Claire Akin's Blog, page 13

August 31, 2023

Meet Our Team: Beverly

A key contributor to our success here at Indigo Marketing Agency, as an Account Manager, Beverly Anderson helps financial advisors develop a solid marketing strategy from the ground up—completely tailored to their niche, their location of their business, and their personal goals and ambitions for their firm.

Reflecting on the camaraderie of the Indigo team, Beverly remembers waking up one morning in March 2023 to hear about the Silicon Valley Bank collapse. “For our Total Marketing Package monthly clients at Indigo, we provide on-demand articles when there’s something urgent that has happened in the financial world. And that morning in March our writers had already started writing the phenomenal article that it came to be, which highlighted what had happened and what this means for financial advisors’ clients—to give them some peace of mind.

“It starts from our writers at the top, then goes to proofing, and then goes to our account managers to then send to our clients. If the advisor accepts the article, it goes on to deployment to put out on their social media channels, email blasts, and blog posts. You just feel that sense of camaraderie when you’re texting each other back and forth to make sure it gets out on time because it’s an urgent topic. And this one got great feedback.”

Beverly says one phrase always pops into her head when she thinks about the collaborative dynamic of the Indigo team’s working environment: “We’re all just a bunch of doers.” She explains, “We work completely remotely in different time zones and somehow we’re still a very well-oiled machine. I think that just speaks to how adaptable we are at Indigo, how efficient we are, and how accountable we are as individuals and as a team.”

We invite you to watch this short video to hear more from Beverly about her active life outside of work living in Central Oregon and why she loves collaborating with the Indigo team to better meet our financial advisor clients’ needs.

We are thrilled to have Beverly as part of our team and look forward to the continued success she brings to our organization.

At Indigo Marketing Agency, we understand firsthand how much work you have on your plate as an independent financial advisor. If you’d like help handling your marketing, we encourage you to schedule a free strategy session with our team today. We’d love to hear more of your story and talk about how we can help you cross marketing off your to-do list for good.

The post Meet Our Team: Beverly appeared first on Indigo Marketing Agency.

August 23, 2023

Embracing Millennial Clients in 2023: What Financial Advisors Need to Know

Ah, millennials—those dynamic individuals who’ve reshaped everything from sustainability to dining norms. These trendsetters now form the bulk of the global workforce, and as they ascend, they’re on the lookout for financial advisors who understand their evolving financial landscape.

Why Engaging With Millennial Clients MattersSure, millennials have been stereotyped as entitled and impatient, but there’s more to them than meets the eye. They prioritize values, seek purpose-driven companies, and thrive on collaboration to solve challenges. Beneath the surface, there are three compelling reasons why financial advisors should focus on millennials.

A New Workforce MajorityToday, millennials dominate the workforce. After facing the challenges of a post-2008 financial crisis world, many have thrived as entrepreneurs and in higher career roles. Over the next decades, they will inherit the roles of previous generations in investments and real estate, necessitating financial advisors to guide their financial growth.

Inheritances and Wealth TransferMillennials are poised to inherit a staggering $68 trillion from their baby boomer parents. This transfer could potentially make them the wealthiest generation in history. The demand for financial advisors will surge as millennials navigate this significant wealth transition.

Complex Financial LandscapeAs they age, their financial needs become more intricate. Even I, a millennial, find myself seeking guidance from advisors for:

Retirement planningTax strategiesLife insuranceReal estateCollege funds for childrenLong-term care plansEstate arrangementsGiven their life stage, millennials require assistance with various financial planning aspects.

Meeting Millennials’ NeedsServing millennials may seem different from high-net-worth clients, yet advisors embracing this challenge are investing in their long-term success. They come with unique demands, urging advisors to adapt their strategies. Here are some key areas to consider:

Tackling Debt Head-OnMillennials grapple with substantial debt, often stemming from student loans. They crave guidance on efficient debt repayment. Advisors can offer innovative strategies and plans to accelerate debt relief, introducing alternatives they might not have considered.

As of 2022, millennials’ average net worth hovers around $106,000, despite being aged 24 to 39. Assisting them in increasing net worth as they repay debt can position advisors as allies on their financial journey.

Comprehensive Financial PlanningBeyond debt, millennials seek comprehensive financial advice. They need help initiating or boosting retirement plans, and saving prudently. Many aspire to own homes, but the hurdle is often saving for down payments. Setting achievable savings goals and holding them accountable nurtures their trust in your expertise.

Given their initial capital limitations, considering lowered minimum investment thresholds can foster relationships that yield future dividends.

Embrace Virtual EngagementMillennials champion virtual interactions, preferring online platforms over calls or in-person meetings. Even before COVID-19, they gravitated toward remote work and flexible options. As digital natives, they are at ease navigating online spaces.

A whopping 93% of millennials manage their finances online, making virtual meetings and screen-sharing a viable mode of communication. And nearly 80% of millennials get their financial advice from social media, which means having an online presence is crucial. Aligning with their preference can set advisors apart and attract millennial clients.

Build Trust Through TransparencyAbove all, millennials seek trustworthy relationships with advisors. Having lived through financial crises, they’re cautious with investments and big decisions. So offering reassurance and transparency can foster their confidence.

They value education, understanding processes, and transparency, aligning with advisors who prioritize client education as well as their best interests. Their enthusiasm for learning can be mutually rewarding.

Welcoming Millennials As Clients: A Bright FutureAspiring for personal growth and a better world, in the coming years, millennials will seek financial advisors in unprecedented numbers. Advisors that are attuned to their distinct needs and personalities will position themselves for enduring success.

If you’re seeking to connect with millennials and adapt to the digital era, we’re here to help! Our expertise aligns your marketing strategy with their unique requirements. Book your free consultation today to receive tailored recommendations for reaching the next generation and ensuring your business’s growth for years to come.

The post Embracing Millennial Clients in 2023: What Financial Advisors Need to Know appeared first on Indigo Marketing Agency.

August 16, 2023

Unveiling Our Website Maintenance Services for Financial Advisors

A robust online presence is imperative for the success of any business. For financial advisors, a well-crafted website serves as the virtual face of your brand, connecting you with potential clients and fostering credibility.

Simply launching a website is not enough. Your website requires continuous care and attention to truly thrive in the competitive online landscape. We’ve helped hone and perfect marketing strategies for financial advisors for years, but we realized—a strong marketing strategy doesn’t mean much if your website is always on the fritz!

That’s why we’re announcing our new monthly website maintenance services specifically designed for financial advisors. We offer a comprehensive, hassle-free solution to keep your online platform running smoothly and securely.

Read on to learn more about our latest service offering.

What Is Website Maintenance?Website maintenance refers to the ongoing process of regularly updating, optimizing, and safeguarding a website to ensure its seamless functionality, security, and relevance. It encompasses various tasks like software updates, plugin management, content revisions, security monitoring, and data backups.

Investing in website maintenance helps financial advisors prevent potential issues such as security breaches, broken links, slow loading times, and outdated information. Ultimately, a well-maintained website provides visitors with a positive user experience, fosters credibility, and supports your marketing goals in the dynamic online landscape.

What Our Website Maintenance Services Look Like for YouWe understand your primary focus should be growing your business, not worrying about website management. Our month-to-month website maintenance services are designed to alleviate your burden, ensuring your website remains up-to-date, secure, and performing optimally. Here’s what our website maintenance services will look like for you:

1. Website Updates & Backups

The digital landscape is constantly evolving, and your website must keep pace with the latest trends and technologies. Our website maintenance services cover regular updates to your site’s software, plugins, and other elements, ensuring your clients and prospects have a seamless browsing experience.

We also utilize robust backup strategies to safeguard your website data, providing peace of mind knowing your valuable information is secure and recoverable in case of any unforeseen incidents.

2. Website Optimizations

First impressions matter—when it comes to your website, content and speed are key. Our team of talented writers can enhance your web copy, making it more engaging, informative, and conversion-oriented.

To maximize user experience, we focus on optimizing your website’s loading speed. A faster website provides a better user experience for your clients and prospects and improves your search engine rankings. Talk about a win-win!

3. Website Security

Website security is a top priority, especially in the financial services industry, where you are handling sensitive personal information on a daily basis. A single cyber threat can lead to disastrous consequences, tarnishing your reputation as an advisor and losing valuable client trust. With our website security services, we implement robust measures to protect your website against potential threats by regularly scanning for malware and fortifying your site’s defenses.

4. Premium Website Plugins

To enhance the functionality and performance of your website, we provide access to premium website plugins. These plugins can add valuable features, such as advanced analytics, lead generation forms, social media integrations, and much more. Our experts carefully select and integrate plugins that align with your business goals, keeping your website at the cutting edge of innovation.

5. Website SSL

SSL stands for Secure Sockets Layer, which is a security protocol that establishes a secure link between your website and the server where you store information. User data protection is paramount, especially if your website involves sensitive information, such as personal details or payment transactions. By incorporating a Website SSL certificate, we encrypt the data exchanged between your website and your clients, adding an extra layer of security that instills confidence and trust in your site.

6. Website Changes & Edits

As your business evolves, so should your website. Our maintenance services include timely updates and edits to align your content and visuals with your current offerings and brand message. Whether it’s adding information about new services, updating contact details, or refreshing the design, our team is at your service.

Get Started TodayOverlooking website maintenance can lead to unnecessary headaches for your business. From potential security breaches to poor user experiences, the risks are too great to ignore! Our monthly website maintenance services offer a comprehensive solution to address these concerns and keep your online platform thriving.

Let Indigo Marketing Agency take the reins and manage your website while you focus on building your business and providing great service to your clients. With our expertise, dedication, and commitment to excellence, your website will remain a robust and secure platform, engaging clients and prospects and driving conversions. Schedule your free strategy call to get started today!

The post Unveiling Our Website Maintenance Services for Financial Advisors appeared first on Indigo Marketing Agency.

August 10, 2023

Why Do Great Financial Advisors Fail to Get New Business? (Video)

Financial Advisor Prospecting

Financial Advisor ProspectingHave you ever struggled to bring in new business even though your client satisfaction and retention is through the roof? If so, you’re not alone. Great advisors across the country have wrestled with how to turn great service into consistent new business.

Just take a look at one of the most recent clients we helped. He was a veteran advisor with over 35 years of experience. He built a successful firm but struggled to grow his business. After just 3 months of working with Indigo, he was onboarding 6 new high-net-worth clients. This advisor was used to the occasional referral from existing clients, but he had no idea it was possible to reach that many highly qualified leads organically!

So, what was the difference between the 35 years marketing on his own versus the 3 months working with Indigo? He was the same advisor before and after, giving the same exceptional service to his clients. But in the 35 years on his own, he never managed to get proactive with his marketing.

Like this client, many advisors struggle to bring in new business because of common marketing mistakes. Let’s take a look at the top 6 marketing mistakes we see and what advisors can do to avoid these pitfalls.

1. They Don’t Know Their Audience

1. They Don’t Know Their AudienceOver and over we’ve found that advisors who struggle to bring in new business are those who don’t have a crystal-clear idea of who they are trying to reach. In some cases, advisors are failing to put themselves in the shoes of their ideal clients; in other cases, their marketing focuses on what they care about as advisors as opposed to what their target audience cares about as clients. Either way, failing to identify the unique needs, preferences, and pain points of your audience will significantly impact your ability to bring in new business as an advisor.

Some advisors believe it’s better to keep their audience general, but the truth is that if you market to everyone, you’re really marketing to no one. A well-defined niche, though smaller, is always better than a large audience that is hard to describe—and even harder to market to.

By investing time and effort into understanding their audience’s demographics, interests, and motivations, financial advisors can tailor their marketing strategies to resonate with their target market and ultimately build meaningful connections that drive business growth.

2. They Have Unclear MessagingUnclear messaging stands as another marketing mistake that prevents great financial advisors from bringing in new business. Financial advisors often struggle to articulate the one urgent problem they solve, leaving potential clients unsure of the value of their services.

Maybe you know what you want to communicate but the message gets lost in translation. Or maybe your sales messages lack value and helpfulness, coming across as self-serving rather than genuinely addressing clients’ needs.

Financial advisors who tell their story in a compelling and memorable way, and clearly communicate their unique value proposition, will establish strong connections with their audience and foster long-term client relationships.

3. They Have Inconsistent MarketingWe’ve all been there: You’re cranking out blog posts, social posts, and emails for months–until you get busy and your marketing falls by the wayside. But inconsistent marketing can create confusion and erode trust among potential clients. It can also undermine the establishment of a strong, reliable, and recognizable brand identity.

One of the most common problems we see is confusing call-to-action statements. Do you want prospects to book a call, send an email, or sign up for your newsletter? Asking them to do all three across various platforms is confusing and will likely result in no action being taken.

Instead, keep it clear and consistent. Ask prospective clients to contact you in the same way every time and ensure that this request makes sense given the unique characteristics of your audience. If you know that you work best with retirees who enjoy in-person meetings, don’t ask them to book a discovery meeting on Zoom.

4. Their Content Is Hard to FindEven if advisors create valuable content, they often fail to share it in a way that garners strong exposure or makes it easy for their target audience to find. Sharing to your network on LinkedIn or via email is great, but are those groups your target audience? Without effectively promoting your content through targeted marketing channels, you’ll miss out on opportunities to reach the audience your content was created for.

Make it easy for prospects to find your content by sharing in a way that gets strong exposure. Keep in mind that you should also ensure that it’s easy for prospects to get in touch with you online or after hours. If there are difficulties in taking the next step to work with you (like no online scheduler or an unclear call-to-action), potential clients may hesitate to reach out or may not understand how to engage further. Remove these barriers to entry by making both your content and next steps easy to find and utilize.

5. They Don’t Track Their Marketing MetricsNot tracking marketing metrics or failing to consistently track the same metrics each month is a detrimental mistake that can impede great financial advisors from bringing in new business. Without diligent monitoring and analysis of marketing efforts, advisors are unable to gauge the effectiveness of their strategies, identify areas for improvement, or make informed decisions to optimize their campaigns.

Pick a few key metrics, like website traffic, conversion rates, or lead generation, and track them consistently over time to understand what is working and what needs adjustment with your marketing campaigns. At Indigo, we send you monthly snapshots of your most important metrics so you always know how your marketing is performing.

6. They Give Up on Marketing Too QuicklyRome wasn’t built in a day and neither are effective marketing campaigns. A common reason why great financial advisors may struggle to bring in new business is the tendency to give up on marketing efforts too quickly.

The truth about marketing is that immediate results are great, but they are not realistic. Much like you tell your clients to stay invested during market downturns, we tell financial advisors to stick to a well-designed marketing strategy for months or years to see the fruits of your labor.

Don’t become disheartened if the first couple emails or social posts don’t yield a sudden influx of clients. Building brand awareness, establishing trust, and nurturing relationships with potential clients require consistent and persistent efforts. Market for the long term and don’t give up if your initial efforts don’t immediately yield results.

Prospecting Ideas for Financial AdvisorsHow Great Advisors Can Get More Ideal ClientsPutting together a marketing strategy for a client is about more than just writing blogs and posting on social media. At Indigo, we help great financial advisors focus on the following key actions to hone in on an audience and a message that optimizes your ability to connect with prospective clients:

Identify your ideal client, the person you love to help.Pinpoint the one urgent problem you solve for a specific group.Tell your story and share your passion.Understand the fears and motivations of your ideal client.Focus on helping your clients.Answer the most common questions your clients are asking.Educate and communicate with your existing clients.Create content that is worth sharing.Establish yourself as the go-to specialist in your niche.Create a long-term marketing strategy that doesn’t change from month to month.Understand that the buying process takes up to one full year.Show consistent execution that your network comes to expect.All marketing efforts lead to a clear, easy-to-take call to action.Deliver content that is relevant and valuable to your audience.Review the most important marketing metrics each and every month.Stay top-of-mind on all marketing channels (website, email, social media).

If you need help with your marketing, schedule your free consultation today to learn more about how we help great financial advisors grow their businesses. Don’t let these common marketing mistakes stop you from bringing in new clients. With our Total Marketing Package, you’ll get customized recommendations on how to improve your strategy and connect with more prospective clients!

The post Why Do Great Financial Advisors Fail to Get New Business? (Video) appeared first on Indigo Marketing Agency.

July 28, 2023

Crack the Code: A/B Testing Your Path to LinkedIn Advertising Success

Have you ever posted an ad on LinkedIn and questioned whether the copy was too long or if you should target a different audience? There are many variables that go into creating a successful ad campaign on LinkedIn, including ad copy, visuals, call-to-action buttons, audience targeting, and more.

So, how can financial advisors make the best decisions about which elements are most effective for their LinkedIn ads? A/B testing, that’s how. Read on to learn more about LinkedIn’s A/B testing feature and how you can use it to create successful ad campaigns.

What Is A/B Testing?A/B testing, also known as split testing, is a process that involves comparing two or more variations of a specific element or campaign to determine which one performs better. For years, LinkedIn lagged behind other services like Meta and Google which offered built-in A/B testing tools for their ads. But now LinkedIn Campaign Manager has finally released a new A/B testing update that will allow financial advisors to ditch the manual workarounds they used before and automatically test the reach and efficacy of their ads.

A/B Testing With LinkedIn Campaign ManagerTo get started with A/B testing, log in to LinkedIn Campaign Manager and click on the “Test” tab. Next, click the “Create a Test” button and select “A/B test” from the dropdown menu.

Define the Test SettingsOnce you’ve created a new test, you’ll need to outline the test settings by creating a name and selecting the variable you’d like to assess. You can choose from the following:

Ad: Test campaigns with different ad formats or content.Audience: Test campaigns with different target audiences.Placement: Test campaigns with different ad placements, such as showing your ad on the LinkedIn Audience Network.

If you plan to run multiple tests on the same campaign, it’s helpful to clearly label each test so you can easily compare results in the future. Example: Second Opinion Service Ad – A/B Test – Copy.

You’ll also want to set a lifetime or daily budget for your A/B test. The minimum budget is $10 daily and $700 lifetime, which will be equally divided between the two campaigns you are testing. Next, set a schedule for your A/B test by selecting a start date and an end date. The minimum length for an A/B test is two weeks and the maximum length is 90 days.

Customize Your Ad CampaignsAfter defining your A/B test settings, it’s time to customize your ad campaigns. Adjust your settings for the elements below.

Objective: Choose from LinkedIn’s preset campaign objectives, including brand awareness, website visits, engagement, video views, website conversions, and lead generation.Test metric: Depending on what you chose as your campaign objective, the applicable test metrics will populate in a dropdown menu. Select the metric you want to use to define “success” for your ad. For example, if you chose brand awareness as your objective, then average reach would be a good test metric to measure success.Audience: If you chose audience as your variable, here is where you can define both target markets. Otherwise, the attributes selected will apply to both campaigns. You can upload saved audiences or utilize information gathered from your website to build your target audience.Ad format: In ad format, you can select from 8 different ad types, including single image, carousel image, video ad, text ad, and more. If this is not the variable you want to test, be sure to unselect the “Test creatives using different ad formats” box.Placements: Here you can select if you want your ad to appear on LinkedIn, LinkedIn Audience Network, or both. LinkedIn Audience Network is a network of trusted third-party apps and websites you can advertise on.Budget & schedule: Here you can get more detailed with your bidding strategy and optimization goals. These options will vary depending on your campaign objective. We recommend advertising at least $1,000 per month (the cost per action could be higher but effective on LinkedIn).Conversion tracking: This section allows you to track ad views, form submissions, URL clicks, and more. If you haven’t already set this up, it’s highly recommended to better understand what actions your audience takes after viewing your ads on LinkedIn, and it can help you rate the success of one ad over another.

Remember that whichever options you select in this section of the set up will apply to both campaigns. You will design the testing variable in the Variant section.

For those testing the audience or placement variable, the next step is to define the ad format to use across both versions of your campaign. Start by adding an image or video, creating a caption, and choose a call to action. In this step, you can design an ad from scratch or browse templated options. Since this is the same workflow as the standard ad creation process, you can create up to 5 ads, though this isn’t recommended if you are already testing the audience or placement element.

Design Your VariantThe exact Campaign Manager Workflow you experience will depend on the variable you select in the beginning of the process. Here are some additional details to keep in mind based on your selected variant.

AudienceWhen setting up your audience preferences, you choose to test between your own saved audiences, LinkedIn-generated audiences, or create a new audience entirely. You also have the option to exclude audiences to create an even more targeted campaign.

PlacementIf you would like to include your ads on LinkedIn Audience Network, there are additional Brand Safety features you should explore. These features allow you to exclude certain websites or apps from your campaign. This is helpful in honing in on your specific audience and also allows you to control in which environment your ad could be viewed.

Ad FormatFor ad format, start by identifying the specific elements you want to test. This could include variations in imagery, ad copy, headline, color schemes, or the overall layout. Clearly define the variables you want to experiment with to create a structured testing plan. LinkedIn gives you 8 different types of ads to choose from, but you can get even more detailed with your test—changing as little as the font type or size, for instance.

Tips for A/B TestingIf you’re thinking about utilizing A/B testing for your LinkedIn Ads, here are some best practices to keep in mind:

Create a hypothesis: Don’t run an A/B test just to do it. Instead, be intentional with why you’re running the test and what you hope to discover with the data you collect. Do you think your ad copy is too long or that you’re targeting too general of an audience? A hypothesis can help you set a clear objective and focused direction for the test.Understand the key metrics: The metrics available for A/B testing vary depending on your chosen campaign objective, so selecting the most relevant metric is crucial to obtain meaningful data and identify the winning campaign accurately. LinkedIn’s metrics do not always align with which metric would be most useful. For instance, cost-per-conversion is not available. We encourage you to get familiar with LinkedIn’s metrics so you can better understand what the results of the A/B test mean in terms of your campaigns.Allow enough time: Other ad platforms allow you to run A/B tests in as little as 7 days. With LinkedIn’s 14-day minimum, however, it’s important to adjust your strategy and allow for enough time to gather the data you need to make informed decisions about your ads.Do You Have Questions About Your LinkedIn Strategy?LinkedIn ad campaigns are a great way to improve your reach and connect with more A+ clients as a financial advisor. Harness the power of A/B testing to take your strategy one step further with invaluable insights, optimized ad formats, and data-driven decisions.

Do you have questions? We’re here to help! Let the Indigo team guide your marketing strategy both on and off LinkedIn. Schedule your free strategy call to get started.

The post Crack the Code: A/B Testing Your Path to LinkedIn Advertising Success appeared first on Indigo Marketing Agency.

July 27, 2023

How to Redirect Fee Conversations to Value Propositions

As a financial advisor, engaging in fee conversations with prospective clients can be challenging—and sometimes downright awkward! There are those who will focus solely on what you charge and overlook the broader value of how you can help. Others are convinced that they can DIY their financial plan for free.

To overcome the fee hurdle, it is essential to redirect these conversations toward the value propositions you offer. Financial advisors who can effectively communicate the benefits they provide will build a practice based on value, rather than fees. In this article, we’ll explore 4 tips for redirecting fee conversations to focus on your value proposition instead.

Proactively Address FeesRather than waiting for clients to bring up the topic of fees, take the initiative to address them head-on. During your initial conversations or presentations, clearly explain how your fees are structured and what services they cover. It can be off-putting to many prospective clients if advisors avoid the topic of fees or wait for the client to ask first. By openly discussing fees from the start, you establish transparency and set the stage for a value-focused conversation.

Here’s an example: “I want to take a moment to address our fee structure, as I believe it’s important for you to understand the value you receive in return. Our fee covers comprehensive financial planning, personalized investment management, ongoing portfolio monitoring, and regular performance reviews. By bundling these services together, we can ensure your financial goals are met effectively and efficiently.”

Consider utilizing a graphic or some other visually appealing presentation to illustrate the value you provide. (Hint: Check out this great graphic from Kitces.com highlighting 101 ways financial planning can help!)

Communicate in a Personalized WayIt’s one thing to communicate the full scope of your services, but it’s another thing to connect the dots between what services you offer and how that truly affects the prospective client sitting in front of you.

Avoid broad language that doesn’t really mean much to your client’s day-to-day needs. Saying that you offer investment management and financial planning may sound great to other advisors in the industry, but does your prospect know what that actually means? Use personalized language that addresses your prospect’s specific pain point.

Try something like this: “I understand that you recently went through a divorce and preserving your assets for your children is a top priority for you. Our comprehensive financial planning services include a detailed insurance and estate planning review to shield your assets properly for future generations.”

Go beyond what you will be doing and highlight how you will work together with your client to get it done. Discuss the steps involved, including any meetings, expected follow-up emails, and the timeline for the final presentation. Breaking down the barrier between what you provide and how you actually do it can provide insight into the process and allow prospective clients to better understand the value of your services.

Showcase Your Experience and ExpertiseProspective clients often underestimate the knowledge and experience that financial advisors possess. To redirect fee conversations toward value, showcase your credentials, certifications, and track record of successful outcomes for clients. Share stories and case studies that highlight how your guidance has made a meaningful impact on the financial well-being of others.

This social evidence can help prospects recognize the value of your services and position you as a trusted advisor capable of navigating complex financial landscapes. This is also a great time to highlight any niche-specific credentials or experience you may have.

Here’s an example: “I’ve been helping clients navigate the transition to retirement for over 10 years. I hold the Retirement Income Certified Professional® (RICP®) designation and have helped clients answer questions about Social Security claiming, tax-efficient portfolio withdrawals, and how to build an income floor using personalized investment strategies.”

Highlight Time Savings and EfficiencyTime savings is another area where financial advisors add value. Explain how often you make trades, rebalance portfolios, research investment opportunities, monitor regulatory changes, and make adjustments to their financial plan. Emphasize how this ongoing management frees up their time to focus on passions and priorities, knowing their financial affairs are in capable hands. Highlighting the time-saving aspect of your services demonstrates an additional layer of value.

You can say, “One of the key benefits of working with our firm is the time you save. We handle all the behind-the-scenes tasks, such as monitoring your portfolio, researching investment opportunities, and staying up to date with changes in the financial landscape. This allows you to spend more time doing what you love while we keep your financial strategy on track.”

Define Your Value With Indigo Marketing AgencyFee conversations can be easier than ever before with a well-defined value proposition and a team of experienced marketing professionals on your side. At Indigo Marketing Agency, we can help you identify your target market and craft a compelling value proposition that actually resonates. Schedule a free strategy session to transform your awkward fee conversations into well-defined value propositions.

The post How to Redirect Fee Conversations to Value Propositions appeared first on Indigo Marketing Agency.

July 8, 2023

Dive Into Summer With Our Total Marketing Package for Financial Advisors! 🌞🏊♀️

Summer is here, and if you’re a financial advisor, you’re probably dreaming of sandy beaches, picturesque sunsets, and sipping refreshing tropical beverages. But while you’re soaking up the sun, it’s crucial to ensure your marketing efforts don’t take a vacation. That’s where Indigo Marketing Agency comes in! Our Total Marketing Package is designed to provide you with seamless marketing support so you can enjoy your summer while your business continues to thrive.

Here’s what our Total Marketing Package includes:

Custom Content Creation: Our team of skilled copywriters will craft engaging and informative content that resonates with your target audience. From thought-provoking blog posts to attention-grabbing social media updates, we’ll make sure your message shines through.Dedicated Account Manager: You deserve personalized attention, and that’s exactly what you’ll get. Your dedicated account manager will be your go-to person, ensuring your marketing campaigns are executed flawlessly and delivered on time, every time.Timely Content Distribution: Consistency is key in building your brand and nurturing client relationships. Our team will meticulously schedule and distribute your content across various channels, ensuring maximum visibility and engagement.

In addition to these core services, our Total Marketing Package also offers a range of valuable extras to enhance your marketing strategy:

But that’s not all! We understand the importance of long-term success, which is why we provide ongoing monthly benefits to keep your marketing strategy on track. These include:

At Indigo Marketing Agency, we’re not just here for the summer. We’re your long-term partner committed to your success. With our Total Marketing Package, you can have a worry-free summer, knowing that your marketing efforts are in expert hands.

So, if you’re still dreaming of those vacation days, let us take the reins and ensure your marketing efforts continue without a hitch. Sit back, relax, and let Indigo Marketing Agency handle the rest!

Ready to make a splash with your marketing? Schedule a free strategy consultation with our team. Let’s make this summer your best one yet!

Don’t let the summer heat slow down your marketing momentum. With Indigo Marketing Agency’s Total Marketing Package, you can enjoy your well-deserved time off while we take care of your marketing needs. From custom content creation to dedicated account management and timely content distribution, we have the tools and expertise to keep your business thriving.

Contact us today and dive into summer with confidence!

The post Dive Into Summer With Our Total Marketing Package for Financial Advisors! 🌞🏊♀️ appeared first on Indigo Marketing Agency.

June 23, 2023

How Financial Advisors Can Use YouTube To Grow Their Business in 2023

When I think about the future of marketing for financial advisors, I’m excited about two things: webinars and YouTube. Webinars are an incredible solution to get in front of your ideal prospects 24/7 online with an up-front investment of 4 to 8 hours of your time. YouTube for financial advisors is an up-and-coming way to get exposure to millions of people searching for the exact answers you’re offering.

Marketing on YouTube is still pretty much in its infancy for financial advisors. There are a handful of advisors running away with all the success. Here’s one strong YouTube Channel with over 28,000 subscribers and over 6 million video views. Jeff Rose, the marketing genius behind Good Financial Cents, has about 380,000 subscribers and publishes content almost daily on his channel Wealth Hacker.

Key Benefits Of Investing In YouTube Marketing For Financial AdvisorsFirst and foremost, YouTube is a great way to get more traffic and exposure without paying for ads. Did you know that Google owns YouTube? This means that when people type in a search query, Google puts YouTube videos right at the top of the search results. If your video is the best (or only) video on that topic, you are automatically at the very top of search results.

Next, there is relatively low competition from other advisors. Because of compliance, lack of confidence on camera, or whatever other reason, there are only a handful of advisors using YouTube well. Any advisor willing to do a decent job on the platform will rise to the top quickly.

YouTube is a rising platform. While today YouTube is the second social media channel behind Facebook, it is growing every day. Over 88% of those over 55 years old use YouTube regularly, and that is projected to increase in the future. To invest in a marketing foundation for tomorrow, it may be wise to start a YouTube channel today.

Short-form content is a big opportunity: YouTube Shorts is very similar to TikTok, and there has been data showing that YouTube Shorts has outperformed TikTok in terms of the number of monthly users. Repurpose your longer-form content, taking bite-sized pieces of videos to publish on YouTube Shorts to take advantage of the opportunity to reach more viewers.

Watching videos helps people know, like, and trust you. While no single video is likely to land you dozens of new clients, people who have watched your videos are more likely to work with you, more educated about the topic and your firm, and more willing to take the next step.

People would rather watch videos than read. Research shows that 83% of people prefer watching a video to access information over reading an article on a topic. An easy way to boost your exposure? Create both videos and written articles on each piece of content you put out.

Video is an easy way to create content on a regular basis. Every advisor should be creating regular marketing content to stay top-of-mind. Shooting videos is one of the easiest ways to do so in a hurry. You’re already comfortable speaking in front of people on financial topics, so use that strength to get your marketing content created in an authentic and easy-to-consume format.

YouTube can help you narrow your niche! Using videos for your marketing strategy can help uncover marketing niches that you should focus on going forward. Bridgeriver Advisors’ Dan Casey has a YouTube channel with several dozen videos that have about 100 to 400 views on average. But his top 3 videos have tens of thousands of views:

8 Fatal Retirement Mistakes That Can’t Be Undone (65,000 views)Social Security Changes After the New Budget (33,000 views)The Good, Bad, and Ugly of Long-Term Care Insurance (22,000 views)I would suggest that Dan dig deeper and create more content on one of these topics by creating a playlist on that topic and gaining even more traffic to his videos. By experimenting with different topics, you can understand which ones will get you the most exposure and focus on what works.

YouTube Best Practices For Financial AdvisorsNarrow Your Channel’s FocusYou’re not going to win searches for “401k investing” (that award goes to this video), but guess what? If you created a video for “Maximizing Your Ford Motor Company Benefits Package and 401(k),” you would be the only YouTube search result on that topic.

Publish RegularlyThe name of the game on YouTube is creating a lot of videos consistently. This manages the expectations of your subscribers and helps YouTube promote your videos. Beyond that, creating lots of videos on the same topic can help you dominate search results for those search terms. If you’re going to dive into YouTube, I recommend that it be your top marketing focus for at least a year and that you commit to publishing new videos weekly or biweekly until you reach at least 50 videos.

Optimize Your Videos for SearchQuantity over quality: If you’re going to upload content to YouTube, make sure you’re checking as many boxes as possible. Here are the areas we recommend paying special attention to for all your videos:

Title: Name your video something people will want to click on. A lot of advisors make the mistake of not changing the title from the file name of the video (no one will want to click to watch “Video 1”). This is arguably the most important real estate, so use it well!Description: Don’t just add a title and a one-sentence description. Think of how your video description can complement the content in the video, serving as a mini blog of sorts, which can also help with YouTube SEO. (Do this for all videos.)Captions: YouTube will automatically generate captions after you publish. But you should go back into your video to make sure names and other proper nouns are spelled correctly.Thumbnails: Adding thumbnail images to your videos is essential because they allow you to attract viewers to your video. A well-designed image makes your video stand out from the competition and helps you get more views.Do what YouTube asks: YouTube will often suggest taking steps, like adding end screens to videos, callout text, captions, and more. We’re firm believers in playing into the requests that YouTube makes of your account to better your chances of higher distribution.Convert Your ViewersVideo views mean nothing if you can’t convert that traffic into leads.

Links in description: At the top of your YouTube video description, offer an easy next step for viewers to take, such as scheduling a call or asking a question. Make sure you have a “Links” section with multiple calls to action: Book a Meeting, Contact Us, Take an Assessment, etc.Like & subscribe: Just like asking for the business with a prospective client, don’t forget to ask viewers to take the actions you really want them to take, liking your video and subscribing to your channel. People may do this on their own, but prompting viewers is something many successful YouTube creators do in all their videos.Callout cards: Promote subscribing to your channel or a related video at a point of your choosing during the video through YouTube’s callout card feature.End screen: Take advantage of the opportunity to promote your channel and other videos/playlists at the end of your video.What Should Your Videos Be About?The best advice here comes from Blair Kelly at FMG: “Simply keep a list on your computer of all the questions your clients and prospective clients ask. Each time they ask you a question, write it down! If they have the question, that means others do too—and it could be a great piece of content for you to record a video answering.”

In addition to answering common questions for your target audience, create videos that showcase your story, your passion, and garner emotion from viewers. Check out a video from Indigo’s founder about who we serve and why she started our firm. Think about creating videos on your team members, updates at your office, and current events.

The 3-minute video is dead (almost): Content that tends to perform well on YouTube tends to fall into two categories: YouTube Shorts and longer-form content. By longer-form content, those are pieces that tend to be above 7 minutes long. You’ll hear a lot of people saying that videos should be three minutes long, but that advice is a bit dated and stemmed from publishing videos on Facebook prior to the rise of TikTok. If you’re going to produce content that’s longer than 60 seconds, think about how you can turn it into a video that is in the realm of 8-10 minutes.

Want to learn more about creating a YouTube channel? Review how to set up and optimize your YouTube channel and examples of excellent advisor YouTube channels. Do you have questions about your marketing strategy? Reach out today to schedule a free strategy call with one of our marketing experts!

The post How Financial Advisors Can Use YouTube To Grow Their Business in 2023 appeared first on Indigo Marketing Agency.

June 22, 2023

Supercharge Your Financial Advisory Business With Our SEO Checklist

Stand out from the crowd and watch your business thrive. As a financial advisor, you understand the importance of getting noticed in today’s competitive landscape. Now we have a solution that helps you take immediate action and propel your business to new heights.

Introducing our comprehensive SEO checklist tailored specifically for financial advisors like you. By implementing the strategies outlined in this checklist, you’ll ensure your website is optimized for search engines, driving more traffic and potential clients your way. While it’s not an exhaustive list, it covers all the essential bases and provides a solid foundation for your future SEO efforts.

The Importance of Local SEOWhy focus on local SEO, you ask? The answer is simple: local is where you can make all the difference. While having a national presence is undoubtedly admirable, the competition on a national scale is fierce and challenging to surpass. In the United States alone, there are over 330,000 financial advisors, and this number is rapidly growing. By concentrating your SEO efforts locally, you’ll see results much more quickly, effectively reaching the clients in your area who need your expertise the most.

SEO SimplifiedDon’t worry if the idea of tackling SEO seems daunting. If you have access to the back end of your website and a willingness to learn (it’s not as scary as it sounds, we promise!), you can make many of these changes yourself. However, if you’d rather not navigate the intricacies of SEO alone, our team is here to help. We have the expertise and experience to optimize your website effectively, so you can focus on what you do best—providing exceptional financial advice.

Let’s break down the three essential components of SEO covered in our checklist:

On-page SEO: Craft compelling content, optimize your meta tags, utilize targeted keywords, and ensure your website structure is search engine-friendly.Off-page SEO: Build high-quality backlinks, engage with your audience through social media, and leverage online directories to boost your website’s visibility.Technical SEO: Fine-tune your website’s performance, improve page load speed, optimize mobile responsiveness, and enhance overall user experience.The SEO Checklist: Supercharge Your Marketing Now!Remember, our SEO checklist is just the beginning. It’s a road map to success that helps you rise above the competition and attract the clients you deserve. Don’t wait another day to take action. Download our SEO checklist now and start transforming your financial advisory business.

Your future success starts here. Act now and unlock the true potential of your business with our comprehensive SEO checklist.

At Indigo, we know how to showcase what you do best and connect with potential clients. The best part? We do it with no ongoing monthly fees or expensive contracts. Don’t miss out on the opportunity to attract and retain clients with a stunning website and a compelling narrative. Schedule your free consultation to get started today.

The post Supercharge Your Financial Advisory Business With Our SEO Checklist appeared first on Indigo Marketing Agency.

June 21, 2023

The Shifting Financial Landscape in 2023: How Financial Advisors Can Stay Ahead of the Curve

Can you believe we’re halfway through 2023? Looking back to the beginning of the year, the financial headlines spelled a near-certain disaster. Between persistent inflation, rising interest rates, bank failures, and a looming recession, financial advisors across the country have had their hands full with uncertainty and fear. But is that still the case going forward? Let’s take a look at the shifting landscape for financial advisors and how marketing can play an important role in the second half of 2023.

And stay tuned til the end to claim your free blog post to send to your clients!

What Happened to the Recession?While the financial landscape at the beginning of 2023 looked rather bleak, there are signs that the economy is turning around—specifically when it comes to the long-predicted recession. Strong job growth and a pause in interest rate hikes have experts revising their initial predictions.

In May, the U.S. job market grew by 339,000 new jobs, which was much higher than anticipated and more than any single month of job growth in 2019. Consistent gains in the job market over the last several months combined with low unemployment has many experts believing that the once-certain recession is becoming increasingly unlikely.

In another sign that things are turning around, the Federal Reserve has stopped raising interest rates after 15 months of consecutive hikes. The Federal Reserve may slightly raise rates later this year, but it isn’t expected to be raised as dramatically as it was during 2022. Inflation, most recently 4% as of May, has slowed since reaching a peak of 9.1% last year. The decision to pause rates will give the Fed time to assess whether further rate hikes are needed. We’re certainly not out of the woods yet, but there is hope on the horizon that the second half of 2023 will be brighter than initially predicted.

Looking ForwardThe stock market has seen a surge of optimism as well with the S&P 500 reaching bull market status on June 9th. The index has rebounded 23% since its low in October 2022, causing the Chief Equity Strategist at Bank of America, Savita Subramanian, to announce, “The bear market is officially over.”

So what can financial advisors expect from the second half of 2023? Increasing interest in AI stocks and the technology of the future. Interestingly, most of the S&P 500 rebound has been driven by gains in the tech sector as seasoned investors and everyday consumers are flocking to technology (see: NVDA) to stay ahead of the curve.

Focus on EngagementDespite the shift in the financial landscape, many Americans believe we are currently experiencing a recession. According to a recent survey from TransUnion, 44% of Americans believe we are either already in a recession or will be by the end of June 2023, regardless of the ongoing optimism in job growth, interest rate hikes, and stock market performance.

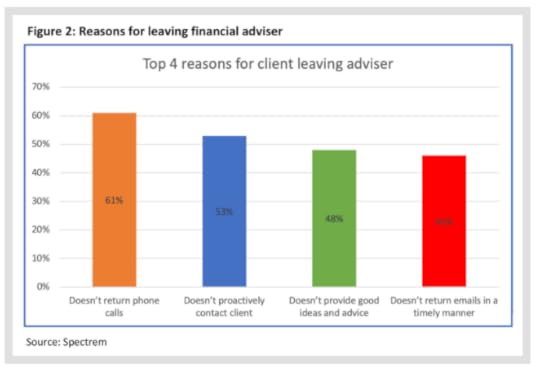

Our best advice for dealing with this gap between economic data and consumer perception is to focus on client engagement through marketing. Considering 3 of the biggest reasons why clients leave a financial advisor are communication related, marketing and other timely communications are a crucial element of client retention in a shifting financial landscape. Take a look at the graph below from a Spectrem Group study to learn more.

As the financial landscape for the second half of 2023 continues to develop, here are 5 steps financial advisors can take to improve client engagement and retention through proactive marketing:

1. Build Trust in Uncertain TimesDuring periods of economic uncertainty, trust becomes an invaluable asset for financial advisors. Clients rely on you to provide guidance and stability amidst fluctuating markets and confusing financial indicators.

Prioritize client communication even when times are uncertain. Don’t hesitate to put out content that addresses ongoing market events (think: SVB collapse, debt ceiling crisis). Though economic and market events change rapidly, keeping your clients informed can build and strengthen their trust in you as an advisor and reinforce the value of your services. (Hint: Working with an expert marketing team can make keeping up with current events much easier!)

2. Provide Personalized GuidanceUncertain times also call for tailored strategies that address clients’ unique financial situations and goals. Engage with clients through personalized marketing that addresses their specific needs and concerns in the context of the current financial landscape. It’s one thing to post generic stats about ongoing recession fears or market volatility, but it’s another thing entirely to provide concrete examples of how your target audience can prepare for a recession or weather an economic storm. See some examples below:

What size emergency fund is appropriate for your average client? If you work with clients in a particular sector, what does the landscape look like? Are there layoffs coming or a change in management? How can clients prepare for this possibility?Are your clients retired and disproportionately affected by persistent inflation? What are specific strategies to alleviate this risk?This level of individualized attention demonstrates a commitment to the client’s financial well-being and helps create a sense of partnership, instilling confidence even in the face of economic uncertainty.

3. Anticipate and Adapt to Changing Client NeedsDuring periods of potential recession or high inflation, clients’ financial priorities and goals may shift. By fostering client engagement, financial advisors can stay attuned to these changing needs and adapt their strategies accordingly. Regular check-ins with email and content marketing can open up conversations and allow advisors to proactively address concerns, provide updated information, and adjust recommendations to align with clients’ evolving circumstances. This adaptability demonstrates a client-centric approach and reinforces your value in guiding clients through uncertain times.

4. Empower Clients With EducationJust like uncertainty can negatively affect the stock market, it often breeds financial anxiety and confusion among clients. By prioritizing client engagement through marketing, financial advisors can empower their clients with knowledge and education. Host webinars, post blogs, videos, or other educational content discussing market trends, potential risks, and investment strategies to help clients understand the rationale behind recommendations and make better informed decisions. By acting as a reliable source of information and providing ongoing education, you can position yourself as a trusted advisor and help clients navigate through periods of economic uncertainty.

5. Strengthen Client Relationships for Long-Term SuccessClient engagement is not a short-term tactic but a long-term strategy for financial advisor success. By consistently engaging with clients, advisors can develop strong, lasting relationships that extend beyond specific market conditions. During uncertain times, clients are more likely to stick with advisors they trust and feel connected to, which can help weather challenging market conditions and even lead to referrals and new business opportunities. By focusing on engagement and nurturing client relationships, you can establish a solid foundation for long-term success and growth.

Stay Ahead of the Curve With an All-Weather Marketing StrategyIt’s easy to stay connected when everything is going well. But to succeed in a changing financial landscape, financial advisors must have a consistent, reliable, and high-quality marketing strategy in good times and in bad.

At Indigo Marketing Agency, we help financial advisors stay competitive with impactful messaging through every economic outlook. The second half of 2023 may be on an upswing, but will your marketing keep up? Schedule your free consultation today to receive personalized recommendations about how you can stay ahead of the curve.

BONUS: If you book your free call, you’ll get a free blog post on this topic to send out to your clients. I call that a win-win!

The post The Shifting Financial Landscape in 2023: How Financial Advisors Can Stay Ahead of the Curve appeared first on Indigo Marketing Agency.