Greg Palast's Blog, page 91

October 25, 2014

Greg Palast on Firedoglake Book Salon on Robert Mutch's Buying the Vote

A book review by Greg Palast for Firedoglake Book Salon

Buying The Vote: A History of Campaign Finance Reform

Buying The Vote: A History of Campaign Finance Reform

Using money to influence—ie. purchase—elections began when Thug gave Ugg a big, sharp rock in return for his vote for cave leader. It’s an ugly scene—and it has never stopped.

But with the advent of formalized democracy, purchasing a vote has gone through a psychological shift. With money, you can buy a voter’s neurons, board the brain like a pirate, and steal the booty—some poor schmuck’s “choice” made in a voting booth.

If political ads, balloons dropped at conventions, phone banks and all that detritus that makes for a US electoral campaign really can change a vote – and we know they can—then the candidate with the biggest pile of this partisan dreck, this mind-wrecking machine, has the best chance of winning. And as all this stuff costs money, the guy with the biggest pile is likely to have the I-just-won smile.

So this is what Tom Paine’s and Tom Jefferson’s democracy has come down to: sucking up bucks like a reverse ATM gone wild and spitting out attack ads linking Obama to Osama. Oh, mama!

It makes you want to puke. Better yet, it should make you pick up Robert Mutch’s Buying the Vote, terrific history of America, the one party state, that is Hezb’shekel—Party of the Cash.

The subtitle of the book is, “The History of Campaign Finance Reform”—which is a bit misleading, because it’s really a history of the failures of campaign finance reform. He makes some really useful points, each of which you should memorize and regurgitate when you hear cracked-brained ideas for campaign financing like, promoting small donations.

Remember the “money bombs” for Ron Paul? Paul’s start began with cash from the Brothers Koch and he’s never forgotten who holds the mortgage. Remember the gazillions of on-line donations in 2008 to The One We’ve Been Waiting For? Obama’s big cash came from Penny Pritzker, the rogue banker, banned for life from the finance industry by the federal government – and now our Secretary of Commerce. Who picked the Secretary of the Treasury? Why, Robert Rubin of Citibank who chose his protégé Tim Geithner. No $20 donors were in the smoked-filled room that turned the Obama Administration into a Club Med for bankers.

There’s some myth-busting along the way: Apparently Teddy Roosevelt wasn’t a campaign finance reformer — and he never claimed to be. Interestingly, the first campaign finance laws, enacted a century ago, didn’t require an enforcement agency because the 1% complied—and they tended to own all the candidates anyway. (You don’t have to bet on a horse if you own the race track.)

Today, the Right Wing, even the poor ones in the funny Tea Party outfits, oppose campaign finance reform. It’s become ideological with them. The free market says you can buy anything; why not the airwaves and thereby buy the House, the Senate and 1600 Pennsylvania Ave?

And that’s the gravamen of Mutch’s history of campaign cash: The main obstacle to reform isn’t the Supreme Court but the conservative politics that made that Court possible. Opposition to reform isn’t based on constitutional law but on a conservative theory of democracy that opposes efforts to reduce political inequalities based on wealth. The pigs who prosper from conservatives’ political argument use a twisted reading of the Constitution to put the lipstick judicial doctrine on the little porker.

And what the hell. I was a student of George Stigler back in my University Chicago days. Professor Stigler (NOT Stiglitz) who was famous for his papers, says that there should be open markets for ballots, open stock-table-like quotes to purchase Congressional votes. He believed that the public would best be served by an open and efficient market for bribery. And he won the Nobel Prize. (I never asked him if he bought it.)

Mutch has his competitors in the world of bitching about money in politics: Robert Post, Zephyr Teachout, Timothy Kuhner, and Ken Vogel.

Post and Teachout see the problem as legal (they are, after all, law professors), while Mutch sees the block to reform as political. Post wants the Court to change its definition of the First Amendment and Teachout wants to change its definition of corruption. Mutch’s position is that the Court’s definitions of those things are based on a conservative political argument. After all, The Nine on the court are all politicians; the law is simply a costume they put on with their robes.

Mutch does not believe you can get money out of politics with some new rule. That always fails. Better campaign finance laws would make for better politics, but we won’t get such laws until we have better politics. Public funding would be the ideal system, he avers, but it would take a tectonic shift in our politics to get Congress to pass such a law and to get political and economic elites to comply with it.

So are we screwed? Is there no hope. There’s always hope. Indeed, I’ve never seen a presidential campaign that doesn’t have “Hope” somewhere in the slogan—crafted by a team of PR mavens paid for by the billionaires who choose the puppets we get to choose.

* * * * * *

Greg Palast is the author of the New York Times bestsellers Billionaires & Ballot Bandits, The Best Democracy Money Can Buy, Armed Madhouse and Vultures’ Picnic , a BBC Television Book of the Year.

Greg Palast recently released his film Vultures and Vote Rustlers.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

September 23, 2014

Investigó a Paul Singer y cuenta quiénes pudieron ganarle

by Francisco de Zárate for Clarin.com

by Francisco de Zárate for Clarin.com

Investigó a Paul Singer y cuenta quiénes pudieron ganarle

Entrevista con Greg Palast, periodista de la BBC y The Guardian También relata cómo el poderoso titular del fondo buitre NML venció a Perú y al Tesoro de Estados Unidos.

Durante su vida anterior, cuando era detective privado, el estadounidense Greg Palast (62) trabajó para sindicatos, para el Gobierno de Estados Unidos y hasta para los indios nativos de Alaska, a los que ayudó a descubrir un fraude de British Petroleum por el desastre ecológico del petrolero Exxon Valdez en 1989. Hasta que se cansó que ver cómo los reporteros hablaban de su trabajo y se pasó al otro lado: “Me convertí en periodista de investigación de la BBC y The Guardian (Leer la traducción del artículo). No les importaba que supiera o no escribir. Lo que les interesaba era la información”.

Desde Nueva York, Palast habló por teléfono con Clarín sobre Paul Singer. El hombre que maneja el fondo NML y principal demandante de Argentina en el conflicto por la deuda en default, es uno de los personajes de Picnic de buitres, el bestseller con que Palast retrató el trabajo de estos fondos especializados en comprar deuda defaulteada para reclamarla en la Justicia (también hay un documental).

- ¿Alguien le ganó a Singer?

- Sí. La República del Congo. Pude demostrar que los buitres, entre los que estaba Singer, habían sobornado a autoridades de Bosnia para hacerse con una deuda que el Congo había contraído con ese país, y que estaba en proceso de ser condonada. El tribunal ante el que los buitres demandaban al Congo estaba en la isla de Jersey, que depende del Reino Unido. Cuando conté la historia en la BBC, la indignación fue tan grande que el parlamento británico prohibió que los buitres cobraran, aunque un juez fallara en su favor. Eso es algo que podría pasar también en el caso argentino. Obama dice que apoya a Argentina, pero la Constitución le otorga la autoridad para impedir que Singer cobre y no la está ejerciendo.

- ¿Por qué?

- Tiene miedo. Todo el mundo teme a Singer. Es uno de los multimillonarios más poderosos del país. Si los políticos no hacen lo que quiere, él y un grupo de multimillonarios como él usan un fondo gigantesco llamado “Recuperar nuestro futuro”, en el que inyectan plata para atacarlos con feroces campañas por televisión. Obama lo sabe. Si se cruza con Singer, también será víctima de esos ataques.

- ¿Quién perdió contra él?

- El Tesoro de EE.UU. En 2009, cuando General Motors y Chrysler entraron en bancarrota, Obama las rescató con dinero público, y Singer armó una maniobra para quedarse con la empresa de autopartes Delphi, proveedora de gran parte de muchos de sus insumos. Bajo la amenaza de interrumpir los suministros, Singer forzó al Tesoro para que les pagasen 12.900 millones de dólares. Mitt Romney, el candidato republicano, también ganó con la operación. Singer suele invitar a los políticos para que inviertan discretamente con él. Yo encontré los papeles que demostraban la participación de Romney. Dijeron que no era ilegal.

-¿Y Perú?

- Una de las primeras operaciones de Singer fue con unos títulos de deuda de Perú. Un tribunal desestimó su primera demanda porque consideró que los había comprado sólo para demandar a su emisor, algo que está prohibido en EE.UU. Pero una corte de apelaciones le dio la razón y Singer embargó el avión presidencial. (Alberto) Fujimori tenía que escapar del país para que no lo juzgaran por asesinato. Singer le dijo: ‘Si me das todo lo que quiero –58 millones de dólares–, acá están las llaves’. Fujimori firmó y se fue a Japón.

September 14, 2014

Scotland Should Declare Its Independence From Alex Salmond

By Greg Palast for Reader Supported News

I mean, what's the bloody point? Why pretend to declare your independence only to chain yourself to a coin with a British snout on it and simultaneously beg to become a colony of Angela Merkel's Fifth Reich, aka the European Union?

I mean, what's the bloody point? Why pretend to declare your independence only to chain yourself to a coin with a British snout on it and simultaneously beg to become a colony of Angela Merkel's Fifth Reich, aka the European Union?

I realize that, as an American and an economist, I carry into this debate a double dollop of disrespect from Scottish readers. But, with thousands of miles of salt water separating me equally from London and Edinburgh, I think I can see clearly what you miss from having your head inside the fish bowl.

There are two overwhelming and undeniable advantages for Scotland to declare its sovereign independence: to end both Scotland's damaging enchainment to the British pound and the debilitating tyranny of European Union membership.

Yet, weirdly, inexplicably and inexcusably, Alex Salmond promises to throw away the two most valuable benefits of national self-determination.

First, the pound. In all the hoo-hah over whether Scotland can keep the coin with the Queen's schnozzola on it, no one seems to have asked, Why in the world would Scotland want this foreign coinage?

The Bank of England's singular task at this moment is to figure out how to counteract the disastrous macroeconomic consequences of George Osborne's austerity fixations and the bleating demands of City bankers. The only time when the Bank of England gives any consideration to Scotland's economy is when a BOE governor checks the little gauge which tells them how much of Scotland's oil they have left to spend.

Why should the interest rates, exchange rates and monetary supply of a resource nation like Scotland be subject to the needs and whimsies of the rusting realm to your south? According to the well-accepted theory of Optimum Currency Areas, Scotland would be best off adopting the Canadian dollar, also a damp, salmon-choked oil exporter or, better yet, the Vietnamese dong.

No nation controls its economic destiny until it controls its currency--a concept easier to understand if you read it in Greek.

And Scotland's own coin, backed by taxing power over its oil extractors, would undoubtedly be stronger than sterling and more flexible alone. Control over its own currency will enable Scotland to cut interest rates when local manufacturing falters while the Bank of England is raising rates to fight a speculative bubble in The City.

To give you a head start, my daughter has designed your new currency (above).

Second, why this pathological need to remain subjugated by the European Union? Is there some extraordinarily wise legislation crafted by the solons of the European Parliament? Does Scotland need the guiding hand of Angela Merkel, Marie LePen and the Italian premier du jour? Does Scotland fear a sudden shortage of Bulgarian plumbers?

The USA trades with Europe without giving Lithuania veto power over trade terms. And as Swiss nationals will tell you, a lack of an EU passport will not cause you to be strip-searched on your way to the Costa del Sol. Disadvantages of EU membership: loss of control over terms of trade, and policies of industrial regulation, immigration and environmental control. And sorry, Mr. Salmond, you will indeed have to join the euro, at which point, Germany's finance minister will draft your budgets.

So that is my question to my friends north of Hadrian's wall. Why demand your independence from Britain only to insist on keeping your shackles? If you too find attachment to your chains nonsensical, then shouldn't your first referendum be a vote to declare Scottish independence from Alex Salmond?

* * * * * *

Greg Palast is the author of the New York Times bestsellers Billionaires & Ballot Bandits, The Best Democracy Money Can Buy, Armed Madhouse and Vultures’ Picnic , a BBC Television Book of the Year.

Get a signed copy of Palast's latest film Vultures and Vote Rustlers.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make a tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

September 11, 2014

BP and the Three Stooges Defense

By Greg Palast for Truthdig Forget Stephen King. If you want scary, read U.S. District Judge Carl Barbier's 150-page Findings of Fact released Thursday in the Deepwater Horizon case.

Forget Stephen King. If you want scary, read U.S. District Judge Carl Barbier's 150-page Findings of Fact released Thursday in the Deepwater Horizon case.

Although the judge found BP liable for “gross negligence,” some U.S. media failed to mention that Barbier let BP off the hook on punitive damages. And that stuns me, given that the record seems to identify enough smoking guns to roast a sizable pig.

Here's a standout example:

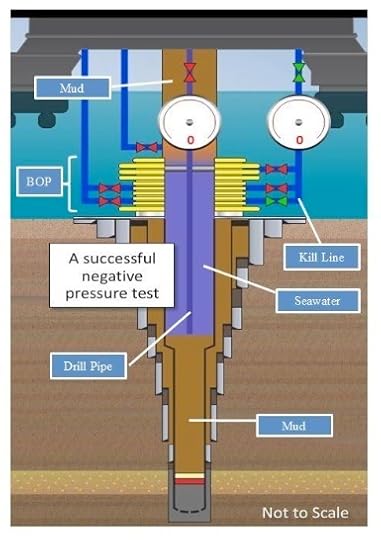

Every rig operator knows that, before a rig can unhook from a drill pipe, the operator has to run a “negative pressure test” to make sure the cement has properly sealed the drill pipe. If the pipe is safely plugged, the pressure gauge will read zero. The amount of pressure BP measured at 5 p.m. on April 20, 2010, the day of the explosion? 1400 psi (see the findings, pages 62-65).

1400 psi is not zero. Stick a balloon in your mouth with zero pressure and nothing happens except that you look silly. Replace the balloon with a hose delivering a 1400 psi blast and it'll blow your skull apart.

So, how could the company record zero? Answer: BP's crew re-ran the test measuring the pressure in something called the “kill line,” which is definitely not the drill pipe.

So, how could the company record zero? Answer: BP's crew re-ran the test measuring the pressure in something called the “kill line,” which is definitely not the drill pipe.

By reporting that the pipe had no pressure and all was safe, BP could begin to unhook the Deepwater Horizon from the pipe—and sail away. Why would BP do that? In my view, there were three motives: money, money and money. It costs BP a good half million dollars each extra day the rig stays on top of the drill hole. It seems that BP wanted the rig gone and quickly.

So, instead of halting the disconnection process, BP appears to have lied and recorded the pressure reading as “zero.” The rig's owner, Transocean of Switzerland, went along with BP's actions.

So how did BP get away with mere “gross negligence” as opposed to the more serious claim of fraud? Because the court found that the blowout, explosion, fire and oil spill were caused by “misinterpretation of the negative pressure test.”

Misinterpretation? If a woman says “thanks” when you say she's dressed nicely and you think she wants a kiss, that's “misinterpretation.” But on the Deepwater Horizon, the drill pipe gauge read 1400 psi and BP picked a different pipe that gave the company the magic zero. That's not, I contend, “misinterpretation.”

Maybe the judge thought he was pretty tough by calling out BP for “gross” negligence (rather than plain-vanilla negligence, the finding against Transocean and contractor Halliburton). But, in fact, it seems Barbier fell for the Three Stooges defense.

Get the “eye-opening, heart-pumping, mind-blowing experience that should not, MUST not, be missed” (Nomi Prins): Palast's hunt of BP and the petroleum pirates, Vultures' Picnic, BBC-TV “Book of the Year,” signed by Palast, for a tax-deductible donation to fund our work. Includes the videos that go with the book.

Throughout the 150-page decision, the judge cites one instance after another of bone-headed, buffoonish, slapstick decisions, and plenty of pratfalls and banana-peel slips by BP, Transocean and Halliburton. You have to wonder how these schmucks even found their drill hole. It was a corporate Larry-Moe-and-Curly-Joe routine that would provide a lot of belly laughs if 11 men hadn't died as a result.

I've seen the Three Stooges defense before in federal court. In 1988, the corporate owner and the builder of the Shoreham nuclear plant were on trial on accusations they bilked their New York customers out of $1.8 billion. In court, they pleaded stupidity and incompetence as a defense against deliberate deception. As the government's investigator, I didn't buy it—billion-dollar corporations can't be that stupid—and neither did the jury. (The racketeering charges were settled after trial for $400 million.)

And here is a new set of Stooges: BP plays Larry, Transocean puts on Moe's wig and Halliburton makes “Nyuk! Nyuk! Nyuk!” sounds like Curly Joe. Halliburton, the judge found, failed to test the final cement mix and BP bitched about it—“[Halliburton engineer Jesse Gagliano] isn't cutting it any more,” reads an email between two BP managers on the rig—but BP went ahead and used the bad cement anyway (Findings, paragraphs 227-228)

When the pressure in the drill pipe read 1400 psi, BP and Transocean managers should have stopped the rig departure immediately. They didn't. Nevertheless, other systems should have prevented a blowout. According to Barbier, other safety systems were jacked with to save a penny here, a penny there (or, a million here, a million there). Example: BP used leftover cement (Findings, paragraphs 209-211) that contained chemicals that destroyed the integrity of the new cement, because using the old stuff saved some serious cash.

And this leads to the question of punitive damages.

Barbier had the power to levy a fine big enough to make BP plc, BP America's London-based parent corporation—a company with revenue of a quarter of a trillion dollars a year—go “ouch.” But to slam BP with a fine that would hurt, the judge needed to hear from the Justice Department about corporate-wide perfidy. He pointed out that the case would have to be made against BP plc, the international parent, if he were to level a fine that would punish the corporation.

Against BP there is evidence aplenty. For years BP plc has played fast and loose with safety—from Asia to Alaska.

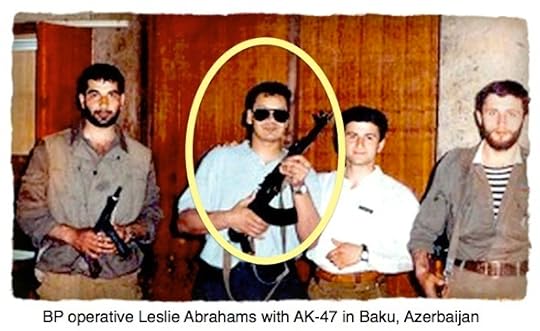

Chasing BP across five continents, I've found that “gross negligence” could be BP's corporate motto. In 2010, I was arrested in Azerbaijan hunting down evidence of another BP/Transocean offshore blowout that occurred 17 months before the Deepwater Horizon explosion. The cause of the Caspian blowout was the same as in the Gulf disaster: mishandling of “foamed” cement. Had BP not covered up the prior blowout off the coast of Azerbaijan, the deaths in the Gulf, I'm certain, would have been avoided.

Yet on this and other examples of BP's transcontinental penny-pinching negligence, the Justice Department was silent.

The ugly truth is that the U.S. State Department knew of the Caspian disaster and kept its lips sealed. Our own government wasn't going to admit that in the Deepwater Horizon trial.

Furthermore, the U.S. government can't tag BP as an endemically rogue, dangerous operator without casting doubt on the administration's recent grant to the corporation of new deep tracts to drill in the Gulf of Mexico.

This week, download for FREE, the latest compilation of Palast’s investigative films, Vultures and Vote Rustlers including, "BP: In Deep Water." Made possible by a grant from Cloud Mountain Foundation.

So maybe it was not the judge but the public that was blinded by the government and media crowing about a possible $18 billion fine for gross negligence. Eighteen billion dollars may sound like a lot to us mere mortals, but to a trillion-dollar behemoth like BP, it is not a punishment, but a reasonably priced permit for plunder.

* * * * * *

Greg Palast is the author of the New York Times bestsellers Billionaires & Ballot Bandits, The Best Democracy Money Can Buy, Armed Madhouse and Vultures’ Picnic , a BBC Television Book of the Year.

Get a signed copy of Palast's latest film Vultures and Vote Rustlers.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make a tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

September 6, 2014

Lap Dancers, the CIA, Pay-offs, and BP’s Deepwater Horizon

By Greg Palast | for Truthdig

Originally published April 17, 2014

From his investigation for Channel 4 Television in the newly released film, Vultures and Vote Rustlers.

There was CIA involvement through a company called Mega Oil. They were shipping in arms under the cover of oil tools.

The BP executive was explaining to me how the CIA, MI6 and British Petroleum engineered a coup d'état, overthrowing an elected president of a nation who was “not favorable to BP.” The corporation's former Vice-President, Leslie Abrahams, is pictured here, holding an AK-47 in front of BP headquarters in Baku, Azerbaijan. Like most of the other BP executives I spoke with, he proudly added that while he was working for BP, he was also an operative for MI6, British intelligence.

The conversation was far from the weirdest I had in my four-continent investigation of the real story of the Deepwater Horizon.

The BP oilrig blew out on April 20, 2010, four years ago this Sunday.

Earlier this month, the Obama Administration officially OK'd BP's right to resume drilling in the Gulf of Mexico. And two weeks ago, just to assure the company that all is forgiven, the U.S. Department of the Interior gave BP a new contract to drill in the Gulf of Mexico–right next to where the Deepwater Horizon went down. At the same time, the forgive-and-forget U.S. Justice Department has put the trial of David Rainey, the only BP big-shot charged with a felony crime in the disaster, on indefinite hold.

The Deepwater Horizon blow-out incinerated eleven men on the rig and poisoned 600 miles of Gulf coastline. What political fairy dust does BP keep in its pocket to receive virtual immunity from the consequences?

To understand what really happened in the Gulf of Mexico, and how BP became a corporate creature beyond the reach of the law, British television network Channel 4 sent me on a four-continent investigation through a labyrinthine funhouse of bribery, lap-dancing, beatings, Wikileaks, a coup d'état, arrests and oil-state terror.

I found the cause of the tragedy of the Deepwater Horizon seven thousand miles from the Gulf in the ancient city of Baku, the Central Asian caravan stop on the Silk Road.

For the interview with agent Abrahams and the full story of the Deepwater Horizon, see, Vultures and Vote Rustlers, the documentary which will be available as a download without charge for the next two days courtesy of the not-for-profit Palast Investigative Fund.

The literal source of Soviet power until 1991, Baku has been exporting petroleum for 3,000 years. As the Soviet Union shattered into pieces that year, BP set its sights on the city. It is now the capital of the new nation of Azerbaijan, which sits atop the biggest untapped oil field in the world, right beneath the Caspian Sea.

A coup for BP

In 1992, then-BP Chairman Lord Browne flew into Baku as soon as the young state elected its first president, Abulfez Elchibey. Former British... READ THE FULL STORY AT TRUTHDIG

* * * * * *

Greg Palast is the author of Vultures’ Picnic, inside his investigations from the Arctic to the Congo, hunting down rogue billionaires. Palast’s reports are seen on BBC-TV and Britain’s Channel 4.

Greg Palast is also the author of the New York Times bestsellers Billionaires & Ballot Bandits, The Best Democracy Money Can Buy and Armed Madhouse.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make a tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

August 26, 2014

Crime Scene – New Orleans

By Greg Palast for Reader Supported News

[Lower Ninth Ward, New Orleans] Nine years ago this week, New Orleans drowned. Don’t you dare blame Mother Nature. Miss Katrina killed no one in this town. But it was a homicide, with nearly 2,000 dead victims. If not Katrina, who done it? Read on.

The Palast Investigative Fund is making our half-hour investigative report available as a free download – Big Easy to Big Empty: The Untold Story of the Drowning of New Orleans, produced for Democracy Now. In the course of the filming, Palast was charged with violation of anti-terror laws on a complaint from Exxon Corporation. Charges were dropped, and our digging continued.

It wasn’t an Act of God. It was an Act of Chevron. An Act of Exxon. An Act of Big Oil.

Take a look at these numbers dug out of Louisiana state records:

Conoco 3.3 million acres

Exxon Mobil 2.1 million acres

Chevron 2.7 million acres

Shell 1.3 million acres

These are the total acres of wetlands removed by just four oil companies over the past couple decades. If you’re not a farmer, I’ll translate this into urban-speak: that’s 14,688 square miles drowned into the Gulf of Mexico.

Here’s what happened. New Orleans used be to a long, swampy way from the Gulf of Mexico. Hurricanes and storm surges had to cross a protective mangrove forest nearly a hundred miles thick.

But then, a century ago, Standard Oil, Exxon’s prior alias, began dragging drilling rigs, channeling pipelines, barge paths and tanker routes through what was once soft delta prairie grass. Most of those beautiful bayous you see on postcards are just scars, the cuts and wounds of drilling the prairie, once America’s cattle-raising center. The bayous, filling with ‘gators and shrimp, widened out and sank the coastline. Each year, oil operations drag the Gulf four miles closer to New Orleans.

Just one channel dug for Exxon’s pleasure, the Mississippi River-Gulf Outlet ("MR-GO") was dubbed the Hurricane Highway by experts—long before Katrina—that invited the storm right up to—and over—the city’s gates, the levees.

Without Big Oil's tree and prairie holocaust, "Katrina would have been a storm of no note," Professor Ivor van Heerden told me. Van Heerden, once Deputy Director of the Hurricane Center at Louisiana State University, is one of the planet’s the leading experts on storm dynamics.

If they’d only left just 10% of the protective collar. They didn’t.

Van Heerden was giving me a tour of the battle zone in the oil war. It was New Orleans’ Lower Ninth Ward, which once held the largest concentration of African-American owned homes in America. Now it holds the largest contrition of African-American owned rubble.

We stood in front of a house, now years after Katrina, with an "X" spray-painted on the outside and "1 DEAD DOG," "1 CAT," the number 2 and "9/6" partly covered by a foreclosure notice.

We stood in front of a house, now years after Katrina, with an "X" spray-painted on the outside and "1 DEAD DOG," "1 CAT," the number 2 and "9/6" partly covered by a foreclosure notice.

The professor translated: "9/6" meant rescuers couldn’t get to the house for eight days, so the "2"—the couple that lived there––must have paddled around with their pets until the rising waters pushed them against the ceiling and they suffocated, their gas-bloated corpses floating for a week.

In July 2005, Van Heerden told Channel 4 television of Britain that, "In a month, this city could be underwater." In one month, it was. Van Heerden had sounded the alarm for at least two years, even speaking to George Bush’s White House about an emergency condition: with the Gulf closing in, the levees were 18 inches short. But the Army Corps of Engineers was busy with other rivers, the Tigris and Euphrates.

So, when those levees began to fail, the White House, hoping to avoid Federal responsibility, did not tell Louisiana's Governor Kathleen Blanco that the levees were breaking up. That Monday night, August 29, with the storm by-passing New Orleans, the Governor had stopped the city’s evacuation. Van Heerden was with the governor at the State Emergency Center. He said, "By midnight on Monday the White House knew. But none of us knew."

So, the drownings began in earnest.

Van Heerden was supposed to keep that secret. He didn't. He told me, on camera––knowing the floodwater of official slime would break over him. He was told to stay silent, to bury the truth. But he told me more. A lot more.

"I wasn't going to listen to those sort of threats, to let them shut me down."

Well, they did shut him down. After he went public about the unending life-and-death threat of continued oil drilling and channelling, LSU closed down its entire Hurricane Center (can you imagine?) and fired Professor van Heerden and fellow experts. This was just after the University received a $300,000 check from Chevron. The check was passed by a front group called "America’s Wetlands"—which lobbies for more drilling in the wetlands.

In place of Van Heerden and independent experts, LSU’s new "Wetlands Center" has professors picked by a board of petroleum industry hacks.

In 2003, Americans protested, "No Blood for Oil" in Iraq. It’s about time we said, "No Blood for Oil"—in Louisiana.

* * * * * *

For more revelations from Professor van Heerden, the true untold story of Katrina, get a signed copy of Palast’s bestseller, Vultures’ Picnic , a BBC Television Book of the Year.

Greg Palast is also the author of the New York Times bestsellers Billionaires & Ballot Bandits, The Best Democracy Money Can Buy and Armed Madhouse.

Get Palast's latest film Vultures and Vote Rustlers.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make a tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

August 24, 2014

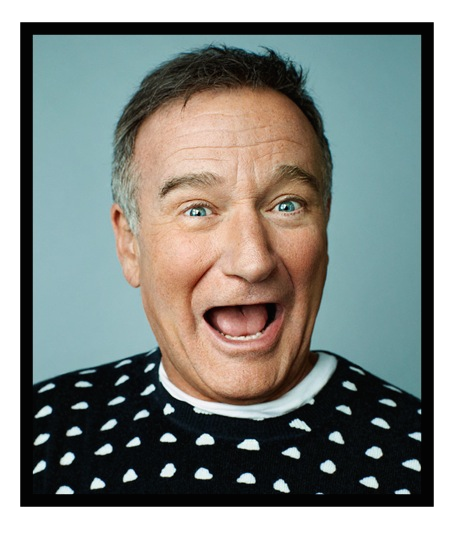

Robin Williams and the Happiness Industry

By Greg Palast

I can't help feeling that Robin Williams was a victim of his industry: the happiness industry.

I can't help feeling that Robin Williams was a victim of his industry: the happiness industry.

Williams was typecast for those parts with manic, unstoppable joy. Listen up, Aladdin! Williams' genie said, You're not suffering from poverty–what you need is a positive attitude! You know, put on a happy face! Let a smile be your umbrella!

Our culture despises and fears unhappiness. We pathologize unhappiness; we conflate it with a disease, "depression." And it's a disease we insist you can cure–so you don't spread your unhappiness germs to the rest of us. We stigmatize those who are unhappy, like we stigmatize those who are overweight: If you're fat, you just don't have any self-control. If you're unhappy, it's your personal failure to just buck up.

We laud the congenitally happy, like Ronald Reagan, the chipper Gipper, the Grinning Grandpa, who could unleash his death squads and smile all the while.

We are a nation of salesman, commercially optimistic. We don't like downers; we don't like people who spoil the party.

And so we push those who find themselves unhappy to medicate themselves–avoid The Deep, get out of the blues and join the Disney. Williams chose booze, pills and that most devastatingly addictive drug, fame cocaine.

(And no, I don't claim I'm exempt from the pull of let's-forget potions.)

Robin Williams wasn't depressed. He was unhappy. Life, even with your own jet, is sickeningly unfair and difficult. His disease was the human condition. There is no cure. It is always fatal.

Like Robin Williams, Goethe's Faust suffered through fear of the unstoppable horror of aging, the ineluctable withering of talents and fame and sexual power. A stone-deaf God has sentenced us to our inevitable decay and execution. Before you're ready: bam! – you're 63 and suddenly, darkness falls–Walpurgisnacht, the Dark Night of the Soul.

The trick, says Goethe, is to hold on until morning. In dawn's dirty light, we find this barely breathing compensation: gratitude for those that have loved us, not just applauded us. It used to be called Wisdom. And, at the last hour, Grace.

But in our Disney'd world, that deepest unhappiness simply cannot be tolerated, not even for a night. So, we give up the dark night at the cost of giving up our soul.

Forgive me, but I never found Robin Williams funny. He always seem to try too hard, to yuck it up too easily and too much. I found his film persona manic, disturbing and false.

The funniest comic writer I've known was Charles Bukowski. To him, The Darkness was Lady Death, with long legs and lots of sticky lipstick. Bukowski would tell the lady, the Darkness, to come on in, sit down. Let's have a drink together. Bukowski died laughing.

He recognized that the joke's on us, with the same old punch line: Rest in peace, Mr. Williams. Rest in peace.

* * * * * *

Greg Palast is the author of the New York Times bestsellers Billionaires & Ballot Bandits, The Best Democracy Money Can Buy and Armed Madhouse and the highly acclaimed Vultures’ Picnic.

Get Palast's latest film Vultures and Vote Rustlers.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make a tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

August 8, 2014

Cómo podría Barack Obama poner fin a la crisis de deuda argentina?Argentine president cites and posts Palast report on “The Vulture”

En virtud del principio conocido como “respeto mutuo” (comity), lo único que tendría que hacer Obama es informar al juez federal Thomas Griesa que la demanda de Singer interfiere con la autoridad exclusiva que tiene el presidente para dirigir la política exterior.

En virtud del principio conocido como “respeto mutuo” (comity), lo único que tendría que hacer Obama es informar al juez federal Thomas Griesa que la demanda de Singer interfiere con la autoridad exclusiva que tiene el presidente para dirigir la política exterior.

De Greg Palast para el diario inglés The Guardian

El Presidente de los Estados Unidos sólo necesita informar a un juez federal que el multimillonario de fondos buitre Paul Singer está interfiriendo con la competencia exclusiva del presidente de dirigir la política exterior. No lo ha hecho. Pero ¿por qué no?

Una simple nota a los tribunales enviada por Barack Obama podría parar en seco al financista “buitre” que está amenazando con devorar a la Argentina. Pero aunque el Presidente oficialmente apoya a la Argentina, no ha hecho esto que podría salvar a Buenos Aires del default.

Obama podría evitar que el multimillonario de los fondos buitre, Paul Singer, cobre ni un solo centavo de la Argentina invocando la autoridad de larga data otorgada a los presidentes por la cláusula de “Separación de Poderes” de la constitución de los Estados Unidos. En virtud del principio conocido como “respeto mutuo” (comity), lo único que tendría que hacer Obama es informar al juez federal Thomas Griesa que la demanda de Singer interfiere con la autoridad exclusiva que tiene el presidente para dirigir la política exterior. Caso desestimado.

De hecho, el presidente George W. Bush invocó esta facultad contra el mismo hedge fund que ahora amenaza a la Argentina.

Bush bloqueó el embargo de bienes de Congo-Brazzaville en los EE.UU. por parte de Singer, a pesar de que el jefe de este hedge fund es uno de los más importantes y más influyentes contribuyentes a los candidatos republicanos.

Específicamente, un tribunal de apelaciones advirtió a este mismo juez hace 30 años, que debía prestar atención a la directriz de un Presidente al invocar sus facultades en materia de política exterior. En el caso de Singer, el Departamento de Estado de Estados Unidos sí informó al Juez Griesa que el gobierno de Obama estuvo de acuerdo con los argumentos jurídicos presentados por Argentina; pero el Presidente nunca invocó la cláusula mágica de freno a los buitres.

La devastadora indecisión de Obama no es ninguna sorpresa. Repite la capitulación del Presidente ante Singer la última vez que estuvieron en un mano-a-mano. Fue en 2009. Singer, a través de una brillante y compleja maniobra financiera, asumió el control de Delphi Automotive, el único proveedor de la mayor parte de las autopartes que precisan General Motors y Chrysler. Ambos gigantes automotrices ya se encontraban en quiebra.

Singer y otros coinversores le exigieron al Tesoro de los Estados Unidos que les pagara miles de millones, incluyendo US$ 350 millones en efectivo y de inmediato, o – como amenazó el consorcio de Singer- “los obligaremos a cerrar”. Cortarían el flujo de repuestos hacia GM, literalmente.

GM y Chrysler (que contaban apenas con el equivalente a un par de días en repuestos), hubiesen tenido que cerrar sus puertas de manera permanente, y verse obligadas a una liquidación.

El negociador de Obama, el sub secretario del Tesoro, Steven Rattner, denominó la demanda de los fondos buitre una ‘”extorsión” – una caracterización de Singer que la presidenta de Argentina Cristina Fernández de Kirchner repitió la semana pasada.

Pero mientras que Fernández declaró “No puedo, como presidenta, someter al país a una extorsión semejante”, Obama cedió en cuestión de días.

En última instancia, el Tesoro de Estados Unidos pagó discretamente al consorcio Singer la friolera de US$ 12.900 millones en efectivo y subsidios del fondo de rescate del sector automotriz del Tesoro de Estados Unidos.

Singer respondió a la generosidad de Obama cerrando rápidamente 25 de las 29 plantas de autopartes de Delphi en Estados Unidos y trasladando 25.000 puestos de trabajo a Asia. La empresa Elliott Management de Singer se embolsó US$ 1.290 millones, de los cuales Singer personalmente se quedó con la mayor parte.

En el caso de Argentina, Obama sin duda tiene motivos para actuar. El Departamento de Estado de EE.UU. advirtió al juez que la adopción de las teorías jurídicas de Singer pondría en peligro los acuerdos de rescate soberanos en todo el mundo. De hecho, se informó que en 2012 Singer se unió a su compañero inversionista multimillonario buitre Kenneth Dart, para exprimir al gobierno griego, buscando un enorme desembolso durante la crisis del euro, al amenazar con crear un default masivo de los bancos en toda Europa.

La prensa financiera ahora se vuelca contra Singer. Los comentaristas del Wall Street Journal y FT están enfurecidos ante la quijotesca reinterpretación que ha hecho el financista de los términos de los préstamos soberanos, en el sentido en que los talibanes interpretan un acuerdo de paz. No hay paz, no hay acuerdo.

Singer sin duda se ha ganado sus plumas de buitre. Con su ataque contra Congo-Brazzaville arrebató la ayuda para reducir la deuda que pagaron los contribuyentes estadounidenses y británicos y según Oxfam, socavó la capacidad de este país para luchar contra una epidemia de cólera. (El portavoz de Singer respondió que la corrupción del gobierno de Congo-Brazzaville, y no sus demandas, es lo que ha empobrecido a esa nación.)

Como para pulir sus credenciales de tipo duro, Singer emprendió ataques legales sobre JP Morgan Chase, Citibank, BNY Mellon y UBS, exigiendo que le paguen el dinero que Argentina les había pagado durante la última década. Además, los abogados de Singer convencieron al juez para detener al BNY Mellon, agente fiduciario de Argentina, de efectuar un pago de US$ 500 millones a los tenedores de bonos argentinos.

Seguramente el presidente intervendría. No lo hizo. No lo ha hecho. ¿Por qué?

No soy psicólogo. Pero esto sí lo sabemos: desde que empezó a atacar a Argentina, Singer abrió su cuenta bancaria millonaria en dólares, convirtiéndose en el principal donante a las causas republicanas de Nueva York.

Es uno de los fundadores de Restore Our Future, un club de multimillonarios, y canaliza los fondos de Bill Koch y otros chicos ricos republicanos a un arca de guerra temible dedicada a las solicitadas con ataques políticos que atacan de manera despiadada.

Y Singer recientemente donó US$ 1 millón a Crossroads de Karl Rove, otra máquina de ataques político.

En otras palabras, se paga un precio si se contraría a Singer. Y, a diferencia de la presidenta de Argentina, Obama no parece dispuesto a pagarlo.

* * * * * *

Greg Palast es autor de Vultures’ Picnic ‘y produjo una serie de informes de investigación sobre los fondos buitre para The Guardian, The Nation y Newsnight, de la la BBC.

August 7, 2014

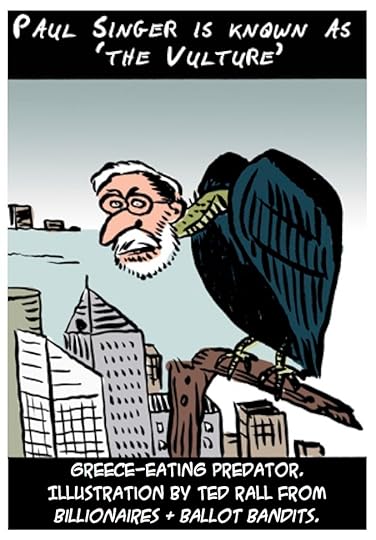

Obama Can End Argentina's Debt Crisis with a PenThe President has the Constitutional power to pluck vulture-fund billionaire Paul Singer. Obama hasn't. Why not?

By Greg Palast for The Guardian

The "vulture" financier now threatening to devour Argentina can be stopped dead by a simple note to the courts from Barack Obama. But the president, while officially supporting Argentina, has not done this one thing that could save Buenos Aires from default.

Obama could prevent vulture hedge-fund billionaire Paul Singer from collecting a single penny from Argentina by invoking the long-established authority granted presidents by the US constitution's "Separation of Powers" clause. Under the principle known as "comity", Obama only need inform US federal judge Thomas Griesa that Singer's suit interferes with the president's sole authority to conduct foreign policy. Case dismissed.

Obama could prevent vulture hedge-fund billionaire Paul Singer from collecting a single penny from Argentina by invoking the long-established authority granted presidents by the US constitution's "Separation of Powers" clause. Under the principle known as "comity", Obama only need inform US federal judge Thomas Griesa that Singer's suit interferes with the president's sole authority to conduct foreign policy. Case dismissed.

Indeed, President George W Bush invoked this power against the very same hedge fund now threatening Argentina. Bush blocked Singer's seizure of Congo-Brazzaville's US property, despite the fact that the hedge fund chief is one of the largest, and most influential, contributors to Republican candidates.

Notably, an appeals court warned this very judge, 30 years ago, to heed the directive of a president invoking his foreign policy powers. In the Singer case, the US state department did inform Judge Griesa that the Obama administration agreed with Argentina's legal arguments; but the president never invoked the magical, vulture-stopping clause.

Obama's devastating hesitation is no surprise. It repeats the president's capitulation to Singer the last time they went mano a mano. It was 2009. Singer, through a brilliantly complex financial manoeuvre, took control of Delphi Automotive, the sole supplier of most of the auto parts needed by General Motors and Chrysler. Both auto firms were already in bankruptcy.

Singer and co-investors demanded the US Treasury pay them billions, including $350m (£200m) in cash immediately, or – as the Singer consortium threatened – "we'll shut you down". They would cut off GM's parts. Literally.

GM and Chrysler, with no more than a couple of days' worth of parts to hand, would have shut down, permanently forced into liquidation.

Obama's negotiator, Treasury deputy Steven Rattner, called the vulture funds' demand "extortion" – a characterisation of Singer repeated last week by Argentina President Cristina Fernández de Kirchner.

But while Fernández declared "I cannot as president submit the country to such extortion," Obama submitted within days. Ultimately, the US Treasury quietly paid the Singer consortium a cool $12.9bn in cash and subsidies from the US Treasury's auto bailout fund.

Singer responded to Obama's largesse by quickly shutting down 25 of Delphi's 29 US auto parts plants, shifting 25,000 jobs to Asia. Singer's Elliott Management pocketed $1.29bn of which Singer personally garnered the lion's share.

In the case of Argentina, Obama certainly has reason to act. The US State Department warned the judge that adopting Singer's legal theories would imperil sovereign bailout agreements worldwide. Indeed, it is reported that, in 2012, Singer joined fellow billionaire vulture investor Kenneth Dart in shaking down the Greek government for a huge payout during the euro crisis by threatening to create a mass default of banks across Europe.

The financial press has turned on Singer. Commentators in the Wall Street Journal and FT are enraged at the financier's quixotic re-interpretation of sovereign lending terms in the way that the Taliban interprets a peace agreement. No peace, no agreement.

Singer has certainly earned his vulture feathers. His attack on Congo-Brazzaville in effect snatched the value of the debt relief paid for by US and British taxpayers and, says Oxfam, undermined the nation's ability to fight a cholera epidemic. (Singer's spokesman responded that corruption in the Congo-Brazzaville government, not his lawsuits, have impoverished that nation.)

As if to burnish his tough-guy credentials, Singer has mounted legal attacks on JP Morgan Chase, Citibank, BNY Mellon, and UBS, demanding they pay him the money that Argentina had paid them over the last decade. Furthermore, Singer's lawyers persuaded the judge to stop BNY Mellon, Argentina's agent, from making $500m in payments to Argentinian bondholders.

Surely the president would intervene. He didn't. He hasn't. Why?

I'm not a psychologist. But this we know: since taking on Argentina, Singer has unlocked his billion-dollar bank account, becoming the biggest donor to New York Republican causes. He is a founder of Restore Our Future, a billionaire boys club, channelling the funds of Bill Koch and other Richie Rich-kid Republicans into a fearsome war-chest dedicated to vicious political attack ads.

And Singer recently gave $1m to Karl Rove's Crossroads operation, another political attack machine.

In other words, there's a price for crossing Singer. And, unlike the president of Argentina, Obama appears unwilling to pay it.

* * * * * *

Greg Palast is the author of the New York Times bestsellers Billionaires & Ballot Bandits, The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic.

Get Palast latest film Vultures and Vote Rustlers featuring Paul "The Vulture" Singer.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make a tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

July 30, 2014

The Vulture: Chewing Argentina’s Living Corpse

Vulture investor Paul Singer has forced the nation of Argentina into default. Here’s the real story, from Billionaires & Ballot Bandits by Greg Palast.

A call came in from New York to my bosses at BBC Television Centre, London. It was from one of the knuckle- draggers on the payroll of billionaire Paul Singer, Number One funder for the Republican Party in New York, million-dollar donor to the Mitt Romney super-PAC, and top money-giver to the GOP Senate campaign fund. But better known to us as Singer The Vulture.

A call came in from New York to my bosses at BBC Television Centre, London. It was from one of the knuckle- draggers on the payroll of billionaire Paul Singer, Number One funder for the Republican Party in New York, million-dollar donor to the Mitt Romney super-PAC, and top money-giver to the GOP Senate campaign fund. But better known to us as Singer The Vulture.

“We have a file on Greg Palast.”

Well, of course they do.

And I have a file on them.

I had just returned from traveling up the Congo River for BBC and the Guardian. Singer’s enforcer indicated that Mr. Singer would prefer BBC not run a story about him— especially not with film of his suffering prey: children, cholera victims.

Like any vulture, Singer feasts when victims die. Literally. For example, Singer made a pile buying asbestos company Owens Corning out of bankruptcy. The company had concealed from its workers they would get asbestosis from handling their product.

You don’t want to die of asbestosis. Your lungs turn to mush and you drown inside yourself.

The asbestos company was forced to pay tens of thousands of its workers for their medical care and for their families after their deaths.

But then Singer used his political muscle to screw down the compensation promised to the workers. He offered them peanuts. And, dying, they took it. Like the Ice Man, Singer The Vulture used the cudgel of “tort reform” to beat the weakened workers into submission. With asbestos workers buried or bought-off cheap, Singer’s asbestos death factories were now worth a fortune . . . and Singer made his first “killing.”

Then it was on to Peru, where Singer had, through a brilliant financial-legal maneuver too questionable for others to attempt, grabbed control of the entire financial system of the country. When Peru’s scamp of a president, Alberto Fujimori, decided it was a good idea to flee his country (ahead of his arrest on murder charges), Singer, Peru’s lawyer Mark Cymrot of Baker & Hostetler told me, let Fujimori escape in return for the Murderer-in-Chief ordering Peru’s treasury to pay Singer $58 million. Singer had seized Peru’s “Air Force One” presidential jet; for the payoff, Singer handed him the keys to the getaway plane.

And by the way, I didn’t give Singer the name “Vulture.”

His own banker buddies did—with admiration in their voices.

What provoked the threatening call to BBC from Singer’s tool was my film from the Congos (there are two nations in Africa called “Congo”). There is a cholera epidemic in West Africa due to lack of clean water. Our investigation learned that Singer paid about $10 million for some “debt” supposedly incurred by the Republic of Congo. To collect on his $10 million, Singer had begun seizing about $400 million in the poor nation’s assets.

Clean water for the Congo? Forget it—Singer and his vulture colleagues grabbed it all.

In Africa, I spoke with Winston Tubman, the former deputy secretary-general of the UN. He asked me to ask the Vulture and his cronies, “Do you know you are causing babies to die?”

It’s legal, it’s sick, it’s Singer.

Well, not legal in most of the civilized world. Britain, Germany, Holland, and many others have outlawed Singer’s repo-man seizures. In Europe, Singer is a financial outlaw. But in the USA, he’s a “job creator.”

Singer The Vulture gets loads of positive press, in the New York Times especially, where the corpse-chewer offered an open checkbook to any state Republican who would vote for the right of gays to marry. Don’t think of this as an unselfish act of moral courage: it was more droit du seigneur, the right of the Lords of the Manor to deflower the virgins of choice on their lands. The Vulture’s son wanted to marry another man, and so Vulture would buy the New York State Legislature to approve the nuptials. (That almost all Singer’s money would go to national candidates who would make gay marriage illegal, well, money is thicker than blood.)

But, under press cover of funding the GOP for social rights, Singer’s influence in the state legislature has paid back a hundredfold. He lobbied the legislature to change the law on the calculation of interest charges on his vulture loan-sharking operation, a change that will guarantee him hundreds of millions of dollars more from the Congo.

The Vulture’s latest hit was a pay-off from the bankrupt government of Greece.

On April 4, 2012, seventy-seven-year-old Greek pharmacist Dimitris Christoulas wrote, “I find no other solution for a dignified end before I start sifting through garbage to feed myself.” Christoulas then shot himself in the head. The government had cut his pension as part of an austerity plan to pay foreign creditors. One in four workers also lost their jobs.

Greece’s creditor banks took their pound of flesh, but gave up some of theirs, canceling 80 percent of the loan principal. That is, all but two “bankers”: billionaires Ken Dart and Singer The Vulture told the European Central Bank and Greek government, they wanted it all. Singer and Dart would not cancel 80 percent or even 8 percent of the bonds they held, even though Singer and Dart, apparently, only paid a fraction of the face value for them only a few weeks before. Either the Greek government would pay Singer and Dart several times what the speculators invested, or Singer and Dart would undermine the entire bailout deal, bringing down the remnant of Greece’s economy—and the rest of Europe with it.

Held hostage, the Greek government dipped into its emptying purse and paid Singer and Dart every penny they demanded. Singer’s co-investors in his fund Elliott Management made a killing—including the “blind” trust of one Mittens Romney.

But the Vulture’s gravy train of greed was about to run into an unexpected obstacle on the track. On April 4, just hours after Christoulas took his own life, in a courtroom in Washington, DC, the President of the United States and his Secretary of State hit Singer with a legal brick. Without any public announcement, without the usual press release and in language so abstruse only a lunatic journalist who went to the University of Chicago Law School would notice, Obama’s Justice Department nailed the Vulture to the wall.

It was Ash Wednesday and Obama’s boys drove those nails in: they demanded a US federal court to stop Singer from attacking Argentina.

In this case, Singer had sued to get millions, even billions, from the government of Argentina for old debt that President Ronald Reagan had already settled in a deal involving the biggest US banks. But Reagan’s deal was not good enough for Singer and his hedge fund NML Capital. Singer demanded that a US court order Argentina to pay him ten times the amount he’d get under the Reagan deal. And to get his way, the Vulture also sued to stop the Big Banks from getting their own payments from the Reagan deal.

But then a bolt of legal lightning cooked the Vulture’s goose: Obama’s Justice Department and Hillary Clinton’s State Department together filed an amicus curiae, a “friend of the court” brief in the case of NML Capital et al. v. Republic of Argentina. It wasn’t all that friendly. Obama, a constitutional law professor, suddenly remembered that the president has the power, unique to the Constitution of the USA, to kick the Vulture’s ass up and down the continent, then do it again.

Specifically, Obama and Clinton demanded the court throw out Singer’s attempt to bankrupt Argentina (because that is what Singer’s demand would have done).

This was Singer’s nightmare: that the President of the United States would invoke his extraordinary constitutional authority under the Separation of Powers clause to block the Vulture and his hedge-fund buddies from making superprofits over the dead bodies of desperate nations.

The stakes in the legal-financial-political war are enormous, yet the real battle is hidden from the public view.

A titanic struggle had now been set in motion, a battle over billions, between the Obama administration and the wealthiest men in America, the hedge-fund billionaires, all out of sight of the public and press.

Argentina’s consul called me from DC, stunned by the Clinton move. WTF? Did I have any info?

I said, this action goes way, way beyond Argentina. Obama and Clinton told the court that the Vulture was undermining the safety of the entire world financial system, destabilizing every financial rescue mission from South America to Greece to the Congo. (What would Romney do? His expected replacement for Clinton would be his chief foreign policy advisor Dan Senor—currently on the payroll of . . . Paul Singer.)

Does Obama have the stones to stick with his decision? And do Singer and friends, working with Karl Rove, have the money-knife which could cut them off?

The Rove-bots are already flashing their blade: in June 2012, Republicans on the House Committee on Financial Services held an unprecedented emergency hearing about the president’s stealth move on the Vulture. They sat for testimony by Ted Olsen, George Bush’s former solicitor general, who attacked Obama and Clinton with code words and inscrutable legalismo, not once mentioning Singer or his hedge fund by name.

But in the White House and on the top floors of the Wall Street towers, they knew exactly what this was all about. And in the golf carts on Martha’s Vineyard, they knew the Vulture had to be put in his place. Robert Wolf, golfing with President Obama on the Cape, was furious. The CEO of UBS (a.k.a. United Bank of Switzerland), had put together the Argentina deal. And Swiss bankers don’t allow anyone to move the hole on their green.

Wolf bundled plenty of campaign loot for Obama, who made Wolf his “economic recovery” advisor. UBS has recovered nicely (with a sweet plea-bargain deal on criminal tax-evasion charges).

Now, UBS, JPMorgan, and Citibank chieftains are lined up with Obama and Clinton. The Establishment banks look upon the nouvelle vultures like Singer as economic berserkers, terrorists in a helicopter ready to pull the pin on the grenade. If Singer’s demands aren’t met, he’ll blow up the planet’s finance system. In this war of titans, Obama and Clinton are merely foot soldiers, not the generals. It’s billionaire banking-powers versus billionaire hedge-fund speculators. One is greedy and scary and the other is greedy and plain dangerous. Take your pick.

Here is the real battle—a winner-take-all war over the control of the world financial system.

* * * * * *

Greg Palast is the author of the New York Times bestsellers Billionaires & Ballot Bandits,The Best Democracy Money Can Buy, Armed Madhouse and the highly acclaimed Vultures' Picnic.

HELP US FOLLOW THE MONEY. Visit the Palast Investigative Fund's store or simply make a tax-deductible contribution to keep our work alive!

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

Greg Palast's Blog

- Greg Palast's profile

- 138 followers