Mike Trigg's Blog, page 3

May 31, 2023

The Coming AI Marketing Onslaught

Photo credit: idownloadblog.com

This month has been an interesting one in the ongoing, breakneck, and occasionally terrifying evolution of Artificial Intelligence. Just days ago, over 350 thought leaders in the field of AI—including Sam Altman, chief executive of OpenAI, the creator of ChatGPT—signed an open letter warning of the “existential threat to humanity'“ presented by AI.

I try not to be alarmist, but it’s not often that the world’s leading pioneers of a new technology warn of widespread societal risk on the scale of pandemics and nuclear wars, not to mention (heaven forbid!) publicly call for regulation of their own technology. The Oppenheimer-esque significance of that moment aside, the doomsday scenario that I personally fear most is that this technology inevitably ends up in the hands of dangerous people: specifically, marketers.

As a recovering marketing executive myself, I can attest that marketers are second only perhaps to pornographers in adopting and abusing new technology. One of my observations in past posts is that the volume of marketing is rapidly overwhelming the comprehension limits of the human brain. We are simply inundated with promotional pitches all day, every day, via every medium.

If you thought robodialers were bad, in the wise words of Bachman–Turner Overdrive, you ain’t seen nothin’ yet. AI has marketers around the globe licking their chops. The basic instinct of every marketer—whether legitimate, sketchy, or outright fraudulent—is to reach as many people as possible at the lowest cost with their solicitation. Sure, we marketers give lip service to strategic, targeted marketing, but most of the ones I know will opt for scorched earth. You always want to sell more, always need to find new customers. The fundamental limiters to pitching every human being on the planet is essentially budget and time. Given unlimited budget and time, each of us would have a dedicated sales person for AT&T, State Farm, and Doritos camping out in our front yards waiting to pitch us.

Arguably, the only thing preventing that from becoming reality is the expense and labor required to “execute campaigns” on “prospective targets” (in the warfare-oriented verbiage of the profession). AI changes the marketing equation. In fact, that is the inherent value proposition of AI—that we can get an army of human-level intelligence to do our bidding for free (once you pay the software license, of course). So, in other words, if you’re the target of those campaigns, which we all are, prepare for an onslaught.

Don’t believe the threat is real? Let’s take an ordinary, everyday email marketing campaign. Executing such a campaign in the past would require writing copy, creating images, putting the email into layout, deploying test campaigns, refining and proofing the final treatment, assembling a distribution list, and, finally, sending and assessing the campaign. This routine is performed at last once per day by thousands of companies resulting in your inbox becoming a dumpster fire of spam.

Now, there are literally hundreds of companies offering AI tools for marketers to automate the steps of that process. Suddenly, there are no constraints. No copy writing to be done, no art to lay out, no proofreading to do, the whole process is accelerated, indefinitely. The logical escalation? Why execute one campaign per day, when you can execute hundreds or even thousands of campaigns? And not just via email, but text, phone calls, social media campaigns, virtual reality AI chat bots—you name it.

So, as the hunted, what should we do to deal with this marketing Armageddon? The short answer is get AI of our own. I know that sounds like a “buy a gun to protect yourself from guns” argument, but hear me out. The deployment of AI technology in general and AI for marketing specifically is unavoidable. The cat is out of the bag. The train has left the station. The tsunami is on the horizon. But I’ve long advocated (and, in fact, founded a company with the intention of doing this) that there is a huge opportunity for tools that help consumers to manage the modern purchasing landscape. Because we all still do need to buy stuff from time-to-time, and we want to find the best products or services when that time arrives. But, the rest of the time, we need tools for tuning it out. And I believe consumers would pay for such a service, as long as it is uncorrupted by advertisers.

Many of us will need to feel the pain first-hand of our future AI-driven marketing landscape before the necessity of such a solution will become fully evident. But for any budding entrepreneurs out there who want to build a consumer-side AI marketing counter-defense, send me your pitch.

April 30, 2023

Reframing Free Speech

Photo by Edmond Dantès

Freedom of speech is a deeply valued American principle. Enshrined in the First Amendment to our Constitution, free speech is seen by most of us as a fundamental, inalienable right—allowing the expression of personal opinions and ideas without fear of retribution and enabling the democratic process through public debate.

Unfortunately, we no longer seem to have a common understanding of what freedom of speech actually means.

Events in the last few weeks—including banning books, shouting down speakers on college campuses, passing so-called “anti-woke” bills in state legislatures, blocking journalists from social media platforms, and settling an anti-defamation case against Fox News—demonstrate how pressing the topic of free speech remains over 200 years after passing the Bill of Rights.

It makes sense that new technologies, specifically the advent of the internet (which has made any information instantly accessible) and smartphones (which have put that information in the palm of our hands), have provoked the latest debate over free speech. Each technological innovation that accelerates the distribution and consumption of information—printing press, telegram, radio, television, etc.—has raised similar challenges and disputes around the rights, responsibilities, and limitations of free speech.

Unfortunately, many of the debates over free speech are contextual rather than structural. In other words, the debate happens within the context of a particular topic. Too often, that debate predictably results in wanting to ban the free speech we disagree with and unleash the free speech we favor (as is the case in nearly every recent incident mentioned above). Both extremes of our political spectrum exhibit similar hypocrisy on this point—with liberals “canceling” those with differing views, and conservatives “banning” ideas they don’t want to hear. In the face of too much free speech, we’re trying to tune the other side out.

Of course, this is the exact opposite of what freedom of speech was meant to protect.

The very notion of free speech is to expose ourselves to opposing points of view, even ones we may strongly disagree with or even find offensive. If we outright refuse to hear opposing points of view, we lose our ability to understand, compromise, and empathize with others. Free speech is foundational to a functioning democracy.

Of course, the techno-libertarian belief in a completely unfettered ability to say anything you want anywhere and any time has simply never been what freedom of speech has ever meant either. Speech has consequences and public safety, in particular, has always tempered this right—the classic example of yelling “fire” in a crowded theater. As a society, we have always imposed limitations on free speech—particular hate speech and deliberate lies.

In reality, of course, these limitations are rarely enforced, and made evermore difficult by technology. While it has been encouraging to see recent repercussions, specifically within Fox News both around both hate speech and defamation, the idea that even the most egregiously offensive speech can be limited given modern technology is increasingly infeasible. There are always other websites, many operated covertly and offshore, that will allow even more toxic hate speech. There are always other avenues for procuring a banned book. The idea that we can limit free speech by muzzling the speaker is antiquated—applying 20th-century techniques to a 21st-century problem.

And new technologies are only making the problem worse. Fringe groups can and do amplify their message with fake social media accounts. Reposts, comments, and likes are perpetuated by bots. Deep fakes can be used to mimic almost anyone saying practically anything. Seemingly authoritative media outlets can be easily falsified. And generative AI tools will spawn a limitless proliferation of misinformation and propaganda. Further, the complete lack of international boundaries online makes us susceptible to messages from anyone, anywhere in the world. At the end of the day, enforcing limitations on free speech may no longer be impossible.

Given this reality, I believe it is time to reframe the topic of free speech to focus less on the rights of the speaker and more on the rights of the recipient.

Technology and dark money have permitted free speech to be exploited, pummeling us all with more and more information pushing everything from political agendas to purchase decisions. Each of us faces a daily information overload from free speakers. Yet virtually nothing has equipped us as recipients of this constant barrage of messages with an improved ability to evaluate their credibility and make informed decisions.

To me, being an informed recipient of free speech boils down to three fundamental questions:

How reliable is the message? (In other words, is it true?)

How credible is the messenger? (And, increasingly, are they even human?)

Who paid for the message?

Without better transparency on these questions, free speech will continue to be exploited, constructive debate and discourse will continue to diminish, and our belief in truth itself will be further eroded. It’s safe to say that as the First Amendment was drafted in 1789 stating that “Congress shall make no law . . . abridging the freedom of speech, or the press” that they ever could have imagined our current limitless information environment. With the advent of broadcast media, attempts were made to ensure the veracity of information and disclose sources of funding. But those efforts have largely been abandoned in the digital domain. Social media platforms in particular have become a vortex of misinformation and hate speech.

Exactly how we answer the above questions and provide that transparency is a longer topic than I can address in this post. But many good ideas have been proposed—including profile identity verification (basically the exact opposite of Twitter’s recent blue badge disaster), reforming Section 230 of the Communications Decency Act so social media platforms do a better job policing misinformation to avoid liability, political finance reform to require more stringent disclosures and close dark-money loopholes on both sides, and mandating that AI-generated content be explicitly identified.

Whether such initiatives come from the private sector and become de facto standards of online usage or emerge from the public sector as regulatory requirements (or, hopefully, both) doesn’t matter as much to me. But recipient-side tools for processing, understanding, and evaluating free speech are long overdue. Without such safeguards, our political discourse will continue to be dominated by partisan extremes, our willingness and ability to hear opposing views will be even more diminished, and our trust in information itself will be compromised, rendering one of the foundational rights upon which we built our country largely irrelevant.

March 31, 2023

Degenerative AI

An “AI bot in a dystopian wasteland” that I created on Canva, which uses an open source text-to-image AI engine called Stable Diffusion to auto-generate images.

My two worlds, technology and writing, have collided recently around the topic of “generative AI.” If that term is unfamiliar to you, I offer the following explanation:

Generative AI refers to a type of artificial intelligence that is capable of generating new content, such as images, text, or even music, that has never been seen or heard before. This is achieved through the use of algorithms that are trained on large datasets, allowing the AI to learn patterns and relationships between different types of data. Once trained, the AI can generate new content by using these patterns and relationships to make predictions about what might come next. Generative AI has a wide range of potential applications, from creating realistic virtual environments to helping artists and designers come up with new ideas. However, it also raises important ethical questions around issues such as ownership and control over the content that is generated.

The preceding paragraph was written, entirely and verbatim, by OpenAI’s ChatGPT tool, based on my prompt: “write me a paragraph description of generative AI.” And, I have to say, it’s a pretty good summary—even acknowledging the “important ethical questions” around this technology.

Within the technology world, the focus is decidedly more on the “wide range of potential applications” than the “important ethical questions.” With the implosion of Silicon Valley’s eponymous bank already in the rearview mirror (that was so mid-March!), excitement is building for this promising next engine of tech economy growth. Billions of venture capital dollars have flowed into hundreds of generative AI startups, headlined by Microsoft’s bet-the-farm $10 billion investment in OpenAI that justifiably has Google shitting its pants, facing an existential threat to its core search business (imagine a world in which a web search provided actually optimal results, rather than pages of hyper-SEO’ed click bait!)

Within the writing world, the focus is more on the “important ethical questions” (specifically, “will I be replaced by a bot?!”) than the “wide range of potential applications” (including automating the so-called occupation which, for most writers, barely earns them enough for rent and Ramen noodles). The reaction within the writing community to ChatGPT, Jasper AI, Copy.ai, and the dozens of other AI text writing apps can be summarized with one word: consternation. Why do you think this subject has garnered so much media attention? Journalists—the writers scratching out a living within a tiny-margin, revenue-contracting, rapidly-consolidating industry—might be on the front lines of AI replacement.

As we embark on a world in which journalism is further micro-niched to our particular opinions and preexisting biases, students auto-generate everything from term papers to college applications, and marketers are no longer creatively constrained from fully saturating our inboxes and social media feeds with their breathless updates, offers, and sales, I wanted to collect my thoughts here on both the hype and paranoia around this exploding space.

While the term “generative” is appropriate in the sense that it speaks to the technology’s ability to generate content, the antonym “degenerative” also feels appropriate for what the technology implies for the creative process. Merriam-Webster’s definition of Degenerative (of, relating to, involving, or causing degeneration) captures this implication poignantly as:

2: a lowering of effective power, vitality, or essential quality to an enfeebled and worsened kind or state

3: intellectual, moral, or artistic decline

The very concept that artificial intelligence can and should reduce human creativity to an algorithm is one that could only be conceived by computer scientists. I’m no luddite. I see compelling applications for AI in the creative space. After all, who wants to write that one-hundredth engagement-optimized Instagram post or the script for an episode in season 10 of Friends. I already leverage AI technologies myself, for example in proof reading, audiobook generation, and image creation (see my dystopian AI bot expelling a hair ball of content above!).

But I see several reasons why both the potential and threat of generative AI won’t be as significant as predicted by either the technologists or the creatives. And I’ll use a tried-and-true generative AI essay structure of first, second, and third arguments, to make my case.

First and foremost, the mass production of endless volumes of AI-generated content doesn’t really solve a need. Sure an underpaid copy writer dropping a throw-away post into the endless stream of social media content might be more productive. But the publishing industry overall already suffers from too much content, not a lack of it—churning out an estimated 4 million new books every year. The supply has completely overwhelmed the demand. Now we’re going to add AI-generated books to that too? My expectation is that readers will place more value on curated, high-quality, human-generated books. And that AI-generated books, will serve the long tail of the market—the reader who wants the 500th Harry Potter spin-off or the Fifty Fifth Shade of Gray. Crappy writing will be replaced by crappy AI writing.

Second, great content is not created by mimicking “patterns and relationships between different types of data.” That approach to creating content is reductive at best. The gatekeepers of the traditional publishing, entertainment, music and other creative industries have long tried to produce hits formulaically. That’s why so much content feels like an imitation of something else. Since we don’t know what will be a hit, let’s copy something that was a hit. Contrary to industry efforts to churn out blockbusters with the predictability of an assembly line, the content that tends to break through is unique, innovative, bold, and emotion-provoking. Then, when that rare gem of a book, movie, or song comes along, the cycle begins again with dozens of imitators jumping onto the trend. Producing content that is essentially the average of its mathematical inputs can really only ever be that: average.

Third, and perhaps most important, the implicit underlying thesis of generative AI is that one can only derive enjoyment from the consumption of content, not the production. I, like the vast majority of writers, cannot provide an financial ROI for the task of writing. If I ever calculated my hourly wage, I would find it depressing. But that’s not why I write. I write because I enjoy it. The production of written content fulfills something for me. Writers, artists, musicians, and every other creative person takes great joy in the creative process itself—even with all the frustration, fatigue, and disappointment that comes with it. Why would I give that enjoyment away to an AI bot?

For better or worse, regardless of what we think about it, generative AI is coming, and coming rapidly. That much venture capital demands returns. While the rest of us hasten to set up some cursory guardrails, the best and brightest computer scientists will continue to evolve the technology and push the envelope of what is possible. As always, technology’s superlative advantage is speed—it simply moves faster than regulators, ethicists, or the public at-large can keep up. It’s halfway around the world and used by millions before the skeptics get their pants on.

And this reality is why I think it will be degenerative in another sense. Not that it will replace humans, just that it will further marginalize our value, fulfillment, and sense of self-worth. That it will lower our collective “power, vitality, or essential quality” and make us feel “enfeebled.” That it will worsen our sense of “intellectual, moral, and artistic decline” that already feels like a weight on the modern human psyche—particularly for the digital native generation who grew up with iPhones, Google, and Instagram so deeply entrenched in their lives.

At some level, this is the root fear around artificial intelligence overall—that it will render human intelligence obsolete. With its slow clock speed, undisciplined productivity, and faulty logic, our mammalian brain feels like a Motorola flip phone in desperate need of an upgrade. But maybe generative AI can also show us that “intelligence” isn’t the only thing that differentiates humans from technology. It’s also our unique capacity for emotion. And emotions may never be reduced to data, algorithms, and formulas. Though I’m sure someone will try.

March 13, 2023

Silicon Valley Bankrupt

Customers outside a Silicon Valley Bank branch in Santa Clara, CA (Photo credit: Jim Wilson/The New York Times)

Last month I wrote one of my most-read posts on the ten biggest tech industry scandals of 2022. The early front-runner for the top of the list in 2023? Silicon Valley Bank, which failed spectacularly in the span of 48 hours last week.

The immolation of the 16th largest bank in the country has received prominent coverage in the national media, but it was earth-shattering news for those in . . . well, those in Silicon Valley. For the tech industry, the collapse of SVB, as it is universally known, is incredibly un-nerving. If you haven’t followed the bank’s implosion, here’s a thumbnail of what happened:

Wednesday, March 8—SVB seemed to be a healthy, functioning regional bank focused on the tech sector.

Thursday, March 9—SVB unsuccessfully tried to raise over $2 billion of equity to solve a downplayed near-term liquidity crunch. CEO Greg Becker urged everyone to “stay calm”—the exact words you don’t ever want to hear from a bank CEO. Shares of SVB dropped off a cliff and trading of their stock was halted.

Friday, March 10—Prominent VCs urged their portfolio companies to get everything out of SVB ASAP, triggering a text book run on the bank. Companies worried about everything from vendor payments to payroll processing, while account holders lined up outside branches like scenes from the Great Depression, except wearing AllBirds, in a desperate attempt to get their money. By the end of the day, SVB had collapsed and went into FDIC receivership—the largest bank failure in 15 years.

Sunday, March 12—The Fed stepped in and assured SVB’s depositors that they would have full access to their funds by Monday.

Today, fears of contagion are rampant after another bank, Signature, failed over the weekend. Other banks comparable to SVB have seen their share prices plunge, and broader bank stocks overall are down substantially. As the entire tech industry struggles to access their funds, pay their bills, divert their receivables, and come to grips with the biggest banking crisis since 2008, there is one question increasingly on everyone’s mind:

What the hell just happened???

As challenging as it is to cover a story that continues to unfold in real time at Internet speed, media outlets have been offering explanations from experts who often seem to have an agenda. For banking experts who want to assuage fear and stabilize markets, this was an isolated and innocent miscalculation by SVB—tying up too much of their balance sheet in long-term bonds that declined in value as interest rates rose. For proponents of more decentralized banking (read, everyone in the crypto and block chain space), this is all the Fed’s fault with self-serving jabs that “fiat is fragile” thrown around as a timely diversion from their own crisis (see FTX). For haters of Big Tech, this was pure greed caused by a handful of selfish venture capital firms who mandated their portfolio companies remove their funds from SVB, triggering an irrational, fear-based run on the bank.

In my opinion, all these are contributing factors, but they are not root causes. The explanation I’m not hearing, especially not from people in the tech industry, is that the root cause is the tech industry itself.

Let me back that up a bit. The lifeblood of the Silicon Valley tech industry is capital, specifically venture capital. Without it, no start-ups get funded, no innovation happens, no hyper growth ensues, no fabulous fortunes are made, and the whole sector looks like it did in the 1960s when it was run by big, monolithic, blue-chip companies like IBM. Founded in 1983, SVB had as much to do with the creation of the modern tech economy as any financial institution. The venture capital firms get all the glory, but there are hundreds of them and only one commercial bank, really, that served the tech industry. No other financial institution was more symbiotic with the rise of venture-backed technology start-ups than Silicon Valley Bank.

See, SVB isn’t just a regular bank. As the name suggests, they skyrocketed to become the 16th largest bank in the U.S. because of their unusually cozy relationship with the tech industry. Most venture capital firms kept their funds with SVB, and the majority of tech companies banked with SVB. I’ve founded multiple startups and worked for many more, and every single one banked with SVB. In fact, the expectation by venture investors and board members to do so was so great that we would have had to justify putting our funds into any other bank. It’s just what you did. And for over 30 years, that three-way relationship proved beneficial to all parties.

When a VC invests money in a start-up and that company banks with SVB, there’s a tacit understanding that the bank will keep an eye on those funds—even freeze or sweep accounts if needed. When start-ups need more capital, SVB provides loans other banks won’t that are collateralized with illiquid private stock (and the promise from their VC backers not to let the start-up fail), making SVB one of the largest venture debt issuers. When founders want proceeds from their private shares, SVB provides secondary market liquidity. The explosive growth of the tech industry overall drove up SVB’s stock price, reaching a market cap as high as $40 billion in 2022. In short, SVB is the central nervous system of the venture-backed tech industry, facilitating the unique banking transactions that have made so many people so fantastically wealthy.

As such, no other financial institution has deeper ties or better visibility into the state of the tech industry than Silicon Valley Bank. Apparently they didn’t like what they saw. Which brings me to my point. When banks fail, they fail because they (and their auditors, regulators, and board) grossly underestimate the risk of an over-indexed asset on their balance sheet. Washington Mutual failed because they were over-exposed in subprime mortgages. That was the root cause. SVB is failing for the same reason it succeeded: because it is over-exposed to the technology industry. That is the root cause.

Just like SVB tried to buoy confidence with reassurances that everything was fine, many in tech are doing the same thing to buoy confidence in the industry. But SVB’s collapse is a harbinger that things in the tech industry it serves are not healthy. The entire business model of venture-backed start-ups depends on liquidity either via IPO or acquisition, and both those markets have effectively locked up recently. IPO proceeds plunging 94% in 2022, while plummeting stock prices and rising interest rates caused technology acquisitions to dramatically slow at the same time. Even SPACs, the briefly hyped back door to going public, have collapsed. No liquidity = no good for the tech industry. These trends have called into question the underlying premise of venture capital as an asset class. If you can’t get your money out, why do you want to put your money in? Smaller venture funds are struggling to raise new rounds and large funds, in some cases, are quietly handing money back to their limited partners. Meanwhile, start-up companies have faced similar pressures. For unprofitable companies without liquidity options or access to public capital markets, they either need to get profitable fast (hence, the widespread tech layoffs) or raise more equity privately, usually at significantly reduced valuations.

The net effect for SVB straddling the intersection of all this is not good. Declining venture funds, down rounds at start-ups, increased cash burn by depositors, inability to service debt, and other drivers all mean the capital that flowed into SVB so torrentially in 2021 is leaving just as quickly. Compound that pre-existing condition with the shock of thousands of account holders withdrawing $42 billion in one day at the behest of their venture overseers, and you can see why the golden goose wasn’t just sacrificed but was summarily disemboweled, spatchcocked and spit-roasted. The venture firms who ran for the exits may have their money, but they may have killed the flywheel that made them their fortunes. Whatever Federally-backed or firesale-acquired entity takes over may not be as accommodating.

The dirty secret that has arguably propped up the entire venture-backed tech start-up ecosystem into ever-more-dizzying valuations has, for a long time, not been fickle public markets (who wants another dot-com bust!?), but private investors, including foreign sovereign wealth funds—a storyline that happens to be part of my novel, Bit Flip. Perhaps the most disturbing line allegedly came from an SVB insider complaining about the “absolutely idiotic" executive leadership at the bank, saying, “You’re in business for 40 years and you are telling me you can’t raise $2 billion privately? Get on a jet and fly to Kuwait like everyone else and give them control of one-third of the bank.” Like everyone else indeed.

The full fallout from this sequence of events remains to be seen, with other banks, regulators, venture firms, and tech companies all scrambling to preserve their capital. For some start-ups with limited funds, frozen accounts, and few alternatives, this may prove to be an “extinction-level event.” But the tech industry as a whole needs to clean up its act or it risks a moral, ethical, and financial bankruptcy of its own.

January 30, 2023

The 10 Biggest Tech Industry Scandals of 2022

Photo by Luke Jernejcic on Unsplash

Corporate scandals are not a new thing in the tech industry. The last few years have seen a range of incidents from executive misconduct, to gross financial self-dealing, to outright criminal fraud at such well-known, high-flying companies as WeWork, Uber, and Theranos. But 2022 was a year in which the tech industry seemed determined to out-do itself in terms of corporate scandals.

Perhaps it was a hangover from the COVID-induced tech surge, or a generational wake-up call that there actually can be down markets, or a natural vetting triggered by higher interest rates and slower growth that has led to down rounds and a commensurate increase in investor scrutiny. Whatever the reason, 2022 seemed to unearth a new scandal virtually every week—so many, in fact, that I decided to write this post chronicling some of the biggest of the year.

With over 200,000 people who have already lost their jobs in the tech industry in 2022 according to Layoffs.fyi and more layoffs announced this year, the consequences of these scandals, over-investment, and mismanagement, are landing on workers, as is always the case. As I researched this list, I saw three big themes behind the companies that found trouble—that I’ve come to think of as the three C’s:

Cryptocurrency—with the collapse of the crypto market, the full extent of self-dealing and fraud in that sector has been exposed.

COPPA—the Children's Online Privacy and Protection Act dictates how companies need to treat underage users, who constitute a disproportionate percentage of internet and app usage.

Customer exaggeration—several companies got in trouble for a time-honored Silicon Valley tradition of grossly exaggerating their customer traction.

With those themes in-mind, here is my list of the Top 10 Biggest Tech Industry Scandals of 2022:

10) IRL

The interest-oriented messaging app IRL seemed for a while that it was going to be the next big thing to take on legacy social media players like Facebook after the company’s CEO, Abraham Shafi, claimed they had 20 million active users. On the basis of that evident growth, the startup raised $170 million round from SoftBank Vision Fund (which seems to have a knack for investing in dubious companies), Founders Fund, and other investors, reaching coveted unicorn status. The bloom started to come off IRL’s rose in May, when employees at the company said the real user base was a fraction of the 20 million claimed. The SEC is investigating the company over the claims but may not be able to prosecute their case since “users” are an ambiguously defined term and not an established financial metric. Many, many, many tech companies exaggerate their user growth, and they are rarely caught. Although this case is not likely to end up in more than a slap on the wrist by the SEC, the company seems to be entering a downward spiral. In June, they announced a lay off 25% of their 100 employees and actual IRL users are proving harder to find than . . . well, unicorns.

9) Embark

Over-invested categories are breeding grounds for corporate misconduct—flush with cash and pressured to move fast, with no time for diligence or corporate governance. One such category is autonomous and alternative-energy vehicles, eager to draft on the success of Tesla. Embark, an autonomous trucking startup and Y Combinator alumni, seemed determined to follow in the wake of electric and hydrogen fuel cell company, Nikola—one of 2021’s biggest corporate scandals when it was revealed that the company’s founder and CEO, Trevor Milton, made outright fraudulent statements about “nearly all aspects of the business.” (Milton was found guilty in October, 2022). Although Embark’s mismanagement and deception was nowhere near as egregious as Nikola’s, the company has quietly lost 98% of its value. Sidestepping the usual diligence and regulatory filing process of an IPO, Embark went public in 2021 via a SPAC by Northern Genesis Acquisition Corp. II, which valued the company at $5.2 billion. Unfortunately for Embark, its product, revenue, and overall business were nowhere near ready to endure the scrutiny of being a public company. First, a report from corporate misconduct short-seller, The Bear Cave, asserted Embark’s valuation was based more on “puffery rather than actual substance.” Then a shareholder class-action lawsuit charged Embark with overstating its product capabilities. The result has been a loss of over $5 billion in public shareholder value, and a business trading below its cash value—self-driving this company into the ground.

8) Snapchat

Like another social media company on this list (see #2), Snapchat didn’t have one big headline-grabbing scandal, but 2022 was a tough year for the company. In May, the app popular among teens for its vanishing messages was hit with a class-action lawsuit claiming it captured and stored biometric data in a manner that violated of the Illinois Biometric Information Privacy Act, resulting in a $35 million settlement. Also in May, the company faced a separate class-action lawsuit led by a 16-year old girl who says she was sexually exploited on Snapchat starting at age 12. Never would have guessed an anonymous messaging app primarily used by teens would attract sexual predators. The app has also been accused of enabling drug dealers to target teens that have led to fentanyl overdoses.. With over 100 million daily active users in North America and 90 percent adoption among 13- to 24-year olds, Snapchat plays on outsized role in the life of America’s youth—many who naively believe the vanishing messages afford them privacy, but under-appreciate the potential of that stealthy communication model for exploitation. The scandals have taken a toll on the parent company, Snap. In August, Snap announced a 20 percent reduction in staff, nearly 1,300 employees, and went on to badly miss their Q3 earnings target. Meanwhile, Snap’s stock price has steadily plunged by around 90% from its peak at the end of 2021. The only thing disappearing faster than a Snapchat message is Snap’s shareholder value.

7) Fast

The “buzzy” e-commerce start-up, Fast, promised to empower “one-click checkout” for online retailers, similar Amazon’s popular one-click purchase feature. After raising over $120 million, valuing the business at $500 million in 2021, the company disclosed in March of last year that it was unable to raise additional capital on its anemic annual revenue of just $600,000 and was desperate to find a acquirer. That knight in shining armor never arrived. In April, the company abruptly shut down after spending money faster than a craps junkie on a Vegas bender. The scandal with Fast is mostly one of gross internal financial mismanagement by fast-talking founder and CEO, Domm Holland. The company grew to over 500 employees, reaching a burn rate of $10 million per month thanks to extravagant expenditures, including pricey partnerships with sports teams and an alleged offer of $1 million to the electronic pop group, the Chainsmokers, to perform at a Fast corporate event just months before shutting down. I’m not sure the fired employees or bag-holding investors would want “Something Just Like This.”

6) Helium

Here’s a tip: if a company is described as a “crypto darling” run the other way. After a few pivots, the nearly decade-old, Shawn-Fanning-co-founded crypto experiment known as Helium seemed to have finally developed an interesting, if complicated, business model. Touted by the New York Times at the time, Helium intended to build out a nationwide network for the “Internet of Things” (think cameras, sensors, refrigerators, and other appliances) by selling a $500 device that people were supposed to run in their house and then earn money from that device mining Helium’s cryptocurrency. Sound confusing? You’re not alone. Although the company touted stories of savvy Helium owners who had allegedly made fortunes from the devices, the reality was the business was secretly handing out the bulk of its cryptocurrency to insiders, not miners who bought their hardware. When the price of their Helium Network Token, or HNT, collapsed, the people who had bought the devices were left holding the proverbial bag while insiders and investors like Andreessen Horowitz and Tiger Global pocketed millions. As the scheme collapsed, stories have emerged about users (including company employees) cheating the system by clustering devices that were supposed to be distributed network nodes, lying about corporate partnerships with Salesforce and Lime, failing to generate revenue from what is supposed to be the company’s real business of selling access to its wireless network, and a growing perception the entire thing could be a “well-coordinated scam.”

5) Frank

Although not well-known, Frank, a “buzzy fintech startup,” was one of the more brazen fraud cases of the year. Going beyond merely exaggerating their user growth, Frank allegedly fabricated the existence of millions of users entirely. After being named to the Forbes “30 Under 30” list in 2019, founder and CEO Charlie Javice sold her company, a financial service for streamlining student financial aid applications, to JPMorgan Chase in 2021 for a whopping $175 million. In December, Chase sued Frank and Javice herself for completely fabricating 4.265 million customers “who did not actually exist,” more than 15-times the meager 300,000 customer accounts the company actually had at that time, according to the suit. Wow . . . If you’re gonna lie, lie big, I guess. Javice is counter-suing (of course), claiming Chase’s accusations are “groundless” and intended to deny her millions in rightful compensation. Regardless of how the cases are resolved, Frank is emblematic of the worst proclivities of venture-backed tech startups—privileged founders who feel birthright-entitled to fantastic wealth, a “fake it till you make it” mindset that is an enabler to outright fraud, self-reinforcing media hype cycles that anoint companies without journalistic integrity, the ability of high-profile billionaire investors (in this case, Marc Rowan) to Midas-touch their own deals, and abysmal due diligence by investors and acquirers. By all accounts, Frank appears to have run the Theranos playbook. Whether it will also result in criminal conviction of Javice on fraud charges remains to be seen.

4) Vonage

As anyone who has tried to cancel a recurring subscription can attest, tech companies make canceling deliberately hard to do. In the case of internet phone provider, Vonage, the FTC determined that the company’s attempt to obfuscate a customer’s ability to cancel was so deliberate it was illegal. In November, the Federal Trade Commission required Vonage to pay $100 million in refunds to customers it exploited using a variety of unethical tactics. Vonage makes it incredibly easy to sign up for its service using so-called “negative option” schemes, in which a free trial automatically converts to recurring monthly charges unless the customer remembers to terminate it first. Once those charges start, the company makes it extremely difficult to cancel—including not offering any form of online cancelations, forcing customers to speak to a live “retention agent” on the phone, making the cancelation phone number essentially impossible to find, failing to transfer customers to cancelation agents, charging “junk” cancelation fees not disclosed at sign-up, and even blatantly continuing to charge customers without authorization after they cancelled, according to the FTC. Sadly, these same illegal tactics are employed by hundreds of tech companies that rely on monthly subscription payments from customers.

3) Epic Games

The creator of the smash-hit, “kid-friendly” (because, why wouldn’t we teach our children to indiscriminately shoot other people?) online shooter game, Fortnite, was accused by the FTC of illegally collecting the personal information of millions of children, and tricking them, using manipulative techniques called “dark patterns,” into unintentional payments in the game. The shady tactics resulted in a financial windfall for Epic, but violated the aforementioned Children’s Online Privacy Protection Act (COPPA), which limits the collection of personal information and game access for children under age 13. In December, Epic paid for those violations with a record $275 million fine plus $245 million in consumer refunds resulting from an investigation by the Federal Trade Commission, which has vowed to crack down on such tech industry practices. In a statement on the settlement, Epic described its practices as “longstanding industry standards” and, sadly, they’re right. Skirting COPPA rules is a well-honed practice among tech companies, particularly in gaming and social media, because, candidly, users under 13 are voracious, viral, and the primary drivers of huge user growth. And dark patterns, such as confusing button labels, disguising user consent, and deliberately accident-prone UI layouts, that trick users into online purchases are practically ubiquitous in the industry.

2) Twitter

Rather than a single lightning strike scandal, Twitter in 2022 was a never-ending rolling thunder of daily, if not hourly, scandals. From the first moments of tortured courtship, through the dramatic he-said/they-said attempts to back out of the deal, to the epically disastrous reign of the most impetuous, egomaniacal, self-appointed leader the corporate world has perhaps ever seen, Twitter has been a case study in how to destroy value for shareholders, employees, advertisers, and users. An entire journalistic ecosystem documented every cringy moment of this dumpster fire, and whole books will be written on the depths of ineptitude and hubris that this company has descended to. So I have no desire to provide a full recounting here, but just a few of the lowlights in this shit-show-within-a-train-wreck include: suspending journalists accounts, banning links to other social media sites, widespread layoffs, resignations of hundreds of employees, a mass exodus of advertisers, the decimation of the company’s remaining content moderation team, and a litany of other incidents so numerous, tiresome, mercurial, and self-destructive that even Musk’s closest confidants lost faith in his rule—culminating in a public end-user vote of no confidence against him and his pledge to step down, eventually. The meta-scandal to this unprecedented display of hubris is a new bar of ego-centrism that Musk and like-minded tech multi-billionaires have established. Check that, the real scandal is what else could have been done with $44 billion dollars. Once this plays out, it may prove to be one of the most pointless, self-immolating destructions of wealth of all time.

1) FTX

It’s only fitting that the year of the crypto implosion would have a crypto company at the center of one of the greatest frauds of all time. Sam Bankman-Fried has punched his ticket to the fraudster hall of fame, alongside Bernie Ebbers, Kenneth Lay, and Bernie Madoff. The investors in this Chernobyl-esque meltdown include a strangely familiar set of names—among them, Sequoia Capital, SoftBank, and Tiger Global. All told, over 90 different investment funds happily pumped an estimated $1.8 billion into FTX at valuations as high as $32 billion. When you step back, you can’t help but observe how fucked in the head these investors must have been to put that kind of money into a company just founded in 2019 by a then-26-year-old kid who operated the company out of the Bahamas with no corporate oversight and operated by a pack of other twentysomething buddies who were all dating each other. What could possibly go wrong? This punchline of a bad venture capital joke started to unravel in November, when FTX announced it was facing a “liquidity crisis” thanks to the collapse in cryptocurrencies—well . . . that and the estimated $2 billion in customer funds that disappeared out the “back door.” Each generation comes up with a new euphemism for embezzlement, but Sam Bankman-Fried (or SBF as he’s known—side note, never invest in anyone who goes by a three-letter acronym, see MBS) took this to a new level—so unprecedented in its scope, we might need to change the term “Ponzi scheme” to “FTX scheme.” Looking like a stoned, high school dropout apprehended while playing video games in his mom’s basement, SBF was arrested in the Bahamas on December 12. The SEC charges were as outrageous as they were predictable—diverting the funds of customers to FTX’s privately-held subsidiary crypto hedge fund, Alameda Research, which was run by 28-year-old Caroline Ellison, an alleged romantic interest of SBF. You literally can’t make this shit up. While FTX’s gullible users thought they were making a fortune in crypto, SBF and his posse were dipping into their customers’ funds like their own personal stash of Mary Jane—going on a spending orgy that included investments in other crypto companies, purchases of real estate, sports stadium naming rights, and massive political donations (mostly to Democrats). It all culminated in something I, for one, did not see coming (spoiler alert!): a bankruptcy filing as the remaining entity digs through the shrapnel inside the crater for anything salvageable. FTX is the epitome of the malignant self-dealing that has come to define the current tech industry. With no corporate or regulatory oversight, unlimited troughs of money, and obfuscated business models designed to enrich insiders, companies like FTX have come to represent the new Silicon Valley—one in which greed, ego, and hubris have completely overwhelmed the last remaining platitudes of “making the world a better place” that the tech industry used to hold dear.

Perhaps the aspect of this list that most troubles me is it was hard to narrow down to just 10 scandals. Dishonorable mentions go to: Hydrogen Technology Corp, another crypto firm charged by the SEC for manipulating the market for their token for their profit; Genesis, a crypto lender to high-net-worth individuals that recently filed for bankruptcy; Clearco, a mismanaged Canadian fintech company that is rapidly imploding as it lays off staff; HeadSpin, a mobile app testing company that recently settled fraud charges; VM Ware, which the SEC charged with misleading investors and manipulating their financial statements; and NVIDIA, which paid $5.5 million to settle SEC charges that it also misled investors. Meanwhile, 2023 promises to be more of the same, with the U.S. Justice Department accusing Google of monopolistic practices and TikTok being accused of violating children's privacy, not to mention the entire business coming under legislative scrutiny as an alleged pawn of the Chinese government.

These scandals are the symptoms of a broken and morally bankrupt industry. In almost every instance mentioned above, there are dozens, if not hundreds, of similar companies embracing these same “best practices” who just haven’t been caught yet—violating consumer privacy, abusing users’ trust, manipulating customer behaviors, exaggerating metrics to investors, exploiting legal loopholes, and evading regulations. The Libertarian, free-market bent of tech has metastasized into an illness at the heart of the industry—one that the insiders guarding the hen house have proven unable or unwilling to remedy. Fortunately, unlike in the dot-com bust, many of these financial scandals have concentrated their collateral damage on the private investors who are causing the problem in the first place. But as layoffs, customer complaints, and financial losses mount, something eventually might need to be done about Big Tech.

January 25, 2023

My Top 5 Books for 2022

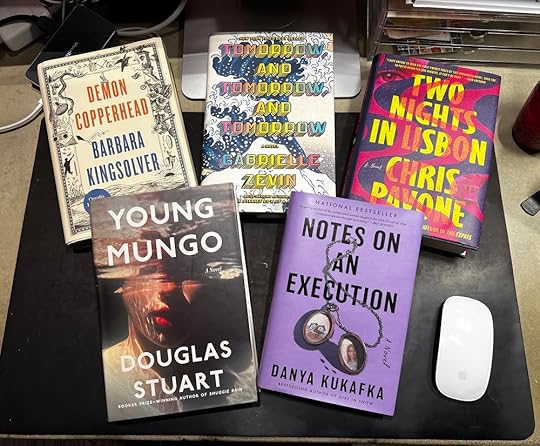

My top 5 novels of 2022 on my actual desk.

For the second year in a row, I set and met a goal of reading 52 novels in the year—one per week for all of 2022. And, again like last year, I’m using this space to call out my top 5 favorites for the year.

I always feel compelled to caveat this list. First and foremost, I’m not a professional book reviewer, just a regular reader. So I don't have a particularly diligent or objective process of selecting books besides just picking ones that are interesting to me personally. Your tastes may vary. Second, not everything I read this year was a 2022 release (my criteria to be in my top 5). There were many great books I read that I didn’t include simply because they were released in prior years. Third, despite hitting my reading goal, I’m only touching the first few snowflakes on the tip of the iceberg of work published in the year. No one except maybe ChatGPT can read them all. It’s a challenge in the publishing industry overall—infinite supply, finite reading time.

All that said, my reasons for putting this list together remain the same. It answers the question I often get: what books do you recommend? It is also a way to acknowledge the authors and work that has influenced me. The only rules: it needs to be a novel, that I’ve read, published in 2022, and (new rule this year), it can’t be my own book! This year’s list has a discernible theme: dark and heartbreaking coming-of-age stories. Probably not surprising since that's the theme of my next book. So here are my top 5.

DEMON COPPERHEAD by Barbara Kingsolver

As soon as I read this book, I knew it would be one of my favorites of the year. The protagonist and subject matter are straight up my alley, examining how poverty, exploitation, and overall life conditions can keep someone down. Demon is a personification of a generation of youth, many from disadvantaged, rural areas, who are forgotten and often disrespected in contemporary American culture.

TOMORROW AND TOMORROW AND TOMORROW by Gabrielle Zevin

I thoroughly enjoyed this book—not just because I was once a developer of games and founder of a gaming company (the underlying context of the book, which struck me as dutifully authentic)—but because of the long arc and entanglement of friendship, creative collaboration, and love. Few works of fiction get the workplace setting right, and this one does—at least for tech.

NOTES ON AN EXECUTION by Danya Kukafka

This book tells the story of a serial killer on death row through the lives of the people he victimized, in a way that somehow simultaneously evokes disdain and empathy. You need to pay attention in this one—lots of characters, shifting timelines, changing narrative voice, and a deeply interwoven plot. But the payoff is a fascinating and incredibly well-crafted story with an impactful message about violence, forgiveness, and politics in modern society.

YOUNG MUNGO by Douglas Stuart

Mungo is a teenage boy growing up poor in Glasgow, struggling with an alcoholic mother, abusive brother, and the societal intolerance and exploitation of his emerging sexuality. This novel is a study in the forces of financial, religious, and identity-based discrimination, and how insidious, self-reinforcing, and difficult to overcome those forces can be. This is a simultaneously compassionate, tragic, and inspiring coming of age story unlike any I’ve ever read.

TWO NIGHTS IN LISBON by Chris Pavone

This unexpected novel feels like a conventional thriller at the start—a woman’s husband is kidnapped in Lisbon—but it goes on to reveal a much bigger cultural commentary that is pitch perfect for our time. This novel is exactly what I aspire to in my own writing: a compelling thriller that keeps you guessing till the very end, combined with a strong, timely, and insightful political message.

For a full list of the books I’ve read this year, along with ratings and reviews, visit my Goodreads author profile.

January 7, 2023

Ode to January

Photo by Jodie Walton on Unsplash

January sucks.

Let’s face it. January is the undisputed, all-time, undefeated champion of “Worst Month of the Year.” Nobody’s all like, “I really can't wait for January!” It’s more like, “Shit… it’s January.”

To be fair to January, it’s easy to get upstaged by December, with its holidays, gift giving, and days off work. Sure, there’s an end-of-year push for some, but December is mostly about slacking off, shopping online while you pretend to work, getting drunk at office holiday parties, and eating that entire Harry & David gift basket from a vendor you forgot you do business with—then ending it all with a week-long vacation. Not bad.

We go from “the most wonderful time of the year” to the calendar equivalent of the Mojave Desert. From the very start of the month, after the balls drop, the champagne pops, and the resolutions are made, New Year’s Day marks the tipping point into the death march that is January.

In December, winter is still a novelty with the magic of the first flakes of snow. In January, you just want winter to end but know you have three more months of it. Your feet are cold, your lips are chapped, and you vow, yet again, to move to someplace warmer.

In December, you indulge in an orgy of consumerism with more presents than you know what to do with. In January, you’re waiting 45 minutes in line to return that shirt you can no longer stuff your fat ass into.

In December, you have a built-in excuse for anything you’ve been procrastinating—“Sorry, didn't have time to get to that over the holidays! :-)” In January, no one gives you any slack, including yourself. All the crap you didn’t want to do in December gets punted to January. There’s nothing on your to-do list that you actually want to do. All the fun stuff is already taken.

In December, you feast on roast beef, Yorkshire pudding, and cheese fondue like you’re in a Dickens novel. In January, you gag down kale, Impossible™ burgers, and chia smoothies like you’re training for the Olympics.

In December, for those who celebrate Christmas, you’re decorating trees, drinking hot chocolate, and listening to carols. In January, you’re dumping that tree like you’re getting rid of a dead body. Sawing off limbs. Scattering pine needles everywhere. Throwing it to the curb. Like you’re cleaning up a crime scene.

In December, you gorge yourself on yule logs, English toffee, and Danish kringles with no guilt and a smile on your face. In January, your pants don’t fit. Not even your “fat pants” fit. You purge your refrigerator and cabinets of the remaining holiday goodies, wondering how you ate an entire tin of Peppermint bark without remembering it.

In December, the stores are filled with festive decorations, perfect gifts, and happy shoppers. In January, the local mall looks like a FEMA disaster relief site. Every gift you just paid full price for a month ago is now marked down 80% and piled haphazardly on a table that looks like a dumpster. The Island of Misfit Toys in Rudolph the Red-Nosed Reindeer was inspired by a Macy’s on January 3rd.

In January, shit gets real in the business world too. Annual budgets are due. Goals for the year are set. Signatures in blood are expected for commitments you have no idea if you can hit. The layoffs your company didn’t want to do around the holidays happen in January. The annual bonuses paid out at the end of the year are replaced by performance reviews in January. Your calendar is jam-packed with day-long planning meetings in January. Apart from MLK Day, there are no vacations, no breaks, nothing to look forward to, except the month eventually being over.

Little known fact: in the original Julian Calendar, January actually had 65 days, because that’s how long Roman mathematicians thought the month lasted. If you have a birthday in January, first off: I’m sorry. But at least you get to look forward to something in this godforsaken month, even if you can’t convince anyone to come to your birthday party because they’re on a 30-day juice cleanse.

The guilt, regret, and bad decisions you managed to suppress through the holidays all smack you upside the head in January. Resolutions to lose weight, get organized, or save money are made then abandoned before the end of the month. January is a never-ending shame-spiral with no end in sight. So this year, my New Year’s resolution is just to get to February.

December 30, 2022

Is the Tech Industry Over?

Is this really what we need next from the tech industry? (Photo by Uriel Soberanes on Unsplash)

Like my protagonist in Bit Flip, Sam Hughes, I came to Silicon Valley during the late 1990s dot-com boom to pursue a career in the technology industry. In the ensuing twenty-plus years, that industry flourished—transforming modern life for consumers and generating truly unprecedented wealth for people in the industry.

But 2022 feels like a year in which something “flipped” in the tech industry, and I’m not just saying that to promote the title of my book. The Atlantic recently summarized the sentiment that the “tech industry seems to be in a recession.” With astronomical financial frauds, jaw-dropping displays of hubris, and a waning ability to dictate “the next big thing,” there is a growing sense of many in tech that the industry, at least as it has been defined for the last 50 years, is over.

From its inception, the definition of a “tech industry” has been nebulous. Always as much a horizontal set of tools as a true vertical market, the tech industry was initially defined by computer hardware manufacturing, advancing through eras of technical innovation: the mainframe, the microprocessor, the personal computer, the mobile phone. Semiconductors, chips, memory, and storage designed to process data and execute commands—that was what defined the tech industry.

In the early days, the software required to make these machines do anything useful was regarded as uninteresting. Many of the first computer programers were women, because the task was seen as clerical and, consequently, under-appreciated and underpaid. Over time, however, the hardware side of the tech industry became commoditized and off-shored, like many manufacturing sectors. Software turned out to be where the money was. Of the twenty largest tech companies today, only four (Apple, Samsung, Cisco, and Broadcom) generate the majority of their revenue from hardware. The other 16 are predominantly software companies embracing a wide variety of business models from advertising to subscription licenses.

With the advent of the internet, software became interconnected and that’s when the tech industry really transformed. Suddenly, software was “eating the world” in the words of venture capitalist, Marc Andreessen—able to perform almost any function in any industry. Which, somewhat paradoxically, leads me to my arguments that the tech industry is over.

First, the tech industry has completely escaped its boundaries. What makes Stripe a “tech company” but Wells Fargo a “financial services” company? What makes Netflix a tech company but Time Warner a media and entertainment company? What makes Uber a tech company but Hertz a transportation company? More importantly, what justifies the tech industry multiple? Certainly, much of that answer lies in the financial statements. “Tech companies” that have disrupted traditional industries often don't carry the tangible assets, contractual obligations, or labor costs that weigh on the balance sheets of their incumbent rivals—leading to growth rates and profit margins that result in huge valuations. But the distinctions between tech companies and non-tech companies continues to blur—with the tech upstarts realizing the strategic value of traditional industry expertise and infrastructure, and incumbents massively investing (or under-investing in the case of Southwest Airlines) in technology. In short, every industry is tech now.

Second, the capital advantage of the tech industry is closing. Arguably, the not-so-secret weapon of many software-centric tech companies lies less with innovation or differentiated product and more with seemingly limitless access to cheap capital. For three decades, venture capital firms, private equity funds, and the broader capital markets have pumped massive amounts of cash into tech companies, giving them an arsenal that incumbents typically lack. With interest rates rising and many tech companies struggling, the world is now realizing there is nothing special about “tech.” The massive drops in public market valuations and new venture investment will mean that tech companies and their investors can no longer just bully their way into new markets with a cash war chest. As the free flow of capital dries up, the tech industry advantage will subside.

Third, the tech industry has lost its moral high ground. One of the great appeals of the tech industry, particularly for employees, was that it was “making the world a better place.” With low externalities, high productivity gains, and egalitarian values, the tech industry long felt like a force for good. Few people share that opinion now. In the wake of multiple industry scandals, we are less comfortable with the tech industry dominating our lives—even as technology itself becomes more unavoidably ubiquitous. The tech industry and tech founders are no longer held on a pedestal. With it, much of what led to outsized growth in the industry will evaporate.

But perhaps the biggest reason the tech industry may be over is it is failing to generate its next era, its next engine of growth. Not for lack of trying. The tech industry has many shiny new things that proponents are hyping up in the hope they will propel the industry forward—from virtual reality and the metaverse, to cryptocurrencies and NFTs, to the over-hyped and poorly understood field of “artificial intelligence.” But while previous generations of technology innovation promised clear benefit to a wide group of people, the utility of these next new things is less obvious. Many feel like things we don’t really need getting pushed down our throats. In many cases, these “web 3.0” innovations seem designed more to concentrate power and profit in a smaller segment of tech elites than do anything useful for humanity.

If an industry extends across every other industry, lacks a central defining business model, loses its appeal among investors and customers, and relies on over-capitalization to succeed, it is hard to really call it an industry any more, at least not in the traditional sense. Technology itself will continue to evolve, innovate, and disrupt, improving our lives in many ways, proving detrimental in many other ways. But the “tech industry” as we’ve known it feels like it is entering its twilight—remaining centrally important to our economy, just as energy, manufacturing, transportation, and other legacy industries are, but no longer deserving special distinction, and the market caps that go with it.

December 24, 2022

Our Real Inflation Woes

Photo by engin akyurt on Unsplash

Inflation has continued to be a top-of-mind issue for most Americans this holiday season, with good reason. The U.S. annual inflation rate across all goods rose to over 7% last year, and has remained at that level throughout 2022—spiking as high as 9.1% in June, its highest level since 1981.

One of the most visible drivers of inflation, as is usually the case, has been the cost of energy—particularly gasoline, the price of which increased nearly 50% in the first six months of the year. There are few other products we as consumers purchase where we are so acutely aware of its price, measured consistently by the gallon with the price displayed on huge digital signs that fluctuate daily. Making any movement in that price extremely noticeable.

I have argued in a previous post that a higher price for gasoline is desirable. The simple economic rationalization is that higher prices lead to decreased gasoline consumption, hence reducing the negative impact of carbon emissions on the planet and diminishing our enrichment of authoritarian regimes around the world.

High gas prices were repeatedly exploited as a political talking point through the summer and fall, as if the rise were somehow the fault of incumbent Democrats. Inflation did not prove to be the political cudgel its shrillest complainers hoped it would be in the midterm elections. I’d like to believe this is because American consumers, and voters, are more sophisticated in their understanding of so-called “pocket-book” issues.

Gas prices spiked in June, but are now only 13% higher than January (Source: BLS)

While the price of gas rose rapidly in the first half of the year, it was starting from a very low price—almost the exact CPI as it was a decade ago. In fact, gas prices were actually below the 2012 price for nine years, only catching up in 2022. Further, after peaking in June, the price of gasoline has actually fallen by 23% on average. At its current price index, gasoline is only 14.8% more expensive than it was 10 years ago. Adjusted for wage increases, gas has gotten relatively less expensive compared to other goods and services.

Ten year average annual CPI of Gasoline benchmarked to College Tuition, Medical Care and Rent (Source: BLS)

But the biggest reason I believe most Americans call bullshit on the weaponization of gas prices in our political narrative is that they see costs of so many other things rising inexorably. Notably absent in the pitched rhetoric of politicians squealing over high gas prices during the November campaigns were complaints about high prices of housing, healthcare, and education. High gas prices may make you feel poor at the pump, but high prices for rent, medical bills, and college tuition make you feel poor for a lifetime.

Compare the CPI increase in these areas to the price of gasoline. Over the same 10-year time horizon, the cost of college tuition has increased 28.5%, nearly twice that of gasoline. Medical care expenses have increased even more, rising 31.6% over that time. And average rent prices tops them all, rising 38.4% from 2012 to today. Unlike gas, inflation in these areas has only gone up—becoming a bigger and bigger piece of the average household budget.

If we are really concerned about inflation, then these are the areas to focus on. Investing in education is one of the best ways for someone to climb the economic ladder, but most of the lower- and middle-income college students who do go to college are saddled with crippling student loan debt.

Spiraling healthcare costs are another unacceptable inflationary crisis. Two thirds of people who file for personal bankruptcy do so because of healthcare costs. Yet many of the same politicians complaining about high gas prices have fought every facet of healthcare reform, practically making the repeal of the Affordable Care Act their main political goal.

Owning real estate is one of the most powerful ways of creating wealth. But with median home prices in the U.S. approaching half a million dollars and over $800K in California, many Americans are completely priced out of home ownership. Relentless rent increases and a lack of affordable housing has driven many people out of expensive urban areas, or worse—into home insecurity, with the rate of homelessness rising significantly since 2018. Yet, those complaining about gas prices also fight the creation of affordable housing.

I don’t understand why or how this topic became so politically fraught. Reducing costs for housing, healthcare, and education shouldn’t be a partisan issue. Making these things affordable is essential for achieving the American dream, and helps every American, of every party and socio-economic class. Why don’t we ever seem to address in a bipartisan way these real drivers of inflation?

Yes, higher gas prices suck. But that feels like more of an inconvenience than a crisis, particularly compared to these other inflationary woes that result in insurmountable debt, personal bankruptcy, and homelessness. Unfortunately, as we move into a divided Congress, political progress on these issues seems unlikely. So in the meantime, during this season of giving, I encourage you to join me in supporting charitable organizations that address these issues. In Northern California, some of my favorites include Peninsula Healthcare Connection for accessible healthcare, United Hope Builders for a unique approach to affordable housing, and The Peninsula College Fund for helping everyone access higher education.

November 30, 2022

The World C(orr)up(t)

Like 5 billion people around the world, I’ve been watching a lot of soccer lately. The World Cup is in full swing, and I’m loving the competition—though not the surrounding controversy. Although enthusiasm for the world’s most popular sport still lags here, the United States Men’s National Team is doing their part—advancing past the group stage with a win against Iran on Tuesday.

U.S. superstar Christian Pulisic scoring against Iran. Photo credit: Fox Sports (Alex Grimm/Getty Images)

The U.S. will play the Netherlands on Saturday in the round of 16 remaining teams. It is win-or-go-home from here on out. With the youngest average age of any team in the tournament, the U.S. side shows incredible talent, promise, and pride. Unlike previous World Cups when simply qualifying for the tournament finals was an achievement and getting out of the group stage a huge accomplishment, this U.S. team seems hungry for more. Stacked with a deep roster of players who compete at the highest levels of international club soccer, the Americans have high expectations of continued success.

Regardless of how far they ultimately advance in the 2022 tournament, this nucleus of generational talent has American soccer fans already excited for 2026, when the U.S. will host the World Cup along with Canada and Mexico. After failing to qualify in 2018, they have bounced back and already accomplished so much, making every American proud.

What is harder to be proud of is the International Federation of Association Football or FIFA, the sport’s governing body and host of the World Cup. The organization has been accused of corruption and mismanagement for decades. Eyebrows were particularly raised in 2010, when FIFA simultaneously announced that the 2018 World Cup had been awarded to Russia and 2022 to Qatar, despite the country lacking any of the necessary infrastructure and averaging 106°F temperatures in the summer when the World Cup is typically held.

These choices were so unexpected that many immediately suspected a tainted selection process. In fact, it was. In 2015 the U.S. Department of Justice indicted multiple FIFA officials on racketeering conspiracy and corruption charges. Netflix is airing an excellent and timely documentary about the scandal called “FIFA Uncovered” which details the schemes and people involved. And yet, the games proceeded in Russia and Qatar. Of course, both countries denied any wrongdoing and were outraged at the mere suggestion of impropriety. Whatever bribes Qatar may have paid, they are a trivial rounding error in the context of their full investment.

As excited as I am for the players and fans at this World Cup, the underbelly of corruption is evident in every match. Watching World Cup games played in November (a concession to the weather) in front of half-full stadiums, larded with VIP seating, constructed with slave labor, and unlikely ever to be used again is not a feel-good, to say the least. Many have called to boycott the games. Qatar spent an estimated $220 billion (5 Twitter’s worth!) on infrastructure projects, from hotels to highways, and of course stadiums, to host just 64 games in 29 days—dwarfing the previous largest World Cup investment by Brazil, at what was then considered an astronomical sum of $15 billion. A disproportionately ridiculous investment for the mere $17 billion the games are expected to generate for Qatar. Further, even the Qatari government acknowledges the massive human cost of “between 400 and 500” people who died during construction, though unofficial (and likely more-accurate) estimates range as high as 6,000 deaths.

Photo by Markus Spiske on Unsplash

The only persuasive argument in favor of Qatar is the same argument South Africa successfully made in their bid to host the 2010 World Cup. As the world’s game, the World Cup should not only be hosted in Europe or the Americas, but in Africa, the Middle East, and other regions as well. And it’s true, one of the most inspiring aspects of the World Cup is its diversity. And that diversity is better served by a wider variety of host nations, exposing us all to different cultures.

That said, given the humanitarian exploitation, it is impossible to see Qatar’s quarter-trillion-dollar investment as some sort of initiative for racial equality or social justice. Like other countries in the region, Qatar is an oil monarchy that has enriched itself while ignoring human rights and democratic ideals. Without oil, the country wouldn’t exist. Under the autocratic rule of the Al Thani royal family, Qatar has bought its way not just into hosting the World Cup but into the modern world, period.

The architect of Qatar’s rise into 21st-century nationhood was Sheikh Hamad bin Khalifa Al Thani, who seized power from his father in 1995. At that time, the population of Qatar was just 513,447. In 1950, the emirate barely existed with a population of just 25,000. But by 2021, the population had exploded 5X to 2.94M, surging 13% in 2021 alone leading up to the World Cup. Even more astonishing was the growth in GDP under Hamad’s reign, exploding 25X from a mere $8 billion in 1995 to $199 billion in 2013 when he handed power to his son, Sheikh Tamim bin Hamad Al Thani, the current Emir of Qatar—making Qatar one of the richest countries in the world in GDP-per-capita, even if they did spend more than their entire annual GDP to host the World Cup.

That wealth is overwhelmingly concentrated among the elites. Only 11.6% of Qatar’s population are even citizens. The vast majority are “non-Qatari residents” shipped in from other countries as cheap labor to build skyscrapers, highways, and stadiums. Because these imported workers are overwhelmingly male combined with a repressive culture for women, the country is severely gender imbalanced, with a population skewed 3:1 male-to-female.

What Qatar wants, like Russia and any other oil-rich oligarchy, is first-world legitimacy. The World Cup is merely a publicity vehicle, focusing the world’s attention on their nation while, they hope, glossing over their abysmal history of human rights, particularly for women and LGBTQ+. Nations like Qatar and Russia along with organizations like FIFA, put the global economy into its true context. The previous distinctions we worried about, of Communism vs Capitalism, or Democratic vs. Autocratic, seem increasingly irrelevant. The modern world is driven less by political ideology and much more by the economics of self-interest. The battle lines are Corruption vs Morality. Exploitation vs Egalitarianism.

Unfortunately, the forces of Corruption seem to be making progress all around the world, not just at the World Cup. Corrupt officials, executives, and oligarchs are increasingly concentrating the world’s wealth and power in their hands, and acting with greater impunity believing themselves to be beyond the reach of any consequence or punishment. We’ve seen in our own politics just how far the tentacles of global corruption reach.

Of course, there is a measure of hypocrisy from the United States and Europe on this subject. A study of history tells you the wealth of so-called Western nations was built on exploitation—both of natural resources and people. From European colonization, to America’s land grab from Native populations, to the African slave trade, to our current exploitation of cheap labor in Asia and immigrant workers from Central and South America, it is easy to claim the moral high ground when your country’s wealth is already secured over past generations.

Qatar might reasonably argue, from a historical context, that they are doing nothing different. Taking what they’ve got (oil) and exploiting what they can buy (cheap labor) to get what they want (a first-world global economy). That may be true, but what the U.S. and Europe can and must demonstrate to the world, even if it is done in part to rectify our past sins, is that true modern nationhood requires not just wealth, but respect, opportunity, and equality for every citizen—inclusive of non-citizen residents. Corruption and exploitation cannot be part of the modern economy. As organically diverse nations, we need to show what a government free of corruption and exploitation could look like, even though we are still far from that ideal.