Harry S. Dent Jr.'s Blog, page 149

June 13, 2015

Introducing “Project Premonition” – Stopping Deadly Virus Outbreaks at Their Source

To predict an outbreak before it even affects its first victim. It sounds impossible.

June 12, 2015

End of the Line! China and Germany Look Ready to Pop

The U.S. stock market has finally hit a speed bump after more than six years of a Fed- and QE-driven rally. The S&P 500 is up 232% since March of 2009 despite this unprecedented stimulus in the feeblest economic recovery in history.

But since late December 2014, U.S. stocks have gone nowhere as investors face some growing realities.

GDP, retail sales, production and exports are slowing.

The dollar’s sharp rise in recent years has crushed global exports.

Long term interest rates are rising consistently… what I call the beginning of the end of stimulus policies designed to keep rates low forever.

Meanwhile, in just six months Germany saw its key stock market, the DAX, rise nearly 50% from mid-October into early April.

Germany’s bubble has shot up 245% since March 2009 — greater than the U.S., despite its slower economy.

It won’t last!

As I’ve explained many times, starting last year Germany has the worst demographic trends of any country in the world lasting through 2022. It’s even worse than Japan’s demographic cliff in the 1990s!

There’s one reason Germany has held up as well as it has in the last year: the euro.

When the euro falls, German exports soar. Between April 2014 and March 2015 the euro fell 25%. Its long-term peak was in July 2008 at 1.60 dollars. It hit 1.05 in March — 34.5% lower!

Consider that Germany exports 50% of its GDP. That’s one of the highest ratios in the world.

Hence, the falling euro gives it a huge advantage. But the euro has barely budged for three months…

That explains why the DAX has fallen 10% since early April, which is when I believe it reached its long-term peak. When the next great crash hits, it’s likely to take the DAX down to its early 2009 low, at least — a 72% crash likely by early 2017.

But if Germany looks bad, there’s nothing short of “terrible” to say about China! China’s stock market makes Germany’s late-stage bubble look pathetic!

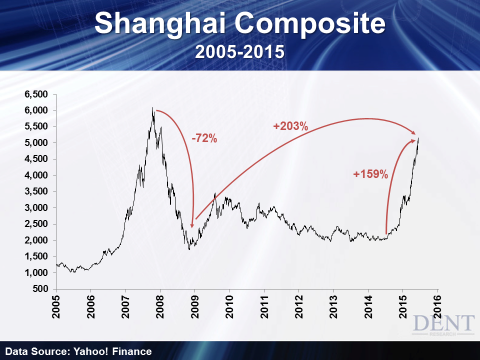

China saw the shortest and steepest bubble from early 2005 to late 2007, up over 500% in less than two years. Its crash into 2008 was one of the largest, down 72%.

After a “dead” market from 2010 into mid-2014, China’s stocks have literally exploded again… up 159% in a straight shot in one year while its economy and exports have continued to slow!

A 48% late-stage bubble in Germany unwarranted by its demographics… 159% in China despite its weakening economy.

What’s driving this mania?

The greatest real estate bubble in modern history just had the legs cut out from underneath it.

So in recent months, investors urgent to find new gains have suddenly piled into stocks.

Cities like Vancouver, Sydney, Melbourne, New York — they’ve all inflated to unnatural highs due to the baby boomers and wealthy Chinese desperate to get out of China.

Now that these cities are cracking, investors are speculating in stock markets — but not ours as the many visible headwinds facing the U.S. made foreign markets like Germany and China look like better deals.

This is the opposite of what happened in the early 2000s. As U.S. stocks crashed from March 2000 onward, investors jumped into real estate, creating a bubble into early 2006.

New trading accounts have skyrocketed since. Two-thirds belong to people that don’t have so much as a high school diploma.

Like I say, the dumb money always piles in right before the market crashes!

Just look at what happened last time. The great late-stage bubble came out of China right before the whole thing popped, and they crashed more than anybody. The exact same thing is happening again!

China’s bubble recently hit 5,500. It’s likely to go a bit higher, but I do not see the Shanghai Composite exceeding its 2007 all-time high of just over 6,000.

I’m expecting China to suffer an 83% crash likely by early 2017, to its 2005 lows near 1,000 — minimum!

The emergence of these late-stage bubbles while the world’s leading economies stall is the clearest sign yet that this global bubble is getting ready to burst.

Third Time’s The Charm for Investors? IPO Market Bubbling to New Highs

June 11, 2015

Tidying up the Student Loan Mess…but Who’s Paying?

The Bulls Are “Out of Shape!”

I enjoy exercising. I don’t see it as “work,” so much as a healthy release of pent-up energy, which I tend to acquire after sitting many hours at my desk.

Of course, like everybody, I’m not able to exercise every single day. And I’m not even sure that would be healthy. You can’t “be on” 100% of the time.

But like many things, I’ve learned there’s an important difference between a little rest… and too much rest. A two-day rest period allows for muscle repair and growth. A two-week rest period can lead to muscle deterioration (It’s a death sentence to motivation, too!).

I guess it’s the idea that “the dose makes the poison.”

Pondering this, I recently wondered the effect of “rest periods” during bull markets.

I think most reasonable investors understand that bull markets

June 10, 2015

The Stock Market, the Music Industry and the New Network Economy

Someone rings the bell at 9:30 a.m. and gets the hell out of the way. All types of chaos erupt from second-to-second. Everyone knows, in real-time, what they made or lost.

Users drive the system. Not management. Management’s nowhere to even be seen. It’s merged within the light-speed, low-cost software and processes that make the whole thing possible.

In short, stock exchanges are the ideal business model — the perfect example of how you must organize around the customer, or bust! It’s run from the bottom-up, not the top-down… It’s a real-life, real-time network!

Today, that’s even more critical. Why? Survival. Survival of the fittest, to be precise.

Recent statistics from the International Federation of the Phonographic Industry — the guys who push and promote the record industry worldwide — show that

30-Year Treasury Bond Yield Suffers From High Volatility

June 9, 2015

Will the IMF and Yuan Destroy the Dollar This October? Hardly

My inbox is filling up — again — with people asking about the collapse of the U.S. dollar in October.

The S&P 500 Is Pushing Its Limits!

June 8, 2015

The Housing Recovery’s a Big Fat Lie!

Most commentary on the housing markets — from the industry, from analysts, from the media — all give the impression that the housing crisis is well behind us. One economist in