Claire Akin's Blog, page 24

August 24, 2020

5 Expensive Marketing Tactics That Aren’t Worth The Money (& What To Do Instead)

Marketing for financial advisors can be frustrating because no one really tells you what works and what doesn’t. When I talk to advisors who are investing heavily in their marketing and not seeing results, I often find out they’re paying exorbitant prices for certain services. We’re talking:

$3,950 a year on their website

$800 a month on SEO

$2,000 a month on radio ads

$6,000 per event for dinner seminars

$25,000 on webinar marketing

Sound familiar?

The truth is, it’s absolutely unnecessary to spend this much money on these tactics. Yes, some of these are essential for growing your business. You need a website. You need SEO. But you shouldn’t pay over $10,000 a year for these services. You can spend less money and still reach your ideal client.

Let’s talk about why these five marketing tactics aren’t worth the high price tag (and what you can do instead).

1. Website

The average advisor spends almost $4,000 a year on their website and doesn’t think twice about it. They chalk it up as “the price of doing business” and move on about their day.

One industry-specific company that’s quite popular with financial advisors charges anywhere from $179 to $695 a month for website creation and maintenance. That’s $2,148 to $8,340 a year just for a website! Crazy, right?

I promise you don’t have to pay this much for a secure, mobile-responsive website that grabs your prospects’ attention. In fact, we’ve found that spending extra time and money on your website has diminishing returns. As long as it looks good and functions well, you’ll see results.

How To Save Money On Your Website

We did a case study a while back where one advisor was paying $240 a month on his website. He came to Indigo and we were able to upgrade his website AND save him over $2,500 a year on fees.

How? WordPress. It’s the #1 website platform we recommend for independent advisors. It’s only $10 to $15 a month and you’re the sole owner of the site, so you can do with it as you please.

Learn more about WordPress here.

2. SEO

The average advisor spends around $800 a month on SEO services. It’s quite common for firms to charge high monthly fees for SEO and lock you into a minimum one-year contract. This is completely unnecessary.

Many advisors don’t know this, but you actually don’t need to pay for ongoing SEO maintenance. You’ll see 90% of the payoff just from the work you do up front. Unless you’ve had drastic changes to your business, there’s no need to pay for maintenance.

How To Save Money On Your SEO

There’s a lot you can do for your SEO up front to avoid monthly costs altogether:

Have a well-functioning website that’s mobile-friendly across all devices.

Create social media profiles that point back to your website.

Use targeted keywords throughout the headings, meta descriptions, and text on your website.

Create a Google My Business listing.

Connect Google Search Console to your business.

Integrate Google Maps into your website.

Now, if these suggestions make you want to stick your head in the sand, don’t worry. We offer a top-rated SEO package for financial advisors. This package is designed to help your business rank higher and look better in search results. You’ll only pay a one-time fee of $1,499. Compared to the $9,600 most advisors spend each year on SEO, it pays for itself in less than two months.

Get your free SEO site audit here!

3. Radio Ads

Radio and TV ads used to be the cornerstone of marketing for financial advisors. But the way people consume media today looks completely different than it did 15+ years ago. Back in the day, someone may hear you on the radio and immediately pick up the phone and call.

Now, not so much. Someone is more likely to hear your name on the radio, look you up online, and then decide if they want to move forward. If your website isn’t attractive and responsive, you won’t see many leads.

What To Do Instead Of Radio Ads

Radio ads are an old-school way of advertising that don’t really work anymore. I know several advisors who spend $2,000 a month on radio ads and they’re not even sure if they’re generating leads.

Instead of radio ads, you could test out different ads on Facebook or Twitter to see if they’re effective at driving traffic back to your website. They’re a lot less expensive and you can easily tweak them if they’re not performing well.

4. Dinner Seminars

A lot of advisors used to use seminars back in the day to get clients and it worked. It was a very effective way to convert prospects into clients. But now seminars are expensive.

They typically cost around $6,000 per event and they take up a lot of your time. You have to show up, feed everyone dinner, and worry about those people who are only there to get a free meal. It’s a lot to handle.

Even if dinner seminars really work for you, they’re not feasible in the age of the coronavirus. Many people can’t meet face-to-face or don’t want to. What can you do instead?

What To Do Instead Of Dinner Seminars

Webinars are a great alternative to dinner seminars. They cost about the same, but they’re not one-time events. Webinars run on your website 24/7. If someone is looking for an advisor at 8:00 p.m. on a Tuesday, they can watch your webinar on the spot to learn more about who you are and what you do.

Webinars also have a conversion rate as high as 40% depending on your call to action (versus 2% to 5% for email). That’s not a bad return on investment.

Here are 8 reasons why webinars are so promising for financial advisors.

5. Webinar Marketing

Speaking of webinar marketing for financial advisors, I’d be remiss if I didn’t talk about how much you should be paying for this service.

I recently came across a company that charges $25,000 for webinars for financial advisors. The kicker? This price tag is just for one webinar. I’m a big believer in webinar marketing, but there’s no way I’d ever recommend an advisor pay that much for one.

How To Save Money On Your Webinar Marketing

Don’t pay $25,000 for a webinar. It’s not worth the money. We create custom webinars for financial advisors for a very small fraction of that cost. We do everything from writing and designing your presentation to automating it and promoting it across your social media profiles, so it’s working to bring in new leads 24/7.

Learn more about our custom webinar package for financial advisors.

Stop Overpaying For Marketing Services That Don’t Work

Before you spend any money on your marketing, make sure it’s going to bring in new clients for you. The last thing you want to do is waste money on marketing services that don’t work.

I created Indigo Marketing Agency because I’ve seen what works for advisors. My goal is to put you in the driver’s seat of your marketing so you know what tactics are actually worth the money and which ones aren’t.

Want to learn more? I’m hosting a free webinar on the truth about marketing for financial advisors.

For weekly marketing tips for financial advisors by video, subscribe to our YouTube channel here: https://www.youtube.com/c/IndigoMarketingAgency.

Looking for more ways to improve your marketing as a financial advisor? Find more information on our blog. Or learn more about how we help financial advisors just like you grow their businesses with our Total Marketing Package.

The post 5 Expensive Marketing Tactics That Aren’t Worth The Money (& What To Do Instead) appeared first on Indigo Marketing Agency.

August 19, 2020

What’s Included in The Total Marketing Package (Video)

Our Total Marketing Package is designed to keep you in front of your network and capture the urgency your prospects and clients may be facing.

We do that through the following methods:

Setting up and optimizing your social media profiles

Our top-rated search engine optimization (SEO) package

Creating your email marketing engine

Building your marketing calendar

One custom article each month

Posting to Facebook, LinkedIn, and Twitter three times per week

Setting up your online appointment scheduler and adding it to your marketing

Monthly metrics reports to show how your marketing is working

Here’s a sample marketing calendar for review. Want to learn about exactly what we do and why? Join us for an exclusive overview of our Total Marketing Package here.

As always, we’re here to help if you have any specific marketing questions. Feel free to schedule a free strategy session with our team and we’ll help you figure out what’s working for your marketing and what’s not.

You can also check out my latest book, The Marketing Guide for Financial Advisors, for even more digital marketing tips.

The post What’s Included in The Total Marketing Package (Video) appeared first on Indigo Marketing Agency.

August 17, 2020

How To Send Quick Video Messages With Loom (For Financial Advisors)

Send video messages with Loom for easy communication with clients.

How many times has this happened to you? You get an email from a client saying they can’t locate a financial document in their web portal. No biggie. You know exactly where to find it. But as you begin to respond, you realize it’s taking longer than you thought to write out clear step-by-step instructions.

Once you send the email, they respond saying they can’t find the tab you mentioned in Step 5. They’re getting frustrated. You go back and forth via email a bit more until they figure it out. Or you hop on a call and walk them through it.

What was originally supposed to be a quick email ends up being an hour-long ordeal. Which begs the question, is there an easier way to communicate with clients? Turns out, the answer is yes.

Today I want to talk to you about Loom, a free video-recording tool that will make your life 10x easier. I use Loom all the time (and so does everyone else on my team).

What Is Loom?

Loom is a free video-recording tool that lets you create instantly shareable videos using your camera, microphone, and desktop. It couldn’t be easier to use. It’s a plugin for your web browser, so if you use Chrome, it appears in the top right corner of your screen.

When you’re ready to record, you just click the button and start talking. Once you’re finished, it uploads your video to a folder where you can grab the link and share it with whomever you’d like.

Loom is every advisor’s secret weapon for communicating quickly and effectively. It allows you to have really complex conversations without having to spend 30 minutes typing it all up in an email. It’s free. And there’s no learning curve (even technically challenged advisors can figure it out).

How Can Financial Advisors Use Loom?

One quick note: you shouldn’t share sensitive information with your clients using Loom because of compliance. But even with that limitation, financial advisors can use it to:

Show clients how to log into their accounts

Give quick tutorials for the online tools you use

Answer client questions

Give a market update or make an announcement

Explain a complicated graph or chart

Introduce a new team member

Create YouTube videos

And the list goes on

You’ll get an email notification each time someone views your video, which is helpful because you can then send a follow-up email to the viewer asking if they have any questions.

Ready To Give Loom A Try?

As a financial advisor, a large part of your job is communicating with clients. And now, because of the coronavirus, you’re doing most of your communicating through email or phone. But typing out lengthy emails and playing phone tag is time-consuming.

Next time you find yourself writing out a lengthy communication, try creating a quick video with Loom instead. I think you’ll find it really useful. And given the fact that 65% of the population are visual learners, I think your clients (and your team) will find it useful to send video messages with Loom as well.

Want to hear about more ways to boost your productivity with technology? Check out our podcast, The Marketing Podcast For Financial Advisors. In a recent episode, I sit down with Tammy Hawkins—a productivity and technology expert—to talk about top technologies every financial advisor should use. Check it out here.

The post How To Send Quick Video Messages With Loom (For Financial Advisors) appeared first on Indigo Marketing Agency.

August 14, 2020

How Much Time (And Energy) Do You Waste On Internet Passwords?

Picture this…you need to send a quick update to your email list. You go to log into your email marketing system, but you can’t remember the password. You try one password. Wrong. You try another password. Still wrong.

By this point you’re panicking. You don’t want to lock yourself out of your account, so you admit defeat and click the Forgot your password button. Then you spend the next 15 minutes navigating to your email, resetting your password, and finally sending that update to your list.

Sound familiar?

Studies show that you’ll spend 12 full days throughout your life remembering and resetting passwords. 12 full days!

As much as I love technology, I’ll be the first to admit that having to remember dozens of passwords is a huge burden and a waste of time. That’s why I recommend every financial advisor use a secure password manager to store their information.

What Is A Password Manager?

A password manager is just as it sounds. It’s online software that stores and manages your online credentials. It’s mostly used for usernames and passwords, but you can also use it to store credit card information, bank account numbers, and secure notes.

This is how it works…

Once your password manager is set up, you visit a website like normal. But instead of logging into the website, you log into your password manager. Your username and password for that site will then automatically populate so you can sign in.

Instead of having to remember a different username and password for each site, you only need to remember the one password to your vault. It’s a huge time-saver.

What’s The Best Password Manager For Financial Advisors?

My favorite password vault for financial advisors is LastPass. It attaches to your web browser and can be used across all your devices. So if you use a Mac at work, a Windows machine at home, and have an Android phone, that’s okay.

LastPass stores all your information in one centralized location, so you can access it from anywhere. No more getting home and realizing a password you need is on your computer at the office. It’s a game-changer.

You also never have to type in a password with LastPass. All you have to do is log into LastPass each day using your master password. Then it will securely enter your information for each site you visit.

The basic version of LastPass is free, but you can upgrade to the premium version for only $3 a month. With password storage this cheap, you can’t afford not to use it.

Why Should Financial Advisors Use A Password Manager?

Every financial advisor needs a password manager in their life. Here are five reasons why:

1. Password managers boost your productivity.

Think about all the login information you have to remember on a daily basis: your website, your risk analysis software, your financial planning software, your CRM, accounting platform, social media profiles, email addresses, and the list goes on and on and on.

Now, imagine never having to remember those passwords again.

That’s the beauty of a password manager. Instead of having to remember a unique username and password for each account, you just remember one master password.

Suddenly, the frustration that comes with having to remember multiple usernames and passwords is gone. You can quickly and easily complete small tasks without getting caught up on whether you have the log-in info to complete them.

2. Password managers save you time.

Password managers autofill in your credentials for every website, which means you don’t have to waste brainpower trying to remember your password and you don’t have to waste time typing it in.

Even if you spend two minutes each workday logging into accounts, that adds up to 40 minutes a month and 8 hours over the course of a year—an entire workday! It doesn’t seem like much in the moment, but it adds up to a huge chunk of time.

3. Password managers help you keep your accounts secure.

Security best practices teach us that we need strong, unique passwords for every website. Some even say we need unique usernames as well.

But you’re only one person. How can you possibly remember so many usernames and passwords on top of everything else you need to do?

Once again, that’s where a password manager comes in. If you’re setting up a new account, your password manager will generate a unique password for you and store it in your vault. It’s usually a long password made up of random letters and numbers, so it’s almost impossible to hack.

4. Password managers protect you against phishing attacks.

Phishing attempts have gotten really sophisticated over the years. Now it can be almost impossible to tell which websites are real and which ones are fake.

Thankfully, a password manager helps with that. If you navigate to a website that isn’t legit, your password manager won’t automatically fill in your log-in information. It’s a surefire way to know if you’re on the right URL.

5. Password managers allow you to safely share passwords with your team.

Password managers are a powerful tool for financial advisors because they allow you to quickly and securely share passwords with your team. You can share your business credit card information with your assistant, social media passwords with your marketing team, or even your financial planning software credentials with a fellow advisor.

All you do is log into your vault, select which passwords you’d like to share, and then enter the email addresses for any individual or group who needs it. The usernames and passwords will then appear in their vault.

These passwords are encrypted, so they’re much more secure than if you wrote them down on a piece of paper or sent them via email or chat. The best part is, you can revoke access once an individual no longer needs them.

How To Share LastPass Credentials With Your Team

Wondering how to share usernames and passwords with LastPass? Our team created a quick video walking you through how to safely and securely share your credentials.

When a financial advisor works with Indigo, we use LastPass’s sharing features to get your log-in information for your social media channels and website. Watch this video to find out how to do it:

Harness Technology To Supercharge Your Productivity

In today’s information age, the technologies you adopt are the fuel for growing your business. Using a program such as LastPass is just one of many ways you can leverage technology to save you time and supercharge your productivity. You’ll be amazed at how quickly you can complete small tasks when you don’t have log-in information getting in the way.

Want to learn about other tech tools you should be using as a financial advisor? Check out this podcast episode where I sit down with Indigo’s technology guru, Tammy Hawkins, and talk about all things productivity and technology. We go over:

The top technologies for financial advisors

How advisors can successfully implement new technologies into their firms

How to embrace technology to improve client services

It’s an informative and engaging podcast you don’t want to miss.

You can also check out the technology section on our blog to read more helpful information similar to this.

Looking for more ways to improve your marketing as a financial advisor? Find more information on our blog. Or learn more about how we help financial advisors just like you grow their businesses with our Total Marketing Package.

The post How Much Time (And Energy) Do You Waste On Internet Passwords? appeared first on Indigo Marketing Agency.

August 11, 2020

Webinars: The Secret To Increasing Your Conversion Rate

Webinar marketing for financial advisors is the key to unlocking high conversion rates.

If you’ve spent any time on my website or reading my blogs, you know I really like webinars. Way back when I was working at one large marketing firm serving advisors, I ran a statistical analysis to see which efforts correlated most with new sales revenue. Guess what? It was webinars. The more webinar viewers we could get, the faster the business would grow.

So when I was in the thick of launching my business, I created a new webinar each month with the mission of giving away 90% of what I know about financial advisor marketing. And guess what? Creating those webinars allowed me to:

Build trust with my audience.

Share complex marketing topics with prospects in an engaging way.

Double my email list in six months.

Get more free traffic through advisors searching for marketing help on Google.

Get featured on webinars with other companies, broker-dealers, and key influencers.

Create a system for advisors to reach their ideal clients and grow their business through webinar marketing.

I truly believe webinars are the next marketing frontier for financial advisors. When done correctly, they have a 20% to 40% conversion rate compared to just 3% to 5% for email. (You’ll be hard-pressed to find conversion rates this high with other marketing strategies.)

So, why are webinars so powerful? Why are they the key to unlocking such high conversion rates? Here are six reasons.

1. Webinars give you an engaging way to explain complex topics.

Your conversion rate is only going to be as strong as the webinar topic you choose. That’s why it’s critical to pick a topic that’s interesting, relevant, and valuable to your target audience.

When it comes to ideas for webinar marketing for financial advisors, I recommend creating two types of webinars:

A foundational webinar. Think of this as the cornerstone of your webinar marketing. It explains who you are, what you do best, and how you help your clients achieve their financial goals. It allows prospects to get to know you on a personal level to see if you’re a good fit for their needs.

A complex webinar. It’s difficult to explain complex financial topics in an engaging way on your website. But when you can explain them in a webinar, it’s an entirely different story. Your personality and expertise shines through. You can use visuals to guide the discussion. You can get into the weeds of things without coming across as boring or difficult to understand. That’s why I recommend creating at least one webinar on a highly relevant topic specific to your target audience.

A lot of advisors we work with do employer-specific topics for their complex webinars. They may do a webinar on “7 Financial Actions UC San Diego Physicians Should Take In 2020,” “An Overview Of The Qualcomm 401(k) Plan Investments,” or “How To Maximize The Benefits Of Your Indiana State University Retirement Account.”

When you choose the right webinar topic, your ideal prospect thinks, “Wow, this person really knows what they’re talking about!” And even if they don’t take action right then, they move on to the next stage of the sales funnel where you can continue to nurture that lead.

2. Webinars weed out unqualified prospects.

Time is money in the financial services industry. You can’t afford to meet with dozens of prospects each week who aren’t a good fit for you and your firm.

I’ll never forget one time one of my advisor clients got an email from a prospect saying: “I have money to invest, but I don’t want to pay any fees for investment management or advice. Can you help with this?”

This was an email, thankfully, so the advisor could quickly respond without wasting much time. But what if this person had saved this question until the first in-person meeting? It would’ve been a huge waste of the advisor’s time.

Webinars give you a way to automatically weed out unqualified prospects. During your presentation, you can talk about your minimum investable assets and your minimum account size. You can clearly communicate who you serve best and the value you offer, so those no-fit clients don’t wind up in your inbox—or worse, across your desk in an in-person meeting.

3. Webinars help you grow your network.

Webinars are an excellent way to grow your network and showcase your expertise. I know a lot of advisors who have been guest hosts on webinars put on by CPAs, lawyers, and other key influencers in their community.

The advisor joins the webinar and shares valuable information with a group of attendees they might’ve never come into contact with on their own. Those attendees get to learn more about the advisor and what they do. If they’re in the market for a financial professional or know someone who is, they hop on the advisor’s email list where they can nurture them through the sales funnel. Everyone wins.

4. Webinars have an irresistible call to action.

A strong call to action is where the conversion magic happens. It’s where webinar attendees become prospects. It’s where prospects become clients. Your webinar call to action should be so strong that viewers can’t help but take the next step.

So, how do you choose an irresistible call to action?

First, you want to create value. Remember, your prospects don’t necessarily care about the tax strategies you use or the risk analysis software you swear by. They care about how you can help them solve their problems. They care about the value you offer.

When creating your call to action, think about what your prospect will gain from taking the next step with you. Here are some strong call-to-action examples we’ve used in webinars for financial advisors:

Get your free financial review.

Schedule a 15-minute financial goal-setting phone call.

Schedule your Social Security review phone call.

These offers entice webinar attendees to take action.

5. Webinars allow you to showcase the best version of yourself.

I should preface this by saying there are two types of webinars: traditional webinars that are usually held live and automated webinars that are pre-recorded but made to look live. I recommend automated webinars for financial advisors. Here’s why:

The challenge of traditional webinars is that they’re live events. Unless you do live events regularly, they can be scary, you can have technology challenges, you can have a low attendance rate, and you can end up skipping over important information if you get nervous.

With an automated webinar, people who are watching get the best version of your presentation. You don’t have to worry about technology risks. You can record and get compliance approval in advance.

Plus, automated webinars usually have double the engagement over live webinars. I know, this is odd. You’d think if people signed up to view a webinar at a specific time, they’d do it. But what I’ve found over the years is that 55% of registrants actually miss the live event and watch the replay instead. That’s where having an automated webinar comes in handy. If they miss the event they signed up for, they can catch the replay at their convenience.

6. Webinars save you time.

Think about the sales pitch you usually do at a client’s home, in a coffee shop, or at your office. Now imagine having that sales pitch automated, so it can run over and over and over again in a digital format while you’re out camping with the kids or laying on the beach with a piña colada.

That’s the magic of webinars. They allow you to truly automate your marketing so new leads show up on your calendar without you actually doing anything.

Webinars are also a game-changer for those times when you need to get information out to your clients but you don’t necessarily need to tell them one-on-one. I have some advisors who do a webinar every quarter for market updates. I have others who do them every time changes happen with tax laws or IRA rules and they need to get information out quickly.

Instead of having to call up all your clients individually, you can give an update in a webinar and then send it out to your email list. It’s an instant time-saver.

Ready To Grow Your Business With Webinar Marketing For Financial Advisors?

Webinars are the secret to increasing your conversion rate and landing new clients. If you do them right, and you get people to register, you can bring in new clients every month with a predictable conversion rate.

But I’ll be honest, they’re not easy to master. It’s taken me a full six years to get the formula just right. That’s why I encourage advisors to hire an expert to write, design, create, automate, and promote their webinar for them. Our webinar marketing package includes everything you need to launch your webinar in 30 days!

Ready to harness the full power of webinar marketing for financial advisors? At Indigo, we create fully customized webinars at an affordable price. We do everything from writing and designing your webinar to automating it and promoting it across your social media channels. Learn more about our Custom Webinar Creation package here. Or watch our webinar on webinars to find out how to do it yourself.

The post Webinars: The Secret To Increasing Your Conversion Rate appeared first on Indigo Marketing Agency.

How To Choose A Winning Webinar Topic (For Financial Advisors)

Webinars for financial advisors are a great way to secure high conversion rates.

So you’ve decided to create a webinar. Congratulations! Now the tough part—choosing your topic.

After doing dozens of webinars myself and creating countless webinars for financial advisors, I’ve come to realize one thing. Your webinar attendance rate is only as strong as the topic you select. It’s critically important to choose a topic that’s interesting, relevant, and valuable to your target audience if you want to secure high conversion rates.

So, which webinar topic should you choose?

Two Webinars Every Financial Advisor Should Create

I’ve spent a lot of time researching and analyzing which webinar ideas for financial advisors perform best. Through my research, I’ve found that every advisor should have these two types of webinars on their website:

1. A Foundational Webinar That Explains What You Do & How You Help

Every financial advisor should have a webinar that talks about what you do and how you help. Think of this as a foundational presentation that paves the way for every other webinar you end up creating.

Most advisors I meet with say they have the highest-value proposition when they can sit down and talk with prospects one-on-one: their personality and expertise shine; they can clearly explain what they do and how they help their clients. But at the end of the day, you’re just one person. You don’t have enough time to meet with every prospect one-on-one.

That’s where a foundational webinar comes in. Think of this webinar as the sales pitch you make to every new prospect you meet. But instead of having to do it in person, you automate it in a digital format where you can pitch it to new prospects 24/7.

Information To Include In A Foundational Webinar

Chances are, most of the information you need for a foundational webinar is already on your website. But instead of having people read this info on a web page, they get to hear it directly from you, with your personality and passion shining through.

I recommend going over these topics in your foundational webinar:

Who you are and why you’re passionate about financial planning

Your ideal client and the types of challenges they face

How your firm helps them overcome these challenges

Your process and what someone can expect when they work with you

What your ideal client can expect their financial situation to look like after they’ve gotten your help

A strong call to action inviting them to schedule a complimentary meeting with you

2. A Complex Webinar That Addresses A Specific Problem Your Target Audience Is Facing

Take a moment and answer this question: What is the one urgent problem you solve for a specific group of people? Maybe you help oil and gas workers navigate layoffs and buyouts. Maybe you help Intel workers understand complex pension plan options. Or maybe you help women in transition secure their financial futures. Whatever it is, that’s the topic you should be covering in this next webinar.

Let’s face it. Explaining complex financial topics on your website or in a blog post can be challenging. The subject matter usually comes across as stale, boring, and difficult to understand. Most people won’t even bother to read all the way through it.

But explaining these topics in a webinar allows you to break down these topics in an engaging way. It’s a win-win.

Your ideal client is looking for a financial advisor who specializes in whatever challenge they’re facing. Use your next webinar to prove to them that you have the relevant tips and tools they need to overcome that challenge. Then, when they stumble on your website and see that you’re hosting a webinar that addresses their concern, they’ll tune in and think, “Wow, this person really knows what they’re talking about!” Then they’ll book an appointment with you to learn more.

Examples Of Complex Webinar Topics

Here are some popular webinar ideas for financial advisors that have had high conversion rates in the past:

7 Financial Actions UC San Diego Physicians Should Take In 2020

Retirement Planning Strategies for Solo & Small Firm Attorneys

How Your Kids Can Inherit Your IRA 100% Tax-Free

How Married Couples Can Maximize Their Social Security Benefits

An Overview Of The Qualcomm 401(k) Plan Investments

What do all of these topics have in common? They’re specific, they’re timely, and they’re relevant—three qualities you want in a highly converting webinar.

5 Tips For Choosing A Highly Converting Webinar Topic

Still stumped on which webinar topic you should go with? Here are five tips to help you choose a winning webinar topic that converts:

1. Consider Frequently Asked Questions

You talk to clients and prospects day in and day out. What questions do you keep getting over and over again? Maybe they’re concerned with lowering investment fees, minimizing taxes, or passing wealth onto their heirs. You know exactly what it is for your top clients. Think about those questions and jot a few of them down as potential webinar topics you could cover.

2. Ask Your Clients

Be direct and ask your clients what they’re interested in learning about. Maybe they’re interested in a market update or how you create a personalized portfolio for them. I have several advisor clients who have had a lot of success creating quarterly market updates for their clients using webinar marketing. Get your client’s feedback on what you should cover and what they’d be eager to tune into. Then create a winning webinar around that topic.

3. Poll Your Network

The next tip is to poll your network. Create a quick survey asking, “Which webinar topic should I do next?” Then send it to your email list or post it on social media. Create your winning webinar around the most popular response and save the other ideas for future webinars.

4. Look At Google Analytics

Google Analytics records all of the traffic to the different pages on your website. If you do any blogging or have a variety of pages on your website, you can look at Google Analytics to figure out which pages are most popular. Maybe it’s the pages on your investment strategy or your 1035 exchange service. Maybe it’s your pages on business succession planning or your legacy planning. Whatever it is, use Google Analytics to get an idea of what’s popular for your website visitors.

5. Test With Technology

If you really want to get technical, you can test different webinar topics with technology. In the past I’ve created Facebook Ads for two different webinar topics to see which one did best. Then I created a webinar topic for the winning idea. For example, you could do one Facebook Ad on maximizing 401(k) benefits and another on retiring at age 55. Then test both ads to see which one gets more clicks.

Ready To Grow Your Business?

Choosing the right topic for your webinar is the key to increasing your conversion rates and driving home more leads. I love webinars for financial advisors because they’re engaging, they’re highly converting, and once created, they give you a way to generate new leads in your sleep.

Most advisors pay $25,000 on average for webinar creation and marketing. At Indigo, we create fully customized webinars for financial advisors for $6,500—a fraction of that cost. Even better, current Indigo clients get a 50% discount, bringing the total down to $3,250.

If you don’t have the time or expertise to create and promote a webinar (and let’s face it, your plate is full enough as it is), then learn more about our Custom Webinar Creation package here. We’d be happy to do the heavy lifting for you.

Want to create a webinar by yourself? Find step-by-step instructions in my book, The Marketing Guide For Financial Advisors.

The post How To Choose A Winning Webinar Topic (For Financial Advisors) appeared first on Indigo Marketing Agency.

August 7, 2020

Showcase Your Personality And Build Relationships With Personal Content

In today’s virtual environment, is it possible to build relationships with personal content?

When you meet with your clients or call them on the phone, what is the first thing you talk about? Do you immediately discuss your market outlook or investment strategy? I doubt it.

More often, you probably ask about their family, their kids, and how they’ve been doing. You may give them an update on your family and hobbies. Why should your marketing messages and website be any different?

One of my favorite examples is a blog post we did for an advisor client called “Photos From The Father-Daughter Sugar Plum Ball.” If someone you care about posts a topic like that, it’s impossible not to click to see the pictures!

How Personal Content Supports Your Marketing Strategy

People want to do business with a person, not a corporation, especially when it comes to something as personal as their family’s wealth. As a financial advisor, marketing with personal content helps you to be more:

Memorable

Authentic

Likable

Trustworthy

Referable

It is also typically the highest-performing content on an advisor’s website. The increased traffic, email opens, and email click-through rate helps improve your website’s search engine rankings over the long run.

Examples Of Personal Content That Helps Connect With Your Network

At least twice a year, you should incorporate personal content with photos into your marketing strategy. This content could be any updates or stories that your network may find interesting. Here are a few examples that have performed well for our advisors in the past:

Meet Our New Team Member

See Photos Of Our New Office Location

Lessons From Our Family Vacation

Meet The Newest Addition To Our Family (Grandbaby Photos!)

The One Lesson I Teach My Kids About Money

Why I Became A Financial Advisor

The 3 Biggest Money Mistakes I See

Photos From Our Latest Event

My Favorite Golf Courses In San Diego

My Favorite Restaurants In Omaha

Creating Personal Content To Tell Your Story

Because writing and deploying personal content can be uncomfortable for advisors, it’s a fantastic task to outsource to your professional marketing team. One advisor that we support who does this really well is Rocklin Senavinin CFP® of Fiduciary Wealth Management.

Our advisor clients like Rocklin send us their photos and a few bullet points, and then we do the rest of the work, including:

Writing each article

Creating a compelling headline

Editing and proofreading

Adding images

Uploading to their website

Sharing via email

Posting to social media

Tracking the success of each post

For this particular advisor, 5 of his 8 all-time top blog posts are personal posts! Here’s a list of his overall top-performing blog posts and the percentage of total website traffic they represent.

Why I Am Passionate About Being a Financial Advisor (5.31% of total site traffic)

Our Incredible Weekend At The Viking Cooking School (5.05% of total site traffic)

What Does The SECURE Act Mean For You?

We Are An Independent And Fee-Only Investment Advisory Firm

Medicare Part B Premiums Increasing This Year

Photos From The Father-Daughter Sugar Plum Ball (3.12% of total site traffic)

My Favorite Restaurants In Little Rock (2.8% of total site traffic)

Summer Series: My Favorite Restaurants In Little Rock (2.65% of total site traffic)

You can see that almost 20% of traffic to Rocklin’s website is traffic to these pages! These personal posts do really well by both email and on social media to captivate interest and keep him top of mind.

They also give clients something to chat about the next time he meets with them. Being able to build relationships with personal content is an important element of building longer-lasting relationships over time, especially in a virtual environment.

How To Get Your Marketing Strategy Off The Ground

As part of our Total Marketing Package, we help advisors like you to clarify who they serve, create a custom marketing calendar that fits their needs, and create their personalized content each and every month. To learn more, watch our webinar on What We Do and How We Help, then schedule your free Marketing Strategy Call today!

The post Showcase Your Personality And Build Relationships With Personal Content appeared first on Indigo Marketing Agency.

August 4, 2020

How To Invite Connections To Follow Your LinkedIn Company Page (Video)

You have probably gotten a few emails by now inviting you to follow a company’s LinkedIn page. It is a new feature that LinkedIn released recently. Today we’re going to teach you how to invite people to follow your LinkedIn company page! It’s a quick three-step process that only takes a few minutes and can get more exposure for your content on LinkedIn. Watch this video or follow the steps below to learn more!

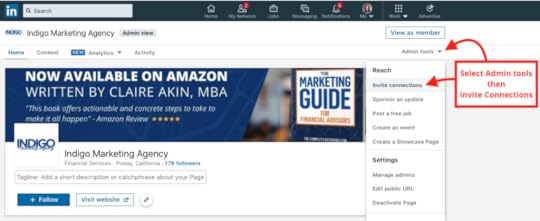

STEP 1: Once you’re logged into LinkedIn, navigate to your company page by clicking on your profile photo and selecting your company page from the drop-down menu.

STEP 2: In the top right, click the dropdown for “Admin tools” then select “Invite connections.”

STEP 3: Once in the pop-up window, select everyone you want to invite to like your page. Then click the Invite button to send your invitation.

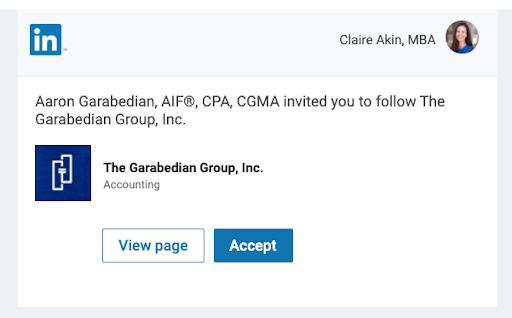

There you have it! Your connections will receive an invite that looks like this:

What Should You Watch Out For?

Inviting people to follow your company page on LinkedIn is pretty straightforward, but there are two limitations to be aware of:

There’s a limit on how many invites you can send each month. LinkedIn gives you 100 free credits each month, which allows you to invite 100 people to follow your company page. Once someone accepts your invite, the LinkedIn credit is returned to you.

So, if you invite 100 people this week and 50 of them accept your invite, you can send another round of invites to 50 more people. But if you send out 100 invites and no one accepts, you’ll have to wait until the next month to send more. Because of this structure, it’s best to only invite the people you think will be most likely to accept.

You can only invite first-degree connections. You must be an official LinkedIn connection with someone before you’re able to invite them to follow your company page. You can’t target a random group of people.

How To Get More Followers On LinkedIn

Once you’ve invited your LinkedIn connections to follow your business page, you’ll want them to engage with your content, which will help you get more exposure. Here are three steps you can take to increase your following:

Send An Email Asking Clients To Like Your Page

This is the easiest step on the list, yet most advisors skip over it. As soon as your business page is up, blast an email to your list announcing you’re now officially on LinkedIn. Share a few recent posts in the email and invite them to follow your page if they want to continue seeing valuable content like this.

Post Engaging Content

Your followers are more likely to engage with posts they find interesting or valuable to them. Think about your main target audience on LinkedIn—whether it’s C-suite executives, small business owners, teachers, doctors, etc.—and create content that speaks to the financial challenges they’re facing. Your followers will be more likely to like and share your posts, which will make those posts show up in their friends’ news feeds.

Grow Your First-Degree Connections

One major drawback to inviting people to follow your LinkedIn company page is that you can only invite first-degree connections. If you’re not already connected with someone on LinkedIn, you can’t send them an invite. One way to get around this is by building up your network of first degree-connections on your personal page.

Now, as an advisor, we know you’re extremely busy. That’s why we recommend using a software like LinkedHub to automatically send connection requests every single day without having to lift a finger. With LinkedHub, you can target certain groups of people by location, keyword, job title, company, and more. This ensures you’re sending invites to individuals you actually want to connect with. Then, once those people accept your personal connection request, you can turn around and invite them to follow your company page.

If you want even more helpful LinkedIn tips for financial advisors, explore the LinkedIn section on our blog. You’ll find useful articles, such as:

How To Set Up And Optimize Your LinkedIn Company Page (For Financial Advisors)

How To Write An Awesome LinkedIn Bio (For Financial Advisors)

How Often Should Financial Advisors Post To Social Media?

As always, we’re here to help if you have any specific marketing questions. Feel free to schedule a free strategy session with our team and we’ll help you figure out what’s working for your marketing and what’s not.

You can also check out my latest book, The Marketing Guide for Financial Advisors, for even more digital marketing tips.

The post How To Invite Connections To Follow Your LinkedIn Company Page (Video) appeared first on Indigo Marketing Agency.

July 23, 2020

Why Do Great Advisors Fail To Get New Business?

Are you curious about top advisor marketing results? Well, I just got off a call with a veteran advisor that has been a client of ours for about 3 months. He was blown away that he is currently onboarding 6 new high-net-worth clients. He’s been an advisor for 35 years and always had a successful firm, but he’s never gotten 6 new highly qualified clients in the same month!

The conversation led me to wonder what he had been doing wrong for all those years. Although he had a decent website and was getting the occasional referral, he wasn’t proactively marketing his firm.

Since this advisor signed on with our team, we have put out three articles for him:

Why I Became A Financial Advisor

How To Manage Your Finances In The 2020 Crisis

What We Do And How We Help

But there’s so much more that we did as part of the setup process to help an advisor focus on whom they want to serve and create a compelling story to reach that audience:

First, we defined the one urgent problem he solves for a specific group.

Then we added an easy way for people to get started on his website 24/7.

Next, we did a full SEO package to get him to show up higher in search results and get more traffic to his site.

Then we set up and optimized his social profiles so that his content gets more exposure and his audience is always seeing his firm online.

Finally, we told his story in a way that’s memorable, compelling, and authentic.

Each month, we deliver valuable and relevant content to his audience through all channels.

All of these pieces work together to create a marketing presence that drives awareness, referrals, and more new business. That’s the way marketing should be done, with a long-term strategy aimed at delivering unique and valuable content to the specific group that you serve.

I thought it would be helpful today to review the most common marketing mistakes that great advisors make and what makes a successful marketing strategy.

Why Do Great Advisors Fail To Get New Clients?

They don’t know who they are trying to reach.

They can’t articulate the one urgent problem they solve.

They haven’t put themselves in the shoes of their ideal client.

Their marketing focuses on what they care about, not what their prospects care about.

They haven’t told their story in a compelling and memorable way.

Their marketing isn’t consistent.

If they do create content, they don’t share it in a way that gets strong exposure.

They don’t have a clear call to action.

It’s not easy for prospects to get started working with them online and after hours.

They start and stop their marketing as they have time.

They don’t track the same marketing metrics each month.

They send too many marketing messages, then stop altogether.

They send sales messages that aren’t valuable or helpful.

There’s no differentiation in the eyes of their audience.

They don’t stick with a good marketing strategy over months or years.

They expect marketing to work after one or two emails.

They don’t understand that marketing (like investing) is a long-term strategy with a long-term ROI.

How Great Advisors Can Get More Ideal Clients

When we put together a marketing strategy for a client, we focus on these key actions:

Identify your ideal future client, the person you love to help.

Pinpoint the one urgent problem you solve for a specific group.

Tell your story and share your passion.

Understand the fears and motivations of your ideal client.

Focus on helping your clients.

Answer the most common questions your clients are asking.

Educate and communicate with your existing clients.

Create content that is worth sharing.

Establish you as the go-to expert in your specialty.

Create a long-term marketing strategy that doesn’t change from month to month.

Understand that the buying process takes up to one full year.

Show consistent execution that your network comes to expect.

All marketing efforts lead to a clear, easy-to-take call to action.

Deliver content that is relevant and valuable to your audience.

Review the most important marketing metrics each and every month.

Stay top of mind on all marketing channels (website, email, social media).

If you need help with your marketing, schedule your free call, review our Marketing Strategy Checklist, and get customized recommendations on how to improve your strategy. Want to learn more about what we do and how we help? Watch our webinar The Truth About Marketing for Financial Advisors here now.

The post Why Do Great Advisors Fail To Get New Business? appeared first on Indigo Marketing Agency.

What Should Financial Advisors Blog About?

Financial advisor blogging really isn’t complicated, however, many advisors who are just getting started with their marketing know they should be producing content, but they have no idea what to write about. You want to cover the topics and questions your ideal clients are thinking about, but where should you start?

The key here is that you want to educate and provide value to your ideal prospects.

Today we’re going to answer the age-old question “Why should advisors have a blog?” and also give you 170+ ideas on what you could blog about.

8 Reasons Advisors Should Blog Regularly

First and foremost, why should you blog? Your plate is already full enough as you juggle day-to-day business tasks, so what’s in it for you? Here are a few reasons why every financial advisor should have a blog.

1. A blog keeps you top of mind.

Your blog serves as a constant reminder of what you do best, who you serve, and what problems you solve. It helps you establish your online presence and answer your prospects’ most pressing questions. Then, when it’s time for your ideal prospect to choose an advisor or get help with an issue they’re facing, your firm is the first that comes to mind.

To stay on top of your financial advisor blogging, we recommend creating a marketing calendar for the year that lists out all of the blog posts you plan on releasing. If you’re not sure where to start, download this sample marketing calendar for financial advisors.

2. A blog creates “forwardable” content.

You know that long list of emails you’ve collected over the years? A blog is a great way to keep your list engaged and aware of what makes your firm different. But even more importantly, blogs make for excellent content that can easily be forwarded to your network’s friends and family.

We see this all the time with advisors who work with us. We send out a blog post to their email list on a topic like “Common Financial Mistakes Pre-Retirees Make.” One person reads the post and it reminds them of a dear friend or family member who is getting ready to retire. So what do they do? They forward that blog post to them via email, which generates another potential lead.

3. A blog builds SEO for your niche.

Blog post content that’s search engine optimized helps put your website in front of more people. When they Google a keyword that’s related to your service, your website has a higher chance of coming up in search results.

No one truly knows how SEO works because Google keeps its algorithms under lock and key. But what we do know is that consistent, high-quality content that focuses on a few keywords helps you rank better in search results.

What do we mean by keywords? We mean the phrases that prospects would typically type into Google to find you. For example, if your target audience is ExxonMobil, you could use the long-tail keyword “financial planning for exxonmobil employees” throughout your website and blog posts to increase your chances of showing up in search results.

4. A blog educates current clients.

Regardless of how many clients you have, you don’t have the time to share your personal insights and opinions with them all individually. Instead, you can create a timely and relevant blog post that helps educate them on a specific topic. Some impactful blog posts we’ve created for clients at Indigo include:

Could A Donor-Advised Fund Save You Money On Taxes?

You May Not Have To Take Your RMDs in 2020

Social Security Claiming Strategies For Single, Divorced & Widowed Women

The Top 5 Financial Planning Challenges In The First 10 Years Of Retirement

What Business Owners Need To Know About The CARES Act

Whatever your specialty is, you can create compelling blog posts that speak directly to your clients and help them stay on track financially—all without ever having to pick up the phone.

5. A blog allows you to proactively communicate with clients during hard times.

Times of crisis—much like the one we’re in now—are the perfect opportunity to get in front of your clients and help them navigate the challenges they face. As an advisor, you know recessions and market declines are normal, but your clients may be panicking.

Gear up crisis-related blog posts to go out to your clients when the time comes. Not only will this help prevent your clients from selling when the market is down, but it will result in fewer phone calls and headaches for you.

Some common crisis-related blog posts we’ve written for Indigo clients include:

What Should You Do During Market Volatility?

The Small Business Survival Guide For The Coronavirus

Does Your Portfolio Need A Second Opinion In This Time Of Crisis?

6. A blog stays online forever.

Unlike that Facebook ad you’ve paid for, a blog post stays online forever. And the longer it sits on your website, the more traffic it could get over time. Studies show for every 10 blog posts you write, one could potentially compound (meaning it could increase in traffic due to organic searches) (1). If that happens, that compounded blog post could drive home 6x more traffic than any of your regular posts (2). That’s why blogging is more of a long-term strategy. You may not see the results right away, but it almost always pays off down the road.

After six years of financial advisor blogging about marketing, I get thousands of free visits each month and don’t have to pay for any ads or traffic.

7. A blog establishes you as an industry expert.

Your clients want to feel like they’re working with an advisor who specializes in whatever challenges they’re facing, and a blog gives you a way to establish yourself as the go-to person on a particular topic.

Even if you don’t have a specialty, you should be embracing one with your marketing. We recommend choosing one specific niche (such as Ford executives or women going through divorce) and one broader niche (such as families working toward financial freedom) so you don’t alienate anyone.

Need help choosing your niche? Join our workshop webinar where we help you create a radically relevant marketing message.

8. A blog generates more leads.

Studies show that businesses that blog get 55% more website traffic than those that don’t (3). And once a prospect has landed on your site, a strong call to action can be all it takes to get them to take the next step—whether that’s having them schedule a call with you, download a free report, or sign up for your newsletter.

What Blog Topics Should Advisors Write About?

Many advisors struggle to come up with good content for their blogs. But you’re in luck. Our team has put together a downloadable list of 170+ financial advisor blogging post ideas. So go ahead. Download your free list now and use it as inspiration for your own content:

Don’t have the time or expertise to run your own blog? At Indigo Marketing Agency, we create fully customized blog posts with your ideas, investment philosophy, and personality in mind. We also share each post with your email list and social media channels—making that one less thing you have to deal with. To learn more, schedule your free marketing strategy session today or watch this exclusive webinar to learn what we do and how we help.

__________________

(1) https://blog.hubspot.com/marketing/co...

(2) https://blog.hubspot.com/marketing/co...

(3) https://blog.hubspot.com/marketing/bu...

The post What Should Financial Advisors Blog About? appeared first on Indigo Marketing Agency.