Claire Akin's Blog, page 16

April 28, 2023

How to Write The Perfect Financial Advisor Bio

Most financial advisors haven’t completely filled out their LinkedIn profiles. They often have trouble writing about themselves and the benefits they offer clients. Writing a LinkedIn bio for financial advisors can be the most difficult type of writing, yet a great bio is critical when attracting prospects online. Follow these five steps to create an impactful bio that resonates with website visitors and communicates what makes you different.

What Do You Do & Who Do You Do it For?Your LinkedIn bio consists of two parts: your tagline and your LinkedIn summary profile.

The first step is to succinctly explain what you do and who you do it for in your tagline. Examples include:

A wealth manager to affluent womenA 403(b) specialist for teachers in DallasFinancial planning for investors in their 20s and 30sFolks reading your bio want to know—first and foremost—what your specialty is and who you serve. It’s important to resist the temptation to be too broad here. The more specialized your niche, the more interesting your bio will read.

Here’s an example of my LinkedIn tagline:

Your LinkedIn profile summary is where you dig deep and think about why your clients choose to work with you, rather than a competitor that offers similar services. Most advisors we work with haven’t thought through exactly why clients make the decision to work with them. It’s helpful to ask some of your clients why they hired you and what they think makes you different. Is it your experience in their particular demographic? The investment philosophy you offer? More than likely, clients choose to work with you because of a service-related aspect, like the trust they have with you or the support they feel from your staff.

Here’s my LinkedIn summary. Notice how I start by talking about my clients and what I do for them. Then I end by talking about my background:

Clients choose to take action and work with you to solve one of their problems. Try to understand which problem you are solving for your top clients. Do you simplify their financial picture? Do you offer risk management that helps them sleep at night? Do you educate them so they can make informed financial decisions and feel empowered? By understanding the biggest problem you solve for clients, you can more persuasively illustrate the benefits you offer to potential clients.

Weave a StoryWe know from analyzing website visitor behavior for thousands of advisors’ sites that people first want to know what you do, then why you do it. This compelling story is the most common missing thread in bios we read. Why did you get into this business and why do you come back each day? What drives you to serve your clients? Weave a story that illustrates your passion. One advisor who formerly worked as a curator for an art museum was moved to change his career after a tragic event: a group of wealthy families returning from a tour of the great museums of Europe were killed in a plane crash, leaving many of their children with no financial resources. Whatever your story, illustrate the why so people can understand what drives you.

Make it PersonalAfter understanding why you do what you do, people want to know who you are. How do you spend your free time? What are your hobbies and interests? What charitable causes are you passionate about? Sharing personal information allows prospects to find commonalities and get to know you, which is where a foundation of trust begins. List organizations you belong to and groups you’re involved with to give an added SEO boost. Don’t be shy in offering up personal details. We hear over and over from advisors that once they make their websites more personal, they get positive feedback from clients and prospects.

Bonus Tip: Try Writing BackwardsHaving trouble getting started? Try writing your bio backwards. Start with the personal side, including your hobbies and interests, then move on to your experience. Write the most important opening paragraph last, when you’re warmed up.

Once you’ve followed these five steps, proofread and fine-tune your bio. Ask a friend or assistant to give it a quick review to make sure there are no spelling or grammatical errors. Once you’re happy with the result, send it to compliance, feature it on your website, and don’t forget to share it on your social media profiles!

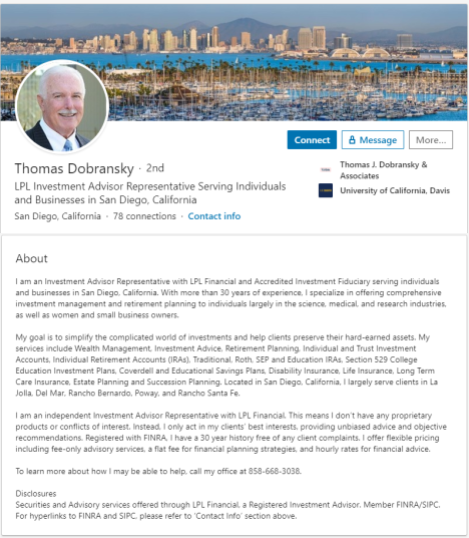

Financial Advisor Bio Sample: LinkedIn Bios for Financial AdvisorsWant to see some awesome LinkedIn bios for financial advisors? Check out three I recommend copying:

1. Thomas Dobransky’s LinkedIn Bio

2. T. Kenny Phan’s LinkedIn Bio

3. Brittney Castro’s LinkedIn Bio

Need help setting up and optimizing your LinkedIn profile? We offer this service (along with many others) as part of our Total Marketing Package. Learn more about what’s included here.

The post How to Write The Perfect Financial Advisor Bio appeared first on Indigo Marketing Agency.

How to Optimize Your LinkedIn Headline

Your LinkedIn headline is a 120-character “hook” that appears right under your name on your profile and in search results. Similar to a newspaper or magazine headline, yours should be catchy, interesting, and easy to read. Your headline is your opportunity to capture interest and invite users to learn more about you.

You may not realize that headlines show up along with your name during an active search, meaning that as I type into the LinkedIn search bar, profiles and their corresponding headlines appear under my search. And because your entire headline appears during a search, it has an impact on whether people choose to click on your profile and learn more about you.

Despite their importance, most LinkedIn headlines are not thoughtfully crafted. The majority of LinkedIn users do not understand what a headline should be or its potential impact. Most people simply list their job title or company and fail to take advantage of all 120 characters.

Just for fun, let’s take a look at some real-life terrible headlines:“I love 401(k) plans!” What does this have to do with me, the prospective buyer? Just because you love doing something doesn’t make you good at it. Who do you sell 401(k) plans to? What types do you specialize in? How are you different than every other wholesaler?

“Rainmaker” For who? In which industry? What are you selling? If I am a prospective buyer, I may be put on the defensive by the headline, as I’m not sure I want you rainmaking with my money.

“President at Jones, Inc.” While this may be your title and company, it tells me nothing about who you serve, what your firm does, what you do, or how I can benefit. Unfortunately, this is the most common headline I see for advisors.

“Author, Speaker, Life Coach & Veterinary Pharmaceutical Sales” This may be my favorite. I’m sorry, but you cannot possibly be the “best of the best” at each of these endeavors. Too many titles and keywords can be confusing to prospects. For your headline, choose your “main thing” and focus on it.

“☆ Lead Generation – Roofing Contractors ☆ Contractor Marketing ☆ Author of Best-Selling 80/20 Internet Lead Generation ☆” Please do not use symbols or emoticons. They come across as silly, cluttered, and unprofessional. Write your headline as a headline, which is a string of words that form a cohesive thought, not a hodgepodge of separate ideas and symbols.

“Unix SME / IA SME / IAM at SPAWAR SSC PAC” This is an actual headline for a government contractor in my network. His experience section reads, “TSw IA Lead, IAO for 5 TSw systems, TSw OCRS Coordinator, Unix SME, IAM for Piers renovation.” While his peers might understand what that means, it’s best practice to translate your LinkedIn profile into language that a layperson can understand. For advisors, this means being careful about your designations and acronyms.

How to Write a Great HeadlineMarketing, in general, should always focus on how you can benefit prospects. Unfortunately, people do not care about what you do, they care about how you may be able to help them.

Headlines should give three important pieces of information as clearly as possible:

What you doWhom you do it forHow it benefits them

Of course, it is challenging to sum up your value in 120 characters. The more specialized and clear you can be, the more easily your ideal prospects will be able to find you. If you use LinkedIn a lot, you will likely find yourself updating your headline periodically when you get a better idea or come up with a more elegant way of phrasing your value. Essentially, you should try to convey the value you offer to your specific clients.

Remember that headlines are searchable by keyword, so you’ll want to spend some time thinking about what your prospects might type into a search when trying to find an advisor to help them with their particular plight. Terms like “Wealth Manager,” “Financial Advisor,” and “Estate Planning” are more powerful than “Founder,” “Managing Partner,” or “CEO” from a keyword search perspective.

Should Job Title Be Included?Advisors often ask me whether they should list their job title and firm name in their headline. Keep in mind that both your job title and your firm name will be listed in your “Experience” section, so there is no need to list them again in your headline unless you have good reason to double down, from an SEO perspective.

If you work for a very large firm with high name recognition, I would use the firm name in your headline, such as Wealth Advisor at XYZ Wealth Management Group.

I would leave your name out of the headline if your firm name has your own name in it since that keyword is already accounted for in your name. If your firm name clearly states what you do and who you do it for, I would include the name, such as Financial Advisor with Women & Wealth Financial Group.

The bottom line is that if you have reason to believe prospects are searching for your business name and it is different from your actual name, include it in your headline. Likewise, if you have professional designations, add them to your name or headline, as some prospects include “CFP®” or “CFA” in their search terms.

An Effective LinkedIn HeadlineThe trick to writing a good headline is to balance the use of keywords for search engines and also write a headline that resonates with humans looking to learn more about how you can help them.

For example, I know from Google Analytics that keyword searches for my website typically include “Indigo Marketing Agency,” and “marketing consultant for financial advisors.”

I wrote my headline as “Director of Marketing at Indigo Marketing Agency | Empowering Independent Financial Advisors to Connect with Ideal Clients and Grow Assets Under Management.” It is keyword-rich for my relevant search terms and explains exactly what I do, whom I do it for, and how I benefit my clients.

Examples of Effective LinkedIn Headlines for Advisors:Fee-only Financial Advisor Serving Widows and Divorcees at Haven Financial Solutions, Inc.Wealth Manager Serving Individuals and Biotech Businesses in San Diego, CaliforniaPension Consultant Specializing in Custom 401(k) and Defined Benefit Plan DesignCERTIFIED FINANCIAL PLANNER™ for Entrepreneurial & Professional Women in Southern CaliforniaChartered Retirement Planning Counselor Providing Alternative Investment Advice to Accredited InvestorsExperience Investment Advisor Offering Institutional Cash Management for School Districts in Texas

What is the worst headline you’ve seen on LinkedIn? What is the best?

Need help? We provide a Social Media Optimization Service or a new LinkedIn Webinar! Stay in touch by signing up for my marketing newsletter today!

The post How to Optimize Your LinkedIn Headline appeared first on Indigo Marketing Agency.

April 10, 2023

Redefine Your Newsletter & Unleash Your Potential With Video

Connecting with your clients is of the utmost importance. But it can be really challenging in today’s digital age with all the noise. How are you supposed to stand out from the crowd?

This is where using videos in your marketing strategy can set you apart and make a huge impact.

Let’s discuss some of the benefits of video marketing so you can level up your marketing game.

What Is Video Marketing?

I’ve heard some advisors write video marketing off as a glorified advertisement—and it’s really so much more than that! It’s about connecting with your ideal audience to build trust and credibility.

Here are a few types of video content to consider:

Short explainer videos: Quickly discuss your services or break down complex topics into quick, easy-to-digest blurbs. Detailed tutorials or courses: Go in depth on frequently asked financial questions. Landing page greetings: Personalize your website and show prospects who you really are.Customer testimonials or success stories: Drive home your level of care and dedication to high-quality service. Why Is Video Marketing Important?The metrics show an undeniable truth. In recent years video has really exploded, and a study done in January said that 91% of consumers would prefer to consume their content via video. Given the popularity of social media, it should be no surprise that video is shared 1200% times more than text or images, and consumers remember about 95% of your video message more than they would if they had read it in an article.

What Makes a Good Video?Here are my top four tips to make your video great:

1. Be short and sweet.Consumers like information in bite-sized chunks. The ideal length of your video should be between three to five minutes.

2. Be timely and passionate.You want to share relevant and timely topics with your audience. And if you’re talking about something you’re passionate about, it’ll come across so much better in the video. If you don’t sound like you care about your topic, your audience likely won’t care either.

3. Invite guests.Be sure to invite a guest or a center of influence. This helps establish trust with your audience, and you’ll become a go-to expert on a wide range of topics. They’ll know they can come to you for answers.

4. Be personal.On your website, I highly recommend having a video about why you became a financial advisor or who you are and how you help. These topics help prospects learn more about you and remove the potential barrier to booking a meeting with you.

Let Videos Do the Work for You!You only have to put in the effort once and then you’ll have an evergreen piece of content that’s going to attract and connect with clients for years. Put in the time and effort by either investing in the right equipment or hiring a professional videographer to make sure you produce high-quality videos.

Bonus tip: If you have a script, please (I’m begging you) do not read from it; it comes across more like a hostage video and less like trying to connect with your audience.

Partner With a Pro!Do you have any questions or need help getting started? We at Indigo Marketing Agency know the ins and outs of marketing for financial advisors. We know what works and what doesn’t—and videos work!

But you don’t have to go about video marketing on your own! We can assist both with creating your videos and deploying them.

From start to finish, our video process includes:

Topic identification/creationCreating a bulleted script as your guideEditing your videoDeploying on social media, email, and posting on your website

If you have any questions or would like to get started today on boosting your marketing with videos, please click here to schedule your free strategy consultation today. We can’t wait to bring your marketing to life!

The post Redefine Your Newsletter & Unleash Your Potential With Video appeared first on Indigo Marketing Agency.

See How Successful Advisors Are Marketing at The Kitces Marketing Summit (And Save $50 on Your Ticket Now!)

The Kitces Marketing Summit is a virtual event happening April 27, 2023 (12:00 – 4:00 p.m. EST)—and you’re invited!

This highly anticipated event is for advisors, by advisors, and features a behind-the-scenes look at what other successful financial planners are doing in their marketing. The event is hosted by two of the biggest names in our industry: Michael Kitces and Taylor Schulte.

What does this mean for you? As a friend of Indigo, you can save $50 on your ticket when you use code IndigoKitces at checkout.

What’s The Kitces Marketing Summit About?The Kitces Marketing Summit is not a typical event. Instead of telling attendees what they should do, advisor guest presenters show (via screen-share) what they are actually doing in their successful practices to tackle common challenges. There are no vendors, sponsors, or PowerPoint lectures—just real-world conversations with advisors who know what success looks like.

The upcoming Kitces Summit on April 27th will feature how financial advisors are using in-person events, referrals, and digital funnels to grow their business. Six practicing advisors will take attendees behind the scenes and share the inside view of their real-world strategies.

So, if you’re interested in expert advice on overcoming your marketing hurdles—and you want to hear how successful advisors are doing it right—register now. This is one event you don’t want to miss.

Your ticket includes access to event recordings, so if you can’t attend live, that’s okay! You can watch all the videos afterward and still walk away with loads of actionable advice on how to improve your marketing.

Save $50 On Your Ticket Now!Regular tickets start at $297. But Indigo clients can save $50 with code IndigoKitces at checkout.

Get your ticket here: https://www.kitces.com/kitces-marketing-summit/

Use this discount code for $50 off: IndigoKitces

The post See How Successful Advisors Are Marketing at The Kitces Marketing Summit (And Save $50 on Your Ticket Now!) appeared first on Indigo Marketing Agency.

April 5, 2023

Making Your Website Visible: Top Takeaways From Our Joint Webinar With Schwab

Recently, Indigo’s very own Hugo Fernandez was featured in a webinar with Schwab Advisor Services. As CEO of Indigo Marketing Agency and author of The Client Acquisition Blueprint, Hugo has a wide range of knowledge about marketing for financial advisors. He discussed his top tips and tricks for incorporating SEO into your marketing strategy and how to make your website more visible to the A+ clients you’re trying to attract. If you missed the webinar, be sure to check out Hugo’s top takeaways below!

1. Advisors Need a Written Marketing PlanJust as you would tell your clients that a written financial plan, or written investment policy, is key to reaching financial success, a written marketing plan is the foundation for organic and sustainable lead generation. A common misconception is that advisors who partner with well-known industry leaders (like Schwab) don’t need as much on the marketing side. But the truth is, all advisors need a strong marketing foundation that incorporates your ideal client persona and your value proposition.

Just take a look at the graphic below, which highlights findings from Schwab’s 2021 Benchmarking study. They found that firms with written marketing plans, ideal client personas, and client value propositions saw a remarkable 42% increase in clients and a 45% increase in client assets.

Median results for all firms with $250 million or more in AUM. Past performance is not an indicator of future results. 2022 RIA Benchmarking Study from Charles Schwab, fielded January to March 2022. Study contains self-reported data from 1,218 firms. Participant firms represent various sizes and business models categorized into 7 peer groups by AUM.2. Understand the Importance of Keywords, Title Tags, and Meta Descriptions

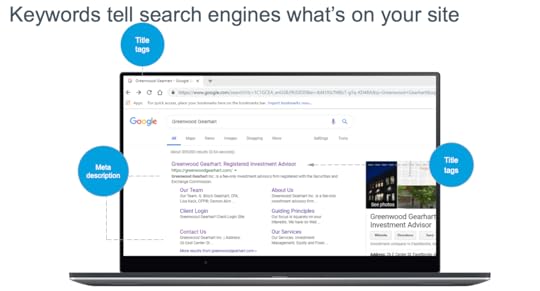

Median results for all firms with $250 million or more in AUM. Past performance is not an indicator of future results. 2022 RIA Benchmarking Study from Charles Schwab, fielded January to March 2022. Study contains self-reported data from 1,218 firms. Participant firms represent various sizes and business models categorized into 7 peer groups by AUM.2. Understand the Importance of Keywords, Title Tags, and Meta DescriptionsDid you know that Google uses over 200 ranking factors to determine who and what ends up on the first page of results?! No wonder most advisors feel overwhelmed at the thought of developing an SEO strategy. In today’s digital age, if you are not up to date on the importance of SEO, you will find yourself behind the curve when it comes to client acquisition.

To put it into context, studies show that 95% of prospects first research a firm online before initiating contact. On top of that, 75% of internet users don’t scroll past the first page of search results! Landing on that first page of results is key to reaching prospective clients, but it doesn’t come by happenstance. Keywords, title tags, and meta descriptions are the tools advisors can use to boost their visibility.

KeywordsThere are three types of keywords advisors should be familiar with:

Branded keywords include things like your firm name or advisor name.Location-based keywords include geographic inputs that make it easier for local prospects to find you (e.g., Financial advisor in Los Angeles, CA).Service and industry keywords are those that indicate your specialty or niche as well as any unique services you provide. (Think: Financial planning for veterans or active-duty service members)

A successful SEO strategy will incorporate all three types of keywords, making sure they’re always geared toward your ideal client and clearly communicating your value proposition.

Title Tags & Meta Descriptions

Title Tags & Meta DescriptionsTitle tags and meta descriptions are HTML elements that provide information about a web page to search engines and users. The title tag is the title of a web page that appears on search engine results pages and at the top of the browser tab when the page is open. The meta description is a brief summary of the content that appears below the title tag on search engine results pages.

These elements are important for financial advisors because they are the first thing potential clients see when they search for financial advice online. A well-crafted title tag and meta description can act as attention-grabbers and entice prospects to click on the link to your website.

Make Data-Driven DecisionsAs with most things in the financial industry, it’s important that your SEO keywords are coming from a data-driven place. Don’t just take a guess. Instead, be sure to use existing tools to research appropriate keywords and track their performance after implementation.

Google Analytics is a free tool that tracks website traffic and provides insights into user behavior, such as how visitors navigate the site and how long they spend on each page. This data can help you optimize your website for better user experience and engagement. Another useful tool is Google Search Console, which provides data on how your website performs in search results and can identify any technical issues that may be affecting its performance.

Additionally, tools such as Semrush and Ahrefs can provide keyword research, backlink analysis, and competitor analysis.

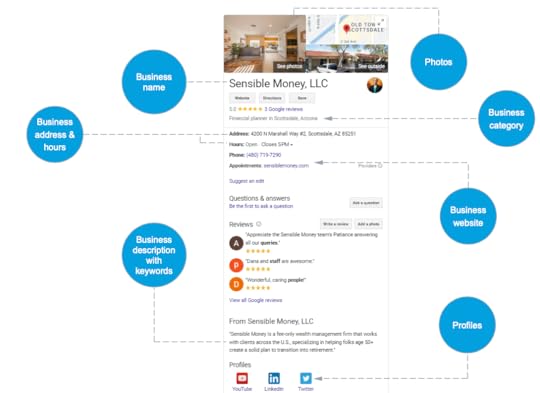

3. Optimize Your “Off-Page” ContentOff-page content is what you can do outside of your website to improve your SEO and increase visibility in search results. The most impactful strategy financial advisors can take is to optimize their Google Business Profile. This is because Google provides preferential SEO treatment to firms that have registered with Google My Business, even if the actual content of your profile is lacking in terms of SEO. Those who register with GMD and optimize their content will be much more likely to land on the first page of search results.

Take a look at the image below to see how you can better optimize your profile.

First, you’ll want to make sure all your information is up to date and accurate. Business name, address, hours, contact information, and website are critical categories since these are the first things prospective clients will see. Next, be sure to include data-driven keywords in your business description and business category. Lastly, don’t forget to add photos and links to your social profiles. This helps to humanize your profile and makes you much more appealing to prospective clients.

4. Putting it All TogetherImplementing a strategic content strategy can have a significant impact on your SEO rankings. The more high-quality, keyword-rich content you produce, the easier it is for search engines to rate your site’s relevance. Content comes in many different forms, including written content, videos, podcasts, and frequently asked questions on your website.

If it sounds overwhelming to create that much content, we suggest focusing on one high-quality piece of content per month that you can post about and email to your contacts. Sustain this content plan for 12 months and track your marketing metrics along the way.

Indigo Can Help

Indigo Can HelpAt Indigo Marketing Agency, we specialize in custom marketing solutions for independent financial advisors. From SEO, web copy, and branding, to custom blog posts, webinars, and social posts, we provide start-to-finish marketing services that tell your story. If you have more questions about your SEO strategy, or would like to chat about your marketing needs, reach out to us for a free consultation.

The post Making Your Website Visible: Top Takeaways From Our Joint Webinar With Schwab appeared first on Indigo Marketing Agency.

March 27, 2023

Culture Is King by Larry Sprung, CFP®

Culture is a term that has been used frequently in the last several years, and is gaining ground in the importance it serves in business. I decided to get a textbook definition of what culture is, and I continue to be surprised that this was not something that was addressed by the masses earlier. Culture, as defined by the Merriam-Webster Dictionary, is the set of shared attitudes, values, goals, and practices that characterize an institution or organization.

Culture, in a positive way, is a tool that can be used to attract the right people to your business, both stakeholders and clients. It can also be used to repel both as well. Stakeholders, or employees, want to be aligned with an organization that shares their attitudes, values, and goals. Similarly, potential clients of your business want the same. Your culture can also be used as a tool to detract those that are not aligned with your culture. Having the right culture in your business is King.

Disney is one of those businesses where culture is King. It has been written time and time again about how they make a concerted effort to assure that everyone involved in the business understands how things should and need to be done to foster the environment they have established.

It does not matter what your role is in the company, everyone understands what their role is, from top to bottom, to create the environment that people want to be a part of and continually attract the best and brightest to come and work. This culture that is ingrained within the organization exudes to the outside and continues to attract families willing to experience things the Disney way, creating clients for life that are raving fans. In addition, the culture at Disney is so strong and respected that they started the Disney Institute. The Disney Institute helps train professionals, teams, and organizations worldwide based on the insights and best practices of Disney Parks and Resorts. Imagine how strong their culture must be that they created a platform that people are wanting to pay to learn how they can implement their “way” into their own business.

We understand the importance of creating the best culture possible here at Mitlin Financial. We feel that by creating and maintaining a strong culture, we will continue to attract the right stakeholders and clients—which is where the magic happens.

When you have an organization that has all of the above (the right culture, the right stakeholders, and the right clients), it creates an environment that does not feel like work and provides the ability to have a tremendous impact. Working with families every day to help them work toward their goals is incredibly rewarding, and as a firm, we want to have as great an impact as possible; and culture is where it all begins!

This article represents the opinion of Mitlin Financial Inc. It should not be construed as providing investment, legal, and/or tax advice. Investing involves risk, including possible loss of principal. No strategy assures success or protects against loss. To determine what may be appropriate for you, consult your financial advisor.

About LarryLawrence “Larry” Sprung, CFP®, is the founder and wealth advisor at Mitlin Financial, Inc.

As a fiduciary advisor, he and his team are dedicated to facilitating the customization of clients’ portfolios as they work toward reaching their financial objectives. Larry and the Mitlin team prioritize clients first and consistently help clients make healthy financial decisions and offer a tremendous client experience that leverages today’s top tools and technology.

Larry is also host of Mitlin Money Mindset™, a podcast that’s all about getting your mind right when it comes to all things money. He has appeared on numerous industry podcasts as a guest speaker and was recently featured on CNBC where he spoke about money and parenting. To learn more about Larry, connect with him on LinkedIn.

How Indigo Can HelpMarketing plays a significant role in communicating your firm’s culture to prospects. By crafting messaging and visuals that align with your values and mission, you can effectively convey your unique identity as a financial advisor and differentiate yourself from competitors.

From your website and social media to your advertising and blog articles, every touch-point with prospects is an opportunity to showcase your value proposition and build trust and loyalty with your audience.

Remember, your company culture is a powerful asset that sets you apart and communicates why prospects should work with you. The Indigo team is ready to help you design a powerful marketing strategy that will enhance your firm’s culture through our custom content solutions and advertising services. With our expert guidance, you can attract more clients and grow your business like never before. Contact us today and let’s get started!

The post Culture Is King by Larry Sprung, CFP® appeared first on Indigo Marketing Agency.

March 24, 2023

Maximizing Your Network: Why Collaborating With CPAs Is A Game Changer For Financial Advisors (And How To Do It Successfully)

As a financial advisor, building a robust network of referral sources is key to growing your business and delivering high-quality service to your clients. One group which financial advisors often consider partnering with are certified public accountants (CPAs). Yet, despite connecting with CPAs, many financial advisors still struggle to turn a networking moment into a sustainable referral source.

Here are some of the most common reasons why financial advisors struggle to collaborate with CPAs and actionable steps you can take to build a two-way referral pipeline.

Why Collaborate With CPAs?First and foremost, let’s review why CPAs make one of the best referral sources for financial advisors.

Expertise in Tax Planning & Compliance: A CPA can help you identify tax-saving opportunities and help keep your clients in compliance with tax laws, reducing the risk of costly penalties and fees.A Broader Perspective on Financial Planning: Financial planning and tax planning are so closely related that clients expect you to have contacts who are CPAs. Those advisors without a network of knowledgeable tax professionals may be viewed as less competent or less experienced than others. Working closely with CPAs helps you provide a more comprehensive suite of services to your clients and enhance your value proposition.Improved Client Relationships: Collaborating with a tax professional allows you to become a better resource to your clients, which can increase their loyalty and trust of your brand. This makes you more referable, both from a client standpoint and a professional network standpoint.

Having a CPA in your corner is a valuable resource and benefit to offer clients. Not only have you taken the time to vet them for their expertise, but they complement your services and make you that much more adaptable to clients’ everyday needs.

Common MistakesIf working with a CPA is so great (and so many advisors and CPAs are already connected), why is it so difficult to generate actual referrals? Here are some of the most common mistakes we see financial advisors make.

Are You Missing a Compelling Value Proposition?Financial advisors often fail to articulate the value they can offer to CPAs. A clear and compelling value proposition can help establish a mutually beneficial relationship and make it easier for CPAs to refer clients. In that same vein, it can be difficult for CPAs to distinguish between the strategies of different advisors. Be sure to differentiate yourself from your competitors in order to stand out and make it easy for CPAs to work with you.

Do You Have an Easily Identifiable Niche?A financial advisor with a specific niche can provide greater value to CPAs. One, it makes you easy to distinguish from other financial advisors, and two, CPAs know exactly who you serve. CPAs will be more likely to refer to financial advisors who specialize in working with a particular industry or profession that is clearly identified with strong, consistent messaging.

Are You Forgetting the CPA in the Equation?Collaboration between financial advisors and CPAs is about more than just referrals. You need to demonstrate how you can work with CPAs to benefit the client. There are several ways to incorporate a CPA into your planning process, including:

Communicating major changes: Make it a point to notify your clients’ CPAs of any major changes that may have negative tax consequences. This can allow you both to work together to come up with solutions before tax season.Provide 1099s or cost-basis information: Proactively provide CPAs with all necessary tax documents, such as 1099s and cost-basis information. Designating someone in the office to help gather this information can make the process smoother.Provide case studies: Consider providing CPAs with case studies of how you’ve helped clients to showcase the value you offer and help establish a strong referral network. If you don’t know where to start with creating a case study, check out our case study examples or book a free strategy call to discuss! Build Your CPA Connections TodayGet started building successful relationships with CPAs and expanding your network with these actionable steps.

Ask Your Clients for ReferralsOne of the easiest ways to connect with a CPA is by asking your top clients for referrals. Your clients likely have a trusted CPA they work with or know someone who does; this can be a great starting point for building a relationship with a new CPA and a value-add for your services. Let your clients know you will keep their CPA information on file for proactive tax planning or tax-related questions.

Reach Out to CPAsOnce you have the contact information for your client’s CPA, reach out to introduce yourself and your services. Explain that you work with their client and want to provide the necessary tax documents or projections. Don’t be afraid to set up a meeting to ask if they are accepting new clients and discuss how you can help some of their higher-net-worth clients (just make sure it’s not during the height of tax season!).

Deliver a Tax Survival Gift BasketDuring tax season, CPAs are often swamped with work. Show your appreciation by sending a Tax Survival Gift Basket with a note expressing your interest in connecting with them when things settle down. Get your free CPA survival kit here.

Showcase the Benefits of a PartnershipWhen you do meet with a CPA, be sure to showcase the benefits of a partnership. Explain how you can provide value to them (e.g., proactive planning, identifying Roth conversion strategies, tax-loss harvesting opportunities, coordination and implementation of tax-related recommendations). This can be a valuable asset to a CPA and can lead to a successful partnership.

Invite Them to Speak or WriteInvite a CPA to speak at an event or write a guest article for your blog or newsletter. This is a great way to build a relationship, establish credibility, and recognize their expertise and professional accomplishments.

Create a Specific CampaignCreate a specific campaign email series directly targeting CPAs. Provide valuable resources or insights they can use in their own practice or share with their clients. This helps you differentiate yourself as a specialist and build a valuable relationship with the CPAs in your network.

Have More Questions?If you’re ready to start building a robust referral network, but don’t know where to start, we would love to hear from you! Schedule your free strategy session today to learn more about how we can level up your marketing and boost your referability.

The post Maximizing Your Network: Why Collaborating With CPAs Is A Game Changer For Financial Advisors (And How To Do It Successfully) appeared first on Indigo Marketing Agency.

March 21, 2023

Let’s Talk About AI

Artificial intelligence is revolutionizing how business gets done in just about every industry. A prime example is ChatGPT, the remarkable AI chatbot that can converse like a human and even write articles with amazing accuracy—all using its transformer algorithm that mimics the way the human brain works.

Here at Indigo Marketing Agency, we’ve been pondering what implications this might have for us, as well as other businesses out there looking to use artificial intelligence in their marketing strategies. Let’s explore the pros and cons of utilizing such technology so you can make informed decisions moving forward!

The Hot Topic of AIAccording to CNBC, Morgan Stanley is transforming their advisors’ knowledge base with a state-of-the art chatbot powered by OpenAI. With this tool, the bank’s 16k+ advisors can access an expansive pool of research and data to give clients reliable advice on financial matters—as if they had an expert at their side. While AI cannot yet replace industry professionals, it will provide invaluable support in helping them stay informed and up to date.

At the recent Technology Tools for Today (T3) Conference, AI was a popular talking point in sessions. One of the most useful discussions, given by Raj Madan at AdvisorEngine, covered the following:

ChatGPT can help an advisor and team within wealth management create content.ChatGPT can be used to quickly produce the equivalent of code (e.g., Excel formula) for those who need to do operations within wealth management.ChatGPT requires oversight and cannot be blindly trusted at this time to auto-create content.Generative AI in general has serious concerns on plagiarism (lawsuits are already underway).

You can attend AdvisorEngine’s webinar on the topic here.

Using ChatGPT as an example, enter the following question: “What are a few fun client event ideas in Tampa, FL?”

ChatGPT’s response:

Sunset Cruise: Organize a sunset cruise on a yacht or catamaran in Tampa Bay. Your clients can enjoy a beautiful sunset while networking and socializing.

Beach Volleyball Tournament: Set up a beach volleyball tournament at a nearby beach like Clearwater Beach or St. Pete Beach. It’s a great way to get clients active and having fun.

Escape Room Challenge: Book an escape room challenge at one of Tampa’s many escape rooms. This will encourage teamwork and collaboration among your clients.

Thanks, ChatGPT!

Use AI to Email Updates to ClientsQuickly send an email to clients about an update they should be aware of; e.g., stock splits, back-office changes, when to expect 1099s in the mail, etc.

Use AI to Flesh Out Article NotesThe custom articles our team writes for our financial advisor clients’ blogs sometimes require notes. You can use AI to help you express your ideas, which we will then customize to ensure we communicate your perspective in your voice, and that it remains strategic without being plagiarized. Your specialty is helping your clients achieve financial freedom; our specialty is increasing your online presence to bring those A+ clients to your door.

Use AI for Social Media PostsLooking for a quick social media post to summarize a client event or share real-time thoughts on a market decline? AI can be a great tool to get your point across succinctly and effectively.

Beware of BugsDespite being incredibly powerful, AI can still make mistakes. To ensure accuracy in the financial industry, where even minor errors have serious implications, Morgan Stanley is working to improve their tool by actively involving humans when verifying responses. Jeff McMillan, head of analytics and data at the firm’s wealth management division, admitted, “Machines can’t replace people when it comes to catering to sophisticated clients”—which is precisely your bread and butter as an independent financial advisor.

Indigo’s AI UsageAt this time, Indigo is not using ChatGPT for our clients, but we have been testing it out for our use internally.

Our findingsWe prefer to use AI to summarize a piece of content, however, we’ve found a lot of repetitive phrasing and lack of source citing.The capabilities of AI softwares are limited, and it remains to be seen how compliance will work with AI and the lack of citing sources for information given.Advisors understand the financial industry better than ChatGPT.

With a firm grasp on the nuances of the financial industry, Indigo Marketing Agency crafts marketing content that makes your brand stand out! Our reliable approach includes implementing search engine optimization (SEO) and keywords as part of an effective overall strategy—giving you confidence in consistent results. With our marketing experts in your corner, you can trust that your message will reach its desired audience!

We work exclusively with financial advisors and understand how your prospects think. Can AI say the same?

If you have questions about how you can leverage artificial intelligence in your marketing or if your marketing strategy could use some help, reach out to one of our marketing experts today!

The post Let’s Talk About AI appeared first on Indigo Marketing Agency.

March 14, 2023

How to Communicate the Silicon Valley Bank Failure to Your Clients

The collapse of a bank is a significant event—one that can cause shockwaves throughout the financial industry. In the case of the Silicon Valley Bank failure, it can be particularly alarming for those invested in the technology sector. As a financial advisor, it’s crucial to effectively communicate this event to your clients to help them understand the potential impact it may have on their investments and overall financial well-being.

Why Financial Advisors Should Communicate the Silicon Valley Bank FailureThe Silicon Valley Bank failure could have a significant impact on the tech industry and the broader economy. You know events like this are possible, but when they actually happen, your clients will inevitably get nervous, feel a knot in their stomach, and want to hear from you immediately. It’s your job to talk them off the ledge by keeping them calm and informed. By doing so, you can help them make informed decisions about their financial future.

Proactive communication is good client service. Your clients hire you to not only help plan for their financial future, but to educate them in good times and in bad. They are eager to hear from you to receive an explanation of what’s going on—and guidance on what they should (or shouldn’t) do about it.

Staying in touch results in fewer phone calls and panicked clients. If you’re able to act quickly, clients are more likely to trust that you’re prepared for the volatility and they’ll feel they’re in good hands. This results in less time spent educating and calming individual skittish clients.

How Financial Advisors Should Communicate the Silicon Valley Bank FailureBe transparent: The first step in effectively communicating the Silicon Valley Bank failure is to be transparent with your clients. Let them know what happened and what the potential impact may be. This could include discussing how their investments may be affected and steps they can take to mitigate potential losses.Provide context: It’s important to provide context around the Silicon Valley Bank failure to help your clients understand the bigger picture. This may involve reviewing how the tech industry has been performing overall and how this event fits into the broader economic landscape.Emphasize the long-term perspective: While a bank failure can be concerning, it’s important to emphasize the long-term perspective. Market crashes and economic downturns are a natural part of the economic cycle, so it’s good to remind your clients that these events typically have a limited impact on their long-term financial goals—and you’ve built their financial plan and investment strategy for the long term, with short-term volatility in mind.Offer solutions: As a financial advisor, it’s your job to help your clients navigate difficult financial situations. In the case of the Silicon Valley Bank failure, consider offering solutions to mitigate any potential losses, such as diversification strategies or alternative investments that may be less impacted by this event. Encourage clients to get in touch if they have questions, are feeling nervous, or want to review their accounts.Free Template: Reach out to our marketing specialists for our crafted template (“SVB & Signature Bank Collapsed: Why Banks Fail & How to Protect Your Savings”) which explains this event, addresses your clients’ concerns, and offers a way to reach out to you for help.Demonstrate Your Value

The bottom line? The Silicon Valley Bank failure is a significant event that financial advisors should communicate to their clients. Financial advisors are a valuable asset during tumultuous times, helping their clients strategize for long-term success and financial stability. Use this opportunity to demonstrate your value to clients: Be transparent. Provide context. Emphasize the long-term perspective. Offer solutions.

Effective communication necessitates staying informed about the latest news and developments through news outlets, industry publications, and government websites. Does this level of communication feel overwhelming? Let Indigo take it off your plate! Our comprehensive marketing solutions keep your clients informed while you focus on what you do best—guiding your clients to their ideal financial future.

The post How to Communicate the Silicon Valley Bank Failure to Your Clients appeared first on Indigo Marketing Agency.

March 6, 2023

Culture Is King by Larry Sprung, CFP®

Culture is a term that has been used frequently in the last several years, and is gaining ground in the importance it serves in business. I decided to get a textbook definition of what culture is, and I continue to be surprised that this was not something that was addressed by the masses earlier. Culture, as defined by the Merriam-Webster Dictionary, is the set of shared attitudes, values, goals, and practices that characterize an institution or organization.

Culture, in a positive way, is a tool that can be used to attract the right people to your business, both stakeholders and clients. It can also be used to repel both as well. Stakeholders, or employees, want to be aligned with an organization that shares their attitudes, values, and goals. Similarly, potential clients of your business want the same. Your culture can also be used as a tool to detract those that are not aligned with your culture. Having the right culture in your business is King.

Everyone Understands Their Role

Disney is one of those businesses where culture is King. It has been written time and time again about how they make a concerted effort to assure that everyone involved in the business understands how things should and need to be done to foster the environment they have established.

It does not matter what your role is in the company, everyone understands what their role is, from top to bottom, to create the environment that people want to be a part of and continually attract the best and brightest to come and work. This culture that is ingrained within the organization exudes to the outside and continues to attract families willing to experience things the Disney way, creating clients for life that are raving fans. In addition, the culture at Disney is so strong and respected that they started the Disney Institute. The Disney Institute helps train professionals, teams, and organizations worldwide based on the insights and best practices of Disney Parks and Resorts. Imagine how strong their culture must be that they created a platform that people are wanting to pay to learn how they can implement their “way” into their own business.

Right Culture, Right Fit

We understand the importance of creating the best culture possible here at Mitlin Financial. We feel that by creating and maintaining a strong culture, we will continue to attract the right stakeholders and clients—which is where the magic happens.

When you have an organization that has all of the above (the right culture, the right stakeholders, and the right clients), it creates an environment that does not feel like work and provides the ability to have a tremendous impact. Working with families every day to help them work toward their goals is incredibly rewarding, and as a firm, we want to have as great an impact as possible; and culture is where it all begins!

This article represents the opinion of Mitlin Financial Inc. It should not be construed as providing investment, legal, and/or tax advice. Investing involves risk, including possible loss of principal. No strategy assures success or protects against loss. To determine what may be appropriate for you, consult your financial advisor.

About LarryLawrence “Larry” Sprung, CFP®, is the founder and wealth advisor at Mitlin Financial, Inc.

As a fiduciary advisor, he and his team are dedicated to facilitating the customization of clients’ portfolios as they work toward reaching their financial objectives. Larry and the Mitlin team prioritize clients first and consistently help clients make healthy financial decisions and offer a tremendous client experience that leverages today’s top tools and technology.

Larry is also host of Mitlin Money Mindset , a podcast that’s all about getting your mind right when it comes to all things money. He has appeared on numerous industry podcasts as a guest speaker and was recently featured on CNBC where he spoke about money and parenting. To learn more about Larry, connect with him on LinkedIn.

, a podcast that’s all about getting your mind right when it comes to all things money. He has appeared on numerous industry podcasts as a guest speaker and was recently featured on CNBC where he spoke about money and parenting. To learn more about Larry, connect with him on LinkedIn.

How Indigo Can Help

Marketing plays a significant role in communicating your firm’s culture to prospects. By crafting messaging and visuals that align with your values and mission, you can effectively convey your unique identity as a financial advisor and differentiate yourself from competitors.

From your website and social media to your advertising and blog articles, every touch-point with prospects is an opportunity to showcase your value proposition and build trust and loyalty with your audience.

Remember, your company culture is a powerful asset that sets you apart and communicates why prospects should work with you. The Indigo team is ready to help you design a powerful marketing strategy that will enhance your firm’s culture through our custom content solutions and advertising services. With our expert guidance, you can attract more clients and grow your business like never before. Contact us today and let’s get started!

The post Culture Is King by Larry Sprung, CFP® appeared first on Indigo Marketing Agency.