Greg Palast's Blog, page 94

November 20, 2013

Chris Christie will Hate this Film

Know why the Guvna of Joyzee is so bloated? It ain’t the burgers: He’s pumped up with billionaire big bucks – from buck-a-roos who happen to be the stars of our new film:

Know why the Guvna of Joyzee is so bloated? It ain’t the burgers: He’s pumped up with billionaire big bucks – from buck-a-roos who happen to be the stars of our new film:

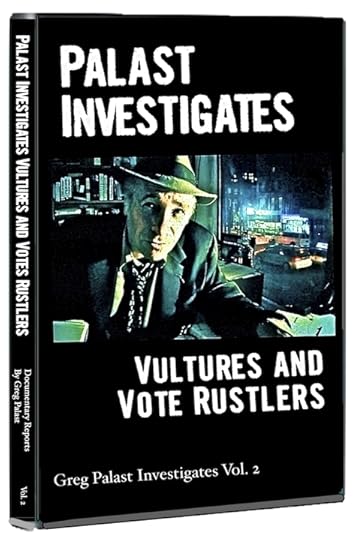

Vultures and Vote Rustlers

Greg Palast Investigates Vol. 2

Working with The Nation Institute, the Palast investigative team ripped the cover off this cabal of billionaires who secretly funding the GOP –– and their fave Christie –– through a series of corporate disguises. And who surreptitiously stuffed $115 million into Ann Romney's "blind" trust. Find out how this Billionaire Boys Club took down the US Treasury for $4 billion.

Find out how this Billionaire Boys Club took down the US Treasury for $4 billion.

And that’s only ONE of the seven investigative reports on this smoking hot, new DVD, the updates of our special broadcasts for BBC Television, Free Speech TV, Democracy Now! and The Guardian.

So how do you get your hands on these killer reports?

YOU PRODUCE THEM!

Here’s how:

We are finishing the edit this week.

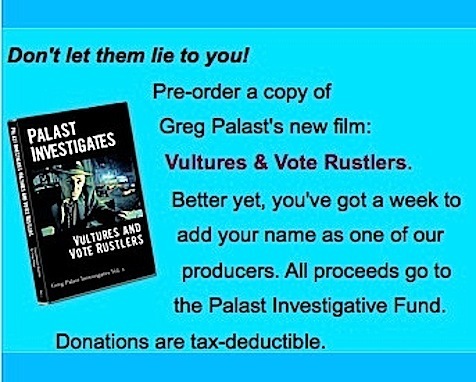

Make a tax-deductible donation of $1,000 and we’ll list you as a Producer.

Or donate $500 and be listed as a Co-Producer.

You have until November 28th to get your name on the film credits!

Or... Right now, pre-order Vultures and Vote Rustlers: Palast Investigates Vol. 2 –– for a minimum donation of $40, tax-deductible, and we will send you a copy of the DVD at its December release. I'll sign it to you myself with my thanks.

Or get your signed 2-DVD combo Palast Investigates Vol. 1 & 2 for a tax-deductible donation of $65.

Or get your signed 2-DVD combo Palast Investigates Vol. 1 & 2 for a tax-deductible donation of $65.

For more stuff visit the Palast Investigative Fund store or simply make a tax-deductible contribution to keep our work alive!

Check out the trailer. "Great fun" (New Yorker) with "Stories so relevant they threaten to alter history" (Chicago Tribune).

In 7 episodes,

...I take you along with my gonzo cameraman Rick Rowley (Dirty Wars, Fourth World War) up the Congo River to hunt for the man behind Christie’s money.

...to the Caspian Sea for the story of the Deepwater Horizon that you won’t see on the Petroleum Broadcast System.

...and to Ohio, the ballot-box Bermuda Triangle. Vote Theft 2016 is only a ballot burglary away. In Vultures and Vote Rustlers you’ll get the latest on the black-out of Black voters.

7 reports –– crazy, sickening, weirdly funny, eye-opening, more informative and more substantial than anything you’ll find on PBS, CBS or other big network BS.

Michael Moore praises our "Courageous reporting." But, as Michael knows, it takes more than courage to make our films –– it takes funding. And the Kochs aren't opening up their checkbook to us.

So we're asking YOU to be OUR mogul.

Michael Moore calls our work, "Courageous reporting." And indeed, one of Christie's billionaires had his goons call BBC-TV to try to stop the broadcast of one of these reports.

But it takes more than courage to make our films –– it takes funding. And the Kochs aren't opening up their checkbook to us.

As Noam Chomsky says, “Greg Palast upsets all the right people.” And so it's not surprising that one of Christie's billionaires had his goons call BBC-TV to try to stop the broadcast of these reports. BBC wouldn't back down. Neither will we.

Help us upset a few more One Percenters. Please support our work with a tax-deductible donation.

Now is the moment to say you will support our continuing investigations –– and get the skinny on the fat cats.

Yours,

Greg Palast, reporting

* * * * * *

Greg Palast is the author of the New York Times bestsellers Billionaires & Ballot Bandits,The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make a tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

November 14, 2013

Rand Paul’s Zombie-nomics versus Janet Yellen

By Greg Palast for Truthout

Will Senator Rand Paul, misunderstanding the voices of the un-dead, block the appointment of Janet Yellen to head the Federal Reserve Board? No joke. Tea Party fave Paul told the Wall Street Journal he would have preferred Milton Friedman, the free-market fanatic, to the liberal-ish Yellen. But, as a stunned Journal reporter informed the Senator, Milton Friedman is, alas, some years dead.

No joke. Tea Party fave Paul told the Wall Street Journal he would have preferred Milton Friedman, the free-market fanatic, to the liberal-ish Yellen. But, as a stunned Journal reporter informed the Senator, Milton Friedman is, alas, some years dead.

Unbowed, Paul contends he is channeling Friedman from beyond the grave, invoking the Nobel Laureate economist to support the Senator's quest against Yellen's well-known commitment to easy money policies at the Fed.

Paul has written, "One need not be an economist or mathematician to wonder whether printing money out of thin air is a sound way to help the economy."

You're more than correct, Senator. If you don't know why America is printing more dollar bills, then you definitely are NOT an economist NOR a mathematician.

As a former student of the late professor Friedman, I'm quite certain that Milty would have been thrilled by Yellen's push to main-line more greenbacks into the US economy.

If you return to your séance, Senator, and ask Friedman's ghost about "printing money out of thin air," you'd find out he all but invented the idea. Or, throw away the Ouija Board and read Friedman's A Monetary History of the United States 1867-1960, his Nobel-winning work, in which he argued convincingly that the Federal Reserve could have prevented the Great Depression had it radically pumped up the money supply.

If you return to your séance, Senator, and ask Friedman's ghost about "printing money out of thin air," you'd find out he all but invented the idea. Or, throw away the Ouija Board and read Friedman's A Monetary History of the United States 1867-1960, his Nobel-winning work, in which he argued convincingly that the Federal Reserve could have prevented the Great Depression had it radically pumped up the money supply.

Friedman's — and Yellen's — greatest fear is not inflation, but deflation, a disastrous fall in prices due to starving the economy of dollars.

Senator Paul moans that, since the market crash of 2008, the Federal Reserve has printed $3.6 trillion and dumped these dollar bills, ink still wet, into the financial system. Paul is waiting for the day when the printing of all these dollars will suddenly cause the price of a can of tuna to soar to $7,000.

But despite the Fed's smoking-hot printing press, the price of tuna is perilously close to falling. Price inflation today stands at a teeny-weeny 1.2%.

It's time for Senator Paul and daddy Congressman Ron Paul and their followers in gold-foil hats to admit that adding trillions to the money supply has not caused hyper-inflation. After a quarter-century of hysterical warnings from the two Pauls, the hyperinflation spaceship never landed and little green dollar men did not eat up the planet.

An Idiot's Guide to Gold-Buggery

The Pauls have told us horror stories of the German hyper-inflation of the early 1920s when you had to schlep a wheelbarrow full of currency to buy a loaf of bread. The cure Paul père hawks, is a return to the Gold Standard, raising Zombie economic theories from the grave where Friedman buried them.

The Pauls have told us horror stories of the German hyper-inflation of the early 1920s when you had to schlep a wheelbarrow full of currency to buy a loaf of bread. The cure Paul père hawks, is a return to the Gold Standard, raising Zombie economic theories from the grave where Friedman buried them.

As Friedman warned, there's something far worse than having to pay for a loaf of bread with bags of currency, and that's having to pay for a loaf of bread with a bag of gold.

Notably, the Tea Party, not the guys in the goofy wigs on Fox TV, but the real one in Boston in 1773, was formed principally to protest King George's re-imposing the Gold Standard on the colonies.

The colonies faced a crisis. Bricks of gold don't have babies; and so, when an economy grows rapidly as did early America, there simply is not enough money to represent that new trade and wealth because the currency is limited by a fixed and arbitrary amount of metal.

Here's why. When the money stock stays flat as production and workforce grows, each dollar buys more of that production. Sounds good? No way. A monstrous fall in prices and wages means workers and businesses get less for their output and can't pay off old loans. To simplify: When a farmer borrows $100 for land and seed, then sells his corn for $50, the farmer goes bust.

The American colonies faced such ruin when gold-backed currency was insufficient to fund our massive expansion. A revolutionary leader of the time explained the insurgent solution, "Happy for us that we fell upon the Project of giving a Credit to Paper."

Happy days ended when the British Parliament counter-attacked with the Currency Act of 1764 that, "renders our Paper Money no legal Tender." King George, to shackle the States to the Crown's metal-based currency, required purchasing a tax-stamp for each case of tea which had to be paid for in His Majesty's "pounds sterling."

So the dissidents threw the tea into the ocean.

A century and a half later, after World War I, the British Parliament did it again, re-imposing the gold standard. The US and most of the world joined Britain in the golden noose. Economies strangled and dangled. The Great Depression eased only when FDR, in one of his first acts of office, rescued the US, setting the dollar free of gold and letting fly the "Federal Reserve Note," created out of thin air — just like America itself.

And while your beloved Friedman did not care for the government caring for people's welfare via New Deal programs, my professor did praise FDR's printing press for expanding the money supply.

In today's hearing, Janet Yellen might remind the Senate of economist J.M. Keynes warning about, "Madmen in authority, who hear voices in the air, distilling their frenzy from some academic scribbler of a few years back."

Senator Paul, if you are going to listen to the voices of deceased economists, at the least, listen carefully.

* * * * * *

Forensic economist Greg Palast, author of the New York Times bestseller, Billionaires & Ballot Bandits, is a Puffin Foundation Fellow for Investigative Reporting.

Greg Palast is also the author of the New York Times bestsellers, , The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

November 11, 2013

My Father's Victory in the Pacific

By Greg Palast

In 1995, in Chicago, veterans of Silver Post No. 282 celebrated the fiftieth anniversary of their victory over Japan, marching around a catering hall wearing their old service caps, pins, ribbons and medals. My father sat at his table, silent. He did not wear his medals.

He had given them to me thirty years earlier. I can figure it exactly: March 8, 1965. That day, like every other, we walked to the newsstand near the dime store to get the LA Times. He was a Times man. Never read the Examiner.

He looked at the headline: U.S. Marines had landed on the beach at Danang, Vietnam.

As a kid, I was fascinated by my dad’s medals. One, embossed with an eagle and soldiers under a palm tree, said “Asiatic Pacific Campaign.” It had three bronze stars and an arrowhead.

My father always found flag-wavers a bit suspect. But he was a patriot, nurturing this deep and intelligent patriotism. To him, America stood for Franklin D. Roosevelt and the Four Freedoms.

My father’s army had liberated Hitler’s concentration camps and later protected black students on their way to school in Little Rock, Arkansas. His America put its strong arm around the world’s shoulder as protector. On the back of the medal, it read “Freedom from Want and Fear.”

His victory over Japan was a victory of principles over imperial power, of freedom over tyranny, of right over Japan’s raw military might. A song he taught me from the early days of the war, when Japan had the guns and we had only ideals, went,

We have no bombers to attack with,

We have no fighters to defend the flag with

But Eagles, American Eagles,

fight for the rights we adore!

“That’s it,” he said that day in 1965, and folded the newspaper.

The politicians had ordered his army, with its fierce postwar industrial killing machines, to set upon Asia’s poor. Too well read in history and too experienced in battle, he knew what was coming. He could see right then what it would take other Americans ten years of that war in Vietnam to see: American bombers dropping napalm on straw huts, burning the same villages Hirohito’s invaders had burned twenty years earlier.

Lyndon Johnson and the politicians had taken away his victory over Japan.

They stole his victory over tyranny. When we returned home, he dropped his medals into my twelve-year-old hands to play with and to lose among my toys.

A few years ago, my wife Linda and I went to Vietnam to help out rural credit unions lending a few dollars to farmers so they could buy pigs and chickens.

On March 8, 1995, while in Danang, I walked up a long stone stairway from the beach to a shrine where Vietnamese honor their parents and ancestors.

Halfway up, a man about my age had stopped to rest, exhausted from his difficult, hot climb on one leg and crutches. I sat next to him, but he turned his head away, ashamed of his ragged clothes, parts of an old, dirty uniform.

The two of us watched the fishermen at work on the boats below. I put one of my father’s medals down next to him. I don’t know what he thought I was doing. I don’t know myself.

In ’45, on the battleship Missouri, Douglas MacArthur accepted the surrender of Imperial Japan. I never thought much of General MacArthur, but he said something that stuck with me.

“It is for us, both victors and vanquished, to rise to that higher dignity which alone benefits the sacred purposes we are about to serve.”

********

Greg Palast is the author of the New York Times bestsellers Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic, named Book of the Year on BBC Newsnight Review.

Visit the Palast Investigative Fund's store or simply make a contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

November 8, 2013

Steven Cohen Can't Make His Mommy's Monkey Jump

By Greg Palast for Truthout

[New York] Billionaire Steven A. Cohen's marriage was in hot water because his wife wouldn't tolerate the "other woman." The other woman was Steven's mother.

[New York] Billionaire Steven A. Cohen's marriage was in hot water because his wife wouldn't tolerate the "other woman." The other woman was Steven's mother.

This week, Cohen's hedge fund, SAC Capital Advisors will plead guilty to criminal charges of insider trading and pay $1.2 billion in fines and forfeitures.

Cohen says he'll pay the $1.2 billion from his own pocket — but it's a pretty big pocket. His net worth just hit ($9.4 billion). It would have been an even $10 billion, but last year he coughed up over half a billion for his company's illegal trades.

Cohen himself is not accused of knowing the information he used was obtained by criminal means. But, he still faces SEC charges of letting his minions operate like a high-finance NSA, sucking up and trading on illegally obtained information. And the US district attorney, when asked about imprisoning Cohen, said, in cryptic language, that unspecified criminal charges are yet to come.

And it's all Steven's mommy's fault. And her monkey's.

Tip to young journalists: Billionaires' ex-trophy wives are a terrific source of information. The blonder the better. They have vengeance in their eyes and files under their mattresses. And they want just three things: money, revenge, and ...money.

Patricia Cohen is very blonde and very ex'd. She split from the nona-billionaire in 1990 when he was still a poor, struggling nona-millionaire. Or so he led her to believe.

Patricia claims she was robbed — and that she firmly deserves a little of the ice from Cohen's private ice-skating rink, the one in his garden next to his own cinema theater and indoor pool.

So, Patricia, bent on justice, approached this reporter with a authoritatively detailed story of Cohen's first inside-trading scam, documents included.

Now, I should say at the outset that, despite Patricia's selfless exposure of the pitiless facts about Cohen's suspicious trades, and despite the guilty plea and charges pending, I don't for a minute believe that Steven Cohen is anything but an innocent genius.

Indeed, Cohen's brilliance borders on the clairvoyant. He knows which way a stock will move before God knows. He knows your kid's name before you know you're pregnant.

How? By using illegally obtained insider information? Heavens no!

So how does Cohen know the cards in your hand before they're dealt?

"Guessing,” says Cohen. "I was pretty good at guessing which way those [stock price] numbers would go.” In a drooling profile, Vanity Fair compares him to the "mathematical genius” in the film A Beautiful Mind. However, as Cohen was a crap student in math, his uncanny ability to predict the market better than any other mortal is attributed to some otherworldly brain kryptonite that gives him, "a Rain Man–like gift for reading the stock ticker.”

The ex-Mrs. Cohen has a different narrative. We sat in the kitchen at her Upper East Side digs, close enough to Mick Jagger's to borrow a cup of sugar, but not on a very high floor. (Deprivation is a relative concept.) Before jumping into the facts of finance flim-flam, I first wanted to know from her why she left Mr. Bullion Baggins.

"He loved his mother.” That's no crime.

"Yea, but he really loved his mother. Steven couldn't take a poopie without calling Mommy. Every week we'd go have dinner with her, and she would say to him, ‘All I know is, money makes the monkey jump! Money makes the monkey jump!"

"And we'd leave and half the time in the car he'd be in tears about his mommy humiliating him." No matter how many millions and billions he piled up, he couldn't make his mommy's monkey jump.

As a reporter, billionaires are my beat. For The Guardian, I've covered the Brothers Koch, Paul "The Vulture" Singer, Adnan Guns-for-Hostages Kashoggi, and many others. I'm often asked, "Why? Why is two billion or nine billion or twenty billion not enough for these guys?" Why would they play fast and loose with laws statutory and moral to make one more billion?

And the answer is, They can't make their mommy's monkey jump. In every twisted billionaire bamboozler I've investigated, I've found a hole in their soul which they are trying to fill with wads of dollar bills, but can't.

But then, "why" is for their shrinks and next wives to ponder. My issue is "how."

According to Patricia Cohen, Steven began to have visions of future stock moves when he was just a small-change trader at Gruntal & Co.

One night, Steven was again in tears, literally crying into his pillow, sleepless. Patricia claims he 'fessed to her that he'd secretly bought up a load of RCA stock, knowing the company would be taken over by General Electric. She also claims that she was too blonde at the time to know Steven's RCA purchase was a crime.

But she did suggest that he go to his boss and tell the truth because, whatever money he would make on the deal wasn't worth the midnight tears. "Is $9 million worth it?" he said to her. Apparently, it was — because she ceased to suggest confession until she felt shafted by her divorce settlement.

Well, that's her story. Steven's? He won't talk to me about it — nor to the FBI (to whom he invoked his Fifth Amendment right against self-incrimination).

The pattern of activities in past and recent indictments, including those to which he has now confessed, and the known facts of the RCA deal, comport with Patricia's accusation. But, given Patricia's own motive for revealing her hubby's pillow talk, I wasn't ready to bite.

Nevertheless, we have to ask: if his first big score, the RCA-GE merger, was more than a brilliant "guess,” then doesn't his entire $9.4 billion pot come from a scam?

In which case, he should give it up. All of it. All $9.4 billion.

One afternoon, Cohen made a cool quarter billion dollars after telling one of his traders to contact a doctor consulting with Wyeth Pharmaceuticals whom Cohen knew had inside information on drug tests. The trader comes back with the info, Cohen made the trade — though the government can't (yet) prove that Cohen knew the info was obtained illegally. Only the trader and SAC Capital were indicted for the crime.

According to the SEC, that's just a day in the life of SAC Capital.

But, according to Cohen's puppies in the financial press, he is just a brilliant risk-taker, his firm forced to plead guilty to what one Wall Street Journal columnist described as a crime "with no victims, it actually helps people.” CNN got all teary for Cohen, claiming he was the victim of a "longstanding anomaly in American law.” Who was the real criminal? "SAC Capital punished for the government's own failure” screamed their headline. This is the same crew that told us that JP Morgan only paid a $13 billion fine last week as part of a government "anti-business witch-hunt.”

Really? When a Cohen sells soon-to-swoon Wyeth stock to some schmuck who's not clued in, the "counter-party" loses his shirt. When JP Morgan labels financial feces as "prime” mortgages and dumps it on Fannie Mae, the US taxpayer gets a hosing. When Goldman Sachs and billionaire John Paulson sell the Royal Bank of Scotland "synthetic CDOs" that are as valuable as a chocolate kettle, the Bank of England pays and the people of England lose two million jobs. When hedge fund predator Paul Singer mounts a vulture attack on the Congo and makes a killing, Oxfam says he's taking cholera medicine away from kids who are facing death.

In other words: There's no such thing as a victimless billionaire.

Nevertheless, our financial press lauds these predators. Paulson slicking RBS into buying turds painted gold was "genius.”

And just this week, a New York Times columnist lauded Paul Singer a "loving father and generous donor.” Why? Because Singer tosses an insignificant amount of his ill-making gains back to support gay rights in Africa. There's no mention that Singer has buttered "human rights” groups with cash to front his campaigns to discredit governments he has sued for billions.

Cohen is a "modern-day Medici.” Witness his extraordinary philanthropy — the new Steven & Alexandra Cohen Children's Medical Center. Hey, thanks, Mr. Generous. Little Caesar might have avoided jail time and bad press if he'd only funded a wing of a Chicago's Cermak Prison Hospital called, "The Al Capone Center for Gunshot Wounds and Unfortunate Accidents."

Keep your hospital wing, Mr. Cohen. Keep your "human rights" donation, Mr. Vulture. If you'd let the sheep you fleece keep their skin, they wouldn't need your charity.

As to your generosity, genius, and brilliant guesses — sorry, my monkey ain't jumping.

* * * * * *

Greg Palast, author of Vultures' Picnic, featuring Cohen and other billionaires, is a former expert advisor to the US Department of Justice on financial fraud and racketeering.

Greg Palast is also the author of the New York Times bestsellers, Billionaires & Ballot Bandits, The Best Democracy Money Can Buy and Armed Madhouse.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

October 24, 2013

Naughty Nuns, Bad Bankers and Ballot Bandits

By Greg Palast for Truthout

On May 6, 2008, twelve fraudulent voters, dressed as nuns, attempted to cast ballots in the Presidential Primary in Indiana.

Luckily, ten of them were caught, stopped cold by Indiana's new voter photo ID law. The law had been found to be constitutional by Federal Judge Richard Posner of the 7th Circuit Court of Appeals.

Luckily, ten of them were caught, stopped cold by Indiana's new voter photo ID law. The law had been found to be constitutional by Federal Judge Richard Posner of the 7th Circuit Court of Appeals.

It turns out the nuns that Posner's ruling turned away were, in fact …nuns. All the sisters had photo drivers licenses, but they had expired (the licenses, not the nuns). The Sisters of the Holy Cross, had, mercifully, given up driving (they were pushing 90 years of age.)

It was a cute story that ran nationwide. What wasn't so cute, and ran nowhere in the US press, was that 72,000 Black voterswere blocked at the polls by this Posner-blessed photo ID law.

It was Posner's decision that first allowed states to return to the Jim Crow vote suppression tactics that we thought had vanished with the passage of the Voting Rights Act.

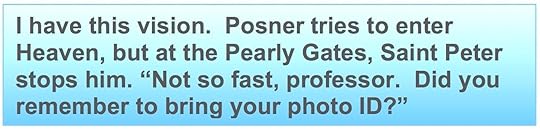

In his newly released autobiography, the aging Posner, hearing the wings of mortality and the gavel of Judgment Day coming down, admits that he was stone cold wrong. Posner now concedes that that the voter ID rule was a Republican partisan ploy in intent and viciously racist in practice. Posner, seeking forgiveness, says it wasn't his fault. He wasn't “really given strong indications that requiring additional voter identification would actually disfranchise people [who are] entitled to vote.”

Posner, seeking forgiveness, says it wasn't his fault. He wasn't “really given strong indications that requiring additional voter identification would actually disfranchise people [who are] entitled to vote.”

Sorry, Your Honor, you're still going straight to Hell. For fibbing.

In fact, Judge Posner was presented with a statistical analysis by Professor Matt Barreto of Washington University detailing, by race, the hundreds of thousands of poor voters who do not have, believe it or not, passports or other newly required ID.

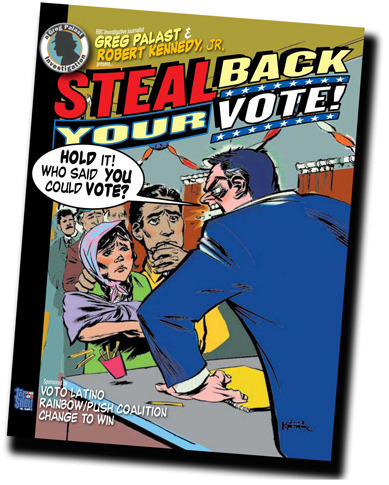

And in case the Judge couldn't understand the statistics of Barreto's analysis, he could have read the comic book version, right here. [And so can you: Download the entire comic/legal treatise for free: Steal Back Your Vote, by Greg Palast and Robert F. Kennedy Jr., with comics by Ted Rall, Lloyd Dangle and bubble text by Zach Roberts.]

And in case the Judge couldn't understand the statistics of Barreto's analysis, he could have read the comic book version, right here. [And so can you: Download the entire comic/legal treatise for free: Steal Back Your Vote, by Greg Palast and Robert F. Kennedy Jr., with comics by Ted Rall, Lloyd Dangle and bubble text by Zach Roberts.]

Judge Posner's excuse at the time he ruled: a voter ID law would prevent fraudulent voting, someone voting under someone else's name. But, Your Honor, you were told that, in a review of records going back 100 years, Indiana had not discovered one single case of voter identity theft.

Now Posner wants us to believe that he's shocked—shocked!—at the racial and partisan result of his ruling. He says, “Indiana's requirement that prospective voters prove their identity with a photo ID [is] now widely regarded as a means of voter suppression rather than fraud prevention.”

Judge Posner and the Bank Busters

Who cares about this Posner guy? You should.

Dr. Posner, who teaches at the University of Chicago Law School, is correctly described as the most influential judge of our generation. Lord help us.

I'm not saying he's acted as Satan's consigliere, but that's only because I don't believe in the Devil. Evil is human, often humans with professorships.

While famed for giving Constitutional color to Indiana's Ku Klux voter ID law, Posner's real influence was in his judicial review of the regulations on business.

In yet another recent book, the prolific Posner blames the 2008 collapse of the world financial system on the elimination of the Glass-Steagall Act, on banking deregulation and on “hostility to taxation and to government in general.”

While not a stunning observation, I was still stunned: The attacks on Glass-Steagall and calls for the deregulation of banking had their intellectual origin in The Journal of Law & Economics. This ultra-right-wing slough of corporation-kissing pornography was founded by Chicago economists Gary Becker, George Stigler and …Richard Posner.

Posner and the so-called “law and economics movement” was violently hostile to virtually all regulation, from food and drug safety to the minimum wage. Pollution laws? Eliminate them all! Looney, yes, but Posner's acolytes and movement fellow-travelers soon ruled the federal bench, appointed, like Posner himself, by Ronald Reagan.

The highfalutin sophistry of Posner, Stigler and their fellow Chicago professor Milton Friedman, sprinkled intellectual fairy dust on the markets-über-alles crowd in Washington. This high-toned bullshit transformed lobbyists' wish-lists and corporate greed grabs into quests for “freedom” and “market solutions.”

In his weak mea culpa over the bust of his bank deregulation dreams, Posner claims that the crash engendered by deregulation was “not anticipated.”

You've got to be joking, Your Honor. At the time the Glass-Steagall Act was shattered, Economist Joseph Stiglitz (not to be confused with Stigler) was crying frantically about the disaster to come. Even one of their Chicago students stood up and asked if they were insane or just crazy. (I was warned by another famed professor to shut the f- up or I'd find myself tossed out on my keister.)

Police Batons and Free Markets

Look, I don't care if Professor Posner can save his soul by recanting a lifetime of professorial gibberish and horrific rulings.

What's important to understand is the nexus: attacking voting rights, attacking worker and consumer rights, are of one piece: the right-wing free-marketeers deep-rooted distrust of democracy.

Throughout their writings (until now), the Friedman-Posner-Stigler crowd all disparaged the rights of citizens to determine the social contract, the rules of economic play. To them, voters are fools, not to be trusted with telling corporations or cops how to run our world.

This fascist bend (and I use the term advisedly) came shining through in one of Posner's infamous outbursts from the bench. Background: The Chicago police were known for beating the crap out of peace demonstrators and, demonstrating or not, minority kids. The ACLU sued when cops arrested citizens and reporters who attempted to film the police and their batons. Posner tried to stop the ACLU lawyers from even arguing their case, saying, “I'm always suspicious when the civil liberties people start telling the police how to do their business.”

Well, Judge Posner, I'm always suspicious of a robed Torquemada who believes that corporate “persons” have civil liberties but person-persons have none.

I'm sure Judge Posner would have been thrilled to see the police “do their business” on Zach Roberts, our Palast team photographer. Here's a photo Zach took at Occupy Wall Street just as a police baton was coming down on his head—and on our camera.Unfortunately, former Chicago law professor Barack Obama clearly took a little too much Posner with him to the White House, as we see in the charges against Bradley Manning and Edward Snowden and in the witch-hunt for “leakers” that makes Richard Nixon look like Thomas Jefferson.

I'm sure Judge Posner would have been thrilled to see the police “do their business” on Zach Roberts, our Palast team photographer. Here's a photo Zach took at Occupy Wall Street just as a police baton was coming down on his head—and on our camera.Unfortunately, former Chicago law professor Barack Obama clearly took a little too much Posner with him to the White House, as we see in the charges against Bradley Manning and Edward Snowden and in the witch-hunt for “leakers” that makes Richard Nixon look like Thomas Jefferson.

Judgment Day

I have this vision. Posner gets to the Pearly Gates, and despite the testimony against him by ten pissed-off nuns, he's admitted to Heaven. But before Posner can enter the Kingdom of Paradise, Saint Peter stops him and says, “Not so fast, professor. Did you remember to bring your photo ID?”

* * * * * *

Greg Palast is the co-author with Bobby Kennedy of the comic book Steal Back Your Vote and the treatise on deregulation, Democracy & Regulation, with Jerrold Oppenheim and Theo MacGregor, winner of the ACLU's Upton Sinclair Freedom of Expression Award.

Greg Palast is also the author of the New York Times bestsellers, Billionaires & Ballot Bandits, The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic, named Book of the Year 2012 on BBC Newsnight Review.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make tax-deductible contribution to keep our work alive!

October 23, 2013

Vultures and Vote Rustlers Palast Investigates – Vol. 2

Out this November!

Out this November!

Get Palast's brand new DVD of his documentary investigations for BBC and Democracy Now!

Watch 90 minutes of hard-hitting reports by Palast at his best.

Reports include:

- Election 2012 - Ohio Ballots

- Mitt Romney's Auto Bailout Bonanza

- DR Congo Vulture Threat

- Vultures Picking over Liberia's Debt

- The Generalissimo of Globalization (featuring the Larry Summers and the "End-Game" Memo)

- Goldman Sachs vs Occupy Wall Street

- BP Blow-out

Vultures and Voter Rustlers Palast Investigates – Vol. 2

Out this November!

Out this November!

Get Palast's brand new DVD of his documentary investigations for BBC and Democracy Now!

Watch 90 minutes of hard-hitting reports by Palast at his best.

Reports include:

- Election 2012 - Ohio Ballots

- Mitt Romney's Auto Bailout Bonanza

- DR Congo Vulture Threat

- Vultures Picking over Liberia's Debt

- The Generalissimo of Globalization (featuring the Larry Summers and the "End-Game" Memo)

- Goldman Sachs vs Occupy Wall Street

- BP Blow-out

October 21, 2013

Larry Summers and the Secret "End-Game" Memo

By Greg Palast for Vice Magazine - 22 August 2013

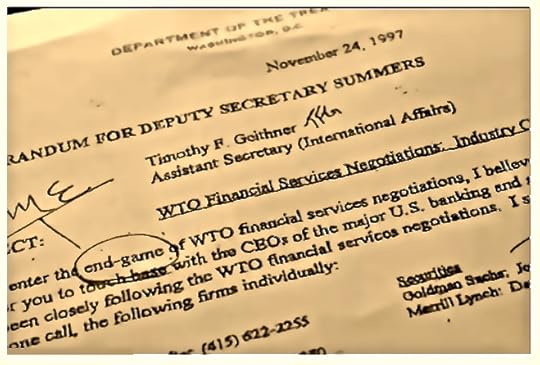

When a little birdie dropped the End Game memo through my window, its content was so explosive, so sick and plain evil, I just couldn't believe it.

The Memo confirmed every conspiracy freak's fantasy: that in the late 1990s, the top US Treasury officials secretly conspired with a small cabal of banker big-shots to rip apart financial regulation across the planet. When you see 26.3% unemployment in Spain, desperation and hunger in Greece, riots in Indonesia and Detroit in bankruptcy, go back to this End Game memo, the genesis of the blood and tears.

The Treasury official playing the bankers' secret End Game was Larry Summers. Today, Summers is Barack Obama's leading choice for Chairman of the US Federal Reserve, the world's central bank. If the confidential memo is authentic, then Summers shouldn't be serving on the Fed, he should be serving hard time in some dungeon reserved for the criminally insane of the finance world.

The memo is authentic.

To get that confirmation, I would have to fly to Geneva and wangle a meeting with the Secretary General of the World Trade Organization, Pascal Lamy. I did. Lamy, the Generalissimo of Globalization, told me,

"The WTO was not created as some dark cabal of multinationals secretly cooking plots against the people…. We don't have cigar-smoking, rich, crazy bankers negotiating."

Then I showed him the memo.

It begins with Summers’ flunky, Timothy Geithner, reminding his boss to call the then most powerful CEOs on the planet and get them to order their lobbyist armies to march:

"As we enter the end-game of the WTO financial services negotiations, I believe it would be a good idea for you to touch base with the CEOs…."

To avoid Summers having to call his office to get the phone numbers (which, under US law, would have to appear on public logs), Geithner listed their private lines. And here they are:

Goldman Sachs: John Corzine (212)902-8281

Merrill Lynch: David Kamanski (212)449-6868

Bank of America, David Coulter (415)622-2255

Citibank: John Reed (212)559-2732

Chase Manhattan: Walter Shipley (212)270-1380

Lamy was right: They don't smoke cigars. Go ahead and dial them. I did, and sure enough, got a cheery personal hello from Reed–cheery until I revealed I wasn't Larry Summers. (Note: The other numbers were swiftly disconnected. And Corzine can't be reached while he faces criminal charges.)

It's not the little cabal of confabs held by Summers and the banksters that's so troubling. The horror is in the purpose of the "end game" itself.

Let me explain: The year was 1997. US Treasury Secretary Robert Rubin was pushing hard to de-regulate banks. That required, first, repeal of the Glass-Steagall Act to dismantle the barrier between commercial banks and investment banks. It was like replacing bank vaults with roulette wheels.

The year was 1997. US Treasury Secretary Robert Rubin was pushing hard to de-regulate banks. That required, first, repeal of the Glass-Steagall Act to dismantle the barrier between commercial banks and investment banks. It was like replacing bank vaults with roulette wheels.

Second, the banks wanted the right to play a new high-risk game: "derivatives trading." JP Morgan alone would soon carry $88 trillion of these pseudo-securities on its books as "assets."

Deputy Treasury Secretary Summers (soon to replace Rubin as Secretary) body-blocked any attempt to control derivatives.

But what was the use of turning US banks into derivatives casinos if money would flee to nations with safer banking laws?

The answer conceived by the Big Bank Five: eliminate controls on banks in every nation on the planet – in one single move. It was as brilliant as it was insanely dangerous.

How could they pull off this mad caper? The bankers' and Summers' game was to use the Financial Services Agreement, an abstruse and benign addendum to the international trade agreements policed by the World Trade Organization.

Until the bankers began their play, the WTO agreements dealt simply with trade in goods–that is, my cars for your bananas. The new rules ginned-up by Summers and the banks would force all nations to accept trade in "bads" – toxic assets like financial derivatives.

Until the bankers' re-draft of the FSA, each nation controlled and chartered the banks within their own borders. The new rules of the game would force every nation to open their markets to Citibank, JP Morgan and their derivatives "products."

And all 156 nations in the WTO would have to smash down their own Glass-Steagall divisions between commercial savings banks and the investment banks that gamble with derivatives.

The job of turning the FSA into the bankers' battering ram was given to Geithner, who was named Ambassador to the World Trade Organization.

Bankers Go Bananas

Why in the world would any nation agree to let its banking system be boarded and seized by financial pirates like JP Morgan?

Why in the world would any nation agree to let its banking system be boarded and seized by financial pirates like JP Morgan?

The answer, in the case of Ecuador, was bananas. Ecuador was truly a banana republic. The yellow fruit was that nation's life-and-death source of hard currency. If it refused to sign the new FSA, Ecuador could feed its bananas to the monkeys and go back into bankruptcy. Ecuador signed.

And so on–with every single nation bullied into signing.

Every nation but one, I should say. Brazil's new President, Inacio Lula da Silva, refused. In retaliation, Brazil was threatened with a virtual embargo of its products by the European Union's Trade Commissioner, one Peter Mandelson, according to another confidential memo I got my hands on. But Lula's refusenik stance paid off for Brazil which, alone among Western nations, survived and thrived during the 2007-9 bank crisis.

China signed–but got its pound of flesh in return. It opened its banking sector a crack in return for access and control of the US auto parts and other markets. (Swiftly, two million US jobs shifted to China.)

The new FSA pulled the lid off the Pandora's box of worldwide derivatives trade. Among the notorious transactions legalized: Goldman Sachs (where Treasury Secretary Rubin had been Co-Chairman) worked a secret euro-derivatives swap with Greece which, ultimately, destroyed that nation. Ecuador, its own banking sector de-regulated and demolished, exploded into riots. Argentina had to sell off its oil companies (to the Spanish) and water systems (to Enron) while its teachers hunted for food in garbage cans. Then, Bankers Gone Wild in the Eurozone dove head-first into derivatives pools without knowing how to swim–and the continent is now being sold off in tiny, cheap pieces to Germany.

Of course, it was not just threats that sold the FSA, but temptation as well. After all, every evil starts with one bite of an apple offered by a snake. The apple: The gleaming piles of lucre hidden in the FSA for local elites. The snake was named Larry.

Does all this evil and pain flow from a single memo? Of course not: the evil was The Game itself, as played by the banker clique. The memo only revealed their game-plan for checkmate.

And the memo reveals a lot about Summers and Obama.

While billions of sorry souls are still hurting from worldwide banker-made disaster, Rubin and Summers didn't do too badly. Rubin's deregulation of banks had permitted the creation of a financial monstrosity called "Citigroup." Within weeks of leaving office, Rubin was named director, then Chairman of Citigroup—which went bankrupt while managing to pay Rubin a total of $126 million.

Then Rubin took on another post: as key campaign benefactor to a young State Senator, Barack Obama. Only days after his election as President, Obama, at Rubin's insistence, gave Summers the odd post of US "Economics Tsar" and made Geithner his Tsarina (that is, Secretary of Treasury). In 2010, Summers gave up his royalist robes to return to "consulting" for Citibank and other creatures of bank deregulation whose payments have raised Summers' net worth by $31 million since the "end-game" memo.

That Obama would, at Robert Rubin's demand, now choose Summers to run the Federal Reserve Board means that, unfortunately, we are far from the end of the game.

* * * * * * * *

Special thanks to expert Lori Wallach of Public Citizen without whom our investigation could not have begun.

The film of my meeting with WTO chief Lamy was originally created for Ring of Fire, hosted by Mike Papantonio and Robert F. Kennedy Jr.

Further discussion of the documents I laid before Lamy can be found in "The Generalissimo of Globalization," Chapter 12 of Vultures' Picnic by Greg Palast.

Greg Palast is also the author of the New York Times bestsellers, Billionaires & Ballot Bandits, The Best Democracy Money Can Buy and Armed Madhouse.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make a tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

October 7, 2013

The Golden Dawn Murder Case Larry Summers and the New Fascism

By Greg Palast for Truthout

On September 18, hip-hop artist Pavlos Fyssas, a.k.a. Killah P, was stabbed outside a bar in Keratsini, Greece.

Larry Summers has an air-tight alibi. But I don't believe it.

Larry didn’t hold the knife: The confessed killer is some twisted member of Golden Dawn, a political party made up of skin-head freaks, anti-immigrant fear-mongers, anti-Muslim/ anti-Semitic/ anti-Albanian sociopaths and ultra-patriot fruitcakes. Think of it as the Tea Party goes Greek.

Larry didn’t hold the knife: The confessed killer is some twisted member of Golden Dawn, a political party made up of skin-head freaks, anti-immigrant fear-mongers, anti-Muslim/ anti-Semitic/ anti-Albanian sociopaths and ultra-patriot fruitcakes. Think of it as the Tea Party goes Greek.

Following Fyssas’ killing, other groups of dangerous psychopathic misfits, namely the European Union and Greece’s governing coalition, moved to ban Golden Dawn.

Over the weekend, Greece’s rulers arrested six members of Parliament who belong to Golden Dawn. Apparently, Greece’s political leaders prefer democracy as defined by Egypt’s General Sisi to the precepts of Aristotle and Thomas Jefferson.

To my friends on the Greek Left: It’s sickening to watch you cheer the arrest of Golden Dawn parliamentarians.

Mark my words: You are next.

Listen up:

My investigation reveals that behind the banning of Golden Dawn, besides the usual European distaste for democracy, is something far more sinister: the ruling parties are distracting the public from their own involvement in the crime.

The rise in violence and hate-crimes is no surprise. The official unemployment rate in Greece is 28%, and over 60% among young men. No wonder desperate youths are wrapping batons in Greek flags and beating immigrants: When people are pressed to the wall, they hunt for their tormentors –– and too often find their fellow victims to blame.

Economic devastation breeds fascism. In the 1930s, the hungry and angry sought relief in hyper-patriotism, racism and pogroms. In the 1980s Reagan Recession in the USA, when factories shut down in the Midwest, the hopeless unemployed joined right-wing skinhead cults and went on a killing rampage –– beginning with the murder of Jewish journalist Alan Berg and ending with the bombing of a government building in Oklahoma, killing 168 people.

Vultures Over Athens

Golden Dawn is a symptom of the nation's illness, not its cause. Unfortunately, the Brown-shirts go after easy targets –– Pakistanis, Gypsies, Africans, whoever is different and easy to whack. It's a lot easier to stab a hip-hop rapper than it is to go after a hedge-fund shark.

The real culprits behind the suffering are well camouflaged. So let me name some: In Greece, we begin with billionaires Kenneth Dart and Paul “The Vulture” Singer.

The real culprits behind the suffering are well camouflaged. So let me name some: In Greece, we begin with billionaires Kenneth Dart and Paul “The Vulture” Singer.

Dart and Singer bought up Greek government bonds for pennies on the dollar. While the holders of 97% of Greek bonds agreed to accept a loss of 75% of their value, Dart and Singer demanded several hundred percent more than they paid. Then Dart and Singer threatened the dead-broke Greek government. If Greece did not pay this ransom, Dart and Singer would declare Greek bonds in default. Every bank in Europe holding these government debts as reserve funds would face technical bankruptcy; the value of government bonds worldwide would implode in value and the entire hemisphere would face a new financial collapse.

It was financial terrorism, and the Greek government gave in. It paid the full ransom demanded. Dart grabbed over half a billion dollars ($513 million) from the Greek treasury –– and only the gods know how much Singer has pocketed. [Get the full story on Singer the Vulture, read Billionaires & Ballot Bandits and Vultures' Picnic.]

How was this vulture food paid for? With “austerity” — tightening a belt that’s already not much bigger than its buckle. To pay Singer and Dart, the Greek government announced it would fire 15,000 workers.

What’s sick is that the ruling coalition (or misruling coalition) does not say this is to cover the payoffs to the vultures. Rather, the government says it is the just punishment Greeks deserve for their "laziness and greed." The victims’ punishment is called, “austerity.”

The Austerity Fairy Tale

My children often ask me, “Daddy, where does ‘austerity’ come from?” And I tell them:

Once upon a time, there was a good fairy named John Maynard Keynes. He wanted to stop depressions, financial crises and suffering, so he conceived of the International Monetary Fund and the World Bank. He said, When a nation’s foreign exchange earnings drop (say, if the price of oil rises or Greek tourism falls because its currency is over-valued), the countries taking the poor nations’ money, rich countries like Germany and the USA, would lend it back via the IMF.

By this rule, the rich lending to the poor, the world prospered and lived happily ever after … until the 1980s, when a wicked witch, known as the Iron Lady, and America’s gaga grandpa, Reagan of the Rich, insisted that the IMF and the World Bank beat poor nations with a stick called, “structural adjustment.”

Nations facing destitution because of higher oil costs, currency imbalance or predatory interest rate demands were “structurally adjusted.” Structural adjustment is a cruel and debilitating potion of mass firings of public employees, cheap sell-offs of national assets and deregulation of corporate profiteering. This ripping the wings off the better angels of government is called, “austerity.”

The good fairy Keynes had warned about this evil potion, this snake oil called “austerity.” Cutting government spending during a recession, he said, will only make things worse.

And that’s what happened: In every single case, the “adjusted” nations’ economies were devastated.

Structural adjustment reached its cruel apotheosis in the early 1990s under the guidance of the World Bank’s Chief Economist, one Larry Summers.

But then, in 1997, Summers’ post was taken by Prof. Joseph Stiglitz.

In 2001, I met Stiglitz whom I’d heard was quietly expressing grave doubts about austerity and structural adjustment à la Summers. He agreed to go public. Over several hours of discussion, which I recorded for BBC TV, Stiglitz charged that IMF-imposed austerity was “ a little like the Middle Ages, when the patient died they would say well, we stopped the bloodletting too soon, he still had a little blood in him.”

Stiglitz detailed for me the ill effects of the “structural adjustment” demands, including “free” trade, which he likened to the Opium Wars; bank deregulation, which he found ludicrously dangerous; privatization, which Stiglitz called “briberization”; and budget-cutting austerity.

The budget cuts and free-market nostrums, Stiglitz told me, were as cruel as they were stupid. And he said of those who profited off these IMF diktats, “They don’t care if people live or die.”

Stiglitz went on to win the Nobel Prize in economics for his skepticism of Markets über Alles.

So how, a decade after austerity, briberization and all their cruelties exposed and discredited, did Greece (and Spain and Portugal and too many others) end up under austerity’s bloody grip?

To begin with, in 2000, Larry Summers, as US Treasury Secretary, successfully demanded the World Bank fire Stiglitz and purged the Bank and IMF of austerity apostasy.

Why? Austerity may fail the public, but it’s damn profitable for those on the inside.

All you need is a riot and a few dead bodies.

The IMF Riots

Among Stiglitz’ stunning revelations to me was his description of “the IMF riot.” I showed him confidential World Bank and IMF plans for the nation of Ecuador. These included what seemed to be a warning to that nation’s finance minister that austerity could lead to violence in the streets, “social unrest” — which the World Bank recommended be crushed with “resolve”. In Ecuador, “resolve” meant tanks.

Did the IMF really write the riots into the plans?

Yes, Stiglitz said, matter-of-factly. “We had a name for it ‘The IMF Riot’”.

When a nation is “down and out, [the IMF] takes advantage and squeezes the last pound of blood out of them. They turn up the heat until, finally, the whole caldron blows up”.

And that’s what we’re seeing in Greece. It began in May 2010, when some sick, misguided berserker set fire to a bank in Athens and killed four bank employees. The killings did the trick: the Left’s protests against insane austerity and banker gangsterism came to a halt.

Still, people could see that the austerity medicine was making Greece ill. So, they put their hopes in a new party, Syriza, which, from nowhere, became the second highest vote-getter in Greece by promising to oppose austerity. Once in parliament, the faux-Left Syriza completely sold out its positions.

That leaves Golden Dawn, although diseased by racism and violently bent, it is the only one of Greece’s top four parties to stand firm against rabid austerity and the economy being chained like a beaten dog to Germany’s currency.

In 2010, the bank burning was used to discredit protests by the Left. Today, once again, the Greek government, dancing on its hind legs, begging for a biscuit from German bankers, has used a murder as an excuse to outlaw the only major party dissenting from the austerity suicide pact.

I wish I could say that the reason Golden Dawn is being banned is because of the violent bend of its racist followers. But that’s just not what’s going on here.

Dimitris Kazakis, the leader of Greece’s true progressive party, the United People’s Front (EPAM), has spoken out against Golden Dawn’s racist violence — and the greater danger of the bogus charges created to arrest members of Parliament. He scolds Greeks, reminding them that this is how the military dictatorship seized power in 1967.

So, who are the real Fascists?

Fascism, as defined since the days of Il Duce, is the official combine of government and big business. By that definition, Golden Dawn is the only non-Fascist party among Greece’s top four. And that is why Golden Dawn has been targeted for elimination.

I hope my fellow progressives will excuse me for not applauding.

* * * * * *

Greg Palast is the author of the New York Times bestsellers, Billionaires & Ballot Bandits, The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic, named Book of the Year 2012 on BBC Newsnight Review.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

September 30, 2013

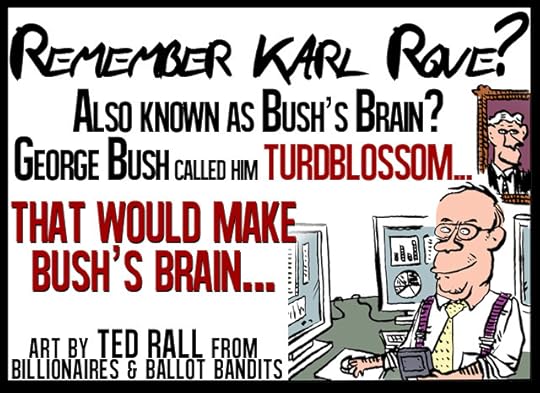

Karl Rove’s Carolina Scheme Faces Justice

By Greg Palast.

By Greg Palast.

Updated from the original article published on TheMudflats.net

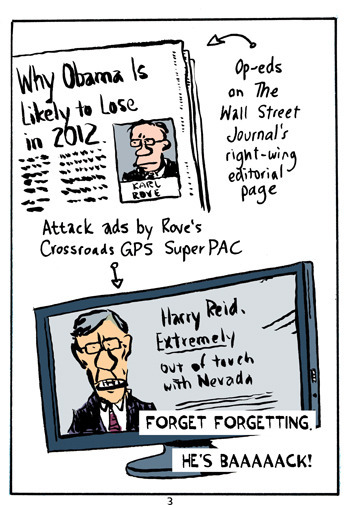

Note from TheMudflats.net: In 2011 Karl Rove wrote a column called “Why Obama Is Likely to Lose in 2012” - Rove was betting on North Carolina to be a swing state for the Republicans... Romney took the state but to Rove's surprise he failed at stealing Ohio for the third time. Just Google "Karl Rove Meltdown," and you'll see a video from Fox News election night, he did not take it well.

After the knock-down of the Voting Rights Act by the US Supreme Court earlier this year North Carolina jumped at the chance to change their voting laws – claiming, as these states always do – that the changes would actually protect the vote. Never mind that over 300,000 people were instantly disenfranchised due to the lack of the an 'acceptable' ID. BBC Investigative Journalist (and Mudflats Contributor) Greg Palast has long gone after this premise - calling voter fraud itself a fraud. In an interview with Buzzflash he said:

"However, the Republican cry of 'Vote Fraud!' has become the cover for purges and challenges to legal voters by the millions. I even tracked down and filmed some of these so-called fraudulent voters handed me from a GOP list. Every one was a legal voter."

Watch Palast try to track down these supposed illegal voters in his 2008 BBC election report.

With the Voting Rights Act no longer protecting voters in key states as it has for decades the DOJ is acting on the voter suppression laws that North Carolina has imposed on their voters.

Whatever Democrat hopes to run for President in 2016 better hope that the Justice Department prevails in the Tar Heel state as this excerpt from Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps shows it's importance will only be growing.

[Greg Palast is currently editing a film detailing the effect of these laws and big money in American elections - you can watch the trailer below - and donate to support the project – TheMudflats will be getting exclusive excerpts as the project continues]

Excerpts from Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps

“Why Obama Is Likely to Lose in 2012” is the title of a column Karl Rove wrote in the Wall Street Journal in June 2011.

It’s not Rove’s prediction: this is his plan to make sure Obama will lose. That’s fine with me—if Rove prefers vanilla to chocolate, hey, it’s a free country. But how Rove plans to take Obama down is contained in the subhead, and it gives me the chills:

“even a small drop in the share of black voters would wipe out [Obama’s] winning margin in North Carolina.”

Here, Rove is not talking about winning by convincing black voters to vote Republican. The key to victory is preventing the black vote. Period. Rove suggests, with a wink and nudge, the Game Plan:

“If their [black voters’] share of the turnout drops just one point in North Carolina, Mr. Obama’s 2008 winning margin there is wiped out two and a half times over.”

The smell of freshly laundered white sheets, brown shirts, and sulfur is unmistakable: The key to Republican victory, in the Carolinas and nationwide, then, is making sure black people don’t turn out. Or, if they do, that they’re turned away. Or, if they can’t be turned away, that their votes are not counted.

If Rove can stand in the polling station doorway and block three million voters from entering and bulldoze another three million ballots into a landfill he can make the Ice Man’s dreams come true.

I can report that Rove is well on his way to success, and he’s only just begun. How Rove and his compadres set out to do that—eliminate six million votes and voters—and how he and his partners have done it in the past to black voters, Hispanic voters, students, Jews, and any kind of Blue-ish voter— that’s the story you’ll get here. And not just Rove’s sleight of hand, but deliberate ballot-burgling done by others in the GOP and—cover the children’s ears!—Democrats too.

How Rove and his compadres set out to do that—eliminate six million votes and voters—and how he and his partners have done it in the past to black voters, Hispanic voters, students, Jews, and any kind of Blue-ish voter— that’s the story you’ll get here. And not just Rove’s sleight of hand, but deliberate ballot-burgling done by others in the GOP and—cover the children’s ears!—Democrats too.

When voting-rights attorney Robert F. Kennedy Jr. joined our investigations team in 2008, he examined the latest documents we’d squirreled out of Republican Party head- quarters’ files. And then he said, speaking of Karl Rove and his associate Tim Griffin, “What they did was absolutely illegal—and they knew it and they did it anyway. Griffin should be in jail.”

But Griffin’s not in jail, he’s in Congress. Rove is not in prison, either. According to IRS records, he’s director of a nonprofit “social welfare” organization. American Crossroads GPS, tax-exempt under section 501(c)(4) of the tax code, aims to improve society’s welfare by dragging Democrats out of their seats in Congress and removing The Black One from the White House.

Let me be clear: whether Obama is reelected, that’s none of my business. As a journalist, I stay clear of cuddling up to candidates of either party. Who gets elected, well, that’s your problem, gringo.

I’m a reporter, and it’s not my job to preserve Democrats. But preserving democracy, with that fragile little d, that means something to me.

* * * * * * * * * * * *

It was investigative reporter Greg Palast, for The Guardian and BBC Television who uncovered Katherine Harris purge of Black voters in 2000.

He is the author of the New York Times bestsellers, Billionaires & Ballot Bandits, The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic, named Book of the Year 2012 on BBC Newsnight Review.

Visit the Palast Investigative Fund's store or simply make tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

Greg Palast's Blog

- Greg Palast's profile

- 138 followers