Chris Hedges's Blog, page 379

December 26, 2018

Taiwanese Launch Their Version of Yellow Vest Protest

TAIPEI, Taiwan — Protesters in Taiwan are taking a page from France’s yellow vest movement.

Thousands of demonstrators turned out Thursday for the third time in a week to demand lower taxes and the fair handling of tax disputes.

Wearing yellow vests, they shouted slogans outside the Ministry of Finance in Taipei and waved banners calling Taiwan’s tax collection policies illegal.

A ministry official said earlier this week that it had addressed some of the complaints of anti-tax activists on its website.

Protest organizers say they’re inspired by the success of the recent French protests, which were sparked by a tax hike for gasoline and diesel.

French President Emmanuel Macron eventually agreed to a number of steps including an increase in the minimum salary for full-time workers.

Could This Be Our Best Hope of Removing Trump From Office?

The dog whistle couldn’t have been any clearer. When Donald Trump said two weeks ago that “the people would revolt” if he were impeached, his extremist base of neo-Nazis, Klan members, right-wing militias and sympathetic service members likely heard the following: “Feel free to attack Democrats, liberals, leftists and progressives if the coming Democratic Party-run House of Representatives acts on its constitutional right to impeach me.”

Impeachment alone probably wouldn’t trigger a right-wing uprising. But impeachment followed by the unlikely prospect of removal, which requires 67 votes in the Republican-majority U.S. Senate, might well make it happen. So too could invoking the 25th Amendment on the grounds that Trump is incapable of performing his presidential duties.

Officially, the Democratic Party—led by corporate allies like Chuck Schumer and Nancy Pelosi—isn’t interested in moving ahead with either of these constitutionally available processes. That could change, however, if and when the report from special counsel Robert Mueller directly implicates Trump. But even if the party’s efforts proved successful, America would be left with President Mike Pence—an honest-to-goodness Christian fascist.

The case for Trump’s ouster grows stronger by the week. Beyond his possible obstruction of justice, criminal acceptance of foreign emoluments while in office and felonious campaign finance violations—any one of which could provide grounds for legal proceedings against him—the president has routinely embraced authoritarian rulers around the world and engaged in obvious appeals to violence. He has, at every turn, revealed himself to be entirely unfit for office.

Ironically, the most effective means of achieving his removal may be to revolt, albeit in a fashion radically different from the one the president has envisioned. America must instead engage in civil unrest that targets not just the current inhabitant of the Oval Office but the entire bipartisan ruling class that birthed his monstrous presidency. Forget Watergate; think sit-down strikes and the march from Selma to Montgomery, Ala.

The gilets jaunes (yellow vests) in France have given us a taste of what’s required. Among their list of demands is a real and functioning democracy—popular self-rule. Further to that, they have called for a referendum whereby 700,000 citizen signatories would force the French Parliament to debate and vote on a given law within one year. Evoking the French Revolution of 1789, there have even been calls for a Constituent Assembly to draft a new constitution meant to create a new French government—a Sixth Republic based on popular sovereignty and majority rule rather than the demands of a de facto corporo-financial dictatorship. Imagine!

That Trump has never had a functioning democracy to overthrow is evidence enough that this kind of activism is long overdue. Released in the early spring of 2008, Sheldon Wolin’s classic study “Democracy Incorporated: Managed Democracy and the Specter of Inverted Totalitarianism” revealed that the U.S. was no longer a “democracy,” if it ever had been. America, Wolin found, had mutated into a new sort of totalitarian regime wherein economic power and state power were conjoined and virtually unchecked by a demobilized, atomized and politically disinterested populace, conditioned to stay that way. “At best,” Wolin determined, “the nation has become a ‘managed democracy’ where the public is shepherded, not sovereign.”

“Should Democrats somehow be elected,” he prophesied, they would do nothing to “alter significantly the direction of society” or “substantially revers[e] the drift rightwards. … The timidity of a Democratic Party mesmerized by centrist precepts points to the crucial fact that for the poor, minorities, the working class and anti-corporatists there is no opposition party working on their behalf.”

Sure enough, a nominal Democrat was elected president along with Democratic majorities in both houses of Congress in 2008. What followed under Barack Obama (as under the prior Democratic administration of Bill Clinton) was standard-issue neoliberal rule in the service of big-money bankrollers and their global empire. The nation’s first black president implemented the preferred policies of Wall Street and the Pentagon more effectively than wealthy white Republicans like John McCain or Mitt Romney could have ever hoped to. America’s “inverted totalitarianism” was rebranded, to deadly effect. Fed by a widespread and easily exploited sense of abandonment and betrayal, the country’s rightward shift grew more pronounced, as the Democrats depressed and demobilized their purported base. Over a period of eight years, the party lost more than 1,000 elected offices nationwide, including the U.S. presidency.

Along the way, its power brokers managed to stamp out a progressive insurgency from Bernie Sanders through dubious means, clearing the field for a deeply unpopular candidate in Hillary Clinton. And in so doing, they handed the populist torch to a far-right reactionary in a change election.

We should expect a similar outcome from the Democrats’ presidential nomination process in 2020. The smart money is on anti-populist Joe Biden or the telegenic faux-progressive Beto O’Rourke—this despite the continued popularity of Sanders and his progressive agenda.

One year after Hillary’s ignominious defeat, the distinguished liberal political scientists Benjamin Page (Northwestern) and Marin Gilens (Princeton) published their expertly researched book “Democracy in America?” The volume’s key finding: “The best evidence indicates that the wishes of ordinary Americans actually have had little or no impact on the making of federal government policy. Wealthy individuals and organized interest groups—especially business corporations—have had much more political clout. When they are taken into account, it becomes apparent that the general public has been virtually powerless. …”

Whether we vote or not, Mammon reigns in the United States, where, as Page and Gilens note, “government policy … reflects the wishes of those with money, not the wishes of the millions of ordinary citizens who turn out every two years to choose among the preapproved, money-vetted candidates for federal office” (emphasis added). Plus ça change, plus c’est la même chose. (“The more it changes, the more it’s the same thing.”)

Perhaps our only hope is a mass movement for “the radical reconstruction of society itself”—what Dr. Martin Luther King Jr. called “the real issue to be faced”—and the replacement of the unelected and interrelated dictatorships of capital and empire by popular sovereignty and workers’ control. As Chris Hedges wrote earlier this year:

“The Trump administration did not rise, prima facie, like Venus on a half shell from the sea. Donald Trump is the result of a long process of political, cultural and social decay. He is a product of our failed democracy. The longer we perpetuate the fiction that we live in a functioning democracy, that Trump and the political mutations around him are somehow an aberrant deviation that can be vanquished in the next election, the more we will hurtle toward tyranny. The problem is not Trump. It is a political system, dominated by corporate power and the mandarins of the two major political parties, in which we don’t count. We will wrest back political control by dismantling the corporate state, and this means massive and sustained civil disobedience. … If we do not stand up, we will enter a new dark age.” (Emphasis added.)

“A new dark age” may ultimately prove euphemistic. The original Dark Ages concluded with the planet still habitable. Humanity now faces the near-term historical threat of extinction thanks to the grave “ecological rifts” generated by a global profit system upheld by both ruling parties that is turning earth into a great, big Greenhouse Gas Chamber. “The uncomfortable truth,” philosopher Istvan Meszaros rightly argued 17 years ago, “is that if there is no future for a radical mass movement in our time, there can be no future for humanity itself.”

Sustained civil disobedience in the United States could provoke a response far bloodier than anything seen in France. But while the human costs of revolution are great, none can compare with the ecocidal rule of capital.

Wall Street Notches Best Day in 10 Years in Holiday Rebound

Stocks rocketed on Wednesday in Wall Street’s best day in 10 years, snapping a stomach-churning, four-day losing streak and giving some post-Christmas hope to a market that has been battered this December.

The Dow Jones Industrial Average shot up more than 1,000 points — its biggest single-day point gain ever — rising nearly 5 percent as investors returned from a one-day Christmas break.

The broader S&P 500 index also gained 5 percent, and the technology-heavy Nasdaq rose 5.8 percent.

But even with the rally, the market remains on track for its worst December since 1931, during the depths of the Depression, and could finish 2018 with its steepest losses in a decade.

“The real question is: Do we have follow-through for the rest of this week?” said Sam Stovall, chief investment strategist for CFRA.

Technology companies, health care stocks and banks drove much of the broad rally. Retailers also were big gainers, after a holiday shopping season marked by robust spending. Amazon had its biggest gain in more than a year.

Energy stocks also rebounded as the price of U.S. crude oil posted its biggest one-day gain in more than two years.

But what really might have pushed stocks over the top was a signal from Washington that President Donald Trump would not try to oust the chairman of the Federal Reserve.

In recent days, Trump’s tweet attacks on the Fed and chairman Jerome Powell for raising interest rates stoked fears about the central bank’s independence, unnerving the market.

The partial government shutdown that began over the weekend also weighed on the market, as did personnel turmoil inside the Trump administration, trade tensions with China, the slowing global economy and worries that corporate profits are going to slip sooner or later.

The Dow lost 1,883 points over the prior four trading sessions and is still down 2,660 for December.

Wednesday’s gains pulled the S&P 500 back from the brink of what Wall Street calls a bear market — a 20 percent tumble from an index’s peak. Another day of heavy losses would have marked the end of longest bull market for stocks in modern history — a run of nearly 10 years.

The S&P is now down 15.8 percent since its all-time high on Sept. 20.

All told, the S&P 500 rose 116.60 points Wednesday, or 5 percent, to 2,467.70. The Dow soared 1,086.25 points, or 5 percent, to 22,878.45. The Nasdaq gained 361.44 points, or 5.8 percent, to 6,554.36. The Russell 2000 index of smaller-company stocks picked up 62.89 points, or 5 percent, at 1,329.81.

Trading volume was lighter than usual following the Christmas holiday. Markets in Europe, Australia and Hong Kong were closed.

Among tech stocks, Adobe rose 8.7 percent. Credit card company Visa climbed 7 percent, and Mastercard was up 6.7 percent. Among big retailers, Amazon rose 9.4 percent, Kohl’s 10.3 percent and Nordstrom 5.8 percent.

Most economists expect growth to slow in 2019, though not by enough to slide into a full-blown recession. Unemployment is at 3.7 percent, the lowest since 1969. Inflation is tame. Pay growth has picked up. Consumers boosted their spending this holiday season.

The market apparently got a lift Wednesday when Kevin Hassett, chairman of the White House Council of Economic Advisers, said in an interview with The Wall Street Journal that the Fed chairman is in no danger of being fired.

The president could help restore some stability to the market if he “gives his thumbs a vacation,” Stovall said.

“Tweet things that are more constructive in terms of working out an agreement with Democrats and with China. And then just remain silent as it relates to the Fed.”

___

AP Economics Writer Josh Boak contributed to this story from Washington.

In Surprise Trip to Iraq, Trump Defends Decision on Syria Withdrawal

AL-ASAD AIR BASE, Iraq—In a surprise trip to Iraq, President Donald Trump on Wednesday defended his decision to withdraw U.S. forces from Syria where they have been helping battle Islamic State militants.

“We’re no longer the suckers, folks,” Trump told American servicemen and women at a base in western Iraq. “We’re respected again as a nation.”

Trump said it’s because of U.S. military gains that he can withdraw 2,000 forces from Syria. During his first visit to a troubled region, Trump also said he has no plans to withdraw U.S. forces from Iraq.

“I made it clear from the beginning that our mission in Syria was to strip ISIS of its military strongholds,” Trump told troops clad in fatigues at al-Asad Airbase west of Baghdad.

“Eight years ago, we went there for three months and we never left,” he said. “Now, we’re doing it right and we’re going to finish it off.”

He said that Turkish President Recep Tayyip Erdogan has agreed to take out “any remnants” of IS left in Syria. The U.S. presence in Syria was not meant to be “open-ended,” he said, adding that other wealthy nations should pay for rebuilding Syria.

“The nations of the region must step up and take more responsibility for their future,” said Trump, who said there would be a “strong, deliberate and orderly withdrawal” of U.S. forces from Syria.

Trump’s trip to Iraq came a week after he stunned his national security advisers by announcing the U.S. troop withdrawal from Syria.

Defense Secretary Jim Mattis abruptly resigned following the announcement, and Trump’s decision rattled allies around the world, including in Iraq.

Trump’s trip was shrouded in secrecy. Air Force One flew overnight from Washington, landing at an air base west of Baghdad under the cover of darkness Wednesday evening. It is his first visit with troops stationed in a troubled region.

Fifteen years after the 2003 invasion, the U.S. still has more than 5,000 troops in Iraq supporting the government as it continues the fight against remaining pockets of resistance by the Islamic State group. IS has lost a significant amount of territory in Iraq and Syria but is still seen as a threat.

Trump, who speaks often about his support for the U.S. military, had faced criticism for not yet visiting U.S. troops stationed in harm’s way as he comes up on his two-year mark in office. He told The Associated Press in an interview in October that he “will do that at some point, but I don’t think it’s overly necessary.” He later began to signal that such a troop visit was in the offing.

Trump had planned to spend Christmas at his private club in Florida, but stayed behind in Washington due to the shutdown. It’s unclear whether his trip to Iraq was added after it became apparent that the government would be shut down indefinitely due to a stalemate between Trump and congressional Democrats over the president’s demand for a wall along the U.S.-Mexico border.

Adding to the tumult, the stock market has been experiencing heavy losses over concerns about a slowing global economy, Trump’s trade war with China and the president’s public slamming of the Federal Reserve and its chairman over interest rate hikes by the independent agency.

Trump’s visit comes at a time when his Middle East policy is in flux. He went against the views of his top national security advisers in announcing the Syria withdrawal, a decision that risks creating a vacuum for extremists to thrive.

There are dire implications in particular for neighboring Iraq. The Iraqi government now has control of all the country’s cities, towns and villages after fighting its last urban battles against IS in December 2017. But its political, military and economic situation remains uncertain, and the country continues to experience sporadic bombings, kidnappings and assassinations, which most people attribute to IS.

Iraqi Prime Minister Adel Abdul-Mahdi recently said Iraqi troops could deploy into Syria to protect Iraq from threats across its borders. Iraq keeps reinforcements along its frontier to guard against infiltration by IS militants, who hold a pocket of territory along the Euphrates River.

Trump campaigned for office on a platform of ending U.S. involvement in foreign trouble spots, such as Syria, Afghanistan and Iraq. The Syria decision will ultimately affect all of the approximately 2,000 troops deployed in the war-torn country. The Pentagon is also said to be developing plans to withdraw up to half of the 14,000 American troops still serving in Afghanistan.

During the presidential campaign, Trump blamed Democrat Hillary Clinton for the rise of IS, due to the withdrawal of U.S. troops from Iraq at the end of 2011 during her tenure as secretary of state.

President George W. Bush is the one who set the 2011 withdrawal date as part of an agreement with the Iraqi government to gradually shrink the U.S. footprint and slowly hand off security responsibilities to the government and Iraqi security forces.

His successor, President Barack Obama, wanted to leave a residual force in Iraq to help the government manage ongoing security challenges. But he ultimately went ahead with the scheduled pullout in 2011 after Iraqi’s political leaders rejected terms the U.S. sought for legal protections for the U.S. troops that would have remained.

Two of Trump’s recent predecessors visited Iraq early in their terms.

Bush visited Iraq in November 2003, about eight months after that conflict began. Due to security concerns, Bush waited until 2006 to make his first visit to Afghanistan.

Obama visited Iraq in April 2009, the first year of his eight years in office, as part of an overseas tour. He visited Afghanistan in 2010.

Vice President Mike Pence visited Afghanistan in December 2017, not long after Trump outlined a strategy to break the stalemate in America’s longest war. Pence met with Afghan leaders and visited with U.S. troops stationed in the country. Trump has not visited Afghanistan.

__

Associated Press writer Philip Issa contributed to this report.

___

Follow Darlene Superville on Twitter: http://www.twitter.com/dsupervilleap

Ralph Nader: Canada’s Health Care System Puts America’s to Shame

Dear America:

Costly complexity is baked into Obamacare. No health insurance system is without problems but Canadian-style single-payer— full Medicare for all— is simple, affordable, comprehensive and universal.

In the early 1960s, President Lyndon Johnson enrolled 20 million elderly Americans into Medicare in six months. There were no websites. They did it with index cards!

Below please find 25 ways the Canadian health care system is better than the chaotic U.S. system.

Replace it with the much more efficient Medicare-for-all: everybody in, nobody out, free choice of doctor and hospital. It will produce far less anxiety, dread, and fear.

Love, Canada

Number 25:

In Canada, everyone is covered automatically at birth – everybody in, nobody out.

In the United States, under Obamacare, 28 million Americans (9 percent) are still uninsured and 85 million Americans (26 percent) are underinsured.

Number 24:

In Canada, the health system is designed to put people, not profits, first.

In the United States, Obamacare has done little to curb insurance industry profits and in fact has increased the concentrated insurance industry’s massive profits.

Number 23:

In Canada, coverage is not tied to a job or dependent on your income – rich and poor are in the same system, the best guaranty of quality.

In the United States, under Obamacare, much still depends on your job or income. Lose your job or lose your income, and you might lose your existing health insurance or have to settle for lesser coverage.

Number 22:

In Canada, health care coverage stays with you for your entire life.

In the United States, under Obamacare, for tens of millions of Americans, health care coverage stays with you for as long as you can afford your insurance.

Number 21:

In Canada, you can freely choose your doctors and hospitals and keep them. There are no lists of “in-network” vendors and no extra hidden charges for going “out of network.”

In the United States, under Obamacare, the in-network list of places where you can get treated is shrinking – thus restricting freedom of choice – and if you want to go out of network, you pay dearly for it.

Number 20:

In Canada, the health care system is funded by income, sales and corporate taxes that, combined, are much lower than what Americans pay in insurance premiums directly and indirectly per employer.

In the United States, under Obamacare, for thousands of Americans, it’s pay or die – if you can’t pay, you die. That’s why many thousands will still die every year under Obamacare from lack of health insurance to get diagnosed and treated in time.

Number 19:

In Canada, there are no complex hospital or doctor bills. In fact, usually you don’t even see a bill.

In the United States, under Obamacare, hospital and doctor bills are terribly complex, making it very difficult to discover the many costly overcharges or massive billing fraud.

Number 18:

In Canada, costs are controlled. Canada pays 10 percent of its GDP for its health care system, covering everyone.

In the United States, under Obamacare, costs continue to skyrocket. The U.S. currently pays 17.9 percent of its GDP and still doesn’t cover tens of millions of people.

Number 17:

In Canada, it is unheard of for anyone to go bankrupt due to health care costs.

In the United States, health-care-driven bankruptcy will continue to plague Americans.

Number 16:

In Canada, simplicity leads to major savings in administrative costs and overhead.

In the United States, under Obamacare, often staggering complexity leads to ratcheting up huge administrative costs and overhead.

Number 15:

In Canada, when you go to a doctor or hospital the first thing they ask you is: “What’s wrong?”

In the United States, the first thing they ask you is: “What kind of insurance do you have?”

Number 14:

In Canada, the government negotiates drug prices so they are more affordable.

In the United States, under Obamacare, Congress made it specifically illegal for the government to negotiate drug prices for volume purchases, so they remain unaffordable and skyrocketing.

Number 13:

In Canada, the government health care funds are not profitably diverted to the top one percent.

In the United States, under Obamacare, health care funds will continue to flow to the top. In 2017, the CEO of Aetna alone made a whopping $59 million.

Number 12:

In Canada, there are no required co-pays or deductibles in inscrutable contracts.

In the United States, under Obamacare, the deductibles and co-pays will continue to be unaffordable for many millions of Americans.

Number 11:

In Canada, the health care system contributes to social solidarity and national pride.

In the United States, Obamacare is divisive, with rich and poor in different systems and tens of millions left out or with sorely limited benefits.

Number 10:

In Canada, delays in health care are not due to the cost of insurance.

In the United States, under Obamacare, patients without health insurance or who are underinsured will continue to delay or forgo care and put their lives at risk.

Number 9:

In Canada, nobody dies due to lack of health insurance.

In the United States, tens of thousands of Americans will continue to die every year due to lack of health insurance and much higher prices for drugs, medical devices, and health care itself.

Number 8:

In Canada, health care on average costs half as much, per person, as in the United States. And in Canada, everyone is covered.

In the United States, a majority support Medicare-for-all.

Number 7:

In Canada, the tax payments to fund the health care system are modestly progressive – the lowest 20 percent pays 6 percent of income into the system while the highest 20 percent pays 8 percent.

In the United States, under Obamacare, the poor pay a larger share of their income for health care than the affluent.

Number 6:

In Canada, people use GoFundMe to start new businesses.

In the United States, fully one in three GoFundMe fundraisers are now to raise money to pay medical bills. Recently, one American was rejected for a heart transplant because she couldn’t afford the follow-up care. Her insurance company suggested she raise the money through GoFundMe.

Number 5:

In Canada, people avoid prison at all costs.

In the United States, some Americans commit minor crimes so that they can get to prison and get free health care.

Number 4:

In Canada, people look forward to the benefits of early retirement.

In the United States, people delay retirement to 65 to avoid being uninsured.

Number 3:

In Canada, Nobel Prize winners hold on to their medal and pass it down to their children and grandchildren.

In the United States, Nobel Prize winners sell their medals to pay for their medical bills.

Leon Lederman won a Nobel Prize in 1988 for his pioneering physics research. But in 2015, the physicist, who passed away in November 2018, sold his Nobel Prize medal for $765,000 to pay his mounting medical bills. According to a report in Vox, the University of Chicago professor began to suffer from memory loss in 2011, and died in an Idaho nursing home.

Number 2:

In Canada, the system is simple. You get a health care card when you are born. And you swipe it when you go to a doctor or hospital. End of story.

In the United States, Obamacare’s 2,500 pages plus regulations (the Canadian Medicare Bill was 13 pages) is so complex that then Speaker of the House Nancy Pelosi said before passage “we have to pass the bill so that you can find out what is in it, away from the fog of the controversy.”

Number 1:

In Canada, the majority of citizens love their health care system.

In the United States, a growing majority of citizens, physicians, and nurses prefer the Canadian type system – Medicare-for-all, free choice of doctor and hospital , everybody in, nobody out and far less expensive.

Banks Are Making Black and Latino Homeownership a Thing of the Past

Fifty years after the federal Fair Housing Act banned racial discrimination in lending, African Americans and Latinos continue to be routinely denied conventional mortgage loans at rates far higher than their white counterparts.

This modern-day redlining persisted in 61 metro areas even when controlling for applicants’ income, loan amount and neighborhood, according to a mountain of Home Mortgage Disclosure Act records analyzed by Reveal from The Center for Investigative Reporting.

The year-long analysis, based on 31 million records, relied on techniques used by leading academics, the Federal Reserve and Department of Justice to identify lending disparities.

It found a pattern of troubling denials for people of color across the country, including in major metropolitan areas such as Atlanta, Detroit, Philadelphia, St. Louis and San Antonio. African Americans faced the most resistance in Southern cities – Mobile, Alabama; Greenville, North Carolina; and Gainesville, Florida – and Latinos in Iowa City, Iowa.

No matter their location, loan applicants told similar stories, describing an uphill battle with loan officers who they said seemed to be fishing for a reason to say no.

“I had a fair amount of savings and still had so much trouble just left and right,” said Rachelle Faroul, a 33-year-old black woman who was rejected twice by lenders when she tried to buy a brick row house close to Malcolm X Park in Philadelphia, where Reveal found African Americans were 2.7 times as likely as whites to be denied a conventional mortgage.

The analysis – independently reviewed and confirmed by The Associated Press – showed black applicants were turned away at significantly higher rates than whites in 48 cities, Latinos in 25, Asians in nine and Native Americans in three. In Washington, D.C., the nation’s capital, Reveal found all four groups were significantly more likely to be denied a home loan than whites.

“It’s not acceptable from the standpoint of what we want as a nation: to make sure that everyone shares in economic prosperity,” said Thomas Curry, who served as America’s top bank regulator, the comptroller of the currency, from 2012 until he stepped down in May.

Yet Curry’s agency was part of the problem, deeming 99 percent of banks satisfactory or outstanding based on inspections administered under the Community Reinvestment Act, a 40-year-old law designed to reverse rampant redlining. And the Justice Department has sued only a handful of financial institutions for failing to lend to people of color in the decade since the housing bust. Curry argued that the law shares part of the blame; it needs to be updated and strengthened.

“The Community Reinvestment Act has aged a lot in 40 years,” he said.

Since Curry departed nine months ago, the Trump administration has gone the other way, weakening the standards banks must meet to pass a Community Reinvestment Act exam. During President Donald Trump’s first year in office, the Justice Department did not sue a single lender for racial discrimination.

The disproportionate denials and limited anti-discrimination enforcement help explain why the homeownership gap between whites and African Americans, which had been shrinking since the 1970s, has exploded since the housing bust. It is now wider than it was during the Jim Crow era.

This gap has far-reaching consequences. In the United States, “wealth and financial stability are inextricably linked to housing opportunity and homeownership,” said Lisa Rice, executive vice president of the National Fair Housing Alliance, an advocacy group. “For a typical family, the largest share of their wealth emanates from homeownership and home equity.”

The latest figures from the U.S. Census Bureau show the median net worth for an African American family is $9,000, compared with $132,000 for a white family. Latino families did not fare much better at $12,000.

What lenders keep secret

Lenders and their trade organizations do not dispute the fact that they turn away people of color at rates far greater than whites. But they maintain that the disparity can be explained by factors the industry has fought to keep hidden, including the prospective borrowers’ credit history and overall debt-to-income ratio. They singled out the three-digit credit score – which banks use to determine whether a borrower is likely to repay a loan – as especially important in lending decisions.

“While quite informative regarding the state of the lending market,” the records analyzed by Reveal do “not include sufficient data to make a determination regarding fair lending,” the Mortgage Bankers Association’s chief economist, Mike Fratantoni, said in a statement.

The American Bankers Association said the lack of federal enforcement proves discrimination is not rampant, and individual lenders told Reveal that they had hired outside auditing firms, which found they treated loan applicants fairly regardless of race.

“We are committed to fair lending and continually review our compliance programs to ensure that all loan applicants are receiving fair treatment,” Boston-based Santander Bank said in a statement.

New Jersey-based TD Bank, which denied a higher proportion of black and Latino applicants than any other major lender, said it “makes credit decisions based on each customer’s credit profile, not on factors such as race or ethnicity.”

Reveal’s analysis included all records publicly available under the Home Mortgage Disclosure Act, covering nearly every time an American tried to buy a home with a conventional mortgage in 2015 and 2016. It controlled for nine economic and social factors, including an applicant’s income, the amount of the loan, the ratio of the size of the loan to the applicant’s income and the type of lender, as well as the racial makeup and median income of the neighborhood where the person wanted to buy property.

Credit score was not included because that information is not publicly available. That’s because lenders have deflected attempts to force them to report that data to the government, arguing it would not be useful in identifying discrimination.

In an April policy paper, the American Bankers Association said reporting credit scores would be expensive and “cloud any focus” the disclosure law has in identifying discrimination. America’s largest bank, JPMorgan Chase & Co., has argued that the data should remain closed off even to academics, citing privacy concerns.

At the same time, studies have found proprietary credit score algorithms to have a discriminatory impact on borrowers of color.

The “decades-old credit scoring model” currently used “does not take into account consumer data on rent, utility, and cell phone bill payments,” Republican Sen. Tim Scott of South Carolina wrote in August, when he unveiled a bill to require the federal government to vet credit standards used for residential mortgages. “This exclusion disproportionately hurts African-Americans, Latinos, and young people who are otherwise creditworthy.”

A case study: Philadelphia

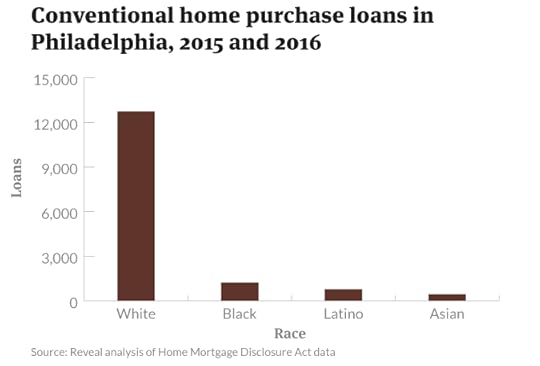

Philadelphia was one of the largest cities in America where African Americans were disproportionately turned away when they tried to buy a home. About the same number of African Americans and non-Hispanic whites live in the City of Brotherly Love, but the data showed whites received 10 times as many conventional mortgage loans in 2015 and 2016.

Banks also focused on serving the white parts of town, placing nearly three-quarters of their branches in white-majority neighborhoods. Reveal’s analysis also showed that the greater the number of African Americans or Latinos in a neighborhood, the more likely a loan application would be denied there – even after accounting for income and other factors.

When Faroul applied for a loan in April 2016, she thought she was an ideal candidate. She holds a degree from Northwestern University, had a good credit score and estimates she was making $60,000 a year while teaching computer programming as a contractor for Rutgers University. Still, her initial loan application was denied by Philadelphia Mortgage Advisors, an independent broker that made nearly 90 percent of its loans to whites in 2015 and 2016.

“I’m sorry,” broker Angela Tobin wrote to Faroul in an email. Faroul’s contract income wasn’t consistent enough, she said. So Faroul got a full-time job at the University of Pennsylvania managing a million-dollar grant.

But that still wasn’t enough. When she tried again a year later, this time at Santander Bank, a Spanish firm with U.S. headquarters in Boston, the process dragged on for months. Her loan officer kept asking for new information, she said – or sometimes the same information again.

By this time, Faroul had been trying to get a mortgage for over a year, and the process itself was damaging her credit. Every time a lender pulls a hard inquiry on a credit report, the score goes down to guard against people who are trying to take on a lot of debt.

“They had done so many hard pulls that my credit score had dropped to 635,” she said.

Then, an unpaid $284 electric bill appeared on Faroul’s credit report. It was for an apartment she didn’t live in anymore. She paid the bill right away, but the bank said it couldn’t move forward.

Civil rights groups and real estate professionals said Faroul’s experience follows a familiar pattern of discrimination by banks and mortgage lenders that has kept people of color from building wealth.

“It’s one thing after another. It’s like pulling layers off an onion,” said Arlene Wayns-Thomas, president of the Philadelphia chapter of the National Association of Real Estate Brokers, which represents African American real estate professionals.

Wayns-Thomas, who has been selling real estate for 30 years, said her black clients are treated differently by lenders.

“They may not like what happened between the last time you were working on this particular job to this one. They may see there was a gap,” she said. “I have seen situations where they’ve asked people for the children’s birth records.”

“The things that happen behind the scenes is what’s disturbing,” she said.

A change of tune from lenders

For Faroul, things suddenly took a turn for the better after her partner, Hanako Franz, agreed to sign on to her loan application. At the time, Franz – who is half white, half Japanese – was working part time for a grocery store. Her most recent pay stub showed she was making $144.65 every two weeks. Faroul was paying for her health insurance.

The loan officer had “completely stopped answering Rachelle’s phone calls, just ignored all of them,” said Franz, 32. “And then I called, and he answered almost immediately. And is so friendly.”

A few weeks later, the couple got the loan from Santander and bought a three-bedroom fixer-upper. But Faroul remains bitter.

“It was humiliating,” she said. “I was made to feel like nothing that I was contributing was of value, like I didn’t matter.”

Contacted by Reveal, the lenders defended their records. Tobin, who turned down Faroul on her first application, said race played no role in the rejection.

“That’s not what happened,” she said and abruptly hung up. A statement followed from Philadelphia Mortgage Advisors’ chief operating officer, Jill Quinn.

“We treat every applicant equally,” the statement said, “and promote homeownership throughout our entire lending area.”

Faroul’s loan officer at Santander, Dennis McNichol, referred Reveal to the company’s public affairs wing, which issued a statement: “While we are sympathetic with her situation, … we are confident that the loan application was managed fairly.”

Reveal’s analysis of lending data shows that nationally, Santander turned away African American homebuyers at nearly three times the rate of white ones. The company did not address that disparity in its statement but said it was more likely to grant a loan application from an African American borrower than five of its competitors.

Redlining history repeating

Lending patterns in Philadelphia today resemble redlining maps drawn across the country by government officials in the 1930s, when lending discrimination was legal.

Back then, surveyors with the federal Home Owners’ Loan Corporation drew lines on maps and colored some neighborhoods red, deeming them “hazardous” for bank lending. Leading causes of risk, according to government officials, included the presence of African Americans or immigrants.

This practice has been outlawed for half a century. And for the last 40 years, banks have had a legal obligation under the Community Reinvestment Act to solicit clients – borrowers and depositors – from all segments of their communities.

But in many places, the law hasn’t made much difference. When you combine home purchase loans, refinancing and home equity lines of credit, banks were more likely to deny a conventional loan application than grant it in more than 40 percent of Philadelphia. People of color were the majority in nearly all those neighborhoods.

“You’re killing us here,” said Cindy Bass, a member of the Philadelphia City Council, who worked for a mortgage company before entering politics. The data shows banks have frozen out borrowers in much of her district – including Nicetown, a North Philadelphia neighborhood where boarded-up row houses dot the landscape.

“We need dollars. We need investment,” Bass said, “like every neighborhood needs investment.”

Nicetown is among the neighborhoods redlined in the 1930s. In his assessment, government surveyor W.R. Hutzel said the hazardous neighborhood had some positives, including “new industry – good transportation” and a high school. On the other hand, he wrote, it had a “heavy concentration of negro.”

Today, the economic recovery largely has bypassed Nicetown. Blight is a major concern. Some of the vacant homes, empty for years, have attracted squatters. Although it’s just a few blocks from Temple University Hospital, banks and mortgage brokers largely stay away. Lenders have been particularly stingy when it comes to home improvement loans. From 2012 to 2016, they made 67 home improvement loans here and denied 315.

“It creates this cycle where properties fall into dilapidation for a long period of time,” said contractor Eric Marsh Sr., 48, whose family has lived in Nicetown for three generations.

Marsh started his own construction business “because I saw dilapidation and empty houses,” he said, and wanted to help. But because banks rarely lend here, there’s no capital to improve the neighborhood. So Marsh gets most of his jobs in more affluent sections near the center of town.

“I was wondering why people weren’t purchasing these houses or renovating them,” he said. “As I’ve gotten older and talked to people, I’ve found out that a big part of it is the lack of lending in neighborhoods like this.”

‘It’s like a glass ceiling’

It’s not only historically redlined areas that suffer from a lack of credit. Some neighborhoods that were predominantly African American decades ago have since gentrified and are now majority white. Today, they benefit from a large number of home mortgages from banks.

Other neighborhoods that experienced white flight after World War II have become home to a substantial black middle class. And in those neighborhoods, banks are more likely to turn away borrowers.

Four miles from Nicetown, toward the suburbs near the Awbury Arboretum, the homes of Germantown are set back from the street behind garden patios and beautiful stone facades.

This area wasn’t redlined in the 1930s. Government officials colored it green – “the best” – and blue, which meant “still desirable,” and told banks to lend here. Back then, most residents of Germantown were white.

Today, this part of Philadelphia is majority African American, and the homes are occupied by middle-class workers – teachers, nurses and union craftsmen. Yet in every year from 2012 to 2016, banks denied more conventional loans of all types than they made in Germantown.

“It’s like a glass ceiling,” said Angela McIver, CEO of the Fair Housing Rights Center in Southeastern Pennsylvania. “OK, we’ll allow you to go this far, but … you’re not going to go any further.”

Corporate Democrats Are Already Punching the Left Ahead of 2020

Well-informed public discussion is a major hazard for Democratic Party elites now eager to prevent Bernie Sanders from winning the 2020 presidential nomination. A clear focus on key issues can bring to light the big political differences between Sanders and the party’s corporate-friendly candidates. One way to muddy the waters is to condemn people for pointing out facts that make those candidates look bad.

National polling shows that the U.S. public strongly favors bold policy proposals that Sanders has been championing for a long time. On issues ranging from climate change to Medicare for All to tuition-free public college to Wall Street power, the party’s base has been moving leftward, largely propelled by an upsurge of engagement from progressive young people. This momentum is a threat to the forces accustomed to dominating the Democratic Party.

In recent weeks, Texas Rep. Beto O’Rourke has become a lightning rod in a gathering political storm—largely because of the vast hype about him from mass media and Democratic power brokers. At such times, when spin goes into overdrive, we need incisive factual information. Investigative journalist David Sirota provided it in a deeply researched Dec. 20 article, which The Guardian published under the headline, “Beto O’Rourke Frequently Voted for Republican Legislation, Analysis Reveals.”

Originating from the nonprofit Capital & Main news organization, the piece reported that “even as O’Rourke represented one of the most solidly Democratic congressional districts in the United States, he has frequently voted against the majority of House Democrats in support of Republican bills and Trump administration priorities.”

Progressives have good reasons to like some of O’Rourke’s positions. But Sirota’s reporting drilled down into his voting record, reviewing “the 167 votes O’Rourke has cast in the House in opposition to the majority of his own party during his six-year tenure in Congress. Many of those votes were not progressive dissents alongside other left-leaning lawmakers, but instead votes to help pass Republican-sponsored legislation.”

The meticulous and in-depth reporting by Sirota was a public service, but some angry reactions were classic instances of blaming the messenger for the unfavorable news. At times vitriolic, the denunciations of Sirota came from people who apparently would have preferred for O’Rourke’s actual voting record to remain shrouded in a hagiographic haze.

But it’s better to learn revealing political facts sooner rather than later. Thanks to Sirota’s coverage, for instance, we now know “O’Rourke has voted for GOP bills that his fellow Democratic lawmakers said reinforced Republicans’ anti-tax ideology, chipped away at the Affordable Care Act (ACA), weakened Wall Street regulations, boosted the fossil fuel industry and bolstered Donald Trump’s immigration policy.”

The backlash to Sirota’s news article was in keeping with a tweet two weeks earlier from Neera Tanden, the president of the influential and lavishly funded Center for American Progress, who has long been a major ally of Bill and Hillary Clinton. On Dec. 6, Tanden went over the top in response to a tweet from Sirota simply mentioning the fact that O’Rourke “is the #2 recipient of oil/gas industry campaign cash in the entire Congress.”

Tanden lashed out via Twitter, writing: “Oh look. A supporter of Bernie Sanders attacking a Democrat. This is seriously dangerous. We know Trump is in the White House and attacking Dems is doing Trump’s bidding. I hope Senator Sanders repudiates these attacks in 2019.”

Such calculated nonsense indicates just how panicky some powerful corporate Democrats are about Sanders’ likely presidential campaign—and just how anxious they are to protect corporate-oriented candidates from public scrutiny. The quest is to smother meaningful discussions of vital issues that should be center stage during the presidential campaign.

Corporate Democrats are gearing up to equate principled, fact-based critiques of their favored candidates with—in Tanden’s words—“seriously dangerous” attacks that are “doing Trump’s bidding.” Such demagogic rhetoric should be thrown in the political trash cans where it belongs.

This is not only about O’Rourke—it’s about the parade of Democratic contenders lined up to run for president. Should the candidates that mass media and party elites put forward as “progressive” be quickly embraced or carefully scrutinized? The question must be asked and answered.

No End in Sight to Partial Government Shutdown

WASHINGTON — Christmas has come and gone but the partial government shutdown is just getting started.

Wednesday brings the first full business day after several government departments and agencies closed up over the weekend due to a budgetary stalemate between President Donald Trump and Congress. And there is no end in sight.

So far, the public and federal workers have largely been spared inconvenience and hardship because government is closed on weekends and federal employees were excused from work on Christmas Eve and Christmas, a federal holiday. The shutdown began at midnight last Friday.

Trump said Tuesday that the closed parts of the government will remain that way until Democrats agree to wall off the U.S.-Mexico border to deter criminal elements. He said he’s open to calling the wall something else as long as he ends up with an actual wall.

Asked when the government would reopen fully, Trump said he couldn’t say.

“I can’t tell you when the government’s going to be open. I can tell you it’s not going to be open until we have a wall or fence, whatever they’d like to call it,” Trump said, referring to Democrats who staunchly oppose walling off the border.

“I’ll call it whatever they want, but it’s all the same thing,” he told reporters after participating in a holiday video conference with representatives from all five branches of the military stationed in Alaska, Bahrain, Guam and Qatar.

Trump argued that drug flows and human trafficking can only be stopped by a wall.

“We can’t do it without a barrier. We can’t do it without a wall,” he said. “The only way you’re going to do it is to have a physical barrier, meaning a wall. And if you don’t have that then we’re just not opening” the government.

Democrats oppose spending money on a wall, preferring instead to pump the dollars into fencing, technology and other means of controlling access to the border. Trump argued that Democrats oppose a wall only because he is for one.

The stalemate over how much to spend and how to spend it caused the partial government shutdown that began Saturday following a lapse in funding for departments and agencies that make up about 25 percent of the government.

Some 800,000 government workers are affected. Many are on the job but must wait until after the shutdown to be paid again.

Trump claimed that many of these workers “have said to me and communicated, ‘stay out until you get the funding for the wall.’ These federal workers want the wall. The only one that doesn’t want the wall are the Democrats.”

Trump didn’t say how he’s hearing from federal workers, excluding those he appointed to their jobs or who work with him in the White House. But many rank-and-file workers have gone to social media with stories of the financial hardship they expect to face because of the shutdown.

___

Associated Press writer Nomaan Merchant in Houston contributed to this report.

___

Follow Darlene Superville on Twitter: http://www.twitter.com/dsupervilleap

Ultra-Deep Life Forms May Survive Climate Change, Even If We Don’t

Microbiologists have good news for those who fear that runaway global warming could disrupt human civilisation, trigger a sixth great extinction of animal and plant species or even start to wipe out most of life on Earth. Even in the worst case, ultra-deep life forms may ensure that is not the end of life as we now know it.

New research confirms that far below the continental surface, at depths of 5km or more, and 10kms below the highest ocean waves, there is a huge and diverse community of living things, seemingly isolated from any climatic disruption and oblivious to catastrophic drought or flood, global thermonuclear war or even asteroid impact.

This community of deep-dwelling single-celled creatures is enormous: bulky and crowded enough to outweigh the mass of the seven billion human beings on the planet by a factor of at least 245, and perhaps as much as 385 times. They have immensely slow life-cycles: they have even been called “zombie” microbes.

Altogether, the mass of archaea, bacteria and eukarya – the three main stems of the tree of life – to be found in the deep Earth adds up to at least 15 billion and possibly 23 billion tonnes.

Rock colonists

Carbon-based life forms that, 20 years ago, no one could be sure existed, are thought to have colonised porous rock and buried sediments in a separate biosphere space of 2 billion cubic kilometres: a volume far greater than the world’s oceans.

Researchers involved in a co-operative called the Deep Carbon Observatory revealed these astonishing figures at the American Geophysical Union’s autumn conference in Washington, D.C.

“Exploring the deep subsurface is akin to exploring the Amazon rainforest,” said Mitch Sogin of the Marine Biological Laboratory at Woods Hole in Massachusetts, who chairs the Deep Life community of more than 300 scientists in 34 countries.

“There is life everywhere, and everywhere there’s an awe-inspiring abundance of unexpected and unusual organisms.”

“Scientists do not yet know all the ways in which deep subsurface life affects surface life and vice versa”

Estimates of carbon-based life are important in climate calculations: researchers are still trying to calculate with a degree of accuracy the seasonal traffic of carbon between living things, rocks, ocean and atmosphere.

But the same estimates are vital in simply understanding life’s complexity: earlier this year, US and Israeli researchers published a comprehensive assessment of the distribution of carbon between living things on the planet’s surface: trees, herbs, grasses, fungi, microbes, vertebrates and so on.

But all surface creatures breathe air, consume rainwater and absorb energy that comes primarily from the sun, via photosynthesis. It was only in the last years of the last century that researchers began to confirm a strange, unexpected but rich biosphere far below the surface: composed of microscopic creatures that gain their energy from the heat of the deep crustal rocks, live on nutrients from the chemistry of the planet’s minerals, and flourish in conditions of almost unimaginable temperature and pressure.

Researchers have found microbial communities in deep submarine coal mines off the coast of Japan, in slabs of submarine basalt, below oilfields, in the deepest hydrothermal vents at the bottom of the deepest oceans.

Just surviving

Microbes have been found surviving at temperatures of 121°C and at atmospheric pressures 400 times greater than those at sea level. And, like life on the surface, these creatures exhibit diversity: they may be as various or even more diverse than lifeforms that dwell in the sunlight and air.

“Ten years ago, we knew far less about the physiologies of the bacteria and microbes that dominate the subsurface biosphere. Today we know that in many places, they invest most of their energy in simply maintaining their existence and little into growth, which is a fascinating way to live,” said Karen Lloyd of the University of Tennessee at Knoxville.

“Today, too, we know that subsurface life is common. Ten years ago, we had sampled only a few sites – the kinds of places we’d expect to find life. Now, thanks to ultra-deep sampling, we know we can find them pretty much everywhere.”

The discovery raises new questions about the nature of life, and how it may have begun. It suggests that even in the worst climate catastrophe precipitated by human exploitation of fossil carbon, life would continue.

Our neighbours?

It also suggests that Earthlings may not be alone, even in the solar system: if microbes can survive deep in planet Earth, then perhaps they cling on to life under the seemingly sterile surface of Mars, or Saturn’s moon Titan, or in the ice-sealed ocean of Jupiter’s moon Europa.

There are other questions. Is life on the surface a consequence of subterranean beginnings? Or is the traffic the other way – did the deep Earth biosphere evolve from surface creatures? If their primary energy source is not solar radiation, what is it that powers them? Hydrogen? Methane? Uranium?

“Our studies of deep biosphere microbes have produced much new knowledge, but also a realisation and far greater appreciation of how much we have yet to learn about subsurface life,” said Rick Colwell of Oregon State University.

“For example, scientists do not yet know all the ways in which deep subsurface life affects surface life and vice versa. And for now, we can only marvel at the nature of the metabolisms that allow life to survive under extremely impoverished and forbidding conditions for life in deep Earth.”

Netanyahu Remains Election Favorite, Despite Scandals

JERUSALEM — A day after snap elections were called in Israel, Prime Minister Benjamin Netanyahu emerged as the overwhelming early front-runner Tuesday, with rivals and commentators alike pinning their primary hopes of unseating him on a potential corruption indictment.

With Netanyahu holding a commanding lead in the polls, all eyes are on Attorney General Avichai Mandelblit and whether he will decide before April’s elections on whether to press charges against the longtime leader on a series of corruption allegations.

“Avichai Mandelblit needs to tell us before the elections if there is an indictment or not,” Yesh Atid leader Yair Lapid, one of Netanyahu’s primary challengers, told the YNet news site. “People need to know what they are voting for.”

For now, Israelis seem to be sticking with Netanyahu, with the first poll since early elections were called showing him cruising to an easy re-election.

The Panels Politics poll in the Maariv daily showed Netanyahu’s ruling Likud party securing 30 seats in the 120-seat parliament and a majority for his current right-wing, nationalist bloc. Coming in second at 13 seats was the still hypothetical party headed by former military chief Benny Gantz, who has yet to declare whether he is even running. The established left and center parties lagged far behind.

The survey polled 500 Israelis and had a margin of error of 4.3 percentage points.

Netanyahu on Monday called early elections for April, setting the stage for a three-month campaign clouded by a series of corruption investigations against the long-serving Israeli leader. With the traditional opposition parties splintered, the only thing seeming to stand in Netanyahu’s path toward a fourth consecutive term is a potential indictment. While Israeli law is unclear on such a scenario, several party chiefs have vowed not to serve in a coalition led by someone facing criminal charges.

Netanyahu, facing the possibility of bribery and breach of trust charges in three different cases, brushed aside questions on how his legal peril would influence the election at a gathering of his Likud Party as he announced plans for what is expected to be an April 9 vote.

Netanyahu has denied any wrongdoing, dismissing the allegations as a media-orchestrated witch hunt aimed at removing him from office. With the accusations looming, the upcoming election is expected to emerge as a referendum on Netanyahu as he seeks to become the longest serving premier in Israeli history.

Mandelblit’s office says his decision, expected in the coming months, would not be influenced by any political timetable.

“Mandelblit has an unprecedented time bomb sitting on his desk,” wrote Ben Caspit in Maariv, noting that some of Netanyahu’s staunchest backers have vowed to support him even if he is convicted. “In this chaotic lunatic asylum, Avichai Mandelblit is the sole responsible adult.”

Yediot Ahronot columnist Nahum Barnea said Mandelblit was in a no-win situation and likened his plight to that of former FBI Director James Comey during the 2016 American presidential election.

“If Mandelblit decides to postpone the decision until after the elections, many Israelis will ask — and justly so — for whom are they being asked to vote. Is it for a man who is facing charges of bribery or for a man who is facing lesser charges?” he wrote.

“If Mandelblit decides to release his decision in the midst of the run-up to the elections, he will be attacked by all of the candidates running on the Likud’s list, first and foremost among them Netanyahu. By what right is he meddling in the elections, they will ask.”

Earlier this month, police recommended that Netanyahu be charged with bribery for promoting regulatory changes worth hundreds of millions of dollars to the country’s main telecom company Bezeq. In exchange, they believe Netanyahu used his connections with Bezeq’s controlling shareholder to secure positive press coverage on the company’s popular news site.

Police have also recommended indicting Netanyahu on corruption charges in two other cases. One involves accepting gifts from billionaire friends, and the second revolves around alleged offers of advantageous legislation for a major newspaper in return for favorable press coverage.

Chris Hedges's Blog

- Chris Hedges's profile

- 1897 followers