Stuart Jeanne Bramhall's Blog: The Most Revolutionary Act , page 1389

April 27, 2013

Boston Bombers: All in the CIA Family

According to Daniel Hopsicker in MadCow Morning News, it turns out Ruslan Tsarni, the uncle of the two alleged Boston bombers, was married to the daughter of former top CIA official Graham Fuller. Uncle Ruslan, in turn, had a decade-long business relationship with Halliburton, the oil company/defense contractor formerly run by Dick Cheney that awarded billions of dollars in no-bid contracts in Iraq and Afghanistan. Back in the nineties, Tsarni served for two years as a “consultant” for the U.S. Agency for International Development (USAID), in the former Soviet Republic of Kazakhstan. It’s been well-documented that USAID (which is funded by the US State Department) is often used as a front for CIA and other US intelligence operations.

In the early 1990s Ruslan Tsarni married the daughter of former top CIA Graham Fuller, who spent 20 years as operations officer in Turkey, Lebanon, Saudi Arabia, Yemen, Afghanistan, and Hong Kong. In 1982 Fuller was appointed the National Intelligence Officer for Near East and South Asia at the CIA, and in 1986, under Ronald Reagan, he became the Vice-Chairman of the National Intelligence Council, with overall responsibility for national level strategic forecasting.

At the time of their marriage, Ruslan Tsarni was known as Ruslan Tsarnaev, the same last name as his nephews Tamerlan and Dzhokhar Tsarnaev, the alleged bombers.

It is unknown when he changed his last name to Tsarni.

Coincidentally Graham Fuller is listed as one of the American Deep State rogues on FBI translator whistleblower Sibel Edmonds’ State Secrets Privilege Gallery. According to Edmonds, the gallery features subjects of FBI investigations she became aware of during her time as an FBI translator.

She asserts that these individuals engaged in criminal activities subsequently protected under the doctrine of State Secrets. After Attorney General John Ashcroft went all the way to the Supreme Court to silence her, she posted the twenty-one photos to the Internet with no names.

One photo has been subsequently identified as

All this is just the tip of the iceberg. Read full post here: MadCow Morning News

photo credit: ford via photopin cc

Crossposted at Daily Censored

April 26, 2013

The Government Attacks the Price of Gold

It’s hard to read any investment or economics blogs without being bombarded with recommendations to buy gold. The conventional wisdom is that it’s the only safe investment banks stop paying interest and stock prices are vastly overinflated due to the current Wall Street bubble and unstable real estate market. While real estate and other investments linked to specific currencies (such as the US dollar) can become virtually worthless the currency collapses, gold supposedly has intrinsic value as a precious metal. Unless, of course, food and other necessities are in such short supply that no one will trade them for gold. With so many Americans, and governments such as China, India and Russia buying gold, investors have been baffled that the price of gold has been dropping. According to supply and demand, the price should rise. In a recent essay in Global Research, former Reagan economic adviser Paul Craig Roberts reveals that the Federal Reserve has been actively suppressing the price of gold through “naked” short selling. In short selling an investor sells a stock or commodity he expects to drop in price, then buys it back at the lower price. In “naked” short selling, an investor sells a stock or commodity he doesn’t own. The effect of a large number of investors selling short is to drive the price of a stock or commodity down. According to Roberts, the Fed short sold 500 tons of gold on April 12th, at a cost of $1.16 billion (remember they didn’t own the gold to begin with). No individual or bank could handle that kind of loss, but it’s no problem for the Fed. They just print the money, via Quantitative Easing, to cover it.

In the video below, Greg Hunter interviews Roberts about his recent article. Roberts explains that the US government has no choice but to suppress the price of gold to protect the value of the US dollar. In the last four years the Fed has “printed” one trillion dollars pure year, using “quantitative” easing to purchase bad bank debt. This would be fine if there were sufficient demand with the US economy or overseas to soak up $5 trillion and thus prevent inflation. Thus to prevent a run on the dollar, through massive conversion of dollars to gold, the Fed discourages investors from buying good by effectively capping the price.

According to Roberts, attacking the price of gold helps the dollar by propping up bond prices (especially of bonds based on derivatives) that are the life blood of investment banks. Because private banks, rather than government, have primary responsibility for issuing money (by issuing loans not covered by reserves) the health of the US dollar is intimately connected to the health of investment banks and the bonds they issue and hold.

Other mechanisms the US uses to prop up the dollar include persuading other governments to inflate their own currencies by printing more money. If the euro and yen are also over inflated, currency traders aren’t tempted to exchange all their dollars for European and Japanese currency.

He mentions that Australia, which has much closer ties with China than the US, has refused to print money by engaging in the quantitative easing game. All you need to do is look at the exchange rate to get a real sense how rapidly the US dollar is losing value. When I first moved to New Zealand, $1.00 Aus sold for $0.90US. Now it sells for $1.03 US.

The change in New Zealand’s exchange rate (China has just exceeded Australia has our major export partner) is even more extreme. In 2002 $1.00 NZ sold for $0.50 US. Now it sells for $0.88 US.

The most interesting part of the interview is toward the end, in which Hunter and Roberts discuss the likelihood the US dollar will collapse and the US government will seize depositors’ savings accounts (like they did in Cyprus) and private pensions. Hunter asks if this is why the government is trying to restrict citizens’ access to guns. Roberts makes the very astute observation that no police state can operate in a society with an armed population. “As we move closer and closer to a police state, they’re going to have to take the guns away. . . The police state has doomed the 2nd amendment. It’s just a question of time.”

photo credit: digitalmoneyworld via photopin cc

April 24, 2013

How the US Tried to Steal the Venezuelan Elections

BBC investigative reporter Greg Palast published a fascinating article in Vice Magazine this week (Nicolas Maduro Did Not Steal the Venezuelan Election) about being hired by Hugo Chavez and Nicolas Maduro in 2004 to investigate the possibility the US might tamper with Venezuela’s elections (following Palast’s 2001 expose detailing how Florida governor Jeb Bush stole the election for his brother).

The article describes how he presented Chavez and Maduro with a collection of secret FBI memos revealing that ChoicePoint Corp – under a no-bid contract (from the US government) – had “shoplifted” Venezuela’s voter rolls, as well as the voter rolls of Argentina, Brazil, Nicaragua, Mexico and Honduras, all of whom were on the verge of electing presidents from the political left.

By coincidence it was a subsidiary of ChoicePoint Jeb Bush engaged in 2000 to illegally “purge” more than 56,000 voters, the vast majority black and poor, from Florida’s voter rolls. A maneuver which would ultimately give George Bush the US presidency by just 537 ballots.

After reading Palast’s report, Chavez moved swiftly to establish a virtually tamper-proof electoral system. In Venezuela every voter gets TWO ballots. One is electronic; the second is a paper print-out of the touch-screen ballot, which the voter reviews, authorizes and places in a locked ballot-box. Fifty-four percent of the boxes are opened at random and checked against the computer tally – making the system virtually tamper proof.

When Maduro’s opponent Henrique Capriles officially challenged the recent outcome, he was allowed to add as many precincts as he wanted (12,000) to this automatic audit.

It would appear the US State Department doesn’t have a leg to stand on in backing opposition claims that Maduro’s win is fraudulent. Thus, according to Palast, they have turned to another old CIA trick, violent street demonstrations protesting the electoral outcome. He points out that most, but not all, of the voters killed in street protests are Chavistas.

photo credit: sterno_inferno via photopin cc

Crossposted at Daily Censored

April 22, 2013

Reagan’s Ex-Budget Director Slams Crony Capitalism

An attack on “crony capitalism” David Stockman, Reagan’s former budget director, published in the the March 31st New York Times has come in for major attack from both the right and left. Given the piece provides a fairly accurate analysis of America’s current economic woes, I find this quite sad.

Stockman also attacks crony capitalism (i.e. government corrupted by corporate interests) in his latest book The Great Deformation: The Corruption of Capitalism in America.

I find it a little astonishing to see a so-called conservative come up with so many progressive-sounding solutions for America’s economic mess. For example: 1) 100% public financing of elections 2) Restricting the duration of campaigns (like they do in New Zealand). 3) Prohibiting lobbying, for life, by anyone who has been on a legislative or executive payroll. 4) Overturning Citizens United. 5) Ending the corrosive financialization that has turned Wall Street into a giant casino since the 1970s. 6) Eliminating access by Wall Street Banks to cheap Federal Reserve loans 7) Banning banks from trading, underwriting and money management in all its forms [I wonder if this means he supports the IMF proposal to end the ability of private banks to create money in the form of loans?] 8) Reigning in the Federal Reserve by ending their ability to buy government debt and micromanage the economic [some of us would go all the way and abolish it].

Here’s an excerpt from the end of the oped:

“All this would require drastic deflation of the realm of politics and the abolition of incumbency itself, because the machinery of the state and the machinery of re-election have become conterminous. Prying them apart would entail sweeping constitutional surgery: amendments to give the president and members of Congress a single six-year term, with no re-election; providing 100 percent public financing for candidates; strictly limiting the duration of campaigns (say, to eight weeks); and prohibiting, for life, lobbying by anyone who has been on a legislative or executive payroll. It would also require overturning Citizens United and mandating that Congress pass a balanced budget, or face an automatic sequester of spending.

It would also require purging the corrosive financialization that has turned the economy into a giant casino since the 1970s. This would mean putting the great Wall Street banks out in the cold to compete as at-risk free enterprises, without access to cheap Fed loans or deposit insurance. Banks would be able to take deposits and make commercial loans, but be banned from trading, underwriting and money management in all its forms.

It would require, finally, benching the Fed’s central planners, and restoring the central bank’s original mission: to provide liquidity in times of crisis but never to buy government debt or try to micromanage the economy. Getting the Fed out of the financial markets is the only way to put free markets and genuine wealth creation back into capitalism.”

I guess America’s stubborn economic difficulties have at least one silver lining. In the mad scramble to identify workable solutions, conventional notions of right, left and progressive are rapidly breaking down. I have always found such labels arbitrary, artificial and too easily hijacked by the two major parties – who can’t see beyond the banks and corporations who are funding their next campaign.

photo credit: The Aspen Institute via photopin cc

Crossposted at Daily Censored

April 20, 2013

Lady Gaga Backs Anti-Fracking Campaign

In October 2012, Lady Gaga joined a coalition of 200 artists started by Yoko Ono and Sean Lennon called Artists Against Fracking. She simultaneously urged her 90 million Facebook and Twitter fans to support the organization and sign a petition asking New York Governor Andrew Cuomo to ban fracking. Seems pretty newsworthy to me. Wonder how the corporate media missed this explosive story.

A list of all the artists in the coalition can be found at http://artistsagainstfracking.com/, along with an inspiring rendition of “Don’t Frack My Mother.”

Readers unacquainted with the term fracking – aka hydraulic fracturing – can also use the website and the video below to get up to speed.

photo credit: PVBroadz via photopin cc

Crossposted at Daily Censored

April 18, 2013

Would You Donate to Stop a Saudi Execution?

No, this isn’t spam. It’s actually a novel form of crowdfunding, the latest fad in raising funds for new movies and community projects.

The Philippine government is asking for “kind hearted individuals” to assist in raising the 512,066.35 Saudi Arabian Riyals (approximately $1 million US) the Saudi government is demanding as blood money to halt the execution of a Filipino guest worker named Joselito Zapanta, convicted of killing his landlord in 2009. According to Filipino in death row, the man’s family and the Philippine government have raised approximately one-eighth of the required amount.

I see a clear moral dilemma here, especially for death penalty opponents. It seems similar to the dilemma western governments face in deliberating whether to ransom kidnap victims of Somali pirates. If we reward brutal thugs by paying them off, doesn’t it just encourage them?

The ability to “buy” justice is totally antithetical to most Americans’ thinking about the rule of law. Yet the reality is that justice in the US is bought and sold. Rich people hire the best lawyers available and get off. While the poor, stuck with badly paid, overworked public defenders, get long sentences and the death penalty.

Under the Obama administration, the US remains Saudi Arabia’s strongest ally in the developed world. In 2010, the Obama administration approved the biggest arms sale in American history: an estimated $60.5 billion purchase by the Kingdom of Saudi Arabia.

Here are the contact details for the Office of the President of the Philipines: http://www.president.gov.ph/contact-us-2/

I recommend you do as I did and email them first. Ask about getting your money back if this fundraising endeavor fails and the Saudis proceed with the execution. And be sure to get a receipt.

April 17, 2013

The Criminal Nature of Austerity

Guest post by Steven Miller

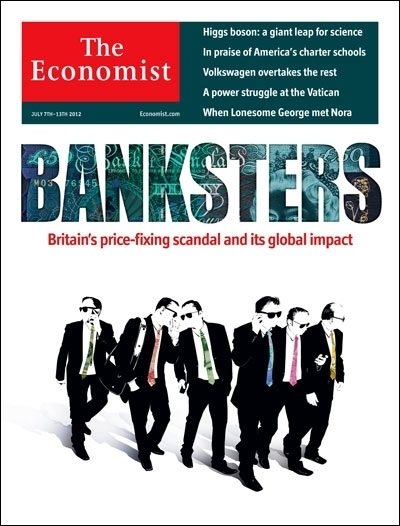

(This is the last of three guest posts laying out the real story about the role of Wall Street banksters in the recent bankruptcy of Stockton California . In this post Miller lays out the extra-legal, criminal nature of government austerity measures.)

If the Oakland Tribune or any other newspaper were really representing the public interest they would spread the word that the people of this country are paying the Banksters twice. The government Bail Out to the banks was at least $16 trillion. This was free money at a dollar-for-dollar rate, unheard of in the history of finance. This money could have and should have been used to pay off all outstanding debts from personal debts to student debts, mortgage debts and city debts. After all, if you owe someone money, and then pay him off, you don’t have to keep on paying. Isn’t that how things work?

So why should we pay them a second time? This open collusion by the government to guarantee bank profits at the expense of everything else in America is the 21st Century expression of how Mussolini famously defined fascism – the merger of the corporations and the state.

The economist Michael Hudson describes it this way:

“Today’s economic warfare is not the kind waged a century ago between labor and its industrial employers. Finance has moved to capture the economy at large, industry and mining, public infrastructure (via privatization) and now even the educational system. (At over $1 trillion, U.S. student loan debt came to exceed credit-card debt in 2012.) The weapon in this financial warfare is no larger military force. The tactic is to load economies (governments, companies and families) with debt, siphon off their income as debt service and then foreclose when debtors lack the means to pay. Indebting government gives creditors a lever to pry away land, public infrastructure and other property in the public domain. Indebting companies enables creditors to seize employee pension savings.” (10)

The Politics of Austerity

Austerity is implemented across the world in various forms, but mostly this is accomplished through extra-legal measures. Leaders of the G20 countries, the biggest national economies, met in Toronto to decide how to address the economic Melt Down. Surrounded by the army to hold off the protestors, these leaders “agreed” to implement Austerity across the board. There was no treaty. No legislation was proposed. No plebiscite was held to find out the will of the people. Austerity was simply imposed.

The same extra-legal process occurred earlier this year with the so-called $90 billion Sequester that permanently cuts social programs for millions of people in the US. A bi-partisan Congress that is supposedly broken and not capable of functioning passed the Sequester more rapidly than any legislation since the Bail Out. While the process was disguised with a few hearings, and did end with legislation, the process occurred completely outside of the legally established fact finding process. No one was legally sworn in to hold them accountable for their testimony and bogus inflammatory statements.

Two years ago Michigan passed Public Act 4 – the Emergency Manager bill. This law empowered the governor, at his own personal discretion, to seize any city or municipal government and appoint a financial manager – either a person or a corporation! – with total power to break contracts and sell off public land, parks, buildings, etc to private corporations. In the 2012 election, the people of Michigan voted for a constitutional amendment to void the act.

Two weeks later, the law was simply re-established in a slightly different form by the governor. (11) Then the governor seized the city of Detroit, depriving them of the civil right to vote. These maneuvers completely void the democratic process and confirm the old saying that law is simply the will of the 1%, written down. It is possible that California will see similar propositions proposed in the 2014 election.

This combination of legal and extra-legal maneuvers, the merging of corporations and the state, demonstrate what political power really is. The Banksters work at it 24/7 and impose it upon the rest of us. We are not going to reverse this class political power by voting every 4 years, or by trying to convince bought-off legislators to see things our way for once. It is time to learn from the masters. The 99%’s struggle for political power must consider how to impose the will of the people, every day and every way, and force government officials to be truly accountable or pay the price.

Notes

10) Michael Hudson. “The Finance Industry Has Pried into Every Sector of the Economy, and Has Ended Up Running the Whole Show”. December 31, 2012

11) Rally, Comrades, March-April, 2013. www.rallycomrades.org

photo credit: London Permaculture via photopin cc

Originally posted at Daily Censored

Steven Miller has taught science for 25 years in Oakland’s Flatland high schools. He has been actively engaged in public school reform since the early 1990s. When the state seized control of Oakland public schools in 2003, they immediately implemented policies of corporatization and privatization that are advocated by the Broad Institute. Since that time Steve has written extensively against the privatization of public education, water and other public resources. You can email him at nondog2@hotmail.com

April 16, 2013

The “Interest Rates Swap” Scam Killing Our Cities

Guest post by Steven Miller

(This is the second of three guest posts laying out the real story about the role of Wall Street banksters in the recent bankruptcy of Stockton California . In this post Miller describes how interest rate swaps work. He also explains the LIBOR scandal – in which the crooks who run our big banks rigged interest rates to maximize their payoff from IRS ’s. Note how charges have been dismissed against Bank of America , Barclays and JP Morgan Chase. Instead the good people of Stockton and the workers in the California Public Employees Retirement System are being forced to pay for their crime.)

The issue turns on the “credit default swaps” that the banks tricked cities into taking. This is another financial weapon of mass destruction, like sub-prime mortgage loans. Cities issue bonds to get cash for projects, thus they must make regular payments on the bonds. Wall Street is the aggressive party here, not the cities. The financial boys try to sell the cities a form of insurance called an “interest-rate swap”. The deal is that if interest rates stay high, the bank will pay them extra as insurance, but if the rates stay low, then the cities pay the bankers.

Somehow the Banksters were eerily prescient: since 2008, the Fed has kept interest rates at zero “to stimulate the economy”. Now cities, school districts and water boards pay the banks millions of dollars a month. But the kindly bankers do permit cities to pay exorbitant termination fees. Between 2006 and 2008, banks collected at least $28 billion from cities on top of the swap payments. (3)

The Office of the Comptroller of the Currency reported in 2012 that U.S. banks held $183.7 trillion in interest rate contracts. Only four firms represent 93% of total derivative holdings: JPMorgan Chase, Citibank, Bank of America and Goldman Sachs. (4) They are the bedrock of the derivative market.

“Interest rate swaps are today the single largest type of derivative in existence, making up more than 80% of the value of all derivative contracts signed by U.S. commercial banks. Measured by their notional amounts (the “notional” of a swap is a fictive sum of money corresponding to an actual principle on real debt), U.S. banks have an outstanding $202 trillion in interest rate derivative contracts. In other words, U.S. banks are using swaps to transform interest rate payments on $202 trillion in debt, owed by corporations, governments, and other banks, so that these entities can switch from variable rates to fixed, or vice versa, and so that they can peg their debt payments to any number of global rates.

“On a global level the total notional amount of interest rate swaps were most recently estimated at $441 trillion by the International Swaps and Derivatives Association. These trillions of dollars represent the debts of virtually all major corporations and governments. More than any other development in the last thirty years, this new derivatives regime creates the globalized economy. (5)

Let’s put these incredible figures in context. What do they mean? The total GDP of the entire world for one year is around $50 trillion; for the US alone it is about $14 trillion. (6) So the total amount of interest rate swaps for the world is $441 trillion? Eight times the production of the entire world? How could this be?

Wall Street has been the greatest profit-making sector of the US economy since 2000. In 1973, financial returns were 16% of total corporate profits; by 2007, they reached 41%! Since these profits come mostly from loans, this meant the vast expansion of indebtedness throughout the US economy. (7)

Consumer borrowing doubled in the US between 1980 and 2007, but corporate borrowing quintupled, actually reaching 121% of the GDP in 2008! (8) These investments were mostly not in the form of loans; they were for highly speculative, completely unregulated “financial instruments”.

In a warm example of class solidarity, capitalists loan each other money at rates no normal person could ever hope to get. Capitalists “leverage” their debt by exploiting special laws that let them borrow $100 and more for every dollar they have! Most people are permitted by banks to borrow only a tiny percent, say 10% of their financial worth.

Corporate debt is thus vastly greater that federal debts, state debts, credit card debt, student debt and personal debt combined! That is what the $441 trillion represents. This debt is principally used to speculate on everything from food prices to student loans to interest rate swaps. Corporate debt drives Austerity today. This policy is a mechanism to transfer local assets into corporate assets so that corporations can go even more deeply into debt and borrow in order to speculate. Historically, debt and speculation have been a mechanism to centralize the ownership of everything into the hands of the 1%.

The Swaps Crisis was guaranteed by a second, related scam that many call the biggest single financial crime in history. This is the Libor scandal. Libor stands for London Interbank Offered Rate. This is supposed to reflect the rate that banks would pay to borrow from other banks. This is used as an indicator of how banks perceive their risk based on loans they issue. Libor is used to establish loan rates around the world, including adjustable rate mortgages, credit card payments and US student loans.

It is abundantly documented that Wall Street banks conspired to keep Libor low when the US government was bailing them out. By keeping the rates low, the price of the useless bonds they were turning over to the government were high. Citibank, for example, was reporting low borrowing costs to Libor, even though their credit default prices were sky high. (9)

Libor was likewise used to manipulate interest rate swaps across the country. As the economic crisis deepens, banks that “are too big to fail” are becoming “too big to jail”. On March 30, a US District judge in New York dismissed charges against Bank of America, Barclays and JPMorgan Chase, absolving them of their role in Libor.

Notes

3) Pam Martens. “How Wall Street Gutted Our Schools and Cities”. AlterNet July 21, 2012.

4) Op sit

5) “The Swaps Crisis”. Dollars & Sense Magazine. May-June 2012

6) Tom Formeski. The Size of the Derivative Bubble = $190K per Person on Planet”. October 16, 2008

7) Dave McNally. The Global Slump. 2011. P 86

8) Op sit

9) How Wall Street Gutted Our Cities and Schools”

To be continued.

***

photo credit: dullhunk via photopin cc

Originally posted at Daily Censored

Steven Miller has taught science for 25 years in Oakland ’s Flatland high schools. He has been actively engaged in public school reform since the early 1990s. When the state seized control of Oakland public schools in 2003, they immediately implemented policies of corporatization and privatization that are advocated by the Broad Institute. Since that time Steve has written extensively against the privatization of public education, water and other public resources. You can email him at nondog2@hotmail.com

April 15, 2013

The Real Story Behind Stockton’s Bankruptcy

Guest post by Steven Miller

(This is the first of three guest posts laying out the real story about the role of Wall Street banksters in the recent bankruptcy of Stockton California, the largest city to go bankrupt in US history. It’s a grisly tale involving a Ponzi scheme called interest rate swaps, the LIBOR scandal in which the criminal banking syndicate rigged interest rates to bilk even more money out of cities and how this plays into Wall Street’s secret plans to loot public employee pension funds. Coming soon to a city near you.)

We are marking the 10th anniversary of the invasion of Iraq. This is equally the anniversary of the media treachery that justified this crime against humanity. In this light, the votes are in for the Donald Rumsfeld Award for Deception in Media for the first week of April. The award is now presented weekly since there are so many outstanding lies, distortions and deceptions in the news these days.

And the winner is… the Oakland Tribune!! They tried some dirty stuff this time!

On Monday, April 1, US Bankruptcy Judge Christopher Klein held that the city of Stockton, California, is allowed to go bankrupt. Stockton is a port town of 300,000 people on the river delta, about 50 miles east of San Francisco. This is the biggest municipal bankruptcy of a city in US history.

It is also a sign of things to come. Cities and government agencies commonly sell bonds to raise money for projects from city halls to sewer districts. The bonds are sold to the banks and hedge funds of the financial industry. The Banksters sucked the cities of America into various “debt swap” deals before the 2008 Financial Meltdown. Now some 80% must pay huge fees every month to Wall Street. San Bernardino will soon eclipse Stockton. Detroit will swamp them next. Cities are waiting in line to go broke. This is Austerity in action. Who benefits here?

First Wall Street hooked homeowners into fraudulent sub-prime mortgages. They followed this up with tons of illegal foreclosures. Far more foreclosures will be coming down the pike. Then they turned students into debt slaves, re-establishing debt peonage in America. Students (like felons) can no longer go bankrupt to pay off their loans; they must work for life to pay them off. Now the Banksters are beginning to foreclose on the cities. The debtor is tied more closely to the banker than the slave was to the master.

The Oakland Tribune addressed this issue in a Wednesday, April 3, editorial entitled “Who will pay for Stockton’s bankruptcy?” (link to editorial: http://www.contracostatimes.com/breaking-news/ci_22925442/stockton-bankruptcy-ruling-sets-stage-landmark-pension-showdown). First, the editors set up the trick: who, they wonder, “will have to take a haircut?” Could it be the bondholders? Could it be the California Public Employees Retirement System, the country’s largest pension fund? Could it be the “irresponsible managers” or could it be the workers?

This formulation implies “a fair and balanced” look at the issue. But the editorial is far from impartial. It makes two horrific statements to distort the significance of the bankruptcy. Funny thing – each goes to obscure the role of the Banksters and advance their agenda. The full editorial is appended at the end of this commentary.

The distortions:

“But what happens when a California pension showdown reaches federal bankruptcy court? This is new legal territory. “There are very complex and difficult questions of law that I can see out there on the horizon,” Judge Klein said, in what can only be described as understatement.

“We would not be here but for the irresponsible behavior of past Stockton officials. They thought the housing boom would never end, that the level in the property tax well would continue to rise. (1)

Here’s the case. Decide for yourself:

Let’s begin with a story printed in the Oakland Tribune on Tuesday, April 2, the day before the editorial, entitled “City OK’d to Pursue Bankruptcy”. Apparently the editors don’t pay too much attention to what is in their own paper:

“In a blistering critique, the judge assailed major Wall Street bondholders, Assured Guarantee Corporation and National Public Finance Guaranty Corp., for acting in a heavy-handed manner by refusing to negotiate the city’s bond debt unless Stockton took actions to cut its massive employee pension obligations.

“Klein concluded that National Public Finance and Assured “each took the position that there was nothing to talk about” unless the city sought concessions from the California State Employees Retirement System, to which it was paying $29 million a year. The city and CalPERS argued that pension costs had to be met.

” ‘The translation (was that) if you don’t intend to impair CalPERS, we’re not going to talk to you,’ Klein said of the creditors. “They absented themselves from all discussions….And, having voted with their feet, there was no point in talking to them further.”

“The judge ruled that Stockton had put forth a reasoned effort to resolve its massive fiscal debt but received “nothing but a stonewall on the other side.”

“He also chastised the city’s creditors for refusing to pay their required share of costs of pre-bankruptcy mediation, declaring, “The capital market creditors did not negotiate in good faith. And therefore, they do not have the ability to complain.” (2)

So the problem here is NOT irresponsibility of Stockton officials. But the Banksters are arguing something else. They are demanding that the city go after the CALPERS pension fund, the country’s largest. The city refused to take this step, which plays a role in determining who is “first in line” to get paid off from the bankruptcy. When a corporation goes bankrupt, the creditors are usually first in line and the workers, who may not have received wages for weeks, are last in line. But its new territory when a city goes bankrupt.

The Bankster lawyers refused to participate in the hearings because they are playing a bigger game. They are trying to set a precedent to break the pension fund. Privatizing pensions has been an avowed goal of Wall Street for a decade. This case may go to the Supreme Court and may become the precedent by which all other municipal bankruptcies are measured. They are just playing round one in Stockton. That is why they stonewalled the court – refusal to speak leaves no basis to attack this position. The goal is to force the issue up the judicial chain.

The editorial defines this as a problem of “a California pension showdown”, when in fact it clearly is a case of corporate blackmail, plain and simple. This is not “a pension showdown” at all. But the Banksters would like to characterize the bankruptcy this way, to hide their own dirty tricks. The Oakland Tribune openly collaborates with this.

Notes

1) Oakland Tribune, April 3, 2013

2) Oakland Tribune, April 2, 21 July 12, 3013

To be continued.

***

photo credit: Stuck in Customs via photopin cc

Originally posted at Daily Censored

Steven Miller has taught science for 25 years in Oakland ’s Flatland high schools. He has been actively engaged in public school reform since the early 1990s. When the state seized control of Oakland public schools in 2003, they immediately implemented policies of corporatization and privatization that are advocated by the Broad Institute. Since that time Steve has written extensively against the privatization of public education, water and other public resources. You can email him at nondog2@hotmail.com

April 13, 2013

Provocative Documentary By Woody Harrelson

Ethos

Peter McGrain 2011

Film Review

The hour-long documentary Ethos, narrated by actor/activist Woody Harrelson, is now available free online.

In my opinion, it has powerful take home lessons for Americans across the political spectrum. Largely because it addresses what I view as the two main obstacles to political change in the US 1) the immense power private banks enjoy via their control over the money supply and 2) the enormous power the corporate media exerts over public information. Much of this is elucidated through excellent cameo interviews with prominent dissidents such as Noam Chomsky, Michael Moore, Howard Zinn, Edward Said, Cynthia McKinney, Norman Solomon, Benjamin Barber and Chalmers Johnson.

The main goal of the film is to clearly articulate the current political crisis Americans face in the 21st century, which it does by exploring the historical context in which the crisis has developed. The documentary describes a number of significant historical events that are usually omitted from history textbooks.

It starts out with a general overview of the ways in which corporations have steadily increased their control over our supposedly democratic government.

There is special emphasis on the power private banks wield by controlling the money supply. Harrelson starts back in 1910 with the secret “conspiracy” by J.P. Morgan and other major bankers to create the Federal Reserve. Contrary to popular belief, the Fed isn’t a branch of the federal government. What it is, in essence, is a cartel of private banks.

Harrelson also devotes a long section to the use of the corporate media to manipulate public opinion and instigate Americans’ overwhelming drive to consume. He begins by describing the work, in the early 20th century, of Edward Bernays. Bernays, considered the father of the public relations industry, held the view common to many corporate elites that the wider public must be controlled because they’re incapable of meaningful participation in democratic government. Bernays perfected the technique of manipulating unconscious fears and desires, not only to help corporations sell people stuff they don’t need, but to assist government in social control.

In the final part of the film, Harrelson reveals how the Bush administration used the science of public relations to 1) convince the American people of the need for the US to invade and occupy Iraq and Afghanistan and 2) generate sufficient fear in the population to pass legislation stripping Americans of most civil liberties guaranteed in the Bill of Rights.

photo credit: rick via photopin cc

Crossposted at Daily Censored

The Most Revolutionary Act

- Stuart Jeanne Bramhall's profile

- 11 followers