flickr.com/photos/charkes/

The Traumatised Society: How to Outlaw Cheating and Save Our Civilisation

By Fred Harrison

Book Review – Part III

(This is the third of 3-part review of Fred Harrison’s The Traumatised Society. Part III relates to the potential for LVT to address specific economic and political difficulties. )

As I discussed in my previous blog, Britain enacted a Land Value Tax (LVT) – twice – but was blocked by rent-seekers from implementing it. Harrison moves on to explore how an LVT might have alleviated severe economic and political turmoil in other countries:

Ireland – rent seekers “sucked” out all the wealth of Ireland for 200 years, a process that didn’t end with independence. Ireland’s “Celtic Tiger” could have been sustainable if it had been funded by a LVT rather than debt. The result was a debt/real estate bubble that left the country even worse off when the bubble burst in 2008. In 2010, Harrison advocated for Ireland to pay off its debt by implementing a LVT. This would have provided the revenue the Irish government needed to stimulate growth. Instead the IMF bailout and austerity cuts has deeply suppressed growth.

China – made a fatal error by failing to implement an LVT when they began to privatize collectively owned land in the 1980s. China is currently facing slowing growth, thanks to a $1.7 trillion debt incurred by their city and provincial governments. While the central government was building up massive cash reserves by selling cheap exports, they forced regional governments to self-fund their public services. The only way they could do this was by selling land to property developers and by borrowing money.

Cuba – made a fatal error on November 11, 2011 when they began selling collectively owned land to rent-seekers, and allowed rents to be capitalized into land prices – instead of taxing them.

Russia – Gorbachev envisioned land remaining in public hands as part of Glasnost. After a threatened military coup forced him to step down, Harrison went to Russia trying to persuade Yeltsin to adapt an LVT. Instead Russia’s first president opened the country to the IMF and western rent-seekers. Both sucked out sufficient wealth to set the country’s standard of living back several decades.

Africa – South Africa’s current economic difficulties relate to a fatal error they made in 2004. They amended their LVT to add a tax on property improvements but should have done the opposite – increase the LVT and reduce other taxes. Much of the land in the rest of sub-Saharan Africa is still communally owned. Thus there is still great potential for emerging African economies to adopt an LVT. This would allow them to develop debt-free, sustainable economies that don’t leave the majority of the population in abject poverty.

The US – suffers from a “constitutional neurosis,” according to Harrison. Supposedly the Declaration of Independence and US Constitution were based on the Scottish Enlightenment. Whereas John Locke talked about a universal right to “Life, Liberty and Estate (Land),” our founding fathers changed this to “Life, Liberty and the Pursuit of Happiness” even before the Constitution was written.

The Future of LVT

As Harrison points out, at present rent-seekers are extremely powerful and have absolute control over government, media, and public education. Nevertheless as countries in the Middle East, North Africa and Latin America escape US military control, it’s imperative they have an avenue to escape the economic control of local and international rent-seekers. By adopting an LVT, they guarantee themselves sufficient income to provide government and public services – without falling into the predatory clutches of international bankers and the IMF.

In his 2011 book Resolving the Economic Puzzle, Walter Rybeck describes how the US contemplated LVT enabling legislation during the Carter administration. As an assistant to Representative Henry Reuss (D-Milwaukee), Rybeck helped Reuss (as chair of the House, Banking, Finance and Urban Affairs Committee) promote land and resource taxes as a way to address crumbling infrastructure in financially strapped cities and states.

Enter Sarah Palin

According to Rybeck, a number of communities (and one state) have already adopted variations of an LVT. Alaska’s oil/gas tax is the best example of a resource-based LVT. This tax provides 80-90% of Alaska’s general fund, as well as providing annual dividends to residents. As governor of Alaska, Sarah Palin introduced Alaska’s Clear and Equitable Share (ACES), which charges a 25 percent tax rate on oil profits, with the rate increasing progressively as oil prices go up.

Five other states have passed LVT enabling legislation – Connecticut, Maryland, New York, Pennsylvania, Virginia, Washington – to make it easier for local communities to adopt an LVT.

Other American communities that have already benefited from an LVT include California’s Central Valley, Fairhope in Alabama, Arden in Delaware, and Pittsburgh and other cities in Pennsylvania.

Below is a video of Max Keiser interviewing Harrison about LVT:

The Most Revolutionary Act

- Stuart Jeanne Bramhall's profile

- 11 followers