Gennaro Cuofano's Blog, page 70

January 23, 2025

Is Google Ready To Launch An AR Device?

In a strategic move to bolster its position in the extended reality (XR) market, Google has announced the acquisition of a segment of HTC’s XR division for $250 million. This deal includes the transfer of select HTC employees to Google and grants Google a non-exclusive license to HTC’s XR-related intellectual property, while allowing HTC to continue its own development in this field (see Reuters)

This acquisition is reminiscent of Google’s 2017 purchase of HTC’s smartphone operations for $1.1 billion, a transaction that integrated a significant portion of HTC’s engineering talent into Google’s hardware endeavors, notably influencing the development of subsequent Pixel smartphones (see TechCrunch).

The current deal is poised to accelerate the development of the Android XR platform, Google’s newly announced operating system tailored for extended reality devices such as headsets and smart glasses. Android XR aims to offer immersive versions of Google applications, support existing phone and tablet apps, and feature a multi-window version of Chrome. Central to this experience is Google’s Gemini AI, designed to enhance user interactions within XR environments (see The Verge)

In tandem with this acquisition, Google is collaborating with Samsung on “Project Moohan,” a mixed reality headset set to be the first device running on Android XR. Scheduled for release in 2025, Project Moohan is expected to offer high-end features at a price point significantly lower than Apple’s $3,500 Vision Pro (Financial Times)

These strategic initiatives underscore Google’s commitment to establishing a robust presence in the XR market, positioning itself alongside competitors like Apple and Meta. The integration of HTC’s expertise and the partnership with Samsung signal a concerted effort to develop consumer-ready AR devices, potentially leading to significant product launches in the near future.

The post Is Google Ready To Launch An AR Device? appeared first on FourWeekMBA.

January 22, 2025

The AI Suppy Chain

The Complete AI Stack framework by Gennaro Cuofano breaks down AI systems into four layers: the Hardware Layer, Foundation Models, Vertical Solutions, and the Application Layer. Each layer serves a critical purpose, creating a structured approach to developing, deploying, and scaling AI solutions across industries.

Main Article:

The rise of artificial intelligence has led to increasingly complex systems designed to address diverse challenges. The Complete AI Stack, a framework by Gennaro Cuofano, provides a structured view of how AI technologies are built and deployed. It divides the AI ecosystem into four interconnected layers, emphasizing the importance of collaboration between hardware, foundational models, industry-specific solutions, and user-facing applications.

At the base of the AI stack is the Hardware Layer, encompassing the infrastructure and computational resources needed to power AI systems. This layer includes GPUs, TPUs, cloud computing platforms, and specialized chips optimized for AI workloads. Efficient hardware is critical for training large-scale models, processing massive datasets, and running inference in real-time applications.

Advances in AI hardware, such as energy-efficient chips and quantum computing prototypes, continue to push the boundaries of what’s possible. Without this robust foundation, the upper layers of the stack would lack the computational power required to operate effectively.

2. Foundation Models: Core AI Capabilities

2. Foundation Models: Core AI Capabilities

Building on the hardware layer are the Foundation Models—large, pre-trained models that form the core capabilities of AI systems. These models, such as GPT (for natural language processing) or Stable Diffusion (for image generation), serve as general-purpose engines that can be fine-tuned for specific applications.

Foundation models are trained on vast datasets and require immense computational resources during development. Once trained, they act as a versatile base, enabling organizations to reduce development time and costs when creating AI solutions tailored to specific needs.

3. Vertical Solutions: Industry-Specific Applications

3. Vertical Solutions: Industry-Specific ApplicationsThe next layer is Vertical Solutions, where foundational models are adapted and applied to industry-specific use cases. This layer bridges the gap between general-purpose AI and specialized demands across sectors like healthcare, finance, retail, and manufacturing. For instance:

In healthcare, AI models assist in diagnosing diseases through medical imaging.In finance, algorithms detect fraudulent transactions or optimize investment portfolios.In retail, AI powers recommendation systems and supply chain optimizations.Vertical solutions are essential for maximizing the utility of foundation models, as they address the unique requirements and constraints of individual industries.

4. Application Layer: End-User InterfacesAt the top of the stack lies the Application Layer, which delivers AI capabilities to end users through accessible interfaces. This layer includes AI-driven software, mobile apps, and tools that enable seamless interaction between humans and machines. Chatbots, virtual assistants, and predictive analytics dashboards are common examples.

The application layer ensures that AI’s power is harnessed in a user-friendly manner, making complex technologies accessible to a broader audience. The success of AI systems often depends on how well this layer integrates with existing workflows and solves real-world problems.

A Cohesive FrameworkThe Complete AI Stack framework underscores the importance of collaboration between layers. Hardware innovations empower foundational models, which are adapted into vertical solutions, ultimately culminating in user-facing applications. Each layer plays a vital role, and advancements in one can accelerate progress across the stack.

The post The AI Suppy Chain appeared first on FourWeekMBA.

Psychological Adoption Cycles of AI

The Psychological Adoption Cycle of AI framework, created by Gennaro Cuofano, explores how humans and markets adapt to AI innovations. It emphasizes three interlinked aspects: Market Evolution, Social Impact, and Psychology. This cycle sheds light on how AI technologies move from novelty to normalization, influencing industries and societal behaviors.

1. Market Evolution: Driving Commercial InnovationThe journey of AI adoption begins with Market Evolution. This phase is characterized by the emergence of new AI models, which spark interest and curiosity. These models, ranging from generative AI to predictive algorithms, quickly find applications in commercial industries. From automation in manufacturing to personalized recommendations in e-commerce, AI moves into commercial apps, addressing diverse use cases.

As the market matures, AI solutions become tailored to vertical niches, targeting specific industries like healthcare, finance, and logistics. This specialization maximizes the utility of AI, allowing it to penetrate deeper into workflows and processes. Market Evolution is a continuous cycle, with each innovation opening doors to new possibilities, ensuring AI remains a cornerstone of economic growth.

2. Social Impact: Bridging Fear and IntegrationWhile markets drive innovation, Social Impact focuses on the human experience with AI. Initial exposure to AI often evokes the fear of the unknown, stemming from concerns about job displacement, ethical implications, and loss of privacy. However, as individuals encounter AI through direct experience, this fear begins to dissipate. Examples include voice assistants like Siri or AI-driven customer service tools, which simplify everyday tasks.

Through repeated interactions, society transitions toward integration, where AI becomes a normalized aspect of daily life. The integration phase is pivotal for reducing skepticism and fostering trust. It’s here that societal behaviors adapt to AI, enabling widespread adoption.

3. Psychology: From Awe to AcceptanceThe third element of the cycle focuses on Psychology—the personal and emotional journey of adapting to AI. Initially, new AI technologies trigger a “wow effect”, capturing public imagination with their capabilities. This phase is marked by excitement and optimism, as people envision the potential of AI to solve complex problems.

However, over time, users experience hedonic adaptation, where the novelty of AI wears off. What once felt groundbreaking becomes routine. This shift leads to normalization, where AI is no longer seen as an extraordinary tool but as an integral part of life, akin to smartphones or the internet.

A Continuous CycleThe Psychological Adoption Cycle of AI demonstrates that the adoption of AI is not linear. Instead, it is a recurring process where psychological, societal, and market factors constantly interact. Market innovations inspire social transformations, which, in turn, shape psychological responses to AI.

ConclusionBy examining this framework, we gain a deeper understanding of how AI evolves from a cutting-edge technology to a societal staple. The cycle highlights the importance of addressing both human emotions and practical concerns to ensure smooth adoption. As AI continues to redefine the future, navigating this psychological adoption cycle will remain critical for its success.

The post Psychological Adoption Cycles of AI appeared first on FourWeekMBA.

AI Industry Evolution Cycles

The AI Industry Evolution Cycles framework, designed by Gennaro Cuofano, illustrates the trajectory of technological innovation over time. It maps three key layers—The Web², Emerging Tech, and Future Tech—highlighting how current advancements in content creation and digital services are paving the way for transformative breakthroughs in robotics, biotech, quantum computing, and beyond.

1. The Web²: The Current LandscapeAt the base of the framework lies “The Web²,” representing the technologies and industries dominating the present era. Content creation, fueled by AI tools like generative language models and design automation platforms, is the bedrock of this layer. Similarly, digital services, encompassing cloud computing, personalized applications, and online commerce, are rapidly evolving. These sectors remain essential to the global economy and act as a foundation for more advanced fields.

This phase reflects a focus on immediate utility, where AI augments existing processes to enhance productivity and efficiency. While transformative, these technologies are relatively incremental in comparison to the breakthroughs anticipated in subsequent layers.

2. Emerging Tech: The Next FrontierEmerging Tech marks the 5-10 year horizon, where robotics, automation, and biotechnology take center stage. AI-driven robotics and automation are revolutionizing industries from manufacturing to healthcare, creating systems that are increasingly adaptive and autonomous. Biotech, on the other hand, leverages AI for breakthroughs in drug discovery, genetic engineering, and personalized medicine.

Clean energy technologies also feature prominently in this layer. AI plays a pivotal role in optimizing renewable energy sources, such as solar and wind power, ensuring sustainable energy transitions. These fields represent the critical “bridges” that will lead society toward future technologies.

3. Future Tech: The Long-Term VisionBeyond the 10-20 year horizon, Future Tech encompasses revolutionary fields like quantum computing, space exploration, and new materials. Quantum computing is expected to solve problems that are currently intractable, unlocking new possibilities in cryptography, materials science, and artificial intelligence itself. Space tech, propelled by AI advancements, aims to extend humanity’s reach into the cosmos through innovations in satellite technologies and interplanetary exploration.

New materials, guided by AI-driven simulations, hold the potential to transform industries like construction, energy storage, and electronics. These advancements are not only distant but also foundational, promising to redefine the limits of human innovation.

Interconnected CyclesThe framework highlights how technologies in one layer fuel advancements in another. For instance, robotics and automation rely heavily on AI capabilities developed in the “Web²” layer. Similarly, breakthroughs in biotech or clean energy may become stepping stones for quantum computing and space exploration.

ConclusionThe AI Industry Evolution Cycles framework serves as a roadmap for understanding the technological transformations shaping the 21st century. By mapping the progression from present-day innovations to long-term breakthroughs, it underscores the interconnected nature of technological evolution. As humanity strides toward the future, the role of AI in driving progress across industries cannot be overstated.

The post AI Industry Evolution Cycles appeared first on FourWeekMBA.

NVIDIA’s AI Strategy

In a single session at CES 2025, Nvidia introduced a set of groundbreaking innovations, all following a single trajectory.

Jensen Huang also loudly announced that many of us in the industry are thinking about:

The ChatGPT moment for General robotics is just around the corner!

Let’s, though, put some order to the chaos.

In fact, while it might be easy to get confused about all the things NVIDIA has announced, and rightly so, there is a single innovation thread the company is following, which makes it quite clear where NVIDIA thinks we’re going next.

Iconic Jensen Huang has highlighted the path that took us to where we are today from his company’s perspective.

AI as a computing revolutionAs I’ve explained in The Web²: The AI Supercycle, Jensen Huang has made clear that what we’re living through is a computing revolution that will enable AI to be embedded anywhere at first, then create something completely new:

It’s worth reminding you that this journey, as I’ve explained, might well take anywhere between 30-50 years:

Yet, it’s also worth reminding that it took us nearly 30 years to get to where we are.

A 30 years journey

Jensen Huang reminded the audience what it took for NVIDIA to realize part of its vision, and it was a nearly 30-year journey:

Introduction of the first GPU in 1999.CUDA’s invention in 2006 enabled extensive AI and computational advancements.Transformers in 2018 revolutionizing AI and computing.As the transformer approached, it became clear that we were assisting a “scaling phenomenon” driven mainly through scaling laws.

As Jensen Huang highlighted, the interesting take is that these scaling laws initially played on the pre-training side and then moved along to other parts of the AI ecosystem.

Scaling laws are enabling the whole cognitive revolutionBut pretty much, as also Jensen Huang has highlighted, we have lived through three phases of AI technological development in the last few years.

From 2018 up to 2023, that has been chiefly about pre-training, in which the foundation resided on three things:

More data.More computing.Better algorithms.

This paradigm told us that the more we would scale compute, the more we would get intelligence.

As we went into 2024, the pre-training scaling paradigm was finally replaced by two other technical scaling paradigms:

Post-Training Scaling.And Test-Time Scaling (primarily via “Reasoning”).

Thus, we can summarize the scaling laws as per these three dimensions:

Training Scaling Law: More data and computation yield better AI models.Post-training Scaling Law: Techniques like reinforcement learning enhance AI capabilities.Test-time Scaling Law: Improved computation during AI inference for more accurate results.We’re at the point where the third scaling law (test-time scaling) might give us the most results in the coming years.

And yet, these will keep working in parallel, and we might figure out some new scaling laws in the next few years.

What’s coming next?Jensen Huang has clarified that we’ve seen two of the three core phases that will enable the next steps of AI development:

Indeed, while we’ve been going through the Generative AI phase, and we’re just now scratching the surface of Agentic AI, Jensen Huang highlighted the next critical phase: Physical AIs.

Let’s see how NVIDIA is tackling all of them.

The Web² as the upcoming phaseIn the Web² framework, I’ve highlighted how the first phase for AI will be the integration of it into native-web industries:

That’s what NVIDIA is betting on in its Generative AI offering.

The company offers the infrastructure to integrate AI into digital marketing and content development.

This is only the first step of integration of AI into Consumer, B2B, and Enterprise Applications out of the existing industries we have on the Web:

This integration will happen across consumer, B2B, and enterprise applications.

For that, NVIDIA is upping its game into the AI GPU infrastructure via its Blackwell architecture:

The launch of the RTX Blackwell family will enhance performance across the whole tech stack, thus potentially bringing significant advancements in energy efficiency and performance.

Thus enabling a single massive commercial use case: digital workers.

Digital Workers and Agentic AI for full Web² integration

Digital workers are AI-powered agents designed to function as virtual employees, performing specific tasks, collaborating with humans, and supporting organizational processes.

Unlike traditional automation tools, digital workers combine the flexibility of AI with domain-specific capabilities, making them adaptable to a wide range of applications.

What are the core features that make them up?

Autonomous Task Execution:Digital workers operate independently to complete repetitive or knowledge-intensive tasks, reducing human intervention.Examples include data entry, report generation, customer support, and real-time monitoring.Domain-Specific Expertise: These agents are trained or fine-tuned to understand specific industries, processes, or organizational needs, enabling them to provide highly relevant outputs.Integration with Human Workflows:Digital workers collaborate with human colleagues by augmenting decision-making, handling routine tasks, or managing workloads.They seamlessly integrate with existing IT ecosystems and software tools.Continuous Learning: They improve through post-training feedback mechanisms, reinforcement learning, and adaptive updates, ensuring alignment with evolving business goals.Scalability: Unlike human employees, digital workers can be replicated or scaled effortlessly to handle surges in demand or new tasks.How is NVIDIA advancing the digital worker ecosystem?

NVIDIA Nemo:A framework for onboarding and training AI agents, ensuring they align with an organization’s processes, language, and objectives.Digital workers are “onboarded” like human employees, learning company-specific workflows and terminology.NVIDIA Nim:A suite of pre-built AI microservices that integrate capabilities like speech recognition, language understanding, and computer vision into digital workers.AI Blueprint Models:Open-source blueprints provide developers with a foundation to create custom digital workers tailored to specific business needs.This will create three core trends:

Workforce Augmentation: Digital workers are not replacing humans but augmenting them, taking over mundane tasks and enabling humans to focus on creative and strategic work.AI-Driven HR: IT departments will evolve into managing digital agents as part of their workforce, much like HR departments manage human employees.Trillion-Dollar Opportunity: With over a billion knowledge workers globally, adopting digital workers represents one of AI’s most significant growth opportunities.The whole ecosystem is developing around an entire tech stack made of dozens of AI-native startups, each operating in a different part of the stack:

Physical AI and beyond Web²

Physical AI and beyond Web²Physical AI represents the convergence of artificial intelligence with the physical world, enabling machines to perceive, understand, and interact with their surroundings in a way that mirrors human intuition.

Unlike traditional AI models, which primarily process data in text, image, or numerical formats, Physical AI focuses on integrating knowledge of physical laws, dynamics, and spatial relationships.

The foundation of Physical AI is World Models that simulate and understand the physical dynamics of objects and environments.

These models are designed to:

Recognize gravity, friction, and inertia.Understand geometric and spatial relationships.Incorporate cause-and-effect reasoning.Handle object permanence (e.g., knowing an object remains present even when out of sight).

To get there, NVIDIA highlighted that we’ll need to have this shift:

Action Tokens: Instead of generating text-based outputs like language models, Physical AI produces “action tokens”—instructions that result in physical actions, such as moving an object or navigating a space.Foundation Models for the Physical World: Platforms like NVIDIA Cosmos aim to provide a framework for developing world models. These models are capable of:Ingesting multimodal inputs like text, images, and videos.Generating virtual world states as video outputs.Supporting applications in autonomous vehicles, robotics, and real-world simulations.Simulation and Real-world Data: Physical AI development requires high-fidelity simulations and extensive real-world data. Simulated environments allow for scalable, low-cost training, while real-world data ensures practical applicability.What applications will this primarily enable?

Autonomous Robots: Robots equipped with physical AI can understand their environments and perform tasks such as object manipulation, navigation, and complex assembly.Autonomous Vehicles (AVs): Physical AI enables vehicles to predict and respond to road conditions, simulate scenarios, and improve safety in real-world operations.Industrial Automation: In manufacturing and logistics, Physical AI helps optimize workflows, manage dynamic environments, and reduce human intervention.Industrial digitalizationThe first integration here will be the whole redefinition of manufacturing processes via AI:

Industrial digitalization transforms traditional industrial processes and operations through advanced technologies like artificial intelligence (AI), the Internet of Things (IoT), robotics, and digital twins.

It enables industries to improve efficiency, reduce costs, enhance safety, and unlock new productivity levels by integrating smart systems into their workflows.

Autonomous driving

Autonomous drivingAutonomous driving is one of the most advanced applications of AI, combining machine learning, computer vision, and robotics to enable vehicles to navigate and operate without human intervention.

The goal is to create safer, more efficient, and more convenient transportation systems.

How is NVIDIA contributing to the ecosystem development there?

NVIDIA DRIVE Platform:An end-to-end platform for developing, testing, and deploying AVs.Combines GPUs, deep learning, and simulation to accelerate AV development.AI-Powered Perception: NVIDIA’s AI frameworks power real-time object detection, scene understanding, and environmental mapping.Omniverse for Simulation: Provides a virtual testing environment to simulate millions of miles of driving scenarios, reducing the need for physical road tests.DRIVE Hyperion: A reference architecture with all the sensors and software needed to build AVs, simplifying the development process for automakers.Collaboration with Industry Leaders: NVIDIA partners with companies like Toyota, Mercedes-Benz, and Waymo to integrate its technology into their autonomous vehicle systems.What major commercial applications will we see there?

Passenger Vehicles:Self-driving cars and ride-hailing services like Waymo and Cruise.Enhanced safety features and convenience for personal transportation.Commercial Transport:Autonomous trucks for long-haul freight and logistics.Reduces costs, increases efficiency, and addresses driver shortages.Public Transit:Autonomous shuttles and buses for urban transportation.Improves accessibility and reduces traffic congestion.Robotics in Last-Mile Delivery: Self-driving vehicles for package delivery and logistics in urban environments.Humanoids and the New Economic ParadigmAs Jensen Huang has highlighted:

This will likely be the first multitrillion-dollar robotics industry.

I’ve explained how, in the technology expansion cycle, humanoids will be a critical building block in terms of expanding tech to enable a whole new paradigm:

Humanoids are robots designed to resemble and mimic human physical and behavioral traits, enabling them to perform tasks in human environments with minimal adaptation.

Combining advancements in robotics, AI, and human-like interfaces, humanoids aim to work alongside humans in industries ranging from healthcare and manufacturing to personal assistance.

Interestingly, in just 2 years, we’ve seen a whole humanoid ecosystem created!

Jensen Huang emphasized:

The ChatGPT moment for General robotics is just around the corner!

What role will NVIDIA play in Humanoid Development?

Omniverse for Simulation:NVIDIA’s Omniverse platform allows developers to create and simulate humanoid robots in virtual environments before physical deployment.It provides high-fidelity physics simulations for training and testing humanoid movements and interactions.Physical AI Models: NVIDIA Cosmos offers foundational models for Physical AI, enabling humanoids to understand gravity, friction, and spatial relationships.AI Frameworks: Platforms like NVIDIA Nemo and NVIDIA Nim equip humanoids with natural language understanding, decision-making, and multimodal AI capabilities.Hardware Advancements: NVIDIA GPUs power the real-time perception and decision-making capabilities required for humanoid robots.Collaborations: Partnerships with robotics companies accelerate the development of humanoid robots for various industries.I’ll dedicate a whole issue about it.

But for now, let’s recap the whole thing.

Recap: In This Issue!NVIDIA’s announcements at CES 2025 showcase a clear vision of the future, driven by scaling laws and breakthroughs in AI.

From autonomous vehicles to humanoids and digital workers, NVIDIA is at the forefront of enabling the AI-powered transformation of industries and daily life.

General Vision and StrategyThe ChatGPT Moment for Robotics: Jensen Huang emphasized that the breakthrough moment for general robotics is imminent, signaling a paradigm shift in robotics driven by AI.Unified Innovation Thread: NVIDIA’s announcements follow a coherent strategy to integrate AI into every aspect of computing, industry, and daily life.30-Year Journey: From the introduction of the GPU in 1999 to CUDA in 2006 and Transformers in 2018, NVIDIA has been building the foundation for the AI revolution.AI as a Computing RevolutionScaling Laws:Training Scaling Law: More data and computation yield better AI models.Post-Training Scaling Law: Reinforcement learning enhances AI capabilities.Test-Time Scaling Law: Improved reasoning during AI inference drives next-level results.Generative AI to Physical AI: NVIDIA is transitioning from Generative AI and Agentic AI to Physical AI, enabling machines to perceive and act in the real world.Key Innovations and PlatformsRTX Blackwell Architecture:Launch of RTX Blackwell family, enhancing energy efficiency and performance across the AI tech stack.NVIDIA Cosmos:A platform for developing world models to support Physical AI applications like robotics and autonomous vehicles.NVIDIA DRIVE:End-to-end solutions for autonomous driving, including DRIVE Hyperion and Omniverse simulation for safer, faster development.NVIDIA Omniverse:Simulation and collaboration platform for digital twins, robotics, and humanoid development.Core Areas of ApplicationGenerative AI and Digital Workers:Digital Workers: AI-powered virtual employees that operate autonomously, integrate with workflows, and scale effortlessly.NVIDIA Nemo and Nim: Tools for training and deploying digital workers, creating an AI-driven workforce.Industrial Digitalization:Transforming manufacturing and logistics with digital twins, predictive maintenance, and energy optimization.AI integration into Industrial IoT (IIoT) for smarter, more connected factories.Autonomous Driving:Passenger vehicles, commercial transport, and public transit enhanced by NVIDIA’s AI-powered DRIVE platform.Virtual testing with Omniverse reduces road testing costs and accelerates deployment.Humanoids:Robots resembling humans to operate in human environments, addressing tasks in healthcare, manufacturing, and personal assistance.NVIDIA’s role includes simulation with Omniverse, Physical AI models with Cosmos, and AI frameworks like Nemo.Emerging TrendsWeb² Framework: AI’s integration into digital marketing, enterprise applications, and consumer tech as the next phase of the web.Agentic AI: Systems capable of reasoning, planning, and acting autonomously in complex scenarios.Physical AI: Robots and systems that interact with the real world using action tokens and world models.Economic and Industry ImplicationsTrillion-Dollar Opportunity:Digital workers and autonomous systems represent a massive economic potential.Humanoids are set to drive the first multitrillion-dollar robotics industry.Workforce Augmentation:Digital workers complement human roles, enabling creative and strategic focus.Read Also:

The Web²: The AI Supercycle·

Jan 4

Many people mistakenly view the current AI paradigm as “another technology or another new industry.”

With  Gennaro, FourWeekMBA

Gennaro, FourWeekMBA

Business Engineering Curriculum

Business Engineering Curriculum

The post NVIDIA’s AI Strategy appeared first on FourWeekMBA.

The Transitional Market Dilemma

If you’ve been operating long enough in the business world, you might have reconciled yourself with the seemingly conflictual relationship between the short-term (survival) and long-term (vision).

Not only do these two time frames seem to work one opposed to the other, but often, the short ultimately makes you lose the original vision.

Or yet, the vision itself might make the company go adrift in the short (take the case of a company failing because of liquidity issues; that happen more often than you might imagine).

Why this misalignment? That primarily happens when founders and top executives lose sight of the underlying context driving that shift.

In a tech-driven business world, many new markets developing might, with high probability, die down. In short, they are not a fundamental shift; they turn out to be a blip.

Yet, that’s the thing: when the right market transition hits, it’ll be hard to get the old paradigm back, as it will be gone fairly quickly (which is still a ten-year time frame).

That’s the key take for this issue: when there is a transitional market that works as a force with two conflicting currents.

In the short term, one current will still make the old paradigm look viable, and it might give the short-term belief that it’s still possible to operate with that old paradigm.

Yet, the other current, the “transitional wave,” will come with tides as the new technological paradigm needs to find its grounding, thus becoming stronger and stronger until the whole market is transformed.

And we’re right in the midst of it, as we’re only at the first stage of a paradigm shift, which might happen in three acts.

I’ll tackle this in a dedicated issue about how it might all play out.

But that all starts from the transitional market dilemma.

The transitional market dilemma will tempt you to think the old paradigm still works out, as the new transitional market – while inevitable – is coming in tides.

This paradigm will work by first transforming the outer layer of an enterprise market and – slowly, then suddenly – eating the whole market. The interesting thing is while the transitional market, turning into a foundational market, will eat the whole, it will also expand it many times over!

That means a good chunk of old paradigm players might die, yet those able to transition to the new paradigm might find themselves surfing a much larger market!

That’s the beauty of it.

Are you ready for this transition? The upcoming issues will be dedicated to that…

Recap: In This Short Issue!Short-Term vs. Long-Term Misalignment:Businesses often struggle to balance short-term survival with long-term vision.The short-term focus can erode the original vision, while the long-term vision might cause short-term instability (e.g., liquidity challenges).Transitional Market Dynamics:Many emerging tech markets may prove to be temporary trends (“blips”) rather than fundamental shifts.A transitional market operates with two conflicting currents:Short-term current: Keeps the old paradigm appearing viable.Transitional wave: Gradually strengthens the new paradigm, ultimately transforming the entire market.AI Evolution in Three Phases:Phase 1: AI is integrated as added features into existing products (incremental adoption).Phase 2: AI becomes the core of products, redefining their fundamental purpose.Phase 3: AI enables entirely new, native products and interfaces, forming a new paradigm.Transitional Market Dilemma:Businesses may be tempted to believe the old paradigm is sustainable, delaying adaptation.The new paradigm will expand the market while replacing the old model over time.Market Shift Timeline: The paradigm shift is gradual, spanning approximately 10-20 years, transforming markets “slowly, then suddenly.”Implications for Players:Companies tied to the old paradigm risk irrelevance unless they transition to the new framework.Early adopters of the new paradigm stand to benefit from larger, unified, and expanded markets.AI-Unified Paradigm: Future markets will be characterized by integrated AI solutions, cross-sector APIs, and seamless interoperability, replacing fragmented tech sectors (EdTech, FinTech, etc.).Growth Potential: The foundational market will expand opportunities, enhancing capabilities and scaling advantages for adaptive businesses as they’ll find themselves in a much larger market opportunity.With Massive  Gennaro, FourWeekMBA

Gennaro, FourWeekMBA

The post The Transitional Market Dilemma appeared first on FourWeekMBA.

The AI Supercycle

The AI Supercycle represents a fundamental transformation of the global economy, distinct from any technological shift we’ve seen before.

While we’re witnessing rapid changes today, this transformation will mature over 30-50 years, similar to how the microchip revolution reshaped entire industries and job categories across generations.

What makes this cycle unique is its nature as an intelligence layer rather than merely an informational one.

To understand this distinction, consider how the Internet transformed business from the 1990s to the 2020s.

The web acted primarily as an informational layer, starting with outer-layer transformations like distribution channels and gradually moving inward to transform core business models.

The Web vs. AI Integration Pattern

Amazon exemplifies the web integration journey: beginning as an online bookstore (distribution layer), adding digital features (value enhancement), and eventually becoming a comprehensive platform (core transformation).

This outside-in pattern defined the internet era.

In contrast, the AI paradigm works from the inside out. Rather than starting with distribution advantages, AI begins by transforming the core value proposition of products and services.

This fundamental difference means that while distribution was the key battleground of the internet era, in the AI era, superior core capabilities drive success, with distribution advantages emerging as an organic consequence of a 100x value prop.

The AI Stack ArchitectureThe AI stack reflects this new paradigm through four distinct layers.

At the foundation sits the hardware layer, characterized by massive infrastructure requirements and dominated by a few players like NVIDIA.

Above this lies the foundation models layer, where companies like OpenAI and Anthropic compete to provide core AI capabilities.

The vertical solutions layer follows, offering industry-specific implementations across healthcare, legal, finance, and other sectors.

Finally, the application layer delivers end-user-facing solutions, where both incumbents and startups vie for category leadership.

The Complete AI Stack framework shows how AI integration differs from previous technological paradigms. It consists of four layers:

Hardware: The foundational infrastructure layerFoundation Models: Core AI capabilities and modelsVertical Solutions: Industry-specific implementationsApplications: End-user-facing products/servicesThe key insight is that this stack integrates differently than earlier tech waves like the Web.

While web integration started with external layers (distribution) and moved inward to transform core business functions, AI integration starts from the core.

It radiates outward, fundamentally transforming products and services from the inside out.

The Customer Profiles Perspective

The Customer Profile framework outlines three distinct market segments for AI products:

Consumer: High-volume applications with direct user interaction, focusing on ease of use and accessibility. Success depends on user experience and mass adoption.B2B: Medium-complexity solutions targeting businesses, with emphasis on efficiency and ROI. Requires integration with existing systems and clear value demonstration.Enterprise: High-complexity, customized solutions with stringent security and compliance requirements. Focuses on scalability, control, and deep system integration.Each segment demands different go-to-market strategies, product features, and value propositions.

Understanding these distinct profiles is crucial for product development and market positioning in the AI era.

The Distribution Advantage Perspective

The Distribution Advantage framework analyzes how incumbents and startups compete in the AI landscape:

Incumbents start with significant advantages: existing customer relationships, distribution channels, and brand recognition.

However, they face challenges with legacy systems and organizational resistance.

Startups begin with no distribution but can build AI-native solutions without technical debt.

While they struggle with initial market presence and customer acquisition, their clean-slate approach allows for innovative solutions.

The key insight is that unlike the web era, where distribution advantage was critical, in AI, the core product capability can drive distribution.

Strong AI capabilities can naturally lead to market reach, making initial distribution advantages less deterministic of success.

This creates a unique dynamic where incumbents’ traditional advantages might be less decisive than previous tech waves.

The Product Integration Levels Perspective

The Product Integration framework identifies three levels of AI implementation:

Basic: Pure LLM integration for fundamental capabilities. This represents the simplest form of AI adoption.Medium: Combines LLM with RAG (Retrieval Augmented Generation) and search capabilities. This enables more sophisticated contextual understanding and information processing.Agent: The most advanced level, featuring autonomous AI capabilities. This represents full AI integration with complex decision-making abilities.The progression through these levels isn’t just about technical sophistication—it represents increasing value creation and competitive advantage.

Each level builds upon the previous one, offering greater capabilities and potential for business transformation.

This framework helps organizations understand their current position and plan their AI integration journey.

The Incumbent Paradox

The inherenta developing structure of the AI market might create distinct strategic imperatives for different players.

Incumbents face what might be called the “incumbent paradox” – they possess initial advantages through existing distribution channels and customer relationships but must fundamentally reimagine their core value propositions to survive long-term.

Consider Salesforce’s approach: while integrating AI features into their existing platform, they’re simultaneously developing AgentForce as a separate, AI-native product line.

Saleforce has hired already thousand of salespeople, which will be trained to sell AgentForce alone.

This dual strategy is critical to enable the current business model to survive in the short term, while long-term success requires complete reinvention.

We’re indeed in the midst of a The Transitional Market Dilemma:

The good news is, as an incumbent is you got time (5-10 years depending on the vertical, as some verticals like EdTech have already been in part disrupted), but, on the other end, the bad news is you got to do it by changing the core.

The 100x Value Prop Snowball Effect

The 100x Value Prop Snowball EffectStartups, while lacking established distribution channels, can leverage AI’s inside-out nature to their advantage.

By creating products with fundamentally superior value propositions (10-100X improvements), they can achieve rapid distribution as a side effect of their core capabilities.

This dynamic enables a bootstrap-first mentality, where capital follows success rather than preceding it.

Incumbents vs. StartupsThat will create a scenario of winner-take-all on the capital employment side, which will make it extremely hard to compete from a venture funding perspective, not that differently from the web era, and yet even more skewed toward a few winners of the capital beauty context!

The Application framework examines how AI integration differs for incumbents versus startups:

Incumbents follow a path of:

Distribution Leg Up: Leveraging existing channelsAI as a Feature: Initial integrationRedefining the Core: Complete transformationStartups pursue:

10-100X Value Proposition: Focus on massive value creationBets and Bootstrap First: Start lean and focused, a very small team can create apps consumed by millions. Of course on the enterprise side, capital will be needed as to develop the enterprise customer is way more expensive, yet the point is with minimum capital you can get quick traction.Distribution and Capital as Side Effects: Let superior capabilities drive growthExample: SF approaches through core platform + AgentForce, then standalone products, while startups like Synthesia (Consumer), HeyGen (B2B), and Cohere/Sierra/Writer AI (Enterprise) focus on redefining core value first.

Investment Strategy in the AI EraThe key insight is that incumbents leverage existing advantages while startups focus on fundamental value creation first.

For investors, this paradigm shift demands new deployment strategies.

Capital will be easily available to the top players, and even stronger winner-take-all effects of the web era, will make the run to deploy the capital on the few winners even more skewed.

Visually this is what it looks like.

While this dynamic has also been true during the web era, it’ll get even more skewed in the AI era. This is how it might look visually in terms of winner-take-all effects and skewness of the private capital markets. Remember that the numbers shown are only a reference for you to understand the mental model dynamic of this market!

While this dynamic has also been true during the web era, it’ll get even more skewed in the AI era. This is how it might look visually in terms of winner-take-all effects and skewness of the private capital markets. Remember that the numbers shown are only a reference for you to understand the mental model dynamic of this market!While the hardware and foundation model layers show strong winner-take-all characteristics requiring massive capital, vertical solutions offer more balanced opportunities on the enterprise side, with multiple potential winners per sector.

This creates a barbell strategy where the highest returns might come from either massive infrastructure bets or carefully chosen vertical specialists.

The Capital Deployment framework shows how the “Winner Take All” dynamic varies across the AI stack:

The Foundation Layer shows the highest concentration (2-3 dominant players) due to massive scale advantages and capital requirements.Hardware Layer and Application Layer also show high concentration but for different reasons – hardware due to infrastructure barriers, applications due to strong network effects, and category dominance.The Vertical Layer uniquely shows a more moderate distribution, allowing multiple winners per vertical due to industry-specific needs and specialization opportunities.This understanding is crucial for PE/Family Offices in capital allocation, suggesting different investment strategies based on layer dynamics – concentrated bets in foundation/hardware/applications versus more distributed investments in verticals.

Career NavigationKey implication: While AI drives concentration in most layers, verticals offer more balanced opportunities.

Perhaps most intriguingly, the AI Supercycle is reshaping career trajectories. Technical professionals can accelerate their growth dramatically, potentially achieving senior positions in 2-3 years rather than the traditional decade-long path. However, this requires a builder’s mindset – constantly experimenting with new tools and creating practical applications.

Non-technical professionals must become “specialized generalists,” combining broad technological understanding with deep vertical expertise in specific industries.

The Career Navigation framework outlines strategies for thriving in the AI era:

Technical Path: Jump directly to senior build/technical roles, focusing on deep expertise in AI infrastructure and development.Non-Technical Path: Build networks and develop generalist vertical competencies across multiple industries, emphasizing breadth of understanding over technical depth.The “Replace Then Create” trajectory of AI suggests that it might first replace existing functions with AI, then create new ones, that we could not imagine could exist.

Long-term Impact On WorkThe key insight is the importance of multiple vertical competencies regardless of path – technical or non-technical professionals both benefit from understanding various industries rather than narrow specialization. This approach differs from previous tech waves by emphasizing broad vertical understanding alongside either technical or network-building expertise.

The short-term impact of this transformation may seem alarming, particularly as AI begins to replace certain job functions.

However, just as the microchip eventually created more jobs than it displaced, the AI Supercycle will likely generate entirely new categories of work we cannot yet envision yet.

Recap: In This Issue!The AI Supercycle OverviewAI represents a 30-50 year transformation, reshaping industries like the microchip revolution.Distinct from past shifts, AI acts as an intelligence layer rather than an informational one, fundamentally altering products and services.Web vs. AI Integration PatternWeb Era: Transformation started with distribution and expanded inward (e.g., Amazon’s evolution from bookstore to platform).AI Era: Transformation starts at the core value proposition and expands outward, prioritizing superior product capabilities over distribution advantages.The AI Stack ArchitectureHardware Layer: Dominated by players like NVIDIA; requires massive infrastructure.Foundation Models Layer: Core AI capabilities from companies like OpenAI and Anthropic.Vertical Solutions Layer: Industry-specific applications (healthcare, finance, legal).Application Layer: End-user products/services where startups and incumbents compete.Customer Profiles PerspectiveConsumer Segment: Focused on mass adoption and user experience.B2B Segment: Targets efficiency and ROI with medium complexity.Enterprise Segment: High-complexity, customized solutions requiring deep integration.Distribution Advantage FrameworkIncumbents: Leverage existing channels but face challenges with legacy systems.Startups: Lack initial distribution but thrive by building AI-native solutions with superior capabilities.Product Integration LevelsBasic: Fundamental LLM integration.Medium: Combines LLMs with advanced tools like RAG.Agent Level: Autonomous AI capabilities enabling complex decision-making.The Incumbent ParadoxIncumbents must use their current advantages (distribution, customer base) while reimagining core value to ensure long-term survival.Example: Salesforce developing AgentForce alongside its platform.100x Value Proposition for StartupsStartups prioritize creating transformative value (10-100X improvements) to gain market traction, allowing distribution and funding to follow.Investment Strategy in AIFoundation Models/Hardware Layers: Winner-take-all dynamics dominate due to high capital requirements.Vertical Solutions Layer: Allows multiple winners due to diverse, industry-specific needs.Balanced investment strategies include concentrated bets in foundational layers and distributed investments in verticals.Career Navigation in the AI EraTechnical Path: Accelerated growth to senior roles by focusing on AI infrastructure and development.Non-Technical Path: Build networks and gain broad vertical expertise across industries.With Massive  Gennaro, The Business Engineer

Gennaro, The Business Engineer

The post The AI Supercycle appeared first on FourWeekMBA.

January 13, 2025

The AI Effect in Europe

The European AI startup ecosystem in 2024 witnessed unprecedented growth, cementing its role as a global hub for artificial intelligence innovation. With significant increases in venture capital funding, market value, and employment, the sector demonstrated its resilience and capacity for innovation.

Record Funding and Growing ConfidenceAI startups in Europe secured $13.7 billion in venture capital funding in 2024, accounting for 25% of the region’s total VC investments. This marks a significant jump from 15% just four years ago, reflecting growing confidence in the potential of AI-driven technologies. The increasing allocation of funding to AI underscores its importance in shaping Europe’s technological future and its strategic value in global markets.

Emergence of Unicorns and Rising StarsThe year saw the emergence of new AI unicorns like Poolside and Wayve, showcasing breakthroughs in early-stage technologies and signaling Europe’s growing influence in the global AI ecosystem. Rising stars such as Mistral AI, Photoroom, and Dottxt have further solidified the region’s reputation for nurturing cutting-edge startups. These companies, specializing in fields ranging from generative AI to workflow automation, highlight the diverse applications of AI across industries.

Market Value MilestonesThe collective market value of European AI startups reached an impressive $508 billion in 2024, doubling over the past four years. AI now accounts for 15% of Europe’s overall tech sector value, demonstrating its pivotal role in the region’s innovation economy. This rapid growth reflects not only the success of individual companies but also the strength of the ecosystem supporting them, including accelerators, investors, and research institutions.

Employment and Workflow TransformationThe European AI sector has also been a major driver of job creation. In 2024, the industry employed 349,000 people, a 168% increase since 2020. This surge in employment underscores the growing demand for talent in AI research, development, and implementation. Beyond job creation, AI technologies have significantly transformed workflows across industries. According to a survey of CTOs, 93% reported that AI tools have brought significant changes to their operational processes, enhancing efficiency and innovation.

Operational Efficiency and Business ImpactThe integration of AI has also delivered measurable business impact. Companies adopting AI technologies reported an average 20% reduction in operating costs, illustrating the tangible benefits of AI in streamlining processes and improving profitability. This cost efficiency is likely to drive further adoption of AI across sectors, solidifying its role as a transformative technology.

Europe’s Global StandingEurope’s AI ecosystem continues to attract international attention, particularly from U.S. investors and companies seeking talent and innovation. This global interest reinforces Europe’s position as a key player in the AI landscape, capable of competing with established hubs like Silicon Valley and emerging markets in Asia.

ConclusionThe European AI startup ecosystem in 2024 stands as a testament to the transformative potential of artificial intelligence. With record-breaking funding, the emergence of innovative companies, and significant contributions to the economy and workforce, Europe has positioned itself as a leader in AI innovation. As the sector continues to evolve, its impact on the region’s economy and global standing will undoubtedly grow, shaping the future of technology.

The post The AI Effect in Europe appeared first on FourWeekMBA.

Comprehensive Guide to Seed-Stage Startup Compensation

Building a seed-stage startup involves a delicate balance of resource allocation, growth priorities, and attracting top talent. Compensation for founders and employees at this stage reflects these dynamics, blending modest salaries with equity incentives to align everyone’s goals toward long-term success.

This guide provides an in-depth look at seed-stage startup compensation, based on data from over 450 startups, covering salaries, equity distribution, and regional variations.

Founder Executive SalariesSeed-stage startup founders earn modest salaries, reflecting the resource constraints typical of early-stage companies. These salaries aim to cover basic living expenses while keeping the company’s focus on growth and product development. Median salaries for founders include:

CEO: $132,000CTO: $134,000COO/Operations: $135,000Product/CPO: $149,000The slightly higher salaries for CTOs and COOs emphasize their critical operational and technical roles. Notably, Product and CPO roles earn the highest, underlining their strategic importance in driving product development and innovation.

Founder salaries tend to increase as startups progress through funding stages. By Series B, founders can earn up to $218,000, reflecting improved financial stability and the ability to reinvest in the team.

Employee Salary RangesEmployee compensation at seed-stage startups varies significantly by role and location. However, technical roles, particularly engineering and product management, command higher pay, reflecting their importance in building and scaling the company’s offerings.

Bay Area SalariesThe Bay Area remains the epicenter of the tech industry, offering the highest salaries for seed-stage startups:

Mid-Level Engineering: $100,000 – $145,000Senior Engineering: $180,000 – $235,000Sales (Mid-Level): $80,000 – $110,000Product Roles: $130,000 – $185,000Marketing (Mid-Level): $100,000 – $175,000Other Tech HubsIn comparison, other tech hubs offer slightly lower salaries, reflecting differences in cost of living and market demand:

Mid-Level Engineering: $90,000 – $130,000Senior Engineering: $160,000 – $210,000Sales (Mid-Level): $70,000 – $100,000Product Roles: $110,000 – $175,000Marketing (Mid-Level): $80,000 – $145,000While salaries are lower outside the Bay Area, these regions are increasingly attracting startups due to more affordable living costs and the availability of talent.

Technical vs. Non-Technical RolesTechnical roles, particularly senior engineering positions, often surpass founder compensation. For instance, senior engineers in the Bay Area earn between $180,000 and $235,000—highlighting their importance in the early stages of product development.

Non-technical roles like sales and marketing also play a critical role in scaling and customer acquisition. Mid-level marketing professionals can earn between $100,000 and $175,000 in the Bay Area, showcasing the demand for skilled communicators who can drive early growth.

Equity CompensationEquity compensation serves as a key incentive for early employees, offering them a stake in the company’s success. At the seed stage, startups rely heavily on equity to attract talent while conserving cash.

Initial Equity GrantsEquity allocations typically decrease with each subsequent hire, reflecting reduced risk as the company grows:

First Hire: 0.5% – 4% (Median: 1.49%)Second Hire: 0.3% – 2% (Median: 0.85%)Third Hire: 0.2% – 1.2% (Median: 0.50%)Fourth Hire: 0.18% – 1% (Median: 0.44%)Fifth Hire: 0.13% – 0.8% (Median: 0.34%)Equity serves as a powerful tool to align employees’ interests with the company’s long-term success. It incentivizes early hires to contribute meaningfully to the startup’s growth and take ownership of its mission.

Vesting SchedulesEquity grants typically follow a four-year vesting schedule, with a one-year cliff. This means employees must remain with the company for at least one year to start earning their equity. This structure encourages commitment while providing protection for the company.

Key Factors Influencing CompensationSeveral factors influence compensation at seed-stage startups, including role type, location, and company funding stage.

Role TypeTechnical roles like engineering and product management often command higher salaries due to their critical impact on the company’s development. Non-technical roles such as sales and marketing are essential for scaling operations and acquiring customers, though their salaries are generally lower.

LocationGeography plays a significant role in determining salaries. The Bay Area’s dominance as a global tech hub drives higher compensation, while other tech hubs offer competitive salaries at a lower cost of living.

Funding StageAs startups progress through funding stages, compensation for both founders and employees increases. This reflects the company’s improved financial stability and ability to invest in its team.

Trends in Seed-Stage CompensationThe compensation landscape for seed-stage startups is evolving, influenced by factors such as remote work, industry focus, and competitive talent markets.

Remote WorkThe rise of remote work has leveled the playing field for startups outside major tech hubs. Employees in regions with a lower cost of living can still command competitive salaries, enabling startups to access a broader talent pool.

Industry FocusEmerging industries like AI, climate tech, and Web3 are driving demand for specialized talent. Startups in these sectors may offer higher salaries and equity to attract professionals with the necessary expertise.

Competitive Talent MarketAs the startup ecosystem grows, competition for top talent is intensifying. Seed-stage startups must balance cash constraints with the need to offer attractive compensation packages, often relying on equity to bridge the gap.

Strategies for Startups to Attract Top TalentTo attract and retain talent, seed-stage startups should consider the following strategies:

Offer Competitive Equity: Equity compensation can make up for lower salaries and align employees with the company’s long-term vision.Emphasize Growth Opportunities: Highlight the potential for career advancement and learning in a startup environment.Leverage Remote Work: Tap into talent from regions outside traditional tech hubs to access a broader pool of candidates.Focus on Culture: Build a strong company culture that values collaboration, innovation, and transparency.ConclusionCompensation at seed-stage startups reflects the delicate balance between limited resources and the need to attract top talent. Modest salaries combined with meaningful equity stakes create a compelling value proposition for early employees, aligning their success with the company’s growth.

As the startup ecosystem continues to evolve, understanding these compensation dynamics is critical for founders and employees alike. By offering competitive packages tailored to their unique circumstances, startups can build strong teams and set the foundation for long-term success.

The post Comprehensive Guide to Seed-Stage Startup Compensation appeared first on FourWeekMBA.

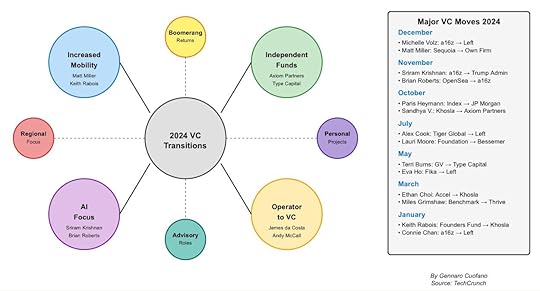

Top VC Moves And Following Capital Flows

The year 2024 marked a seismic shift in the venture capital (VC) landscape, characterized by increased mobility, the rise of independent funds, and a growing focus on specialized sectors like AI and climate tech. The traditionally stable world of VC saw heightened movement among seasoned professionals, reflecting a broader transformation in the industry.

Increased Mobility: A New Era for Senior VCsIn a notable departure from the norm, senior VCs displayed unprecedented mobility in 2024. Traditionally defined by long tenures at established firms, the industry witnessed high-profile transitions, including Matt Miller leaving Sequoia to start his own firm and Keith Rabois moving from Founders Fund to Khosla Ventures. These shifts underscore a growing trend of VCs seeking greater independence and opportunities to shape their investment strategies.

The Rise of Independent FundsOne of the most striking trends in 2024 was the surge in VCs leaving established firms to launch their own specialized funds. Firms like Axiom Partners and Type Capital emerged as key players, targeting niche markets with tailored investment approaches. These funds are focusing on high-growth sectors, particularly AI, climate tech, and early-stage startups. This shift highlights the evolving nature of venture capital as a craft business, where smaller, specialized funds can thrive by addressing specific market needs.

The move toward independence reflects a desire among VCs to operate without the constraints of larger, traditional organizations. This autonomy allows them to target emerging sectors and capitalize on new opportunities more effectively.

AI’s Influence on VC TransitionsThe booming AI sector played a significant role in shaping VC transitions in 2024. Key figures like Sriram Krishnan (formerly of a16z) and Brian Roberts (formerly of OpenSea) shifted their focus to AI, driving the creation of funds dedicated to machine learning and related technologies. These moves align with the broader surge in generative AI spending, which has attracted unprecedented attention from investors.

Boomerang Moves and Advisory RolesAnother emerging trend in 2024 was the rise of boomerang moves, with professionals returning to firms they had previously left. Advisory roles also gained prominence as seasoned VCs transitioned to guiding younger startups and funds. These roles underscore the value of experience in navigating a rapidly evolving industry.

Regional Focus: Europe Gains MomentumRegional investment strategies gained traction, with Europe emerging as a key focus area for many firms. This shift reflects the growing opportunities in European markets, particularly in sectors like fintech, renewable energy, and AI. The increased attention to regional dynamics highlights the global nature of venture capital in 2024.

A Transformative Year for Venture CapitalThe transitions and trends of 2024 signal a fundamental evolution in the VC industry. Increased mobility, the rise of independent funds, and a focus on specialized sectors like AI and climate tech underscore the dynamic nature of the industry. As VCs embrace greater independence and target emerging opportunities, the venture capital landscape is poised for continued innovation and growth in the years ahead.

The post Top VC Moves And Following Capital Flows appeared first on FourWeekMBA.