Cosmo P. DeStefano's Blog, page 2

February 28, 2025

I Don't Know: The Key to Smarter Decisions

Early in my career, it seemed like every other question I was asked led to the same meek response: “I don’t know.” Damn, I felt dumb.

But over time, I realized that not knowing wasn’t a weakness—it was an opportunity. So, I expanded my response to eight words: 'I don’t know, but I’ll figure it out.'

Now, no matter the question, those eight words form the foundation of my entire decision-making process.

The absence of certainty

Everything you know, your entire knowledge base, is rooted in the past and every decision you face is about the future—an unknown and unknowable future. We live in an uncertain world.

Where will the stock market go from here?

Will I be able to retire early?

How will the stock price react to the news?

Will we have a recession soon?

As a result, every decision you make has some level of uncertainty, so the challenge investors take on is how to weigh the alternatives.

In general, successful investors are an extremely confident bunch. Their success, however, doesn’t come from knowing the answer but from continually asking questions and wrestling with the unknown.

‘The market hates uncertainty’ –not so fast

Every time volatility in the market picks up, or the geopolitical climate acts up, the financial ‘news’ outlets start talking about how “the market hates uncertainty.” That comment implies there are times when there is certainty about the future, which is obviously a nonstarter.

More accurately, market forecasters hate uncertainty—it makes their prognostication much more difficult. Successful investors, however, thrive on the uncertainty.

The fallacy behind uncertainty is that the market isn’t just occasionally subject to bouts of uncertainty, the market 100% runs on it.

For every buyer of a security, a seller is taking the opposite position, and both parties believe they are shrewd. If there were no uncertainty, there would be no one left to take the other side of the trade you want to pursue.

Thinking in ranges

Thinking in ranges is the foundation of probabilistic thinking. Instead of chasing one ‘right’ answer, you develop a range of reasonable outcomes, each with its own probability of occurring. A narrow range of likely possibilities will serve you far better than a single, precisely calculated but improbable prediction.

Improbable because with so many variables, and an unknown future, precision is an illusion. This shift in thinking reduces overconfidence and helps you navigate uncertainty more effectively.

You can make informed decisions, well-reasoned assumptions, and educated forecasts, but you still can’t know the future.

When you pause to acknowledge that your investment thesis might prove to be wrong, it will nudge you away from aggressive assumptions and shoddy due diligence and push you toward investments where the potential return is proportionate to the level of risk. Have a slice of humble pie; it will help you sleep better.

Confidence and probabilistic thinking

Practice intellectual humility which is the opposite of intellectual arrogance or conceit. In simple terms, having the ability to say, “I’m not sure” or “I don’t know” and then exploring ‘why not?’ is the great equalizer between overconfidence and indecisiveness.

When evaluating the risks around a decision, it’s important to look not only at your confidence in being right but also at the probability and consequences of being wrong. When formulating a decision or a plan, look at the complete frame. This middle ground where confidence and probability cross paths is where informed decisions are made.

In the early days of November 2016, the New York Times predicted that Hillary Clinton had an 85% chance of winning the US presidency. (Most news outlets had similar predictions.) When Donald Trump won, people were quick to point out that the political commentators got it wrong. But the commentators never said Clinton will win. In fact, the Times implicitly said that there was a 15% chance she would lose.

When judging others, it’s easier to choose between right and wrong than to analyze the opinion on a probability basis. No need to give it much thought. Right or wrong—that’s it. But most of our financial decisions are not so binary.

When you get away from thinking in absolutes, 100% right or 100% wrong, and start thinking in probabilities, you begin to contextualize the decision at hand. As a result, your decision process improves because your decisions are no longer simply about black or white, but about calibrating among all the shades of grey.

There’s a fine line between humility and hesitation

A healthy respect for uncertainty shouldn’t lead to analysis paralysis—where the fear of being wrong keeps you from making a decision at all. The goal isn’t to avoid uncertainty; it’s to recognize it, weigh the probabilities, and act with confidence.

Successful investors don’t wait for perfect information; they act based on well-reasoned assumptions and adapt as new information emerges.

Having doubts about your choice can be uncomfortable, but being certain is only fooling yourself

Yes, be confident in your decisions, but also recognize there are no guarantees. Probabilistic thinking will help you cope with the uncertainty and manage the risk.

I came to realize that (1) “I don’t know” is simply an acknowledgement that we live in an uncertain world, and (2) “But I’ll figure it out” is shorthand for evaluating a range of outcomes in the face of uncertainty, weighing the individual probabilities and making an informed decision.

Sometimes you’ll get your expected outcome and sometimes you’ll get an education. That’s the proverbial win-win.

Stay focused on balancing the probability that your investment thesis will be successful, with the financial and emotional cost of being wrong. Your financial journey will be happier and less stressful.

The next time you face a financial choice (or any decision), ask yourself: what’s the probability of different outcomes, and how will I adjust if things don’t go as planned?

Mastering uncertainty isn’t about having all the answers—it’s about knowing how to weigh the possibilities.

As always, invest often and wisely. Thank you for reading.

If you like this post, share it!

The content is for informational purposes only. It is not intended to be nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

Wealth Your Way is available on Amazon

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and posting your review of Wealth Your Way. Your review will help other readers explore their own path to financial freedom!

January 31, 2025

Boom, Bust, or Just a Breather? What’s Next for Stocks

Markets have been on a tear—racking up consecutive 20%+ years for only the third time in 75 years. But if history is any guide, outsized returns won’t last forever.

After periods of exceptional growth, markets tend to recalibrate—sometimes gradually, sometimes sharply. The real question isn’t whether the rally will continue, but whether your financial plan is built to withstand whatever comes next.

Some historical perspective

Before we look forward, let’s ground ourselves in some crucial market facts:

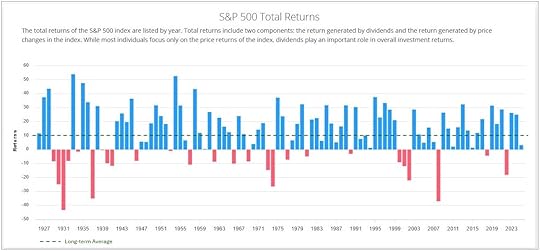

· The S&P 500 has averaged 10% annually since its 1957 inception.

· Individual years rarely deliver the average—only 5 out of the 68 years have landed in the 8-12% range.

· Returns have swung dramatically, from +43% (1958) to -37% (2008). That’s an 80-percentage point spread!

Think of stock market returns like a heart rate monitor. A perfectly steady line would signal trouble—it’s the peaks and valleys that show a healthy, functioning system. Each market cycle, like each heartbeat, has its own rhythm and velocity.

Understanding the 10% average: Not what you might think

The US stock market has a long history of delivering double-digit returns, but the famous 10% average can be misleading. Over nearly a century of market data—going back to 1928—large-cap stocks have indeed delivered a compound annual return of 10.06%.

But here’s what many investors overlook: unless current market returns are approximately equal to the long-term historical average, you shouldn’t expect to receive the average going forward.

In fact, as the current returns move away (whether up or down) from the long-term average, your expectations of future returns should move as well, in the opposite direction! This principle, known as ‘reversion to the mean’ (colloquially: return to normal levels), has been as reliable as gravity in the financial markets.

[Source: Slickcharts]

Recent performance vs. historical norms

Consider this striking contrast:

· From the 2009 market bottom through 2024, the S&P 500 delivered a compounded annual return of 15.2%—a full 50% higher than the long-term average.

· If we assume that the 100-year average remains consistent, simple math suggests this pace is unlikely to continue.

Reversion to the mean pulls averages toward their long-term trend line. But the timing of that reversion is anyone’s guess. Will this 15-year run continue into years 16, 17, etc. or might the reversion begin in 2025?

Investors tend to have short memories. Remember the “Lost Decade” of 2000-2009? Investors endured an annualized return of negative 0.95%, a slow and insidious decline over the ten years.

The analysts weigh in

· Goldman Sachs: Brace yourself—expect just 3% annual returns over the next decade. Their reasoning? The market’s current high valuation starting point. Historically, high valuations lead to below-average future returns (i.e., reversion to the mean).

· A slightly more optimistic view comes from JP Morgan which forecasts US large-cap equities growing at 6.7% over the next 10-15 years, thanks to AI-driven productivity gains.

· Some analysts believe, however, that these long-term forecasts might not be optimistic enough. Yardeni Research thinks “the US economy is in a Roaring 2020s productivity growth boom.” They expect the S&P 500’s average return for the next decade to be “more like 11%.”

Making your portfolio future-ready

How can you prepare for potentially lower returns? Consider these action steps:

1. Review Your Expectations

Are your financial plans based on realistic return assumptions?

Could your portfolio withstand several years of below-average returns?

2. Assess Your Risk Tolerance

If you're nearing retirement, consider reducing portfolio risk.

Ensure your asset allocation matches your current life stage.

3. Build in Safety Margins

Plan for returns below the historical average.

Maintain adequate cash reserves for near-term needs.

As we discussed in Winning the Long Game, being a successful investor requires discipline, patience, and the knowledge that what rockets up is likely to slow down or come down.

Rather than constantly chasing a better investment, put some of that attention on being a better investor. You’ll likely grow more wealth and cause less heartache over the long term.

Final thought: are you prepared?

Are you prepared for lower returns or are you letting recent gains lull you into complacency?

The market doesn’t care about the analysts’ or your expectations. Your financial plan needs to withstand all seasons, not just the sunny ones.

Trees don’t grow to the clouds. What soars eventually slows. A little conservatism in your return assumptions won’t just protect your portfolio, it will help you sleep better.

As always, invest often and wisely. Thank you for reading.

If you like this post, share it!

The content is for informational purposes only. It is not intended to be nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

Wealth Your Way is available on Amazon

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and posting your review of Wealth Your Way. Your review will help other readers explore their own path to financial freedom!

December 20, 2024

Are Your Financially Literate? 3 Simple Questions

Understanding money is a skill everyone needs, yet too many people struggle with the basics. While the financial world is continuously growing and evolving, our collective grasp of it is not.

Alarming statistics from the World Economic Forum reveal a significant number of U.S. and EU adults are financially illiterate.

Subscribe for free to receive new posts and support my work.

To measure and improve financial understanding, two researchers developed three deceptively simple questions known in financial circles as the “Big Three.” For two decades, these questions have been asked across dozens of countries, offering insights into global financial literacy—and revealing the gaps we need to close.

The Big Three

1. Suppose you had $100 in a savings account and the interest rate was 2% per year. After 5 years, how much do you think you would have in the account if you left the money to grow?

a. More than $102

b. Exactly $102

c. Less than $102

d. Don’t know

e. Refuse to answer

2. Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After one year, how much would you be able to buy with the money in this account?

a. More than today

b. Exactly the same as today

c. Less than today

d. Don’t know

e. Refuse to answer

3. Do you think the following statement is true or false? Buying a single company’s stock usually provides a safer return than a stock mutual fund.

a. True

b. False

c. Don’t know

d. Refuse to answer

Answering these questions does not require difficult calculations but rather a basic understanding of the language of finance. If you’re a regular reader of Wealth Your Way Insights, you likely know the correct answers are a, c, and b.

These simple yet powerful questions focus on key concepts—interest, inflation, and diversification—that are essential for making informed financial decisions.

According to the research results, however, financial literacy is strikingly low in the U.S. with less than half (43%) of respondents answering all three questions correctly. This is consistent across the globe. Overall, only half or less of the population in most countries is knowledgeable about the basic concepts covered in the “Big Three.”

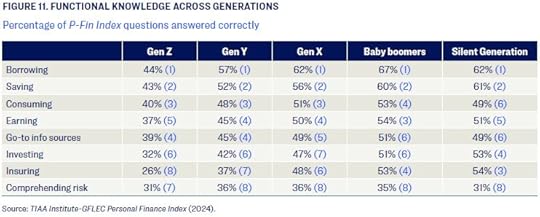

Stratifying by age group, the young (age 18-29) display the lowest financial literacy, with only one-third able to answer all three questions correctly. This is troubling, as many are making important financial decisions about student loans, managing credit card debt, buying or renting a home, and investing for retirement, all with far-reaching implications.

Are you surprised by the results for the young group? Well, the results for older folks are not much more encouraging. Only half (51%) of the 50-59 age group answered all three correctly, 43% for ages 40-49, and just 39% for ages 30-39.

More complex studies (like the P-Fin Index) have confirmed the findings of the Big Three, specifically that low financial literacy is intergenerational, and risk management is what people understand the least.

Extra credit

Although not tested as extensively, the following two questions have been added to the original three and all together are known as…wait for it…the “Big Five.”

4. A 15-year mortgage typically requires higher monthly payments than a 30-year mortgage, but the total interest paid over the life of the loan will be less.

a. True

b. False

c. Don’t know

d. Prefer not to say

5. If interest rates rise, what will typically happen to bond prices?

a. They will rise

b. They will fall

c. They will stay the same

d. There is no relationship between bond prices and the interest rate

e. Don’t know

f. Prefer not to say

Two-thirds of respondents knew the answer to the mortgage question was true. For the bond question, 75% of respondents got it wrong. (Correct answer: b).

Take back your time (employers take notice)

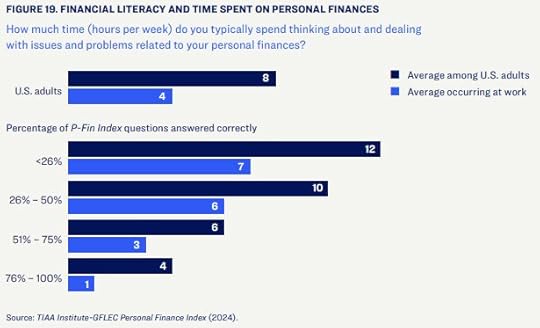

In the U.S., the most financially literate spend 4 hours per week thinking about and dealing with money issues and problems. At the other end of the spectrum, the least financially literate spend 12 hours per week, and 7 of those 12 are spent in the workplace (the equivalent of almost an entire workday every week).

Education is key

Around the globe, the need to improve financial literacy is gaining momentum. Denmark already has mandatory financial education for students aged 13-15, covering budgeting, saving, banking, consumer rights and more, while the UK has incorporated it into its national curriculum.

In the U.S., more than 90% of states incorporate elements of financial literacy into school curricula, but still, only half require students to complete a financial literacy course to graduate.

In 2020, Finland launched a national strategy for financial literacy setting the objective to have the world’s best financial literacy by 2030.

Your financial future starts with small steps today

The good news is you don’t need a national strategy, but you do need a personal one. Have a life plan, be motivated and self-driven. Take an interest in personal finance. You don’t need to be a financial whiz kid, but you should be motivated to learn, and fully aware of the responsibilities that accumulating and managing money require.

Money is deeply influential in almost every aspect of your life, and you likely spend over 2,000 hours each year working to earn more of it. So, ask yourself one last question: Do you spend more time clicking “like” than understanding your finances?

Enjoy today but also make a little time for educating future-you.

As always, invest often and wisely. Thank you for reading.

If you like this post, share it!

The content is for informational purposes only. It is not intended to be nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

Wealth Your Way is available on Amazon

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and posting your review of Wealth Your Way. Your review will help other readers explore their own path to wealth!

Subscribe for free to receive new posts and support my work.

November 22, 2024

Finish Strong: Your 2024 Year-End Financial Tune-Up

Planning for prosperity

With 2025 just around the corner, now is the perfect time to hit “pause” and take stock of your financial journey. Think about where your money went this year and how it aligned with your values and goals. Did your spending reflect what truly matters to you?

Maybe you tackled a home improvement project, splurged on a once-in-a-lifetime vacation, or prioritized saving for your child’s education. Were those choices part of the plan, or did they happen on the fly? Did you stick to your budget—or did it slip through your fingers?

This is also a moment to reflect on the big life changes that may have shifted your financial picture. A new baby, a career move, or retirement can reshape your priorities and demand a fresh look at your strategy.

If you don’t have a plan yet, no worries—it’s never too late to start. Whether you’re stretching every dollar or enjoying a financial surplus, crafting a plan gives you clarity and control. It’s about aligning your spending with your goals for the year ahead and your vision for the future.

Here’s the thing: true financial freedom isn’t about chasing an ever-elusive number. It’s about understanding and defining enough. And without clear goals and a thoughtful plan, figuring out what “enough” means for you is exponentially harder.

So, as the New Year approaches, why not take this opportunity to plan for your prosperity? The path to financial freedom starts with reflection, intention, and action.

Just. get. started.

Check-in on your investments

· Replenish your emergency fund

If you tapped into your emergency fund during the year, it is a good time to refill it, or if you don’t have an emergency fund, start one. Having these funds at the ready can help you cover surprise expenses, such as car repairs or medical expenses, without relying on high-interest credit cards or selling long-term investments.

Is your cash working for you? Borrowing rates remain stubbornly high while savings rates have decreased slightly. But with today’s money market funds and CDs still paying 4%+, your cash can provide not only an emergency cushion but a reasonable return as well.

· Top off retirement contributions

If your financial situation allows, it may be a good idea to increase your contributions to your retirement account(s). This can be a good annual practice until you’re contributing the maximum amount allowable to an IRA, 401(k), 403(b), or their Roth counterparts.

For example, if you have access to a 401(k) through your employer, you’ll have until the end of the year to contribute up to the $23,000 limit for 2024. People above the age of 50 can make additional catch-up contributions of up to $7,500 for a total of $30,500.

If you have a health savings account (HSA), consider maxing out that contribution as well--$4,150 for an individual ($5,150 if age 55 or older) and $8,300 for a family ($9,300 if age 55 or older).

Whether you use the HSA for long-term saving or near-term spending, it is triple tax-advantaged: Funding is tax deductible, growth isn’t taxed, and withdrawals are tax-free if spent on qualified medical expenses.

[Pro-tip: If you are a prodigious accumulator of wealth, most HSA plans have investment alternatives, but research has found that only 12% of account holders invest in assets other than cash. Explore your options.]

Tax planning strategies for high-income earners

· Consider a mega-backdoor Roth conversion…or its smaller cousin

This tax planning strategy potentially allows high-income earners to put away even more in a Roth account by sidestepping the income limits of a Roth IRA and the tax consequences of a regular Roth conversion. If permitted by your workplace retirement plan, you would first max out your normal 401(k) contributions then contribute after-tax dollars up to the 2024 overall account limit (including employer matches) of $69,000 ($76,500 if 50 or older). You’ll want to rollover these funds (“in-service distribution”) as quickly as possible to a Roth 401(k) or to a Roth IRA to minimize any tax on investment returns.

If your employer-sponsored retirement plan doesn’t allow both (a) after-tax contributions, and (b) “in-service distributions” for the mega-backdoor Roth, you could consider the smaller version, known simply as a backdoor Roth. With this strategy, you contribute after-tax dollars (up to $7,000; or $8,000 if age 50 or older) to your traditional IRA and then immediately convert it to a Roth IRA. (Caveat: if you have any traditional IRAs with a previous balance, this gets more complicated and could trigger a tax liability on the conversion.)

[Pro-tip: A little short of cash during the year-end holidays? Use the IRA extension. You can contribute to your IRA through the tax filing deadline next year and it will count towards the previous year. That is, up until April 15, 2025, you can designate an IRA contribution as counting against the limit for tax year 2024 or 2025.]

· Tax-loss harvesting

As you are plotting year-end moves, inevitably you will hear about investors considering tax-loss harvesting in their taxable brokerage accounts. “Harvesting” refers to the selling of investments at a loss to offset capital gains from other investments. You then use the sale proceeds to buy a different investment so overall you stay invested in the market. The last point is critical—it’s what distinguishes the harvesting strategy from market timing.

[Pro-tip: Harvesting can help minimize taxes but be mindful of something called a “wash sale.” The IRS is fine with you selling at a loss, but it doesn’t like it when you sell at a loss and then quickly buy back the same investment (or a ‘substantially identical’ investment). In fact, buying back the investment within 61-days (beginning 30 days before the sale and ending 30 days after the sale), can trigger a wash sale and defer the loss.]

It’s also a good time to pause and reflect on the premise of this strategy. Harvesting implies you have losses to be harvested. With the markets once again approaching all-time highs, why do you have underwater investments in the first place?

Think about it. If you had been purchasing “the market” (e.g., an S&P 500 ETF or similar broad-based index funds), then you would not have a significant loss on your fund shares since the market is approaching its highest level now!

This means that losses you do have are likely in your individual stock selections. This is just a friendly reminder that picking individual stock winners is difficult (even for professionals) and a humbling experience.

Charitable giving

· Bunch your donations

If you plan to donate the same amount of money each year, consider “bunching” the donations into a single year. This could increase your potential itemized deduction for that year.

· Donate appreciated assets

If you have large unrealized capital gains, rather than selling and donating the cash, consider donating the appreciated assets. If you itemize, you can deduct the full fair market value of the appreciated assets, and you won’t need to report the gain as taxable income.

[Pro tip: For large gifts, consider using a donor-advised fund to spread out the giving while simultaneously taking advantage of “bunching.”]

Block out the noise

This month the ‘news’ stories will start to appear touting the “best-performing investments of 2024.” Making portfolio decisions based on headlines is like buying a house based on the color of the front door.

Don’t chase the hot hand, the hot stock, the hot story. Stay calm and remain cool. Have faith in your planning process.

Don’t be too quick to jump into the high flyers or dump the underperforming ones. Twelve months seems like a long time but with investing, that’s a short look. Often, today’s shooting stars become tomorrow’s laggards and vice versa. There are good reasons for changing between investments but chasing performance isn’t one of them.

Some of the above strategies can be tricky, so consider speaking with a professional.

Above all, remember that investing is a tool, not a plan.

Review (or create) your financial plan, make any necessary adjustments, and then get back to living your best life now.

As always, invest often and wisely. Thank you for reading.

If you like this post, share it!

Want a Chance to Win Wealth Your Way?

Click here to enter the Goodreads Giveaway for a free Kindle copy of my book! Contest ends 11/30/24.

The content is for informational purposes only. It is not intended to be nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

November 1, 2024

10 Habits for a Richer, Happier Life

I traveled the road to financial freedom, but it wasn’t a weekend trip. I didn’t get here by winning the lottery, selling books, or writing viral posts. Nope, I did it walking the same long, winding, and sometimes dimly lit path you’re on. Here’s my flashlight.

1. Take stock or stay stuck.

Get control of your income and expenditures. Understand all your sources of income and where that cash is going. If you don’t know where your last dollar went, it’s tough to plan where your next dollar will go.

To achieve any measure of wealth, you need to understand and internalize this one simple rule: spend less than you make.

Saving cash every month is how you get wealthier. Spending more than you earn makes you poorer. Break the cycle of living paycheck to paycheck by saving cash early and continuously.

2. Make a plan or make excuses.

Develop a robust and dynamic planning process covering life’s accumulation and withdrawal stages. Your plan needs to be purpose-built and goals-driven.

What gets measured, gets done.

Your life evolves and adapts and so too, should your plan. Periodically review progress and make needed course corrections focusing on key drivers: contributions, withdrawals, realistic goals, investment selection, and following a dynamic planning process.

Whether you develop the plan on your own or with the assistance of an advisor, you need to understand it and take responsibility for its path to financial independence.

No one will care about your money as much as you do.

3. Use debt wisely—don’t let it use you.

Debt is neither bad nor good but rather a powerful tool that comes at a cost you should respect. Paying interest is nothing more than giving the lender your money in exchange for temporarily borrowing their money.

If your goal is to accumulate wealth, avoid giving your money to other people whenever possible.

Just like a chainsaw or a bottle of bourbon, debt is a powerful tool. Used carefully and judiciously, it can make your life easier and amplify positive returns. If used indiscriminately, debt can undermine your decision-making or worse, wipe out your investment portfolio.

Those who understand interest earn it. Those who don’t, pay it.

4. Don’t just save, invest.

The discipline of saving and investing every month puts compounding on your side while limiting the impact of emotional decisions during periods of market volatility.

Let the power of compounding portfolio growth do the heavy lifting—without interruption.

You don’t need to be a mystical stock picker. For the core of your portfolio consider low-cost, broad-based index funds. Vanguard’s Total Stock Market ETF (VTI) or S&P 500 ETF (VOO) is a good place to start your search.

5. Don’t speculate.

Investors need to remain mindful of company fundamentals, and cautious of blindly following a fluffy narrative and the crowd to dizzying heights. Investing is probability-based. Speculating is gambling.

But if you can’t resist the urge to have some “play money” in the stock market, keep it to no more than 10% of your portfolio. And good luck.

6. Skill pays, luck strays.

There are a lot of folks who have knowledge and years of experience but who fail to recognize the difference between quality decisions and simple luck. Or worse, they continually believe their decision-making skills are superior and their less-than-stellar track record is attributable to just bad luck. Appreciate the difference and focus on what you can control.

The amount of your monthly contributions and monthly withdrawals are the two most important factors in your financial planning, and both are completely within your control. Bull and bear markets are luck of the draw.

7. Block out the noise.

Nothing undermines rational financial planning and investing behavior more than the relentless onslaught of media noise. In fact, the World Economic Forum’s 2024 Global Risk Report identified misinformation and disinformation as the most severe short-term risk the world faces.

The daily barrage of “breaking news” is not generally relevant to a long-term investment plan. Because of the sheer volume of market data and the tendency of social media to spread misinformation, it’s essential you have faith in your planning process and stick to it.

Don’t chase the hot hand, the hot stock, the hot story. Stay calm and remain cool.

8. Seek out wisdom.

Read, learn, and discuss with those you trust. A study of 1,200 wealthy individuals noticed one trait the rich all have in common: They self-educate by reading. “The middle class reads novels, tabloids, and entertainment magazines. Rich people would rather be educated than entertained.”

We can learn from our own mistakes, but I can attest to the fact that learning from the mistakes of others is less expensive.

Read and learn from those who have already traveled the road that lies ahead of you. Develop your own informed perspective and do not forget the lessons history has taught us.

9. Recognize there are only seven ways to get rich (Don’t pick #3!)

1. Inherit money

2. Marry money

3. Steal money

4. Leverage a unique talent

5. Get extraordinarily lucky

6. Own or run a successful business

7. Spend less than you make and invest wisely for the long-term

The first six ways are rare, often unreliable, and at least one of them will land you in jail.

Follow number seven, and you’re destined to eventually become wealthy.

10. Enjoy the journey.

Life is not a dress rehearsal: there is no do-over. Considering both current-you and future-you, decide what truly makes you happy and then spend – or save – accordingly.

Balance today’s joy with tomorrow’s freedom.

You can look wealthy or be wealthy, but you probably won’t be around long enough to achieve both. So regardless of who might be watching, every now and then get up and dance.

As always, invest often and wisely. Thank you for reading.

The content is for informational purposes only. It is not intended to be nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

Want a Chance to Win Wealth Your Way?

Click here to enter the Goodreads Giveaway for a free Kindle copy of my book! Contest ends 11/30/24.

Wealth Your Way is available on Amazon

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and posting your review of Wealth Your Way. Your review will help other readers explore their own path to wealth!

October 4, 2024

Four Signs It’s Time to Sell a Stock

When it comes to investing, much of the focus is often placed on finding the right stocks to buy. However, knowing when and why to sell a stock is just as critical to achieving long-term financial success.

A well-thought-out strategy for selling investments can help you optimize your portfolio, minimize risks, and ensure your financial goals remain on track.

Here are four factors that an investor should consider when determining “when” and “why” it’s time to sell a stock.

1. Your investment thesis has changed.

As all good investors do, you buy each stock in your portfolio after performing your due diligence, weighing the pros and cons, and evaluating the potential upsides. Has that view changed for one or more of them?

Many factors can drive a change in your investment thesis, so keep watch on the company’s fundamentals. Maybe the company has lost its competitive advantage (Netscape, Yahoo); maybe demand for its products is waning (Kodak, Polaroid); maybe its technology is becoming obsolete (Blackberry, Motorola); maybe its business model is failing to innovate (Blockbuster, Tower Records), etc. The list goes on.

If the upside from your original thesis looks to be slowing or has disappeared altogether, it’s likely that stock is a candidate for selling so you can redeploy that capital into a different investment.

2. Opportunities look brighter elsewhere.

Every time you invest in a stock, you're making a choice that excludes other investment opportunities. This choice represents an opportunity cost, or the potential benefits you miss by choosing one stock over another. As you evaluate your current holding, consider whether its prospects remain compelling enough to continue forgoing other promising investments.

Given that your investment capital is limited, even a well-performing stock might not be the optimal use of your cash if better opportunities arise elsewhere. If your current investment’s outlook starts to fade in comparison to alternative options, it might be wise to sell and reallocate your capital to where it can work harder for you.

3. You need access to your capital.

The whole point of having an investment portfolio is to build wealth so that it will be available to provide cash when you need it. If that time has come (or will arrive soon), and you need more cash than is available in your checking account and other liquid assets, it could be time to sell.

It’s generally not a good idea to invest in the stock market with money you expect to need in the next year or two. Being forced to sell in a down market to raise cash is not a fun experience. Sell on terms dictated by you, not the market.

4. Market conditions are causing you to lose sleep.

For the long-term investor, I don’t consider market volatility a good reason to sell stocks. I do believe, however, that volatility combined with your temperament needs to be considered in your dynamic financial plan.

Are you comfortable with your level of stock market exposure? What if the market were to drop 30%? If the decline would create anxiety and keep you up at night, then you likely have too much of your portfolio in stocks. Whether this overallocation is a result of strong stock returns or simply putting too much new money into stocks, you should revisit your overall plan and, if you so choose, rebalance your portfolio by selling some of your stock allocation.

There is some wisdom in the investing adage “sell down to the sleeping point,” especially if you are in or near retirement.

Selling winners or losers?

If after completing your diligence and financial plan review, you determine you need to sell some stocks, but none in particular stands out, how do you choose which ones to ax?

Here’s a shortcut you have likely heard or followed in the past: “I’m not happy with this stock’s performance. It’s a loser, so I’m going to sell it.” It’s an easy decision, but not necessarily the best one.

When we label a stock as either a “winner” or a “loser,” we likely made that determination based on the investment’s past performance. But as we know from the ubiquitous disclaimer: Past performance is not a guarantee of future results.

It’s helpful to shift your perspective. Rather than evaluating based solely on past performance, layer on its prospects for delivering results going forward. How we got to today’s stock price is important, but where its value is going tomorrow is what matters most.

You’ll want to stick with the ones with the most upside potential, regardless of their label as a winner-to-date or loser-to-date. Those with less potential going forward are your candidates for selling.

Keep this in mind

A few words of caution: You should never sell a stock without first considering the tax ramifications of the proposed sale. Never make buy or sell decisions in a vacuum.

Selling a stock is a significant decision that requires careful consideration of various factors, from your need for liquidity to changes in your investment thesis. By approaching the sale of stock with the same diligence and strategic thinking you use when making a purchase, you can ensure that your actions align with your goals and financial plan.

Remember, the decision to sell should be informed by where the stock is likely headed, not just where it’s been. Ultimately, a well-planned approach to selling stocks can help you maintain a balanced, resilient portfolio that supports your journey to financial independence.

In an old Kenny Rogers song, The Gambler, he sings about poker and life. The lyrics ring true for investors as well:

You've got to know when to hold 'em

Know when to fold 'em

Know when to walk away

And know when to run

As always, invest often and wisely. Thank you for reading.

The content is for informational purposes only. It is not intended to be nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

Wealth Your Way is available on Amazon

The best way to spread the word about a book you enjoyed is to leave an honest review. Click here to post your review of Wealth Your Way. Thank you for taking the time to help other readers explore their own path to wealth!

September 6, 2024

Looking for a Great Read?

National Read a Book Day encourages people to step away from the hustle and dive into a good book. Though it's celebrated on just one day—September 6—reading is a habit that can enrich your life every day.

Looking for a great read? I’ve handpicked a collection of books that resonated with me and influenced my thinking on building, managing, and enjoying wealth. I'm confident you'll discover at least a few that speak to you.👇

For future reference, the list will be periodically updated and maintained on my Substack (see the “Bookshelf” tab on the top of my homepage). Happy National Read a Book Day!

As always, invest often and wisely. Thank you for reading.

August 2, 2024

Four Steps to Secure Your Retirement Income

This is part three of a three-part series that takes a look at planning for retirement during the “fragile decade” — the five years before you retire plus the first five years of your retirement. Part one is In Retirement Planning, Consider the Entire Journey. Part two is Goals-Based Retirement Planning Is All About You.

When it comes to withdrawing from your portfolio, many retirees fear that their cash flow might run out before they do. As illustrated in part one of this series, relying on stock sales to meet retirement expenses can be risky, especially during a market downturn early in retirement.

How can we leverage the insights from parts one and two to safeguard our retirement cash flow? Here are four actionable steps to consider.

1. Redefine and reframe your principal risk.

Price volatility is a popular measure of risk but not a great one for retirement planning. Volatility on its own is simply a probability statistic (and hence why it’s described with technical terms such as alpha, beta, R-squared, and the Sharpe ratio).

For our financial planning purposes, volatility needs to be linked with a consequence to provide a practical measure of risk. For example, the fundamental risk in your portfolio is not having the cash available when you need it to meet your spending needs. In measuring your success, your personal monthly spending need is your ultimate yardstick and the only benchmark that matters.

If an adviser says to you (or you tell yourself) that you beat the market last year, your response should be, that’s an interesting factoid, but underperforming the market is not a risk I worry about. Much more importantly, where am I relative to my financial goals? And do I need to course-correct?

2. Utilize a goals-based safety-first strategy.

With a more practical and fundamental definition of risk, it’s time to let your financial goals guide your planning and investing, not simply your risk tolerance. Match your assets and income with future liabilities and spending.

The premise of our goals-based safety-first strategy is to rely as little as possible on the sale of stocks to cover basic needs, especially when the stock market is falling. Your primary objective during the withdrawal stage is not to maximize investment returns but rather to meet your spending needs.

3. Be conservative with your withdrawal rate.

Lower your projected withdrawal rate in your modeling to account for the sequence of return risk (that is, the risk that you start withdrawing during a bad stretch of market returns). Financial author William Bernstein calculated that a particularly bad sequence of returns can penalize your safe withdrawal amount by about 1.5 to 2 percentage points.

So, for example, if you are projecting a 5% withdrawal rate, consider lowering that estimate to an amount closer to 3% to 3.5% to provide a cushion against “bad” market returns in the early years of the withdrawal stage. This may also lead you to conclude that you need to make other course corrections — for example, targeting a larger portfolio balance on your retirement date than you originally assumed. Simply put, plan to spend less and save more.

4. Maintain a cash reserve.

As you approach your retirement date, have a cash cushion. Keep three to five years of spending needs out of the stock market and in cash. Since you hopefully won’t need to sell and withdraw from the equity portion of the portfolio if the market is declining, you avoid the negative compounding effects we saw illustrated in part one. (Remember, compounding works with you during the accumulation stage and against you in the withdrawal stage.) And as the market eventually recovers, you can then sell some of your equity investments to replenish your cash reserve.

Three to five years of cash is my personal comfort zone. What do others say? Author and investor Darrow Kirkpatrick found that the S&P 500 recovers from declines, on average, in about three years. For business cycle declines going back to the 1800s, it’s about five years. Citing research by Wade Pfau, Kirkpatrick notes that worst-case real stock market losses of greater than 50% take, on average, nine years to recover.

Based on Kirkpatrick’s findings, on a worst-case basis, you might consider having upwards of 10 years of spending needs in cash, plus potentially more in other conservative investments.

Take as little risk as you need

The above suggestions are but four considerations as you make personal course corrections to your robust financial plan. And each suggestion is based on the same common theme: Build your financial plan with a margin of safety.

One thing is for sure, your plan will prove to be wrong. You may do worse than planned, or even better, but the distant future will not equal the number in today’s precisely calculated but improbable spreadsheet. Improbable because with so many variables, and an unknown future, precision is an illusion. Leave room in your plan for this inevitable drift.

My primary message is this: Make sure to reconcile cash withdrawal plans with what your modeling and current market conditions indicate you can support—including a margin of safety.

In other words, as you plan for the withdrawal stage, don’t take as much risk as you can tolerate; take as little risk as you need.

With a focus on safety first to cover basic spending needs and the right balance of liquidity, the fragile decade can be a lot less frail.

As always, invest often and wisely. Thank you for reading.

The content is for informational purposes only. It is not intended to be, nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

July 26, 2024

Goals-Based Retirement Planning Is All About You

Note: This is part two of a three-part series that takes a look at planning for retirement during the “fragile decade” — the five years before you retire plus the first five years of your retirement. Part one is In Retirement Planning, Consider the Entire Journey.

In part one of this series, we discussed how a prolonged downturn in the market during the fragile decade can derail withdrawal plans. The conventional approach to managing through market declines and loss years is to take the long view, keep investing, and rely on long-term averages to eventually help the portfolio recover.

This approach can work well when you are younger and have salary income and decades to ride out the storm before taking withdrawals. For those of us near or in the fragile decade, the long view may not be the optimal course of action, or worse, it could be downright devastating, as we saw in part one.

As you approach your retirement date, you should have a more accurately defined and refined list of spending needs. As a result, this is when your investment strategy can (and likely will) diverge from the accumulation stage.

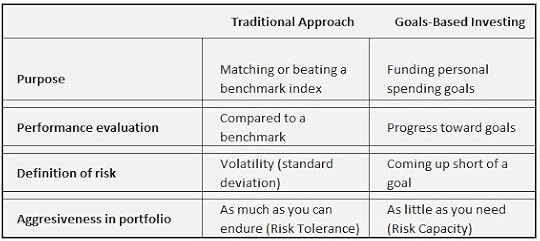

A lot of the investing concepts we discuss for the accumulation stage (and are put forth by financial advisers) are grounded in Modern Portfolio Theory (MPT), which seeks to optimize market returns and risk by asset class. Simply stated, as you invest for the long term, get as much of a return as you can, given your level of risk tolerance.

Harry Markowitz introduced the world to MPT in 1952, and his principles have influenced generations of financial thinking. In 1990, Markowitz shared the Nobel Memorial Prize in Economic Sciences for his efforts around MPT.

Finding this optimal balance of return and risk is what Markowitz describes as investing along the efficient frontier. MPT has been successfully used for decades by institutions such as endowments, pension plans and large trust funds, etc. The traditional approach to retirement planning has taken the principles of MPT and adapted them to individual investors.

But here’s the rub: Large institutions, like endowments, have an infinite time horizon without a fragile decade. Institutions are effectively in a perpetual accumulation stage. They do not need to plan for and manage through a significant and finite withdrawal stage, but you do.

“If you want something you’ve never had, you must be willing to do something you’ve never done.” — Thomas Jefferson

Enter goals-based planning. With origins going back decades, goals-based planning gained in popularity after the 2008-2009 financial crisis. It seeks to refocus our goals away from obtaining abstract market return rates and toward meeting specific personal goals (e.g., our monthly spending needs).

As such, we should similarly reframe our risk profile, moving away from focusing on the volatility of market prices. We should describe our risk in a much more personal way: Our principal risk is the chance that we fall short of our spending goals.

A goals-based approach to planning can help make the risk more tangible. We take measured, personally defined risks and don’t endlessly ponder esoteric risks (such as standard deviation, alpha, beta, R-squared and the Sharpe ratio). Goals-based planning is focused on optimizing a limited pool of financial assets by matching assets and income with future liabilities and expenses (i.e., future spending needs).

If, for example, you can meet all your cash flow needs with a 5% return, then why take on a greater risk of loss to try to achieve a higher return? Why risk losing what you have and need to chase what you don’t have and don’t need? Learn to be comfortable with having enough.

Your goals, not just your risk tolerance, should drive investing decisions. During the withdrawal stage, income and capital preservation become much more important than stretching for outsized returns.

Under the umbrella of goals-based planning, the idea of a safety-first strategy has evolved. Briefly, a goals-based safety-first strategy looks at your spending goals in two broad buckets. The first, the safe bucket, seeks to cover your basic financial needs (e.g., housing, food, health care, emergency fund, etc.) with assets invested with as little risk as possible (the safety-first component).

Safety-first investments to consider

To start, you might think of safety-first investments such as bank CDs, money market funds, short-duration government bonds and bond ladders, etc. But don’t lose sight of other financial resources you might have beyond cash and bonds that could also provide safety-first withdrawals. For example, Social Security, a pension, rental income from real estate, income annuities, and insurance products. The key is to build a stream of income that will cover your basic needs regardless of a declining stock market.

Once this safety-first basket is secure, you can then put the remainder of your portfolio in the second or aggressive bucket, to cover discretionary spending (wants), which can be invested as aggressively (or conservatively) as you see fit. When your basic needs are met, you can decide how much risk you want to take to achieve your aspirational wants — those items that would be nice to have (more frequent vacations, etc.), but in a falling stock market, you could do without.

In part three of this series, we’ll offer up some specific ideas for mitigating the impact of sequence of returns risk and protecting the retirement cash flow you have diligently worked to achieve.

As always, invest often and wisely. Thank you for reading.

The content is for informational purposes only. It is not intended to be, nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

July 19, 2024

In Retirement Planning, Consider the Entire Journey

Note: This is part one of a three-part series that takes a look at planning for retirement during the “fragile decade.”

The fragile decade is the wonderfully exhilarating time that spans the last five years of working and the first five years of retirement. It’s also the period that could blow up your whole retirement plan.

If you have not yet reached your fragile decade, pay even closer attention, because this is a glimpse into your financial future — a future that you can be better prepared to take on when it arrives faster than you can imagine.

Think about mountain climbing. The journey begins with careful planning for the ascent up the mountain to eventually attain the summit. But mountain climbing isn’t only about standing on the peak, it’s also about getting back down safely. Mountain climbers often say that planning and executing the descent is more involved and difficult than the journey up.

And just like mountain climbing, both stages of our financial plan, the ascent (accumulation) and descent (withdrawal), are best executed when planned out before ever stepping foot on the mountain.

Some investors are obsessively focused on the ascent — accumulating wealth, getting to the peak, and triumphantly quitting their job. But recognize this: We must plan for not only getting to the withdrawal stage but also getting through it.

The goal of your investment portfolio isn’t to build the tallest mountain of assets, but to provide you with an acceptable monthly cash flow that you won’t outlive — a comfortable, stress-reduced walk around and down the mountain.

Once you’ve won the game, stop playing

Please notice that nowhere in this goal do we talk about beating the market. As you approach your fragile decade and put your focus on covering your monthly expenses, you should realize that success is best measured by meeting your goals, not beating some arbitrary market benchmark.

But ignoring those around you isn’t always easy. As John Pierpont Morgan once observed, “Nothing so undermines your financial judgment as the sight of your neighbor getting rich.” So, hang tough and continually remind yourself: Don’t try to keep up with the Joneses or beat the market. Take a deep breath and realize the only person you need to beat tomorrow is the person you are today. True financial freedom is having enough.

“Markets can remain irrational longer than you and I can remain solvent.” −A. Garry Shilling

One of the most significant reasons that the fragile decade can be so perilous is the effects of sequence risk. This is the danger that the order (i.e. sequence) of market returns will have a material negative impact on your planned withdrawals. Why? Because compound interest works with you during the accumulation stage and against you in the withdrawal stage. Let’s look at a simple example to explain the math.

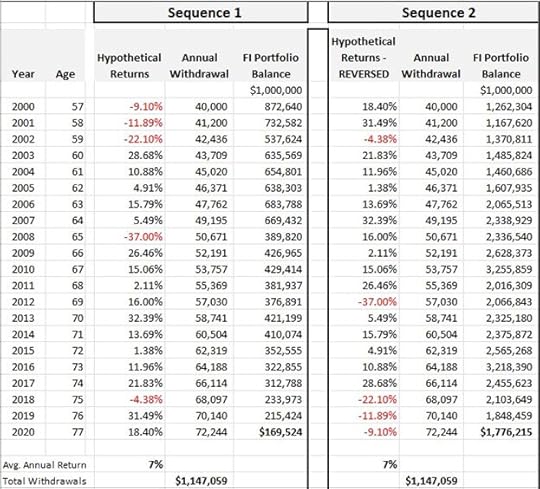

Assume you retired at age 57 with $1 million at the beginning of 2000. You started with an annual withdrawal of 4% of your portfolio ($40,000), which you increased each year by 3% because of inflation. Sequence 1 in the below chart shows that by 2020, at 77 years young, you would have enough to cover just two more years of withdrawals (and this assumes you had no unexpected expenses over the 20 years).

Sequence 2 has identical assumptions, except that the sequence of the returns is different (I simply reversed the order of the returns). You can see that in both sequences, you achieved the same average annual return (7% simple average) and total withdrawals ($1.1 million). In Sequence 2, however, you would have reached age 77 with almost $1.8 million remaining in your portfolio — $776,000 more than you retired with. The sequence of returns matters!

Note: For those of you who think the hypothetical returns in the above example look far-fetched, Sequence 1 lists the actual annual returns of the S&P 500 Index in chronological order.

The above period, 2000-2020, illustrates the negative compounding impact on withdrawals of down markets especially early on. But to be fair, there are plenty of other periods where the results would not be disastrous and, in fact, could grow the portfolio, or allow you to withdraw more, like Sequence 2. That’s why it’s a risk — you just don’t know what kind of sequence you’re going to be dealt as you enter the withdrawal stage.

Like with the game of chess, see the whole board

While planning for your fragile decade, remember that bull and bear markets are beyond your control — simply luck of the draw. So, it’s crucial to concentrate on factors that are within your control: the amount of your monthly contributions and withdrawals, setting realistic goals, making informed investment choices, and adhering to a dynamic planning process.

In the next article (part two), we will explore goals-based planning — an idea that helps us get beyond simply focusing on how much risk we can stomach. In part three, we pull it all together and offer up some specific ideas for mitigating the impact of sequence of return risk and protecting the retirement cash flow you have diligently worked to achieve.

As always, invest often and wisely. Thank you for reading.

The content is for informational purposes only. It is not intended to be, nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.