Scott Galloway's Blog, page 20

March 4, 2022

Yachts & War

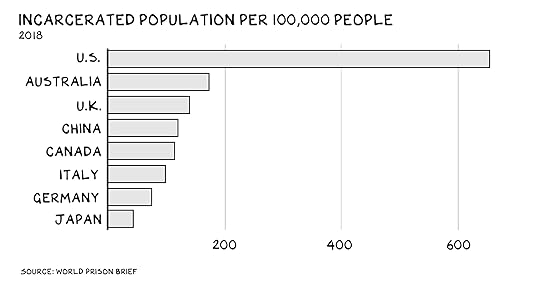

Capitalism gets a bad rap. It’s subject to weaponization by elites (cronyism), and the inequality it creates gives rise to caricatures of wealth as immoral and the wealthy as bad people. But this system has brought about more prosperity in the past century than any other force in the entirety of prior human experience. Capitalism encourages positive social behaviors, triggering self-preservation instincts that inspire cooperation.

As Yuval Noah Harari has written, what led to the human species commanding life on Earth was our proclivity to communicate and cooperate in large groups. Capitalism taps this: The tools we use to increase wealth — entrepreneurship, entering new markets, achieving scale — don’t work without collaboration. No war has ever been won, no company built, and no significant amount of wealth amassed without the help of allies. A businessperson who doesn’t build connective tissue within a company, throughout an industry, and across borders is much less likely to succeed.

This connective tissue creates leverage and exponential growth. The lifestyle wealth affords someone in 2022 is an order of magnitude more stunning and diverse than it was a generation ago. Wealth doesn’t get you a bigger TV to watch science fiction; it puts you in space. Wealthy people now don’t just live longer, they enjoy eight or nine more “disability-free” years than the poor. How society allocates the spoils of success is a worthwhile debate, but that’s another post. The reality, like it or not, is that being rich in the modern world is something people will (correctly) devote extraordinary effort and creativity to achieve and keep.

We’re obsessed with wealth not only because it’s scarce — more than half of the world’s adults have a net worth below $10,000 — but also because it can be taken away. Free markets are a form of democracy, and we vote with our dollars. Wealth creates a shield, but the material is penetrable. If your business is producing enemies, at some point they will come for you and your money. Dial it up to the national level, and your currency will collapse.

Fifty years ago, Czechoslovakia attempted to turn away from the USSR and gaze west. It liberalized restraints on the press and the arts and began to open its economy. The Soviets sent in 250,000 troops and 5,000 tanks, deposed the government, and imposed their own. Western nations protested but, unwilling to go to war with a nuclear power, they did nothing of substance, and the USSR incurred no penalty.

Vladimir Putin was 15 when those tanks rolled into Prague. One lesson he likely drew confirmed the upshot of every previous military confrontation: The side with the most armaments wins. However, things may be changing. The most powerful carrier squadron in the world today is the dollar, and it appears that the delta in traditional firepower may not be the sole determinant of the outcome.

What’s not on that chart? Eight days into the war, Russia’s currency has shed nearly 30% of its value. Within hours of tanks crossing Ukraine’s border, the U.S. pulled the plug on all financing to Russia. Soon after, the Western allies threatened to block Russia from the global Swift payment system and froze its central bank assets. And then … the unthinkable: Apple stopped selling iPhones in Russia. The supermajor oil companies are pulling up stakes, and Big Tech is banning Russian media outlets. Even soccer and kids’ movies have cut ties with Russia.

Cinquante-CinqEverybody has a boss — even Putin. Two decades ago, he won over the public by promising to eliminate the oligarchy while covertly ensuring the protection of a select few. That meant the “decline of some oligarchs and the elevation of others,” and his job today is no different from when he took over: handling disputes and allocating resources among billionaires, GoT-style.

Similar to a medieval hamlet, the resources in question are almost always finite minerals. Roman Abramovich, who recommended Putin for office to his predecessor Boris Yeltsin, paid billions for political favors and protection fees for shares of Russia’s oil and aluminum. Oleg Deripaska, Putin’s “favorite industrialist” (who recently helped him launder money), was famously berated by the president on live television for not producing enough cement. More than half the nation’s billionaires sit on stockpiles of oil, gas, coal, or metal, and the 500 richest Russians own … 40% of the nation’s wealth. In no other country do billionaires control so large a share of the national economy.

Being a Russian elite 50 years ago was different. When Brezhnev sent tanks into Prague, his buddies weren’t worried about docking their yachts in the south of France. At most, wealth meant purchasing an abandoned castle off the coast of Leningrad. In 2022 it means flying to your 200-acre Aspen ranch in a Gulfstream 650ER. Also: having mansions in St. Tropez, St. Barts, Tel Aviv, Monte Carlo, and Kensington, three Central Park penthouses, a majority stake in a European football club, a Boeing 787-8 Dreamliner, and two 500-foot yachts. BTW, a fleet of the 20 largest Russian-owned luxury yachts is worth more than Ukraine’s defense budget.

“You may not be interested in war, but war is interested in you.”

—Leon Trotsky

The oligarchs will live and die by the Kremlin until they stop getting tables at Club 55. But the true crisis of allegiance begins when the Port de Saint-Tropez starts denying their boats from docking. Europe knows this: France is hunting oligarch-owned yachts for seizure, and the EU Commission has banned Russian aircraft (private jets included) from flying over the continent.

Forty-four of the 200 richest Russians do not live in Russia. The second-most popular place of residence for this cohort is London, where the 11th-richest Russian just relinquished his decades-long management of a Premier League football club and is looking for a buyer.

DisconnectedPutin shares common features with Amin, Gaddafi, and Hussein. Men in their sixties who became so insulated they could no longer read the label from inside the bottle. The connective tissue of capitalism is likely a feature Putin has underestimated.

The price of warfare is enormous. In addition to death and destruction in Ukraine, the price of fuel and grain will rise everywhere, putting additional pressure on poor nations. And then there’s the anxiety of knowing we’re only a few bad decisions by old men away from true horror.

The costs to Russia will be especially large. Its economy relies heavily on trade with other nations: Exports and imports account for 46% of GDP. That number is comparable to those of EU nations (which take pride in diplomacy with their trade partners), but dramatically larger than in other world powers (i.e., the U.S. and China). Two-thirds of Russia’s exports are oil and gas. The EU (which Ukraine is in the process of joining) is Russia’s largest trading partner. Almost all of Russia’s assets are held in foreign central banks. Put the pieces together, and you get an unstable economy unfit to make enemies.

Even if Russia attempted to operate independently, it wouldn’t get far. Despite controlling the world’s largest landmass and having one of the largest populations, Russia’s economic output is small. On a per-capita basis, Russia’s GDP is below the world average. Its total GDP is similarly unimpressive, a quarter of Japan’s.

Capitalism isn’t a cure-all for bad actors. And even in the case of sins on the scale of Russia’s invasion of Ukraine, there’s no guarantee of sustained cooperation by the majority of market participants. Saudi oligarchs find parking for their yachts despite MBS’s penchant for bone saws and wars of attrition. That said, if taking away soccer teams and Disney movies changes the course of history in Ukraine, the U.S. and the EU might reconsider their relationship with the sheikhs.

Maybe the best example of the power of capitalism’s connective tissue is the dog that hasn’t barked: I believe a key deterrent against China’s ambition to absorb Taiwan is the iPhone. An invasion by China may or may not risk a military response. (If we refuse to make Ukraine a no-fly zone, are we really going to land marines on beachheads along Taiwan’s southwestern plain?) But it warrants a capitalist response. The net effect of a Chinese invasion would be to sever ties with its partners, and Xi Jinping’s people would be angry if a quarter of their mobile phones switched off overnight. Even angrier if their economic miracle became sclerotic as supply chains rerouted.

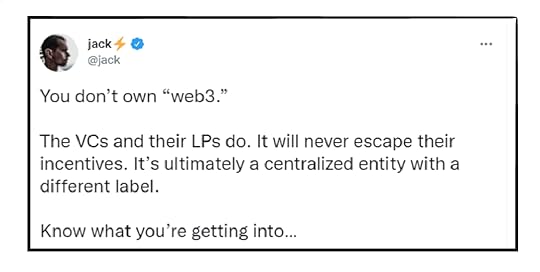

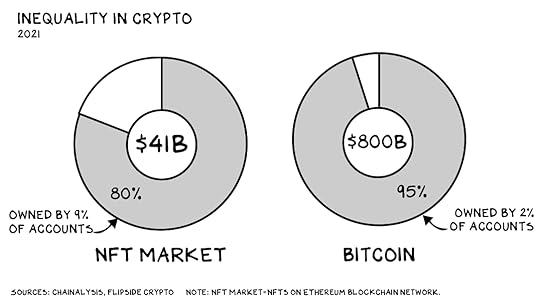

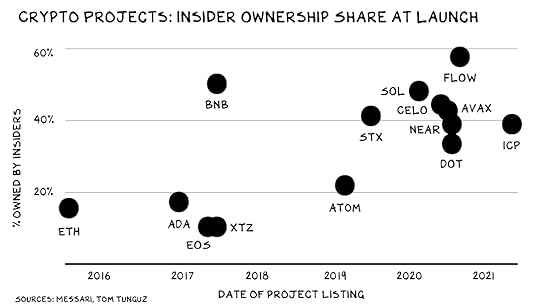

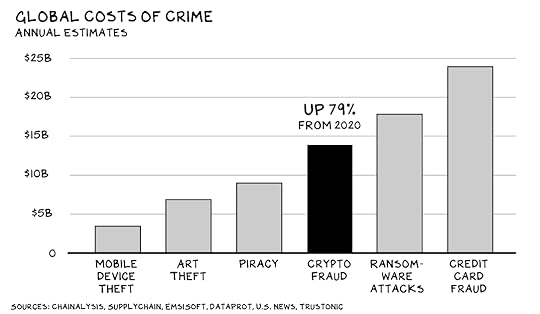

KryptoIf tanks are less effective in the face of capitalist’s connective tissue, what might be the kryptonite to the dollar’s superpowers? That was a clue. It’s crypto. Democratic rule (i.e., government control) over global systems of trade and commerce enables us to put sanctions in place. Crypto wants to evade them, and there will be new wind in the sails of Bitcoin as nations realize the problem with dependence on dollars held in Western banks: They’re yours until they’re not. Fortunately, crypto companies will abandon the decentralized mission when it matters. In response to Putin’s war, Binance, the world’s largest cryptocurrency exchange, is about to do the very thing it said it never would: block transactions. Viva la centralizatión.

All of this means life is shaping up to be lonely for Mr. Putin. He’s reportedly been in self-isolation since the pandemic began, and we’ve seen numerous photos of him sitting far away from other humans, appearing alone and disturbed. He can silo himself personally, but neither his wealth, his yacht, nor his nation will survive in isolation. Money is an addictive substance. The U.S. and Europe are the biggest dealers, and Russia has been using for several decades now.

Life is so rich,

The post Yachts & War appeared first on No Mercy / No Malice.

February 25, 2022

Down Round

A week of contrasts that mark the age: A Russian president launches the invasion of a sovereign nation ahead of schedule; and a (former) U.S. president can’t launch a microblogging platform on time. At least our innovators will keep inspiring us. My favorite headline this week: “Artist Blows up Lamborghini Huracan to Sell Videos of Shrapnel as NFTs.” But I digress.

What’s thankfully diverted my attention from the full-scale war in Europe is spelled out below. As in look out below. Way below.

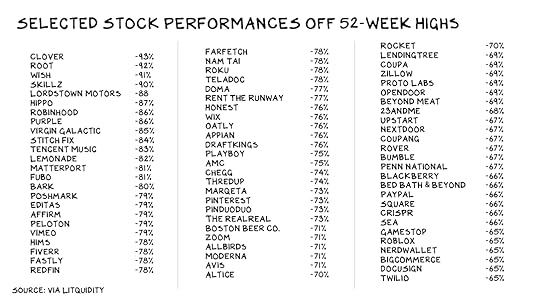

These aren’t cryptocurrencies. They’re stocks — many of them, large-cap stocks. OK, there are a few meme stocks in there, but there’s a mess of good, even great, companies that have shed more than two-thirds of their market value: Paypal, Zillow, Bumble, Roku, etc. Aggregate the losses above and you get … $2.2 trillion. So the aforementioned businesses have lost the equivalent of the GDP of Canada.

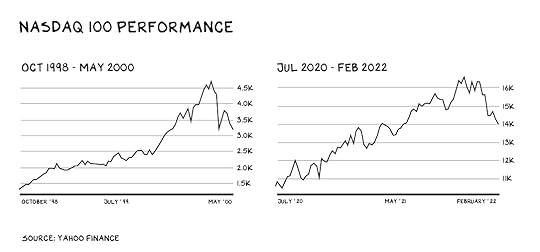

History doesn’t repeat itself, but it rhymes. Check that — it is repeating itself. If you’re too young to have seen Heathers, what’s going on may feel alien or as if it will soon revert back to “normal.” But if your perspective is broader (i.e., older), you probably recognize this is what the beginning of a bear market looks like.

The last big swing in the market followed the 2008 meltdown. For tech that was only a speedbump, not a tractor-trailer pileup. We need to venture back to the turn of the millennium for a deep, cyclical transition in tech. It’s feeling very 2000: record venture funding, record quit rates, day trading frenzies, a mass tech movement that promises to better humanity. BTW, my favorite movie of 2000 was Magnolia. That same year, I moved to New York to join the faculty of NYU and registered a (paper) wealth decline of 95%. Good times.

Public markets synthesize billions of signals every second and distill these bits and emotions into an indifferent number that points to a direction. Private markets take longer to reflect reality, because private ownership changes hands less often, and out of view. But private markets inevitably come in line, and just like the tail of a whip, the smaller market can deliver greater pain.

Growth hedge funds are registering their worst numbers in years. Earlier this month, Tiger Global announced it was pulling back from funding large, late-stage startups. So did D1 Capital, another growth specialist. Q: Why? A: Simple. They believe there is now better value in the public markets.

Eyes Wide ShutIf you’re under 35, the year 2000 might as well have been the Middle Ages. Which means founder/CEOs are about to add a new phrase to their vocabulary: “down round.”

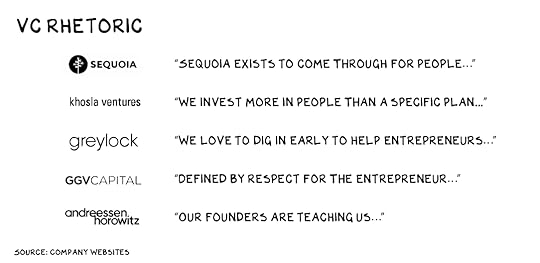

For two decades, the script, lighting, and backdrop have all centered around one narrative: Grow … at any cost. More raising, hiring, building — the fun parts of running a company. All the while, investors rubbed the smalls of CEO’s backs and channeled their inner Billy Joel: “I love you just the way you are …”

There’s no way, short of experience, to appreciate how violently things can turn. I’ve been on this ride: It’s nauseating and, though it’s lightning fast, feels as if it will never end … leverage shifts from ideas (founders) to capital (investors). In a bull market, money is everywhere, chasing ideas and founders. When money becomes scarce, its stewards accrete power. Adam Neumann may have been peak founder; super-voting shares and his investors’ fear of losing face gave Mr. Neumann leverage that garnered him a 10% commission on $12 billion in losses. This fulcrum of advantage, like a clock’s pendulum, is rarely in a place of equilibrium. The asymmetric advantage can and will flip to capital.

Power is the medium through which this conflict plays out. Power on the cap table, on the board, to determine the exit and who gets liquidity. Dilution becomes punishing as capital becomes more dear. Companies are forced to raise money at a valuation below that of their prior round: the dreaded “down round.” But they have no choice, because they’re built to burn and need the fuel. So investors take bigger and bigger chunks, while founders’ shares dwindle. In three financing rounds from 1999 to 2002, onerous terms (see above: asymmetric leverage) reduced my ownership in Red Envelope from 30% to 6%.

After years of acting as the doormen, DJs, and dealers at the disco party, VC firms begin scolding CEOs for their profligate spending and demand they sober up. Boards, correctly, ask management to construct a plan that acknowledges the new reality, which is Latin for “fire people.” Over the past three decades, I estimate I’ve hired (personally) 400+ people and fired 100. It’s always awful. It never gets easier.

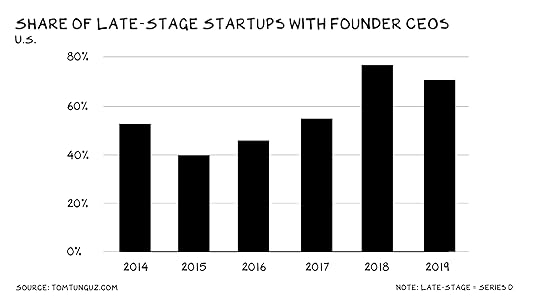

Founders rarely get fired, but you should expect to see a rise in tweets announcing how thrilled these thirtysomething wunderkinds are to have the wisdom of a new CEO (who the board forced in above them). The share of late-stage startups that are founder-led has been growing, but that will come to an end this year. Prediction: By 2025, the trend in the chart below will be sharply down.

If this is the beginning of a correction, Big Tech will be (wait for it) a winner. For years the narrative has been how difficult it is to hire talent, and how startups with limitless upside are poaching from established players. In 2001, B2C and B2B (as in, business-to-consumer commerce and business-to-business commerce) went from being the two pillars of the dot-com venture-backed boom to being derided as “back to consulting” and “back to banking.” This time, it will be B2BT.

The Walking DeadA host of illusionist tricks will be deployed to obscure what’s actually happening in the private markets. Deals will be structured so the headline valuation stays high, but the terms — liquidity preference, control mechanisms, and deal structures — will radically change the economics and governance. The next step is euthanasia. Expect to see a lot of unicorns bought for undisclosed amounts. The deals will be presented as strategic, but they’ll really be acqui-hires. The best talent gets new options on more viable equity, the lawyers pick over the patent portfolio, and everything else gets quietly shut down. Peace with honor, sort of.

As you read this, some unfortunate partner at Andreessen Horowitz is pitching a Web3 portfolio firm on a real-time social-audio platform that would be synergistic — and it can be yours for the price of the cash on the balance sheet. The terms of the deal will not be disclosed. We’ll also see a lot of venture firms disappear. Money has been pouring into early-stage investments for years, but as go the private markets, so go VCs. With less money looking for a shepherd, the newcomers and weaker brand names will be unable to raise another fund.

I still shudder at the memory of calling a third of the employees at my first startup into a room and telling them they didn’t have a job any longer. It was horrible, especially because I knew I was the person in the room who’d lost the least that day. But we couldn’t afford them, and if we hadn’t laid them off, we’d have shut the whole business down six months later. Instead, that firm is now a $100+ million business with offices on three continents, employing far more people than we did the day before we fired a third of the team.

Your company is not your family, and your job is not your life. In this growth cycle, the workplace errantly became a platform for your conscience and political beliefs. It isn’t. Your job can be the ink in your pen, but it’s not your story. And despite the Hallmark Channel version of work, where management wraps itself in a progressive blanket and pretends to give a shit about your views on societal issues, don’t bring your whole self to work. This isn’t your family … it’s a team. Do what Jack Grealish did and go where the opportunity is. I have been fired, kicked off boards, had VCs hire Kroll in an attempt to intimidate me, and taken companies through chapter 11 receivership. All of it hurt, a lot. But each setback presented an opportunity, a new perspective, and a chance — even if it wasn’t clear at the time — to allocate my human capital elsewhere at a better return.

Breath of Fire“Hi, this is Nurse Amanda from Gulfstream School. Your son threw up in class. Poor thing isn’t feeling well — can you come get him?”

Ughhh … I jump in the car, and at school I meet Nurse Amanda and a pale, sweaty 11-year-old. He’s got a minivan strapped to his back and holds a sole-purpose, neon-blue plastic bag. Nurse Amanda recommends he drink plenty of fluids and stay at home tomorrow.

We get in the car, and before I can reassure him he blurts out, “So I started feeling nauseous and went to Mr. Matthew’s desk and … Dad … I began vomiting. So much … it was like the breath of a dragon, and everyone was scared of me. The class began screaming, so I started chasing people as I was vomiting.” There’s real pride in his voice as he walks me through his barf bacchanalia.

Of course, I ask if he caught anybody. He turns serious. “Ethan … He’s slow.”

I had to pull over, I was laughing so hard. Once I caught my breath, I looked over to see my son fixated on me with the type of awe you register when you see something extraordinary for the first time. I don’t laugh out loud a lot. He seemed so happy … that I was so happy.

This Friday we’ll assemble in the school chapel, and they’ll read the names of all the fifth graders who made the head’s list. Last semester my son’s name was on that list. Not this term. But everyone in that chapel will know I am the father of the boy who chased kids down to vomit on them.

I don’t believe it’s possible for him to know how much joy he gives me. What does any of this have to do with the markets melting down? Nothing. But neither does anything really important.

Life is so rich,

P.S. If I’m right — and frankly I hope I’m not — the next five years will introduce early-stage companies to the meaning of the word “crisis.” I cover crisis management in the Brand Strategy Sprint — let’s get to work.

The post Down Round appeared first on No Mercy / No Malice.

February 18, 2022

Apple: Thief

Round numbers have no inherent meaning — they’re a consequence of 10 fingers. But they provide a benchmark, a way to focus our observations. The last few years in tech, we’ve witnessed several firms breach $1 trillion market capitalizations, a few hit $2 trillion, and one touch $3 trillion.

Let’s set a more audacious goal: $1 trillion in revenue. We’re still a few years away — the largest company by revenue today, Walmart, brought in $559 billion last fiscal year. And while market cap can fluctuate 20%+ in several minutes, revenue is closer to the epicenter of stakeholder value, because it benchmarks actual commerce. The English call revenue “turnover,” which conveys someone doing actual work.

Revenue of $1 trillion won’t be found in a single category. Few categories even offer a $1 trillion market, and market dominance in any category comes with problems. It’s better to have a 20% share of five markets than 100% of one. Diversity offers security, and monopolies attract legal attention: Facebook and Google’s shared dominance of digital advertising makes it easier to fit them into the antitrust legal framework.

A trillion in revenue will require stealing markets from incumbents. It’s already happening in Big Tech: Amazon flew head-on into the cloud, Microsoft is eating gaming, and in the next decade we will see The Great Heist: $1 Trillion Edition. One company is best poised to ascend to the Iron Throne of theft.

Six-ShooterApple’s sidearm is a thermonuclear device. Each bullet, an unmatched asset.

Familiar operating system. For the wealthiest billion people on earth, iOS is the operating system of their life. When presented with a “smart” television, home, car, or retail store, they don’t want to learn a second language.

Epicenter. The iPhone, the most successful consumer product in history, is the epicenter of tech. The phone contains speakers and microphones, a barometer, an accelerometer, a proximity sensor, an ambient light sensor, a gyroscope, and four cameras. And it connects a web of interfaced devices that meet you everywhere: living room (Apple TV), kitchen (HomePods), keys (AirTags), ears (AirPods), and wrist (Apple Watch). Nobody else has this, or any discernible path to it. The Android ecosystem is fragmented across a dozen competitors; Alexa can’t leave the house alone; and Facebook (Meta) has given up on the real world entirely.

Beachheads. Apple has established a beachhead in multiple businesses beyond its core hardware products, including payments (Apple Pay, Apple Card, Apple Cash), games (App Store, Apple Arcade), media (Apple TV+, Apple Music, Apple News), mapping (Apple Maps), cloud and email services (iCloud), and even advertising (App Store Search Ads).

Hardware expertise. As capital increasingly funneled to a monster that would eat the world (software), Apple further differentiated its hardware competence. Think about it: There are dozens of great software firms, but scant firms (i.e., one) that have dominated hardware for decades. Nobody rivals Apple’s refined hardware or ability to produce actual things on a global scale. The company shipped 236 million iPhones and 58 million iPads in 2021. That’s a stack of devices 1,400 miles high — 23 times further than Bezos’ trip to “space.”

Trust. Most battles are determined before the first shot is fired. The cache of the invading army here is trust. One of the great brand moves in history was anticipating the increasing relevance of privacy and staking huge capital and focus on it. Apple’s much vaunted iOS tracking change was a ninja move, registering damage not from sheer force, but by striking where it hurts the most. Violating privacy is central to the business model of Apple’s rivals, and thwarting that has left them befuddled.

Capital. In 2021, Apple generated an astounding $93 billion in free cash flow (operating cash flow minus capital expenditures), which are funds it can allocate toward new opportunities. That’s on top of a $22 billion R&D budget. Meaning Apple has potentially $126 billion annually to invest in new battles. This number is staggering and singular.

And Apple’s stock is also currency. Tech companies routinely make acquisitions equal to 10% or more of their total value. What could Apple purchase with 10% of its market cap?

BTW, 10% of Apple is $290 billion.

Apple could swallow all these firms and the total haul would represent a smaller acquisition, on a relative basis, than Salesforce buying Slack. And then, the following year, Apple could buy Salesforce ($197 billion market cap). That’s not to say Apple could or should try to buy into all these markets at once, but it’s market cap gives the company virtually unlimited strategic agility.

So with more than $100 billion in cash and $290+ billion for M&A, where might Apple go next?

Tim Cook’s mantra is “the intersection of hardware, software, and services.” He said it twice on the company’s last earnings call, and words uttered in these calls are a tell for a firm’s plans. What does that cover? Better question: What doesn’t it cover?

Let’s Get Ready to RundleApple’s road to $1 trillion in revenue starts with the markets it’s already in. iDevices and Macs are still setting sales records. But there’s more upside in Apple’s ancillary markets.

Apple Pay removes at least five steps of motor function required to pull out a credit card. Our lizard brain doesn’t want to fumble with wallets and pockets, and our conscious brain understands there’s no reason a cheap piece of branded plastic processes a payment better. Today, we tap. Tomorrow, Siri will confirm payment via our AirPods.

Apple has gotten off the sidelines in gaming. Mobile gaming is a nearly $100 billion market, larger than PC and console gaming combined, and 45% of it flows through the iOS App Store, where Apple charges a mob-like 30% toll.

AppleTV+ produces Murphy Brown on a Game of Thrones budget, and it’s thus far been underwhelming. But it doesn’t matter — eventually, the army with the most tanks wins. And Apple’s armament makes NATO look like Peacock. I just read the last sentence, and it makes almost no sense, but I’m too lazy to fix it. (It’s late — 4 a.m. in Tulum.)

As strong as these businesses are, Apple can unlock more value by rolling them together into the ultimate subscription product: You’d pay one monthly fee for all your Apple needs. The company currently offers AppleOne, combining the company’s media and cloud services, and, separately, the iPhone Upgrade Program, which offers a new iPhone annually in return for a monthly fee. Serving up the latest hardware (auto-shipped on release) is a no-brainer and likely coming. But Apple shouldn’t (and won’t) stop there.

So let’s play Tim Cook. Going full rundle will maintain Apple’s historic 7%-8% annual revenue growth — the company will generate $650 billion in revenue by 2030. That leaves $350 billion it needs to take from someone else.

Let’s light this candle.

Consumer BankingBanks offer two things: capital and trust. Done and done. The next step is to let people direct their paycheck auto-deposit into their Apple Cash account (perhaps offering a modest interest rate), so they can send money or print checks to recipients not on Apple Cash. Apple could/will offer checking/savings accounts with modest tweaks to existing features.

From there, Apple moves into loans and investment products. Auto loans (offering a preferred rate on an Apple Car?), home mortgages, lines of credit. It might stretch Apple’s brand to go full Robinhood, with margin trading and crypto, but it could do something akin to Goldman’s Marcus product, a robo-advisor that directs customer’s investments toward diversified holdings.

The largest U.S. banks each pull in around $35 billion in consumer banking revenue. Investment advisers such as Schwab and Fidelity generate $10 billion to $20 billion in turnover. The industry is awash in new entrants and uncertainty. Apple is a global player that already has many of the pieces in place. By 2030, this is a $75 billion business for the Iron Bank of Cupertino.

SearchSearch is the most potent advertising channel in history. It’s the bottom of the funnel for trillions in consumer purchases, the point of maximum leverage for marketers. Google made $149 billion in revenue from advertising against search results last year — greater than the total for global TV and radio businesses, and soon print, combined. Apple is already in this business, albeit in a smaller way, selling ads against App Store searches. Search is too big to ignore.

Moving into search would initially decrease Apple’s revenue, as the company would forfeit the estimated $15 billion per year Google pays to be the default search engine on the iPhone. But it’s a strategic unlock. Keeping iOS searches inside the Apple ecosystem, and integrating results with the contacts, calendars, locations, and other data in that ecosystem, would make the whole show more valuable (and undermine the value of Google’s ecosystem), driving year-over-year growth in Apple’s iCloud subscriptions and its soon-to-be-supercharged rundle. It’s coming. Apple has gone vertical in a variety of categories (i.e., microprocessors) that appeared unthinkable at the time.

Apple is unlikely to squeeze as much ad revenue from searches as Google: The search giant has structural advantages thanks to its role across the ad ecosystem, two decades of advertising AI expertise, and the absence of any moral compass. But $50 billion in annual revenue by 2030 is within reach.

HealthTo date, Apple has positioned the health capabilities of the Apple Watch as a feel-good consumer benefit. Fall down, it calls 911. Have an irregular heart beat, it tells you to contact a cardiologist. But on Apple’s most recent earnings call, Tim Cook said, “we’re still in the early innings with our health work.” Apple is continuing to build an array of sensors (hardware) and data mining and analysis tools (software). The low-hanging fruit: athletic heart rate monitors. A bit further up the tree: hearing aids. But what’s likely next? Services.

“Hey Siri, does this mole look suspicious to you?”

Unless CVS starts putting devices in customers’ hands, the best decision it can make is to pay to become the default integrated health-care provider on the iPhone — the medical version of the Apple-Google search contract. Google pays about 6% of its revenue for that contract. If CVS made the same calculation, Apple would receive another $17 billion direct deposit every year.

Or, Apple could just … become CVS. There’s nothing stopping the company from turning the iPhone into a homing device for a network of Jokr-like dark stores that could deliver every consumer health-care item (plus diapers) to your doorstep. Health services and premiums aside, Apple could take out CVS’s product sales. What’s reasonable? Half? A third? Let’s say a quarter: $75 billion by 2030.

FitnessA year ago, I said Peloton’s $36 billion valuation was hard to justify. For Apple, however, I said it would be difficult not to justify paying $36 billion for two to four hours of attention per week from the most influential people on the planet. Peloton is now 70% off at $10 billion.

Peloton projects $5 billion in revenue this year, but that’s without the power of Apple behind it. Fitness is a much bigger market. Roughly 64 million Americans belong to a health club, a $40 billion industry. Gym members skew (are) rich — I speculate 75% of these people own an iPhone. Nike makes nearly $50 billion in annual revenue. This is a $20 billion business for Apple by 2030.

HomeHome automation is an $80 billion market, thanks to the potential for upgraded appliances, new tech, and services. The current Apple Home offering is weak, but once the company aims that $22 billion R&D cannon at it, the Apple brand will be a huge differentiator in a category that involves listening to your every word and watching your every move. In addition, the amount of friction in home automation is maddening. Apple reigns supreme at integrating devices, and this is where the familiar interface of iOS and that central hub in your pocket can really shine.

Connected doorbells, thermostats, and speakers are nice, but one device rules the American home: the big-screen TV. Rumors of an Apple television are a Silicon Valley evergreen. The global smart TV market is worth more than $300 billion and projected to grow to nearly $1 trillion by 2028. It’s a natural fit for Apple, which makes industry-leading displays from 1 to 32 inches in size (including the $6,000 nano-textured glass Pro Display XDR). It will be bundled with Apple TV+ and integrate the Apple ecosystem and features including Facetime and Shareplay.

I don’t see Apple getting into connected refrigerators by 2030 (not saying I wouldn’t buy one), but between smart TVs, automation control, and other devices, this is another $20 billion opportunity.

CarsThis one’s obvious: The first overnight $250+ billion transfer of shareholder value from a guy who finds humor in Hitler memes to a guy who’d never find himself in that position will occur when Tim Cook stands onstage in front of an automobile bearing an Apple logo.

The Apple car is in the works, and it could transform the company’s business just as the iPhone did. And not to get carried away with market cap, but imagine how much Apple will be worth if it starts receiving the multiples that are now standard in the electrical vehicle market.

Tesla controls roughly 70% of the U.S. EV market today and does more than $50 billion in revenue per year. Tesla’s revenue is a drunk tourist stumbling home late at night wearing a Hublot. Apple taking half of Tesla’s sales is, in my view, a conservative estimate: $25 billion. This is a high growth market, and I expect to see $50 billion in Apple Cars driving themselves off the lot by 2030. Tim Cook cost Facebook a quarter of its market cap just flexing its privacy muscles — the Apple Car will cost the inner child from outer space a similar share of the value of his firm.

Identity and InconveniencesThe breadth of Apple’s ecosystem will sweep up many more relatively small opportunities. Anywhere that requires an ID to enter could turn that infrastructure over to Apple. Expedited airport security as a premium service, a la Clear, is an obvious fit, and why wouldn’t Madison Square Garden and The Colosseum at Caesars Palace just hand over the whole interface to Apple? Let’s call it $4 billion.

And then there’s my domain: education. It’s time for Apple to show up at reunion as an alumni who wants to make their mark. U.S. education from preschool to college is in dire need of a technological revolution. The leading provider is Blackboard, a privately held business with products that are … OK. Apple could become the operating system of education — an alchemy of Chegg, Coursera, and Udemy: $2 billion per year.

Blend up all these and more, Apple could be generating $10 billion in revenue from businesses that fall into its lap.

B2BIt’s an inevitable part of the tech cycle — innovation sparks in the consumer space, but as the tech matures, the smart players head where the real money is … the business-to-business economy. In 2020, Apple acquired a startup called Mobeewave for $100 million. It wasn’t a sexy brand acquisition like Beats, so no one cared. But we should have. Mobeewave develops technology that lets smartphones process payments with the tap of a credit card. In other words, it turns iPhones into credit card readers.

This is bad news for payment processors. Especially Square, which has been hard at work installing terminals in coffee shops since 2009. Apple’s strategy will be different. It’ll simply turn on a feature in the next software update and boom: a billion credit card machines. Out of the gate, Square offers a suite of services that Apple doesn’t, so this looks like a partnership. Sure, like a virus partners with a host.

Today, Apple relies on AWS and Google to supplement its own data centers, just to handle its consumer iCloud business. But the company is one of the largest data center operators in the world, and it’s finishing a five-year, $10 billion expansion. It’s only a matter of time before Apple flips the script and offers its own commercial cloud services.

Half of Square’s revenue (not including its “revenue” from Bitcoin) + half of AWS’s revenue = $35 billion. Eight years later it’s $50 billion.

Will I Dream?Imagine Apple executed the above. We’d have the first $1 trillion revenue company.

At our Pivot MIA conference this week, my NYU colleague Aswath Damodaran called Apple a “rare exception” to the life cycle rules that govern almost all companies. He credits its success in part to discipline. The largest acquisition the company has ever made? A mere $3 billion for Beats — nearly eight years ago. They’ve been looking at cars, AR, and televisions for a decade or more. If it’s the first company to get to $1 trillion, and we think it will be, it’ll likely be because Cook & Company isn’t in a hurry to get there.

Life is so rich,

P.S. You haven’t taken my Brand Strategy Sprint yet, and honestly — I’m hurt. There’s still time. Sign up now or check out our scholarships.

The post Apple: Thief appeared first on No Mercy / No Malice.

February 11, 2022

Unreal Estate

The shifting tectonic plates that inspire earthquakes in the markets are interest rates. And for the entirety of Gen Z’s lifetime, they’ve laid still at record lows. In the 1980s, consumers garnered 10% interest on a CD. That’s a “certificate of deposit” for anyone under 30. For anybody 40 to 60 it’s still a “compact disc.” But I digress.

It’s the boring things that make money — software, insurance — and/or kill you. Lawnmowers kill 90 Americans each year, vs. 10 people killed by sharks globally. Interest rates got their close up in Die Hard (1988), in which Hans Gruber plans to fake his own death and murder dozens of people so he can steal Nakatomi Corporation’s interest-bearing bonds. “By the time they work out what went wrong,” says the villain, played by Alan Rickman, “we’ll be sitting on a beach, earning 20%.”

Scant chance of that line getting written today. Bond yields are at all-time lows, a quarter what they were in the 1980s, and “savings” accounts offer comically low “interest rates” that begin with “point oh” and get worse from there. Low interest rates make fixed income investments less appealing and drive up asset values via cheap leverage. The S&P 500’s Shiller P/E ratio, a respected gauge of the relative price of U.S. equities, is flirting with an all-time high.

The American dream of homeownership has become a hallucination — the apparent perception of something not present. Housing, already on a 12-year tear, has now gained the chaser of a pandemic that made everyone’s home feel unbearably small and shabby. Eight out of 10 urban areas in America registered average home price increases of more than 10% in 2021. Fifty years ago, the average home cost two years of the average American household’s income. Today it costs four.

[image error]

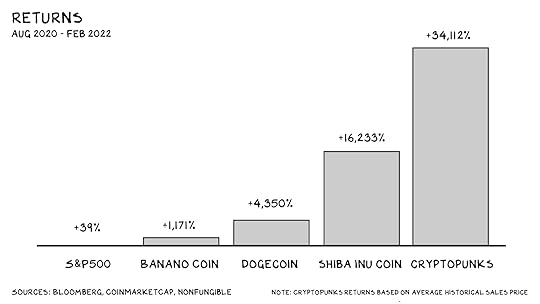

All of which raises a significant question: Where should people put their money? Typically, crises offer buying opportunities for the next generation, as they come into their prime earning years in the wake of a reset. Just as earthquakes relieve geological pressure, decreased asset values are a societal release, birthing a key component of any healthy economy: churn. But this time, our boomer-dominated government employed Covid-19 as cloud cover to protect and extend the wealth of the already rich. Suppressing volatility protects the incumbents; for the first time in U.S. history, a 30-year-old is not doing as well as his/her parents at 30. The result? Young people are creating their own asset classes and volatility. In 2021, these forces manifested in crypto and meme stocks, which offered a mix of volatility, a halo of technology, and a lively cast of aggressive carnival barkers (i.e. evangelists).

But established crypto assets have been bid up, and trade correlated to the stock market. Across the street, the meme-stock trade is unwinding as investors realize they’re not investing in a movement, but a theater chain. It feels as if the era of outsized returns is drawing to a close. However, as Yoda said, there is another. I believe 2022 will bring increased attention, and potentially asymmetric upside to … virtual real estate.

MetastateVirtual real estate is simple: plots of land in a digital world (i.e. the metaverse) whose value is determined by factors similar to those that drive the value of physical real estate — namely, how big/cool/developed/proximate to other cool people/events they are. In a virtual platform like Sandbox you can buy a beachfront property, or something next to the mall, or something next to the … Warner Music Group headquarters?

Once you own it, it’s yours and leverages the only utility I can discern from the blockchain — a ledger that keeps awesome records. You can develop the real estate, rent it out, have friends over, host parties, open a store or a (virtual) theme park, whatever you want. You just can’t … live there.

UntetheredWhy do we think metaverse real estate could be the Gamestop of 2022? Answer: Brand. The mythology of real estate is that its value never goes down, and ownership makes you more responsible and attractive to potential mates. Seventy percent of single women in China say if you don’t have a deed, you’re not a viable mate.

Just as Robinhood fomented a myth that staring at a day-trading app is investing or learning vs. gambling, metaverse real estate combines the heavy, comfortable blanket of a boring asset class with the memetastic growth narrative of crypto. Nitro, meet Glycerin.

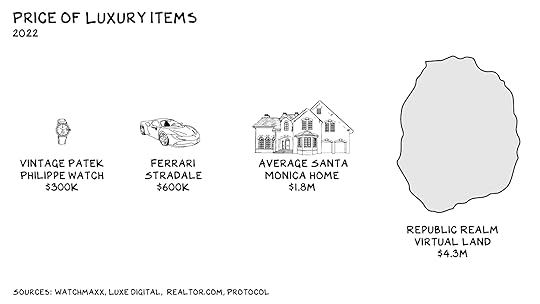

Money is pouring in, and a flood could follow. Virtual real estate sales exceeded $500 million in 2021. Analysts project that number will double in 2022. A plot of land on Sandbox was recently purchased for $450,000, as it meant … being meta-neighbors with Snoop Dogg. There’s also commercial real estate: Luxury designer Philipp Plein purchased a property on Decentraland for $1.4 million; it will soon become Plein Plaza. And dedicated real estate development: Metaverse real estate firm Republic Realm recently made the largest virtual land purchase in history — $4.3 million.

The upside defies projection — 5x, 10x, 20x? The innovation in web3 assets is that they aren’t benchmarked against any tangible revenues, much less profits. Moving in deep space, void of any giant astrophysical objects, neither time nor relative size/valuation holds any meaning. Instead of downers such as manufacturing, human customers, or anything producing reliable cash flow, this asset class offers the love of credentialed, persistent, and rabid supporters. They recognize the story as the book, not any actual words inside of it.

Similar to crypto, virtual real estate will be awash in pump-and-dumps and artificial inflation. Crypto allows you to operate multiple wallets: What’s to stop you from buying a property, selling it to yourself a dozen times at spiraling valuations, hiring a PR agent to place breathless stories in the press, and then selling it for 5,000 times what you originally paid? BTW, nothing in the system stops you from doing this. Indeed, the anonymity of blockchain encourages it: The most expensive art sale in history was a $532 million NFT that the owner sold to … themself.

The Wild West gestalt of virtual real estate will likely attract more users than it will repel. As in gambling, the odds don’t need to be in your favor to make it worth it, as the upside could be enormous.

OK, but what’s the fundamental value? Pass. There’s no way to know, and it might be zero. [Editor’s Note: It’s probably zero.] When the molly wears off, we may perceive valuations untethered from reality by orders of magnitude. Or we could all look back and claim we “knew this technology would be enduring.” What if it’s 1950, and I’m offering you a chance to buy the Glendenning family farm for $20 an acre?

And why not? Metaverse or not, we live more of our lives virtually every year — we have more conversations on Twitter, more meetings on Zoom. Sex and rock ’n’ roll are increasingly online. (Now, if only they could fit drugs down those tubes …) Don’t we want a place to call home? Fewer people can even afford a starter home on terra firma today, why not a palace in Decentraland? MetaWeWork, anyone? (Prediction: Whatever Adam Neumann is up to buying $1 billion worth of luxury apartments, it’s going to involve NFTs and the metaverse.)

Third LifeThere is precedent for this. In 2006, Ailin Graef (nom de meta: Anshe Chung) became a millionaire developing real estate properties on a virtual platform called Second Life. She soon got a profile in BusinessWeek and became the face of economic opportunity in the digital age. Perhaps it was possible to create real value in a virtual world.

By 2007, Second Life’s GDP was larger than those of several small countries. It had a “population” (metaspeak for monthly users) of nearly 2 million. More than $3 billion was spent on in-game transactions within a decade. But then it faltered. There wasn’t much to do in Second Life, once the thrill of customizing your avatar and walking awkwardly around a cartoon landscape wore off. It required more powerful computers and higher bandwidth than most people had access to at the time. Security was feeble; vandals and griefers proliferated. Several competing virtual worlds entered the fold, splintering the already limited community. The value Second Life promised was only real if enough people believed in it. In 2006, it was the predominant virtual world — and we all believed in it. Until we didn’t.

That’s how much of my net worth I’m thinking of putting into virtual real estate, because that’s how much I’m willing to lose. If I were 25, I might invest 10% of my investment capital — an amount I could afford to see go to zero. Let’s be clear: As a standalone investment, this is gambling. But allocating a fraction of your portfolio to the crazy volatile shit that may offer asymmetric upside (i.e., an outsized return) is less irrational than it sounds.

When you get older, real estate becomes the hippocampus of your brain, where memories reside. I remember the two-bedroom 1,100-square-foot apartment in Tarzana I grew up in. I can see myself under my NFL bedspread in the middle of the night, when my nosebleeds wouldn’t stop and my mom would comfort me with math problems.

I remember the entryway in the coop in New York City my dog ruined, so excited when I came home she couldn’t control her bladder. Our home now is alive in the a.m. with one boy claiming he’s too sick to go to school and the other waiting in front of the door with a backpack that looks like it’s wearing him. In the future I’ll remember how quiet the house was, in the middle of the day, without the boys. I’ll remember feeling helpless, knowing a relentless quiet was coming, when they’d leave and find their own real estate.

Life is so rich,

P.S. Data isn’t the future, it’s the present. If you aren’t using it in your role, you’re probably missing out on opportunities for growth. Sign up for the Data & Analytics Essentials Sprint with industry titan Tom Davenport now.

The post Unreal Estate appeared first on No Mercy / No Malice.

February 4, 2022

The Algebra of Decisions

This has been a week of difficult decisions. I walked away, for now, from a long-time business partner and watched another be fired. It’s been draining, and made me think about decision-making. Specifically, how to make better ones.

When I was younger, I embraced (subconsciously, as I was sleepwalking through life) the notion that you can make any decision the right one through leadership and persuasion. I was more focused on proving my decisions were right … because I’m awesome … than on making the best ones. Granted, there’s a benefit to making decisions quickly, as speed can compensate, somewhat, for misdirection. But there’s being decisive, and then there’s being allergic to course correction. People often mistake this for being principled … it’s not. Your decisions are a guide and an action plan, not a suicide pact. Be open to evolving, changing your mind when presented with new data or compelling views and insights. A step back from the wrong path is a step in the right direction.

Ideally, it’s better to make the right decision in the first place. Your instincts are a decent guide to survival and propagation, but a complex world offers exponentially more challenges and rewards. I’ve learned I need a framework — a set of values that help define how I want to live my life and serve as a lens through which to filter my thinking. It’s the key to navigating by starlight and developing greater situational awareness. I just read the last sentence and feel like maybe I’m trying too hard. Anyway.

My fifth-grade teacher used to say, all the damn time, “You Matter!” No, not necessarily. Your actions matter. It’s easy for a person to be near-meaningless and, if you’re unlucky or choose to stay on the sidelines, to not touch anybody else’s life or happiness. Every action — and every inaction — is the product of a decision. A framework doesn’t guarantee that every decision will be right, but it will help you speed decisions, build trust with others as they know what to expect, make your actions count, and ease the pain of bad decisions as they are authentic.

The hardest part is developing your framework, as it requires identifying a set of values and/or ideologies you believe in. You have to trust these values more than you care about the outcome of any one decision, or you’ll override them whenever the going gets tough. Ultimately, tested by time and decisions made, these values become your filters — an algebra of decisions, if you will. Note: I’m not advocating for any particular set of values, only urging you to identify and frame yours. So, here’s my Algebra of Decisions: CSAM.

[image error]

[image error]

I’ve spent the majority of my waking hours trying to choreograph human capital and technology to create a differentiated product or service so I can charge more than the cost of the inputs. Growth and margin create stakeholder value via cash flow, enterprise value, and (I hope) meaningful work. The full-body-contact violence of competition creates prosperity that gives people and their families economic security, options, and the ability to help others. It also gives us a say in our society. I choose not to eat at Chick-fil-A, as I don’t care for ownership’s social commentary. Competitive markets, the key to capitalism, allow me to opt for In-N-Out instead. (#Awesome.)

It’s important to note that without robust oversight, the wealthy and powerful will overrun the system. When we ignore the externalities of capitalism — hoarding, failing to invest in the middle class, lacking compassion for those left behind — we end up with a G-7 nation that has the greatest inequality, polarization, and Covid mortality. But that’s another post.

Capitalism’s superpower is mutual prosperity brought about by self-interest. However, we all need allies. There’s a cartoon of a billionaire Monty Burns type who lights cigars with $100 bills and pours mercury into the river. It’s just that, a cartoon. I used to see most business relationships as win/lose. Successful capitalists create allies along the way. Capitalists ask how can we be great partners, they execute, and they ensure they’ll benefit from the value created.

Competition and conflict is best hammered out in the marketplace. Strife between people is deadweight. In 30-plus years in business I’ve never sued or been sued by anybody. If I feel I’ve been treated poorly I don’t work with them again. That’s my choice. Your anger at a person or party is a weight, and becomes an ailment — even debilitating — the longer you hold on to it.

This week, I flexed my capitalist muscle, and pulled the Prof G Pod from Spotify. I’ve spent much of the week working through an articulation of why, but Roxane Gay took the words out of my mouth in her superlative New York Times opinion piece … if my words were 10 times more eloquent and powerful.

In sum, I evaluate business decisions through the lens of how we can further differentiate the product and strengthen the relationship. That is my cocktail of prosperity.

Much of what we encounter in life is outside our control. What can we control? Our beliefs, judgment, and desires. As Ennis says in Brokeback Mountain: “If you can’t fix it, you gotta stand it.” Be aware of your emotions and passions and try to disarticulate them when making a key business decision.

I have found emotions are the enemy of investing. Whenever you’re inclined to sell a stock or business, the other side feels the same way, and it therefore may be a good time to hold or buy. The recent market selloff taps into a basic instinct of wanting to avoid any more pain (i.e., sell). Try to ignore your emotions and realize the market is likely picking up billions of similar sentiments at that moment and reflecting them with depressed, or inflated, valuations.

This one is difficult for me. I struggle with anger and hold grudges against people, places, and things. But cultivating an apathy toward antagonism is liberating.

This week, CNN fired its CEO, Jeff Zucker, after he disclosed that he’d been in a consensual relationship with a subordinate for some years. I had no knowledge or input into that decision, but Zucker and CNN are important business partners for me, and I like and respect both the man and the organization. I had a range of emotional responses to the news; a younger version of me would have aired them, probably taking three different positions on the issue and pissing off everyone relevant to me. But the reality is that I don’t know what happened in that boardroom, the decision had nothing to do with me. All I can control is my response. At a minimum, I can continue to like and respect the man and the organization. Note: Be loyal to people, not to organizations.

An easy one. Don’t make an important decision without getting input from others. Perspective matters … it’s difficult to read a label from inside the bottle. A mentor isn’t necessarily someone smarter than you, and they likely won’t know more about your situation, but their standing outside it is what’s valuable. Besides, the ask itself matters. Asking for someone’s advice is an expression of trust — that’s why it’s intimidating. Trust builds trust and deepens relationships. Seek counsel, and your mentor will be invested in your success.

Asking for advice doesn’t mean you have to take it. Often, what’s most valuable about advice isn’t a recommended course of action, but the questions a mentor asks you — pressure testing your reasoning. You might not follow their advice, but don’t ignore what they say. Another benefit? Your actions post-decision will be more refined, because you’ll have a preview of their impact on others.

The most useful construct in my life is … death. Specifically a 99.9% certainty (you should never be 100% certain of anything) that there will be a moment when I look into my boys’ eyes and know our relationship is ending. And that’s OK, as it motivates me and provides perspective. I can see my death. I was 25 yesterday, and I’ll be 84 tomorrow. I know the people, photos, music, and drugs I want to have around me at the end, and I can imagine, and even feel, my thoughts at that moment. It’s the closest thing I have to self-awareness.

As Frida Kahlo said: “I want my exit to be glorious, and I don’t want to come back.” Putting myself there, at near-death, helps me sort through life and weigh the decisions that will give me peace. I know at the end I’ll be more upset about the risks I didn’t take than I will about the fallout from ones I did. That it will give me joy that I kissed my boys every day, let my dogs on the couch, and dressed up as Elizabeth Holmes on CNN+. I’ll be angry that I was so angry so much, and disappointed that I let fear, or my need for people’s approval, get in the way of living out loud.

Wading into public controversies and stepping back from important business relationships are both fraught but necessary expressions of values. I will be subject to pushback, accusations of censorship, etc., but I’m focused on what I can control and how I can exercise my capitalist muscles. I reached out to several people to get their input. And I know that at the end, the only thing I’ll remember is I tried to do something.

Life is so rich,

P.S. We’re headed to Miami next weekend. (Finally.) Last chance to come turn up the heat with me. Purchase your tickets here. I look forward to connecting.

P.P.S. We’ve added a few more seats to the Product Strategy Sprint, with Adam Alter and Malcom Gladwell, due to demand. This isn’t a hard decision: Sign up now.

The post The Algebra of Decisions appeared first on No Mercy / No Malice.

January 28, 2022

The Algebra of Wealth

T-minus 17 days until Pivot MIA, a new three-day event I’m hosting with Kara Swisher. We’ll be joined by the CEOs of Airbnb, the New York Times Company, WeWork, and Parler, and by my role models, professors Aswath Damodaran and Jonathan Haidt. Join us at the Faena and 1 hotels, February 14-16. Purchase your pass here. No Mercy / No Malice subscribers are also invited to an exclusive meet & greet with me and others at the opening night party — just send us a note at pivotmia@voxmedia.com, and we’ll put you on the list.

Switching gears to the market, shit has gotten real the last few weeks. Or less unreal than it has been in the past 13 years. I’d like to say I sold in November, but my portfolio is down 20%+. And yet, I feel … fortunate. This time around, I’ve learned. I know the algebra of wealth, but it took me several decades to develop the discipline to practice it.

The valuations of stocks and assets have changed dramatically in the past few weeks. But the song of wealth creation stays the same.

[The following was originally published on February 12, 2021.]

I know a lot of people who make an extraordinary amount of money, but few people who are rich. Rich is having passive income greater than your burn. People on a path to money focus on their earnings; people on a path to wealth also focus on their burn. Joseph Heller said, “It takes brains not to make money.” (I think he was casting a favorable light on his starving artist friends.) This may be true, but it definitely takes brains to hold onto it (money).

My father receives $48,000 per year from Social Security and his Royal Navy pension (he was a frogman). He spends $40,000, and that’s enough to make him happy. He swims every day, watches a shit-ton of hockey (Leafs fan), and on Fridays goes to the Taco Stand (an actual restaurant in La Jolla) and orders something called a michelada. (Apparently it’s medicine delivered in a chilled, salt-rimmed glass — he claims his hair is regrowing and that he’s sleeping better. I believe half of that, so … I believe it.) Anyway, it’s not your income, but your income-to-expense ratio, that determines if you’re rich.

My observation is that there are four variables in the algebra of wealth: focus, stoicism, time, and diversification.

People conflate a lack of focus with a lack of talent. Intelligence and talent are correlated with success, but the strongest signal of future success is your perseverance and resilience: what the books in airport bookstores call “grit.” Unless you are supremely disciplined, your career will have to be something that gives you some enjoyment. But don’t mistake focus for your “passion.” People who tell you to follow your passion are already rich. Follow your talent. The accoutrements that accompany being great at something (relevance, admiration, camaraderie, money) will make you passionate about whatever “it” is.

Focus on putting yourself in a position to be financially successful. Get certified: In a digital world, much of the corporate world decides whether to swipe right or left based on the logos (aspirational universities/firms, vocational certifications, etc.) on your LinkedIn page.

Sector dynamics will trump your talent. (I realize how awful that sounds.) However, someone of average talent at Google has done better over the past decade than someone great at General Motors. Be thoughtful … any opportunity you have when you’re young to choose among different paths is a profound blessing.

Look for the best wave to ride. Twenty-five years ago, I chose to paddle into the e-commerce wave. My first effort (Red Envelope) failed. Even worse, it failed slowly … over 10 years. I stuck with it and started a firm that helped other firms develop e-commerce strategies (L2) and have owned Amazon stock for 12 years. It took me a while, but the strength of the wave kept me moving, and carried me to the beach. I just read the last sentence and am fairly certain I will never be a truly great writer. Anyway.

Focus on your relationships. Family and friends are essential to long-term happiness, and the most important relationship is with your spouse. The most essential economic decision you make will be who you decide to partner with or, more specifically, who you decide to have kids with. The net worth of married people grows 77% larger than that of single people. Marry the right person, and then invest in that relationship every day. You’ve wagered 50%+ of your net worth, and your value in the marketplace, on that partnership. Don’t keep score, and bring forgiveness, generosity, and engagement. In sum, show up.

Determine what you can and can’t control. You can control your reactions to temptation — a lack of discipline is the antichrist to economic security. Our society of superabundance makes this difficult. Billions of dollars are spent every year on schemes to manipulate our natural impulses into spending more money, consuming more fat, and believing everyone around us is more successful than we are. The upgrade from economy to premium to business to first class to private jet can seem like an investment in yourself — it’s not. The most powerful forward-looking indicator of your financial security is not how much you earn, but how much you save.

A specific activity accelerates in a bull market, conflating luck with talent and dopamine with investing. Diabetes, high blood pressure, and sharing a screenshot of your Robinhood gains are maladies of industrial production that exceed our instincts. Trading — distinct from “investing” — can feel like work and productivity. It’s not. It’s gambling, but with worse odds and no free drinks. One study found that over a 12-year period, only 5% of active retail traders made any profit at all. This time around, apps including Robinhood, with its dopamine-triggering confetti, and 24-hour-a-day, volatile crypto trading are the drugs of choice. Most day traders will be fine, suffering affordable losses … most. However, for many there are darker outcomes. Young men are especially vulnerable, as they are more risk aggressive. Between 80% and 85% of day traders are men, and 23% of men who gamble become addicted (as opposed to 7% of women). Most of us can gamble without becoming addicted, just as most of us can drink without becoming an alcoholic — but know the risks.

Stoicism is not just about remaining calm in the face of temptation. It means having good character. Succeeding in life is much easier if other people want you to succeed. We have a mental cartoon image of rich people as grasping and cruel. The reality, in my experience, is that wealthy people, in general, demonstrate strength, acumen and … kindness. Economic security is in the agency of others, and you want others to want you to win.

I spent the first 40 years of my life chasing some form of Western relevance so I could register more dopamine surges. Nothing was ever enough. More, I want fucking more … now. The pursuit always managed to distract me, and I was unable to get the engines of success and fulfillment firing on all cylinders. This stage of my life was characterized by fits of progress, getting close, but never achieving anything resembling the potential my opportunities warranted. In one moment that all changed for me: When my first son came rotating out of my girlfriend 13 years ago. In sum, shit got real. I was young enough to be selfish, but old enough to recognize it and acknowledge that I needed to change. I decided at that moment (no joke) to bring more focus and discipline into my life.

“Time is the fire in which we burn,” says the poet. It is our most inflexible and valuable commodity, the one thing with which you should not be generous. Squander money, you may earn it back. Squander time, it is gone forever.

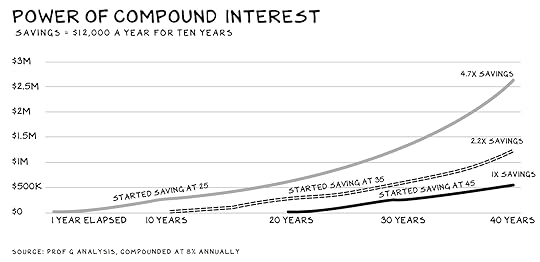

Re investing: The long term is our ally, the short term our nemesis. The gangster authority on time, Albert Einstein, supposedly remarked that compound interest is the eighth wonder of the world. Yet our brains are not wired to understand this. When I was 26, I thought of being 46 as the distant, irrelevant future. Now that I’ve reached that age (actually I’m 56 … ugh), 26 feels as if it was last year. But small investments I made a decade-plus ago have grown into the base of my economic security.

Compounding is not just a financial thing. The most important returns in life come from the compounded effects of our investments over time, whether in our finances, careers, hobbies, or relationships. Change the timescale of your life, and you change your life.

In your life, focus is key. Plan A for financial security is being great at doing something the market values highly, and leveraging that into income and/or equity in a business. But Plan A squared is investments. And with investments, focus is to be avoided. Diversify and, unless your plan is to be in the finance industry, be sure that your time spent tracking/trading does not distract you from what is/should be your source of income and savings.

Investing over the long term pays out, but there are always dips along the way. Diversification is kevlar — with it, bad decisions will still hurt, but they won’t prove fatal. Diversification, in other words, is your bulletproof vest.

A few of my many egregious investing errors:

Red Envelope: I was so emotionally involved (I co-founded the firm in 1997) that I kept putting money into the business and ended up losing 70% of my net worth when it declared Chapter 11 in 2008. I had no kevlar, as I was terribly concentrated in one asset.Netflix: Yes, Netflix. I believed in the company, respected its management, saw its potential, and bought a lot (for a professor) at $12/share. That’s the good news. The bad news is that I sold it six months later at $10/share to capture a tax loss and never re-bought. Today it’s at $558. Not that it doesn’t haunt me … every day. Nope, definitely not.Most of my major mistakes in investing can be distilled down to two things: not diversifying, and trading.

Mistake No. 1 (Red Envelope): Almost fatal. I was 43 and outwardly successful. But with the birth of my first son, I was feeling more economic anxiety than I had since I was a kid. (I grew up in a household with a single mother who worked as a secretary.) Mistake No. 2 (Netflix): Painful but nowhere near fatal. I had eggs in other baskets (i.e. Amazon, Apple, Nike, Oracle). In the end, my kevlar has been not allocating more than 10% of my net worth to any one investment. That doesn’t mean I don’t look for opportunities that offer asymmetric upside — I do. I just don’t ever take off my kevlar. You don’t need to be a hero to get to economic security.

Not Your FaultThese principles have served me well, especially as I’ve become more disciplined about following them. But while I wasn’t born into wealth, I did benefit immensely from the circumstance of my birth. My smartest move was to be born a white male in California in the sixties. An America that loved unremarkable kids presented me with a world-class education (at the time, UCLA had a 60% admissions rate and cost just $400 a semester), thrust me into the financial boom of the 1980s, and, through sheer luck, positioned me to catch the internet wave.

Since I set foot on the UCLA campus in the 1980s (feels like just last year) we’ve told ourselves we remain the Land of Opportunity, and that we’re making progress to remedy our historic imbalances. Yet as illustrated by one metric after another, economic security is harder to obtain, not easier, and is becoming less a person’s individual fault and more a result of circumstance … America is becoming less, well, American.

Are we headed for another revolution? I don’t know, but we are due for another righteous movement. What can you do in the face of a system that profits off you becoming overweight, indebted, divided, and addicted? Answer: Rebel.

Focus on what matters. Be a Stoic in the face of temptation. Use Time to your advantage. Diversify your investments.

In any economic climate, how do we build economic security, foster love, and find joy? How do we get rich?

Slowly.

Life is so rich,

P.S. Malcolm Gladwell has a similar take on focus: “There is no way around hard work. There are never any shortcuts, and anyone who tells you there’s a shortcut is blowing smoke.” He’s guest lecturing on the Product Strategy Sprint in just a few weeks. Sign up now.

The post The Algebra of Wealth appeared first on No Mercy / No Malice.

January 21, 2022

Tell Me a Story

“A man’s reach should exceed his grasp, or what’s a heaven for?”

— Robert Browning

Entrepreneur is a synonym for salesperson, and salesperson is the pedestrian term for storyteller. Pro tip: No startup makes sense. We (entrepreneurs) are all impostors who must deploy a fiction (i.e. story) that captures imaginations and capital to pull the future forward and turn rhyme into reason. No business I have started, at the moment of inception, made any sense … until it did. Or didn’t. The only way to predict the future is to make it.

This is not the same as lying. There’s a real distinction between an entrepreneur and a liar: Entrepreneurs believe their story will come true. This requires confidence … and delusion. It helps to be somewhat detached from reality — to assume that, for whatever reason, you are the one who can see into the future, and that in the new world your product/service will be needed and successful, despite overwhelming evidence (i.e. the current reality) that it’s not. A reality distortion field if you will.

A vision that’s not widely derided likely isn’t much of a vision. MLK was a radical reformer who had a 63% disapproval rating at the height of his activism. Women were perceived as physically incapable of the demands of flight, until Amelia Earhart landed her Lockheed Vega in an Irish farmer’s field. Steve Jobs was a Zen Buddhist college dropout who believed he didn’t need to shower because he only ate fruit and that you could treat pancreatic cancer with juice therapy. He also believed he could put computers in the homes and pockets of everyone on Earth. Crazy.

Being a great storyteller carries risks. Success begets acolytes who tell you you’re right when you’re wrong. Worse, you start believing them. This leads down a dangerous path where vision breaks from reality, and — likely aided by a fear of failure — curdles your confidence into a con.

Elizabeth HolmesHolmes was assembled in a factory from parts of prior visionaries: smart, Stanford dropout, turtleneck, building blood-testing technology. Plus a nice backstory: Her professor told her the original concept for Theranos would never work. In addition, hundreds of millions in funding from backers including Tim Draper and Larry Ellison, coupled with covers on Fortune and Forbes, were a heavy blanket of affirmation that ensured Ms. Holmes was a visionary. The visionary narrative is a self-perpetuating machine: a flywheel of storytelling, capital, and the future that capital can pull forward, which buttresses the storytelling, and so on and so on.

Fun fact: Ms. Holmes cost her investors less than a billion dollars, didn’t make any real money herself, and is going to prison. Adam Neumann cost his investors $11 billion, received a 10% commission on those losses, and is going to Coachella. Note: Ms. Holmes’s vision progressed to the exaggeration/fabrication of contracts and clients, whereas Mr. Neumann’s “only” went so far as accounting irregularities.

When I Say Steve, You Say JobsFast forward: There was no working technology, and Ms. Holmes has been convicted by a jury of her peers — and faces 20 years in prison. Soon after, VCs distanced themselves, claiming they’d seen through the facade. The tell for people who exaggerate for a living is, after it’s been deemed illegal, they begin preaching the importance of restraint. The narrative being wrapped around the very unlikeable Ms. Holmes is that she’s an outlier. No, she’s just one point on the line that is our storytelling economy in a frothy part of the cycle.

The Valley’s “always tell the truth” sermon is reductionist and hypocritical. It ignores the fact that many of our nation’s most valuable companies are priced on promises of technologies that don’t exist. The entire venture capital industry, in fact, is predicated on promising things that don’t exist.

Microsoft, perhaps the most successful tech company in history, got its break when Bill Gates sold IBM an operating system he didn’t have. (He and Paul Allen subsequently bought what they needed from another programmer, but they didn’t tell him they had the deal with IBM to distribute it.) Allegedly, an engineer at the company coined the term “vaporware” a year later. Promising something that doesn’t exist is as central to the Valley ethos as late-night coding sessions, hoodies, and the hallucination that the public has asked you to solve the world’s problems vs. just do less damage.

Yes, claims about health-care solutions warrant scrutiny beyond whether or not rich investors get their money back, but Holmes wasn’t convicted for defrauding patients. She’s going to prison because she ripped off George Schultz, not because her bogus blood-test machine errantly told someone they had HIV.

Florida AR company Magic Leap has (no joke) burnt billions since 2010, with nothing other than a failed $2,300 headset to show for it. The company routinely hyped technology that didn’t exist, even using Hollywood special effects to mock up its PR videos. An early (fired) employee called the company’s founder “a believer in magic.” It was meant as a compliment. And the tricks keep coming. In October, Magic Leap announced it had raised another $550 million and was pivoting from consumer to … wait for it … health care. Nobody seems all that concerned that a company with a 12-year track record of false promises and fake products is now going into medicine. And, with the right leadership and engineers, it could build something valuable. You know … vision and capital … and more vision and more capital.

The line between vision and fraud is only drawn in hindsight. We set arbitrary deadlines for entrepreneurs to deliver on their vision, and their vision only becomes fraud when we say time’s up. What if Holmes, with five more years and another billion dollars, shipped a working product? Or pivoted to a home-testing machine for an acute respiratory syndrome?

Heretic

“Real artists ship.”

— Steve Jobs

When valuations are overwhelmingly driven by stories, things can get ugly. Investors will do whatever it takes to defend their narrative — their investment depends on their flocks screaming “heretic!” at anybody who questions the scripture, as the foundation doesn’t hold up to more modern orthodoxies (i.e. math). Theranos employees made a video game where they shot at the Wall Street Journal reporter who exposed the company’s fraud. The firm also engaged Harvey Weinstein’s attack-dog-attorney, David Boies, to try to shut down the story.

Swarming anyone who questions the narrative is a built-in feature of stocks and sectors that have gotten too far out over their skis. I often commit the crime against humanity of pushing back on Bernie Bros, VC-backed unicorns, Tesla longs, meme stocks, or web3. I do this knowing the flying monkeys and bots will attempt to burn the village to save it from my boomer views. These guys, and they’re always guys, make the High Sparrow’s Faith Militant look thoughtful.

Note: I’m going to see if I can offend everyone with this post. #squadgoals

PendulumThe pendulum swings between stories and fundamentals. Right now, we’re still deep in the story phase. Capital is cheap: $621 billion went to startups in 2021, a 111% jump from 2020. We’re seeing record numbers of unicorns: 959 across the globe, up from 569 in 2020. The hottest sector is fintech, which accounts for 15% of these firms — all promising to become the next JPMorgan. Are they lying or telling the truth? A: Yes. Vision.

There are few fundamental truisms in the markets. One of them is … fundamentals. Another is cyclicality. And in my view, the atmospherics, if not sheer probability, augur that we’ve entered the less-appealing part of the cycle. Ground zero will be a regression from fiction to nonfiction, story stocks that represent ownership in a (shitty) business, not a movement. The meme trade is already unwinding.

The darkest side of our idolatry of innovators is that we become blind to the costs incurred by those who are least able to bear them — and we protect those who least need protection. It bears repeating. Holmes is going to prison because she defrauded investors — specifically, members of the Valley aristocracy and the global elite. Tim Draper led her seed round, and Rupert Murdoch invested $100 million. That’s what brings the feds to your door. Remember Martin Shkreli, the guy who raised the price of a life-saving treatment needed by AIDS patients 56x just because he could? He’s in prison, but not for price gouging. He was convicted of defrauding … investors.

Our laws reflect our values. What we hold dear, who we deem precious (i.e. who needs protection). We’ve decided the rule of law in the U.S. must be a warrior for corporations and old, wealthy investors. Teen girls and rural American families burying opiate addicts? Fuck you, you’re on your own. Who’s going to jail? No member of the Sackler family. Nor this guy.

Life is so rich,