Sue Burke's Blog, page 84

February 8, 2012

Seven billion people

When I was born in 1955, fewer than 3 billion people lived on the Earth. According to the UN, that number reached 7 billion on October 31, 2011.

In my lifetime, the world population has more than doubled — and there was hardly a shortage of human beings on the planet 56 years ago. When my parents were born, there were only 2 billion people. In 1804, there was 1 billion.

We should hit 8 billion before 2030 and 9 billion before 2050.

I can't imagine a billion people, but I know what population growth has meant to me — this single memory, multiplied by everywhere:

When I was eight or nine years old, my friends and I would ride our bikes from our homes in Greendale, Wisconsin, to Boerner Botanical Gardens, about three miles away. (We were free-range children.) The quiet ride took us through suburbs and past farm fields and groves of trees.

The biggest crossroads was Grange Avenue and 76th Street. Grange, a two-lane country road, had a stop sign, and 76th didn't, but it had such scant traffic that an eight-year-old had no trouble peddling across it safely.

Less than a decade later, Southridge Mall opened at that corner, and more development followed. Now, as the photo from Google Maps shows, Grange Avenue is a four-lane boulevard and 76th has six lanes, and the crossroads can intimidate anyone not in an SUV. The fields have been paved over. The once-quiet country road bustles day and night.

And everywhere that I've lived and visited, the roads and shopping malls grow and grow endlessly.

That's what billions more people mean to me: more cars, more roads, and more malls — but fewer farm fields, fewer trees, and less peace and quiet.

— Sue Burke

Also posted at my professional website:

February 1, 2012

Clarion 2012: be there

You have until March 1 to apply to attend Clarion 2012, which will be held in San Diego from June 24 - August 4, 2012. You will learn from writers Jeffrey Ford, Marjorie Liu, Ted Chiang, Walter Jon Williams, Holly Black and Cassandra Clare.

I attended Clarion 1996. What did I learn? Frankly, nothing that I couldn't have learned alone at home, except that I learned it all a lot faster, better, and in a way impossible to forget: how to get ideas, how to turn them into stories, what a short story does in abstract and specific terms, what the publishing world was like, what I could already do as a writer, and what I needed to improve.

Clarion makes you work hard and think hard. Boot camp.

Where to apply:

http://literature.ucsd.edu/affiliated-programs/clarion/index.html

— Sue Burke

January 25, 2012

Grammar you don't know you know: Order your adjectives

Put these words in order: new / highligher / five / pens.

Easy, right?

Five new highlighter pens.

How about this: yellow / French / tasty / little / cheeses.

Not hard at all.

Tasty little yellow French cheeses.

In English, when several adjectives before a noun, they go in a certain order. Although there are exceptions and you may change the order for emphasis, there is a common order. Do you know it?

1. Determiners: numbers, articles (the, a), possessives (her), demonstratives (these, this), quantifiers (some, few).

2. Opinion: beautiful, pure, nice.

3. Size, length, height: huge, long, tall.

4. Age: ancient, young.

5. Shape: square, flat, round.

6. Color: red, pinkish.

7. Origin: French, lunar, eastern.

8. Material: wooden, paper, glass.

9. Purpose: riding (boots), flower (vase), evening (gown).

So you can say: this beautiful long new straight red Italian silk evening gown. It would sound wrong to say: evening this silk Italian red straight long new beautiful gown.

Native speakers know this intuitively. As a teacher of English as a foreign language, I torture Spanish teenagers until they memorize the list in order.

— Sue Burke

January 19, 2012

Go Ahead — Write This Story: Finish what you write

Heinlein's Second Rule of Writing: "You must finish what you write." Easy to say, but a million things will conspire against completing the crucial first draft of your story. Defend yourself. Seduce the muse with frequent, scheduled visits; she will likely be there waiting for your daily or weekly date. Write badly if you must, but do not "fix" the first page until the last page is done; it's a rough draft, and you can become perfect later. If you need ideas for a story to draft, here are a few.

● This is an alternate history story set in 1491 in which the Iroquois League of Six Nations builds a really big canoe and sets out east. Will it bring constitutional government to a Europe poised to accelerate the creation of absolute monarchies in the Renaissance?

● This is a heartwarming story set on a planet being terraformed in which a family struggles with natural disaster and wartime plundering.

● This is a children's picture book story about a trio of friends who discover that albino alligators really do live in the sewers.

— Sue Burke

Not posted yesterday due to the SOPA/PIPA blackout.

January 11, 2012

Tap Qualty

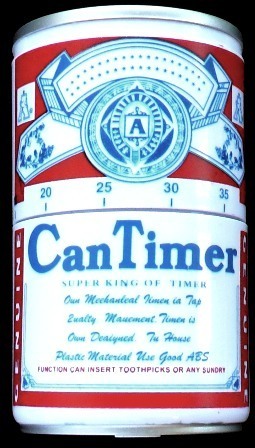

I bought this kitchen timer in a little neighborhood store. It works fine and looks sort of stylish, but the print on the label seems to be purely decorative. I'm not sure where the timer was made, but I suspect a country that uses a different alphabet.

CanTimer

SUPER KING OF TIMER

Oun Meehanleal Timen ia Tap

Qualty. Manement. Timen is

Own Deaiyned. Tu House

Plastic Material Use Good ABS

FUNCTION CAN INSERT TOOTHPICKS OR ANY SUNDRY

(on the sides) GENUINE

— Sue Burke

January 1, 2012

The euro was coming!

Late in December of 2001, I got my first euros, a "starter kit" bag of coins purchased at a bank with Spanish pesetas. I took them home and we admired them, all shiny and new. On January 1, 2002, we would begin to use them.

No more peseta, which had served Spain for 133 years. No more peseta prizes in the El Gordo lottery held every December 22. At the lottery drawing, the winning numbers and prizes are always sung, and in 2001, the audience began to sing along — singing goodbye to the peseta. Rarely do average citizens get to participate directly in such a grand historic event as the introduction of a new international currency involving fourteen European countries.

Euro-ready or not, nine days later, midnight struck! People lined up at ATMs on their way to New Year's parties to withdraw the new cash. The Madrid subway system discovered that its ticket machines were not quite euro-ready and didn't work with the new currency, so people got to ride free until that was fixed the next day.

Officially, the euro had existed as a non-physical currency starting January 1, 1999, so we had a long time to get ready. Despite all the preparation, on January 1 a waiter in France got confused and accepted a 5-denomination Monopoly bill as a 5€ bill: both are grayish, the same size, and have big 5's on them.

Here in Spain, we officially had until February 28 to shift over to the new currency, but it took only a few days. By law, we could pay in pesetas and get our change in euros, and that's how we did it: people would buy a 100-peseta cup of coffee with a 10,000 peseta note.

We all had to do a lot of math to figure out equivalents: 166.386 pesetas equaled 1€. For a long time I saw befuddled elderly people in stores helplessly holding out a handful of euro bills and coins to check-out clerks, who would pick out the right amount. The euro had cents, like dollars, and my husband had to teach our landlord how to write a check with decimals. I knew that the copper coins would tarnish soon like US pennies, but Spaniards were dismayed when they saw the pretty coins turn brown.

But even before the euro began circulating, the problems had begun to surface. To avoid paying taxes on under-the-table earnings, many Spaniards kept significant savings in cash — suitcases full of bills. How could they exchange these for euros without paying taxes? They couldn't, so they began spending the pesetas. One December 2001 advertisement for diamonds simply showed jewelry and the tagline: "Honey, the euro is coming and I don't have a thing to wear."

But where they really stashed their cash was in real estate. Spain already had a real estate bubble, and this spending inflated it fast, with unhappy consequences. The video Españistán (with English subtitles) explains the bubble well, although very angrily. Building became uncontrolled. In addition, the European Union's financial policy of low interest rates designed to favor Germany's growth further fueled the real estate boom in Spain and other European countries.

Then, in 2008, the boom blew up. A US financial crisis spread world-wide, and although it hurt Europe in general, it specifically destroyed Spain's real-estate construction business. Suddenly, Spain's national budget went from surplus to deficit as the government coped with unemployment while revenues dropped. Recession struck Spain and other European countries. Then it turned out that Greece, with the help of Goldman Sachs, had lied about its government finances. Borrowing at the low interest rates had kept Greece afloat for a while, but starting in 2009, it couldn't pay back the money it had borrowed.

Meanwhile, many European banks held the toxic assets created in the US, as well as local mortgages and other real estate investments that had suddenly lost much of their value — but they didn't know exactly how much they had lost, since the investment securities were opaque. They also held Greek government bonds, and since banks had become weak, they couldn't afford to take a hit from Greece, which for some of them would have been a big hit.

The European Union responded by forcing the banks to do that, and a tottering system began to tilt. The fault, supposedly, lay with the PIGS — Portugal, Ireland, Italy, Greece, and Spain — for having acquired too much debt due to unwise spending. In truth, Germany's government had high indebtedness, too, and its smaller banks had frightening balance sheets. In spite of that, financial speculators decided that Germany, whose economy was still robust, would never default, but the PIGS might, so speculators pushed up interest rates on those governments' bonds, which only deepened those countries' debts and troubles.

Social spending has always had ideological enemies, and the debt crisis let these ideologues claim that the error lay in bloated government budgets. Germany, who as it turned out unilaterally runs the European Union, demanded austerity budgets from those countries that slashed social spending in exchange for getting a little protection from speculators. In effect, this was like punishing a man for starving by sending him to bed without his supper.

That's where we are in January 2012. The problem is financial, not fiscal: banks, not budgets. But no one wants to deal with the thorny problem of a dysfunctional financial sector, and "morally upright" northern European countries don't want to pay for the supposed errors of southern Europe.

Simple mechanisms could solve this crisis fast, such as having the European Central Bank behave more like the US Federal Reserve and be a lender of last resort (in effect, printing money), permitting inflation, or issuing Euro-bonds. But Germany, specifically Angela Merkel, says no.

Instead, it's relatively easy to force budget cutbacks. And yet if budgets aren't the root problem, cutbacks won't solve the crisis. Cutting government spending will only deepen the recession, and things will only get worse.

The joy of a decade ago has given way to gloom, and in a recent survey, 70% of Spaniards said the euro has been of little or no benefit to Spain.

— Sue Burke

December 31, 2011

Christmas lights

Due to the economic crisis, the city of Madrid put up the same holiday lights as last year — but last year's were lovely. These are in the traffic circle near Atocha train station, not far from my house.

— Sue Burke

December 30, 2011

The Alhambra

My Christmas present was a trip to the Alhambra — my husband and I went on Tuesday and Wednesday.

More photos here:

http://www.facebook.com/media/set/?set=a.10150467668293611.373116.537088610&type=1&l=e4f9b9b9fb

— Sue Burke