Greg Palast's Blog, page 95

September 16, 2013

Larry Summers: Goldman Sacked

By Greg Palast for Vice Magazine

Joseph Stiglitz couldn't believe his ears. Here they were in the White House, with President Bill Clinton asking the chiefs of the US Treasury for guidance on the life and death of America's economy, when the Deputy Secretary of the Treasury Larry Summers turns to his boss, Secretary Robert Rubin, and says, "What would Goldman think of that?"

Huh?

Then, at another meeting, Summers said it again: What would Goldman think? A shocked Stiglitz, then Chairman of the President's Council of Economic Advisors, told me he'd turned to Summers, and asked if Summers thought it appropriate to decide US economic policy based on "what Goldman thought." As opposed to say, the facts, or say, the needs of the American public, you know, all that stuff that we heard in Cabinet meetings on The West Wing.

A shocked Stiglitz, then Chairman of the President's Council of Economic Advisors, told me he'd turned to Summers, and asked if Summers thought it appropriate to decide US economic policy based on "what Goldman thought." As opposed to say, the facts, or say, the needs of the American public, you know, all that stuff that we heard in Cabinet meetings on The West Wing.

Summers looked at Stiglitz like Stiglitz was some kind of naive fool who'd read too many civics books.

R.I.P. Larry Summers

On Sunday afternoon, facing a revolt

by his own party's senators, Obama dumped Larry as likely replacement for Ben Bernanke as Chairman of the Federal Reserve Board.

Until news came that Summers' torch had been snuffed, I was going to write another column about Larry, the Typhoid Mary of Economics. (My first, in The Guardian, 15 years ago, warned that "Summers is, in fact, a colony of aliens sent to Earth to turn humans into a cheap source of protein.")

But the fact that Obama even tried to shove Summers down the planet's throat tells us more about Obama than Summers—and whom Obama works for. Hint: You aren't one of them.

All these Cabinet discussions back in the 1990s requiring the blessing of Goldman Sachs revolved around the Rubin-Summers idea of ending regulation of the US banking system. To free the US economy, Summers argued, all you'd have to do is allow commercial banks to bet government-guaranteed savings on new "derivatives products," let banks sell high-risk sub-prime mortgage securities and cut their reserves against losses.

What could possibly go wrong?

Stiglitz, who would go on to win the Nobel Prize in Economics, tried to tell them exactly what would go wrong. But when he tried, he was replaced and exiled.

Summers did more than ask Rubin to channel the spirit of Goldman: Summers secretly called and met with Goldman's new CEO at the time, Jon Corzine, to plan out the planet's financial deregulation. I'm not guessing: I have the confidential memo to Summers reminding him to call Corzine.

[For the complete story of that memo and a copy of it, read " The Confidential Memo at the Heart of the Global Financial Crisis " .]

Summers, as Treasury official, can call any banker he damn well pleases. But not secretly. And absolutely not to scheme over details of policies that could make a bank billions. And Goldman did make billions on those plans.

Example: Goldman and clients pocketed $4 billion on the collapse of "synthetic collateralized debt obligations"—flim-flam feathers sold to suckers and dimwits i.e. the bankers at RBS. (See Did Fabrice Tourre Really Create The Global Financial Crisis?)

Goldman also cashed in big on the implosion of Greece's debt via secret derivatives trades permitted by Summers' decriminalization of such cross-border financial gaming.

The collapse of the euro-zone and the US mortgage market caused by Bankers Gone Wild was made possible only by Treasury Secretary Summers lobbying for the Commodities Futures Modernization Act which banned regulators from controlling the 100,000% increase in derivatives assets, especially super-risky "naked" credit-default swaps.

The CMFA was the financial equivalent of a fire department banning smoke alarms.

Summers took over the Treasury's reins from Rubin who'd left to become director of a strange new financial behemoth: The combine of Citibank with and an investment bank, Travelers. The new bank beast went bankrupt and required $50 billion in bail-out funds. (Goldman did not require any bail-out funds–but took $10 billion anyway.)

Other banks-turned-casinos followed Citi into insolvency. Most got bail-outs ... and got Larry Summers–or, at least, Larry's lips for "consulting" or for gold-plated speaking gigs.

Derivatives trader D.E. Shaw paid Summers $5 million for a couple of years of "part-time" work. This added to payments from Citigroup, Goldman and other finance houses, raising the net worth of this once penurious professor to more than $31 million.

Foreclosure fills the Golden Sacks

When Summers left Treasury in 2000, The New York Times reports that a grateful Rubin got Summers the post of President of Harvard University—from which Summers was fired. He gambled away over half a billion dollars of the university's endowment on those crazy derivatives he'd legalized. (Given Summers' almost pathological inability to understand finance, it was most odd that, while President of the university, he suggested that humans with vaginas aren't very good with numbers.)

In 2009, Summers, Daddy of the Deregulation Disaster, returned to the Cabinet in triumph. Barack Obama crowned him "Economics Tsar," allowing Summers to run the Treasury without having to be questioned by Congress in a formal confirmation hearing.

As Economics Tsar in Obama's first term, did Summers redeem himself?

Not a chance.

In 2008, both Democrat Hillary Clinton and Republican John McCain called for using the $300 billion remaining in the "bail-out' fund for a foreclosure-blocking program identical to the one Franklin Roosevelt had used to pull the US out of the Great Depression. But Tsar Larry would have none of it, although banks had been given $400 billion from the same fund.

Indeed, on the advice of Summers and his wee assistant, Treasury Secretary Tim Geithner, Obama spent only $7 billon of the $300 billion available to save US homeowners.

What would Goldman think?

As noted, Goldman and clients pocketed billions as a result of Obama's abandonment of 3.9 million families whose homes were repossessed during his first term. While American homeowners were drowning, Tsar Summers torpedoed their lifeboat: a plan to prevent foreclosures by forcing banks to write-off the overcharges in predatory sub-prime mortgages. Notably, Summers' action (and Obama's inaction) saved Citibank billions.

Loan Shark Larry

The deregulation disaster machinery is not done with mangling Americans. While not-for-profit credit unions, lenders of last resort for working people and the poor in the US, have been under legal and political attack, a new kind of banking operation has bubbled out of the minds of the grifters looking for a way to make loan-sharking legit.

One new outfit, for example, called "Lending Club," has figured out a way to collect fees for arranging loans charging as much as 29%. Lending Club claims it cannot and should not be regulated by the Federal Reserve or other banking police. The recent addition to its Board of Directors: Larry Summers.

If you want to know why Obama would choose such a grifter and gamer to head the Fed, you have to ask, Who picked Obama? Ten years ago, Barry Obama was a nothing, a State Senator from the South Side of Chicago.

But then, he got lucky. A local bank, Superior, was shut down by regulators for mortgage shenanigans ripping off Black folk. The bank's Chairwoman, Penny Pritzker was so angry at regulators, she decided to eliminate them: and that required a new President.

The billionaires connected Obama to Jamie Dimon of J.P. Morgan, but most importantly to Robert Rubin, former Treasury Secretary, but most important, former CEO of Goldman Sachs and mentor of Larry Summers. Without Rubin's blessing and overwhelming fundraising power, Obama would still be arguing over zoning on Halsted Street.

Rubin picked Obama and Obama picks whom Rubin picks for him.

Because, in the end, Obama knows he must choose a Fed chief based on the answer to one question: What would Goldman think?

* * * * * * * *

Special thanks to expert Lori Wallach of Public Citizen without whom our investigation could not have begun.

For the complete story of the investigation of Larry Summers, the "End Game" memo and the finance crisis, see Palast's highly acclaimed book Vultures' Picnic.

Get a signed hardbound copy and support our work with a tax-deductible contribution of $50.

Also visit the Palast Investigative Fund's store or simply make a tax-deductible contribution to keep our work alive!

Greg Palast is also the author of the New York Times bestsellers, Billionaires & Ballot Bandits, The Best Democracy Money Can Buy and Armed Madhouse.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

August 22, 2013

Larry Summers and the Secret "End-Game" Memo

By Greg Palast for Vice Magazine

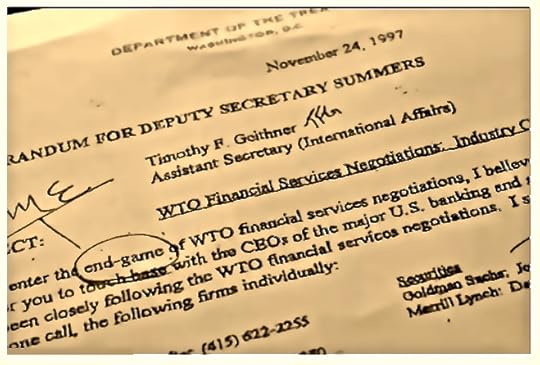

When a little birdie dropped the End Game memo through my window, its content was so explosive, so sick and plain evil, I just couldn't believe it.

The Memo confirmed every conspiracy freak's fantasy: that in the late 1990s, the top US Treasury officials secretly conspired with a small cabal of banker big-shots to rip apart financial regulation across the planet. When you see 26.3% unemployment in Spain, desperation and hunger in Greece, riots in Indonesia and Detroit in bankruptcy, go back to this End Game memo, the genesis of the blood and tears.

The Treasury official playing the bankers' secret End Game was Larry Summers. Today, Summers is Barack Obama's leading choice for Chairman of the US Federal Reserve, the world's central bank. If the confidential memo is authentic, then Summers shouldn't be serving on the Fed, he should be serving hard time in some dungeon reserved for the criminally insane of the finance world.

The memo is authentic.

To get that confirmation, I would have to fly to Geneva and wangle a meeting with the Secretary General of the World Trade Organization, Pascal Lamy. I did. Lamy, the Generalissimo of Globalization, told me,

"The WTO was not created as some dark cabal of multinationals secretly cooking plots against the people…. We don't have cigar-smoking, rich, crazy bankers negotiating."

Then I showed him the memo.

It begins with Summers’ flunky, Timothy Geithner, reminding his boss to call the then most powerful CEOs on the planet and get them to order their lobbyist armies to march:

"As we enter the end-game of the WTO financial services negotiations, I believe it would be a good idea for you to touch base with the CEOs…."

To avoid Summers having to call his office to get the phone numbers (which, under US law, would have to appear on public logs), Geithner listed their private lines. And here they are:

Goldman Sachs: John Corzine (212)902-8281

Merrill Lynch: David Kamanski (212)449-6868

Bank of America, David Coulter (415)622-2255

Citibank: John Reed (212)559-2732

Chase Manhattan: Walter Shipley (212)270-1380

Lamy was right: They don't smoke cigars. Go ahead and dial them. I did, and sure enough, got a cheery personal hello from Reed–cheery until I revealed I wasn't Larry Summers. (Note: The other numbers were swiftly disconnected. And Corzine can't be reached while he faces criminal charges.)

It's not the little cabal of confabs held by Summers and the banksters that's so troubling. The horror is in the purpose of the "end game" itself.

Let me explain: The year was 1997. US Treasury Secretary Robert Rubin was pushing hard to de-regulate banks. That required, first, repeal of the Glass-Steagall Act to dismantle the barrier between commercial banks and investment banks. It was like replacing bank vaults with roulette wheels.

The year was 1997. US Treasury Secretary Robert Rubin was pushing hard to de-regulate banks. That required, first, repeal of the Glass-Steagall Act to dismantle the barrier between commercial banks and investment banks. It was like replacing bank vaults with roulette wheels.

Second, the banks wanted the right to play a new high-risk game: "derivatives trading." JP Morgan alone would soon carry $88 trillion of these pseudo-securities on its books as "assets."

Deputy Treasury Secretary Summers (soon to replace Rubin as Secretary) body-blocked any attempt to control derivatives.

But what was the use of turning US banks into derivatives casinos if money would flee to nations with safer banking laws?

The answer conceived by the Big Bank Five: eliminate controls on banks in every nation on the planet – in one single move. It was as brilliant as it was insanely dangerous.

How could they pull off this mad caper? The bankers' and Summers' game was to use the Financial Services Agreement, an abstruse and benign addendum to the international trade agreements policed by the World Trade Organization.

Until the bankers began their play, the WTO agreements dealt simply with trade in goods–that is, my cars for your bananas. The new rules ginned-up by Summers and the banks would force all nations to accept trade in "bads" – toxic assets like financial derivatives.

Until the bankers' re-draft of the FSA, each nation controlled and chartered the banks within their own borders. The new rules of the game would force every nation to open their markets to Citibank, JP Morgan and their derivatives "products."

And all 156 nations in the WTO would have to smash down their own Glass-Steagall divisions between commercial savings banks and the investment banks that gamble with derivatives.

The job of turning the FSA into the bankers' battering ram was given to Geithner, who was named Ambassador to the World Trade Organization.

Bankers Go Bananas

Why in the world would any nation agree to let its banking system be boarded and seized by financial pirates like JP Morgan?

Why in the world would any nation agree to let its banking system be boarded and seized by financial pirates like JP Morgan?

The answer, in the case of Ecuador, was bananas. Ecuador was truly a banana republic. The yellow fruit was that nation's life-and-death source of hard currency. If it refused to sign the new FSA, Ecuador could feed its bananas to the monkeys and go back into bankruptcy. Ecuador signed.

And so on–with every single nation bullied into signing.

Every nation but one, I should say. Brazil's new President, Inacio Lula da Silva, refused. In retaliation, Brazil was threatened with a virtual embargo of its products by the European Union's Trade Commissioner, one Peter Mandelson, according to another confidential memo I got my hands on. But Lula's refusenik stance paid off for Brazil which, alone among Western nations, survived and thrived during the 2007-9 bank crisis.

China signed–but got its pound of flesh in return. It opened its banking sector a crack in return for access and control of the US auto parts and other markets. (Swiftly, two million US jobs shifted to China.)

The new FSA pulled the lid off the Pandora's box of worldwide derivatives trade. Among the notorious transactions legalized: Goldman Sachs (where Treasury Secretary Rubin had been Co-Chairman) worked a secret euro-derivatives swap with Greece which, ultimately, destroyed that nation. Ecuador, its own banking sector de-regulated and demolished, exploded into riots. Argentina had to sell off its oil companies (to the Spanish) and water systems (to Enron) while its teachers hunted for food in garbage cans. Then, Bankers Gone Wild in the Eurozone dove head-first into derivatives pools without knowing how to swim–and the continent is now being sold off in tiny, cheap pieces to Germany.

Of course, it was not just threats that sold the FSA, but temptation as well. After all, every evil starts with one bite of an apple offered by a snake. The apple: The gleaming piles of lucre hidden in the FSA for local elites. The snake was named Larry.

Does all this evil and pain flow from a single memo? Of course not: the evil was The Game itself, as played by the banker clique. The memo only revealed their game-plan for checkmate.

And the memo reveals a lot about Summers and Obama.

While billions of sorry souls are still hurting from worldwide banker-made disaster, Rubin and Summers didn't do too badly. Rubin's deregulation of banks had permitted the creation of a financial monstrosity called "Citigroup." Within weeks of leaving office, Rubin was named director, then Chairman of Citigroup—which went bankrupt while managing to pay Rubin a total of $126 million.

Then Rubin took on another post: as key campaign benefactor to a young State Senator, Barack Obama. Only days after his election as President, Obama, at Rubin's insistence, gave Summers the odd post of US "Economics Tsar" and made Geithner his Tsarina (that is, Secretary of Treasury). In 2010, Summers gave up his royalist robes to return to "consulting" for Citibank and other creatures of bank deregulation whose payments have raised Summers' net worth by $31 million since the "end-game" memo.

That Obama would, at Robert Rubin's demand, now choose Summers to run the Federal Reserve Board means that, unfortunately, we are far from the end of the game.

* * * * * * * *

Special thanks to expert Mary Bottari of Bankster USA BanksterUSA.org without whom our investigation could not have begun.

The film of my meeting with WTO chief Lamy was originally created for Ring of Fire, hosted by Mike Papantonio and Robert F. Kennedy Jr.

Further discussion of the documents I laid before Lamy can be found in "The Generalissimo of Globalization," Chapter 12 of Vultures' Picnic by Greg Palast.

Greg Palast is also the author of the New York Times bestsellers, Billionaires & Ballot Bandits, The Best Democracy Money Can Buy and Armed Madhouse.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make a tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

August 12, 2013

Euro Krieg! Greece Surrenders to Germany 2013 Greg Palast Interviewed by Greek Radio

By Michael Nevradakis for Truthout

In his career as an investigative journalist, economist, and bestselling author -Vultures' Picnic, Billionaires and Ballot Bandits, The Best Democracy Money Can Buy - Greg Palast has not been afraid to tackle some of the most powerful names in politics and finance.

In his career as an investigative journalist, economist, and bestselling author -Vultures' Picnic, Billionaires and Ballot Bandits, The Best Democracy Money Can Buy - Greg Palast has not been afraid to tackle some of the most powerful names in politics and finance.

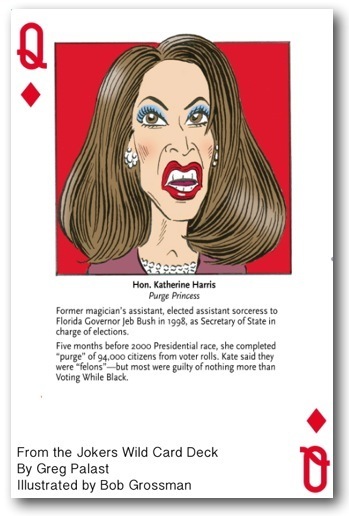

From uncovering Katherine Harris' purge of African-American voters from Florida's voter rolls in the year 2000 to revealing the truth behind the "assistance" provided by the International Monetary Fund and the World Bank to ailing economies, Palast has not held back in revealing the corruption and criminal actions of the wealthy and powerful.

In a recent interview on Dialogos Radio, Palast turned his attention to Greece and to the austerity policies that have been imposed on the country by the IMF, the European Union, and the European Central Bank.

"To me, Greece is a crime scene," said Palast. "Greece is dying, and austerity is one of the things that killed it." He rebuked the recent proclamations made by Greek and EU officials deeming Greece an economic "success story," describing them as "nonsense."

"Austerity has destroyed Greece and the euro has destroyed Greece," said Palast. "Austerity in the middle of a recession is a death sentence."

One of the hallmarks of austerity programs is privatization. Palast, who has investigated the impact of privatization programs in Latin America, drew parallels between those countries' experiences and the demands now being imposed on Greece.

"You see the kind of brutal practices which were first tested on Argentina, Ecuador and Brazil brought to Greece with more severe consequences," said Palast. "You get ripped off. You still need water, you still need electricity. You privatize these things, you're still going to have to buy water and electricity, but now you'll pay a fortune to German and American and Canadian companies."

In his critique of privatization programs, Palast referenced Joseph Stiglitz, the Nobel Prize-winning economist who had been the World Bank's chief economist prior to being fired for expressing dissent against its policies. "[Stiglitz] called privatization 'briberization' because ... when we talk about privatization, we talk about a couple of guys who are close to the government in Greece, who are close to the German government, and they pick up the properties for next to nothing."

One of the biggest controversies in Greece over the past year has involved the Skouries gold mine. Originally transferred to private hands by the Greek state in 2004 for the paltry sum of 11 million euros, the mine has since come into the possession of the Canadian company Eldorado Gold, which has commenced mining activities. This has resulted in a vociferous grassroots movement, protesting the mine on both economic and environmental grounds. According to Palast, companies like Eldorado Gold prey on vulnerable countries.

One of the biggest controversies in Greece over the past year has involved the Skouries gold mine. Originally transferred to private hands by the Greek state in 2004 for the paltry sum of 11 million euros, the mine has since come into the possession of the Canadian company Eldorado Gold, which has commenced mining activities. This has resulted in a vociferous grassroots movement, protesting the mine on both economic and environmental grounds. According to Palast, companies like Eldorado Gold prey on vulnerable countries.

"What they do is, they wait for the moment where a nation is really weak and on its back, and has to give away its gold. Tanzania sold its gold mines for nothing under IMF pressure to Barrick Gold. They've made billions and billions and billions."

"Let's not kid ourselves," added Palast. "Nobody gets a gold mine without making a payoff to the powers that be. That's just how it is ... they're not privatizing, they're stealing your gold."

For Palast, the solution for Greece is to leave the Euro.

"You don't want to be in the euro, take my word for it," said Palast. "To stay in the euro zone is like saying we want to stay in the leper colony. The euro is a monstrous creation. The euro is not about having a happy trade zone. It's about imposing the elimination of the progressive state. The euro is the Fourth Reich ... and you have to give it up."

Palast drew upon the paradigm of several Latin American countries as examples that Greece could follow.

"The Argentines ... disconnected from the dollar; they told the creditors to go to hell and they are a booming economy," said Palast, adding that determined leadership is needed in Greece in order to accomplish this.

"The difference between Greece and Argentina is that the Greek people are gutless. Greek people are cowards by nature, whereas the Argentines are tough. I'm trying to push people to not give up. There's no one standing up against the euro. You had one independent party [Syriza] which completely caved in ... you do need that third voice." Such third parties, according to Palast, were able to attain electoral success in Latin America by saying no to the IMF and to policies imposing austerity and privatization. As a result, he argued, those countries' economies are now booming.

Palast was sharply critical of Germany for its role in the Greek crisis. "I keep saying that the Germans want to change the name of the euro to the Panzer. They're accomplishing through economic manipulation what they tried to do with tanks during World War II. You're going to become a German colony unless you get out of their currency."

Palast also had harsh words for Greece's political establishment. Describing Greece's two major parties, New Democracy and PASOK, as "indistinguishable," he stated: "Morally, the leadership of both main parties is equally responsible for lying to the people and causing massive harm to the public, and I think that they should be held accountable."

Palast cited the actions of Goldman Sachs and other banks in helping successive Greek governments hide the country's deficit."It was a fraud, and they charged almost a half a billion dollar fee to the Greek government to help it hide its deficits. Why would you hide your deficits? For a single reason: to stay within the euro."

Palast's harshest criticism was addressed towards Theodoros Pangalos, a prominent former government minister with PASOK. Palast recently interviewed Pangalos at the Eurasia Media Forum in Kazakhstan.

"I couldn't resist the temptation to interview him," said Palast. "He weighs about 300 pounds, he has a stomach that's about three feet ahead of him ... If someone's overweight, that's usually a personal issue, but in his case, it isn't, because you have people in Greece that are literally starving ... and he's saying that if you complain about austerity measures, you're a communist or an anarchist. You're not a communist or an anarchist: you're just someone that's trying to feed your kids."

"Pangalos has a phrase, 'We ate it all together'," added Palast. "No we didn't. He's fat, and other people are starving."

Palast urged the people of Greece to respond to the crisis by protesting the ongoing austerity measures. "Why are the Greek people agreeing to their own destruction? It's crazy! This is when you have to act. You cannot give up now ... I've seen successful movements formed around the world by people who thought their situation was hopeless."

Palast stated his desire to provide his support to Greece, while expressing his interest to hear from ordinary Greeks, in advance of his upcoming visit to the country in September.

"I would like people to contact me and give me their stories, their ideas, their information, and when I come to Greece, I want to meet you and speak with you. I would like to really speak with people about what the people of Greece think are the best solutions. Let's work this out together, and I will bring the best minds in the field of economics to your side, to discuss how movements are formed."

* * * * * * * *

Greg Palast’s book Vultures' Picnic (Constable Robinson UK/Penguin USA), including chapters on Greece and Goldman, will be published in Greek this fall by Livani. Download the first chapter, Goldfinger, and videos at VulturesPicnic.org.

Greg Palast's other books are the New York Times bestsellers Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, The Best Democracy Money Can Buy and Armed Madhouse.

Visit the Palast Investigative Fund's store or simply make a contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

August 8, 2013

Billionaires & Ballot Bandits The Movie trailer

July 25, 2013

An Open Letter to Trayvon Martin's Father

By Greg Palast for Truthout

I have a 16-year old son. I cannot imagine losing him because some beast decided to play Lone Ranger.

And so, with cautious humility, I make this suggestion, this plea.

Sue the beast. You must.

I understand you are reluctant to launch another painful trial of uncertain outcome and cost, monetary and emotional. And I know a money judgment won't bring your son home.

But imagine this: George Zimmerman gets a half-million-dollar book deal and $25,000 a pop to appear at gun shows - plus a fee to put his name on a 9mm semi-automatic. The 'Zimmerman Protector.'

There's only one way to put this monster out of business: Justice can only come out of the barrel of a lawsuit.

Only in a lawsuit can you force Zimmerman to the witness stand. That's crucial. In the criminal case, Zimmerman's daddy, a magistrate no less, could say it was poor George yelling for help on that desperate phone call.

In a civil action, your son's lawyer can say to Zimmerman, "Come on, George, let's hear you scream for help. George, let's hear you scream that this skinny kid is going to kill you. Come on, George, show us how Trayvon somehow grabbed your big fat head while he was taking the gun from your hand."

A federal indictment won't do that: Zimmerman can't be called as a witness in a criminal case. A federal trial won't disgrace Zimmerman nor stop him from getting rich off your son's corpse.

A civil trial has none of that "reasonable doubt" crap that can get Zimmerman off the hook with some fantasy story about Trayvon as the dangerous aggressor. Zimmerman's consigliere said it was Trayvon’s own fault he was murdered. The “decision [to get shot] was in Trayvon Martin's hands more than my client's.” Do you want that to be the last word about your son?

Maybe you don't want the money. OK, then: Set up a foundation and make Zimmerman turn over all that blood money, those book deals and gun show fees, to the Trayvon Foundation. Make him work every day of his lousy life for Trayvon.

There’s another advantage to civil action. To be blunt, you won't have to rely on painfully befuddled prosecutors like the ones we witnessed in that courtroom. In a lawsuit, you can choose the best legal gunslingers in the country.

I'm not guessing about that. I asked fearsome Florida trial lawyer Mike Papantonio if he and his partner, civil rights attorney Bobby Kennedy Jr., would take on the case if called. Papantonio said his firm is standing by, ready to help your legal team if asked. And I have no doubt there are other great plaintiff lawyers who would leap to your cause.

Americans love to complain that there are "too many lawyers." I agree that if some corporate defense lawyers drown in their hot tubs, only their mothers should cry. But it is our unique system of tort law that gives Americans the true Hammer of Justice. Plaintiff lawsuits, even more than government agencies or the FBI, are what keep drug companies from poisoning us and keep dangerous toys from maiming our kids. And, using section 1983 of the federal civil rights statute, it’s the power of the plaintiffs’ bar that stops racist jerks from denying jobs, mortgages and freedoms to people of color.

And there's one final reason to bring a civil action. Let the word go forth to any Zimmerman wannabe dreaming that wealth and admiration requires only their hunting down another dark-skinned kid in a hoodie: Maybe sick Florida law will keep you out of prison, but you will have your sorry ass dragged onto a witness stand, where you will be ripped up, ruined and busted for the rest of your life.

So I'm asking you, as one dad to another, stand your ground and sue this killer - for Trayvon and for all our kids.

With respect,

Greg Palast

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers, Billionaires & Ballot Bandits, The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic, named Book of the Year 2012 on BBC Newsnight Review.

Please sign up for Palast's free Newsletter.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

July 23, 2013

The Frog Who Crushed The Planet Did a French Yuppie really create the Finance Crisis?

By Greg Palast for Vice Magazine

You just knew it had to be one of those brie-biting, Sartre-spewing, overly-garlicked Frenchmen who pushed the Earth's finance system over a cliff.

You just knew it had to be one of those brie-biting, Sartre-spewing, overly-garlicked Frenchmen who pushed the Earth's finance system over a cliff.

This week, US prosecutors finally began the trial of the only person on the entire planet whom they have charged with the financial crimes that sank worldwide stock markets by trillions in 2008 and left millions homeless and jobless, from Detroit to Manchester.

Amazingly, say prosecutors, it all came down to a single Frenchman, Fabrice "Fabulous Fab" Tourre, only 29 years old at the time. Even Julius Caesar waited until he turned 51 to bring the known world to its knees.

Here's the story which his defence team does not dispute:

In August 2007, hot-shot hedge fund manager John Paulson walked into Goldman Sachs with a brilliant plan to cash in on the US housing crisis.

He paid Goldman to announce that Paulson would invest a big hunk of his fund's wealth, $200 million, in securities tied to the US mortgage market's recovery. A few lucky investors would be allowed to give Goldman their billions to bet with Paulson that Americans would never default on their home mortgages.

It was a con. Secretly, Paulson would bet against the mortgage market, hoping it would collapse – making sure it would collapse. All he needed was Goldman to line up the suckers to put up billions to be his "partners".

It was Goldman's and Paulson's financial version of Mel Brooks' The Producers, in which a couple of corrupt theatre producers schemed to suck investors into a deliberate flop.

Throughout 2007 and 2008, Paulson & Co. worked with Goldman to create the financial equivalent of Springtime for Hitler.

Paulson personally chose the group of mortgages for the fund. Rather than pick the least risky, he deliberately loaded the fund with sub-prime losers. To polish this turd, Goldman and Paulson paid a highly respected risk analysis firm, ACA, to endorse the selection. Paulson and his vice president met with ACA to assure them of the value of the crappola – never telling ACA that, in fact, Paulson would profit if the securities failed.

Based on Paulson's pitch, ACA endorsed the value of these "synthetic derivatives" securities. This led rating agencies Moody's and S&P – recipients of fat fees from Goldman – to give the package an AAA rating – that is, marking them as safer than US Treasury notes.

In just a few weeks, by August 8, 2008, the securities lost 99 percent of their value.

The dupes paid up. One, Royal Bank of Scotland, handed over nearly a billion dollars ($840,909,090) to Goldman. Goldman then quietly shifted the loot, minus its fee, to Paulson & Co.

For more on Paulson and what he bought with your money, see Billionaires & Ballot Bandits.

The payout busted RBS. But don't shed tears. The Bank of England and British taxpayers took over the bank and covered the loss.

The collapse of RBS and the billions lost by others in the scheme fuelled a panic which caused banks in the US to shut their lending windows, refusing to re-finance sub-prime mortgages. Over two million American families now faced eviction.

Paulson was thrilled. Each default and eviction just made Paulson & Co. richer, altogether pulling in a profit for his hedge fund of over $3.5 billion on the Springtime-for-Hitler game. Paulson's personal earnings on this economic tragedy exceeded one billion dollars.

I happened to be in Detroit that August, at the home of auto union member Robert Pratt. He'd already received his eviction notice. Like almost all black home buyers in the USA, he was steered to a "sub-prime" mortgage. Under a formula years later deemed to be "predatory", his payments suddenly doubled. Pratt's mortgage balance grew to $110,000 on a home worth $30,000. The bank would not refinance, so Pratt prepared to move into his car with his wife and four kids.

Government watchdogs hunted for the financial crimes perpetrators, and, discovering the Goldman/Paulson fraud, brought charges against... the French kid. Goldman had leant Fabrice Tourre to Paulson to take on flunky tasks, including putting together a 28-page "flip book" to lure European banks into the scam.

In a text message discovered by investigators, Fabrice admitted to a friend that he couldn't understand the insanely complex derivatives Paulson had crafted with Tourre's bosses at Goldman. He did, though, grasp that the strange securities were, he wrote, "monstrosities". A collapse was coming that would "bring down the whole house", leaving Fabrice standing in a ruined planet – with a fat bonus.

What did the Feds do to Paulson? He received... a special tax break.

Am I defending the Fabulous Fabrice, the French-fried scapegoat? After all, he was just along for the ride. But he was deeply thrilled to carry water for the Bad Boys. And the charges against him are merely "civil", meaning he won't get jail time even if found guilty.

And what about Goldman, whose top brass knew of the entire game? The Securities and Exchange Commission did fine Goldman for its duplicity – a sum equal to 5 percent of the cash Goldman got from the US Treasury in bail-out funds.

After Goldman's con became public, its CEO Lloyd Blankfein was hailed as a visionary for offloading mortgage-backed securities before the shit hit the finance fan. Blankfein hailed himself for, he said, "doing God's work". God did well. Blankfein's bonus in 2007 brought his pay package to $69 million for the year, a Wall Street record.

Rather than prison or penury, Blankfein was appointed advisor to both the business and the law school at Harvard University.

So here's the lesson all Harvard students are taught: If you can't do the time, don't do the crime... unless your booty exceeds a billion.

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers, Billionaires & Ballot Bandits, The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic, named Book of the Year 2012 on BBC Newsnight Review.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make tax-deductible contribution to keep our work alive!

For media requests contact us.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

The Frog Who Crushed The Planet Did a French uppie really create the Finance Crisis?

By Greg Palast for Vice Magazine

You just knew it had to be one of those brie-biting, Sartre-spewing, overly-garlicked Frenchmen who pushed the Earth's finance system over a cliff.

You just knew it had to be one of those brie-biting, Sartre-spewing, overly-garlicked Frenchmen who pushed the Earth's finance system over a cliff.

This week, US prosecutors finally began the trial of the only person on the entire planet whom they have charged with the financial crimes that sank worldwide stock markets by trillions in 2008 and left millions homeless and jobless, from Detroit to Manchester.

Amazingly, say prosecutors, it all came down to a single Frenchman, Fabrice "Fabulous Fab" Tourre, only 29 years old at the time. Even Julius Caesar waited until he turned 51 to bring the known world to its knees.

Here's the story which his defence team does not dispute:

In August 2007, hot-shot hedge fund manager John Paulson walked into Goldman Sachs with a brilliant plan to cash in on the US housing crisis.

He paid Goldman to announce that Paulson would invest a big hunk of his fund's wealth, $200 million, in securities tied to the US mortgage market's recovery. A few lucky investors would be allowed to give Goldman their billions to bet with Paulson that Americans would never default on their home mortgages.

It was a con. Secretly, Paulson would bet against the mortgage market, hoping it would collapse – making sure it would collapse. All he needed was Goldman to line up the suckers to put up billions to be his "partners".

It was Goldman's and Paulson's financial version of Mel Brooks' The Producers, in which a couple of corrupt theatre producers schemed to suck investors into a deliberate flop.

Throughout 2007 and 2008, Paulson & Co. worked with Goldman to create the financial equivalent of Springtime for Hitler.

Paulson personally chose the group of mortgages for the fund. Rather than pick the least risky, he deliberately loaded the fund with sub-prime losers. To polish this turd, Goldman and Paulson paid a highly respected risk analysis firm, ACA, to endorse the selection. Paulson and his vice president met with ACA to assure them of the value of the crappola – never telling ACA that, in fact, Paulson would profit if the securities failed.

Based on Paulson's pitch, ACA endorsed the value of these "synthetic derivatives" securities. This led rating agencies Moody's and S&P – recipients of fat fees from Goldman – to give the package an AAA rating – that is, marking them as safer than US Treasury notes.

In just a few weeks, by August 8, 2008, the securities lost 99 percent of their value.

The dupes paid up. One, Royal Bank of Scotland, handed over nearly a billion dollars ($840,909,090) to Goldman. Goldman then quietly shifted the loot, minus its fee, to Paulson & Co.

For more on Paulson and what he bought with your money, see Billionaires & Ballot Bandits.

The payout busted RBS. But don't shed tears. The Bank of England and British taxpayers took over the bank and covered the loss.

The collapse of RBS and the billions lost by others in the scheme fuelled a panic which caused banks in the US to shut their lending windows, refusing to re-finance sub-prime mortgages. Over two million American families now faced eviction.

Paulson was thrilled. Each default and eviction just made Paulson & Co. richer, altogether pulling in a profit for his hedge fund of over $3.5 billion on the Springtime-for-Hitler game. Paulson's personal earnings on this economic tragedy exceeded one billion dollars.

I happened to be in Detroit that August, at the home of auto union member Robert Pratt. He'd already received his eviction notice. Like almost all black home buyers in the USA, he was steered to a "sub-prime" mortgage. Under a formula years later deemed to be "predatory", his payments suddenly doubled. Pratt's mortgage balance grew to $110,000 on a home worth $30,000. The bank would not refinance, so Pratt prepared to move into his car with his wife and four kids.

Government watchdogs hunted for the financial crimes perpetrators, and, discovering the Goldman/Paulson fraud, brought charges against... the French kid. Goldman had leant Fabrice Tourre to Paulson to take on flunky tasks, including putting together a 28-page "flip book" to lure European banks into the scam.

In a text message discovered by investigators, Fabrice admitted to a friend that he couldn't understand the insanely complex derivatives Paulson had crafted with Tourre's bosses at Goldman. He did, though, grasp that the strange securities were, he wrote, "monstrosities". A collapse was coming that would "bring down the whole house", leaving Fabrice standing in a ruined planet – with a fat bonus.

What did the Feds do to Paulson? He received... a special tax break.

Am I defending the Fabulous Fabrice, the French-fried scapegoat? After all, he was just along for the ride. But he was deeply thrilled to carry water for the Bad Boys. And the charges against him are merely "civil", meaning he won't get jail time even if found guilty.

And what about Goldman, whose top brass knew of the entire game? The Securities and Exchange Commission did fine Goldman for its duplicity – a sum equal to 5 percent of the cash Goldman got from the US Treasury in bail-out funds.

After Goldman's con became public, its CEO Lloyd Blankfein was hailed as a visionary for offloading mortgage-backed securities before the shit hit the finance fan. Blankfein hailed himself for, he said, "doing God's work". God did well. Blankfein's bonus in 2007 brought his pay package to $69 million for the year, a Wall Street record.

Rather than prison or penury, Blankfein was appointed advisor to both the business and the law school at Harvard University.

So here's the lesson all Harvard students are taught: If you can't do the time, don't do the crime... unless your booty exceeds a billion.

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers, Billionaires & Ballot Bandits, The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic, named Book of the Year 2012 on BBC Newsnight Review.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make tax-deductible contribution to keep our work alive!

For media requests contact us.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

July 17, 2013

New York Genitals Fight for Office ... While Snowden Fights the Forces of Stupid

By Greg Palast for Vice Magazine

Go ahead and shoot me. It’s hopeless. My War on Stupid is facing defeat on every front.

I open up the New York Times and there’s a page one story about Anthony Weiner, who is now ahead in the race for Mayor of New York.

The article is 17 column inches long. I measured. The entire profile of the candidate – every bumpy, veined inch of it – is about Mr Weiner’s penis.

The article is 17 column inches long. I measured. The entire profile of the candidate – every bumpy, veined inch of it – is about Mr Weiner’s penis.

It is, I admit, a really famous penis. Weiner was a Congressman until two years ago when he resigned because he sent a 21-year-old woman photos of his wiener (modestly bulging from his underpants) via Twitter. Weiner was forced to resign from Congress.

Now he’s back, with a front-runner status conferred by the name-recognition care of the exposure of his jockey shorts.

New York’s school system, with one million students, is desperately screwed up. What is Weiner’s position on privatizing the schools through the “charter” system? The Times won’t tell us. It’s all about Weiner’s weenie. The Times only asks voters if they will forgive him for showing young ladies his Congressional junk.

I do know this (not from the Times story): Weiner said, if elected, his first act would be to remove New York’s new bicycle lanes.

So I didn’t need to see Weiner’s underpants to know that he’s a dick.

Does this mean that I’m endorsing his main opponent, Councilwoman Christine Quinn? No. I don’t endorse candidates, but I do like to learn their positions on the issues. The Times, America’s self-proclaimed “paper of record”, had a story on Quinn yesterday. We learned all about her father, a city cop who they portray as one of those loveable, cartoonish Irish schmucks who dispenses a lot of blarney. But what is Quinn’s position on charter schools? You won’t get that from the Times.

Of course, the Times had other stories about Madame Quinn: a big story about her recent marriage to another woman. If she wins the election, she’ll be New York’s first lesbian mayor.

In other words, she would not be in the least interested in Congressman Anthony’s wiener.

So there we have it: the newspaper of America’s intelligentsia has brought the race for the biggest city in the Land of the Free down to a choice of genitalia.

Yes, they are trying to make us stupid. I’m beginning to believe those conspiracy freaks who think the Illuminati are stealing all our useful brainwaves for their reptile overlords from another dimension.

Of course, stupid leads to deadly.

* * * * *

New evidence is mounting that one of the accused Boston Marathon bombers, the deceased Mr Tamerlan Tsarnaev, had previously murdered three former friends of his on the tenth anniversary of the September 11th World Trade Center attacks.

Do the math: the prior murders happened two years before the Boston bombings.

Tsarnaev’s co-killer in the 2011 murders confessed to their bad behaviour when questioned recently by the FBI. While the agents put six bullets in him before he signed the official confession, we are left with the nagging question: Are the cops really that stupid?

It turns out that the local constabulary in Waltham, a suburb of Boston, never questioned Tsarnaev, despite the fact that several of the victims’ friends told the cops there was good reason to do so.

But the cops blew off the leads and let the killer go on to kill again, this time with three dead and 264 injured victims, at the Boston Marathon.

So what does this have to do with Edward Snowden? Everything.

One pinhead official said that Snowden’s revelation of the National Security Agency spying on worldwide internet traffic “could have prevented another Boston” Marathon massacre.

But, of course, it didn’t prevent the first Boston massacre.

And that’s the point.

Snowden has been called a "traitor" and charged with crimes regarding the revelation of a private contractor analyzing "metadata" from internet traffic.

As a former professor of statistics, I should explain that “metadata” is defined by experts as, “A big load of bullshit used by consulting firms to get hundred-million-dollar no-bid contracts from government pinheads.”

What Snowden uncovered is not some massive spying operation that could expose terrorist plots, but a massive invasion of the taxpayer’s wallet by connected consultants.

In the meantime, the guys who could have stopped the Boston Marathon attack by using what the FBI called, “old-fashioned police methods”, were too short on of both budget and brain cells to capture the killers.

Instead, they’re hunting Snowden and reading European embassy emails. Terrorists worldwide want to thank the US government for this colossal act of stupid.

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic, just named Book of the Year on BBC Newsnight Review.

Visit the Palast Investigative Fund's store or simply make a contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

July 10, 2013

Summer versus Stupid

By Greg Palast for Vice Magazine

We all have bad habits. And the worst, besides yelling at our kids when we're hung-over or just generally disappointed, is the daily deal we make with Evil.

We all have bad habits. And the worst, besides yelling at our kids when we're hung-over or just generally disappointed, is the daily deal we make with Evil.

Every day we are thrown head first into that dog fight between What is Right, What is Horrible and, our third way, Just-Don't-Give-a-Shit-ism.

We know we are not Bradley Manning, nor Edward Snowden. We know we'd better just shut the fuck up.

And that’s the conflict at the core of civilization's corrosion: not between national security and freedom, but between courage and complicity.

Warren Ellis – you might know his comic books, including Transmetropolitan with Darick Robertson – said that journalism is a terribly weak weapon – though when correctly aimed,can blow the knees off very large villains.

Last week, the US Supreme Court burned a judicial cross on Martin Luther King’s grave, effectively ending the Voting Rights Act. Official apartheid now returns to America’s elections. And by the time you read this, Nelson Mandela will probably be dead – along with his vision of human equality and comity.

In the face of such villainy, my reporter’s weapon feels limp and my aim not so good. That's why I’ve deleted my draft of a column which contained my usual screed on the week’s transgressions of our political leaders. Given the limits of journalism, there might be more to learn from fiction and poetry.

In the face of such villainy, my reporter’s weapon feels limp and my aim not so good. That's why I’ve deleted my draft of a column which contained my usual screed on the week’s transgressions of our political leaders. Given the limits of journalism, there might be more to learn from fiction and poetry.

I begin with Warren Ellis.

Like the assassin in Gun Machine, his latest novel, Ellis is horrified and angry beyond reason that just to walk across Manhattan for a bagel, you step on the unseen skulls of Lanape Indians, on putrefying corpses of immigrants with tuberculosis, on the evidence of unsolved murder-suicides caused by home foreclosures traced back to algorithmic high-speed derivatives trading.

Ellis' killer is not completely nuts when he concludes that whoever dies on this ill ground, this poisoned graveyard, deserves it. Deserves the bullet in the skull, or, more commonly, the demotion to part-time security work at a shopping center owned by some toad-licking financier with a shell company in the Virgin Islands.

Both Ellis' gunman and the cop who hunts him, have—like Manning, Snowden and Mandela--a pathological inability to ignore unpleasant reminders of the flesh on which we've built our empires.

The New York Times editor who greedily used Manning's "Wikileaks" cables, nevertheless called Manning, "disturbed." OK, then, let's accept that courage is a form of insanity. All prophets are nut-cases.

The rest of us are sane. We stare are our paperwork, brown-nose to a promotion, feel up our once-pretty wife's prettier sister, and when Satan says, "Hey, thanks," we pretend not to hear Him.

But Warren Ellis hears Him. In Gun Machine, Ellis uses the police procedural as a brilliantly subversive way to re-tell the Biblical battle in a form that befits our age of lazy-ass electronically-induced ethical somnolence. Listen:

“Jim Rosato’s killer was a bodybuilder gone to burgers and long days on the sofa. He was trembling all over… The top of his head was bald and seemed too small to contain a human brain. …The name Regina was badly tattooed over his chest, stretched by his hairy tits. [Police Officer] John Tallow could not in that moment see any reason why he should not just fucking kill him, so he put four hollow points through Regina, and a stopper through the shitbag’s stupid tiny head.”

Hey, we’ve all had days like that.

I'll admit that my dragging in a comic-book-detective-story writer’s novel has an ulterior motive. It's part of my never-ending, disconsolate battle against stupid.

I recommend, I insist that, after reading Ellis’s Gun Machine, you move on to Anna Chen, the Dragon poet, then Michael Griffin and Robert Parry. Do that, and you won’t have wasted your summer.

It must have been ten years ago. Under the ill influence of the free wine in the Newsnightgreen room, I remember saying things unkind to your nation’s Poet Laureate. I think it was his loafers and fey velour-y jacket that made me think he’d just come from some poet’s costume store. His poems wore loafers, too. Anna Chen’s poetry wears wet leathers, red lipstick, stilettos—and is heavily armed. Her slim volume, Reaching for My Gnu,is filled with what I’d call “strap-on poems.” They look like an evening’s easy pleasure but are far more painful and unforgettable than you’d bargained for.Here’s from “Burgers,” describing the need for the artist to get deep into the grime, to the bottom of Life’s Deep Fryer:

Anna Chen’s poetry wears wet leathers, red lipstick, stilettos—and is heavily armed. Her slim volume, Reaching for My Gnu,is filled with what I’d call “strap-on poems.” They look like an evening’s easy pleasure but are far more painful and unforgettable than you’d bargained for.Here’s from “Burgers,” describing the need for the artist to get deep into the grime, to the bottom of Life’s Deep Fryer:

…I want a burger that’s not cooked through,

burnt outside with a pinkish hue,

coughed on, sploshed on,

kicked around and noshed on…

One where the chef ’s been to the loo,

a number one and a number two

and a number three if he fancies you. …

Chen, a militant BEAA (British East Asian Artist), playwright who blogs as Madam Miaow, jerks around with race stereotypes in the poems “Yellowface” and “Anna May Wong Must Die!” They have that perfect mixture of fun and threat.

Like most good literature today, Gnu is only available online.

No loafers allowed.

Savonarola could have learned a lot about book burning from the British Courts. Michael Griffin told me he doesn’t have a single copy of his extraordinary book, Reaping the Whirlwind—The Taliban Movement in Afghanistan. Instead, he has a certificate from a crematorium certifying that every known copy has been thoroughly burnt.Apparently, one sentence bothered a billionaire, so the auto-da-fé was ordered by a be-wigged freak in a robe, what the English call a “judge,” enforcing the Inquisitional libel laws of the benighted isle.Whatever, I was able to dig through the used book bin at the Strand bookstore in New York to get a copy.

Griffin published Taliban just a couple of months before the September 11, 2001 attacks. He expected the book to be ignored. It was.

That is, by time it became a flash bestseller, it was way too late.

You still get a frisson of horrifying irony as Griffin warns that Osama bin Ladin’s threats against the USA, despite George W. Bush’s la-di-dah view, were no joke.

And there are plenty of sickening OMG moments here, as when Iran masses 200,000 troops on the Afghan border to overthrow the Taliban, “orthodox savages,” in the words of Iran’s president Khatami. Iran hoped to halt the Taliban’s murder-spree against Shia villages—military action blocked by US threats.

Despite the book’s ending before the US-UK invasion, you lose nothing in reading this history of Afghanistan, because Central Asian history simply repeats itself, first as tragedy, then as farce, then as Obama.

As I don’t want Griffin to get in trouble (more trouble than he’s in already), I suggest that you pick up a copy only after your escape from Britain.

Finally, there’s Robert Parry’s new book, America’s Stolen Narrative: From Washington and Madison to Nixon, Reagan and the Bushes to Obama. Don’t be put off by the dull title and crappy cover: this book is a tightly-written, tightly-aimed information drone strike.Example: Parry’s take-down on General David Petraeus whom the US press creamed over (until the General had to resign for creaming over one distaff member of the press). Gen. Petraeus came up with the sick and bloody idea of a “surge”—a massive increase in troops and killing--to subdue occupied Iraq. “The Surge” supposedly quelled the Sunni insurgency.

Bullshit. The insurgency died down when the US quietly handed big bricks of cash to the insurgents and their brethren (“The Awakening Council”)—then turned a blind eye to the Sunni ethnic cleansing of Shia within Anbar province (while Shia were allowed to conduct pogroms elsewhere against Sunni).

[N.B. The danger-addicted photojournalist Ricardo Rowley filmed this US-sanctioned ethnic mayhem for Al Jazeera—a report available in Big Noise “Dispatches” video magazine--another good source of anti-stupid.

Parry was the Associated Press reporter who uncovered the Iran-Contra Arms-for-Hostages scandal. For committing that and other courageous acts of journalism, he was canned by the AP. Parry has suffered the US media’s equivalent of banishment to Siberia. Banned from the airwaves and blocked out of his former newspapers and magazines, Parry must now, like Solzhenitsyn, publish his own books Samizdat style. So forgive him the cheap-o cover design.

Extra credit: If you’re in a stolen vehicle and moving too fast and erratically to read your Kindle, then avail yourself of an alternative cure for stupid: Sorry to Bother You, the latest uneasy listening music from hip-hop master Boots Riley, back with The Coup. If you find his “electromagnetic with a bomb esthetic” difficult to comprehend, here's an excellent translation into Caucasian.

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic, just named Book of the Year on BBC Newsnight Review.

Visit the Palast Investigative Fund's store or simply make a contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

June 25, 2013

Ku Klux Kourt kills King’s Dream Law Replaces Voting Rights Act with Katherine Harris Acts

by Greg Palast for Truthout

They might as well have burned a cross on Dr. King's grave. The Jim Crow majority on the Supreme Court just took away the vote of millions of Hispanic and African–American voters by wiping away Section 4 of the Voting Rights Act of 1965.

They might as well have burned a cross on Dr. King's grave. The Jim Crow majority on the Supreme Court just took away the vote of millions of Hispanic and African–American voters by wiping away Section 4 of the Voting Rights Act of 1965.

I'm so angry, so distraught by this, that I've asked my foundation to release my film, 'Election Files, for free. This is a no-BS, no charge download of my series of investigative reports for BBC Television and Rolling Stone.

Furthermore, I'm directing the Palast Investigative Team to drop all other work for a ‘round-the-clock investigation of the Theft of 2014 and 2016 elections that the Supreme Court's ruling sets in motion. Help us, join us.

When I say "millions" of voters of color will lose their ballots, I'm not kidding. Let's add it up.

Last year, the GOP Secretary of State of Florida Ken Detzner tried to purge 180,000 Americans, mostly Hispanic Democrats, from the voter rolls. He was attempting to break Katherine Harris' record.

Detzner claimed that all these Brown folk were illegal "aliens."

But Section 4 of the Voting Rights Act requires that 16 states with a bad history of blocking Black and Brown voters must "pre-clear" with the US Justice Department any messing around with voter rolls or voting rules. And so Section 4 stopped Detzner from the racist Brown-out.

I'll admit there were illegal aliens on Florida's voter rolls – two of them. Let me repeat that: TWO aliens'–One a US Marine serving in Iraq (not yet a citizen); the other an Austrian who registered as a Republican.

We can go from state to state in Dixie and see variations of the Florida purge game. It quickly adds up to millions of voters at risk.

Yet the 5-to-4 Court majority ruled, against all evidence, that, "Blatantly discriminatory evasions [of minority voting rights] are rare." Since there are no more racially bent voting games, the right-wing Robed Ones conclude there’s no more reason for “pre-clearance.”

Whom do they think they're fooling? The Court itself, just last week, ruled that Arizona's law requiring the showing of citizenship papers was an unconstitutional attack on Hispanic voters. Well, Arizona's a Section 4 state.

You'll love this line from the Ku Klux Kourt majority. They wrote that the "coverage" of Section 4 applies to states where racially bent voting systems are now "eradicated practices."

"Eradicated?"I assume they didn't see the lines of Black folk in Florida last November. That was the result of the deliberate reducing of the number of polling places and early voting hours in minority areas. Indeed, if the Justice Department, wielding Section 4, hadn't blocked Florida from half its ballot-box trickery, Obama would have lost that state's electoral votes.

"Eradicated?"I assume they didn't see the lines of Black folk in Florida last November. That was the result of the deliberate reducing of the number of polling places and early voting hours in minority areas. Indeed, if the Justice Department, wielding Section 4, hadn't blocked Florida from half its ballot-box trickery, Obama would have lost that state's electoral votes.

And that's really what's going on here: The problem is not that the Court majority is racist. They're worse: they're Republicans.

We've had Republicans, like the great Earl Warren, who put on the robes and take off their party buttons.

But this crew, beginning with Bush v. Gore, is viciously partisan. They note that, "minority candidates hold office at unprecedented levels." And the Republican Supremes mean to put an end to that. See "Obama" and "Florida" above.

And when they say "minority" they mean "Democrat."

Because that's the difference between 1965 and today. When the law was first enacted, based on the personal pleas of Martin Luther King, African-Americans were blocked by politicians who did not like the color of their skin.

But today, it's the color of the ballot of minorities – overwhelmingly Democratic Blue—which is the issue.

Pre-clearance goes WAY north of the Confederacy to Alaska where Alaska's Natives are often frozen out of the voting system—and West to California.

In the Golden State, an astonishing 40% of voter registration forms were rejected by the Republican Secretary of State on cockamamie clerical grounds. When civil rights attorney Robert F. Kennedy and I investigated, we learned that the reject pile was overwhelmingly Chicano and Asian—and overwhelmingly Democratic.

How? Jim Crown ain't gone, he's moved into cyberspace. The new trick is lynching by laptop: removing voters, as was done in Florida and Arizona (and a dozen other states), by using poisoned databases to pick out "illegal" and "felon" and "inactive" voters—who all happen to be of the Hispanic or African-American persuasion. The GOP, for all the tears of its consultants, knows it can't rock these votes, so they block these votes.

Despite the racial stench of today's viciously anti-democratic ruling, the GOP majority knew they were "handicapping" the next Presidential run by a good six million votes. (That's the calculation that RFK and I can up with for the racially-bent vote loss in 2004—and the GOP will pick up at least that in the next run.)

And the Court knew full well that their ruling today was the same as stuffing several hundred thousand GOP Red votes into the ballot boxes for the 2014 Congressional races.

The Republican court knows that to swipe 2016, they had to replace the Voting Rights Act with a revival of the Katherine Harris act.

* * * * * *

Please contact us for permission to reprint this article.

It was investigative reporter Greg Palast, for The Guardian and BBC Television who uncovered Katherine Harris purge of Black voters in 2000. He is also the author of the recent New York Times bestseller, Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps.

Palast's film The Election Files is now available as a FREE download.

Or simply support our work by making a No Gift donation.

We are counting on you to voluntarily make a tax-deductible donationand keep our investigations alive—and boy, do we need it! So many evils, so little time—and so few resources. And thank you for keeping us alive for a decade of investigative scoops.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

Greg Palast's Blog

- Greg Palast's profile

- 138 followers