Chris Hedges's Blog, page 378

December 27, 2018

Saudi King Orders Shake-Up; Crown Prince Strengthened

DUBAI, United Arab Emirates — Saudi Arabia’s King Salman issued a wide-ranging overhaul of top government posts on Thursday, including naming a new foreign minister, following international fallout from the killing of Saudi writer Jamal Khashoggi nearly three months ago.

He also ordered a shakeup of the kingdom’s supreme council that oversees matters related to security. The council is headed by the king’s son, Crown Prince Mohammed bin Salman, whose powers including roles as deputy prime minister and defense minister, were untouched in the overhaul.

The changes appear to further consolidate the crown prince’s grip on power by appointing to key posts advisers and members of the royal family seen as close to him.

It may also signal further efforts to show that changes are being made after the U.S. Senate passed a resolution saying it believes the crown prince is to blame for Khashoggi’s grisly murder inside the Saudi consulate in Istanbul.

As the crown prince struggles to convince many in Washington and other Western capitals that he had nothing to do with Khashoggi’s killing, the soft-spoken Adel al-Jubeir was replaced as foreign minister by Ibrahim al-Assaf, a longtime former finance minister. Al-Jubeir was appointed to minister of state for foreign affairs at the Foreign Ministry.

Al-Assaf is well known to international investors, having led several Saudi delegations to the World Economic Forum in Davos. He served as finance minister under King Fahd and King Abdullah.

Al-Assaf sits on the boards of oil-giant Saudi Aramco and the kingdom’s sovereign wealth fund. The crown prince oversees both entities. He holds a Ph.D. in Economics from Colorado State University and a master’s degree from the University of Denver, according to his biography on Aramco’s website.

Al-Assaf had been serving as a minister of state last year when he was reportedly detained at the Ritz-Carlton hotel in Riyadh along with dozens of high-ranking officials and princes in an anti-corruption sweep led by the crown prince. Shortly after, al-Assaf appeared back at a Cabinet meeting to the surprise of many.

The government did not name those detained nor disclose what crimes they were suspected of committing. The Associated Press could not independently confirm reports of al-Assaf’s arrest. The opaque anti-corruption sweep helped Prince Mohammed consolidate power and net the government more than $13 billion in settlements.

The changes announced Thursday include aides to the crown prince, including Musaed al-Aiban as national security adviser — in addition to other positions he holds — and former media minister Awwad al-Awwad as adviser to the royal court. Khalid al-Harbi was named as head of general security.

Turki al-Sheikh, a confidant of the crown prince, was removed as head of the Sports Authority and replaced by Prince Abdulaziz bin Turki al-Faisal. This means al-Sheikh no longer oversees a cybersecurity and programming body that was led by Saud al-Qahtani, a close aide to the crown prince who was fired from his post and sanctioned by the U.S. Treasury Department for helping to mastermind the plot that led to Khashoggi’s killing.

Khashoggi wrote critically of the crown prince in columns for The Washington Post before he was killed. After denying any knowledge of Khashoggi’s death for weeks, Saudi authorities eventually settled on the explanation that he was killed in an operation masterminded by former advisers to Prince Mohammed. The kingdom denies the crown prince had any involvement.

Al-Sheikh will now lead the General Entertainment Authority, a body created in recent years to help organize and promote concerts and other events that had long been banned in the conservative country.

Turki Shabbaneh, who has held positions in privately owned Saudi TV channels, was named minister of media. Hamad al-Sheikh, a royal court adviser and former college dean who studied in the U.S., was appointed minister of education.

The king’s eldest son, Prince Sultan bin Salman, was removed as head of the tourism authority. He will lead a new national space agency. In 1985, he became the first Arab and Muslim astronaut to fly in space.

Prince Abdullah bin Bandar was named head of the National Guard. The force is tasked primarily with the protection of the Al Saud ruling family. Prince Abdullah had been deputy governor of Mecca.

Federal Workers Face Grim Prospect of Lengthy Shutdown

WASHINGTON — Three days, maybe four. That’s how long Ethan James, 21, says he can realistically miss work before he’s struggling.

So as the partial government shutdown stretched into its sixth day with no end in sight, James, a minimum-wage contractor sidelined from his job as an office worker at the Interior Department, was worried. “I live check to check right now,” he said, and risks missing his rent or phone payment. Contractors, unlike most federal employees, may never get back pay for being idled. “I’m getting nervous,” he said.

Federal workers and contractors forced to stay home or work without pay are experiencing mounting stress from the impasse affecting hundreds of thousands of them. For those without a financial cushion, even a few days of lost wages during the shutdown over President Donald Trump’s border wall could have dire consequences.

As well, the disruption is starting to pinch citizens who count on a variety of public services, beyond those who’ve been finding gates closed at national parks. For example, the government won’t issue new federal flood insurance policies or renew expiring ones.

Trump and congressional leaders appear no closer to a resolution over his demand for $5 billion for the border wall that could now push the shutdown into the new year. The House and Senate gaveled in for a perfunctory session Thursday, but quickly adjourned without action. No votes are expected until next week, and even that’s not guaranteed. Lawmakers are mostly away for the holidays and will be given 24-hour notice to return, with Republican senators saying they won’t vote until all parties, including Trump, agree to a deal.

The president spent part of the day tweeting about the shutdown, insisting “this isn’t about the Wall,” but about Democrats denying him “a win.”

“Do the Dems realize that most of the people not getting paid are Democrats?” he asked in one tweet, citing no evidence for that claim. That earned him a reprimand from Democratic Sen. Mark Warner of Virginia, who tweeted: “Federal employees don’t go to work wearing red or blue jerseys. They’re public servants.”

Roughly federal 420,000 workers were deemed essential and are working unpaid, unable to take any sick days or vacation. An additional 380,000 are staying home without pay. While furloughed federal workers have been given back pay in previous shutdowns, it’s not guaranteed. The Senate passed a bill last week to make sure workers will be paid. The House will probably follow suit.

The longer the shutdown lasts, the more government activities will grind to a halt. It’s already caused a lapse in money for nine of 15 Cabinet-level departments and dozens of agencies, including the departments of Homeland Security, Transportation, Interior, Agriculture, State and Justice.

Many national parks have closed while some have limited facilities. The National Flood Insurance Program announced it will no longer renew or issue policies during the shutdown.

“I think it’s obvious that until the president decides he can sign something — or something is presented to him — that we are where we are,” said Sen. Pat Roberts, R-Kan., who opened the Senate for the minutes-long session. “We just have to get through this.”

House Democrats tried Thursday to offer a measure to re-open government, but they were blocked from action by Republicans, who still have majority control of the chamber until Democrats take over Jan. 3.

“Unfortunately, 800,000 federal workers are in a panic because they don’t know whether they’ll get paid,” said Rep. Jim McGovern, D-Mass., who tried to offer the bill. “That may make the president feel good but the rest of us should be terribly bothered by that, and should work on overtime to end the shutdown now.”

Government contractors like James, placed indefinitely on unpaid leave, don’t get compensated for lost hours.

James said the contracting company he works for gave its employees a choice: take unpaid leave or dip into paid time-off entitlements. But James doesn’t have any paid time off because he started the job just four months ago. His only option is forgoing a paycheck.

“This is my full-time job, this is what I was putting my time into until I can save up to take a few classes,” said James, who plans to study education and become a teacher. “I’m going to have to look for something else to sustain me.”

Mary Morrow, a components engineer on contract for NASA, is in the same predicament. In addition to caring for a family largely on her own, she’s got a mortgage.

“I have three teenage boys, it’s near Christmas time and we just spent money, there are credit card bills and normal bills and it’s really nerve-wracking,” she said. “It’s scary.”

As federal employees tell their stories on Twitter under the hashtag #Shutdownstories, Trump has claimed that federal workers are behind him, saying many have told him “stay out until you get the funding for the wall.'” He didn’t say whom he had heard from, and he did not explain the incongruity of also believing that most are Democrats.

Steve Reaves, president of Federal Emergency Management Agency union, said he hasn’t heard from any employees who say they support the shutdown.

“They’re all by far worried about their mortgages,” Reaves said.

Reaves said the shutdown could have consequences that stretch beyond a temporary suspension of salary. Many federal government jobs require a security clearance, he said, and missed mortgage payments or deepening debt could hurt their clearance.

David Dollard, a Federal Bureau of Prisons employee and chief steward for the American Federation of Government Employees Local 709 union in Colorado, said at least two agency employees lost their homes after the 2013 shutdown suspended their salaries. Bureau of Prisons employees are considered essential, and must work without pay. The agency is already understaffed, Dollard said. Shutdown conditions make everything worse.

“You start out at $44,000 a year, there’s not much room for anything else as far saving money for the next government shutdown, so it puts staff in a very hard situation,” he said. “We’ve got single fathers who have child support, alimony. It’s very hard to figure out what you’re going to do.”

Candice Nesbitt, 51, has worked for 1 ½ years for the U.S. Coast Guard, the only branch of the military affected by the shutdown. About 44,000 Coast Guard employees are working this week without pay; 6,000, including Nesbitt, have been furloughed.

Nesbitt worked for a contractor but took a pay cut in exchange for the stability of a government job. She has a mortgage, is the guardian of her special needs, 5-year-old grandson, and makes about $45,000 a year, she said. Any lapse in payment could plunge her into debt. “It shakes me to the core,” she said.

U.S. Stocks Stage Big Rally, Erase 600-Point Drop in Dow

Wall Street staged a swift, last-minute turnaround Thursday that rescued stocks from a steep dive and put the market on track to end a topsy-turvy, volatile week with a gain.

The comeback reversed a 611 point drop in the Dow Jones Industrial Average. The S&P 500 and Nasdaq eked out modest gains after having been down 2.8 and 3.3 percent, respectively.

Thursday’s sharp swing in stocks followed their best day in 10 years. Even so, the market remains headed for what could be its steepest annual loss since the financial crisis.

The market’s sharp downturn that began in October has intensified this month, erasing all of its 2018 gains and nudging the S&P 500 closer to its worst year since 2008. Even with the two-day winning streak, the Dow, S&P 500 and Nasdaq are all down more than 9 percent for the month and stocks are on track for their worst December since 1931.

“There are reasons we should be volatile, including a lot of unknowns as we head into 2019, starting with tariffs,” said JJ Kinahan, chief markets strategist for TD Ameritrade, noting that below-average trading volume this time of year is also contributing to the market’s volatility this week.

Prior to the two-day rally, the S&P 500 had fallen in 11 of 16 trading sessions in December, with five of the declines by 2 percent or more. Investors had grown worried that the testy U.S.-China trade dispute and higher interest rates would slow the economy, hurting corporate profits.

“The last two days are really demonstrable of what the market is struggling with,” said Tom Martin, senior portfolio manager of Globalt Investments. “It’s looking for a bottom. It’s looking for a reason to gain a little more confidence. And it’s also looking for opportunities to reposition and lessen risk.”

Health care and technology companies, banks and industrial stocks accounted for much of the broad gains.

The S&P 500 index rose 21.13 points, or 0.9 percent, to 2,488.83. Earlier, it had been down more than 69 points. The Dow gained 260.37 points, or 1.1 percent, to 23,138.82. Both indexes rose about 5 percent Wednesday, when the Dow had its biggest-ever single-day point gain.

The tech-heavy Nasdaq added 25.14 points, or 0.4 percent, to 6,579.49. The Russell 2000 index of smaller-company stocks picked up 2.01 points, or 0.2 percent, 1,331.82.

Technology companies, a big driver of the market’s gains before things deteriorated in October, rebounded after being down most of the day. Micron Technology gained 3.4 percent to $31.93. It had fallen to $30.59 before the rally.

Cigna rose 2.8 percent to $192.79, one of the big gainers in the health care sector.

Bonds prices rose. The yield on the 10-year Treasury slipped to 2.78 percent from 2.79 percent late Wednesday, although the yield dropped as low as 2.73 percent when stocks were near their lowest levels as investors sought safer investments. The recovery in bond yields helped lift financial stocks. JPMorgan Chase rose 1.1 percent to $97.04.

Benchmark U.S. crude dropped 3.5 percent to settle at $44.61 a barrel in New York. Brent crude, used to price international oils, lost 4.2 percent to $52.16 a barrel in London.

The dollar fell to 110.74 yen from 111.36 yen on Wednesday. The euro strengthened to $1.1449 from $1.1351.

Gold edged up 0.6 percent to $1,281.10 an ounce and silver gained 1.2 percent to $15.31 an ounce. Copper fell 1.2 percent to $2.67 a pound.

Overseas, major indexes in Europe closed lower while markets in Asia mostly rose. The German DAX slid 2.4 percent, while the Nikkei 225 index rebounded 3.9 percent.

Private Immigration Prisons Are Raking In Taxpayer Dollars Under Trump

For-profit prisons are a lucrative industry in the United States. After falling out of favor in the Obama years, they’ve found a new purpose—and extensive profits—in the Trump administration by incarcerating undocumented immigrants.

These prisons have come under scrutiny from advocates alleging extensive human rights abuses, but as The New York Times explained in October, the biggest companies in the industry defend themselves by touting their efficiency, claiming they “build and operate prisons more cheaply than governments can, what with the public sector’s many mandates.”

A new investigation by The Daily Beast, however, found that rather than saving public money, private prison companies are actually costing taxpayers $807 million, while inmates work for $3 a day or less. In 2018, The Daily Beast writes, “For-profit immigration detention was a nearly $1 billion industry underwritten by taxpayers and beset by problems that include suicide, minimal oversight, and what immigration advocates say uncomfortably resembles slave labor.”

A New York Times video on conditions in immigration detention centers revealed “barely edible food, indifferent health care, guard brutality and assorted corner-cutting measures.”

In November, NPR reported that Douglas Menjivar, a former inmate in the Joe Corley Detention Facility in Texas, said “he was raped by gang members in his cell, and when he reported it to the medical staff they mocked him.” Menjivar told NPR that he was forced to work for less than $1 per day at Corley.

Yesica, a current inmate at Corley, told The Daily Beast she earns slightly more at $3 a day for her graveyard shift in the prison kitchen. And that’s at the high end of what inmates are paid.

While inmates are earning $3 or less a day, their jailers are reaping huge profits. GEO Group, which owns the Corley facility, reported in November that it was on track to earn $2.3 billion by the end of 2018.

In compiling its report, The Daily Beast read and analyzed multiple ICE budget submissions and other public records. “For 19 privately owned or operated detention centers for which The Daily Beast could find recent pricing data, ICE paid an estimated $807 million in fiscal year 2018,” the article explains.

Those prisons hold about 18,000 people, or 41 percent of the approximately 44,000 migrants currently detained by ICE. The Daily Beast, however, cautions that this might not be a comprehensive picture; the article notes that “The true figures are likely significantly higher. The National Immigrant Justice Center estimated that for November 2017, roughly 71 percent of immigrant detainees, then a smaller total figure, were held in 33 privately operated jails.”

Advocates are concerned about the low wages and potential for abuse in these facilities. As Emily Ryo, an associate professor at the University of California’s Gould School of Law, told The Daily Beast:

To the extent that the industry is in the business of expanding the system so they can make more money off holding more immigrants that can be confined, and doing everything possible to profit off of it by labor processes like getting detainees to work and paying them a dollar a day, there is very little distinction you can draw between slave labor and what they’re doing.

Read the full Daily Beast report here.

Report: Private Immigration Prisons Receive $800 Million in Taxpayer Money in 2018

For-profit prisons are a lucrative industry in the United States. After falling out of favor in the Obama years, they’ve found a new purpose—and extensive profits—in the Trump administration by incarcerating undocumented immigrants.

These prisons have come under scrutiny from advocates alleging extensive human rights abuses, but as The New York Times explained in October, the biggest companies in the industry defend themselves by touting their efficiency, claiming they “build and operate prisons more cheaply than governments can, what with the public sector’s many mandates.”

A new investigation by The Daily Beast, however, found that rather than saving public money, private prison companies are actually costing taxpayers $807 million, while inmates work for $3 a day or less. In 2018, The Daily Beast writes, “For-profit immigration detention was a nearly $1 billion industry underwritten by taxpayers and beset by problems that include suicide, minimal oversight, and what immigration advocates say uncomfortably resembles slave labor.”

A New York Times video on conditions in immigration detention centers revealed “barely edible food, indifferent health care, guard brutality and assorted corner-cutting measures.”

In November, NPR reported that Douglas Menjivar, a former inmate in the Joe Corley Detention Facility in Texas, said “he was raped by gang members in his cell, and when he reported it to the medical staff they mocked him.” Menjivar told NPR that he was forced to work for less than $1 per day at Corley.

Yesica, a current inmate at Corley, told The Daily Beast she earns slightly more at $3 a day for her graveyard shift in the prison kitchen. And that’s at the high end of what inmates are paid.

While inmates are earning $3 or less a day, their jailers are reaping huge profits. GEO Group, which owns the Corley facility, reported in November that it was on track to earn $2.3 billion by the end of 2018.

In compiling its report, The Daily Beast read and analyzed multiple ICE budget submissions and other public records. “For 19 privately owned or operated detention centers for which The Daily Beast could find recent pricing data, ICE paid an estimated $807 million in fiscal year 2018,” the article explains.

Those prisons hold about 18,000 people, or 41 percent of the approximately 44,000 migrants currently detained by ICE. The Daily Beast, however, cautions that this might not be a comprehensive picture; the article notes that “The true figures are likely significantly higher. The National Immigrant Justice Center estimated that for November 2017, roughly 71 percent of immigrant detainees, then a smaller total figure, were held in 33 privately operated jails.”

Advocates are concerned about the low wages and potential for abuse in these facilities. As Emily Ryo, an associate professor at the University of California’s Gould School of Law, told The Daily Beast:

To the extent that the industry is in the business of expanding the system so they can make more money off holding more immigrants that can be confined, and doing everything possible to profit off of it by labor processes like getting detainees to work and paying them a dollar a day, there is very little distinction you can draw between slave labor and what they’re doing.

Read the full Daily Beast report here.

Universal Basic Income Is Easier Than It Looks

Calls for a Universal Basic Income (UBI) have been increasing, most recently as part of the “Green New Deal” introduced by Rep. Alexandria Ocasio-Cortez, D-N.Y., and supported in the last month by at least 40 members of Congress. A UBI is a monthly payment to all adults with no strings attached, similar to Social Security. Critics say the Green New Deal asks too much of the rich and upper-middle-class taxpayers who will have to pay for it, but taxing the rich is not what the resolution proposes. It says funding would primarily come from the federal government, “using a combination of the Federal Reserve, a new public bank or system of regional and specialized public banks,” among other vehicles.

The Federal Reserve alone could do the job. It could buy “Green” federal bonds with money created on its balance sheet, just as the Fed funded the purchase of $3.7 trillion in bonds in its “quantitative easing” program to save the banks. The Treasury could also do it. The Treasury has the constitutional power to issue coins in any denomination, even trillion dollar coins. What prevents legislators from pursuing those options is the fear of hyperinflation from excess “demand” (spendable income) driving prices up. But in fact the consumer economy is chronically short of spendable income, due to the way money enters the consumer economy. We actually need regular injections of money to avoid a “balance sheet recession” and allow for growth, and a UBI is one way to do it.

The pros and cons of a UBI are hotly debated and have been discussed elsewhere. The point here is to show that it could actually be funded year after year without driving up taxes or prices. New money is continually being added to the money supply, but it is added as debt created privately by banks. (How banks, rather than the government, create most of the money supply today is explained on the Bank of England website here.) A UBI would replace money-created-as-debt with debt-free money—a “debt jubilee” for consumers—while leaving the money supply for the most part unchanged; and to the extent that new money was added, it could help create the demand needed to fill the gap between actual and potential productivity.

The Debt Overhang Crippling Economies

The “bank money” composing most of the money in circulation is created only when someone borrows, and today businesses and consumers are burdened with debts that are higher than ever before. In 2018, credit card debt alone exceeded $1 trillion, student debt exceeded $1.5 trillion, auto loan debt exceeded $1.1 trillion, and non-financial corporate debt hit $5.7 trillion. When businesses and individuals pay down old loans rather than taking out new loans, the money supply shrinks, causing a “balance sheet recession.” In that situation, the central bank, rather than removing money from the economy (as the Fed is doing now), needs to add money to fill the gap between debt and the spendable income available to repay it.

Debt always grows faster than the money available to repay it. One problem is the interest, which is not created along with the principal, so more money is always owed back than was created in the original loan. Beyond that, some of the money created as debt is held off the consumer market by “savers” and investors who place it elsewhere, making it unavailable to companies selling their wares and the wage-earners they employ. The result is a debt bubble that continues to grow until it is not sustainable and the system collapses, in the familiar death spiral euphemistically called the “business cycle.” As economist Michael Hudson shows in his 2018 book, “… and Forgive Them Their Debts,” this inevitable debt overhang was corrected historically with periodic “debt jubilees”—debt forgiveness—something he argues we need to do again today.

For governments, a debt jubilee could be effected by allowing the central bank to buy government securities and hold them on its books. For individuals, one way to do it fairly across the board would be with a UBI.

Why a UBI Need Not Be Inflationary

In a 2018 book called “The Road to Debt Bondage: How Banks Create Unpayable Debt,” political economist Derryl Hermanutz proposes a central-bank-issued UBI of $1,000 per month, credited directly to people’s bank accounts. Assuming this payment went to all U.S. residents over 18, or about 250 million people, the outlay would be about $2.5 trillion annually. For people with overdue debt, Hermanutz proposes that it automatically go to pay down those debts. Since money is created as loans and extinguished when they are repaid, that portion of a UBI disbursement would be extinguished along with the debt.

People who were current on their debts could choose whether or not to pay them down, but many would also no doubt go for that option. Hermanutz estimates that roughly half of a UBI payout could be extinguished in this way through mandatory and voluntary loan repayments. That money would not increase the money supply or demand. It would just allow debtors to spend on necessities with debt-free money rather than hocking their futures with unrepayable debt.

He estimates that another third of a UBI disbursement would go to “savers” who did not need the money for expenditures. This money, too, would not be likely to drive up consumer prices, since it would go into investment and savings vehicles rather than circulating in the consumer economy. That leaves only about one-sixth of payouts, or $400 billion, that would actually be competing for goods and services; and that sum could easily be absorbed by the “output gap” between actual and forecasted productivity.

According to a July 2017 paper from the Roosevelt Institute called “What Recovery? The Case for Continued Expansionary Policy at the Fed”: “GDP remains well below both the long-run trend and the level predicted by forecasters a decade ago. In 2016, real per capita GDP was 10% below the Congressional Budget Office’s (CBO) 2006 forecast, and shows no signs of returning to the predicted level.”

The report showed that the most likely explanation for this lackluster growth was inadequate demand. Wages have remained stagnant; and before producers will produce, they need customers knocking on their doors.

In 2017, the U.S. Gross Domestic Product was $19.4 trillion. If the economy is running at 10 percent below full capacity, $2 trillion could be injected into the economy every year without creating price inflation. It would just generate the demand needed to stimulate an additional $2 trillion in GDP. In fact a UBI might pay for itself, just as the G.I. Bill produced a sevenfold return from increased productivity after World War II.

The Evidence of China

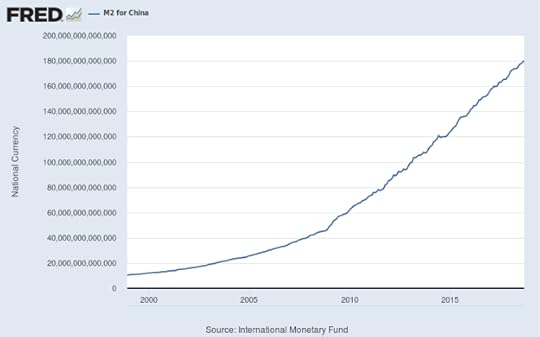

That new money can be injected year after year without triggering price inflation is evident from a look at China. In the last 20 years, its M2 money supply has grown from just over 10 trillion yuan to 80 trillion yuan ($11.6T), a nearly 800 percent increase. Yet the inflation rate of its Consumer Price Index (CPI) remains a modest 2.2 percent.

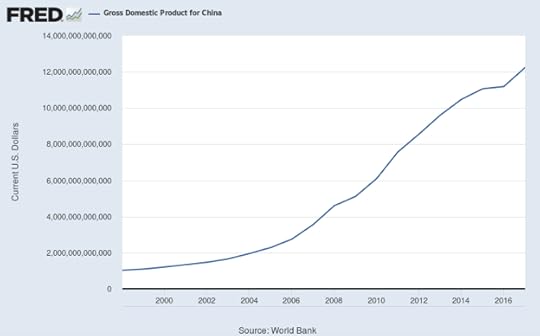

Why has all that excess money not driven prices up? The answer is that China’s Gross Domestic Product has grown at the same fast clip as its money supply. When supply (GDP) and demand (money) increase together, prices remain stable.

Whether or not the Chinese government would approve of a UBI, it does recognize that to stimulate productivity, the money must get out there first; and since the government owns 80 percent of China’s banks, it is in a position to borrow money into existence as needed. For “self-funding” loans—those that generate income (fees for rail travel and electricity, rents for real estate)—repayment extinguishes the debt along with the money it created, leaving the net money supply unchanged. When loans are not repaid, the money they created is not extinguished; but if it goes to consumers and businesses that then buy goods and services with it, demand will still stimulate the production of supply, so that supply and demand rise together and prices remain stable.

Without demand, producers will not produce and workers will not get hired, leaving them without the funds to generate supply, in a vicious cycle that leads to recession and depression. And that cycle is what our own central bank is triggering now.

The Fed Tightens the Screws

Rather than stimulating the economy with new demand, the Fed has been engaging in “quantitative tightening.” On Dec. 19, 2018, it raised the Fed funds rate for the ninth time in three years, despite a “brutal” stock market in which the Dow Jones Industrial Average had already lost 3,000 points in 2 ½ months. The Fed is still struggling to reach even its modest 2 percent inflation target, and GDP growth is trending down, with estimates at only 2-2.7 percent for 2019. So why did it again raise rates, over the protests of commentators, including the president himself?

For its barometer, the Fed looks at whether the economy has hit “full employment,” which it considers to be 4.7 percent unemployment, taking into account the “natural rate of unemployment” of people between jobs or voluntarily out of work. At full employment, workers are expected to demand more wages, causing prices to rise. But unemployment is now officially at 3.7 percent—beyond technical full employment—and neither wages nor consumer prices have shot up. There is obviously something wrong with the theory, as is evident from a look at Japan, where prices have long refused to rise despite a serious lack of workers.

The official unemployment figures are actually misleading. Including short-term discouraged workers, the rate of U.S. unemployed or underemployed workers as of May 2018 was 7.6 percent, double the widely reported rate. When long-term discouraged workers are included, the real unemployment figure was 21.5 percent. Beyond that large untapped pool of workers, there is the seemingly endless supply of cheap labor from abroad and the expanding labor potential of robots, computers and machines. In fact, the economy’s ability to generate supply in response to demand is far from reaching full capacity today.

Our central bank is driving us into another recession based on bad economic theory. Adding money to the economy for productive, non-speculative purposes will not drive up prices so long as materials and workers (human or mechanical) are available to create the supply necessary to meet demand; and they are available now. There will always be price increases in particular markets when there are shortages, bottlenecks, monopolies or patents limiting competition, but these increases are not due to an economy awash with money. Housing, health care, education and gas have all gone up, but it is not because people have too much money to spend. In fact it is those necessary expenses that are driving people into unrepayable debt, and it is this massive debt overhang that is preventing economic growth.

Without some form of debt jubilee, the debt bubble will continue to grow until it can again no longer be sustained. A UBI can help correct that problem without fear of “overheating” the economy, so long as the new money is limited to filling the gap between real and potential productivity and goes into generating jobs, building infrastructure and providing for the needs of the people, rather than being diverted into the speculative, parasitic economy that feeds off them.

Iraqi Lawmakers Demand U.S. Withdrawal After Trump Visit

BAGHDAD — Iraqi lawmakers Thursday demanded U.S. forces leave the country following a surprise visit by President Donald Trump that politicians denounced as arrogant and a violation of national sovereignty.

Trump’s trip to U.S. servicemen and women at al-Asad Airbase in western Iraq on Wednesday was unannounced and the subject of extreme security, which is routine for presidential visits to conflict regions. But it came at a time when containing foreign influence has become a hot-button issue in Iraqi politics, and it provoked vociferous backlash.

Iraqi lawmakers were smarting after the U.S. president left three hours after he arrived without meeting any officials, drawing unfavorable comparisons to the occupation of Iraq after the 2003 invasion.

“Trump needs to know his limits. The American occupation of Iraq is over,” said Sabah al-Saidi, the head of one of two main blocs in Iraq’s parliament.

Trump, al-Saidi added, had slipped into Iraq, “as though Iraq is a state of the United States.”

While Trump didn’t meet with any officials, he spoke with Prime Minister Adel Abdul-Mahdi by phone after a “difference in points of view” over arrangements led to a face-to-face meeting between the two leaders to be scrapped, according to the prime minister’s office.

The visit could have unintended consequences for American policy, with officials from both sides of Iraq’s political divide calling for a vote in Parliament to expel U.S. forces from the country.

The president, who kept to the U.S. air base approximately 100 kilometers (60 miles) west of Baghdad, said he had no plans to withdraw the 5,200 troops in the country. He said Ain al-Asad could be used for U.S. air strikes inside Syria following his announcement last week to withdraw U.S. troops from there.

The suggestion ran counter to the current sentiment of Iraqi politics, which favors claiming sovereignty over foreign and domestic policy and staying above the fray in regional conflicts.

“Iraq should not be a platform for the Americans to settle their accounts with either the Russians or the Iranians in the region,” said Hakim al-Zamili, a senior lawmaker in al-Saidi’s Islah bloc in Parliament.

U.S. troops are stationed in Iraq as part of the coalition against the Islamic State group. American forces withdrew in 2011 after invading in 2003 but returned in 2014 at the invitation of the Iraqi government to help fight the jihadist group. Trump’s visit was the first by a U.S. president since Barack Obama met with then-Prime Minister Nouri al-Maliki at a U.S. base outside Baghdad in 2009.

Still, after defeating IS militants in their last urban bastions last year, Iraqi politicians and militia leaders are speaking out against the continued presence of U.S. forces on Iraqi soil.

Supporters of the populist cleric Moqtada al-Sadr won big in national elections in May, campaigning on a platform of curbing both U.S. and rival Iranian involvement in Iraqi affairs. Al-Sadr’s lawmakers now form the core of the Islah bloc, which is headed by al-Saidi in Parliament.

The rival Binaa bloc, commanded by politicians and militia leaders close to Iran, also does not favor the U.S..

Qais Khazali, the head of the Iran-backed Asaib Ahl al-Haq militia that fought key battles against IS in north Iraq, promised on Twitter that Parliament would vote to expel U.S. forces from Iraq, or the militias would force them out by “other means.”

Khazali was jailed by British and U.S. forces from 2007 to 2010 for managing sections of the Shia insurgency against the occupation during those years.

Trump’s visit would be a “great moral boost to the political parties, armed factions, and others who oppose the American presence in Iraq,” Iraqi political analyst Ziad al-Arar said.

Still, the U.S. and Iraq developed considerable military and intelligence ties in the war against IS, and they continue to pay dividends in operations against militants gone into hiding.

Earlier in the month, Iraqi forces called in an airstrike by U.S.-coalition forces to destroy a tunnel used by IS militants in the Atshanah mountains in north Iraq. Four militants were killed, according to the coalition.

A hasty departure of U.S. forces would jeopardize such arrangements, said Iraqi analyst Hamza Mustafa.

And relations between the U.S. and Iraq extend beyond military ties. U.S. companies have considerable interests in Iraq’s petrochemical industry, and American diplomats are often brokers between Iraq’s fractious political elite.

Iraq’s Sunni politicians have been largely quiet about the presidential visit, reflecting the ties they have cultivated with the U.S. to counterbalance the might of the country’s Iran-backed and predominantly-Shiite militias.

White House press secretary Sarah Huckabee Sanders said Abdul-Mahdi accepted Trump’s invitation to the White House during their call, though the Prime Minister’s office has so far refused to confirm that.

Defying Pundits, GOP Share of Latino Vote Steady Under Trump

LITTLETON, Colo. — Pedro Gonzalez has faith in Donald Trump and his party.

The 55-year-old Colombian immigrant is a pastor at an evangelical church in suburban Denver. Initially repelled by Trump in 2016, he’s been heartened by the president’s steps to protect religious groups and appoint judges who oppose abortion rights. More important, Gonzalez sees Trump’s presidency as part of a divine plan.

“It doesn’t matter what I think,” Gonzalez said of the president. “He was put there.”

Though Latino voters are a key part of the Democratic coalition, there is a larger bloc of reliable Republican Latinos than many think. And the GOP’s position among Latinos has not weakened during the Trump administration, despite the president’s rhetoric against immigrants and the party’s shift to the right on immigration.

In November’s elections, 32 percent of Latinos voted for Republicans, according to AP VoteCast data. The survey of more than 115,000 midterm voters — including 7,738 Latino voters — was conducted for The Associated Press by NORC at the University of Chicago.

Other surveys also found roughly one-third of Latinos supporting the GOP. Data from the Pew Research Center and from exit polls suggests that a comparable share of about 3 in 10 Latino voters supported Trump in 2016. That tracks the share of Latinos supporting Republicans for the last decade.

The stability of Republicans’ share of the Latino vote frustrates Democrats, who say actions like Trump’s family separation policy and his demonization of an immigrant caravan should drive Latinos out of the GOP.

“The question is not are Democrats winning the Hispanic vote — it’s why aren’t Democrats winning the Hispanic vote 80-20 or 90-10 the way black voters are?” said Fernand Amandi, a Miami-based Democratic pollster. He argues Democrats must invest more in winning Latino voters.

The VoteCast data shows that, like white voters, Latinos are split by gender — 61 percent of men voted Democratic in November, while 69 percent of women did. And while Republican-leaning Latinos can be found everywhere in the country, two groups stand out as especially likely to back the GOP — evangelicals and veterans.

Evangelicals comprised about one-quarter of Latino voters, and veterans were 13 percent. Both groups were about evenly split between the two parties. Mike Madrid, a Republican strategist in California, said those groups have reliably provided the GOP with many Latino votes for years.

“They stick and they do not go away,” Madrid said. Much as with Trump’s own core white voters, attacks on the president and other Republicans for being anti-immigrant “just make them dig in even more,” he added.

Sacramento-based Rev. Sam Rodriguez, one of Trump’s spiritual advisers, said evangelical Latinos have a clear reason to vote Republican. “Why do 30 percent of Latinos still support Trump? Because of the Democratic Party’s obsession with abortion,” Rodriguez said. “It’s life and religious liberty and everything else follows.”

Some conservative Latinos say their political leanings make them feel more like a minority than their ethnicity does. Irina Vilariño, 43, a Miami restauranteur and Cuban immigrant, said she had presidential bumper stickers for Sen. John McCain, Mitt Romney and Trump scratched off her car. She said she never suffered from discrimination growing up in a predominantly white south Florida community, “but I remember during the McCain campaign being discriminated against because I supported him.”

The 2018 election was good to Democrats, but Florida disappointed them. They couldn’t convince enough of the state’s often right-leaning Cuban-American voters to support Sen. Bill Nelson, who was ousted by the GOP’s Spanish-speaking Gov. Rick Scott, or rally them behind Democrats’ gubernatorial candidate, Tallahassee Mayor Andrew Gillum, who lost to Republican Rep. Ron DeSantis.

Still, in the rest of the country, there were signs that pleased Democrats. Latinos voted at high rates in an election that saw record-setting turnout among all demographic groups. Latinos normally have among the worst midterm turnout rates, and while official data won’t be available for months, a number of formerly-Republican congressional districts in California and New Mexico flipped Democratic.

That’s why Republicans shouldn’t take solace from being able to consistently win about one-third of Latinos, said Madrid. They’re still losing two-thirds of an electorate that’s being goaded into the voting booth by Trump.

“That is contributing to the death spiral of the Republican Party — even if it holds at 30 percent,” Madrid said. “That’s a route to death, it’s just a slower one.”

Gonzalez, the pastor, sees the trend in Colorado. He distributed literature across Spanish-speaking congregations supporting Republican gubernatorial candidate Walker Stapleton, who was crushed by Democratic Rep. Jared Polis as the GOP lost every race for statewide office.

Gonzalez understands the anger among some Latinos at the GOP and Trump for what he says is a false impression of a solely hardline immigration stance. “In the community that is not informed, that is following the rhetoric of the media, there’s a view that Donald Trump is a bad guy,” Gonzalez said. Evangelicals “understand that he’s there to defend values.”

Gonzalez’s church is Iglesia Embajada del Reino, or Church of the Kingdom’s Embassy. On a recent Saturday night, an eight-piece band played Spanish-language Christian rock before Gonzalez walked to the podium. Wearing a blue corduroy blazer, blue shirt and grey slacks, Gonzalez, a onetime member of a Marxist group in Colombia, told his congregants that they were ambassadors of a higher power — the kingdom of God.

“It’s important that your political opinions, your social opinions,” not enter into it, Gonzalez said. “We need to represent the position of The Kingdom.”

Gonzalez did not mention Trump in his sermon, though he spoke about the Bible as a book of governance.

Afterward the congregation gathered for bowls of posole, a traditional Mexican soup. When politics came up, church-goers struggled to balance their enthusiasm for some of Trump’s judicial appointments with their distaste at his rhetoric and actions.

“I think the president has good, Christian principles,” said Jose Larios, a parks worker. “But we feel as Latinos that he doesn’t embrace our community, and our community is good and hard-working.”

Oscar Murillo, a 37-year-old horse trainer, is not a fan of Trump’s. But he tries to stay open-minded about Republicans. He voted for the GOP candidate for state attorney general, who visited the congregation before the election. “He’s in the same party as Trump, but he seems different,” Murillo said.

Kirstjen Nielsen’s Statement on Migrant Child’s Death Incites Outrage

As human rights groups, Democratic lawmakers, and the United Nations demanded an independent probe into the deaths of two Guatemalan children in U.S. Border Patrol custody, President Donald Trump’s Homeland Security Secretary Kirstjen Nielsen sparked outrage on Wednesday by declaring that “open borders” advocates and the kids’ “own parents”—not Trump’s inhumane treatment of immigrants—are to blame.

“Our system has been pushed to a breaking point by those who seek open borders,” Nielsen said in a statement just hours after eight-year-old Felipe Alonzo-Gomez died in U.S. custody on Christmas day. “Smugglers, traffickers, and their own parents put these minors at risk by embarking on the dangerous and arduous journey north.”

Nielsen, who signed off on the Trump administration’s internationally condemned family separation policy, was immediately denounced for attempting to deflect attention and blame away from the White House’s anti-immigrant agenda.

Children in the custody of the Trump administration are dying, and the best the secretary of Homeland Security can do is blame those who seek open borders” and “parents.”

These people are beyond repulsive. Never forget that. https://t.co/Wwy2DWhRBi

— Pejman Yousefzadeh پژمان یوسف زاده (@Yousefzadeh) December 27, 2018

Sec. Nielsen’s statement on the death of an 8 year old migrant child in @CBP custody is really remarkable. She acknowledges that Jakelin Caal was the first death of a minor in CBP care in a decade, and then blames opponents of Trump policies for humanitarian crisis at the border

— john r stanton (@dcbigjohn) December 26, 2018

In a statement on Wednesday, National Nurses United (NNU) pinned the deaths of the two young children on Trump’s treatment of asylum-seekers fleeing violence and persecution as “criminals.”

“Nurses, whose life work is to protect and heal, are appalled at the lack of humane treatment for vulnerable children, and their families, who are seeking refuge and safety in the U.S.,” said Bonnie Castillo, RN, executive director of NNU, in a statement on Wednesday. “Our government must stop treating these families, and their children as criminals. The imagery of a migrant child dying on Christmas day is especially disturbing, but we need a policy of caring and compassion every day.”

Castillo concluded that the Trump administration must “immediately end its practice of warehousing families and children in the ‘hierleras,’ make sure that all the families and children are provided safe and secure conditions while being considered for asylum, and guarantee that medical professionals are fully available to provide the ongoing professional medical assessment and needed care and support for them.”

As Common Dreams reported on Wednesday, Customs and Border Protection (CBP) announced that it will now order medical checks for all minors in its custody.

In response, critics immediately demanded to know why it took at least two deaths in a single month for CBP to order such basic medical examinations—and why young children are being detained in the first place.

“Why are they jailing children under ten?” asked Scott Hechinger, senior staff attorney and director of policy at Brooklyn Defender Service

Extinction Rates Could Be 10 Times Worse Than We Thought

Two scientists want the world to think again about the extinction toll, the rate at which species could vanish as the planet warms. They warn that the worst fears so far may have been based on underestimates. Tomorrow’s rates of extinction could be 10 times worse.

That is because the loss of one or two key species could turn into a cascade that could spell the end for whole ecosystems. “Primary extinctions driven by environmental change could be just the tip of an enormous extinction iceberg,” they warn.

In their study, long before the complete loss of one species, other species locked into the same ecosystem started to perish. There is no need to worry about the rare but real hazard of an asteroid impact, or a burst of gamma rays from a nearby exploding star. The message from the simulators is that global average warming of between 5° and 6°C above the level for most of history since the end of the last Ice Age would be enough to wipe out most life on the hypothetical Earths.

“This makes it difficult to be optimistic about the future of species diversity in the ongoing trajectory of global change, let alone in the case of additional external, extraplanetary catastrophes.”

Giovanni Strona of the European Commission’s joint research centre in Ispra, Italy and Corey Bradshaw of Finders University in Adelaide, Australia write in the journal Scientific Reports that they turned to computer simulation to resolve an enduring ecological question: quite what is it that drives biodiversity loss?

“Whenever a species leaves our planet, we lose much more than a name on a list.”

The growth in human numbers, and the exploitation of the planet’s surface for economic growth, has destroyed habitats and disrupted ecosystems on a scale without parallel: global warming and climate change will make things worse.

Researchers have confirmed, repeatedly, that ecosystems are under threat; that climate change could be even more damaging than anyone suspected; that half of 976 species in one study were already being extinguished in local ecosystems, even if they survived elsewhere as the thermometer rose.

But most such studies were based on sample examinations of specific patches of woodland, grassland, marsh or lake, or surveys of published literature, and they measured change in a planet that has – since the beginning of the Industrial Revolution – warmed by about 1°C as a consequence of profligate combustion of fossil fuels and the clearance of the great forests. The latest study involved testing life on a planet to destruction.

The two scientists constructed 2,000 “virtual Earths” and populated them with interacting species: that is with a food web composed of competing predators and prey, multiple consumers and consumed. Then they subjected these notional biospheres to extreme environmental change, ranging from runaway global warming driven by ever-greater greenhouse gas emissions to the sudden, intense cooling of a “nuclear winter” in which sunlight is blocked by the dust of global thermonuclear war.

And the experiments, they say, demonstrated, once again, the co-dependency of living things in a stable environment. They set up two scenarios. In one of them a species was subjected to temperature change to the point of extinction. In the other, the researchers triggered a series of co-extinction cascades. They then matched the two outcomes.

More than species

And they found that failure to take into account the complex, entangled interdependencies of living things led to an underestimate, by 10 times, of the magnitude of mass extinction by climate change alone. The message is: don’t just save the giant panda, save the forest.

“Conservationists and decision makers need to move fast beyond a species-specific approach, and look with increasing attention at interaction networks as a fundamental conservation target,” Dr Strona said. “Whenever a species leaves our planet, we lose much more than a name on a list.”

Other such simulations have delivered catastrophic conclusions: one examination of runaway global warming left the Earth uninhabitable, while another found that in the most dreadful outcomes, at least one life form, the tardigrade, might survive.

Any computer model of life on Earth must have its weaknesses, if only because the unknown and unnamed list of creatures is at least 10 times greater than those already catalogued in the world’s botanical gardens, zoos and natural history museums. That is, biologists still don’t know nearly enough about the diversity of life on Earth. There are, the researchers concede, “obvious limitations in our ambitions model.”

But, said Dr Strona: “Our results are consistent with real-world patterns for which we have empirical evidence. This makes us confident that the many assumptions we had to take in order to build a functional model are sound. On the other hand, it would be misleading to just focus on raw numbers.”

Chris Hedges's Blog

- Chris Hedges's profile

- 1897 followers