Andrew Rogerson's Blog, page 55

October 14, 2014

Options To Sell My Business

“What are my options to sell my business” is a question I get most weeks. The good news is that the economy continues to strengthen albeit at what appears to be a slow and uneven pace; especially for those of us in Northern California and not part of the San Francisco Bay area and the IT industry. One of the direct results of the economy strengthening is that business owners with a strong and viable business are now looking at their options with their small business and deciding what to do; especially if they are approaching retirement or have high motivation to do something different. For example, this week I received a call from a business owner whose goal was to be independently wealthy by age 35 so he could go into politics. The good news for him is that he’s just turned 35 years old and arrived at his goal and so now it’s time to sell his business and move to politics which is very important to him.

If you are thinking of selling your business, click this link to learn about where to start and what it involves.

If you have a medical practice, please click this link.

When business owners are approaching their business, personal and professional goals they have different options. Here is a look at six of the main options and their pros and cons.

1. FamilyThis is not an option for the 35 year old I just mentioned, but for a lot of business owners especially if they have reached 55 years of age or more and have children, there is strong motivation to continue the history and achievements of the business by having the ownership transition to their immediate children. Often this comes from a strong desire of the current owner to perpetuate their legacy and have their business “stay in the family.”

If the business has more than one owner be it through a partnership or multiple shareholders, an easy outcome for the owner that wants to sell is to one of the partners or shareholders.

Pros of selling the business to other partners or ownersThere are no secrets. The skills, knowledge, integrity and performance of all the other owners are a known quantity.Selling to other partners or owners is very smooth and takes much less time.Selling to other partners or owners does not require a breach of confidentiality which can damage the business and its value.Selling to other partners or owners does not disrupt the current mission, culture, focus of the business.If the seller chooses, they are often welcome to remain involved in some capacity with the business.Cons of selling the business to other partners or ownersSelling the business for a price lower than fair market value because the other owners may not have the financial resources.The owner that wants to sell may be required to carry a large part of the purchase price as an installment note that may put the business at a higher risk.Getting into a disagreement about the value of the business because each owner puts a higher value on their personal contribution or how they see their personal goodwill contribution.Once the seller leaves the business they may take a specialized business or management skill the other owner(s) didn’t recognize and when gone, damages the performance of the business.Similar to the previous point, the other owners may lack the business or management skills to now own and operate the business.May require the business seller to continue with the business be it financially by providing capital or guaranteeing bank debt.3. Current management of the businessThis option considers selling the business to the current management of the business. Current management would generally only include a General Manager or other upper level management position such as the Financial Controller, Operations Manager or Senior Sales and Marketing Manager.

Pros of selling the business to current management of the businessProbably the best reason to sell the business to current management is that the owner knows their skills, knowledge and performance but most important of all, there is a lot of trust between all parties. All good business is based on trust.The current owner has a defined and clear mission and culture of the business which the current managers understand and follow.Relationships with employees, customers, suppliers, lenders and others are in place.The current performance of the business should be easily measurable.The amount of time to close the sale should be short and relatively easy to complete with little need for detailed due diligence and little to no need for confidentiality.Generally, the current owner can remain active with the business which can be important to all parties including the less obvious groups such as employees, lenders and suppliers.Cons of selling the business to current management of the businessProbably the hardest part of selling a business to current management is arriving at a fair and reasonable price. Sellers of a business may only know the true value of their business when it goes to market and the market decides what price they are willing to offer. Business valuations provide a guide and the market provides the definitive price.The sale of a business from one party to another always includes negotiations. When one party thinks or has a stronger negotiating position it can lead to unfair outcome. The owner may think they are critical to success or executive management may feel the same making it hard for the egos to be held in check.The current owner may need to continue to provide their name and reputation and therefore be exposed to personal risk, for the business to continue trading and operating.Current management will not really know how good or bad they are at now owning and running the business including its inherent risks and difficulties.4. EmployeesThe closest option to sell a business is family. The next is executive management and this third option is to all the employees of the current business through an option called an Employee Stock Ownership Plan or ESOP.

Pros of selling the business to employeesAn ESOP allows the owner to fairly quickly and easily sell the business at Fair Market Value.If the business is a C Corporation it provides the owner with tax advantages when they exit the business.Allows the ESOP to retire debt with pre-tax dollars and then convert to an S Corporation and now pay no income taxes.A way to attract and retain valuable employees as well as increase and motivate higher productivity for the employees when they compare to working at a competitor.Cons of selling the business to employeesAn ESOP often takes on debt from a third party such as a bank to pay out the owner. This debt provides a financial risk to the business as it needs to manage that debt and in most instances, the owner often need to provide a personal guarantee of the bank loan continuing their risk of continued oversight of the business.If the ESOP decides to sell at some time in the future to a competitor or other strategic buyer, it makes the purchase price of the business higher and therefore reduces the chance of the business actually selling.The ESOP model requires all employees to know in much more detail the performance of the business. This therefore leads to many additional conversations and assessments about major and even more mundane management decisions that stakeholders may have a concern about.An ESOP includes all employees. The ongoing financial management and administrative costs are complicated and high which include legal disclosures and education.5. Independent buyerThere are independent business buyers constantly looking for the right business opportunity.

Pros of selling the business to an independent buyerThis provides the seller the best opportunity to receive the highest price and best terms and conditions for the sale of the business.Third party lenders such as banks and the SBA loan programs provide the seller a way to remove themselves from the business including investment and financial risk.For the business, a new buyer brings new ideas, fresh energy and enthusiasms that can take the business in a new and positive direction.Provides the owner a clear date of exiting and running the business and the conclusion of their day to day responsibilities.Cons of selling the business to an independent buyerSelling a business is not a quick process. It normally takes between 6 to 12 months and in California, it’s currently taking an average of 8 months if everything is in order especially the financial statements.For the owner, selling their business which is a personal extension of who they are and their identity can prove too much. Added to this is the owners concern about the change to the company’s mission and culture.With a new owner comes change. This means employees who were once secure now have to prove themselves all over again; if they like the new owner as well as a change in relationship to customers and suppliers.6. Closing down the businessClosing down the business can either be a voluntary or involuntary decision. If the decision is voluntary the advantages and disadvantages are as follows.

Pros of closing down the businessIf the business is declining for whatever reason, a voluntary liquidation provides the owner with the best way to control and maximize the net proceeds from the sale of hard assets such as real estate, fixtures, furniture and equipment.The value of intangible assets, for example, phone numbers, websites, customer lists and more can be separated and sold if there is a willing buyer.A short and finite time period to convert these assets into cash so the owner can move on to other more productive outcomes.Cons of closing down the businessThe highest value for a business when sold comes as a going concern. When there is a voluntary liquidation event the values are lower plus there are costs including a lot of time for the liquidation.Closing down the business means all jobs will now be lost be it for the owner, their family and any of its employees.The economy functions at many levels including global, national, state and local. Each business that closes has a negative impact not only for customers, suppliers, landlords, employees but also the community at large.Are you thinking about selling your business? Would you like to know the value of your business? If you would like more information please visit my website Business valuation.

For more immediate help you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

The article Options To Sell My Business first appeared on Andrew Rogerson and Rogerson Business Services.

October 9, 2014

4 Social Media Marketing Tools Used By The Pros

Social networks reach 80 percent of American Internet users and account for nearly one quarter of all time spent online, according to the Content Marketing Institute. Further, the 2012 Hubspot State of Inbound Market report found that 77 percent of B2C marketers acquired new customers via Facebook, as did 43 percent of B2B campaigns.

Successful companies are using social media to their advantage not only from a marketing standpoint, but also to build trust and loyalty with customers. Those utilizing third-party tools to streamline social media campaigns are ahead of the game. It’s important to first implement safeguards like identity theft protection and virus protection before growing your social circles into the thousands. Once that step is completed, use these four tools to improve the efficiency and effectiveness of your social media campaigns.

Social OomphA data analysis by B2B marketing firm Annuitas Group found that businesses using automation applications for social media and other marketing endeavors experience a 451 percent increase in qualified leads. Social Oomph is one of the best tools out there for this purpose.

Timeless posts on your blogs, known as evergreen content in the SEO world, should be continually promoted on social media to bring traffic to your website. Social Oomph has a content reservoir feature that allows you to set times and dates to re-promote evergreen posts for your new followers who may not have seen them on the original publication date. You can automatically vary the content of the tweets so it doesn’t look as repetitive. The free version works with Twitter, but you’ll need to upgrade to the professional version to automate Facebook posts.

AddvocateThe collective number of followers and friends employees have on their social media profiles usually far exceeds that of the company account. Addvocate provides a means for employees to occasionally share company-related posts on their personal accounts.

This browser plugin enables your marketing team to send recommended content to employees to share with their networks. Addvocate then tracks which employees are sharing the content and the resulting engagement from it. This features gives you the opportunity to offer incentives to employees who are marketing the company on their own time. A free demo is available to try before purchasing the paid version.

Analytics ProEvery company wants to nurture relationships with actively engaged customers, while also observing what competitors are doing to attract more leads. Social Bakers created a simple tool to address these issues and offers a 14 days free trial for those interesting in trying the software. It’s Analytics Pro tool provides an easy-to-use interface that collects data across all your social channels to help determine what content is most effective and which customers are the most active. You can then export the data and compare it with reports from other companies in your industry. Thomas Romieu, Global Digital Director of Louis Vuitton, said Analytics Pro has changed the way his company plans and implements its social media strategies because it paints a concise picture of what’s working and what is not.

MentionA great way to determine the level of success for a particular marketing campaign is real-time feedback. Mention is one of the best tools for this purpose. It monitors social media, blogs, forums, and several other online platforms to identify every “mention” of your brand. It reads content in 42 different languages and creates simple-to-read, exportable reports. This not only allows you to gauge the effectiveness of marketing campaigns, but also enables you to instantly react to anything published about your brand. The basic plan is free, while the premium options offer 14 day free trials to test them out.

October 2, 2014

Kalologie and Best In Class Education franchises

Elza Gennicks was my guest on Money 2.0 and our conversation was about the franchise developments he organizes.

Elza is a Director of Franchising who has been involved in this industry for 11 years. Elza primarily works with franchise organizations that are looking to expand out of the region they are primarily focused. He assists them with marketing plans and manages the leads by walking the potential franchise buyer through the franchise development process. Elza says he finds franchising very exciting. He says he gets to see new business concepts and watch them grow. He says franchising is all about taking other people’s ideas and turning them into profit. He mentions his fondness for the term “franchisepreneurs”, which refers to people with an entrepreneurial spirit who run with proven business concepts. He says franchisepreneurs end up taking much less of a business and financial risk versus typical entrepreneurs who are trying to get a new business off the ground. Elza goes on to talk about the three types of franchise models he is currently involved.

Kalologie franchiseThe first is called Kalologie and this is a massage spa concept. He says they have sold 50 units so far. He notes that Message Envy would be one of their biggest competitors.

Best In Class Education CentersAnother franchise model Elza is involved in is the Best In Class Education Centers. Best In Class is a children’s education and tutoring concept, much like Kumon. Elza says most of the current businesses in this industry focus on either young kids or older kids. Best In Class focuses on a broader age group, catering to children 3 years old on up to 18 years. He says Best In Class’ key point of difference is the enrichment classes the centers offer. He notes that the franchise is a part time business model, with the centers typically open 3 days a week.

Lastly, Elza talks about the third franchise model he is heavily involved with: the Native New Yorker restaurants. He explains that the Native New Yorker is a casual dining, family-oriented and sports themed restaurant. He says it is a sit-down style restaurant much like Buffalo Wild Wings. Elza says the competitive advantage of Native New Yorker is that they have been around since 1979 and have their systems of operations down pat. He notes that there are 28 units currently open, with more coming soon in Colorado and Texas.

If you would like to hear my conversation with Elza Gennicks, you are welcome to listen by clicking here. Elza was my second guests in this episode. The conversation begins 28 minutes into the recording.

September 30, 2014

Should I Buy a Business with a Partner

During the depths of the Great Recession, many potential entrepreneurs put their interest on hold to buy and operate their own business. As good economic growth continues to spread, many potential entrepreneurs are now wondering if now the time is right. Because owning a business comes with risk, a good way to manage that risk is with a partner.

Creating a partnership to buy a business or start a franchiseIf you are considering buying a business with a partner or buying the rights to a franchise there are lots of items to discuss. Keep in mind the following:

At a minimum you need 2 to make a partnership. Beware that the more people that join the partnership the harder it becomes as decision making will slow down as all parties will want to know what’s happening, their opinion considered and they want to know any final decision.Each partner will expect a share of the profit. The more partners the less there is to share.A good strategy at the outset is to understand what each partner brings to the partnership and what that’s worth. Some partners may bring money and little to no interest in knowing day to day operation decisions. Others may want to bring management or specific skills. Others may want a job and compensation over and above their share of the partnership. Yet others may want to work casually in the partnership and be part of all executive decisions. Bear in mind that all these things are often dynamic as not only does the economy change and evolve but so too do people.Every partnership should have a buy/sell agreement. This document clearly states how a partner can choose to leave the partnership and how it must be done such as through retirement or if they wish to pursue other interests. Additionally, a partner may leave involuntarily through a health issue, disability or death and if the partners agree, cover this unexpected contingency with insurance.Here are some other items to consider.What is a partnership?

A partnership is the simplest and least expensive for two or more business people to operate with legal protections and responsibilities.

By definition, a partnership is a business with more than one owner and no papers have been filed as is required to create a corporation or LLC.

There are two types of partnership – a general partnership and a limited partnership. A general partnership, as it sounds, means all partners are treated equally; which includes upside and downside risks and responsibilities as follows.

What are the risks and responsibilities in a partnership?In a general partnership, all partners are equal and this includes being personally liable for all business debits and responsibilities be they legal, financial as well as tax. This means, for example, all partners are responsible for business debts including legal judgments. Similarly, if a business owes a creditor such as a supplier, lender, employee or landlord they can be sued to pay that money by filing a legal complaint and if they win, could be allowed to force the sale of a partner’s house or other asset to settle the debt.

The bottom line is that if you do not have 100% trust in the person or people you are considering for a partnership do not even consider this as a viable business option.

Also, there are options to manage the above risk and responsibilities through a Limited Liability Partnership or LLP.

Taxation of a PartnershipA partnership, unlike an LLC or Corporation is not a separate entity from its owner as far as the IRS or in the state where they conduct their business. Like an S Corporation, a Partnership is a “pass-through entity” which means the partnership reports its profit and losses on their individual income tax return or 1040 plus must make quarterly estimated tax payments. While the partnership doesn’t pay taxes, it must report income and expenses on IRS form 1065 which then sets out each partners share.

How to create a partnershipStarting a partnership is as simple as a verbal agreement. Starting a good partnership comes with many conversations around what, where, how, when and especially why. It’s also a good idea to discuss with others you know that are in a partnership to understand the pros and cons from their perspective as well as your attorney and accountant; especially if you move forward and set things up.

Other items to consider include any state and local tax requirements, a Federal EIN or Employment Identification Number, if appropriate, permits and licenses. In California you are also required to file at the county level, a Fictitious Business Name.

It’s not mandatory but I’m a great believer in a Business plan so building a document like this and having it reviewed by an experienced third party can be invaluable and make learning curves much quicker.

How to end a partnershipAs we said above, it’s very easy to create a partnership and equally, if one partner chooses to leave the company or partnership it generally dissolves. If the partnership is to dissolve, the partners must complete their current business obligations, pay off all debts and divide any property that has been built be it profits or soft or hard assets.

To prevent the company and partnership from needing to dissolve, as was mentioned above, anticipate this scenario when the partnership first comes together by creating a buy-sell agreement or buyout agreement which can be part of a written partnership agreement. If you want to prevent this kind of ending for your business, you should create a buy-sell agreement, or buyout agreement, which can be included as part of your partnership agreement.

A partnership is only the best option if all parties understand the risks and responsibilities. It’s not just a matter of understanding when you start out in business, it’s equally important as you continue be it in year one or year twenty one. People evolve and change. About 50% of the population get a divorce because of change and either one party likes the change while the other party does not.

Before you make that final decision to come together in a partnership, talk to an attorney that specializes in business law to get their legal advice and therefore hopefully avoid needing an attorney later on when you realize that entering a partnership was not the best decision you made.

If you would like more information about buying a business please visit my webpage Buy a business or buy a copy of my book Successfully buy your business.

For more immediate help with buying a business you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674[image error]916 570-2674.

The article Should I Buy a Business with a Partner first appeared on Andrew Rogerson and Rogerson Business Services.

Should I buy a business with a partner

During the depths of the Great Recession, many potential entrepreneurs put their interest on hold to buy and operate their own business. As good economic growth continues to spread, many potential entrepreneurs are now wondering if now the time is right. Because owning a business comes with risk, a good way to manage that risk is with a partner.

Creating a partnership to buy a business or start a franchiseIf you are considering buying a business with a partner or buying the rights to a franchise there are lots of items to discuss. Keep in mind the following:

At a minimum you need 2 to make a partnership. Beware that the more people that join the partnership the harder it becomes as decision making will slow down as all parties will want to know what’s happening, their opinion considered and they want to know any final decision.Each partner will expect a share of the profit. The more partners the less there is to share.A good strategy at the outset is to understand what each partner brings to the partnership and what that’s worth. Some partners may bring money and little to no interest in knowing day to day operation decisions. Others may want to bring management or specific skills. Others may want a job and compensation over and above their share of the partnership. Yet others may want to work casually in the partnership and be part of all executive decisions. Bear in mind that all these things are often dynamic as not only does the economy change and evolve but so too do people.Every partnership should have a buy/sell agreement. This document clearly states how a partner can choose to leave the partnership and how it must be done such as through retirement or if they wish to pursue other interests. Additionally, a partner may leave involuntarily through a health issue, disability or death and if the partners agree, cover this unexpected contingency with insurance.Here are some other items to consider.What is a partnership?

A partnership is the simplest and least expensive for two or more business people to operate with legal protections and responsibilities.

By definition, a partnership is a business with more than one owner and no papers have been filed as is required to create a corporation or LLC.

There are two types of partnership – a general partnership and a limited partnership. A general partnership, as it sounds, means all partners are treated equally; which includes upside and downside risks and responsibilities as follows.

What are the risks and responsibilities in a partnership?In a general partnership, all partners are equal and this includes being personally liable for all business debits and responsibilities be they legal, financial as well as tax. This means, for example, all partners are responsible for business debts including legal judgments. Similarly, if a business owes a creditor such as a supplier, lender, employee or landlord they can be sued to pay that money by filing a legal complaint and if they win, could be allowed to force the sale of a partner’s house or other asset to settle the debt.

The bottom line is that if you do not have 100% trust in the person or people you are considering for a partnership do not even consider this as a viable business option.

Also, there are options to manage the above risk and responsibilities through a Limited Liability Partnership or LLP.

Taxation of a PartnershipA partnership, unlike an LLC or Corporation is not a separate entity from its owner as far as the IRS or in the state where they conduct their business. Like an S Corporation, a Partnership is a “pass-through entity” which means the partnership reports its profit and losses on their individual income tax return or 1040 plus must make quarterly estimated tax payments. While the partnership doesn’t pay taxes, it must report income and expenses on IRS form 1065 which then sets out each partners share.

How to create a partnershipStarting a partnership is as simple as a verbal agreement. Starting a good partnership comes with many conversations around what, where, how, when and especially why. It’s also a good idea to discuss with others you know that are in a partnership to understand the pros and cons from their perspective as well as your attorney and accountant; especially if you move forward and set things up.

Other items to consider include any state and local tax requirements, a Federal EIN or Employment Identification Number, if appropriate, permits and licenses. In California you are also required to file at the county level, a Fictitious Business Name.

It’s not mandatory but I’m a great believer in a Business plan so building a document like this and having it reviewed by an experienced third party can be invaluable and make learning curves much quicker.

How to end a partnershipAs we said above, it’s very easy to create a partnership and equally, if one partner chooses to leave the company or partnership it generally dissolves. If the partnership is to dissolve, the partners must complete their current business obligations, pay off all debts and divide any property that has been built be it profits or soft or hard assets.

To prevent the company and partnership from needing to dissolve, as was mentioned above, anticipate this scenario when the partnership first comes together by creating a buy-sell agreement or buyout agreement which can be part of a written partnership agreement. If you want to prevent this kind of ending for your business, you should create a buy-sell agreement, or buyout agreement, which can be included as part of your partnership agreement.

A partnership is only the best option if all parties understand the risks and responsibilities. It’s not just a matter of understanding when you start out in business, it’s equally important as you continue be it in year one or year twenty one. People evolve and change. About 50% of the population get a divorce because of change and either one party likes the change while the other party does not.

Before you make that final decision to come together in a partnership, talk to an attorney that specializes in business law to get their legal advice and therefore hopefully avoid needing an attorney later on when you realize that entering a partnership was not the best decision you made.

If you would like more information about buying a business please visit my webpage Buy a business or buy a copy of my book Successfully buy your business.

For more immediate help with buying a business you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674[image error]916 570-2674.

September 24, 2014

Balance Sheet and Selling a Business

The Balance Sheet is a critical document when selling a business. The first place almost all buyers start are the financial statements including the Balance Sheet. They typically ask first for the Profit and Loss Statements and Tax Returns as they want to see the cash flow and profitability of the business that is in the Profit and Loss Statements and then check to see if these numbers match what is on the Tax Returns.

The more sophisticated the business the greater the chances it keeps a Balance Sheet. However, many sellers don’t pay too much attention to their Balance Sheet as it is a document that requires a lot of expertise to put together. As I spend a lot of time doing business valuations, I always ask for a Balance Sheet as well as the Profit and Loss Statements and Tax Returns and if I get the Balance Sheet, can easily see whether its accurate and worth using or not adding any value.

Recently I was working with the owner of a business that they wished to sell. When I received the Balance Sheet and other financial statements to prepare the valuation, I was able to tell the seller that if they wished to sell their business for the amount in the business valuation, they would need to pay the buyer at the close of escrow about $120,000. Obviously the owner was a little stunned but here’s what was happening and it only became clear when looking at the Balance Sheet. Here are the steps that were taken to reveal the problem.

During the initial calculation of the valuation using the Profit and Loss statement it showed the business value to be about $750,000 as an asset sale. However, when looking at the Balance Sheet it showed that when the inventory, Fixed Assets including Fixtures, Furniture and Equipment and goodwill transferred to the buyer, the seller would get to keep about $113,000 in assets while around $970,000 in liabilities. That is, if the business sold for $750,000 and the seller kept the assets of $113,000 and then paid out the liabilities of $970,000 he would be at least $107,000 in debt.

If the above was not bad enough it got worse as the business valuation at $750,000 was way too high. What caused the problem is the seller was showing on his Profit and Loss Statement the amounts called Other Income. For one year it was $290,000 in other income and another year it was $34,000. Both these amounts were income the seller had received as compensation for damages caused by a fire in a previous year; so they were one off payments but unrelated to the sales performance of the business. When these items were removed from the valuation it was much lower than the $750,000 leaving the seller with a large problem to manage as they were not going to get anywhere near the value for the business they were expecting.

The financial statements of a business tell a story. Each document also provides its own story – the Profit and Loss shows the performance over a period of time, the Balance Sheet shows a story at a point in time and the Tax Returns; which are signed by the seller, a summary of both of these documents.

Are you thinking about selling your business? Would you like to know the value of your business? If you would like more information please visit my website Business valuation.

For more immediate help you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

September 17, 2014

Current market for selling or buying a business

What is the current market for selling or buying a business?

Each quarter the International Business Brokers Association and M&A Source sponsor a Market Pulse Survey with the support of the Pepperdine Private Capital Markets Project and the Graziado School of Business and Management at Pepperdine University.

The purpose of the Market Pulse Survey is to obtain an accurate understanding of the market conditions for businesses being sold in Main Street (less than $2mm) and Lower to Middle Market (from $2mm to $50mm).

The 2014 second quarter survey is now complete.

Some of the highlights from the report include:

The Median SDE multiple to calculate the value of the business was 2.0 if it was valued at less than $499,000, 2.8 if it was valued from $500,000 to $999,000 and 3.1 if it was valued from $1,000,000 to $2,000,000.The Median EBITDA multiple to calculate the value of the business was 2.6 if it was valued at less than $499,000, 2.9 if it was valued from $500,000 to $999,000, 4.3 if it was valued from $1,000,000 to $2,000,000, 4.5 if it was valued from $2,000,000 to $5,000,000 and 5.4 if it was valued from $5,000,000 to $50,000,000If a business was valued at less than $500,000 69% of the respondents perceived it was a buyer’s market. If the business was valued between $500,000 and $5,000,000, it was perceived to be neither a seller’s market nor buyer’s market. If the business was valued at $5,000,000 or more, 69% of respondents perceived it was a seller’s market.Some of the highlights for those selling a business include:

The main reasons for selling a business were Retirement/Health, Burnout, Relocation/Moving and New opportunities.Seller finance was offered on an average of 10% of all transactions.78% of businesses valued at under $499,000 were not bought and taken off the market.The primary reasons a business did not sell were unrealistic seller expectations, poor financial statements and the owner waiting too long to sell.64% of business sellers are Baby Boomers.Some of the highlights for those buying a business include:

The percent of first time individual business buyers in relation to the value of the business was 55% if the value was less than $500,000, 49% if between $500,000 and $1,000,000, 32% if between $1,000,000 and $2,000,000, 64% if between $2,000,000 and $5,000,000 and 0% if greater than $5,000,000 to $50,000,000.56% of business buyers bought a business worth less than $500,000 to buy themselves a job. 63% of buyers bought a business worth between $500,000 and $1,000,000 to buy themselves a job and get a better Return On Investment. 53% and 54% of business buyers bought a business worth between $1,000,000 to $5,000,000 for a better Return On Investment and a Horizontal Add-on.Click the following link if you would like to download and read a copy of the 109 page 2014 Q2 Full Report.

If you would like more information about buying a business, buying a franchise, starting a business or selling a business, please visit my website Business Advice Books.

September 15, 2014

Automation Nation: Save Time Increase Bottom Line

There are so many tasks a business has to perform that you, a business owner might get overwhelmed occasionally; what if you could automate a lot of it? You might have more time to spend on more important things, or even leave early one day out of 365.

What can you automate? You’d be surprised. Here are four ways to automate some of your more important tasks around the workplace.

Automate Your Social MediaIf you have to post to your company blog each day and it’s kind of inconvenient at times, write a few posts ahead of time and set them to go out each day at a certain time. There are also social media dashboards that allow you to tweet, post to Facebook, and post to your circles in Google+, all at the same time and ahead of time, too. Write everything out, set the time and be on your merry way, knowing that you just got two weeks of posts that will be posted, and it was done in 45 minutes.

Queue-up your social media posts and schedule them to be shared by using a platform such as Buffer, which provides an extensive amount of tools to make social sharing and posting easier.

Automate Your EmailGoing through email takes so much time it’s a wonder anybody gets anything done.

Use automation software that will let you send marketing emails automatically at the time you specify, and the email can be customized by you ahead of time. Chargify is a company that automates refunds, failure to renew messages, subscription requests;just a tiny sampling of what can be done.

If you don’t need a mass marketing campaign but still have a lot of people to respond to at any given time, then you can use the auto filters that many email clients have now. There are types of messages you can have flagged or sent to a special folder, or you can have “out of town” notices sent out. Just enter the information in the appropriate box, set it, and forget about it. When you leave and you’re thinking, I know I forgot something, know that it won’t be your email notifications.

Automate Triggering EventsTriggering events are when someone mentions you in a Facebook post or tweets something about your business. Azuqua, an automated cloud business solution that can be integrated with a variety of apps including LinkedIn, Facebook and Salesforce, can reply directly to customers in response to triggered events. You can set the software program up to abide by a set of rules to go by for each event. Now you don’t have to worry about catching the occasional nasty tweet. The software will catch it and take care of it by the rules that were previously set.

Simply create an account, add a starting event and select your channel or app, and choose from 40 logistic functions to monitor the data that you’re after.

September 12, 2014

Traits of a good franchise

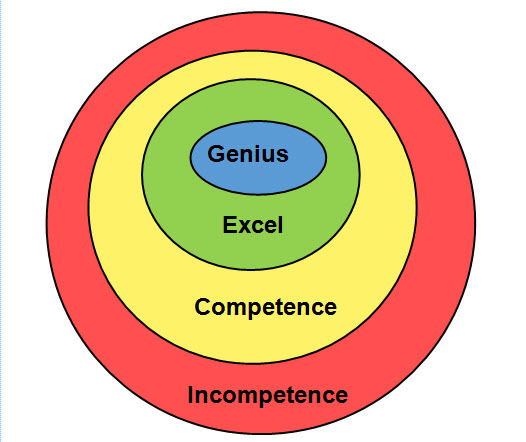

One of the intriguing things about the franchise industry is the range or types of franchises in so many different industries. I currently use an Excel spreadsheet to track the 37 different industry types of franchises that are available. The purpose of this document is to find the right franchise that fits the franchise buyer or as I like to say, each entrepreneur has a genius be it sales, operations, management or whatever so let’s find the right franchise that fits your genius.

Once we know the genius of the entrepreneur, we match them with the better franchise companies so now you have the right combination – matching a franchisee with a franchisor to create an unbeatable combination.

What are the traits of the better franchise systems?The more successful franchise companies understand their strengths and weaknesses and are constantly striving to improve and get better. There are certain traits that I see the successful franchises share.

1. Return On Investment needs to be favorableOne of the keys for a franchise buyer to be successful is understanding the money they pay to buy a franchise should be seen as requiring a Return On Investment. The franchise program should therefore provide an opportunity of profitability that relates to their initial investment. The higher the investment, the greater return the franchisee should expect.

Equally, a good franchise program recognizes that there needs to be a balance between the profit earned by the franchisor and the franchisees. If it becomes out of balance where one party is doing better than the other then the imbalance leads to a downward spiral.

2. Good communication starts at the topA good executive management team communicates issues, improvements as well as strategic changes. But there is more. A good franchise system or indeed any good business has to have a model that includes access to the executive management team or a franchise advisory committee.

Part of my career included spending 5 years working onsite at Hewlett Packard. A common management term was called Management By Walking Around. Just as good communication starts at the top, a good franchisor includes its franchisees in decisions that impact franchisee operations which they facilitate with systems that allow problems and ideas to flow to upper management. This includes a formal process so that franchisees can provide real time feedback to strengthen and hear improvements from “those in the trenches” and how to make things better especially if it includes changes in franchise operations, marketing or finance.

4. When good is not good enoughIf you are following the business news you will find that McDonald’s hamburgers are ranked one of the worst in the industry. A good company is only as good as its last success. As a franchisor rolls out new goods or services, as part of their quality control they must be tested or piloted before being rolled out to the entire franchise network. This establishes standards and creates credibility to not only the customers but also the franchisees.

5. The numbers matterA set of quality financial statements helps the owner of a business know the direction they are travelling. A franchisor needs to create their own set of quality financial statements so they know their direction. A good franchisor should collect quality financial statements from each franchisee on a monthly or quarterly basis so they can guide and help steer them to success.

6. Standards are defined, measured and managedThere is an old business management saying. If you can’t measure it you can’t manage it. A good franchise system has standards. An even better franchise system records and measures those standards to ensure customer’s expectations are at least met and hopefully exceeded which protects and increases the value of the brand or the very reason the franchisor and franchisee have come together.

7. The franchisor attracts the right type of franchiseeIn the last point it said that a good franchise system has standards. The franchisor has different tools to achieve those standards. Their cheapest and most powerful tool is deciding which franchise buyers to become franchisees. They achieve this by creating a strong franchise development team to ensure they bring on the best available franchisees who will meet and maintain the standards of the franchise.

8. Franchisees are only as good as what they knowWhether it’s in business or our personal lives we are only as good as what we know. A quality franchise program has two effective training programs. The first is the initial training while the second is ongoing training and support. The ongoing training and support identifies weaknesses and then corrects these to create habits that now become best franchise practices.

9. Does the franchise qualify for the SBA franchise registryIf a franchise buyer needs finance to purchase their franchise, it’s a good sign if their franchise concept is able to qualify for the SBA franchise registry.

The above are the more common characteristics of the better franchise systems. A franchise buyer will be more successful if they know their strengths and weaknesses or as I like to say, their genius. A franchisor will be more successful if they too understand their genius and attract the right franchise buyers. If you put both together then their chances of success are maximized and this is simply good business.

If you would like more information about buying a franchise please visit my webpage Buy a franchise or buy a copy of my book – Successfully buy your franchise.

For more immediate help with buying a franchise, send an email to Andrew Rogerson or give me a call on 916 570-2674.

September 10, 2014

What is your entrepreneur genius

Leonardo Da Vinci, Albert Einstein, Steve Jobs, Babe Ruth and Mozart to name a very few were all considered to be a genius.

The Merriam Webster dictionary defines genius as “great natural ability: remarkable talent or intelligence.”

If you want to become an entrepreneur, what’s your genius or great natural ability or remarkable talent or intelligence?

Is it sales, operations, marketing, finance, managing people, inventing, creating, fitness, motivating, public speaking, endurance, never giving up, numbers, technology or?

The capitalist system is built on products and services. Those that are successful be it in a corporate environment or running their own privately held company will stand out because of their genius or their great natural ability, remarkable talent or intelligence.

If you want to be an entrepreneur, find your genius. Now find out if the market is willing to pay you for your genius and if so, you have a business.

What’s the benefit in knowing your genius?

As the above diagram shows, we spend our time in one of four places. The first is our genius, the second is where we excel, the third is where we are competent and the fourth is where we are incompetent. It is far more productive and rewarding to spend your time in your genius as this is not only where you operate at your highest level, its where things come easy to you, you get the most enjoyment and most important of all, where you generate your greatest ROI or Return On Investment.

Where we excel is also a productive place but it requires a little more effort as things don’t come quite as easy.

Where we are competent is a place that we get things done but we don’t have too much fun, we are not operating at our highest level and we get the job done but it is simply hard work and takes more time than it would for others.

Where we are incompetent speaks for itself. We don’t enjoy the task, it takes far longer than it would for someone else and we simply are not that good at it.

Find your genius and then apply it to the industry that works best for you. Your genius may not be industry dependent. If you embrace helping and caring for people then being a doctor and the medical profession may be for you. If you are not good at numbers or sciences then a doctor may not be the right choice. Dig hard and dig deep and find your genius. Once you work that out, the rest should take care of itself.

If you would like more information about buying a business, buying a franchise, starting a business or selling a business, please visit my website Business Advice Books.