Stuart Jeanne Bramhall's Blog: The Most Revolutionary Act , page 1379

October 14, 2013

The Politics of Obesity

(This is the first of two posts exploring possible links between intestinal bacteria, obesity, and other chronic illnesses.)

Obesity Has Social and Political Causes

In the US, the most overweight country in the world, rates of obesity have doubled since 1980. Sixty-six percent of Americans over 20 are overweight, with half of them qualifying as obese. Seventeen percent of American children are obese. The corporate media – and much of the medical establishment – would have us believe that obesity is caused by poor self-control and bad lifestyle choices. This attitude has led to a growing call for a “fat tax” to penalize naughty fat people who can’t control themselves.

As Americans, it’s part of our conditioning to see social problems as the result of individual shortcomings. This stems from a subtle form of indoctrination designed to disempower us and keep us separate and passive. It’s nonsensical to blame individuals for a condition afflicting a broad cross section of society. Social problems always have political and social causes. Although we have yet to identify all the responsible factors, the only way to treat the obesity epidemic is to identify and address these political and social causes.

Individualized Treatment Doesn’t Work

In the vast majority of cases, individual, case-by-case treatment of obesity doesn’t work. Even bariatric surgery (stomach stapling or similar surgery) doesn’t work in 100% of patients. Most doctors who try to help patients with weight issues are struck that obesity appears to have a strong physical component, like alcohol or drug addiction. Until recently, however, pinpointing a population-wide physical cause has been elusive.

How Obesity Differs from Other Epidemics

Unlike most epidemics, obesity is more prevalent in industrialized countries than the developing world. The circumstances that contribute to obesity must also meet the following criteria:

The causative agent(s) or condition(s) has doubled in prevalence since the 1980s.

The causative agent(s) or condition(s) clusters in families.

The causative agent(s) or condition(s) exerts some effect across all income levels, while disproportionately affecting low income, disadvantaged groups.

Why Obesity Isn’t Genetic

Owing to obesity’s tendency to cluster in families, scientists have been searching for decades for a genetic cause. However except in places like Hiroshima, Chernobyl, and Iraq, where the population has been fried with mega doses of nuclear radiation, genetic conditions don’t cause epidemics. Genetic illnesses increase at the same rate as population. They also tend to be equally prevalent in industrialized and developing countries.

It’s Not Caused by Junk Food, Either

Owing to the greater prevalence of obesity in low income groups, there has been a strong tendency to blame the media messaging that urges all residents of the developed world to consume high fat, high sugar foods. The argument goes that disadvantaged groups are disproportionately affected by corporate advertising owing to epigenetic* influences, the crazy US food subsidy system that makes junk food cheaper than healthy food, and the growth of “food ghettos”** in major US cities.

This thinking gained a lot of traction about a decade ago with the identification of “metabolic syndrome,” which is also known as insulin resistance. Numerous studies link insulin resistance to “epigenetic” effects, i.e. events that occur during pregnancy and the first year of life. Links have been found between low socioeconomic status and high levels of stress hormones during pregnancy. This, in turn, can permanently alter the way an individual utilizes insulin in regulating blood sugar.

Unfortunately epigenetically-induced insulin resistance and food ghettos don’t explain the rapid spread of obesity to middle and income Americans. Nor the doubling of obesity rates in the past 30 years. I, like most other Americans, have been bombarded with advertising pressuring me to consume high fat sugary snacks as far back as the early sixties. It isn’t logical that this corporate brainwashing would take 20 years to manifest an effect.

The Microbiota and Dysbiosis

In the past five years, new research into intestinal bacteria has finally uncovered a possible “social” cause for the obesity epidemic. The human intestine is colonized by about 1,000 different bacteria, who help digest foods, regulate gut development, regulate immunity and produce essential hormones and vitamins.

The discovery that finally unlocked this riddle came from studies showing a direct link between dysbiosis (i.e. “unhealthy” intestinal bacteria) and the development of insulin resistance. Then other studies revealed that the “microbiota” (our intestinal bacteria) doesn’t recover after antibiotic exposure. In fact, repeated antibiotic exposure encourages the growth of “inflammatory bacteria.” These unhealthy bacteria release an inflammatory peptide known as endotoxin, which causes inflammatory damage in the brain’s appetite center.

While still unproven, this hypothesis meets all the causation criteria laid out above. Even more exciting, it also offers a potential explanation why cancer, chronic degenerative diseases (like arthritis and multiple sclerosis), and autoimmune diseases (like lupus) are also more common in industrialized countries than the developed world. As well as playing a critical rule in immunity, dysbiosis

Is more prevalent in the US than anywhere else, owing to the mass exposure of Americans to antibiotics.

Has doubled in prevalence since the 1980s, roughly corresponding to comparable increases in antibiotic exposure. This is thanks to the Big Pharma-controlled medical system, a Food Inc that feeds massive amounts of antibiotics to livestock, and antibiotic markers Monsanto inserts into genetically modified organisms (GMOs).

Clusters in families. Children acquire their microbiota from their mothers, during their passage through the birth canal and through breast feeding.

Occurs at all income levels but is more prevalent in low income groups, due to epigenetic influences and dietary factors.

Research into Treatment

The April issue of Mother Jones has a great article summarizing some of this research. And even more exciting studies showing that diets rich in certain fermented foods can bring about weight loss by restoring bacterial balance in the intestine.

*Epigenetics refers to alterations in gene expression (i.e. the protein enzymes genes produce) based on environmental influences during pregnancy and early development.

**Food ghettos refer to the wholesale abandonment of inner cities by major supermarket chains, making it virtually impossible for residents to access fresh fruits and vegetables.

To be continued, with a closer look at the research.

photo credit: Ed Yourdon via photopin cc

Originally published in Veterans Today

October 12, 2013

The Coming Wall Street Crash

The Storm Clouds Gathering video below lays out a strong case that Wall Street is headed for another crash – either in December or January.

According to the filmmakers, the rise in stock prices in 2013 is really a bubble about to burst. The main cause of the bubble is the $85 billion in Quantitative Easing (QE3) the Federal Reserve has been injecting into the economy every month. This money doesn’t go to American businesses or consumers, but to banks. They, in turn, invest it in the stock market. Whenever there are more buyers than sellers, stock prices go up.

The Schiller P/E Ratio

Current price indicators are virtually identical to past bubbles that have triggered crashes, as is the Schiller price to earning (P/E) ration. In a normal market, the rise in a stock’s price should reflect how well it’s performing. Once the Schiller P/E ratio passes a certain critical value, a “correction” (i.e. market crash) is inevitable.

Insiders Pulling Out

The most ominous sign of an imminent crash is all the Wall Street insiders (the 1%) pulling their money out of stocks and putting it into real estate and other tangible assets.

No One Can Predict the Exact Month

There are too many variables to predict the exact month the crash will occur. However the video offers a number of scenarios that could potentially trigger the crash, including a default on the US debt, a war in Syria or Iran, or a meltdown in the $700 trillion derivatives market.

Derivatives are a sophisticated form of gambling in which bankers bet on the future price of a stock or commodity. The derivatives bubble was $500 trillion when the meltdown started in 2007. Because $700 trillion is more than ten times the size of the world economy, the banks exposed to derivatives (all of them) would fail without massive government bail-outs.

Caveat

The only disappointment in the film is the shallow analysis of Quantitative Easing at the end. It seems to support a monetary system in which private banks are allowed to create money out of thin air, but not government. The problem with QE3 isn’t that the Fed is pumping new money into the economy. The problem is giving all $85 billion of it to banks. It should be used to help small businesses and ordinary families. See my last post An Australian Looks at the US Economy

Enjoy.

The Coming Wall Street Crash

The Storm Clouds Gathering video below lays out a strong case that Wall Street is headed for another crash – either in December or January.

According to the filmmakers, the rise in stock prices in 2013 is really a bubble about to burst. The main cause of the bubble is the $85 billion in Quantitative Easing (QE3) the Federal Reserve has been injecting into the economy every month. This money doesn’t go to American businesses or consumers, but to banks. They, in turn, invest it in the stock market. Whenever there are more buyers than sellers, stock prices go up.

The Schiller P/E Ratio

Current price indicators are virtually identical to past bubbles that have triggered crashes, as is the Schiller price to earning (P/E) ration. In a normal market, the rise in a stock’s price should reflect how well it’s performing. Once the Schiller P/E ratio passes a certain critical value, a “correction” (i.e. market crash) is inevitable.

Insiders Pulling Out

The most ominous sign of an imminent crash is all the Wall Street insiders (the 1%) pulling their money out of stocks and putting it into real estate and other tangible assets.

No One Can Predict the Exact Month

There are too many variables to predict the exact month the crash will occur. However the video offers a number of scenarios that could potentially trigger the crash, including a default on the US debt, a war in Syria or Iran, or a meltdown in the $700 trillion derivatives market.

Derivatives are a sophisticated form of gambling in which bankers bet on the future price of a stock or commodity. The derivatives bubble was $500 trillion when the meltdown started in 2007. Because $700 trillion is more than ten times the size of the world economy, the banks exposed to derivatives (all of them) would fail without massive government bail-outs.

Caveat

The only disappointment in the film is the shallow analysis of Quantitative Easing at the end. It seems to support a monetary system in which private banks are allowed to create money out of thin air, but not government. The problem with QE3 isn’t that the Fed is pumping new money into the economy. The problem is giving all $85 billion of it to banks. It should be used to help small businesses and ordinary families. See my last post An Australian Looks at the US Economy

Enjoy.

photo credit: nromagna via photopin cc

October 10, 2013

An Australian Looks at the US Economy

How Private Banks (Not Government) Create Money

Australian economist Steve Keen (author of Debunking Economics) has an excellent 2009 article on his Debtwatch site explaining how Fractional Reserving Banking (FSB) supposedly works. The major premise of the article is that true FSB only exists in the minds of academic economists. Keen begins with a quote from Karl Marx (and a prominent photo) that was featured in a January 2009 article Investors Shortchanged in the Sydney Morning Herald:

“Talk about centralisation! The credit system, which has its focus in the so-called national banks and the big money-lenders and usurers surrounding them, constitutes enormous centralisation, and gives this class of parasites the fabulous power, not only to periodically despoil industrial capitalists, but also to interfere in actual production in a most dangerous manner— and this gang knows nothing about production and has nothing to do with it.” (Das Kapital, Volume 3, chapter 33).

Although Marx was totally off base in predicting the imminent downfall of capitalism, he sure got it right about banks.

The Fiction of Fractional Reserve Banking

In the academic model of Fractional Reserve Banking, a retail bank establishes reserves (with depositors’ money and funds borrowed from the Federal Reserve). They then create $90 in new money for every $10 they hold in reserve. Only it never works this way in real life. The Reserve Bank of Australia totally eliminated the reserve requirement in the 1990s.The Federal Reserve has no reserve requirement for business loans and the 10% reserve requirement for personal loans is full of loopholes.

Keen’s article goes on to present M0/M1 and M2 data showing that what academic economists are calling Fractional Reserve Banking is actually a Pure Credit Monetary System. In other words, private banks are totally free to issue as much money, in the form of new loans, as they choose. They also have total control of both the money created by the commercial system and the money created by government.

M0 (sometimes called M1) refers to the Base Money or fiat money created by the Federal Reserve. M2 refers to M0 plus new money created by banks as loans. The ratio of M2/M0 is called the “money multiplier” ratio.

What his graphs show is that credit money (M2) is created first and M0 or fiat money (the reserves to cover it) is created up to a year later. In a true FRB system, M0 or Base Money would increase first, and M2 would follow as banks issue new money based on their reserves. The other major problem is that combined public and private debt greatly exceeds M2. Under a true FRB system, total debt could never exceed the amount of fiat and bank money created.

Why Quantitative Easing Won’t Work

Keen’s paper also includes an interesting prediction that the Federal Reserve’s quantitative easing (increasing M0 by electronically “printing” $85 billion in new fiat money every month) will be vastly insufficient to bring about economic recovery. He gives four reasons for this:

Instead of using the money the Fed loans them to lend to borrowers, private banks are allowing inactive reserves to rise.

Consumers are too far in debt to take out new loans.

Deflation will continue because retailers and wholesalers must deeply discount their products to keep from going bankrupt.

“Deleveraging” (paying off debt) is massively suppressing consumer demand.

Keen predicts that quantitative easing will have little effect unless Federal Reserve Chairman Ben Bernanke pumps enough money into the economy to make a dent in the $42 trillion US debt. Deducting compound interest, he reckons $20 trillion would reduce it by about a quarter.

Ironically such a massive increase in government-issued Base Money (M0 ) would effectively replace our bank-controlled credit money system with a publicly controlled fiat money system. In other words it effectively restores the ability of the federal government to issue money, as Lincoln did (see The Role of Foreign Banks in US History).

Makes you wonder if this is Obama’s and Bernanke’s true agenda with all the electronic money they’re printing – to quietly nationalize America’s monetary system through the backdoor.

For more background on how private banks create the vast majority of US dollars (out of thin air), check out the free video The Secret of Oz:

Photo credits: youkaine via photopin cc and photo credit: wolfgangfoto via photopin cc

An Australian Looks at the US Economy

How Private Banks (Not Government) Create Money

Australian economist Steve Keen (author of Debunking Economics) has an excellent 2009 article on his Debtwatch site explaining how Fractional Reserving Banking (FSB) supposedly works. The major premise of the article is that true FSB only exists in the minds of academic economists. Keen begins with a quote from Karl Marx (and a prominent photo) that was featured in a January 2009 article Investors Shortchanged in the Sydney Morning Herald:

“Talk about centralisation! The credit system, which has its focus in the so-called national banks and the big money-lenders and usurers surrounding them, constitutes enormous centralisation, and gives this class of parasites the fabulous power, not only to periodically despoil industrial capitalists, but also to interfere in actual production in a most dangerous manner— and this gang knows nothing about production and has nothing to do with it.” (Das Kapital, Volume 3, chapter 33).

Although Marx was totally off base in predicting the imminent downfall of capitalism, he sure got it right about banks.

The Fiction of Fractional Reserve Banking

In the academic model of Fractional Reserve Banking, a retail bank establishes reserves (with depositors’ money and funds borrowed from the Federal Reserve). They then create $90 in new money for every $10 they hold in reserve. Only it never works this way in real life. The Reserve Bank of Australia totally eliminated the reserve requirement in the 1990s.The Federal Reserve has no reserve requirement for business loans and the 10% reserve requirement for personal loans is full of loopholes.

Keen’s article goes on to present M0/M1 and M2 data showing that what academic economists are calling Fractional Reserve Banking is actually a Pure Credit Monetary System. In other words, private banks are totally free to issue as much money, in the form of new loans, as they choose. They also have total control of both the money created by the commercial system and the money created by government.

M0 (sometimes called M1) refers to the Base Money or fiat money created by the Federal Reserve. M2 refers to M0 plus new money created by banks as loans. The ratio of M2/M0 is called the “money multiplier” ratio.

What his graphs show is that credit money (M2) is created first and M0 or fiat money (the reserves to cover it) is created up to a year later. In a true FRB system, M0 or Base Money would increase first, and M2 would follow as banks issue new money based on their reserves. The other major problem is that combined public and private debt greatly exceeds M2. Under a true FRB system, total debt could never exceed the amount of fiat and bank money created.

Why Quantitative Easing Won’t Work

Keen’s paper also includes an interesting prediction that the Federal Reserve’s quantitative easing (increasing M0 by electronically “printing” $85 billion in new fiat money every month) will be vastly insufficient to bring about economic recovery. He gives four reasons for this:

Instead of using the money the Fed loans them to lend to borrowers, private banks are allowing inactive reserves to rise.

Consumers are too far in debt to take out new loans.

Deflation will continue because retailers and wholesalers must deeply discount their products to keep from going bankrupt.

“Deleveraging” (paying off debt) is massively suppressing consumer demand.

Keen predicts that quantitative easing will have little effect unless Federal Reserve Chairman Ben Bernanke pumps enough money into the economy to make a dent in the $42 trillion US debt. Deducting compound interest, he reckons $20 trillion would reduce it by about a quarter.

Ironically such a massive increase in government-issued Base Money (M0 ) would effectively replace our bank-controlled credit money system with a publicly controlled fiat money system. In other words it effectively restores the ability of the federal government to issue money, as Lincoln did (see The Role of Foreign Banks in US History).

Makes you wonder if this is Obama’s and Bernanke’s true agenda with all the electronic money they’re printing – to quietly nationalize America’s monetary system through the backdoor.

For more background on how private banks create the vast majority of US dollars (out of thin air), check out the free video The Secret of Oz:

Photo credits: youkaine via photopin cc and photo credit: wolfgangfoto via photopin cc

October 8, 2013

The Phone Company That Said No to NSA

Former US West CEO Released from Prison

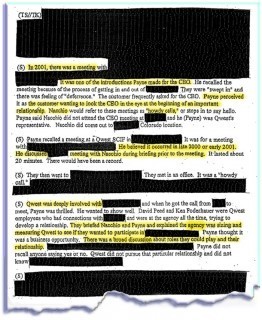

Former US West CEO Joseph Nacchio was released from prison last week after completing a four year insider trading sentence. He still claims the NSA framed him on the insider trading charges – after he refused to participate in their illegal phone surveillance program in 2001. US West was the only major telecommunication program that refused to spy on its customers. According to the Wall Street Journal, Nacchio feels vindicated by Edward Snowden’s recent revelations about NSA spying on Americans’ phone and email communications.

Nacchio was convicted of selling US West stock based on inside information about the company’s deteriorating financial health. He denies this, claiming he believed US West’s lucrative contracts with the federal government would continue. Instead his refusal to cooperate with the NSA resulted in the wholesale cancellation of government contracts.

Nacchio had evidence supporting this claim. However the judge ruled it was classified and prevented his defense team from presenting it. The redacted NSA files were only made public after the former CEO was convicted and sentenced. However Harper’s and others have always supported Nacchio’s contention that he was prosecuted in retaliation for saying “no” to the NSA.

Whether or not Vlaccio is guilty of insider trading (all the legal arguments are summarized at Race to the Bottom), the most illuminating information in the redacted files is that the NSA was pressuring US West to spy on customers in February 2001. This was a good seven months before the 9-11 attacks, the supposed justification for curtailing Americans’ civil liberties.

Image credit: Indict Dick Cheney

Originally published at Veterans Today

The Phone Company That Said No to NSA

Former US West CEO Released from Prison

Former US West CEO Joseph Nacchio was released from prison last week after completing a four year insider trading sentence. He still claims the NSA framed him on the insider trading charges – after he refused to participate in their illegal phone surveillance program in 2001. US West was the only major telecommunication program that refused to spy on its customers. According to the Wall Street Journal, Nacchio feels vindicated by Edward Snowden’s recent revelations about NSA spying on Americans’ phone and email communications.

Nacchio was convicted of selling US West stock based on inside information about the company’s deteriorating financial health. He denies this, claiming he believed US West’s lucrative contracts with the federal government would continue. Instead his refusal to cooperate with the NSA resulted in the wholesale cancellation of government contracts.

Nacchio had evidence supporting this claim. However the judge ruled it was classified and prevented his defense team from presenting it. The redacted NSA files were only made public after the former CEO was convicted and sentenced. However Harper’s and others have always supported Nacchio’s contention that he was prosecuted in retaliation for saying “no” to the NSA.

Whether or not Vlaccio is guilty of insider trading (all the legal arguments are summarized at Race to the Bottom), the most illuminating information in the redacted files is that the NSA was pressuring US West to spy on customers in February 2001. This was a good seven months before the 9-11 attacks, the supposed justification for curtailing Americans’ civil liberties.

Image credit: Indict Dick Cheney

Originally published at Veterans Today

October 7, 2013

The Vanishing Farmer

The US Farm Crisis

Americans rarely give much thought to where their food comes from. They should. Rapidly expanding cities mean the US loses two acres of fertile farmland every two minutes. The dwindling number of US farmers – now at 1.5 million – is even more concerning. At present the average American farmer is over 60 – only 5% of them are under 45.

The US government has been desperately trying to recruit more formers since 1992, when they first introduced a special loan program for beginning farmers. Owing to poor uptake, the 2008 Farm Bill greatly expanded the loan program, as well as introducing educational assistance and special training programs, commodities payments, conservation payments and crop insurance subsidies to new farmers. These programs were expanded even further in 2010, when US Secretary of Agriculture Tom Vilsack announced his goal of recruiting 100,000 new farmers in five years.

Corporate Welfare for Factory Farms

Although the number of loans to beginning farmers increased from 9,000 in 2008 to more than 15,000 in 2012, there’s growing skepticism about other aspects of the program. Commodities and crop insurance subsidies clearly benefit large corporate players – factory farms and the private insurance companies – more than small farmers. Last week, GMO and pesticide manufacturer Monsanto bought into the crop insurance racket when they acquired ClimateCorp, a San Francisco based company that employs complex weather data to set prices for its crop insurance policies. At the same time speculative property development, which poses the most immediate threat to productive farmland, remains unaddressed.

Young Farmers are Pro-Organic and Anti-GMO

According to Reuters, the organic and healthy food movements have also been instrumental in inspiring urban youth in returning to the land, where they are supported by a number of national and state nonprofit organizations.

Greenhorns, a national membership organization of 6,000+, is one of the largest and most active. Founded in 2007, the group works to promote, recruit and support young US farmers by putting on events and workshops, networking, resource sharing, and the production of traditional and new media: radio, documentary film, blog, a book of essays, guidebooks, web-based tools. Their primary goals are to “retrofit” the corporate food system by building a thriving agricultural economy, based on solid business skills and sustainable farm practices.

Their website offers a phenomenal range of resources, with links to

Jobs

Agricultural training courses

Mentoring opportunities

Low cost food processing facilities

Core consumer groups wishing to start Community Supported Agriculture schemes*

Market managers seeking new producers

Marketing advice/assistance

Land for sale and lease

Legal services

Grants

Crowdfunding and community based fundraising opportunities

Political action groups

I was especially intrigued by the Greenhorns new documentary and their 2013 New Farmers Almanac. The latter is a new twist on the classic Old Farmers Almanac. Designed to appeal to healthy food advocates as well as farmers of all ages, it presents a collection of essays about adjusting to large scale urbanization and the mega population boom, as well as reclaiming a landscape dominated by monoculture, soil depletion. Available in paperback for $20 from AK Press

Here’s the trailer to the documentary, which can be purchased for $10 from their website:

*In Community Supported Agriculture schemes (CSAs) consumers subsidize a local farm by purchasing a subscription to weekly deliveries of fresh vegetables and/or fruit.

The Vanishing Farmer

The US Farm Crisis

Americans rarely give much thought to where their food comes from. They should. Rapidly expanding cities mean the US loses two acres of fertile farmland every two minutes. The dwindling number of US farmers – now at 1.5 million – is even more concerning. At present the average American farmer is over 60 – only 5% of them are under 45.

The US government has been desperately trying to recruit more formers since 1992, when they first introduced a special loan program for beginning farmers. Owing to poor uptake, the 2008 Farm Bill greatly expanded the loan program, as well as introducing educational assistance and special training programs, commodities payments, conservation payments and crop insurance subsidies to new farmers. These programs were expanded even further in 2010, when US Secretary of Agriculture Tom Vilsack announced his goal of recruiting 100,000 new farmers in five years.

Corporate Welfare for Factory Farms

Although the number of loans to beginning farmers increased from 9,000 in 2008 to more than 15,000 in 2012, there’s growing skepticism about other aspects of the program, which clearly benefit large corporate players – factory farms and the private insurance companies that sell crop insurance – more than small farmers. Last week, GMO and pesticide manufacturer Monsanto bought into the crop insurance racket when they acquired ClimateCorp, a San Francisco based company that employs complex weather data to set prices for its crop insurance policies. At the same time property development and speculation, which poses the most immediate threat to productive farmland, remains unaddressed.

Young Farmers are Pro-Organic and Anti-GMO

According to Reuters, the organic and healthy food movements have also been instrumental in inspiring urban youth in returning to the land, where they are supported by a number of national and state nonprofit organizations.

Greenhorns, a national membership organization of 6,000+, is one of the largest and most active. Founded in 2007, the group works to promote, recruit and support young US farmers by putting on events and workshops, networking, resource sharing, and the production of traditional and new media: radio, documentary film, blog, a book of essays, guidebooks, web-based tools. Their primary goals are to “retrofit” the corporate food system by building a thriving agricultural economy, based on solid business skills and sustainable farm practices.

Their website offers a phenomenal range of resources, with links to

Jobs

Agricultural training courses

Mentoring opportunities

Low cost food processing facilities

Core consumer groups wishing to start Community Supported Agriculture schemes*

Market managers seeking new producers

Marketing advice/assistance

Land for sale and lease

Legal services

Grants

Crowdfunding and community based fundraising opportunities

Political action groups

I was especially intrigued by the Greenhorns new documentary and their 2013 New Farmers Almanac. The latter is a new twist on the classic Old Farmers Almanac. Designed to appeal to healthy food advocates as well as farmers of all ages, it presents a collection of essays about adjusting to large scale urbanization and the mega population boom, as well as reclaiming a landscape dominated by monoculture, soil depletion. Available in paperback for $20 from AK Press

Here’s the trailer to the documentary, which can be purchased for $10 from their website:

*In Community Supported Agriculture schemes (CSAs) consumers subsidize a local farm by purchasing a subscription to weekly deliveries of fresh vegetables and/or fruit.

October 5, 2013

Solutions: Taking Back Our Power

Nothing like a nice government shutdown to remind us that the federal government is hopelessly dysfunctional. Congress and the White House are so focused on the needs of their corporate donors that most of the laws they pass hurt ordinary Americans rather than helping them. Fortunately a growing number of local groups have discovered that the most meaningful form of political change happens outside of official political channels. Together with family, friends, and neighbors, they’re opting out of the “corporate” lifestyle and inventing more meaningful grassroots models for meeting human needs.

The Story of Solutions

Annie Leonard, who produced the world changing video They Story of Stuff in 2008, has just released a sequel The Story of Solutions. Like her first film, it challenges a society built on ever increasing economic growth and accumulating more stuff. However the focus of The Story of Solutions is more on community organizing to move our economy in a more sustainable and just direction. To quote from the film promo:

“In the current ‘Game of More’, we’re told to cheer a growing economy – more roads, more malls, more Stuff! – even though our health indicators are worsening, income inequality is growing and polar icecaps are melting. But what if we changed the point of the game? What if the goal of our economy wasn’t more, but better – better health, better jobs and a better chance to survive on the planet?”

The nine-minute video includes inspiring real-world examples of ways in which communities are mobilizing for change – through programs as simple as “tool-sharing” libraries. There’s absolutely no reason why every American needs to own their own lawnmower, power drill, and chainsaw.

Here’s the original The Story of Stuff for people who missed it when it first came out.

The Most Revolutionary Act

- Stuart Jeanne Bramhall's profile

- 11 followers