Scott Galloway's Blog, page 2

August 8, 2025

The Attention Economy and Young People

Economies are defined by scarcity, not abundance (scarcity = value). Today, information is abundant, attention is scarce. The scale of the world’s largest companies, the wealth of its richest people, and the power of governments are all rooted in the extraction, monetization, and custody of attention. The most recent example: American Eagle added $200 million in market cap overnight, not by increasing sales or lowering costs, but by hacking the attention economy with a Sydney Sweeney ad calibrated for the culture war’s choose-your-own-narrative ecosystem. The stock popped another 20% after President Trump praised the ad on his social media platform. Sydney Sweeney doesn’t have great jeans, or genes, but great memes.

Few people understand attention economy dynamics better than Kyla Scanlon. She captured, monetized, and continues to hold my attention on TikTok. (Where else?) She’s a frequent guest on Prof G Markets — listen here for Kyla’s American Eagle take — and the author of In This Economy? How Money & Markets Really Work. Kyla coined the term “vibecession” to explain the disconnect between the strong fundamentals and gloomy outlook of the Biden economy. This week, I asked her to write about how the attention economy affects young people.

by Kyla Scanlon

We’re all living through a time of immense change. The news cycle is whiplash-inducing, frameworks are being broken, and everything feels unmoored.

Last year on the road talking about my book, In This Economy?, I heard one common thread: worry. A generation-shaping worry. CEOs are worried about their businesses, manufacturers about tariffs, and young people about everything — from identity to employment to whether the world they’re inheriting even makes sense.

Young people today face a triple disruption: technological creative destruction through AI and algorithmic systems, plus political and economic upheaval through tariffs and increasing fiscal uncertainty. While every generation has faced challenges, today’s young people confront a massive reckoning between technology, economic opportunity, and personal identity.

Across the U.S., young people tell me the same thing: They’re worried about jobs, but more important, they question whether the concept of a “career” will even exist in five years. They’re graduating into a Great Uncertainty, where traditional pathways to security are disappearing, affecting how they think about their entire economic future — from employment to homeownership to marriage to having kids.

To understand what’s happening, we need to understand two things: the attention economy and the real economy. But let me start with a very surreal moment that crystallized everything for me.

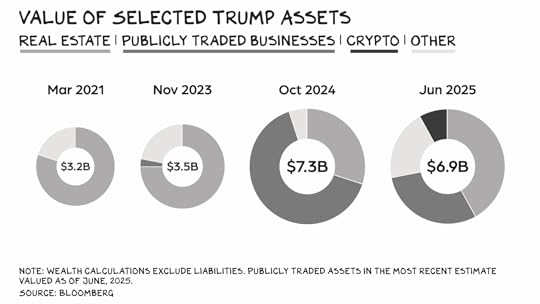

Trumpcoin: The Defining Moment of 2025Late Friday night, on January 17, 2025, Donald Trump launched a memecoin. By Sunday — a mere three days later! — Trump and his team had generated $60 billion in paper wealth from pure narrative value. By Monday, Inauguration Day, he was both president again and one of the world’s richest individuals, entirely through attention-based speculation. The coin officially “has nothing to do with any political campaign or office” (or so they say), but its success came precisely because it’s associated with him.

I believe this moment cemented our final step in the transition into the attention economy. The president of the United States bypassed every traditional wealth-creation mechanism and generated more money in 36 hours than most companies create in decades. All through attention and narrative.

Historically, value creation followed a clear progression:

Capture attention with a quality product (Apple’s iPhone), then convert that attention to business improvement (reinvestment or share buybacks).Build better products, generating real cash flow and compounding value over time. This was the Warren Buffett playbook — attention as a means to an end, with cash flow and tangible assets at its core.Trumpcoin skipped the middle steps entirely:

Capture attention.Convert directly into value.Attention is truly all you need. Attention became the product, the business improvement, the way to compound wealth. It worked with immense speed, because Trump controls political positioning (executive power, regulatory influence); platforms (narrative shaping via Truth Social); and now token wealth (instant value creation through pure narrative).

This was the birth of the Attention Singularity, where power, narrative, and wealth merged into one self-reinforcing system. Attention became so dense that it warped reality itself. We’re watching a system where attention directly creates wealth, wealth instantly empowers, power captures more attention, and each cycle gets faster and stronger.

Many young people watched this and thought: Of course this is how the world works now. Of course attention is the ultimate currency. Of course the old rules don’t apply. I have to change everything.

Watching this unfold made me question everything I thought I knew about value creation. (Cue the meme of someone throwing away a copy of the Intelligent Investor.) But it also made me realize we needed to look at the broader ecosystem that made Trumpcoin possible in the first place, because this was the logical conclusion of the system we’ve built.

The New Rules

The New RulesFour interconnected elements have reshaped our reality:

Digital Infrastructure: Our mass communication system is privatized and optimized for profit. Billionaires own newspapers, platforms, and the very means of connection. Communication has become an addiction because it has to be! That’s how the big bucks are made.The Algorithm Trap: We’ve built our communication infrastructure around engagement metrics rather than knowledge. Attention game winners excel at capturing eyeballs (Mr. Beast, Sydney Sweeney, Joe Rogan, etc.), but aggregated attention rarely equates to societal progress.Brainrot: Short-form video has totally changed how we process information. Instead of reading or having deep conversations, we absorb fragments and regurgitate talking points. We’ve drastically lowered our standards for what constitutes being informed.The Generation Gap: Among U.S. adults younger than 30, 59% use TikTok. To succeed in business, you must master digital media. Many people now work in social media or marketing — an extremely valuable skill set, but one that’s also frying our brains.These four elements reinforce one another, forming a digital cage. When narrative production becomes more valuable than actual production, we risk creating a world where attention harvesting matters more than building things. Hence, Trumpcoin.

But young people aren’t just passive victims of this system. They’re responding to it, and their responses are reshaping politics.

The Politics of DisruptionWhen things are uncertain, people retreat to extremes but also vote for “new normals.” Trump won in 2024 partly by capturing young voters who believed traditional professional paths promising stability might cease to exist soon. Coupled with increased zero-sum thinking, institutional distrust, and attention economy dynamics, young people are trying to find footing in a fundamentally new world.The conservative shift among young voters is about more than politics. When OpenAI’s Sam Altman says AI will require the “whole structure of society to be up for debate and reconfiguration,” the entire nature of the self is being questioned.

Economic HeadwindsThe boomer generation, born between 1946 and 1964, had a somewhat clearish wealth-building formula (broad generalization) and a (seemingly) clearer sense of self:

Career progression + home appreciation + retirement savings, supported by mostly predictable returns on education.This shaped their worldview and understanding of success. Boomers are the wealthiest generation to have ever lived, thanks to affordable housing and strong equity markets.

The boomer formula worked for many despite disruptions like the stagflation of the 1970s and the mega-high interest rates of the 1980s. But many boomers who benefited from this system have participated in its dismantling through thousands of small decisions prioritizing short-term gains over systemic stability.

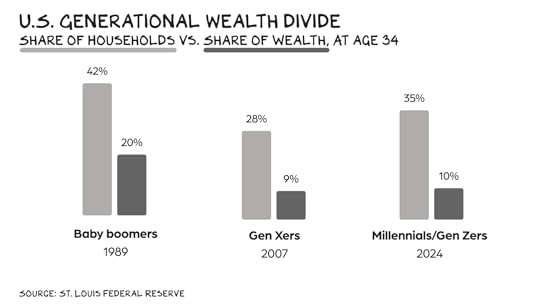

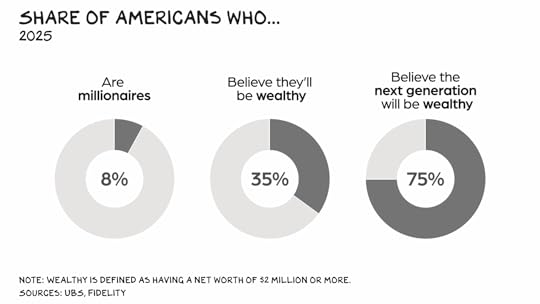

Today, boomers own 38% of homes nationwide, despite comprising just over 20% of the population. Millennials haven’t caught up to boomer life markers and homeownership rates. Homeownership rates are even lower for Gen Z than Millennials at the same ages, according to a UC Berkeley study. Meanwhile, 72.9% of wealth is held by people over 55. Millennials and Gen Z own 71% less wealth than their population representation would predict, according to the St. Louis Federal Reserve.

Young People’s Response: The Barbell Strategy

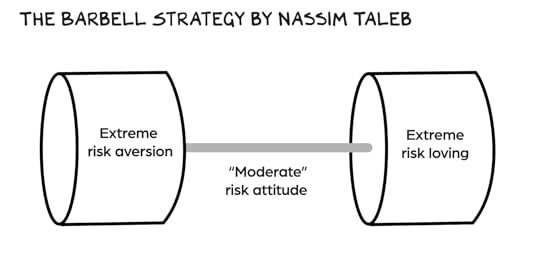

Young People’s Response: The Barbell StrategyThese conditions create a situation that resembles Nassim Taleb’s Barbell Strategy. We increasingly have a world split between young people 1) forgoing college to pursue the trades or 2) gambling everything on digital moon shots.

Taleb writes that the barbell strategy is a “method that consists of taking both a defensive attitude and an excessively aggressive one at the same time.” Here, we see people doing maybe one or the other. The barbell economy creates its own culture:

Safety seekers: Those skipping college debt to pursue trades, finding identity in stability amid chaos. The toolbelt generation is choosing steady work over uncertain professional paths.Digital gamblers: Those embracing the creator economy, crypto speculation, and AI startup moon shots. Finding identity in potential rather than stability.To be clear, a middle path still exists and is evolving. I’m generalizing to make a point. Many people are still going down the traditional road — and rightly so! — albeit with more skepticism. For some, it’s working, especially for those entering healthcare and social services, the only sectors adding jobs currently. Others are trying to bridge the gap between the past and the present with mixed results.

But as my former professor Dr. Indudeep Chhachhi says, “The opposite of rationality isn’t irrationality — it’s being normal.” When the “safe path” might be eliminated by AI overnight, hypergambling becomes emotionally and economically sensible. Safety seekers are making calculated bets. Digital gamblers are responding to an economy that increasingly rewards exponential outcomes.

Two Paths Forward

Two Paths ForwardI see two possible paths, both requiring us to acknowledge how the game has changed:

Path One: Platform Reboot. Build platforms optimized for understanding rather than engagement. Create digital spaces that strengthen society rather than fragment it. Develop algorithms that reward depth and critical thinking instead of emotional manipulation. It’s a lot. Is it possible? I’m not sure. But we certainly have to try something new.Path Two: Navigation. Teach digital literacy — beyond privacy settings — to understand attention dynamics. Create systems to preserve digital culture independent of any single platform.There are policy choices here around technology regulation, wealth transfer mechanisms, platform governance. But spending this year talking to young people across America has convinced me that the deeper challenge isn’t just technical or policy-driven. It’s about something more important: our collective capacity to understand one another across the attention economy’s fault lines.

Young people aren’t broken. They’re adapting to a world that’s fundamentally different from the one their parents knew. But their parents aren’t wrong either for feeling like the ground has shifted beneath their feet. The attention economy has created new forms of value and new pathways to wealth. The old ways of understanding ourselves and one another are straining to keep up.

The attention economy isn’t going anywhere. It’s too powerful, too integrated into how value gets created now. It’s a system, though, and systems can be changed. As historian Howard Zinn wrote: “If we remember those times and places — and there are so many — where people have behaved magnificently, this gives us the energy to act, and at least the possibility of sending this spinning top of a world in a different direction. And if we do act, in however small a way, we don’t have to wait for some grand utopian future. The future is an infinite succession of presents, and to live now as we think human beings should live, in defiance of all that is bad around us, is itself a marvelous victory.”

_______

P.S. Kyla Scanlon is the author of In This Economy? How Money & Markets Really Work. After you buy her book, you should subscribe to her newsletter.

The post The Attention Economy and Young People appeared first on No Mercy / No Malice.

August 1, 2025

Friending

This year, I wrote a book called Notes on Being a Man. My publisher is billing it as a “path forward for men and parents of boys.” (Sounds … pretentious.) It’s also my life story — the good, the bad, and the ugly. Working on the book, I observed a pattern: My friends were/are key to the trajectory of me. According to Pew, 61% of U.S. adults say having close friends is extremely or very important for a fulfilling life. The shares of people who say the same about marriage (23%), children (26%), and making a lot of money (25%) pale in comparison.

And yet, American males have fewer friends than they used to. Three decades ago, 55% of men reported having at least six close friends — plenty for a pickup basketball game. Today only 27% of men can say the same. Worse, 15% of men say they have zero friends — a 5x increase since 1990. Read that sentence again: Nearly 1 in 7 men today doesn’t have a single person he can call to shoot hoops, grab a drink, or catch a movie.

What happens to those men when the shit gets real? One horrifying data point: Men account for 3 out of every 4 deaths of despair in America. Too many men are stuck, isolated, unproductive, and prone to obesity. They’re addicted to drugs, gambling, porn, and whatever other substances provide a dopa hit with minimal friction. They’re susceptible to misogyny, conspiracy theories, and radicalization. They make inadequate mates, employees, and citizens. Can we turn this around? Yes. We have to. That’s why I wrote the book. Here’s an excerpt about making friends.

________________

The best thing anyone can do to improve their own success is make friends with people of high character who are ambitious. You are the average of your five closest friends.

For the past three or four decades, my friends have mostly been men. For a long time earlier in life, women represented two things to me—they could either help make me rich, or I could (maybe) sleep with them. Men could help me out professionally. This was the stupid, closed-minded, transactional, and sexist way I approached my life until well into my forties. No longer. I’ve spent the past ten years developing really strong friendships with women and am especially close with the women I work with. One female colleague has been with me fifteen years, another twenty-five. I love my male friends for reasons that have nothing to do with me getting ahead.

Your goal at any age is to surround yourself with impressive, good, nice people. As you get older, though, the lanes in which you might feel comfortable narrow. The idea of going on a man-date or investing in a new friendship feels more difficult. The older you get, the more you just want to hang out at home, see your partner and kids, pop a gummy, watch Netflix, and maintain links with the friends you have, without putting effort into new ones.

Socially engaged men face the decision of whether to cap the number of their friendships or not. My advice: Never shut down possibility. Get in the way of chance. I’m always on the lookout for new friends. As we’re the average of our five closest friends, wouldn’t it make sense that I’d want to keep expanding and upgrading that friend group? The goal isn’t to surround myself with doppelgangers, it’s more about me learning, getting better, thinking differently. I find friends by pushing the limits. By not being afraid to put myself out there. By going beyond my comfort zone, e.g., staying home and watching Netflix. By assuming other people are on the lookout for friends, too. Example: George Hahn reads the audio version of my weekly newsletter. During Covid, he came out with a bunch of very funny viral videos. One day I sent him a Tweet: Can we be friends? Sure, he wrote back. What are you doing now? Nothing, I said. Okay, said George, let’s grab coffee. An hour later, we were having brunch in Soho. Recently, the CIO of an investment firm texted me out of nowhere: I think we’d be great friends. Think of it as friendship cold-calling. It takes courage and resilience. If others aren’t interested, they’re not interested. If they bite, you might find yourself having breakfast or lunch with someone great.

These days, in my quest for immortality, I’ve begun getting PRP—platelet-rich plasma—injections. The doctor draws my blood, spins it in a centrifuge, and re-injects it in my shoulders. It’s supposed to relieve aches, pains, and stiffness. I’ve gone a few times, and have gotten friendly with the doc, a young, good-looking guy in his mid-forties. Last visit, I asked him about himself—was he single/married/partnered, gay/straight, did he have kids? Straight, single, and childless, he appreciated my offer to set him up. We began talking about raising boys. Turns out he’s the team physician for the New York Rangers. He suggested we go to a hockey game—would my sons be interested?

A decade or two ago, I would have said no. Not his fault. I wouldn’t have been confident enough. He was too impressive, and I would have been intimidated. It would have been too important to me to not admit I wanted him to like me, and for us to become friends. This happens to a lot of young people in America—for various reasons, their self-esteem gets so battered from hitting roadblock after roadblock while watching others succeed that they give up, foreclose on taking any more risks, whether it’s applying for a job or approaching a woman. Don’t bother, they tell themselves. You’re not worthy, you’re not that guy. In my thirties and forties, I went to every social event, found the most powerful people in the room, and became their friends or invited them to golf so I could get their business. And for reasons too exotic for me to comprehend, I was struggling with happiness? I said yes to the hockey game. The four of us had a great time. Note: You’re the average of your five closest friends. Never shut down the opportunity to meet and learn from new people.

Life is so rich,

P.S. You can pre-order Notes on Being a Man here. It will be available Nov 4.

The post Friending appeared first on No Mercy / No Malice.

July 25, 2025

Last Laugh

It’s getting awfully late, early, for late-night TV.

Stephen Colbert shocked his audience on July 17 with the news that CBS had canceled The Late Show. I interpreted it as the latest sign of America’s descent into fascism — another media company bending the knee. The headlines came just three days after Colbert slammed Paramount’s decision to pay Trump $16 million to settle a nuisance lawsuit over the editing of a 60 Minutes interview, calling it a “big fat bribe.” CBS is part of Paramount, which needed the Trump administration to bless the transfer of billions from one billionaire nepobaby (David Ellison) to another billionaire nepobaby (Shari Redstone). At some point, people will notice the only ones willing to buy media companies are rich kids who didn’t have to actually make any money. But I digress.

I was wrong about Colbert. Economics are driving him out, not politics. Granted, two things can be true at once, and Colbert’s constant ribbing of the president probably made his walk on the green mile shorter. But, let’s be clear … winter was coming. This is an overdue reshaping of the supply chain in TV. Colbert isn’t going anywhere, it’s 185 of the 200 people working for him who are going to be getting their real estate licenses. The media reaction was outrage. Nothing is more precious than a 60-something comedian, who earns 100x what his staff makes, getting furious at the suits.

But the opportunistic infection that took a weakened late-night show down was the WGA’s decision to go on strike in 2023. Netflix and, to a lesser extent, scripted TV had enough shows in the bank to hang on to all or most of their audience, respectively, for about five months. But nobody was going to tune in to Jimmy Kimmel to see Michael Avenatti … again. When late-night went dark, millions of Americans realized they didn’t miss it, and they never returned. Jon Stewart should tell the WGA board, not Paramount’s management, to go fuck themselves.

Glory DaysJohnny Carson, the “king of late night” during his three-decade run as host of The Tonight Show, attracted a nightly audience of 10 million to 15 million at his peak. Adjusted for population growth, that would be like 25 million people tuning in tonight. By the late ’70s, Tonight accounted for 17% of NBC’s revenue. In 1988, a few years before Carson handed the reins to Jay Leno, advertising dollars spent on late-night TV surged to more than $1.2 billion, as carmakers, beverage companies, and movie studios rushed to win over younger, more affluent consumers.

In 2002, Leno’s show routinely attracted more than 5 million viewers a night — still strong — and late-night shows continued to deliver into the next decade. About 15 years ago, a popular late-night program could earn about $100 million a year.

Those days are gone. The entertainment sector has experienced a seismic shift, with late-night-TV advertising revenue collapsing 50%, to an estimated $220 million in 2024 from $439 million in 2018, according to data firm Guideline. In the five years leading up to its Chapter 11 filing, General Motors’ revenue declined 40%. In sum, if late-night television were a stand-alone business, it would have declared bankruptcy last year.

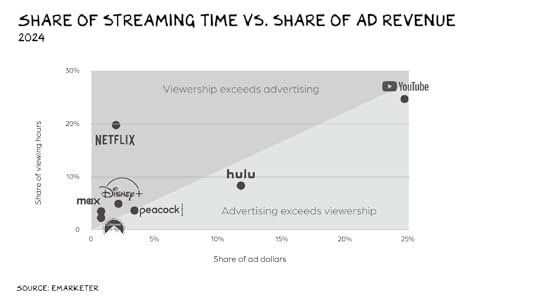

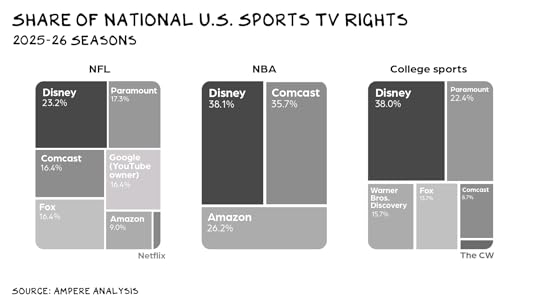

During the last two months — for the first time ever — viewers spent more time watching streaming services, including YouTube and Netflix, than the broadcast and cable networks combined. We’re still catching the highlight clips of late-night TV. But, as they do with the rest of media, technology platforms rent the content for 2 cents on the dollar.

It isn’t the end of Colbert. It’s the end of late-night TV. Colbert’s Late Show reportedly has been losing more than $40 million a year for CBS, with a budget of $100 million per season and about 200 employees. Colbert quipped: “I could see us losing $24 million, but where would Paramount have possibly spent the other $16 million? Oh, yeah.” Assuming the show is reeling in $60 million a year in revenue, that equates to $300,000 per employee. But less than 10% of The Late Show’s audience is between 18 and 49 years old, that coveted demographic still in their mating years and making irrational, high-margin purchases. And one of the key insights from the 2024 election is that podcast listeners swing elections, as they are (much) younger and more likely to be swayed. Nine out of 10 people who watch cable news and late-night, from an economic lens, don’t matter.

From Carlson to ConanThink about it: As a percentage of the population, late-night has shed 90% of its audience over the past several decades. Contrast Colbert with our company, Prof G Media. (I never miss the opportunity to boast.) We expect to generate $15 million to $20 million in annual revenue next year, with about 15 full-time people. That figure, which excludes my podcast Pivot with Kara Swisher, equates to $1 million to $1.3 million per employee. Unlike the late-night category, we’re growing 20% to 30% annually, with half of our listeners in the 18-49 age bracket. We’re reaching nearly as many of the core demographic as late-night with 8% of the staff/cost.

Talent Wins

TV’s biggest stars are simply arbitraging the means of production (i.e., losing 90% of their staff). The talent in front of the camera/mic has figured out how to hold on to their income and cultural relevance by reducing production costs.

When Fox News fired Tucker Carlson in 2023 — a week after the network settled a defamation lawsuit with Dominion Voting Systems for almost $800 million — he embraced his newfound independence. The Tucker Carlson Show averaged 1.06 million views throughout most of June and sat at No. 11 on YouTube’s podcast rankings last week. Even if his audience is smaller than it was previously, he’s likely capturing similar economic value (i.e., pay) with a smaller team. Podcasts are TV … just more efficient.

Megyn Kelly, ousted from NBC in 2019, is another example. Semafor reported last year that her Megyn Kelly Show was drawing audiences comparable to those of the legacy media outlets — with only six employees. The show, among the most followed political podcasts in the U.S., had 3.5 million subscribers in March.

Finally, consider Conan O’Brien, who hosted Late Night and The Tonight Show, both on NBC, and then Conan on TBS. I’d speculate that O’Brien, who launched the weekly podcast Conan O’Brien Needs a Friend in 2018 and later sold his podcast business to SiriusXM for $150 million, is making more money today than he did in his late-night heyday. The 150 people who worked at Late Night? See above: real estate agents.

Even though his audience has dropped from a peak of more than 3.1 million viewers in 2017-18, Colbert enjoys better ratings than his competitors, Jimmy Kimmel and Jimmy Fallon, registering an average of 2.42 million viewers during the three-month period ending in June. That compared with 1.77 million and 1.19 million for Kimmel and Fallon, respectively. If Colbert can’t hang on, it doesn’t bode well for his rivals or the staff who don’t make it onto the podcast arc with their boss.

Colbert, Fallon, and Kimmel shouldn’t be worried. They are caged in a broken business model, and it’s only a matter of time before they break free. In his first broadcast since CBS pulled the plug, Colbert earlier this week warned Trump that the “gloves are off.” When his contract ends in 10 months, the economic shackles will also come off. Instead of leading a $60 million business with 200 staff, Colbert will likely helm a $20 million business with 12 highly skilled people. These shows might lack the glitz and glamor of late-night. But that can be an advantage, as Colbert demonstrated during the pandemic, when he delivered monologues at home without a live audience, his wife, Evie Colbert, by his side.

More stars will follow Colbert into the next frontier after he leaves the late-night stage. MSNBC’s Rachel Maddow, who’s already reduced her on-air commitments to pursue podcasts, may not be able to match the $25 million salary she reportedly negotiated at the network, but her current compensation is unsustainable … and she knows it.

Primetime for PodcastsWhen it returned to its traditional format in the Ed Sullivan Theater in June 2021, The Late Show seemed eager to embrace the old-school model — and ditch everything it learned in lockdown. But the future looks more like Colbert at his vacation home in South Carolina than in front of a live audience with a band, Manhattan rent, and union workers. It means sharply lower production costs, with a lean team of 20, not 200. Call it the Old Navy of media: 80% of the production quality for a fifth of the price. The end is nigh for late-night TV. But podcasts delivering high-quality — and highly profitable — entertainment are just warming up.

RAFColbert will be just as relevant, and as much a pain in Trump’s ass, he’ll just do it via a different means of production. Podcasts are TV, but with an audio-first overlay and better unit economics. Commending the RAF in 1940, Winston Churchill said that never “was so much owed by so many to so few.” In cable news and late-night television, rarely have so many talented people been less relevant.

Life is so rich,

P.S. On the Prof G Pod Conversations this week I spoke with Michigan Governor Gretchen Whitmer about the future of the Democratic Party. Listen here on Apple or here on Spotify, or watch on YouTube.

The post Last Laugh appeared first on No Mercy / No Malice.

July 18, 2025

Resist

My go-to historical frame of reference is World War II. At a staggering global cost of 85 million lives, the Second World War was the crucible of the 20th century — an explosion of unfathomable destruction, followed by an unparalleled period of (unevenly distributed) peace and prosperity. As I’m a catastrophist, I’m hard-wired to dwell on the first part, and take the second part for granted. Also, World War II, specifically the European theater, is personal. As a kid, my father and his friends kept tabs on people with foreign accents, believing they were tracking Nazi spies in their hometown of Glasgow.

When the war ended, Dad was 15 — three years away from being deployed to the front. My Jewish mother narrowly escaped the horrors of the Holocaust. She found relative safety sheltering in the London tube during the Blitz. Had the Allies not stood their ground, my mom’s life could have ended with a train ride, and you’d be reading something else. So many of us don’t appreciate how much of our success isn’t our fault.

Last week, I wrote that masked agents in fatigues raiding churches, schools, and workplaces and separating families without due process is not modern America, but 1930s Europe. We’ve seen this movie before — it doesn’t end well. History, however, isn’t a single-screen theater, but a multiplex of outcomes. I recently spoke with historian Heather Cox Richardson, who is remarkable. While we share a diagnosis of the present, professor Richardson is an optimist and an Americanist. Comparing the present — what I call our slow burn into fascism — to previous periods of instability in American history, Richardson says, “I’m not convinced that the outcome is going to be a dictatorship. It could just as easily be that the outcome is a renewed American democracy. But it’s going to be messy, either way.” The question isn’t whether she is correct but rather, what can we learn from American history, specifically the 1850s and 1890s?

Crisis of the 1850sAt the beginning of the 1850s, American slaveholders were undefeated. They had the political capital to expand the fugitive slave laws, requiring law enforcement throughout the U.S. to aid in the arrest of runaways. If that sounds like it rhymes with today’s battles over sanctuary cities and the federalization of the California National Guard, trust your instincts. In 1855 free-staters and pro-slavery forces, egged on by national political leaders, clashed in a Civil War sneak preview called Bleeding Kansas. A year later, a pro-slavery senator attacked an abolitionist one, Charles Sumner, with a cane, nearly beating him to death on the Senate floor. If rhetoric leading to political violence reminds you of what currently passes for presidential leadership, again, trust your instincts. And for contemporary parallels of political violence, see: January 6, Charlottesville, Gretchen Whitmer, Josh Shapiro, Paul Pelosi, Steve Scalise, the attacks on state legislators in Minnesota, and the attempted assassination of Donald Trump. As Alaska Senator Lisa Murkowski recently said, “We are all afraid.” Given our history, that’s common sense.

As the 1850s neared their end, slaveholders appeared invincible. In a distant echo of today’s court battles over birthright citizenship, the Supreme Court ruled in Dred Scott that Black Americans, whether free or slaves, couldn’t be U.S. citizens. Two years later, abolitionist John Brown led a Hail Mary raid on the U.S. arsenal at Harper’s Ferry, intending to ignite a nationwide slave revolt. Federal military forces under the command of Colonel Robert E. Lee put down what contemporary accounts called an insurrection. At the time, Brown’s failed raid was a low point for abolitionists, but in retrospect it may have represented the high-water mark of pro-slave power in U.S. politics. Within a few years, a previously unthinkable coalition of unionists (many of whom held deeply racist views) and abolitionists had formed around Lincoln’s Republican Party, won a war to preserve the union, freed the slaves, launched Reconstruction, and set America on the path of industrialization.

The Gilded AgeThere’s a reason many contemporary scholars are talking about a new Gilded Age. The period between 1870 and 1900, similar to our era, was defined by extreme inequality, the corporate capture of government, corruption, and widespread distrust in institutions. Today the robber barons have rebranded as tech bros. Boss Tweed and the Tammany Hall machine have been reborn as Trump’s meme coin — a pay-for-play crypto scheme operating out of the Oval Office. The fear that Congress and the courts work for corporations and the wealthy … remains a constant.

Reformers offer another parallel. The trust-busters of the Gilded Age had Teddy Roosevelt, who took on monopolies in railroads, sugar, and oil. We have Lina Kahn working to regulate digital monopolies that dictate the terms of commerce and preside over a broken information ecosystem. Leveraging distrust of Republicans and Democrats, the short-lived Populist Party of the 1890s demanded the direct election of senators, progressive taxation, and labor protections. Andrew Yang, who consistently loses elections but wins arguments, has championed reforms, notably the universal basic income and ranked choice voting. Zohran Mamdani, a progressive beneficiary of ranked choice voting, echoes William Jennings Bryan’s slogan, “Plutocracy is abhorrent to the Republic,” when he talks about “halalflation.” Reformers and their demands change throughout our history, but they share a common theme of fighting for the little guy against monied interests.

False Prophets

False ProphetsAmerican history is a competition between two visions of governance, according to professor Richardson. Either we’re a society where people are equal under the law and have a say in their government, or we’re a society where elites have the right to rule and concentrate wealth, as they’re simply better than everyone else. At this moment, I’d argue that the 1% are protected by the law but not bound by it, and the bottom 99% are bound by the law but not protected by it.

In the Gilded Age, Andrew Carnegie personified the elite. An immigrant who made his fortune in steel during the early years of American industrialization, Carnegie initially credited his adopted country with his success. Later, however, Carnegie argued he was self-made, insisting he had a right to concentrate wealth in his hands, as he was the best steward for society. Elon Musk, also an immigrant, built his first fortune on internet infrastructure financed by American taxpayers. He built his second fortune jump-starting the electric car industry, financed once again by billions in subsidies.

Somewhere along the way, he became convinced he was humanity’s savior. For Musk, anyone who stands in the way of anointing him First Friend and/or (unelected) president is an enemy of the state. The most fortunate among us have replaced patriotism with techno-karenism. Daniel Kahneman found that, above a certain threshold, money offers no incremental increase in one’s happiness. However, there’s evidence everywhere that men who aggregate billions from technology firms become infected by an inexplicable sense of aggrievance.

Our idolatry of wealth makes Americans vulnerable to men like Carnegie and Musk. As the citizens of a country predicated on the dream of economic prosperity, Americans conflate wealth with leadership. The bottom 90% tolerate — even celebrate — a Hunger Games economy, where the rich live long, remarkable lives and everyone else dies a slow death. Why? Because each of us believes we’ll eventually reach the top. That belief isn’t optimism but opium, and it keeps the bottom 90% from realizing they’re essentially nutrition for the top 10%. Private jet owners can now accelerate the depreciation on their plane(s), but we’re stripping healthcare from millions of people. Does that make any fucking sense?

Antidote

AntidoteOne common protest slogan in the Trump era is “This is not who we are.” I agree, but as a student of history I know that’s incomplete. A more accurate slogan: “This isn’t who we want to be.” Richardson says our model should be Abraham Lincoln, who navigated through a period of political instability and violence and renewed American democracy by appealing to the values expressed in the Declaration of Independence. This Independence Day, Richardson wrote about the men who signed America’s founding document. They risked everything they had to defend the idea of human equality — an idea that’s been America’s work in progress since 1776.

“Ever since then, Americans have sacrificed their own fortunes, honor, and even their lives, for that principle. Lincoln reminded Civil War Americans of those sacrifices when he urged the people of his era to ‘take increased devotion to that cause for which they gave the last full measure of devotion — that we here highly resolve that these dead shall not have died in vain — that this nation, under God, shall have a new birth of freedom — and that government of the people, by the people, for the people, shall not perish from the Earth.’”

I find it difficult to see optimism in Lincoln’s story (see catastrophist). After he won the bloodiest war in American history, an assassin’s bullet robbed him of the opportunity to shape the peace. But at Gettysburg, just a few months after a pivotal battle where tens of thousands of Americans gave the last full measure of devotion, Lincoln appealed to American values as well as the American people. Then as now, the ball is in our court. “I’m not ready to give up on America,” Richardson told me. “We’ve renewed our democracy in the past, and we have the tools to do it again.”

The Hard PartNone of us knows how this moment will turn out.

Perhaps that’s the point. But previous generations of reformers who renewed American democracy didn’t have the luxury of hindsight or guarantees, either. They had only the present moment and a choice: retreat into cynicism or push forward into the messy, uncertain work of democracy. Susan B. Anthony faced decades of ridicule and arrest. Martin Luther King’s dream must’ve seemed impossible from his Birmingham jail cell. Dolores Huerta and Cesar Chavez organized immigrant farmworkers who had every reason to believe the system would never change. Harvey Milk knew visibility meant vulnerability in a hostile world. What they shared wasn’t optimism, but the willingness to act as if democracy could be renewed even when the evidence suggested otherwise.

My mother survived the Blitz because the Allies refused to give fascists the satisfaction of her fear; my father spent his youth tracking imaginary Nazi spies and joined the Royal Navy as freedom felt worth protecting. Democracy survives the same way it always has — not because the outcome is guaranteed, but because ordinary people decide it’s worth the risk. Resist.

Life is so rich,

P.S. My co-host Jessica Tarlov and I discuss Trump’s Epstein problem on this week’s Raging Moderates podcast. Listen here on Spotify or here on Apple, or watch on YouTube.

The post Resist appeared first on No Mercy / No Malice.

July 11, 2025

ICE Age

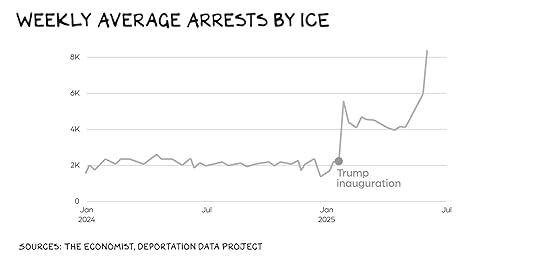

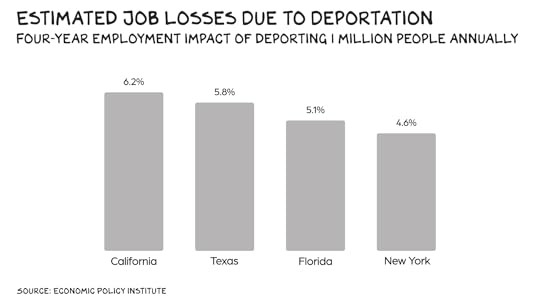

President Trump is no longer fighting inflation, China, or AI. Instead, he’s declared war on a manufactured threat: the “enemy within” — immigrants, journalists, and professors. Our biggest threat, apparently, isn’t Russian aggression or economic inequality; it’s your Uber driver or anthropology professor. This is not only cruel (and depraved) but stupid, as the chill being cast across the agriculture, services, and construction sectors will likely be more inflationary than the tariffs (more stupidity). Trump’s goal is to deport 4 million undocumented people over four years — that’s about 3% of the U.S. workforce; 10% to 15% in several sectors dependent on immigrant labor.

The “Big, Beautiful Bill” signed into law on July 4 isn’t about border security. It’s a blueprint for mass detention and deportation, a $75 billion hammer in search of a scapegoat. Under the law, ICE gets funding that rivals the military budgets of Italy or Israel to build sites like the facility in the Everglades nicknamed Alligator Alcatraz. The goal? Fear.

This isn’t law enforcement. It’s authoritarian cosplay designed to scare the electorate and silence dissent. Trump’s war doesn’t punish behavior but identity, as immigrants from certain countries and ethnicities are targeted. Federal agents in full tactical gear swept through a park in Latino-heavy L.A. this week, just to make a point. The mayor said: “It’s the way a city looks before a coup.” Q. What do storm troopers, the KKK, and ICE have in common? A mask.

Modern-Day Gestapo

Modern-Day GestapoICE has become Trump’s personal Praetorian Guard. Minnesota Governor Tim Walz, Vice President Harris’s running mate, was excoriated for comparing ICE to the gestapo. But spare us the bullshit indignation: Masked agents in fatigues raiding churches and schools separating families is not modern America but 1930s Europe. Or is it?

In the 2026 fiscal year, ICE will receive over $11 billion, a 10% increase from current funding. The new law will more than double that. It authorizes the hiring of 10,000 agents, bringing ICE’s force to nearly 30,000. In 1944, Nazi Germany had 32,000 gestapo officers and $2b (inflation adjusted) in funding. They were fighting a world war. Trump is fighting home health aides and Uber drivers.

Criminals? Not ReallyICE claims it’s targeting “the worst of the worst.” But fewer than one-third of the record 59,000 immigrant detainees have been convicted of any crime. The rest? A: Immigrants who didn’t look like the typical Iowa voter.

Trump’s reach even extends to his political rivals. He publicly questioned the citizenship of NYC mayoral candidate Zohran Mamdani and his former First Friend (Elon). Mamdani has been a U.S. citizen since 2018. Doesn’t matter. “Criminal” now also means “not for Trump.”

Jobs and LiesThe argument that immigrants are stealing jobs is a lie told by people who’ve never built a business or managed a P&L. Immigrants create jobs. They work jobs native-born Americans won’t touch. They pay into Social Security but rarely collect. Deporting them is an economic own goal. The Cato Institute estimates the cost of mass deportations could eventually exceed $1 trillion. The Peterson Institute projects a 1.2% drop in GDP if 1.3 million people are deported, growing to 7% if deportations hit 8 million. That’s not policy, but (see above) stupidity: hurting others while hurting yourself.

The Real Invasion: AI

The Real Invasion: AI Instead of militarizing immigration enforcement, we should be investing against the real challenge: AI. The World Economic Forum says 9 million jobs globally may be displaced in the next five years. Anthropic’s CEO warns AI could eliminate half of all entry-level white-collar jobs. Imagine the population of Greece storming the shores of America and taking jobs (even jobs Americans actually want), as they’re willing to work 24/7 for free. You’ve already met them. Their names are GPT, Claude, and Gemini.

Want to protect American workers? Train, don’t terrorize.

Media and Academia in the CrosshairsTrump’s war on domestic enemies doesn’t stop with ICE. He’s coming for the press and the academy. Disney, Meta, and Paramount have all settled nuisance lawsuits with Trump, for a combined total of about $60 million. All the funds go to his presidential library — where truth will go to be laundered, not learned. Newsrooms are folding or playing defense. Breaking with a long-standing tradition, the White House is handpicking press pool participants.

Harvard, once America’s aircraft carrier strike force of soft power, is now a MAGA speed bag. Autocrats always come for universities, which train people to ask questions. The White House is threatening to defund billions in research, choke off international student visas, and criminalize campus dissent. Nearly 300 top researchers have applied for “scientific asylum” — in France. In the thirties and forties, some of the world’s premier academics fled Europe for America. They brought quantum theory, chemotherapy, modern computing, and other breakthroughs with them. Oh, including the bomb. The rivers of elite human capital are now flowing in reverse, and we’re sending the scholars back. How can we be this fucking stupid?

Warriors vs. WhinersThis isn’t a slippery slope, but a vertical drop. Trump has Congress kneeling, courts folding, and corporations cashing in. What’s left is us. This was never just about immigrants, professors, or journalists. It’s about unchecked power that, unchallenged, is metastasizing.

Democracy doesn’t defend itself. We won’t fight this with hashtags, but with votes, lawsuits, and courage. This is the moment we decide: Are we citizens of a republic, or spectators to its collapse?

Life is so rich,

P.S. Historian Heather Cox Richardson joined me this week on the Prof G Pod to discuss the rise of authoritarianism, the myth of rugged individualism, and what Democrats keep getting wrong. Listen on Apple or Spotify or watch on YouTube.

The post ICE Age appeared first on No Mercy / No Malice.

June 27, 2025

The Grown-Up Tax Bill

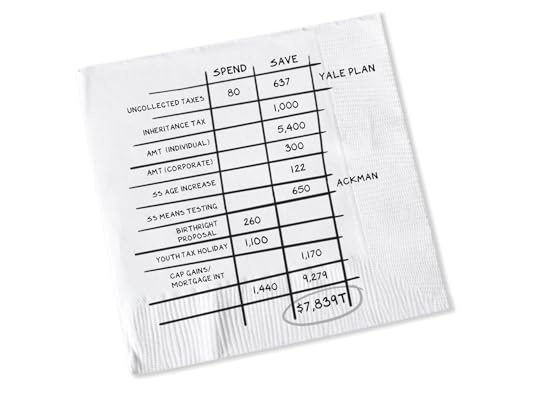

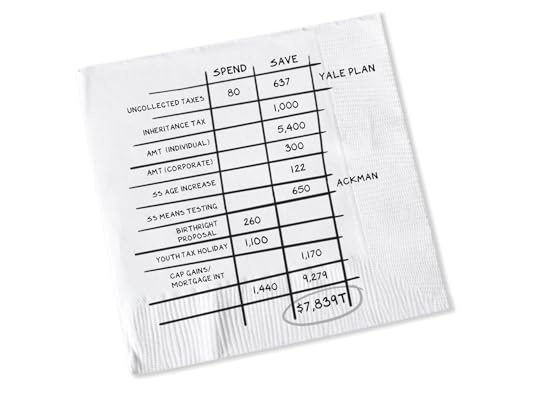

Next week the Republican-led Congress plans to move President Trump’s Big Beautiful Bill one step closer to law. The most recent CBO analysis factoring in interest rates, inflation, and economic growth put the cost to $2.8 trillion. Democrats have criticized the bill but haven’t offered alternatives as they live up to their signature “right, but ineffective” brand. Not offering a contrasting bill is a missed opportunity. So here’s my plan to reduce the deficit gradually, increase investments in future generations, and maintain economic growth. (Note: While healthcare and defense are ripe for cost-cutting, I’ve left them out of this analysis, as those are posts for another time.)

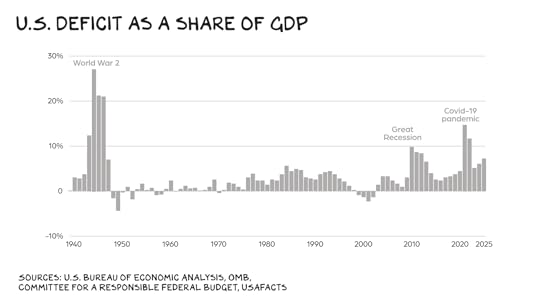

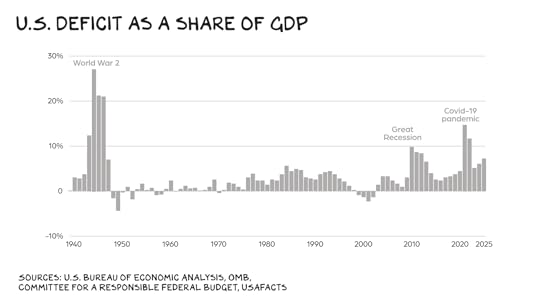

Bipartisan HallucinationEconomists frame the trade-off between defense spending and social welfare as guns vs. butter. As spending on guns increases, there’s less money for butter, and vice versa. That’s the theory, anyway. In practice, the GOP believes cutting taxes is the best strategy for growth (it isn’t), and Democrats believe the government can fix social ills by throwing money at problems. So, in the sole act of bipartisanship that endures, we cut taxes and increase spending, resulting in massive deficits that amount to deferred taxes on the young. The result? The federal budget’s fastest-growing line item isn’t defense or entitlements, but interest on our debt. So, raise taxes or cut spending? The answer is … yes.

Three ChoicesA budget involves three variables: time (costs and opportunities left for future generations), people (redistribution), and values. On my podcast, University of Michigan economics and public policy professor Justin Wolfers told me the question isn’t whether a budget increases or decreases the deficit, but what is the right level. “The basic logic is we should stash away a bit of money when times are good, so we can splash cash when times are rough.” Our current deficit-to-GDP ratio is 6.4%, meaning we’re spending money as if we’re combating a pandemic or the Great Recession. Instead, we need to run moderate surpluses that don’t stifle economic growth and/or budget deficits that are below the forecast for GDP growth. Some back of the envelope math: To reduce our deficit-to-GDP to a 1% target over the next decade, we’d need spending cuts and revenue increases that net out to approximately $150 billion, or less, in annual deficits.

Money on the Table

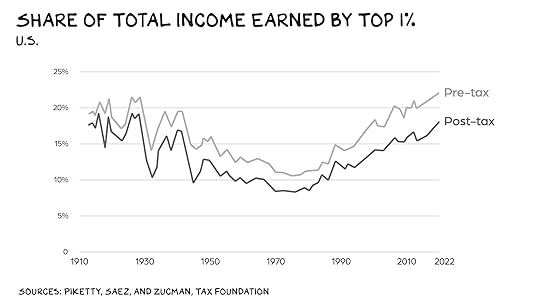

Money on the TableThe tax gap is the difference between the amount of taxes owed and the amount collected on time. According to the most recent IRS data, the tax gap in 2022 was $696b, meaning we’d make significant progress on our deficit-to-GDP target simply by cracking down on tax avoidance. Biden’s Inflation Reduction Act (IRA) put us on that path. According to an analysis from the Yale Budget Lab, its $80b increase in IRS funding over 10 years (since rescinded) would’ve netted $637b in revenue over that period. Another analysis by Larry Summers and Natasha Sarin estimated that restoring tax compliance efforts to historical levels could generate over $1 trillion in the next decade. Neutering the IRS amounted to the most regressive tax in recent history: Lower- and middle-income tax returns are simple and easy to audit/enforce. However, the explosion in the tax code from 400 to 74,000 pages over the last century created an obstacle course that must be run at night. Wealthy households have experienced navigators (tax lawyers, advisers, etc.) to guide them. Reducing the agency’s staff is a conscious decision to not enforce the tax code for the wealthy. We’re gutting the fire department during wildfire season to save water. It’s not stupidity — it’s a(nother) conscious decision to transfer wealth from poor to rich as the effective tax on the wealthy plummets.

The lion’s share of uncollected revenue ($381b) would come from individuals, unreported employment taxes ($111b), underpayments ($80b), and non-filings ($53b). One paper estimated the top 1% of earners are responsible for nearly 30% of unpaid taxes, as high earners incur greater tax liabilities, and their income tends to flow from opaque sources that aren’t subject to third-party reporting. According to Summers and Sarin, every dollar invested in audits returns $7 in revenue. But since 1960 the audit rate has fallen from 3% to 0.36%. To paraphrase the bank robber Willie Sutton, audits are where the money is. According to a GAO report, AI could help the IRS deploy its limited resources to identify suspect returns, understand complex audits, and free up staff to improve customer service.

Dynasties vs. DecencyOne of the most offensive provisions in Trump’s Big Beautiful Bill is a permanent increase in the estate tax exemption to an inflation-indexed $15m, per person — letting couples pass $30m to their heirs tax-free while slashing food stamps. We’re opting for dynasties over decency. Good governance is implementing taxes that are the least “taxing.” That’s the basis for a progressive tax system — I can more easily endure a high tax rate than a special needs teacher making $40k. Vastly reducing the inheritance exemption is likely the least taxing tax that could raise substantial revenue. Your kid inheriting $7m vs. $9m won’t hurt. I know a lot of rich kids. The very rich are no happier than the rich; there are diminishing returns to happiness above a $200k annual in income. My proposal: Drop the exemption to $1 million and tax inheritances above that threshold at 40%, without loopholes. That would raise an estimated $118b in annual revenue, or more than $1 trillion over a decade.

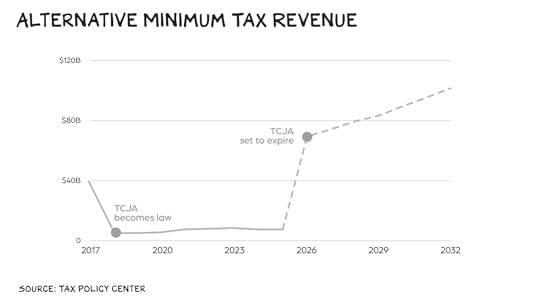

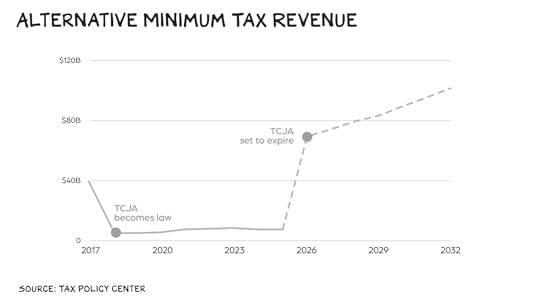

Alternative Minimum TaxIn 1969, Congress learned that 155 taxpayers with incomes exceeding $200,000 (nearly $2m today) had paid no federal income tax in 1966. Representatives received more constituent letters about these 155 taxpayers than about the Vietnam War. In response to that outrage, Congress created an early version of the alternative minimum tax. Over the following decades, Congress tinkered with the AMT, but the basic idea was to compare an individual’s income before and after they claimed certain deductions and dove into the torrent of loopholes inserted by lobbyists.

After a portion of their income is exempted, the taxpayer must pay tax on whichever amount is greater. The 2017 Tax Cuts and Jobs Act didn’t eliminate the AMT, but it limited its scope, dropping the number of taxpayers affected by the tax from 5.2m to 200k. We should bring back the individual AMT with a $1m threshold taxed at 40% and a $10m threshold taxed at 60%. If 60% sounds high, historically … it isn’t. This would raise $540b in revenue per year, while only affecting the top 0.2% of filers, or about 275k taxpayers, according to my back-of-the-envelope calculation. We could also do nothing, as the TCJA’s assault on the AMT is set to expire this year if Congress doesn’t act.

Eliminate the Youth Tax

Eliminate the Youth TaxLower long-term capital gains rates and mortgage interest deductions are nothing but a transfer of wealth from young to old, poor to rich. Who owns stocks/homes? A: The old/rich. Who rents and makes their money from a salary? A: The young/poor. Eliminating the capital gains tax deduction (taxing windfalls at the same rate as ordinary income) and the mortgage interest deduction would add $117b/annum to revenue.

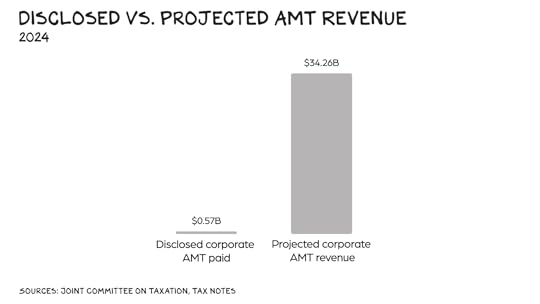

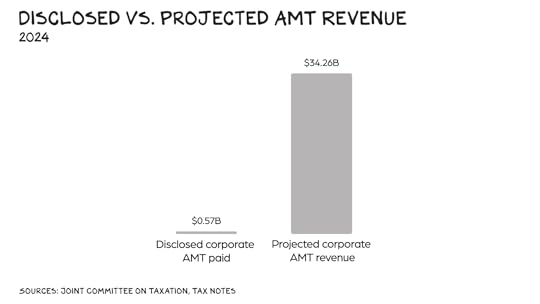

Corporate CitizensHow many lobbyists does it take to change a light bulb? A: None, as they prefer to keep everyone in the dark. In 2024, U.S. businesses spent $4.4b on lobbying. It may be the greatest ROI in economic history. One study found that lobbying connected to a 2004 law that created a one-time tax holiday for repatriated profits delivered a 22,000% return. You can’t ban lobbying, but you can make it less profitable by turning on the lights. In 2017 the TCJA did away with the corporate AMT, which had raised only $13b over the previous decade. The 2022 IRA brought back the corporate AMT, but it was so poorly executed that it fell far short of its projected $222b in revenue. Here’s my idea: Lower the threshold to $500m, double the rate to 30%, and take a machete to the tax code. By limiting accelerated depreciation, restricting R&D and clean energy credits, capping deductions for net operating losses, and limiting foreign tax credits, we can design a corporate AMT that raises an estimated $300b in revenue over a decade, while affecting approximately 400 corporations, or fewer than 0.1% of all U.S. businesses.

Third Rail

Third RailSince 1957 the share of Americans who are 65 and older has nearly doubled from 9% to 17%. At $1.5 trillion dollars, Social Security is the largest expenditure in the federal budget. U.S. seniors are the wealthiest cohort in history and the recipients of the largest redistribution in history. The program, which currently serves 69m Americans, is due to run out of money in eight years. Three trends are driving insolvency: more people reaching retirement age (good), people living longer into retirement (also good), and a decline in workforce participation (not good). If/when Social Security becomes insolvent, America’s grandparents will likely put their retirement on their grandkids’ credit cards. The fix is straightforward, but politically fraught: Means-test benefits and raise the retirement age (exempting people in physically demanding professions). According to a CBO analysis, increasing the full retirement age by two months per birth year until it reaches age 70 for Americans born in 1978 or later would decrease total federal outlays by $122b through 2032. Phasing out benefits for those with more than $150,000 of non-Social Security income would save an estimated $600b to $700b over a decade. We now spend $5 on seniors for every $1 on children. Enough already. Seniors who need Social Security should get it, but it shouldn’t mean an upgrade from Carnival to Crystal Cruises for NaNa and PopPop. At current rates, within a decade, we’ll spend half our federal budget on programs for seniors. (See above: The wealthiest generation in history.)

Planting SeedsLast year, I gave a TED Talk that asked whether we love our children. Spoiler alert: We don’t. Our policy choices rob from the young/poor and give to the old/wealthy. The Big Beautiful Bill is no exception, but it does contain one “concept of a plan” worth mentioning. “Trump Accounts” would give each child $1,000 in a tax-deferred savings account; parents would be able to add up to $5k annually. The problem isn’t the $3.6b annual price tag, but the authoritarian branding gimmick. The tell? Only children born during Trump’s second term receive the benefit; the rest of America’s children are shit out of luck.

But there are other interesting “baby bond” proposals. Senator Cory Booker’s American Opportunity Accounts Act would grant every American $1k at birth, plus an annual supplement of up to $2k, scaled by family income. The funds become available when the recipient turns 18 and can be used for education, homeownership, or retirement contributions. Financier Bill Ackman’s Birthright proposal would grant every American $6,750 at birth at an estimated annual cost of $26b. The money would be invested in index funds until the recipient turns 65 — at an 8% rate of return, the bond would be worth $1m at maturity. Giving young people seed capital can grease the skids toward upward mobility, erode stark racial and regional wealth disparities, and renew the American dream. If our leaders do their job(s) and think long term, we’ll adopt an Ackman-like plan and, in 30 years, see an end to Social Security. In another 30 years we’d likely register a decline in interest rates and our largest line item, interest on our debt. As an old Greek proverb says, “A society grows great when old men plant trees whose shade they know they will never sit under.”

Tax HolidayTo combat high youth unemployment and stem the tide of young people leaving the country, Portugal announced a tax holiday for workers younger than 35. Under the plan, young people earning up to €28,000 a year receive a 100% tax exemption in their first year of work and reduced tax rates over the subsequent decade. U.S. youth unemployment is lower than in Portugal, and brain drain isn’t an issue, unless you’re a scientist or talented immigrant. Nevertheless, a tax holiday would benefit young Americans, as many of their challenges — education and housing affordability, stagnant wages, loneliness, declines in sex and dating, and a mental health crisis — reverse-engineer to income. My proposal: A federal tax holiday for workers under 35 earning less than $75k per year. (Note: These workers would still pay withholding taxes.) This would cost $110b annually, according to my back-of-the-envelope calculation. However, the extra cash — anywhere between $4,500 and $11,500 — would be a lifeline to struggling young people, and just as important, a rare sign that America actually loves its children.

Free Gift With PurchaseThe first rule of holes is simple: Stop digging. For too long, Washington has been in a bipartisan shovel brigade. Somewhere on the horizon is a fiscal cliff. We don’t have to turn on a dime, as we didn’t get here overnight. But the moment we reverse course and signal that we’re grown-ups, the bond markets will notice, and interest rates will likely come down. Or we can continue to fuck around and find out. For every percentage-point increase in the debt-to-GDP ratio, the interest on Treasuries increases 2 basis points, according to a CBO analysis. That’s not much. But as Michigan’s Wolfers told me, we’re on track to raise the debt-to-GDP ratio by 25%, to 50%, in the coming years, resulting in a 1% increase on the interest we pay to borrow money. That translates to an additional $400b/year in interest costs. The more we spend servicing our debt, the more our creditors will worry about repayment. That means interest rates will continue to rise, and there won’t be any fiscal room left to keep seniors out of poverty, lift up young people, pay for healthcare, and provide for the common defense. Even without modeling for behavioral changes, my rough calculations illustrate a stark directional choice: Continue our march toward that fiscal cliff, or find real savings and invest in our future over the next decade.

Grow Up

Grow UpJust as Big Tech weaponizes the “illusion of complexity” to convince us they just can’t figure out how to fact-check, stop Nazi content from going viral, or age-gate their platform (spoiler alert: They’re lying), lobbyists will fear-monger and claim these are complex issues with unintended consequences. The solutions are simple, but they’re also hard, requiring us to resume the adult conversation that ended when George W. Bush told Americans we could prosecute a war and cut taxes at the same time. And we believed him. I’ve come to realize I’m not my sons’ friend, but their father: Our difficult conversations instill a set of values which will serve them well in the future (I hope). We’ve been told we can have chocolate cake for dinner and not go to school if we don’t feel like it. At some point, let’s hope/trust an adult shows up.

Life is so rich,

P.S. Our full conversation with economist Justin Wolfers on Prof G Markets is required listening for grown-ups. Here on Apple or Spotify or YouTube.

The post The Grown-Up Tax Bill appeared first on No Mercy / No Malice.

The Grown Up Tax Bill

Next week the Republican-led Congress plans to move President Trump’s Big Beautiful Bill one step closer to law. The most recent CBO analysis factoring in interest rates, inflation, and economic growth put the cost to $2.8 trillion. Democrats have criticized the bill but haven’t offered alternatives as they live up to their signature “right, but ineffective” brand. Not offering a contrasting bill is a missed opportunity. So here’s my plan to reduce the deficit gradually, increase investments in future generations, and maintain economic growth. (Note: While healthcare and defense are ripe for cost-cutting, I’ve left them out of this analysis, as those are posts for another time.)

Bipartisan HallucinationEconomists frame the trade-off between defense spending and social welfare as guns vs. butter. As spending on guns increases, there’s less money for butter, and vice versa. That’s the theory, anyway. In practice, the GOP believes cutting taxes is the best strategy for growth (it isn’t), and Democrats believe the government can fix social ills by throwing money at problems. So, in the sole act of bipartisanship that endures, we cut taxes and increase spending, resulting in massive deficits that amount to deferred taxes on the young. The result? The federal budget’s fastest-growing line item isn’t defense or entitlements, but interest on our debt. So, raise taxes or cut spending? The answer is … yes.

Three ChoicesA budget involves three variables: time (costs and opportunities left for future generations), people (redistribution), and values. On my podcast, University of Michigan economics and public policy professor Justin Wolfers told me the question isn’t whether a budget increases or decreases the deficit, but what is the right level. “The basic logic is we should stash away a bit of money when times are good, so we can splash cash when times are rough.” Our current deficit-to-GDP ratio is 6.4%, meaning we’re spending money as if we’re combating a pandemic or the Great Recession. Instead, we need to run moderate surpluses that don’t stifle economic growth and/or budget deficits that are below the forecast for GDP growth. Some back of the envelope math: To reduce our deficit-to-GDP to a 1% target over the next decade, we’d need spending cuts and revenue increases that net out to approximately $150 billion, or less, in annual deficits.

Money on the Table

Money on the TableThe tax gap is the difference between the amount of taxes owed and the amount collected on time. According to the most recent IRS data, the tax gap in 2022 was $696b, meaning we’d make significant progress on our deficit-to-GDP target simply by cracking down on tax avoidance. Biden’s Inflation Reduction Act (IRA) put us on that path. According to an analysis from the Yale Budget Lab, its $80b increase in IRS funding over 10 years (since rescinded) would’ve netted $637b in revenue over that period. Another analysis by Larry Summers and Natasha Sarin estimated that restoring tax compliance efforts to historical levels could generate over $1 trillion in the next decade. Neutering the IRS amounted to the most regressive tax in recent history: Lower- and middle-income tax returns are simple and easy to audit/enforce. However, the explosion in the tax code from 400 to 74,000 pages over the last century created an obstacle course that must be run at night. Wealthy households have experienced navigators (tax lawyers, advisers, etc.) to guide them. Reducing the agency’s staff is a conscious decision to not enforce the tax code for the wealthy. We’re gutting the fire department during wildfire season to save water. It’s not stupidity — it’s a(nother) conscious decision to transfer wealth from poor to rich as the effective tax on the wealthy plummets.

The lion’s share of uncollected revenue ($381b) would come from individuals, unreported employment taxes ($111b), underpayments ($80b), and non-filings ($53b). One paper estimated the top 1% of earners are responsible for nearly 30% of unpaid taxes, as high earners incur greater tax liabilities, and their income tends to flow from opaque sources that aren’t subject to third-party reporting. According to Summers and Sarin, every dollar invested in audits returns $7 in revenue. But since 1960 the audit rate has fallen from 3% to 0.36%. To paraphrase the bank robber Willie Sutton, audits are where the money is. According to a GAO report, AI could help the IRS deploy its limited resources to identify suspect returns, understand complex audits, and free up staff to improve customer service.

Dynasties vs. DecencyOne of the most offensive provisions in Trump’s Big Beautiful Bill is a permanent increase in the estate tax exemption to an inflation-indexed $15m, per person — letting couples pass $30m to their heirs tax-free while slashing food stamps. We’re opting for dynasties over decency. Good governance is implementing taxes that are the least “taxing.” That’s the basis for a progressive tax system — I can more easily endure a high tax rate than a special needs teacher making $40k. Vastly reducing the inheritance exemption is likely the least taxing tax that could raise substantial revenue. Your kid inheriting $7m vs. $9m won’t hurt. I know a lot of rich kids. The very rich are no happier than the rich; there are diminishing returns to happiness above a $200k annual in income. My proposal: Drop the exemption to $1 million and tax inheritances above that threshold at 40%, without loopholes. That would raise an estimated $118b in annual revenue, or more than $1 trillion over a decade.

Alternative Minimum TaxIn 1969, Congress learned that 155 taxpayers with incomes exceeding $200,000 (nearly $2m today) had paid no federal income tax in 1966. Representatives received more constituent letters about these 155 taxpayers than about the Vietnam War. In response to that outrage, Congress created an early version of the alternative minimum tax. Over the following decades, Congress tinkered with the AMT, but the basic idea was to compare an individual’s income before and after they claimed certain deductions and dove into the torrent of loopholes inserted by lobbyists.

After a portion of their income is exempted, the taxpayer must pay tax on whichever amount is greater. The 2017 Tax Cuts and Jobs Act didn’t eliminate the AMT, but it limited its scope, dropping the number of taxpayers affected by the tax from 5.2m to 200k. We should bring back the individual AMT with a $1m threshold taxed at 40% and a $10m threshold taxed at 60%. If 60% sounds high, historically … it isn’t. This would raise $540b in revenue per year, while only affecting the top 0.2% of filers, or about 275k taxpayers, according to my back-of-the-envelope calculation. We could also do nothing, as the TCJA’s assault on the AMT is set to expire this year if Congress doesn’t act.

Eliminate the Youth Tax

Eliminate the Youth TaxLower long-term capital gains rates and mortgage interest deductions are nothing but a transfer of wealth from young to old, poor to rich. Who owns stocks/homes? A: The old/rich. Who rents and makes their money from a salary? A: The young/poor. Eliminating the capital gains tax deduction (taxing windfalls at the same rate as ordinary income) and the mortgage interest deduction would add $117b/annum to revenue.

Corporate CitizensHow many lobbyists does it take to change a light bulb? A: None, as they prefer to keep everyone in the dark. In 2024, U.S. businesses spent $4.4b on lobbying. It may be the greatest ROI in economic history. One study found that lobbying connected to a 2004 law that created a one-time tax holiday for repatriated profits delivered a 22,000% return. You can’t ban lobbying, but you can make it less profitable by turning on the lights. In 2017 the TCJA did away with the corporate AMT, which had raised only $13b over the previous decade. The 2022 IRA brought back the corporate AMT, but it was so poorly executed that it fell far short of its projected $222b in revenue. Here’s my idea: Lower the threshold to $500m, double the rate to 30%, and take a machete to the tax code. By limiting accelerated depreciation, restricting R&D and clean energy credits, capping deductions for net operating losses, and limiting foreign tax credits, we can design a corporate AMT that raises an estimated $300b in revenue over a decade, while affecting approximately 400 corporations, or fewer than 0.1% of all U.S. businesses.

Third Rail

Third RailSince 1957 the share of Americans who are 65 and older has nearly doubled from 9% to 17%. At $1.5 trillion dollars, Social Security is the largest expenditure in the federal budget. U.S. seniors are the wealthiest cohort in history and the recipients of the largest redistribution in history. The program, which currently serves 69m Americans, is due to run out of money in eight years. Three trends are driving insolvency: more people reaching retirement age (good), people living longer into retirement (also good), and a decline in workforce participation (not good). If/when Social Security becomes insolvent, America’s grandparents will likely put their retirement on their grandkids’ credit cards. The fix is straightforward, but politically fraught: Means-test benefits and raise the retirement age (exempting people in physically demanding professions). According to a CBO analysis, increasing the full retirement age by two months per birth year until it reaches age 70 for Americans born in 1978 or later would decrease total federal outlays by $122b through 2032. Phasing out benefits for those with more than $150,000 of non-Social Security income would save an estimated $600b to $700b over a decade. We now spend $5 on seniors for every $1 on children. Enough already. Seniors who need Social Security should get it, but it shouldn’t mean an upgrade from Carnival to Crystal Cruises for NaNa and PopPop. At current rates, within a decade, we’ll spend half our federal budget on programs for seniors. (See above: The wealthiest generation in history.)

Planting SeedsLast year, I gave a TED Talk that asked whether we love our children. Spoiler alert: We don’t. Our policy choices rob from the young/poor and give to the old/wealthy. The Big Beautiful Bill is no exception, but it does contain one “concept of a plan” worth mentioning. “Trump Accounts” would give each child $1,000 in a tax-deferred savings account; parents would be able to add up to $5k annually. The problem isn’t the $3.6b annual price tag, but the authoritarian branding gimmick. The tell? Only children born during Trump’s second term receive the benefit; the rest of America’s children are shit out of luck.

But there are other interesting “baby bond” proposals. Senator Cory Booker’s American Opportunity Accounts Act would grant every American $1k at birth, plus an annual supplement of up to $2k, scaled by family income. The funds become available when the recipient turns 18 and can be used for education, homeownership, or retirement contributions. Financier Bill Ackman’s Birthright proposal would grant every American $6,750 at birth at an estimated annual cost of $26b. The money would be invested in index funds until the recipient turns 65 — at an 8% rate of return, the bond would be worth $1m at maturity. Giving young people seed capital can grease the skids toward upward mobility, erode stark racial and regional wealth disparities, and renew the American dream. If our leaders do their job(s) and think long term, we’ll adopt an Ackman-like plan and, in 30 years, see an end to Social Security. In another 30 years we’d likely register a decline in interest rates and our largest line item, interest on our debt. As an old Greek proverb says, “A society grows great when old men plant trees whose shade they know they will never sit under.”

Tax HolidayTo combat high youth unemployment and stem the tide of young people leaving the country, Portugal announced a tax holiday for workers younger than 35. Under the plan, young people earning up to €28,000 a year receive a 100% tax exemption in their first year of work and reduced tax rates over the subsequent decade. U.S. youth unemployment is lower than in Portugal, and brain drain isn’t an issue, unless you’re a scientist or talented immigrant. Nevertheless, a tax holiday would benefit young Americans, as many of their challenges — education and housing affordability, stagnant wages, loneliness, declines in sex and dating, and a mental health crisis — reverse-engineer to income. My proposal: A federal tax holiday for workers under 35 earning less than $75k per year. (Note: These workers would still pay withholding taxes.) This would cost $110b annually, according to my back-of-the-envelope calculation. However, the extra cash — anywhere between $4,500 and $11,500 — would be a lifeline to struggling young people, and just as important, a rare sign that America actually loves its children.

Free Gift With PurchaseThe first rule of holes is simple: Stop digging. For too long, Washington has been in a bipartisan shovel brigade. Somewhere on the horizon is a fiscal cliff. We don’t have to turn on a dime, as we didn’t get here overnight. But the moment we reverse course and signal that we’re grown-ups, the bond markets will notice, and interest rates will likely come down. Or we can continue to fuck around and find out. For every percentage-point increase in the debt-to-GDP ratio, the interest on Treasuries increases 2 basis points, according to a CBO analysis. That’s not much. But as Michigan’s Wolfers told me, we’re on track to raise the debt-to-GDP ratio by 25%, to 50%, in the coming years, resulting in a 1% increase on the interest we pay to borrow money. That translates to an additional $400b/year in interest costs. The more we spend servicing our debt, the more our creditors will worry about repayment. That means interest rates will continue to rise, and there won’t be any fiscal room left to keep seniors out of poverty, lift up young people, pay for healthcare, and provide for the common defense. Even without modeling for behavioral changes, my rough calculations illustrate a stark directional choice: Continue our march toward that fiscal cliff, or find real savings and invest in our future over the next decade.

Grow Up

Grow UpJust as Big Tech weaponizes the “illusion of complexity” to convince us they just can’t figure out how to fact-check, stop Nazi content from going viral, or age-gate their platform (spoiler alert: They’re lying), lobbyists will fear-monger and claim these are complex issues with unintended consequences. The solutions are simple, but they’re also hard, requiring us to resume the adult conversation that ended when George W. Bush told Americans we could prosecute a war and cut taxes at the same time. And we believed him. I’ve come to realize I’m not my sons’ friend, but their father: Our difficult conversations instill a set of values which will serve them well in the future (I hope). We’ve been told we can have chocolate cake for dinner and not go to school if we don’t feel like it. At some point, let’s hope/trust an adult shows up.

Life is so rich,

P.S. Our full conversation with economist Justin Wolfers on Prof G Markets is required listening for grown-ups. Here on Apple or Spotify or YouTube.

The post The Grown Up Tax Bill appeared first on No Mercy / No Malice.

June 20, 2025

Pomp vs. Protest

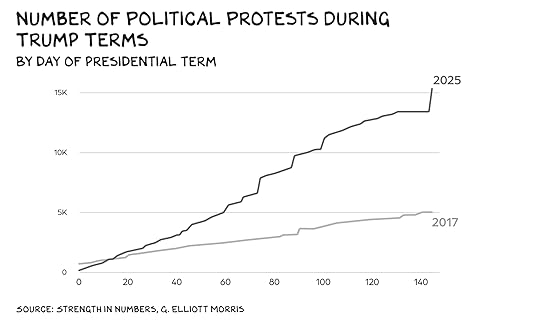

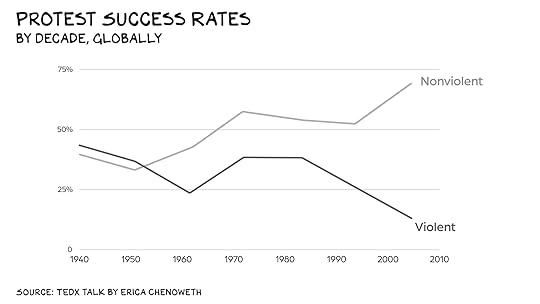

June 14 was a day of stark contrasts and dueling narratives. As President Trump staged a military parade and tanks squeaked down Constitution Avenue, millions of Americans — from Bangor to Beverly Hills — marched in the streets to protest. Trump celebrated the country’s military might (and his 79th birthday), vowing to crush foreign adversaries that threaten the U.S. and use “heavy force” to stop any domestic protesters who stood in his way. The peaceful resistance movement in 2,100 cities and towns across America had a simple message: No thrones. No crowns. No kings.

The clash between hardware and software made strikingly clear that putting tanks and troops on your own roads isn’t a sign of strength, but weakness. There are three firewalls between a democracy and autocracy: the courts, the media, and the citizenry. The GOP represents the 1% at the cost of the 99%. The Democrats are more interested in grasping for social virtue than improving the material and emotional well-being of Americans. When your representatives won’t represent, you become your own delegation.

No KingsAttendance at Trump’s parade to commemorate the U.S. Army’s 250th anniversary appeared to fall far short of the White House’s estimate of 250,000 people. Secretary of State Marco Rubio’s yawn, captured on camera, said it all. The celebration, brought to you by sponsors such as Coinbase and Palantir, was a sad spectacle. The event had the cool factor of your drunk uncle showing off his karate moves at Thanksgiving. I wonder if what ultimately limits the damage of this clearance-rack autocrat isn’t the courts or the 10-year bond, but just how lame he is.