Catherine Crier's Blog, page 8

July 23, 2012

Banking industries are not exempt from Rule of Law or our system of justice

Over the past two decades, global financial institutions have earned the moniker: ‘criminal enterprises’. Daily, we read about this sector’s self-dealing, theft, fraud, money-laundering and covert manipulation of rules designed to protect the world economies.

Despite its power, this industry is not exempt from the Rule of Law and our system of justice. It is time to demand that our elected officials choose sides. Are they loyal to the Republic and its people or to the banksters who have chosen short-term profits over America’s economic and political stability/survival?

From The Huffington Post

Banking Is a Criminal Industry Because Its Crimes Go Unpunished

By Charles Ferguson

Consider just this month’s news in financial services.

First, Barclay’s has been manipulating the Libor, the main interest rate upon which most other interest rates and financial transactions are based, since 2005. Moreover, Barclay’s traders were colluding with traders in many other banks to assist them in manipulating the Libor too, so that they could all profit from their bets on it.

Second, JP Morgan Chase is having a really great month. Recent reports describe how it is resisting Federal subpoenas related to price-fixing in U.S. electricity markets. It is also accused (by former employees among others) of deliberately inflating the performance of its investment funds to obtain business. And finally, JP Morgan’s failed “London whale” trade, which has now cost over $5 billion, is being investigated to determine whether the loss was initially concealed from regulators and the public.

Third, HSBC is paying a fine because it allowed hundreds of millions, perhaps billions, of dollars of money laundering by rogue states and sanctioned firms, including some related to terrorist activities and Iran’s nuclear efforts. But HSBC is only one of at least 12 banks now known to have tolerated, and in some cases aggressively courted, money laundering by rogue states, terrorist organizations, corrupt dictators, and major drug cartels over the last decade. Others include Barclay’s, Lloyds, Credit Suisse, and Wachovia (now part of Wells Fargo). Several of the banks created special handbooks on how to evade surveillance, created special business units to handle money laundering, and actively suppressed whistleblowers who warned of drug cartel activities.

Fourth, a new private lawsuit cites documents indicating that Morgan Stanley successfully pressured rating agencies into inflating the ratings of mortgage-backed securities it issued during the housing bubble.

Fifth, Visa and Mastercard have just agreed to pay $7 billion to settle a private antitrust case filed by thousands of merchants, who alleged that Visa and Mastercard colluded to fix fees and terms of service.

Just another month in financial services. Is it unusual? No, it’s not. If we go back just a little further, we have UBS, HSBC, Julius Baer, and other banks actively marketing tax evasion services to wealthy U.S. and European citizens. We have senior executives of several banks (including JP Morgan Chase and UBS) strongly suspecting that Bernard Madoff was running a Ponzi scheme, but deciding to make money from him rather than turn him in. And then, of course, we have the financial crisis and everything that led to it. As I show in great detail in my book Predator Nation, we now possess overwhelming evidence of massive securities fraud, accounting fraud, perjury, and criminal Sarbanes-Oxley violations by mortgage lenders, investment banks, and credit insurers (including senior executives of Countrywide, Citigroup, Morgan Stanley, Goldman Sachs, Bear Stearns, AIG, and Lehman Brothers) during the housing bubble that caused the financial crisis. If we go back to the late 1990s, we have the massively fraudulent hyping of Internet stocks, and several banks (including Merrill Lynch and Citigroup) actively aiding Enron in committing its frauds.

So, July 2012 really isn’t abnormal at all. The reason for this is very simple. Over the past two decades, the financial services industry has become a pervasively unethical and highly criminal industry, with massive fraud tolerated or even encouraged by senior management. But how did that happen?

Well, deregulation helped, of course. But something else was far more important. It is the one critical factor that unites all of the episodes cited above, including those of this month. This critical unifying factor is the total number of criminal prosecutions of major firms and senior executives as a result of all of these crimes combined.

And what is that number?

Zero.

Literally zero. A number that neither President Obama nor Mitt Romney shows the slightest interest in changing.

Consider the Obama administration’s choices for the four most important positions in financial sector law enforcement. The attorney general (Eric Holder) and the head of the Justice Department’s criminal division (Lanny Breuer) both come to us from Covington & Burling, a law firm that represents and lobbies for most of the major banks and their industry associations; indeed Breuer was co-head of its white collar criminal defense practice, and represented the Moody’s rating agency in the Enron case. Mary Schapiro, the head of the SEC, spent the housing bubble in charge of FINRA, the investment banking industry’s “self-regulator,” which gave her a $9 million severance for a job well done. And her head of enforcement, perhaps most stunningly of all, is Robert Khuzami, who was general counsel for Deutsche Bank’s North American business during the entire bubble. So zero prosecutions isn’t much of a surprise, really.

In contrast, what do you think would happen to you if, as a lone individual, you were caught supporting Iran’s nuclear program? Do you think that you would get off with a “deferred prosecution agreement” and a fine equal to a few percent of your annual salary? No?

But that’s because you don’t live right. You probably haven’t been to the White House a dozen times since President Obama took office, or attended White House state dinners, like Lloyd Blankfein has. Nor have you probably overseen millions of dollars in lobbying and campaign donations, or hired senior administration officials, or sent your executives into the government in senior regulatory positions, or paid $135,000 for a speech by someone who later became chairman of the National Economic Council. And, well, you get the law enforcement that you pay for.

July 22, 2012

‘Shadow Years’ is a must read as voters sort out Romney’s conflicting narratives.

If we examine the achievements that Romney says qualify him to lead our economy, two things are certain: He generated great returns for investors but job creation was never a goal; and his success was dependent on a financial system designed and manipulated by powerful special interests.

David Bernstein’s article on the ‘Shadow Years’ is a must read as voters struggle to sort out the conflicting narratives about Romney’s corporate and political career.

From The Boston Phoenix

Romney’s Shadow Years

Mitt wants to make his departure for the Olympics a clean break from his business life — but it’s not that simple

By DAVID S. BERNSTEIN

With just six weeks to go before the Republican National Convention, Mitt Romney’s campaign has bogged down over the seemingly insignificant minutia of how to precisely define the leave of absence he took from Bain Capital, while he ran the Winter Olympics from 1999 to 2002.

It was predictable that this issue would arise — it has cropped up periodically virtually from the moment Romney returned from Salt Lake City in 2002, to run for governor of Massachusetts.

What may seem surprising is the intensity with which the Obama campaign is pressing its side of the argument: that Romney is responsible for Bain’s actions during those years. Equally noteworthy is the tenacity with which the Romney campaign is fighting back. Romney even submitted himself to five network-television interviews this past Friday, in a mostly unsuccessful attempt to quell the dispute.

The battle over these Bain “Shadow Years” looks especially odd, since the basic facts are not in much dispute.

When Romney left for the Olympics in February 1999, he removed himself from the day-to-day operations of the company. But he did not legally extricate himself at that time, remaining full owner of Bain Capital and most of its related entities, as well as president and CEO.

That only changed more than two years later, when he decided not to return to Bain after the Olympics.

Nobody claims that Romney was running Bain Capital’s day-to-day business from Utah; nobody can dispute that he was legally the head of the company at the time, and at the very least signed occasional documents in that role.

The devil is in the details. Did Romney truly have no input during that time, as he and the company insist? Or, did he keep a hand in the business, as many suspect?

That hardly seems like a huge matter of debate in a presidential contest. It’s not as if Bain Capital operated so much differently during those Shadow Years than it did while Romney was there in person. Romney has not even indicated that he would have done much of anything different had he been in charge at the time.

So why are both camps acting as though the election hangs in the balance?

The answer lies in the dual view Americans hold of corporate magnates.

For the most part, Americans respect supremely successful business leaders. We admire their skill, wisdom, hard work, and risk-taking; gobble up their memoirs and how-to books; and turn to them for analysis and insight.

But it’s a different story when the curtain draws back to reveal tales of greed, manipulation, and double-dealing. Then, America’s populist anger turns against those corporate titans. Think of cigarette executives who swear ignorance of their product’s harm; oil and energy executives whose shortcuts befoul the land while they rake in astronomical profits; business executives, like those at Enron, who rig the system while screwing over employees and customers; and bailed-out bank executives rolling around in multi-million-dollar bonuses.

A close election could easily turn on which of these two images captures the American electorate, as they consider handing the country over to Romney.

NO-LOSE LIFE

The “retroactive retirement” Romney finalized with Bain Capital, in 2002, claimed February 1999 as his exit date. For three years, Romney got to enjoy the perks of being the boss, including an annual salary of at least $100,000, as well as investment opportunities, and, presumably, the authority to intercede in Bain deals if he chose to, whether or not he actually exercised that power. He also held open the option of returning as boss and owner after the Olympics, if he wanted to.

He got all of that, while being absolved in the end of all responsibility and blame for anything the company did during that time.

The ability to fashion that kind of no-lose arrangement, frankly, is one way that the very wealthy and powerful differ from the rest of us. When revealed, it can make successes look inevitable, rather than impressive.

If Romney’s history of stacking the deck is subject to scrutiny, it could undermine the accomplishments at the core of the argument for his candidacy.

Bain Capital, for instance, often structured its deals as no-lose propositions: Bain extracted enormous fees and contracts from its takeover targets, making millions even when those companies collapsed.

And Romney has applied the principle to his own carefully guarded personal image for decades.

One of the most blatant was his pre-arranged face-saving plan when he agreed to head Bain Capital in the first place, in 1983.

In a tale first revealed by Boston Globe reporters in 2007, Romney agreed to do it only if his boss at Bain & Company, William Bain, ensured that there was, in Bain’s words, “no professional or financial risk.”

If Bain Capital failed, Romney would reclaim his old job and salary, plus any raises he would have received. Plus, Bain agreed to “craft a cover story,” the Globe wrote, to shield Romney from personal blame for Bain Capital’s failure.

It seems very likely that this is more-or-less how Romney arranged his leave of absence for the Olympics. It makes for curious bookends to his career at Bain Capital: he started by pre-arranging a way to avoid responsibility, and ended by retroactively arranging to avoid responsibility.

If so, it doesn’t make Romney sound like the bold turnaround master he claims to be. And it raises the question: what else in his life is as he claims, and what is just a pre-arranged “cover story”?

The secrecy and deception make it hard for voters to judge how much credit — or blame — Romney really deserves for Bain, or the Olympics, or his time as governor. It also suggests that a Romney presidency would be even more opaque than most.

COMPLICATED BUSINESS

The Shadow Years loom large with Romney because they fall within a time when his investment activity was particularly complex and wide-ranging — and open to criticism.

In earlier years — when both the leveraged buyout field, and Bain Capital itself, were newly developing, Bain Capital tended to get involved in fewer, fairly straightforward deals.

And after 2002, Romney placed his investments in a blind trust prior to taking the oath of office as governor. That has allowed him to wave off questions about his holdings since then. (Although Romney had previously derided the idea that a blind trust absolved Senator Ted Kennedy of responsibility, and Romney’s trust is considerably less “blind” than most.)

But from the mid 1990s through 2002, Bain Capital and Romney personally had enormous wealth, leverage, relationships, and influence that translated into an increasingly wide range of often difficult-to-unravel investments — some of which might look sketchy to average Americans.

And, in some cases, while he was running the Olympics, Romney made personal investment decisions in tandem with those made by Bain — making it hard to believe he was really out of the Bain loop.

One of those is DDi Corp., which Bain Capital took over in 1996, while Romney was still unambiguously in charge.

Bain took DDi public in 2000, and over the following year sold off two-thirds of its shares, at a reported $36 million profit. Romney personally signed the SEC documents reporting those sales — as well as the documents reporting his own sale, in the same time period, of some $4 million of his own personal DDi shares.

DDi’s stock collapsed soon after, falling from $28 a share to pennies. Among those hit was the Massachusetts pension fund, which had close to $350,000 invested in DDi.

The SEC claimed that Lehman Brothers’ research business over-touted the stock, under pressure from DDi, Bain Capital, and Lehman’s banking arm, which helped underwrite the DDi IPO. Lehman later paid a massive settlement to resolve that and a host of similar SEC charges.

The SEC did not accuse Bain Capital or Romney of wrongdoing in the DDi case, but it certainly smacks of the type of insider-always-wins stock manipulation that outraged people in the housing-market collapse.

Romney’s response, when the case made news while he was governor, was to say that he was on leave of absence for the Olympics at the time. Maintaining that excuse is even more vital for him as he runs for president, in the aftermath of banking scandals.

PROFITEERING, IN BERMUDA?

Then there is the case of Endurance Specialty, one of several casualty insurance companies that sprung up immediately after the 9/11 attacks, which some accused of profiteering off the tragedy.

Endurance Specialty was created in December 2001, and was one of the first major investments of Golden Gate Capital — a fund started by former Bain Capital managers, consisting primarily of large investments from Bain and from Romney personally.

As Endurance Specialty itself proclaimed in its 2002 prospectus, there was an “attractive opportunity” because “many global property and casualty insurers and reinsurers are currently experiencing significantly reduced capital” due to several factors, including “the World Trade Center tragedy.”

In other words, existing insurance companies had their money tied up waiting to sort out 9/11 claims — just as fear-driven customers were desperate to add more coverage, and willing to pay skyrocketing premiums. Companies like Endurance Specialty were able to charge 300 to 400 percent more than pre-9/11 rates, according to reports at the time.

That business can be viewed either as profiteering, or meeting a need.

Either way, Endurance Specialty did do one thing Romney is sensitive about: the company avoided paying US income taxes by basing its operations in Bermuda. It set up shop there, even though almost all of its funding and management were American, and two-thirds of its sales were in the US.

In its prospectus, the company even claims to have received assurances from the Bermuda Ministry of Finance that Endurance Specialty would be exempt from any newly passed taxes there until 2016.

Romney still has at least $2 million invested in Golden Gate, according to his financial disclosure of 2011 (and his wife Ann has at least $250,000), and Golden Gate has sold off its Endurance Specialty holdings — presumably meaning that Romney made money from his investment in the tax-sheltered company.

There was plenty of press back in late 2001 about Golden Gate’s involvement with Endurance Specialty — not just in investors’ trade publications but mainstream media including the Boston Globe. Certainly Romney could have withdrawn his own investment, if not Bain Capital’s — so it behooves him to argue that he was too busy in Salt Lake City to have paid attention to his investments.

There is one more reason that Romney may want to play down his investment persona during the Shadow Years: it may reveal that his much-touted Olympic turnaround was not quite the heroic effort he claims.

Saving the Salt Lake Olympic Games after the bribery scandal is a crucial piece of Romney’s biography — and he was well aware of the political value at the time. The Boston Globe reported that, when pleading for John Hancock to return as a major Olympic sponsor, Romney told his longtime friend and Hancock CEO David D’Alessandro that if the Olympics were not a success, “I won’t be anything anymore in public life.”

Running the Olympics involved many things, but the most important was selling sponsorships — a task that Romney describes at length in Turnaround, his 2004 book about the Olympics experience.

But Romney has never revealed what deals he made to get those $300 million worth of sponsorships (in cash, products, and services) — he exempted those agreements from his pledge of total transparency for the Salt Lake Organizing Committee (SLOC), and they have never been made public. That’s a mighty selective, and potentially self-serving, definition of transparency.

So we don’t know whether Romney used any of his leverage at Bain to help him get those career-saving sponsorships.

There are at least a couple of curious coincidences.

One is Gateway, which ended up as the provider of 4000 free computers.

As Romney describes in Turnaround, every computer maker had turned down the crucial sponsorship, including Gateway. “We were about 30 days out from our September 30, 1999, drop-dead date,” Romney wrote. “If we didn’t have a computer sponsor by then, we would have to start buying them at retail.”

Gateway came on board only after what Romney describes as a highly unusual mano a mano meeting with the company’s CEO.

What we do know is that in 2001, according to SEC documents, Gateway made a deal for services from Bain Consulting — payment for which came in the form of options to buy $5 million of Gateway common stock at a price above what it was trading for at the time.

Jon Huntsman Sr. (father of the presidential candidate) was another who had a change of heart, and later found doors open at Bain.

Huntsman repeatedly insisted that he would not contribute to the Olympics — even as late as the very week when, in a reversal, he wrote a million-dollar check. Huntsman’s support was crucial, many said at the time, to convince other Utah philanthropists to follow suit.

A year later, Bain Capital provided the bulk of a $600 million investment that allowed Huntsman’s company to complete a purchase of Imperial Chemical Industries, making Huntsman Corp. the world’s largest privately held chemical company at the time.

To some, that windfall of assistance from Romney’s company looked like a quid pro quo for Huntsman’s help raising the money for the Olympics to succeed. It raised enough questions that a SLOC spokesperson had to deny that Romney had anything to do with the deal.

DOING BUSINESS

The Gateway and Huntsman deals (first reported by the Phoenix in 2007) could have been purely coincidental. But it certainly wouldn’t be out of character for Romney to use that kind of leverage from one area of his influence to get results in another.

Bain Capital was a pioneer in that kind of synergy. Examples abound of one Bain-controlled company helping another. Staples became a huge buyer from American Pad & Paper; Mattress Discounter stores pushed Sealy mattresses; and Bain-funded start-ups received key early contracts with Bain-owned companies.

And the apparent conflicts of interest didn’t bother Romney, as he made sponsorship deals with Bain-held companies, like Sealy; companies he helped run, like Marriott; or companies where his son worked, like monster.com.

The most telling, though, is a deal that ultimately did not get made — with Staples, where Romney served on the board, and held 50,000 shares worth more than $1 million. A Bain Capital fund held 10 times that stake in the company in 2000 — and increased its holding to more than three million shares in 2001, according to SEC documents.

As Romney describes it in Turnaround, Staples CEO Tom Stemberg had no interest in the office-supplies sponsorship. But he agreed after Romney sweetened the deal to include “lobbying SLOC board members and other corporate contacts to switch their office-supply contracts to Staples.” That proposal was so valuable, Stemberg offered an additional $1 million after Romney learned that Office Depot had beaten Staples to the deal. (Office Depot insisted on keeping the sponsorship.)

It’s not hard to speculate that some of those “other corporate contacts” might have included Bain companies — and to wonder whether Romney was making similar offers, leveraging his Bain connections, to land other Olympic sponsors.

That kind of deal-making could help explain why Romney wanted to keep presenting himself as Bain Capital’s owner, president, and CEO, with some control over the company — and not as the fully separated retiree he describes now.

But it might also say something much more important.

If Olympic sponsors were paid off with business from Bain-controlled companies, then Romney’s Salt Lake success seems less a matter of skillful management, and more a function of his ability to buy what he wants. To most voters, that’s a far less presidential trait.

To read the Talking Politics blog, click here. David S. Bernstein can be reached at dbernstein@phx.com and you can f ollow him on Twitter @dbernstein.

July 21, 2012

Weapons makers now suggesting that GOP reconsider tax hikes.

Our global military presence requires a mammoth defense industry, one that consumes nearly half of all military expenditures worldwide. In January, 2013, automatic defense cuts are scheduled to occur under the Budget Control Act. This sequestration has members of Congress and major defense contractors scrambling to dodge this bullet.

Desperate to protect their bottom line, weapons makers now suggest that the GOP consider raising revenues (taxes!). Just maybe those top tier Bush tax cuts should expire to facilitate a budget agreement before the New Year’s deadline. How will Republicans respond to this powerful lobby?

From The Huffington Post

As Defense Cuts Loom, Weapons Makers Say Tax Hikes Should Be On The Table

By Joshua Hersh and Patrick Svitek

WASHINGTON — Executives for some of the leading defense industry corporations told Congress on Wednesday that tax hikes should be among the remedies considered in order to prevent steep cuts to their budgets.

The remarks came during a tense hearing of the House Armed Services Committee to discuss a looming deadline that would see defense funding slashed by $500 billion if legislators cannot find a way to balance the budget.

The defense industry has lobbied hard to prevent the automatic cuts, known as sequestration, but it has offered little by way of alternatives. At the hearing, Democratic lawmakers lashed out at the generally reticent executives, pressing them on just what, exactly, they believe Congress should do to avoid the cuts.

“I think everything has to be on the table at this point,” said Pratt and Whitney’s president David Hess.

A second CEO, Lockheed Martin’s Robert Stevens, offered more equivocal support for including revenue-raising measures, telling legislators, “When we face challenges in our business … we try to put into the recipe every possible ingredient that might lend itself to the formation of a solution.”

Two other CEOs on the panel — Sean O’Keefe of EADS North America, and Williams-Pyro’s Della Williams — avoided making similar remarks about tax hikes but joined Hess and Stevens in stressing the damage to their industry and their employees if the companies are forced to make cutbacks.

Sequestration would automatically take effect on Jan. 1 if lawmakers cannot find a solution to the debt crisis.

Throughout the day, partisan fissures grew over how to handle the crisis, even as all but two lawmakers voted to make President Obama explain how he would carry out the cuts.

Washington Rep. Adam Smith, the top Democrat on the Armed Services Committee, spent much of the hearing criticizing the industry titans for dodging a barrage of questions about their recommended solutions.

“Everybody does exactly what you did today,” Smith said as the hearing wound down. “You flatly refused about saying anything about making those choices and dump it all on us. Not only do you flatly refuse to say anything about it, you take steps that systematically kick our legs out from under us as we try to deal with it.”

The committee’s Republican chair, Rep. Howard “Buck” McKeon (Calif.), pushed back against the Democratic hostility, declaring the Armed Services Committee is not the “general welfare committee” and that the defense contractors were only there to elaborate on the sequester’s impact on their industry.

After Rep. Tim Ryan (D-Ohio) asked the panel how he should explain to his constituents that averting sequestration will involve borrowing money, a smirking McKeon thanked him for his “beautiful, eloquent arguments.”

The political rancor over the automatic cuts did not ease up as the day dragged on.

A news conference with House Majority Leader Eric Cantor (R-Va.) and Virginia Gov. Bob McDonnell (R) was canceled hours after Virginia’s Democratic delegation decried the GOP-only event as a strictly partisan affair.

Cantor and McDonnell were expected to discuss how the defense sequester would affect military-heavy Virginia.

Led by Sen. Mark Warner, Virginia Democrats in the House and Senate boycotted McDonnell’s routine meeting with his state’s elected officials on the Hill earlier in the day.

“In politics everyone wears two hats,” McDonnell spokesman Tucker Martin said in an email later Wednesday. “However, policy must always come first. That is why, to assuage Democratic concerns, we canceled our unrelated press conference scheduled for after today’s meeting. And yet, even after they got what they wanted, the Democrats still unfortunately chose to just take their ball and go home.”

Instead, only GOP members from Virginia’s delegation met with McDonnell in Cantor’s office.

Despite the partisan tone of the day’s events, lawmakers managed to reach a bipartisan consensus on the House floor Wednesday afternoon.

The House passed the Sequestration Transparency Act in a 414-2 vote, effectively asking Obama for a specific outline of how he will implement the more than $100 billion in automatic cuts triggered by the failure of the Super Committee last fall. That bipartisan panel was tasked with finding a $1.2 trillion deficit reduction package.

During floor debate Wednesday, Rep. Todd Young (R-Ind.) described the bill as “blessedly bipartisan.”

Cantor’s office blasted out a statement on the law’s approval just a half an hour short of when he and McDonnell would have addressed reporters outside the Capitol.

“Time is overdue for the President to come to the table to work with Congress,” Cantor said in the statement. “There should be no disagreement that a strong national defense and job creation are top priorities.”

July 19, 2012

For-profit prison industry, an example of how profit motive leads to perverse business incentives.

While privatizing certain state/local government functions can be beneficial, the for-profit prison industry has become a prime example of how the profit motive leads to perverse business incentives. Administrators are pressured to hire fewer, less-experienced guards, cut food/health care, inflate costs, and ignore physical and sexual abuse among prisoners.

Now, Virginia is contracting out a facility for indefinitely sentenced sex offenders. Guaranteed occupancy for those cells?

From The Huffington Post

Private Prison Company May Take Over Virginia Sex Offender Center

By Chris Kirkham

Virginia is in the final stages of reviewing proposals that would privatize a mental health treatment facility for sex offenderswho can be held indefinitely under state law, according to state officials and a private prison company seeking a contract to operate the institution.

The GEO Group, the nation’s second-largest private prison operator, and Liberty Healthcare Corp., which manages mental health institutions, are vying to manage the 300-bed state facility, known as the Virginia Center for Behavioral Rehabilitation. Both companies bring checkered histories in their experiences managing a similar facility in Florida, according to reports in that state.

The proposed contract in Virginia would give a private company authority over convicted sex offenders enrolled in a controversial program known as “civil commitment,” through which the state designates some inmates sexually violent predators. That label gives the state the right to hold those inmates indefinitely while administering mental health treatment.

Twenty states and the District of Columbia employ the process, which the U.S. Supreme Court has upheld as constitutional in three separate cases. But critics contend that ceding control of the process to a profit-making corporation poses an enormous conflict of interest: The company would have a financial incentive to hold onto sex offenders for as long as possible while skimping on required mental health services.

“These people could be held forever,” said Tracy Velazquez, executive director of the Justice Policy Institute, a non-profit group that is critical of the rise of private involvement in the nation’s penal system. “There’s a disincentive for the companies to provide treatment, because the inmates continue to be customers. There is no end of sentence.”

A spokesman for the GEO Group said the company would administer the facility in the public interest.

“Under public-private partnerships, private operators provide high-quality management services of correctional, detention, and residential treatment facilities under strict and constant oversight and monitoring from state officials,” said Pablo Paez, a GEO spokesman, in an emailed statement. “These services have absolutely no bearing on sentencing policies or decisions which are exclusively made by policymakers.”

In a recent conference call with investors, a GEO Group executive, Jorge Dominicis, said he expects Virginia to decide on his company’s contract proposal by July.

Liberty Healthcare, a privately owned company based in suburban Philadelphia, did not respond to requests for comment.

The Virginia Department of Behavioral Health and Developmental Services, which oversees the sex offender facility, declined to comment on the deliberations, but confirmed that a formal review of the privatization proposal is in the later stages.

For the private prison industry, the prospect of overseeing the sex offender facility beckons as a lucrative opportunity. Virginia spent more than $24 million running its civil commitment program last year. The number of inmates landing in the program is projected to more than double over the next four years, as the state continues its intensified scrutiny of sex offenders.

Virginia began its civil commitment program nine years ago in what it portrayed as an effort to protect the public. Since then, about 300 sex offenders have been sent to the special facility, located in the town of Burkeville, about 60 miles southwest of Richmond. Only 35 people have been released, according to state officials.

As costs for the program have risen dramatically, the private prison industry has stepped forward with proposals to assume control, promising savings. Under a novel law, Virginia must review any proposal submitted by a private company seeking to take over many state functions. In Feb. 2011, the GEO Group bid to assume management of the facility. Liberty soon put in a competing proposal.

Should officials at the Department of Behavioral Health opt to accept one of the proposals, they would be required to forward them to a commission comprised of state legislators and cabinet members for additional review. The commission may comment, but is not empowered to alter the decision, which would remain with the department, according to state law.

Virginia’s deliberations have advanced without official public input or legislative hearings. When The Huffington Post this week contacted Virginia Del. David Albo – a Republican who chairs the state legislative committee that oversees criminal justice issues — he said he was unaware of a proposal to privatize the Burkeville facility.

“Why would we allow this decision to be made without any legislative input whatsoever?” said Mary Devoy, executive director of Reform Sex Offender Laws of Virginia, an advocacy group that opposes the privatization proposal.

The GEO Group has in recent years injected significant contributions into Virginia political campaigns. In the state’s gubernatorial campaign three years ago, the GEO Group was one of the largest single contributors to the Republican who won, Bob McDonnell, giving him a total of $28,000, according to state records. A spokesman for McDonnell declined to respond to questions about the GEO Group’s donations and any influence on its privatization proposal, saying only that the governor was “playing no direct role in this process.”

The GEO Group has made smaller contributions to Virginia legislative leaders. A GEO Group mental health subsidiary, GEO Care, has spent more than $13,000 on lobbying related to the sex offender facility during the past two years, according to state records.

Those who follow on the intersection of public policy and campaign finance say the process underway in Virginia appears to be a classic case of contributors gaining access to tilt policy in their favor.

“For them to come in and make an unsolicited offer after they gave a campaign donation does not really pass the smell test,” said Edwin Bender, executive director of the National Institute on Money in State Politics, a nonpartisan group that tracks political influence at the state level. “That just stinks, because it’s very obvious that there’s a profit motive here. It’s not doing something in the public interest.”

A GEO Group spokesman did not directly respond to assertions that political contributions were part of an attempt to curry favor in Virginia, but argued that any decision by the state would be on the merits of the company’s proposal.

“That contract is part of a competitive procurement in which GEO and other companies can participate,” the company spokesman said. “The award of a contract to GEO or any other company who bids on it would be based solely on the proposals submitted under said competitive procurement process.”

He added that GEO is not unique in contributing to political campaigns.

“We have participated in the political process in states across the country and nationally — as do a variety of organizations, including private corporations and organized labor organizations –- through contributions to political candidates and parties who support different public policy viewpoints,” the GEO Group spokesman said.

Both companies competing to take over Virginia’s center for sex offenders tout their experience running a similar institution in Florida, which has the only fully privatized civil commitment system in the nation. The GEO Group currently holds the contract to operate the Florida Civil Commitment Center, located south of Tampa. Liberty held the contract before GEO, but the state opted not to renew the agreement in 2006, following a series of state inspector general’s reports that detailed widespread mismanagement.

Residents at the facility regularly made and drank homemade alcohol, according to a 2005 inspector general’s report from the Florida Department of Children and Families, which oversaw the contract with Liberty. Several inmates admitted to being intoxicated during the investigative interview with the department.

The report described an interview with a drunken inmate who said he had been in a “brutal” fight after drinking earlier in the day: “His eyes were bloodshot, he smelled of alcohol, and he admitted he was still drunk and could not talk at that time. He was badly beaten and sustained a broken nose.”

State probes found that a top manager in the facility had been altering and falsifying reports of security incidents, withholding troubling details of inmate injuries that resulted from staff neglect.

The GEO Group took over the facility in 2006. Two years later, a convicted rapist escaped, eluding local police for more than a day, according to news reports. In 2010, a mental health counselor who worked for GEO at the facility was arrested by the local sheriff’s office and accused of having a sexual relationship with an inmate.

The GEO Group spokesman said the company was proud of its “long-standing record of quality operations,” including at the Florida center, which he said has provided “significantly improved outcomes, all while delivering significant savings for Florida taxpayers.”

“While no correctional, detention, or residential treatment facility -– be it public or private -– is immune from operational challenges, our company has always strived to achieve the highest standards in the industry,” he said.

Both GEO and Liberty have promised they can save Virginia substantial amounts of money — a central concern for state lawmakers, who have seen the costs of the civil commitment program multiply nearly tenfold in less than a decade. The soaring costs are the result of a surge of new entrants to the sex offender program following the Virginia General Assembly’s 2006 passage of laws that greatly expanded the pool of potential inmates.

One new law prescribed specific questions the state must use in assessing the likelihood that a given sex offender will commit a similar crime following release. Among them: “Have you ever lived with a lover for at least two years?” “Any male victims?” and “Any stranger victims?”

The state uses the answers to compute a score intended to serve as a snapshot of risk. The state is required to administer the test on all inmates convicted of any one of 28 different sexual-related crimes, including rape and aggravated sexual battery. Scores above a certain threshold trigger a mandatory state review that can result in referral to the Attorney General’s Office and, eventually, civil commitment.

Since the General Assembly passed the law, the number of inmates referred to the sex offender facility has increased dramatically — from about 10 per year from 2003 to 2006 to about 57 annually from 2007 to 2010, according to a state legislative audit report.

A report by the research arm of the Virginia legislature warns that any savings that result from corporate management of the facility could come at the expense of required mental health treatment.

“The incentive to make a profit tends to encourage efficiency and quick decision-making that often results in lower costs,” the report asserts. “However, the same profit motive could supersede treatment and safety considerations.”

The Florida facility that GEO operates has only one-third of the staff devoted to each patient than is standard in Virginia, according to the report.

The same report notes that staff at Virginia’s treatment facility have concerns about inadequate security amid overcrowded conditions, quoting one employee: “I was in some situations where it was downright dangerous and it could have gotten out of hand very quickly.”

Critics assert that Virginia is effectively compromising the well-being of one slice of its incarcerated population in order to hand a profit opportunity to an influential private interest.

“The idea here is, ‘This is a problem. We can’t afford this system, but politically we don’t have the will to change the system, so let’s just give it to a private company and wash our hands of it,’” said Velazquez, the Justice Policy Institute executive director. “Let’s take the people who we care about the least in society, lock them up forever and let people make money off of it.”

July 18, 2012

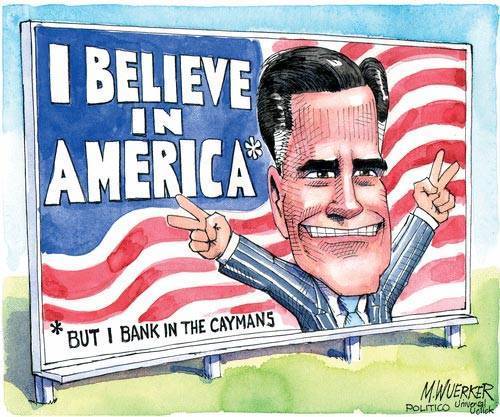

Why is Romney continuing to stonewall despite pleas for complete disclosure?

On PoliticsNation with Reverend Al Sharpton, I joined Bloomberg’s Joshua Green and Huffington Post’s Ryan Grim to discuss Mitt Romney’s continued stonewalling on the tax return issue and asked these questions: Is it possible that Romney participated in the 2009 IRS Amnesty program for Americans with undeclared off-shore bank accounts? If so, might this doom his campaign? Some viewers objected to my “boneheaded partisan attack.” As you read this, change the name ‘Romney’ to ‘Obama’, then ask if GOP supporters would look the other way.

From PoliticsNation with Reverend Al Sharpton

GOP split over Romney’s tax returns

PoliticsNation | Aired on July 18, 2012

More Republicans are calling for Mitt Romney to release his tax returns, despite criticism from Rush Limbaugh and other party members. Romney is still shrugging it off, but how long can he dodge the issue? Ryan Grim of the Huffington Post, former judge Catherine Crier, and Josh Green of Bloomberg Business Week discuss what could be learned from Romney’s tax returns.

In 2008, Romney showed the McCain campaign his tax returns for 23 years. (It is not known how much, if any, supporting documentation was included.) He has made his 2010 return public but without the FBAR document detailing his off-shore accounts, and he promises to release the 2011 return in October. But Romney is adament that only 2010-11 will be made available to the American people. So, to date, ‘outsiders’ have seen part/all of 25 annual IRS filings. Why is Romney stonewalling despite pleas for complete disclosure from leading conservatives and publications like WSJ and National Review?

Well, it is all or nothing. He cannot agree to cough up those documents reviewed by the McCain campaign without releasing ’08-’09. Obviously, it is logical to focus on these years.

Some suggest he may have suffered sufficient setbacks in the ’08-’09 collapse to zero out his tax bill during that period. I believe his low tax rate is already ‘built into the political equation and that this information would be damaging to his campaign, not devastating. However, another possibility exists.

In 2009, cracks appeared in the Swiss iron curtain. The IRS acquired closely guarded, seemingly inviolate information about unreported US dollars stashed overseas. Federal prosecutors began filing cases and obtained some high-profile convictions. That year, amnesty was offered to citizens who voluntarily disclosed these accounts. About 15,000 people came forward, tendering billions in unpaid taxes, fines and penalties. (The offer was extended again in 2011-12.)

I do not know if Romney ever failed to report his off-shore accounts to the IRS. If so, I don’t know if he sought amnesty in 2009 to avoid the previously unfathomable prospect of criminal prosecution. But as a former criminal prosecutor and civil judge, I do know the inquiry is valid. And if he did? Then he must guard those returns with his political life. Watch the segment clip above and let me know your thoughts on Twitter.

Additional Info:

Prediction: Romney Will Not be the Republican Nominee

IRS Offers New Amnesty For Offshore Tax Cheats

MSNBC Guest: Mitt Romney Could End Up Withdrawing From GOP Race Before Convention

Peddling partisan rhetoric is not the same as objective reporting.

Allowing government officials or politicos final approval on press quotes enables them to manipulate a story’s narrative while undermining media objectivity and credibility. As the New York Times reported on Sunday, ‘quote approval’ has now become common practice among journalists who protest that their only alternative is an absence of sources. Nonsense.

It’s time for the many journalists who cringe at peddling political talking points to support the resurgence of hard-hitting, watchdog journalism.

From The New York Times

Latest Word on the Trail? I Take It Back

By JEREMY W. PETERS

The quotations come back redacted, stripped of colorful metaphors, colloquial language and anything even mildly provocative.

They are sent by e-mail from the Obama headquarters in Chicago to reporters who have interviewed campaign officials under one major condition: the press office has veto power over what statements can be quoted and attributed by name.

Most reporters, desperate to pick the brains of the president’s top strategists, grudgingly agree. After the interviews, they review their notes, check their tape recorders and send in the juiciest sound bites for review.

The verdict from the campaign — an operation that prides itself on staying consistently on script — is often no, Barack Obama does not approve this message.

The push and pull over what is on the record is one of journalism’s perennial battles. But those negotiations typically took place case by case, free from the red pens of press minders. Now, with a millisecond Twitter news cycle and an unforgiving, gaffe-obsessed media culture, politicians and their advisers are routinely demanding that reporters allow them final editing power over any published quotations.

Quote approval is standard practice for the Obama campaign, used by many top strategists and almost all midlevel aides in Chicago and at the White House — almost anyone other than spokesmen who are paid to be quoted. (And sometimes it applies even to them.) It is also commonplace throughout Washington and on the campaign trail.

The Romney campaign insists that journalists interviewing any of Mitt Romney’s five sons agree to use only quotations that are approved by the press office. And Romney advisers almost always require that reporters ask them for the green light on anything from a conversation that they would like to include in an article.

From Capitol Hill to the Treasury Department, interviews granted only with quote approval have become the default position. Those officials who dare to speak out of school, but fearful of making the slightest off-message remark, shroud even the most innocuous and anodyne quotations in anonymity by insisting they be referred to as a “top Democrat” or a “Republican strategist.”

It is a double-edged sword for journalists, who are getting the on-the-record quotes they have long asked for, but losing much of the spontaneity and authenticity in their interviews.

Jim Messina, the Obama campaign manager, can be foul-mouthed. But readers would not know it because he deletes the curse words before approving his quotes. Brevity is not a strong suit of David Plouffe, a senior White House adviser. So he tightens up his sentences before giving them the O.K.

Stuart Stevens, the senior Romney strategist, is fond of disparaging political opponents by quoting authors like Walt Whitman and referring to historical figures like H. R. Haldeman, Richard Nixon’s chief of staff. But such clever lines later rarely make it past Mr. Stevens.

Many journalists spoke about the editing only if granted anonymity, an irony that did not escape them. No one said the editing altered the meaning of a quote. The changes were almost always small and seemingly unnecessary, they said.

Those who did speak on the record said the restrictions seem only to be growing. “It’s not something I’m particularly proud of because there’s a part of me that says, ‘Don’t do it, don’t agree to their terms,’ ” said Major Garrett, a correspondent for The National Journal. “There are times when this feels like I’m dealing with some of my editors. It’s like, ‘You just changed this because you could!’ ”

It was difficult to find a news outlet that had not agreed to quote approval, albeit reluctantly. Organizations like Bloomberg, The Washington Post, Vanity Fair, Reuters and The New York Times have all consented to interviews under such terms.

“We don’t like the practice,” said Dean Baquet, managing editor for news at The New York Times. “We encourage our reporters to push back. Unfortunately this practice is becoming increasingly common, and maybe we have to push back harder.”

The Obama campaign declined to make Mr. Plouffe or Mr. Messina available to explain their media practices. “We are not putting anyone on the record for this story,” said Katie Hogan, an Obama spokeswoman, without a hint of irony. She pointed to the many unrestricted interviews with campaign officials every day on television and when the press corps travels with the president.

Jay Carney, the White House press secretary, said the White House has made a concerted effort to make more officials available to the news media. “We have a lot more people talking a lot more often now,” he said.

Both presidential campaigns are keenly aware of what can happen when they speak too freely. Damaging sound bites can live on in the news cycle for days. Mr. Obama’s remark last month during a televised news conference that “the private sector is doing fine” landed almost immediately in attack ads. And Eric Fehrnstrom’s “Etch A Sketch” comment on CNN, about softening some of the harder positions Mr. Romney took during the primaries, continues to haunt the Romney campaign five months later.

Reporters who have covered the Obama presidency say the quote-approval process fits a pattern by this White House of finding new ways to limit its exposure in the news media.

“We realize there’s a caution and a wariness about stray comments driving the news cycle,” said Caren Bohan of Reuters, president of the White House Correspondents’ Association. “The argument we make is that if a president or a candidate is out there more, I think these things are less likely to be as glaring.”

Modern White Houses have long had “background briefings,” gatherings of top officials who speak to reporters under the condition that they are quoted anonymously. With time, the restrictions have become broader, often bordering on the absurd.

In 2007, Vice President Dick Cheney outed himself in a briefing the White House intended to be anonymous during an overseas trip. “I’ve seen some press reporting says, ‘Cheney went in to beat up on them,’ ” the vice president told reporters, according to the official transcript, adding, “That’s not the way I work.”

Though reporters with him protested, the vice president’s office refused to allow them to identify Mr. Cheney by name — even though it was clear who was speaking.

Under President Obama, the insistence on blanket anonymity has grown to new levels.

The White House’s latest innovation is a variation of the background briefing called the “deep-background briefing,” which it holds for groups of reporters, sometimes several dozen at a time. Reporters may paraphrase what senior administration officials say, but they are forbidden to put anything in quotation marks or identify the speakers.

The White House held such a briefing after the Supreme Court’s health care ruling last month with officials including Mr. Plouffe, Mr. Carney and Dan Pfeiffer, the communications director. But when reporters asked to quote part of the conversation, even anonymously, they were told no. Even the spokesmen were off limits.

July 17, 2012

Corporate emissaries in Washington out themselves by voting against DISCLOSE.

Government transparency at its finest… Read the article below to find out which Republican senators are moonlighting as corporate ambassadors to Washington.

From The Huffington Post

Disclose Act: 14 Republican Senators Were For Disclosure Before They Were Against It

By Dan Froomkin

WASHINGTON — Back when Democrats were pushing for limits on campaign spending, the Republican Party line was that full, immediate disclosure of political donations and expenditures was a better way to avoid corruption.

In fact, in 2000, Senate Republicans joined Democrats in overwhelmingly passing a bill, 92 to 6, that required a growing number of secretive tax-exempt groups to reveal their donors and spending.

Back then the controversy centered on groups formed under section 527 of the Internal Revenue code, although the amounts involved look quaint in comparison to the vast gushers of secret political money being funneled through 501(c)4 “social welfare” organizations and 501(c)6 trade associations in this election cycle.

Today, with the Supreme Court having essentially outlawed limits on political spending, Republicans have made a complete about-face on the issue. All of a sudden, they vehemently oppose disclosure.

Case in point: Senate Democrats are calling for a cloture vote Monday on their Disclose Act, which would require any organization that conducts political activity to make public the sources of its funding, in real time — as did the bill in 2000. But this time, all the chamber’s Republicans are expected to block it from coming to the floor.

What’s changed, other than the Republicans’ vote, is that unlimited corporate money is now pouring into political campaigns, overwhelmingly in favor or Republicans, with a significant portion of it flowing through groups that, thanks to the legal loopholes the Disclose Act would plug, are allowed to keep their donors anonymous.

Those groups include Crossroads GPS, founded by Karl Rove, and others funded by the Koch brothers and the U.S. Chamber of Commerce, which alone intends to spend over $50 million on pro-Republican advertising this cycle, all secretly funded by corporations.

Of today’s Republican senators, 14 were there in 2000 and voted in favor of disclosure.

President Ronald Reagan

“Full disclosure of all campaign contributions, including in-kind contributions, and expenditures on behalf of any electoral activities.” From the 1988 Legislative and Administrative Message: A Union of Individuals, January 25, 1988.

President George H.W. Bush

“Disclosure — full disclosure — that’s the answer here.” - Remarks to Congressional and Administrative Interns Announcing Campaign Finance Reform Proposals, June 29, 1989.

Senator Olympia Snowe

“Greater disclosure and transparency in the process will act as a strong deterrent against unethical behavior in Congress.” Statement in favor of lobbying reform, March 2006.

Senator Susan Collins

“Sen. Collins…believes that it is important that any future campaign finance laws include strong transparency provisions so the American public knows…who is funding … a political candidate or issue.” Statement from Collins’ spokesman, GOP Senators avoid co-sponsoring campaign finance reform legislation, The Hill, March 20, 2010.

Senator Scott Brown

“Attack ads from unaccountable outside groups that spend millions of dollars from anonymous donors portraying their opposition unfairly and misleading voters are wrong.” Open letter to Elizabeth Warren challenging her to join his call for outside groups to stay out of the Massachusetts Senate race, The Boston Herald, January 13, 2012.

Senator Dick Lugar

“To make certain that The Club for Growth has not…undermined the public trust, I call upon your organization…to immediately release the names of the individuals and entities contributing.” Open letter to the Club For Growth calling on them to release the names of their donors, April 13, 2012.

Mitch McConnell

“We need to have real disclosure… why would a little disclosure be better than a lot of disclosure?” Campaign Finance Bill has GOP Wary, The Hill, April 22, 2010.

“This is nothing less than an effort by the government itself to exposes (sic) its critics to harassment and intimidation, either by government authorities or through third-party allies.”Speech to the American Enterprise Institute, May 15, 2012.

Please share this video to help inform your friends and family about the Republican back-pedaling on disclosure and the urgent need to take action today to convince the Senate to pass DISCLOSE.

ICYMI: The Ed Show on MSNBC

On last night’s Ed Show, I joined the Big Panel with NJ Republican Assembly Leader Jon Bramnick and Democratic strategist Keith Boykin to discuss the messages coming from both sides of the campaign trail.

If you haven’t already seen it, check out Obama’s “Firms” ad in the clip below and share your thoughts on Twitter!

From The Ed Show

Obama campaign in full attack mode with new ad

The Obama campaign has released a devastating new ad on Mitt Romney that hits on everything from his outsourcing of jobs to his offshore bank accounts. The Romney campaign attempted to respond with their own ad, but didn’t have much luck. NJ Republican Assembly leader Jon Bramnick, author and attorney Catherine Crier, and Democratic strategist Keith Boykin join Ed Schultz to discuss the dueling ads.

Geithner’s 2008 Libor recommendations display textbook regulatory capture.

It’s no wonder the Fed and big banking lobbies resist increased transparency. As head of the New York Federal Reserve, Treasury Secretary Timothy Geithner had the opportunity to act on Libor rate-rigging back in 2007-08. Instead, he took marching orders from the very U.S. banks that were wreaking havoc on our domestic economy.

Three decades of regulatory capture, manipulated interest rates, collusion, and disregard for the public interest culminate in a perfect storm of self-dealing, political corruption and global fraud. As loyal Americans, our first instinct is to defend free market capitalism, but we can no longer mistake that economic system with the international corporatism now in place.

From The Huffington Post

Tim Geithner’s Libor Recommendations Came Straight From Banks, Documents Show

By Ryan Grim

WASHINGTON — Treasury Secretary Timothy Geithner has so far escaped responsibility for the spreading Libor fixing scandal by releasing documents showing that when he became aware of the problem in 2008, as head of the Federal Reserve Bank of New York, he made recommendations to address it.

“The New York Fed analysis culminated in a set of recommendations to reform LIBOR, which was finalized in late May. On June 1, 2008, Mr. Geithner emailed Mervyn King, the Governor of the Bank of England, a report, entitled ‘Recommendations for Enhancing the Credibility of LIBOR,’” a Fed statement released Friday reads. “As is clear from the work culminating in the report to Mr. King of the Bank of England, the New York Fed helped to identify problems related to LIBOR and press the relevant authorities in the UK to reform this London-based rate.”

With that, Geithner earned a rash of headlines focused on his foresight, as well as criticism for the cozy relationship between regulators and bankers that had led to the controversy.

But the Fed, along with its statement, also released the staff work that led to the recommendations. Those documents reveal that the recommendations Geithner sent to London did not come from staff, but rather were proposed by major banks and more or less forwarded on verbatim.

The policy recommendations Geithner forwarded in an attachment on June 1 first appear in a staff memo dated May 20 that reads: “A variety of changes aimed at enhancing LIBOR’s credibility has been proposed by market participants, and seem to be under consideration by the BBA. These proposed changes include, but are not limited to…”

A comparison between Geithner’s recommendations and those put forward by “market participants” – shorthand for banks — makes it clear that Fed staff asked banks how to fix the problem, then presented those answers as their own. (Most of the banks consulted were likely U.S.-based institutions, as several of the recommendations are aimed at giving more power, not surprisingly, to U.S. banks.)

Below are excerpts from the recommendations, side by side:

Geithner: Strengthen governance and establish a credible reporting procedure. To improve the integrity and transparency of the rate-setting process, we recommend the BBA work with LIBOR panel banks to establish and publish best practices for calculating and reporting rates, including procedures designed to prevent accidental or deliberate misreporting. The BBA could require that a reporting bank’s internal and external auditors confirm adherence to these best practices and attest to the accuracy of banks’ LIBOR rates.Banks: lmplementing an audit process designed to ensure that reporting procedures and quotes adhere to an agreed and published set of best practices.

Geithner: Increase the size and broaden the composition of the USD panel. The BBA should increase both the size and tile proportion of US banks on the USD panel. Currently, the only US banks on the panel are Bank of America, Citibank, and JPMorgan, but there are several other US banks active in tills market and potentially eligible for inclusion in the panel, including Wachovia, State Street, Northern Trust, and BoNY.

Banks: lncreasing the size of the panel and including more US institutions, so that the resulting rate is more representative of the global demand for unsecured interbank dollar funding, and less susceptible to issues concentrated within any particular region’s banking sector.

Geithner: Add a second USD LIBOR fixing for the U.S. market. The BBA should consider adding a second USD fixing to capture rates for transactions that occur when the US market is active.

Banks: Changing the time of the fixing, or adding a second fixing that occurs when US-based sources of dollar funding are active.

Geithner: Specify transaction size. … [T]o reflect the fact that actual transaction sizes can fluctuate markedly with changes in market conditions, the BBA should consider allowing the transaction size it specifies to adjust flexibly over time, with these adjustments occurring either at regular frequency in response to significant changes in market conditions.

Banks: Specifying transaction size, which could adjust flexibly to market conditions.

Geithner: Only report the LIBOR maturities for which there is a net benefit.

We recommend that, in consultation with panel banks, the BBA adopt guidance on consistent methods for determining quotes across the range of maturities of LIBOR. In addition, we recommend that the 13BA consider reducing the number of maturities for which it solicits quotes and publishes rates. For tenors such as the 3-month tenor, LIBOR quotes provide valuable information to the public because of the volume of activity occurring at that tenor, whilequotes for tenors at which little or no trading occurs, such as the 11-month, are less indicative and therefore less valuable. The current practice of soliciting rate quotes across 15 tenors, when only a subset of those tenors reflect meaningful market activity, likely leads to more subjective andformulaic responses across all tenors. By asking banks to quote fewer rates, the BBA may solicit higher quality responses for those more informative tenors, with relatively little value lost by excluding less informative tenors.

Banks: Reducing the number of maturities quoted. The high number of maturities may lead to formulaic responses, and it is not clear that the market highly values, for example, a 7-month LIBOR quote. A key issue here may be the existence of derivatives contracts that reference all existing maturities.

Geithner: Eliminate incentive to misreport. If the combination of best practices and audit recommendations in (1) above seems unlikely to be sufficiently effective in ensuring accurate reporting, a complementary approach might be to adopt the following process for collecting, calculating, and publishing LIBOR rates. The BBA could collect quotes from all members of the expanded panel, and then randomly select a subset of 16 banks from which the trimmed mean would be calculated. The names and quotes for the 8 banks whose rates are averaged to calculate the LIBOR fixing would be published. The banks whose reports fall above or below the midrange would not be publicly identified,nor would the level of their outlying rates. This random sampling from an expanded panel would lessen the likelihood that the market would draw a negative inference regarding a particular bank’s continued absence from the list of published quotes.

Banks: Making some or all of the individual quotes anonymous, so that even if the quotes refer to own-borrowing rates, banks at the high-end of the rate spectrum won’t fear reporting accurately.

A Treasury spokesperson referred questions to the New York Fed. A Fed spokesperson said that the proposals put forward were the result of the bank’s own analysis.

“The recommendations made by the New York Fed to the Bank of England to address the well publicized problems with LIBOR were the result of its own analysis by its economists and market specialists of what it considered to be the best solution to those problems,” said the spokesperson in a statement.

Indeed, some of the proposals put forward by banks were not included in Geithner’s list of suggestions. And one element of Geithner’s set of proposals — to randomize andanonymize the submissions, rather than just anonymize them — did not come directly from Wall Street, according to the documents.

From The New York Times

Geithner Tried to Curb Rate Rigging in 2008

BY BEN PROTESS

When Timothy F. Geithner ran the Federal Reserve Bank of New York, he acknowledged fundamental problems with the process for setting key interest rates in the midst of the 2008 financial crisis, according to documents provided to The New York Times.

Mr. Geithner, who is now the United States Treasury secretary, questioned the integrity of the benchmark as reports surfaced that Barclays and other big banks were misrepresenting the rates. In 2008, Barclays had several conversations with New York Fed officials about the matter.

Mr. Geithner then reached out to top British authorities to discuss issues with the interest rate, which is set in London. In an e-mail to his counterparts, he outlined reforms to the system, suggesting that British authorities “strengthen governance and establish a credible reporting procedure” and “eliminate incentive to misreport,” according to the documents.

But the warnings came too late, and Barclays continued the illegal activity.

For years, Barclays reported false rates in an effort to bolster its profit and deflect concerns about the British bank’s health. Last month, the bank agreed to pay $450 million to American and British authorities to settle claims that it had manipulated key benchmarks, including the London interbank offered rate, or Libor.

Libor and other such rates affect the cost of borrowing for consumer and companies, providing a benchmark for trillions of dollars in mortgages and other financial products. The case against Barclays is the first action to stem from a broader multiyear investigation into how big banks set the rates. Authorities around the world are pursuing investigations against more than 10 big banks, including UBS, JPMorgan and Citigroup.

Since the Barclays settlement, regulators have faced scrutiny of their roles in the rate-manipulation scandal.

Lawmakers in London and Washington have questioned whether government officials turned a blind eye to years of misconduct at Barclays. The bank has disclosed that it informed regulators, including the Bank of England and the Federal Reserve Bank of New York, that it had reported artificially low rates, along with the rest of the Wall Street.

This week, the oversight panel of the House Financial Services Committee sent a letter to the New York Fed seeking transcripts from several phone calls involving regulators and Barclays’ executives. The New York Fed plans to release the transcripts on Friday.

Mr. Geithner is not mentioned in the transcripts, a person briefed on the matter said who did not want to be identified because the investigation was continuing. But it is unclear if other documents will detail whether he had deeper knowledge of the issues with Libor, and what further actions — if any — Mr. Geithner took. According to the person briefed on the matter, New York Fed officials told regulators in Washington about the problems with Libor.

The New York Fed, which oversees the holding company at some of the nation’s biggest banks, first got wind of brewing problems with Libor in the summer of 2007. At the time, Barclays executives started briefing the regulators in the United States and Britain about their interest rate submissions.

In April 2008, a Barclays employee acknowledged to the Financial Services Authority of Britain that the bank was lowering its Libor submissions. “So, to the extent that, um, the Libors have been understated, are we guilty of being part of the pack? You could say we are,” the Barclays manager said, according to regulatory documents. Barclays made similar comments to the New York Fed, the documents say.

The bank never explicitly told regulators that it was reporting false interest rates that amounted to manipulation, according to regulatory documents.

In Basel, Switzerland, Mr. Geithner discussed the Libor with Mervyn King, the governor of the Bank of England, Britain’s central bank, according to the documents provided to The New York Times. Mr. Geithner then followed up with a June 2008 e-mail to Mr. King, outlining in a two-page memo his suggested changes to the way big banks set the interest rate, a copy of the memo shows. Mr. Geithner made six main recommendations for “enhancing the credibility of Libor.”

“We would welcome a chance to discuss these and would be grateful if you would give us some sense of what changes are possible,” Mr. Geithner wrote.

Mr. King responded “favorably” the person briefed on the matter said. The person added that the respective regulators continued discussions.

Documents released by the Bank of England on Friday show that Mr. King and Paul Tucker, the central bank’s deputy governor, passed on Mr. Geithner’s recommendations to the British Bankers’ Association, the trade body that oversees the Libor rate.

Mr. Tucker also talked to William C. Dudley, the current president of the Federal Reserve Bank of New York, who was the executive vice president of the central bank’s markets group at the time of the discussion.

In a separate note, Angela Knight, the chief executive of the British Bankers’ Association, told Mr. Tucker that the suggestions from U.S. authorities were being included in a review of Libor. The trade body published its findings at the end of 2008, but is now conducting a further review into how the rate is set.

The memo from Mr. Geithner, however, raises new questions about why the Bank of England failed to halt the actions. At a hearing this week, British politicians hammered Mr. Tucker, the senior Bank of England official who is now a front-runner to become the next head of the bank, for failing to thwart the misconduct.

Geithner’s 2008 Libor recommendations are textbook regulatory capture.

It’s no wonder the Fed and big banking lobbies resist increased transparency. As head of the New York Federal Reserve, Treasury Secretary Timothy Geithner had the opportunity to act on Libor rate-rigging back in 2007-08. Instead, he took marching orders from the very U.S. banks that were wreaking havoc on our domestic economy.

Three decades of regulatory capture, manipulated interest rates, collusion, and disregard for the public interest culminate in a perfect storm of self-dealing, political corruption and global fraud. As loyal Americans, our first instinct is to defend free market capitalism, but we can no longer mistake that economic system with the international corporatism now in place.

From The Huffington Post

Tim Geithner’s Libor Recommendations Came Straight From Banks, Documents Show

By Ryan Grim

WASHINGTON — Treasury Secretary Timothy Geithner has so far escaped responsibility for the spreading Libor fixing scandal by releasing documents showing that when he became aware of the problem in 2008, as head of the Federal Reserve Bank of New York, he made recommendations to address it.

“The New York Fed analysis culminated in a set of recommendations to reform LIBOR, which was finalized in late May. On June 1, 2008, Mr. Geithner emailed Mervyn King, the Governor of the Bank of England, a report, entitled ‘Recommendations for Enhancing the Credibility of LIBOR,’” a Fed statement released Friday reads. “As is clear from the work culminating in the report to Mr. King of the Bank of England, the New York Fed helped to identify problems related to LIBOR and press the relevant authorities in the UK to reform this London-based rate.”

With that, Geithner earned a rash of headlines focused on his foresight, as well as criticism for the cozy relationship between regulators and bankers that had led to the controversy.

But the Fed, along with its statement, also released the staff work that led to the recommendations. Those documents reveal that the recommendations Geithner sent to London did not come from staff, but rather were proposed by major banks and more or less forwarded on verbatim.

The policy recommendations Geithner forwarded in an attachment on June 1 first appear in a staff memo dated May 20 that reads: “A variety of changes aimed at enhancing LIBOR’s credibility has been proposed by market participants, and seem to be under consideration by the BBA. These proposed changes include, but are not limited to…”

A comparison between Geithner’s recommendations and those put forward by “market participants” – shorthand for banks — makes it clear that Fed staff asked banks how to fix the problem, then presented those answers as their own. (Most of the banks consulted were likely U.S.-based institutions, as several of the recommendations are aimed at giving more power, not surprisingly, to U.S. banks.)

Below are excerpts from the recommendations, side by side:

Geithner: Strengthen governance and establish a credible reporting procedure. To improve the integrity and transparency of the rate-setting process, we recommend the BBA work with LIBOR panel banks to establish and publish best practices for calculating and reporting rates, including procedures designed to prevent accidental or deliberate misreporting. The BBA could require that a reporting bank’s internal and external auditors confirm adherence to these best practices and attest to the accuracy of banks’ LIBOR rates.Banks: lmplementing an audit process designed to ensure that reporting procedures and quotes adhere to an agreed and published set of best practices.

Geithner: Increase the size and broaden the composition of the USD panel. The BBA should increase both the size and tile proportion of US banks on the USD panel. Currently, the only US banks on the panel are Bank of America, Citibank, and JPMorgan, but there are several other US banks active in tills market and potentially eligible for inclusion in the panel, including Wachovia, State Street, Northern Trust, and BoNY.

Banks: lncreasing the size of the panel and including more US institutions, so that the resulting rate is more representative of the global demand for unsecured interbank dollar funding, and less susceptible to issues concentrated within any particular region’s banking sector.

Geithner: Add a second USD LIBOR fixing for the U.S. market. The BBA should consider adding a second USD fixing to capture rates for transactions that occur when the US market is active.

Banks: Changing the time of the fixing, or adding a second fixing that occurs when US-based sources of dollar funding are active.

Geithner: Specify transaction size. … [T]o reflect the fact that actual transaction sizes can fluctuate markedly with changes in market conditions, the BBA should consider allowing the transaction size it specifies to adjust flexibly over time, with these adjustments occurring either at regular frequency in response to significant changes in market conditions.

Banks: Specifying transaction size, which could adjust flexibly to market conditions.

Geithner: Only report the LIBOR maturities for which there is a net benefit.